Two critical points from the Fed's November meeting

Understanding the state of play & the Fed’s thinking

Before delving into the two key points from the Fed’s November meeting, it is important that you have a strong understanding of the state of play that led to the Fed’s November announcements, as this will help you to understand why they were made, and also better understand where monetary policy will head into the future.

The first thing that needed be ascertained, was whether anything had materially changed since the Fed’s September meeting. In order to have determined that, one needed to look at the movement in key data points.

The movement in key statistics from the Fed’s September announcement to now, are as follows:

CPI: 8.3% vs 8.2% now

Core CPI: 6.3% vs 6.6% now

Unemployment rate 3.7% vs 3.5% now

Average hourly earnings: 5.2% vs 5.0% now

Job openings: 11.2m vs 10.7m now

Ratio of job openings to unemployed: 1.97 vs 1.86 now

From this we could ascertain that inflation was basically unchanged, whilst core CPI moved HIGHER and the unemployment rate DECLINED. While there was a decline in average hourly earnings growth and job openings, the ratio of job openings to unemployed people continues to remain high.

In summary, this meant that there was NOT a material change in the economic indicators to justify ongoing market talk of a “pivot”, or otherwise marked change in the Fed’s policy.

Therefore instead of spending too much time listening to people concocting wild theories and beliefs that a pivot was imminent, as the data had not materially changed, what one needed to do was analyse what the Fed Chair Powell had told everybody in his September press conference. Some of the key statements he made were:

The Fed is "moving purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent."

"Participants continue to see risks to inflation as weighted to the upside."

"Over coming months, we will be looking for compelling evidence that inflation is moving down consistent with inflation returning to 2%."

"At some point, as the stance of monetary policy tightens further, it will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation."

"Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy."

"As shown in the Summary of Economic Projections (SEP), the median projection for the appropriate level of the federal funds rate is 4.4% at the end of this year ... the median projection rises to 4.6% at the end of [2023]"

Given these prior Fed statements, what should have been the expected outcomes from its November meeting? I made the following conclusions on Twitter, amidst my wider November FOMC preview thread:

What did we get and hear from the Fed? The adoption or reinforcement of, all four key points:

A 75bp hike was delivered ✔️

The Fed flagged the potential for a step-down in rate hikes in December, but the chance of a 75bp hike still very much remains alive ✔️

Rate hikes are likely to taper significantly in 2023 as the Fed has acted expeditiously to raise rates to a restrictive level in 2022 ✔️

BUT Fed Chair Powell also VERY clearly articulated that the Fed is much more focused on the costs of cutting rates too quickly as opposed to overtightening i.e. do NOT expect rate cuts anytime soon ✔️

Given that a proper, common sense evaluation of the state of play, which focused on what the Fed has been articulating (as opposed to what one may have wanted to believe such as that a pivot was coming), led to successfully predicting the outcome of the meeting, were there any new key points that need to be understood and considered in order to understand the outlook for future monetary policy? Yes!

Two key things came out of this meeting, 1) a higher terminal rate than the Fed’s previous forecast; and 2) confirmation from Fed Chair Powell on the level of importance that the Fed places on lagging rental measurements.

The Fed has telegraphed a higher terminal rate than it previously forecast

Given that the key economic data didn’t materially change since its September meeting, it should not have been surprising that the Fed continues to adopt a hawkish stance. Indeed, as opposed to getting better on balance, the picture got worse, with the Fed’s key measurements of core CPI & PCE rising!

This leads to the first key point that you NEED to know out of the Fed’s November meeting — that despite a potential slow-down in the speed of tightening in December or February, the Fed now expects the terminal rate to be HIGHER versus its September SEP.

In Fed Chair Powell’s own words:

“At some point, as I’ve said in the last 2 press conferences, it will become appropriate to slow the pace of increases, as we approach the level of interest rates that will be sufficiently restrictive to bring inflation down to our 2 percent goal. There is significant uncertainty around that level of interest rates. Even so, we still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.”

The reason for this is fairly straightforward. A key metric that the Fed has been looking at achieving in order to bring down inflation, is to have its federal funds rate ABOVE their forecast of core PCE inflation. Back in September, the Fed was forecasting that YoY core PCE price growth would end 2022 at 4.5% and the federal funds rate would end 2023 at 4.6%. By taking the federal funds rate to 4.6% in 2023, this would have, in the Fed’s eyes, achieved a positive real interest rate. It could have achieved this via a 75bp hike in November (which it has now delivered), a 50bp hike in December, and a 25bp hike in February, taking the federal funds rate to 4.50-4.75%.

Back when the Fed made this prediction in September, core PCE was last recorded at 4.7%, which represented a notable decline from its peak of 5.4% in February.

What's happened since? Core PCE has risen back up to 5.1%. Should this persist, and in order to achieve positive real rates, the Fed now needs to take the federal funds rate ABOVE 5.1% (versus its previous median 2023 expectation for a 4.6% federal funds rate).

Given that lagging rents impact both the CPI & PCE price measurements (see my previous article here as to why), there is a significant chance that the core PCE price index remains elevated in the near-term. This is reflected in the Cleveland Fed's Inflation Nowcast, which is currently forecasting YoY core CPI of 5.2% and 5.1% for October and November respectively.

Federal funds rate futures, which are pricing in a peak federal funds rate of 5-5.25%, in my view, thus appear to be largely interpreting the current situation correctly. At present, I would say that risks are to the upside, with a terminal rate of 525-550bps more likely than 475-500. This is in-line with current federal fund futures pricing.

Should inflation and unemployment rates continue to be at around current levels by the time of the Fed's December meeting, then I would be inclined to believe that another 75bp hike in December is more likely than not, versus current market pricing, which slightly favours a tapering to 50bps.

This is supported by the fact that the Fed is much more worried about doing too little, as opposed to doing too much, as it views the risks of inflation becoming entrenched as harder and more painful to deal with than an economic slowdown. In Fed Chair Powell’s own words:

“Again, if we overtighten, and we don't want to, we want to get this exactly right, but if we overtighten, then we have the ability with our tools, which are powerful, to, as we showed at the beginning of the pandemic episode, we can support economic activity strongly if that happens, if that's necessary. On the other hand, if you make the mistake in the other direction, and you let this drag on, then it's a year or two down the road and you're realizing inflation behaving the way it can, you're realizing you didn't actually get it, you have to go back in. By then the risk really is that it has become entrenched in people's thinking and the record is that the employment costs, the cost to the people that we don't want to hurt, they go up with the passage of time. That's really how I look at it.”

To summarise — to whoever needs to still hear it, BURY any hopes for a near-term PIVOT (i.e. a cut in interest rates). Furthermore, a pause is NOT likely to occur until the federal funds rate is ABOVE core PCE inflation. Given that core PCE inflation has been more persistent than the Fed’s September forecast, and given that it is likely to remain high in the months ahead due to the lagging measurement of rents, the federal funds rate is going to keep going up, and by MORE than the Fed had previously anticipated just over a month ago.

Fed Chair Powell’s statement on rent measurement in the CPI & PCE, significantly increases the chance of overtightening & a severe recession

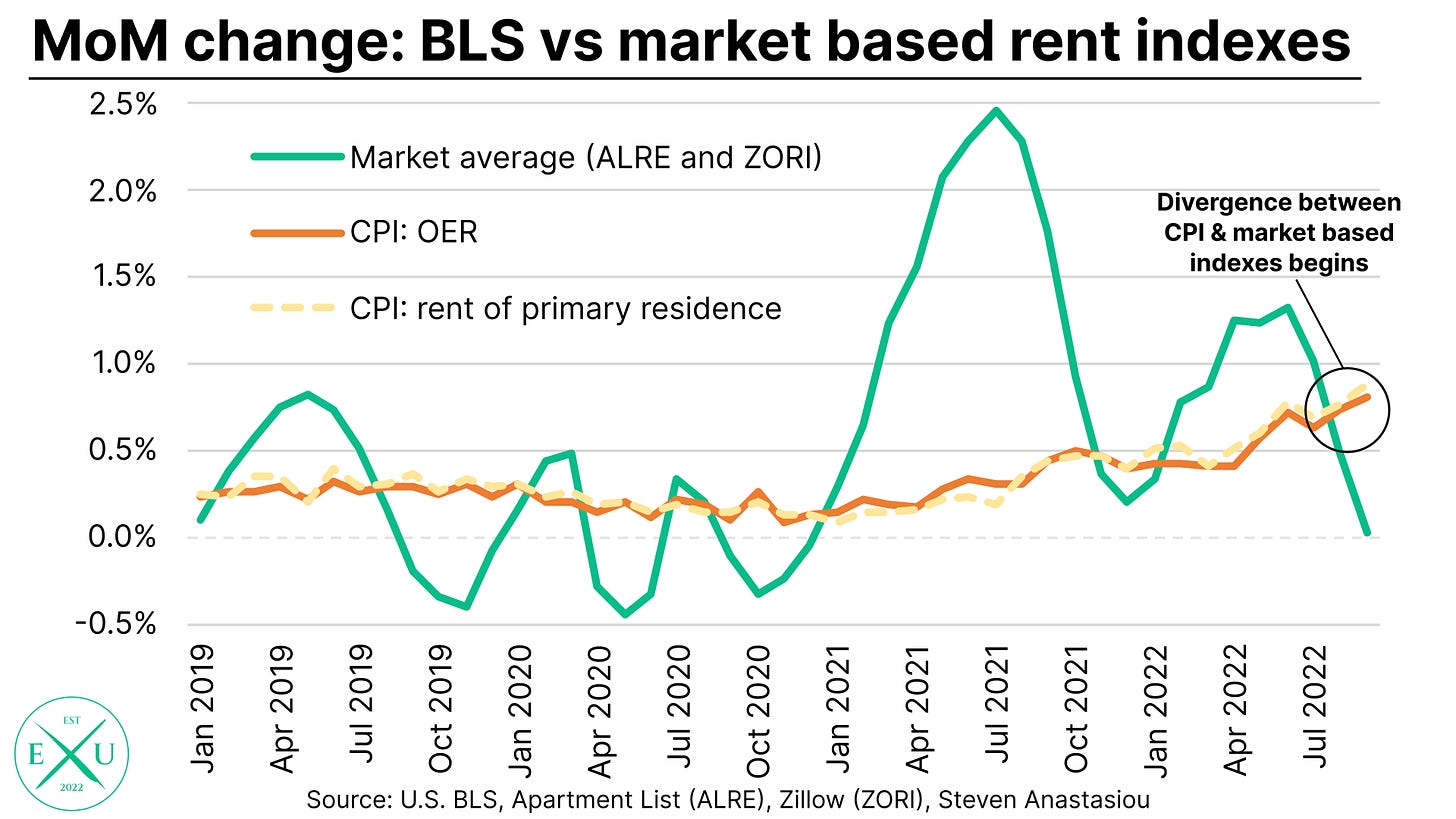

Something I have spoken about significantly this year in my writings on inflation and the economy, is that rent measurement in the CPI & PCE price index significantly lags changes in spot market rents.

During times of rapid changes in spot market rents, a major divergence can thus open up between the CPI/PCE’s measurement of rents versus the actual underlying spot market rents being paid.

While I have provided in-depth detail as to why this occurs here, the quick summary is that at any given time most rents in the US are under a fixed lease agreement. Given that the CPI & PCE measure the actual rental prices paid by a representative sample of individuals in the US, as opposed to the prices set under only NEW lease agreements, the CPI & PCE measures take a significant length of time to reflect current spot market rents, as it takes many months for previous leases to expire and have their rents reviewed (most US leases are for 12 months).

Given that spot market rents surged in 2021, this led to the CPI significantly understating inflation from May 2021. Though given a recent major deceleration in spot market rental price growth, the CPI is now on the verge of beginning to OVERSTATE underlying inflation.

This is set to occur as despite a sharp deceleration/flatlining/decline in spot market rents, the CPI/PCE rent measures are set to continue growing, as they are still catching up to the prior rental increases that it has not yet fully incorporated as old leases gradually expire and have their rents reviewed.

The current gap between the CPI’s rent indexes and spot market rent indexes is MAJOR, meaning that the CPI still has many, many months of catch-up required. With shelter being such a large component of the CPI, and an even larger component of the core CPI, this has a SIGNIFICANT impact on overall levels of measured inflation. While the weights aren’t as large in the PCE price index, the lagging nature of rent measurement is the same.

When asked about this phenomenon, Fed Chair Powell had the following to say:

“This is an interesting subject. So I start by saying I guess that the measure that’s in the CPI and the PCE, it captures rents for all tenants, not just new leases. And that makes sense actually…. that’s sort of the right target for monetary policy…. The private measures are good at picking up … the new leases … they tell you a couple things; one thing is … it’s very procyclical, so rents went up much more than the CPI and PCE rents did. And now they’re coming down faster. The implication is … as non-new leases rollover and expire … there’s still significant rate increases coming. But at some point once you get through that, the new leases are going to tell you … is there will come a point at which rent inflation will start to come down. But that point is well out from where we are now. So we’re well aware of that of course and we look at it…. but I would say that in terms of the right way to think about inflation really is to look at the measure that we do look at, but considering that we also know that at some point you’ll see rents coming down.”

So while the Fed is well aware of it (it would have been astounding if they weren’t), it appears that they are going to largely ignore it. In their opinion, the CPI/PCE approach to rents is the better measurement. While I disagree significantly with that, this isn’t important when trying to determine Fed policy. What’s important is that we instead monitor what the Fed is looking at, being the CPI and PCE. Given that the CPI and PCE measurements are going to have a SIGNIFICANT lag versus underlying inflation, the chances of the Fed overtightening and causing a severe recession is greatly increased.

We can analyse how this may play out by looking at what happened in 2021. Looking again at the the chart posted above, which compares CPI to CPI under a spot market rent approach, we can see that under the official CPI metric, inflation only changed slightly between May and September 2021, moving from 5.0% to 5.4%. All the while, underlying inflation as measured using spot market rents, SURGED from 6.1% to 9.2%. So as the Fed was waxing lyrical about inflation being transitory, it was in actual fact, surging higher. This very likely significantly contributed to the Fed’s initial lackadaisical approach to inflation, which resulted in a lagging monetary policy response, and the Fed’s now more drastic moves than would have otherwise been required. Just as the Fed mistakenly ignored analysing CPI under a spot market rent approach in 2021, which showed underlying inflation rising, it is now repeating the same mistake in reverse, as it shows underlying inflation falling.

This further reinforces that 1) rate rises have a way to go and 2) rates will remain higher for longer. The impact on the economy of the prolonged tightening is likely to be HIGHLY significant, as the Fed will be adjusting rates based upon a measure that does NOT reflect the circumstances of current underlying inflation, but instead reflects inflation from many months ago, as a result of the high weighting to lagging rent measurements.

I hope you enjoyed this latest piece. If you would like to help support my work, please subscribe, and help me spread the word by sharing this article.

As the readership of Economics Uncovered continues to grow, please feel free to also leave questions & comments below - I intend to nourish & build a community whereby we can all improve our knowledge and understanding of the important economic issues that impact our day-to-day lives. A healthy debate & conversation is the best way to help achieve that.

Thank you for continuing to read and support my work.