While positives can be drawn from this employment report, the jobs market is not out of the woods yet

While a lower unemployment rate and a sharp rise in nonfarm payrolls represent positive shifts, many concerning trends remain within the broad array of US employment data.

A sharp rise in nonfarm payrolls and a lower unemployment rate headline the positive news from September’s employment data

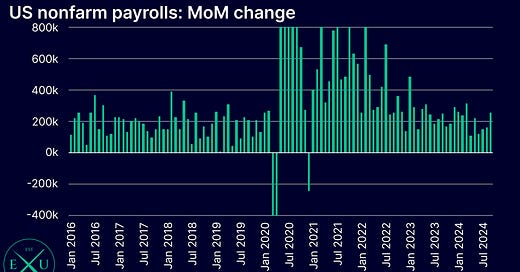

A material jump in nonfarm payrolls, which rose by 254k MoM — the fastest pace of growth since March — headlined a much more positive employment report in September.

With upward revisions also made to nonfarm payroll growth in July (+55k) and August (+17k), 3-month moving average growth rose to 186k, its highest level since May.

Most of the stronger employment growth was driven by private employment, which rose by 223k MoM, also the fastest pace of growth since March.

Importantly, the breadth of private employment growth also turned materially higher, with the 1-month diffusion index rising to 57.6 points, its highest level since January.

Stronger employment growth saw the unemployment rate fall to 4.1%, its lowest level since June.

This saw the Sahm rule soften to 0.50 percentage points (from 0.57 percentage points).

But lots of concerning data points remain, with the broader outlook still negative

Though given the long-standing weakening of US employment data, it will take much more than one month of more positive numbers — particularly given the broader backdrop of negative revisions — to suggest that the US employment market is now back on stronger footing.

In terms of the headline numbers, this broader downtrend can be illustrated by the fact that both total nonfarm payrolls and private payrolls saw a reduction in 6-month moving average growth in September.

The 3-month moving average of the unemployment rate was also unchanged at 4.2%, while the 3-month moving average of the U-6 unemployment rate actually rose further, to 7.8% . At 0.50 percentage points, the Sahm rule also remains at a critical juncture (see charts above).

Looking at US employment data more broadly, lots of additional concerning data points remain — some of which worsened in September — which suggests that the outlook for the US employment market remains negative.

Some key points to be aware of, include: