While a rate cut is very likely to be made at the September FOMC meeting, its size remains anything but certain, with markets positioning for either a 25bp or 50bp rate cut.

In my view, the monetary policy backdrop and key economic data, support the case for a larger, 50bp reduction.

Here’s 3 key reasons why:

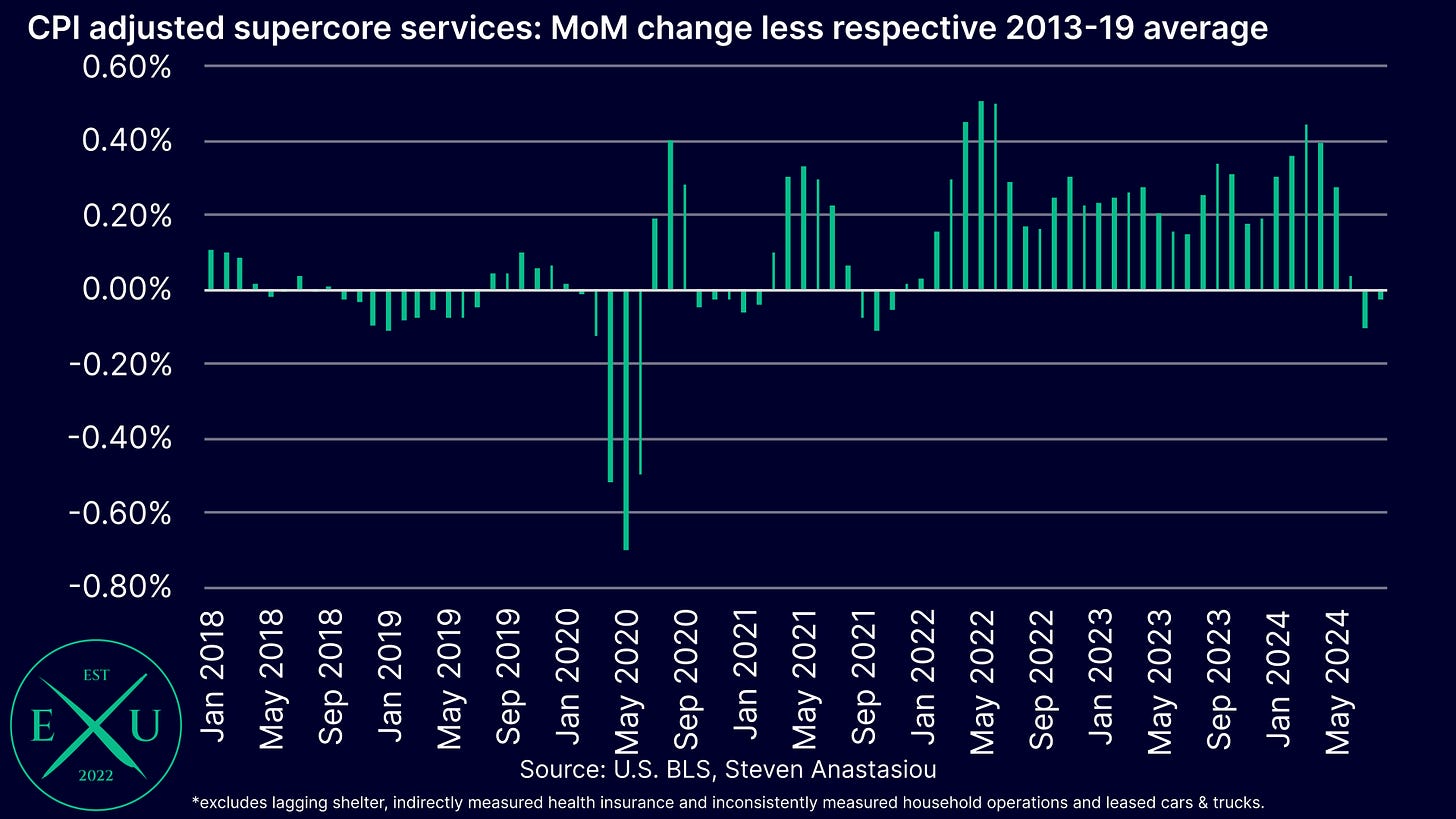

1) Inflation is no longer a major problem, with the disinflationary cycle now largely complete

With the M2 money supply remaining relatively constrained (see point 3 below), the disinflationary cycle has continued to strengthen, with adjusted core services prices (the most lagging component of the price cycle) now showing a clear disinflationary trend, with way above average price growth reverting to below average price growth on a 3-month moving average basis.

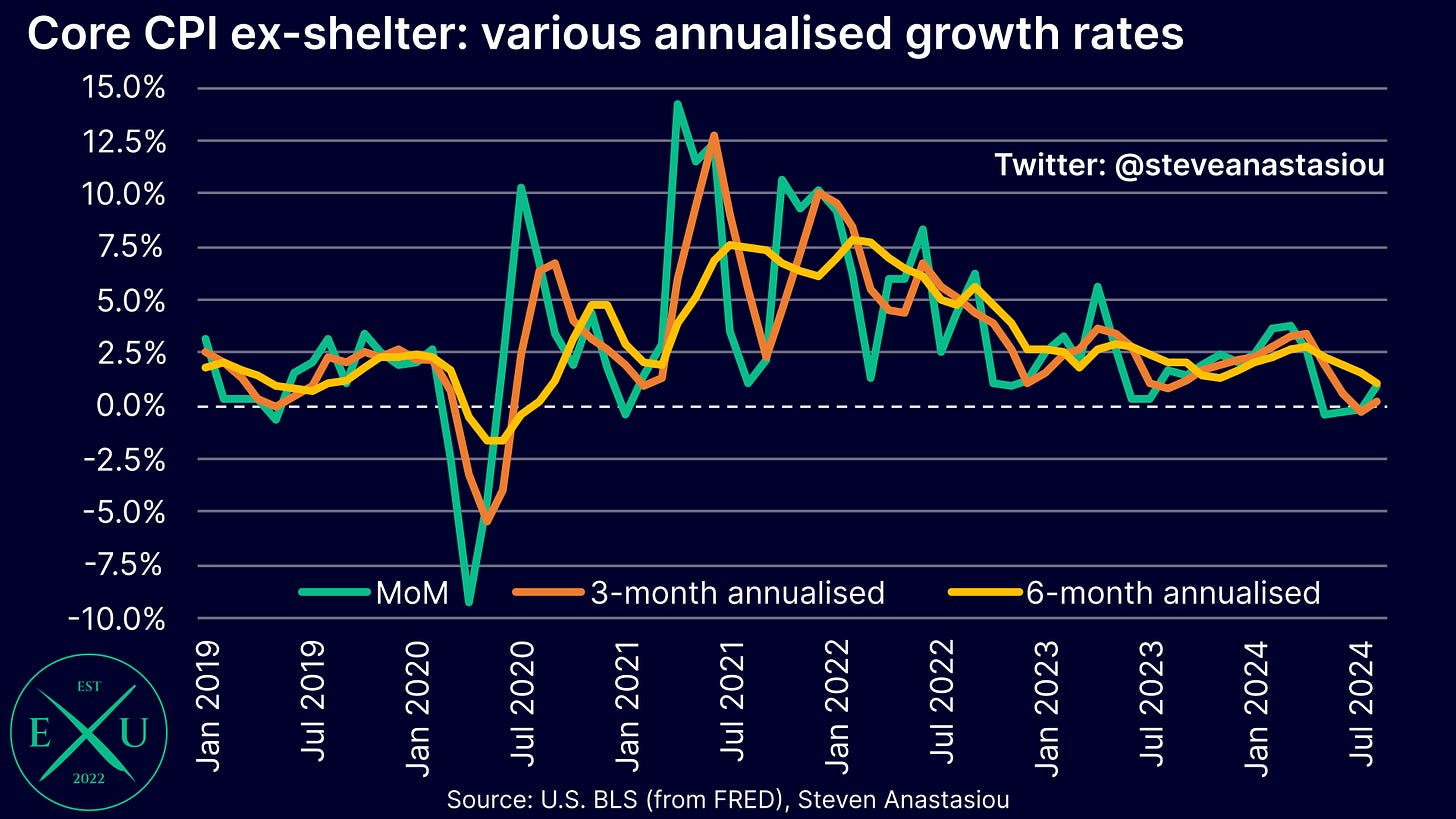

This has resulted in the core CPI ex-shelter recording a major reduction in growth, with 6-month annualised growth now just 1.1%, the slowest pace of growth since August 2020.

Given the lagging nature of the CPI’s rent based measures and the fact that leading indicators currently point to material declines in these rent based measures over the quarters ahead, looking at the CPI on an ex-shelter basis continues to provide a better insight into underlying price pressures.

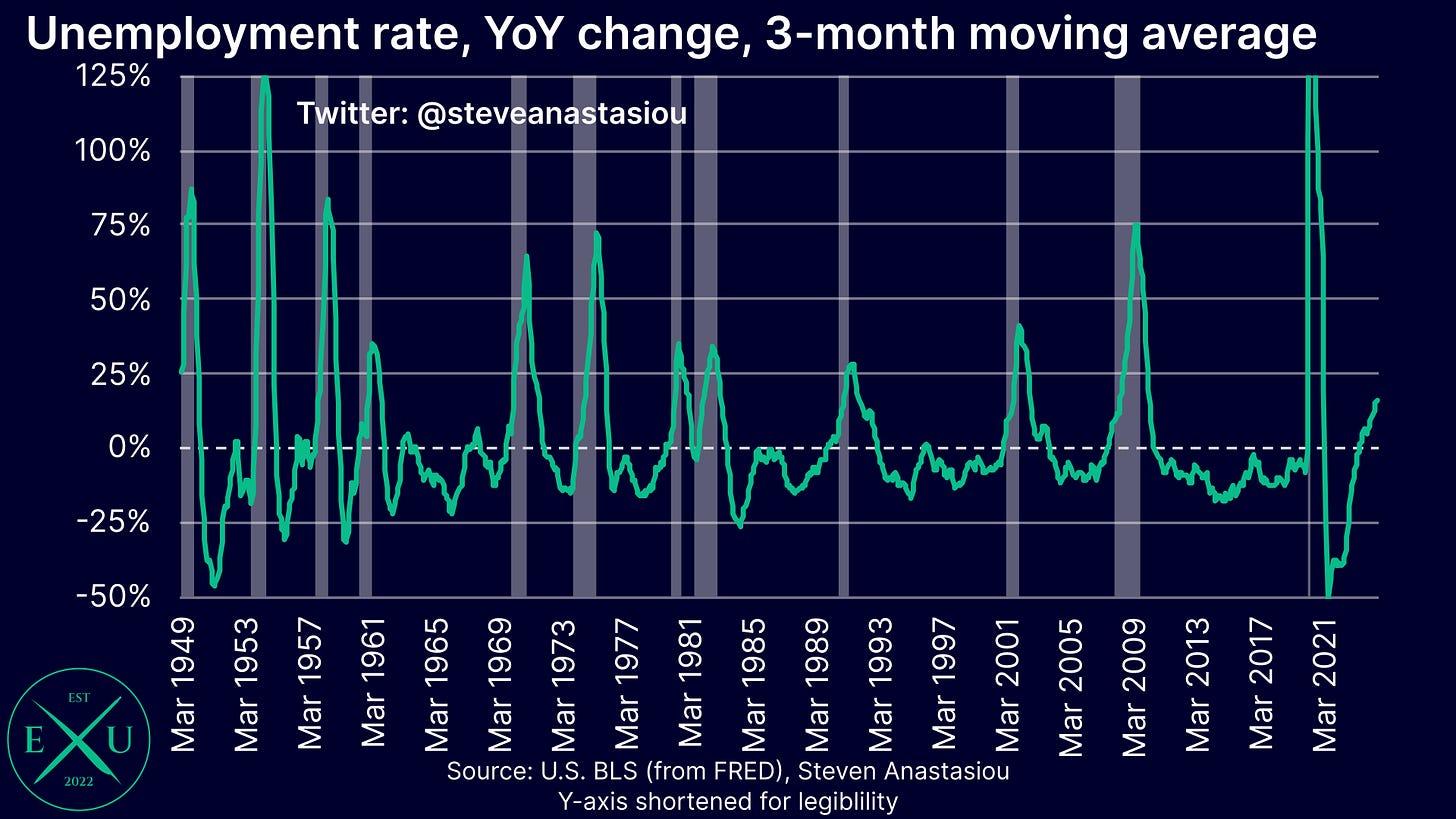

2) The jobs market has seen a major weakening and is trending in the wrong direction

In addition to the disinflationary cycle having largely completed, the full employment side of the Fed’s mandate is heading in the wrong direction, with a major weakening seen in the US labour market.

Some key indicators of this weakening include: a major increase in the unemployment rate; falling full-time employment; and a major weakening in the breadth of payroll growth.

As a result of this weakening, many key employment market indicators are now at levels that would generally only be seen in the event of a recession.

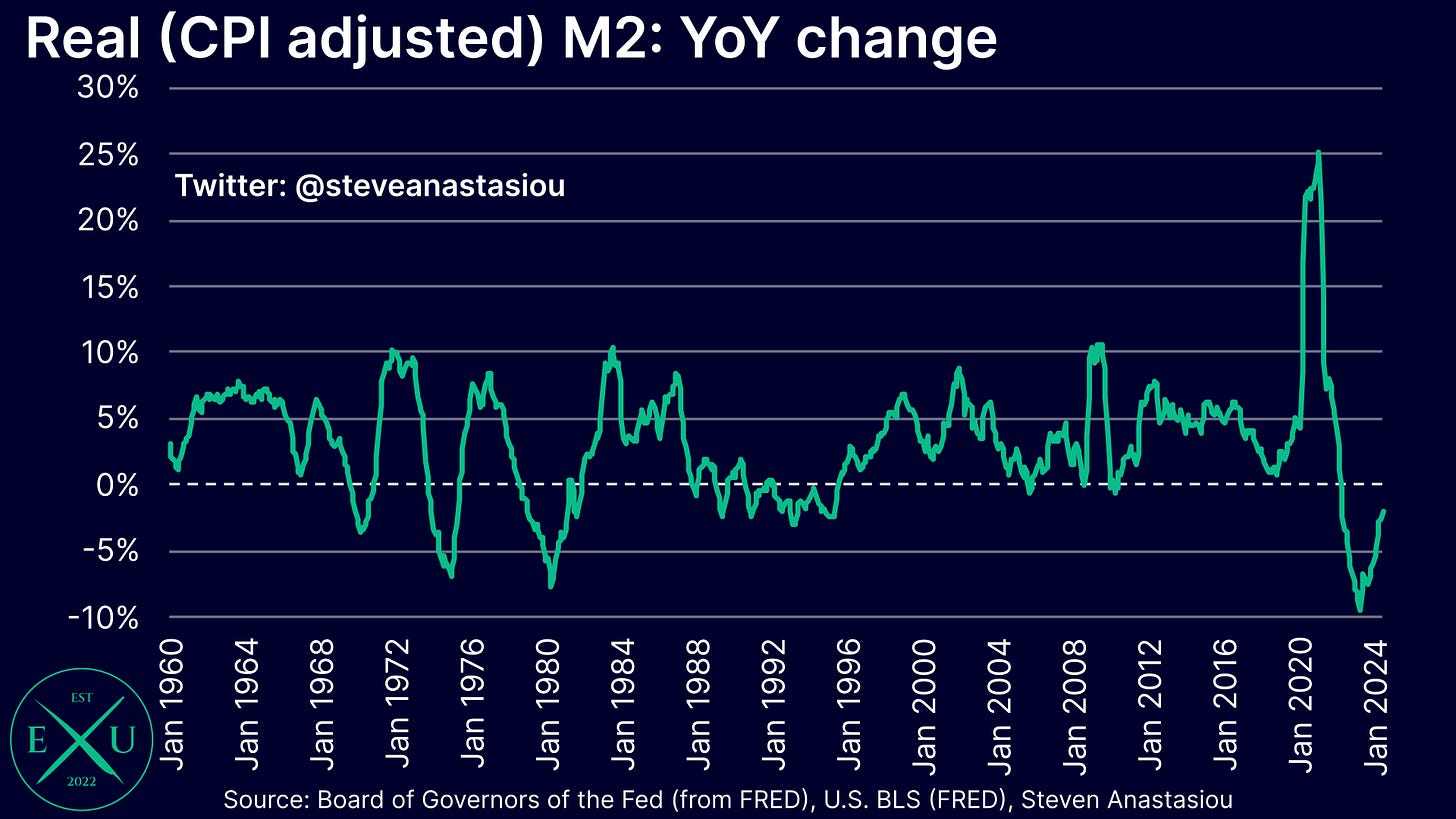

3) M2 growth remains constrained by significantly positive real rates

Solidifying the case for a 50bp rate cut, is that real interest rates are significantly positive and becoming more restrictive as inflation falls. As a result, despite a return to YoY growth in the M2 money supply, the real M2 money supply remains YoY negative, suggesting that without less restrictive interest rates, the US employment market may see a material further weakening.

In terms of what the Fed will do, I had forecast a 50bp rate cut since 5 August, alongside my review of July’s US jobs report. Though given the significant uncertainty surrounding the September FOMC decision and the big shift in market expectations following the August CPI report (the CME FedWatch Tool fell to just a 14% chance of a 50bp rate cut), I conceded that with the Fed well attuned to market expectations and little in the way of major data releases on the way before the September FOMC meeting, that a 25bp rate cut now looked like the more likely outcome.

Though with market expectations once again shifting dramatically — in part on the back of media reports — a 50bp rate cut has now become the more likely outcome expected by markets. Given this major shift and the data outlined above, I now believe that a 50bp rate cut is once again the more likely outcome in September and revert back to my original stance.

Nevertheless, I continue to note that there is a relatively high degree of uncertainty regarding this interest rate decision, and I would not be significantly surprised to see a smaller, 25bp rate cut delivered.

For those wanting more detail on the latest US inflation and jobs data, please see: “US CPI Review: August 2024” and “US economy enters a concerning phase as recessionary employment indicators continue to pile up”.