Weak disposable income growth continues to point to a major economic slowdown

While real US GDP growth was relatively solid in 2Q24, ongoing weakness in real disposable income growth points to a significant economic slowdown ahead.

In this latest update I succinctly break down the latest GDP, personal income and personal consumption data across three key points — let’s get straight into it.

Note that unless otherwise stated, the data points referenced in this report refer to seasonally adjusted data.

1) Economic growth remained solid in 2Q24, driven by fixed investment and government spending

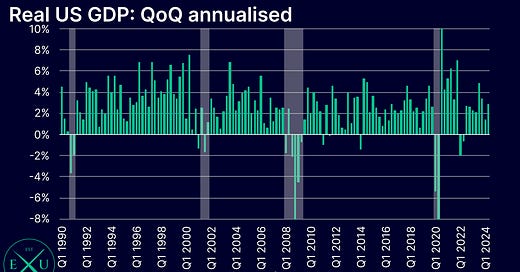

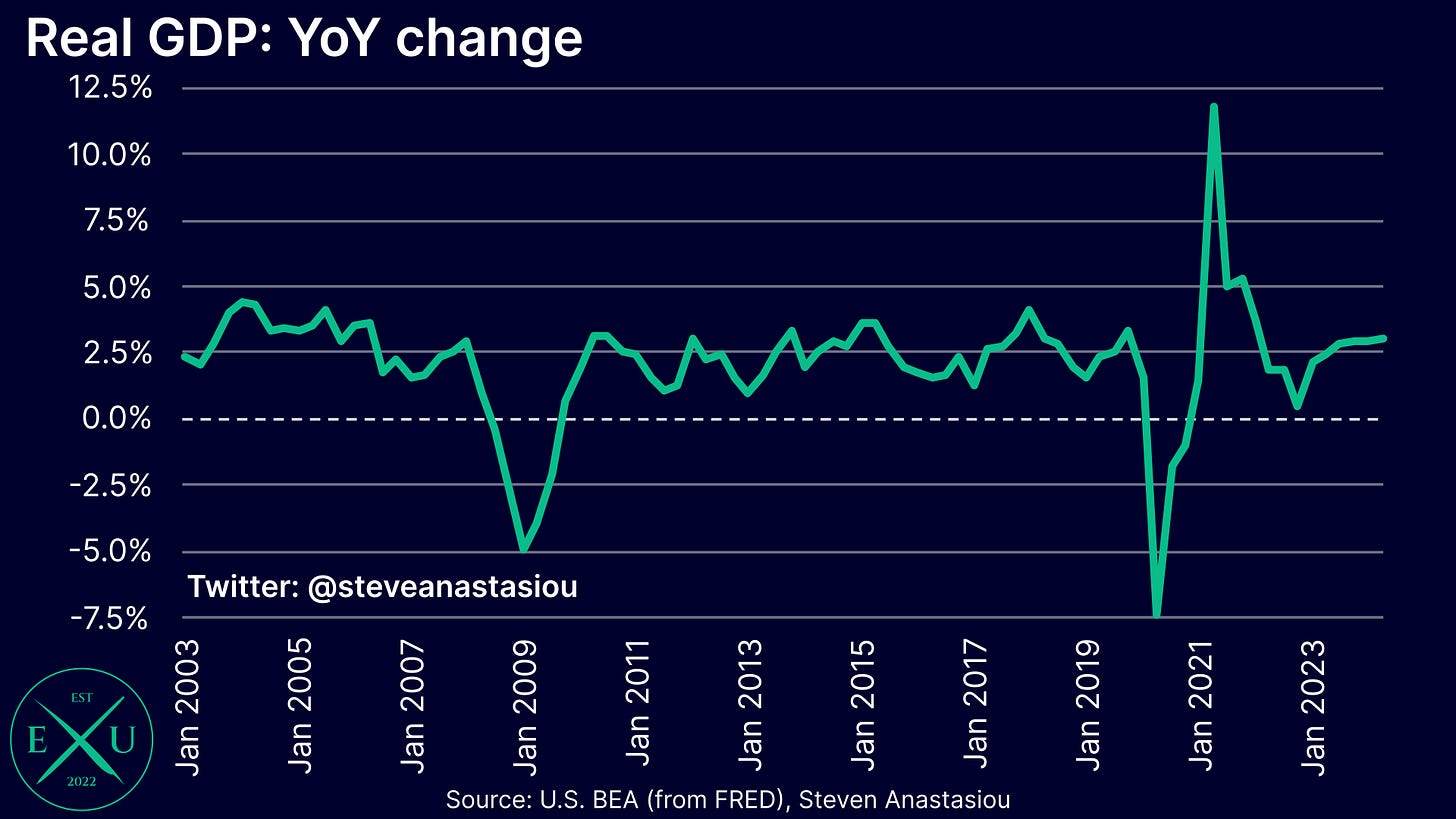

In the advance estimate of US GDP data for 2Q24, GDP growth rebounded to an annualised rate of 2.8%, up from 1.4% in 1Q24.

This saw YoY growth rise to 3.0% (non-seasonally adjusted), the highest level seen since 1Q22 and notably above the 2015-19 average of 2.5% YoY.

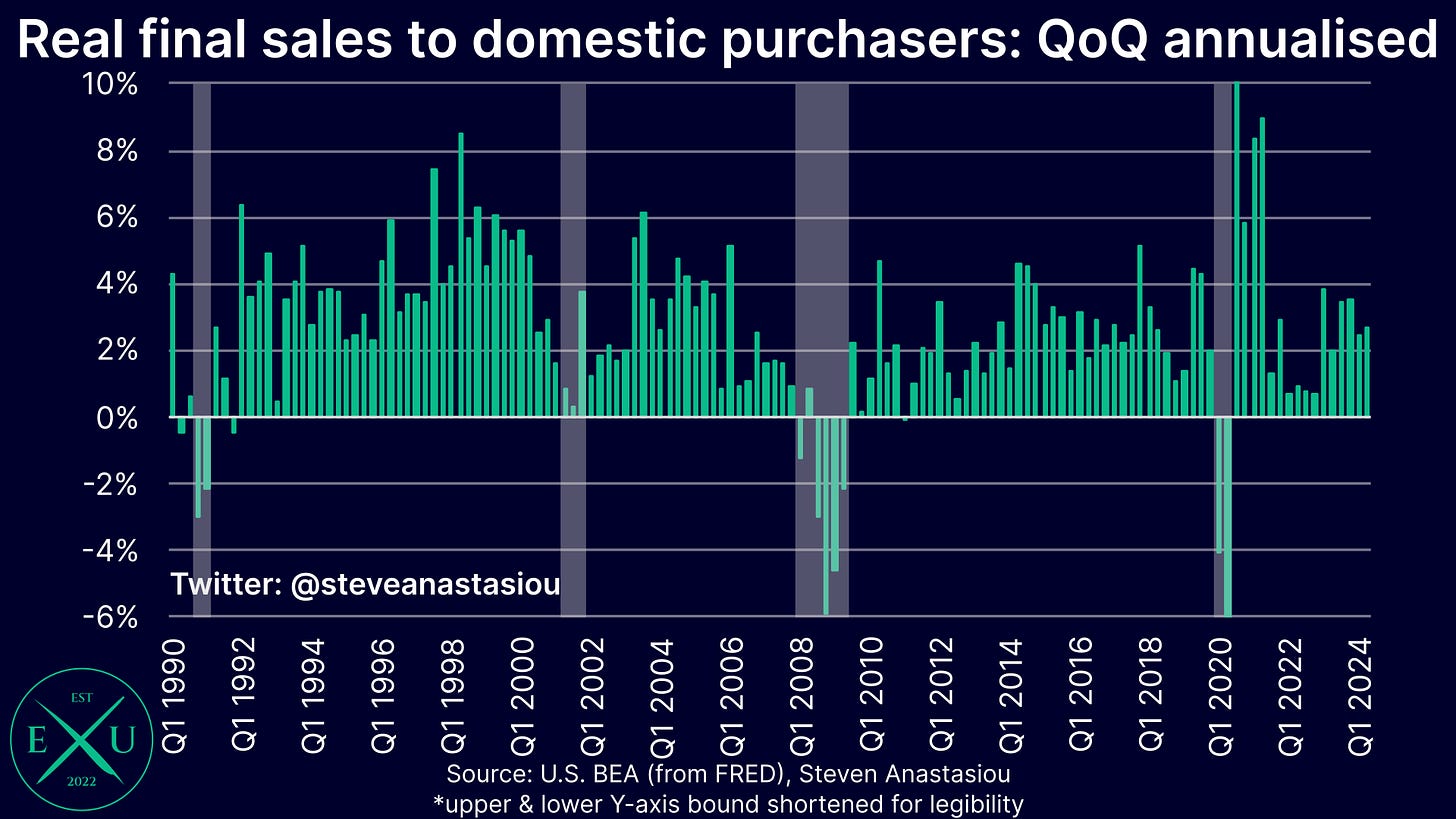

Excluding the volatile private inventories and net exports components, real final sales to domestic purchasers growth was 2.7% annualised in 2Q24, up from 2.4% in 1Q24.

YoY growth rose to 3.0% (from 2.9%) which is above the 2015-19 average of 2.8% YoY.

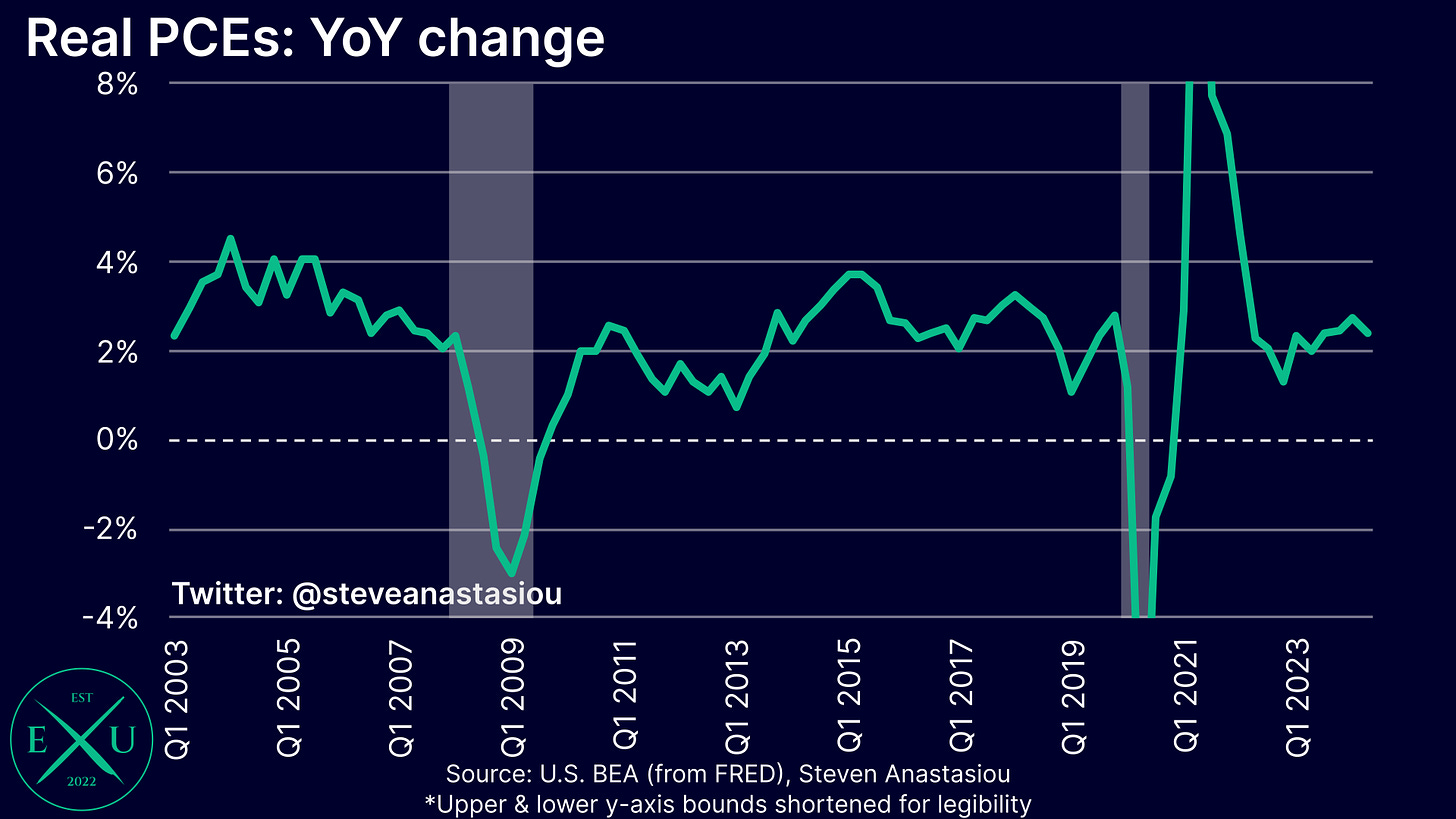

Unpacking the underlying components of real final sales to domestic purchasers, real personal consumption expenditures (PCEs) rose at a 2.3% annualised pace. While not particularly weak, real PCE growth wasn’t strong either, coming in below the 2015-19 annualised quarterly average of 2.6% for a second consecutive quarter (real PCE growth was an even more modest 1.5% in 1Q24).

This saw YoY growth (non-seasonally adjusted) drop to 2.4%, from 2.7% in 1Q24.

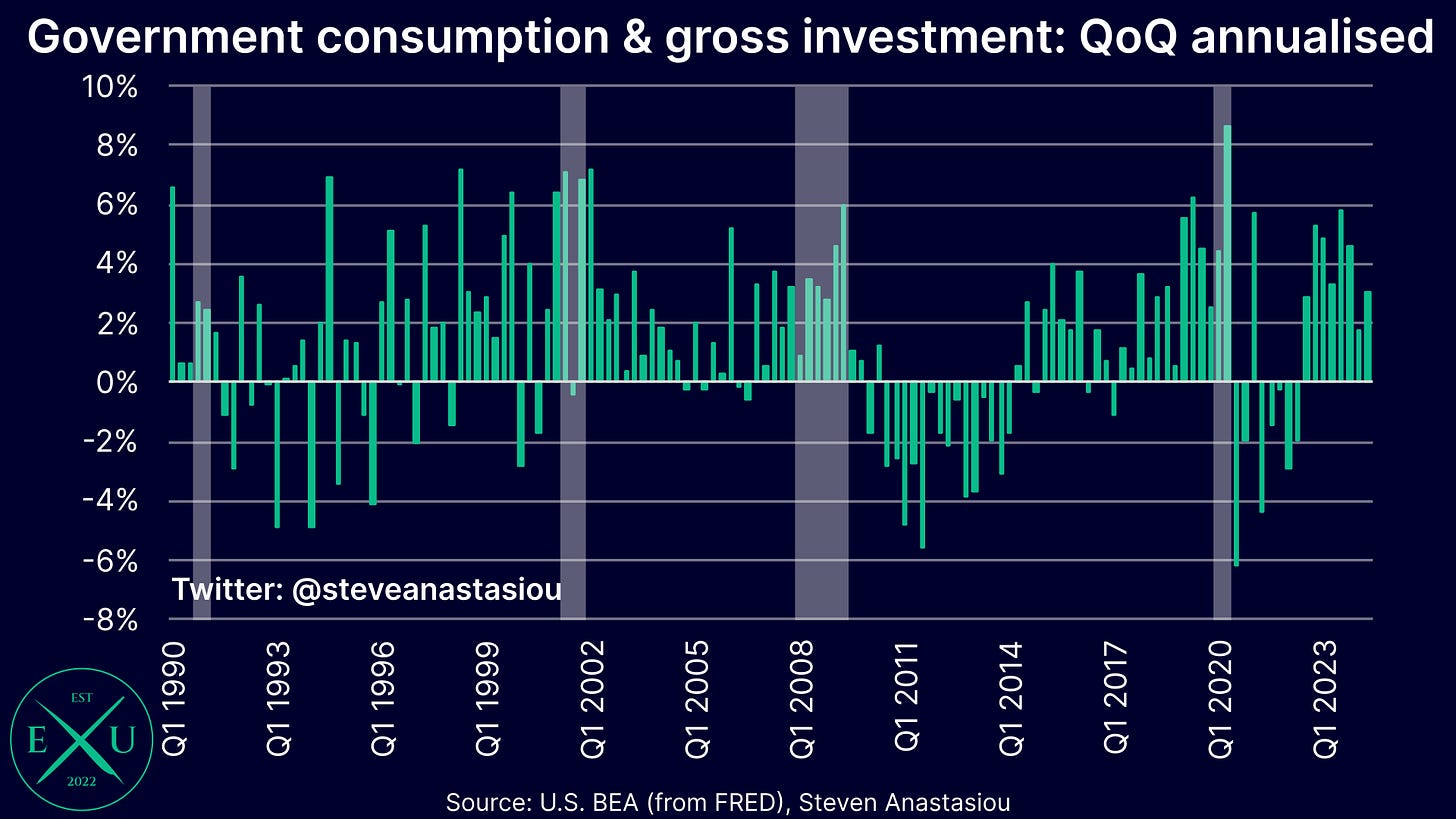

As opposed to real PCE growth, 2Q24 real final sales to domestic purchasers growth was driven by nonresidential fixed investment, which rose by a quarterly annualised pace of 5.2% and government consumption expenditures and gross investment, which rose by a quarterly annualised pace of 3.1%.