US Jobs Report: Employment market is relatively solid, but warning signs remain

While most employment market metrics have weakened, as opposed to indicating an imminent recession, they have instead only broadly fallen back to pre-COVID levels - but warning signs still remain.

Unemployment rate & aggregate employment measures indicate a relatively strong employment market

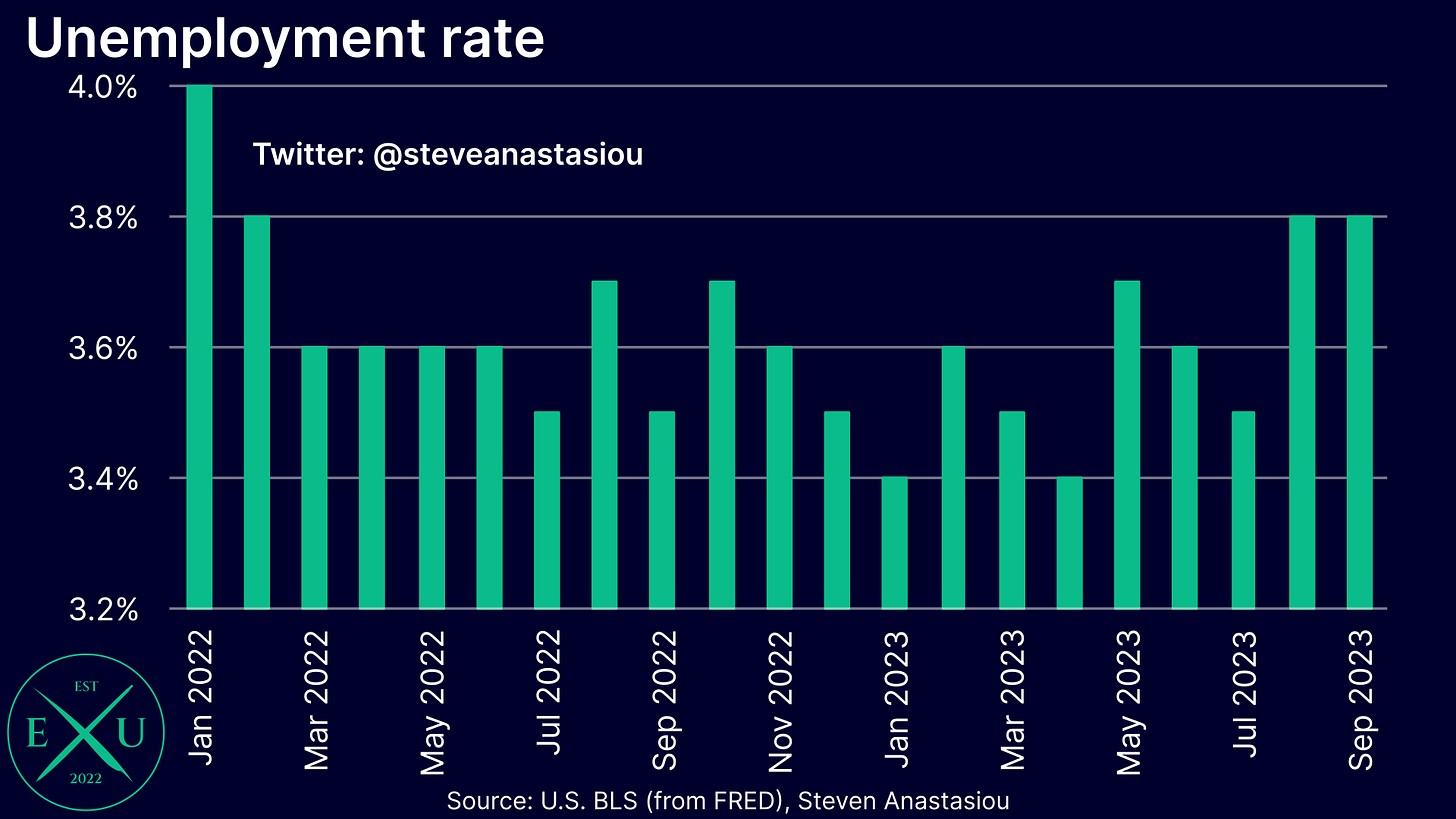

The unemployment rate remained unchanged at 3.8% in September, which while historically low (the monthly average since 1948 is 5.7%), this is above levels that have generally been seen since 2022.

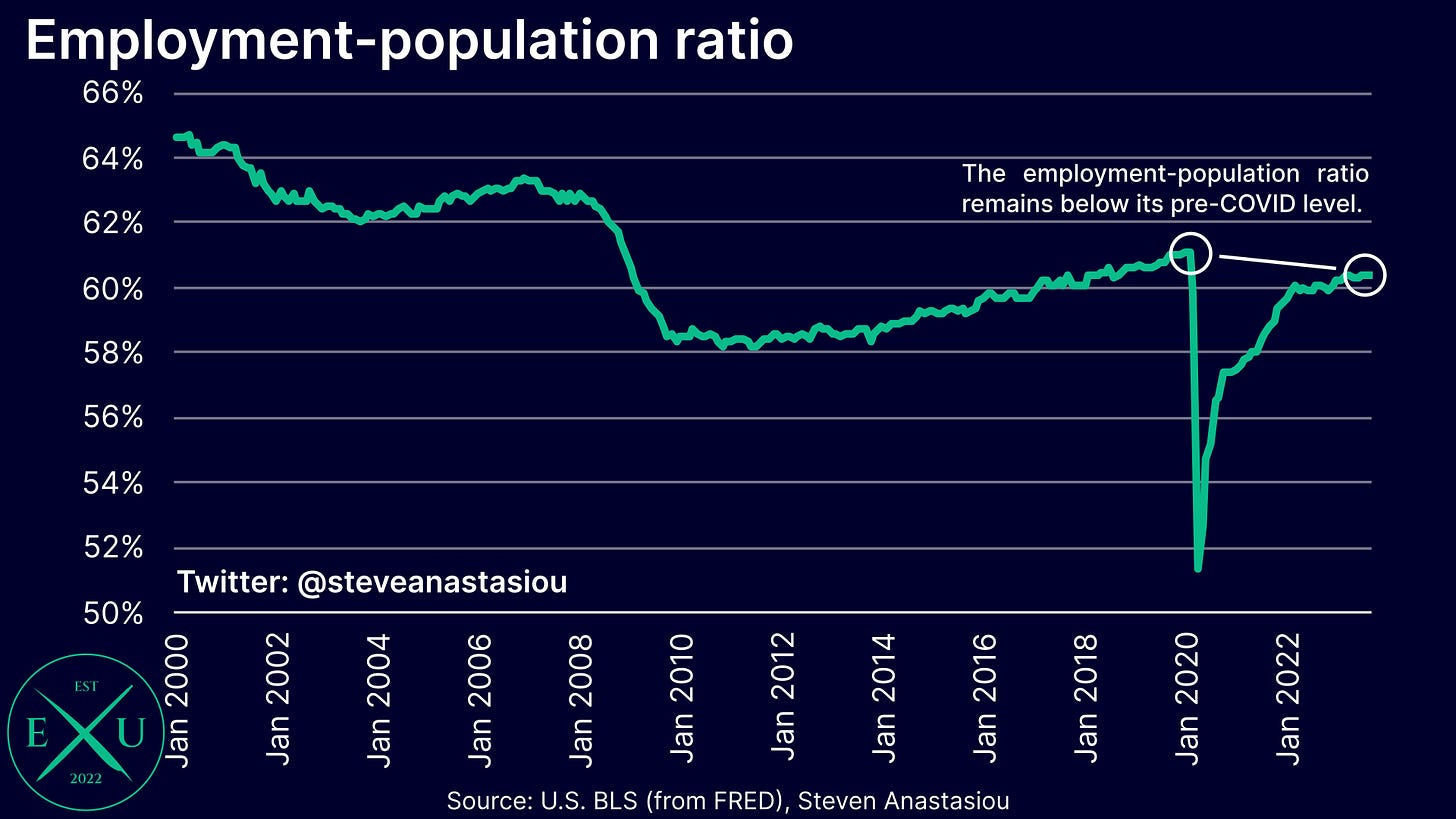

Looking at some additional measures of the overall employment situation, the employment to population ratio was unchanged at 60.4%, which is below the level of 61.1% that was recorded in February 2020.

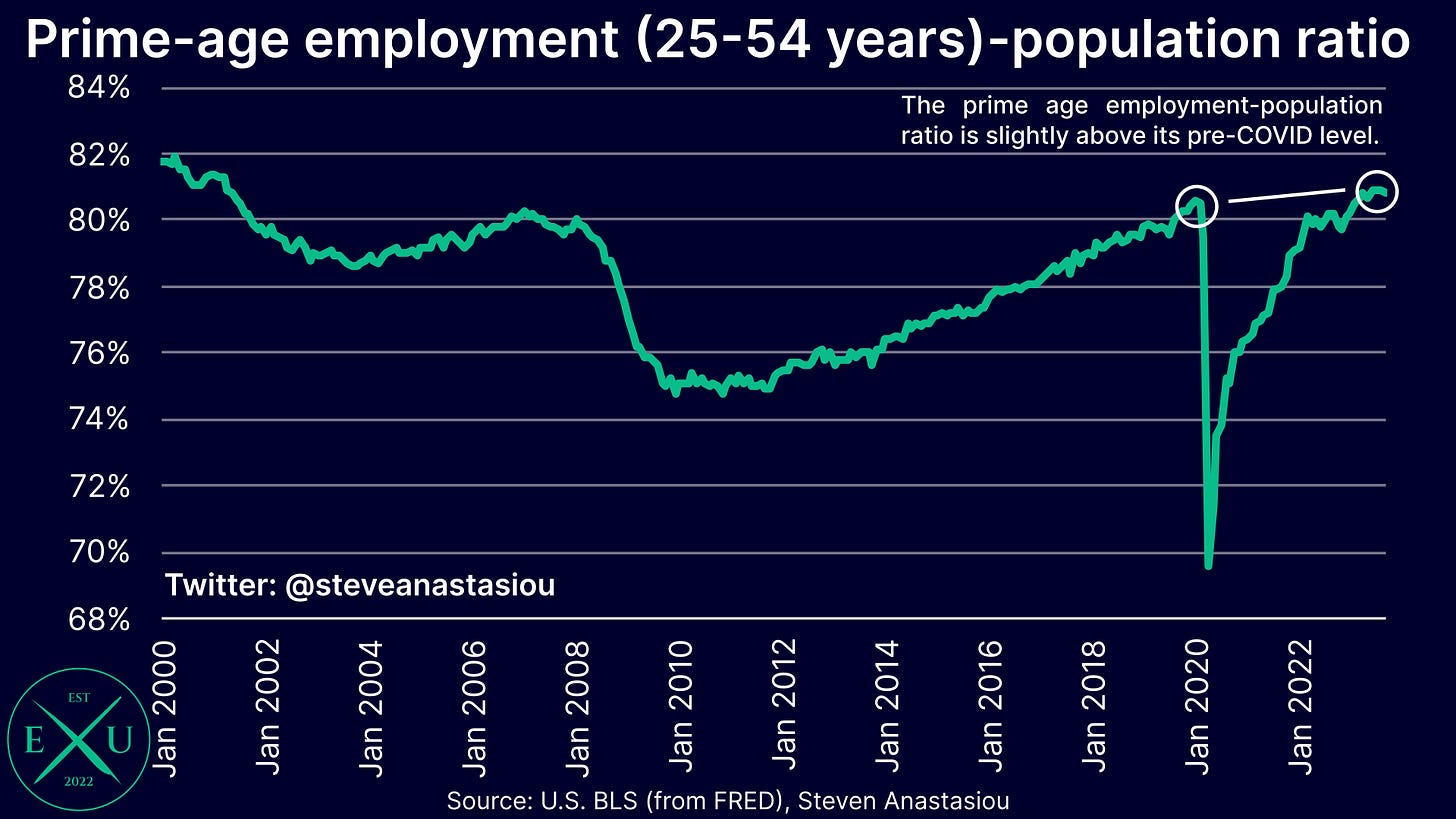

Though focusing in on the prime-age category shows that 80.8% of those aged between 25-54 years old, were employed. While this is down slightly from August (80.9%), this is above the February 2020 level of 80.5% and indicates a relatively strong employment market.

Nonfarm payrolls spike, helped significantly by government employment — what’s more, there were POSITIVE revisions

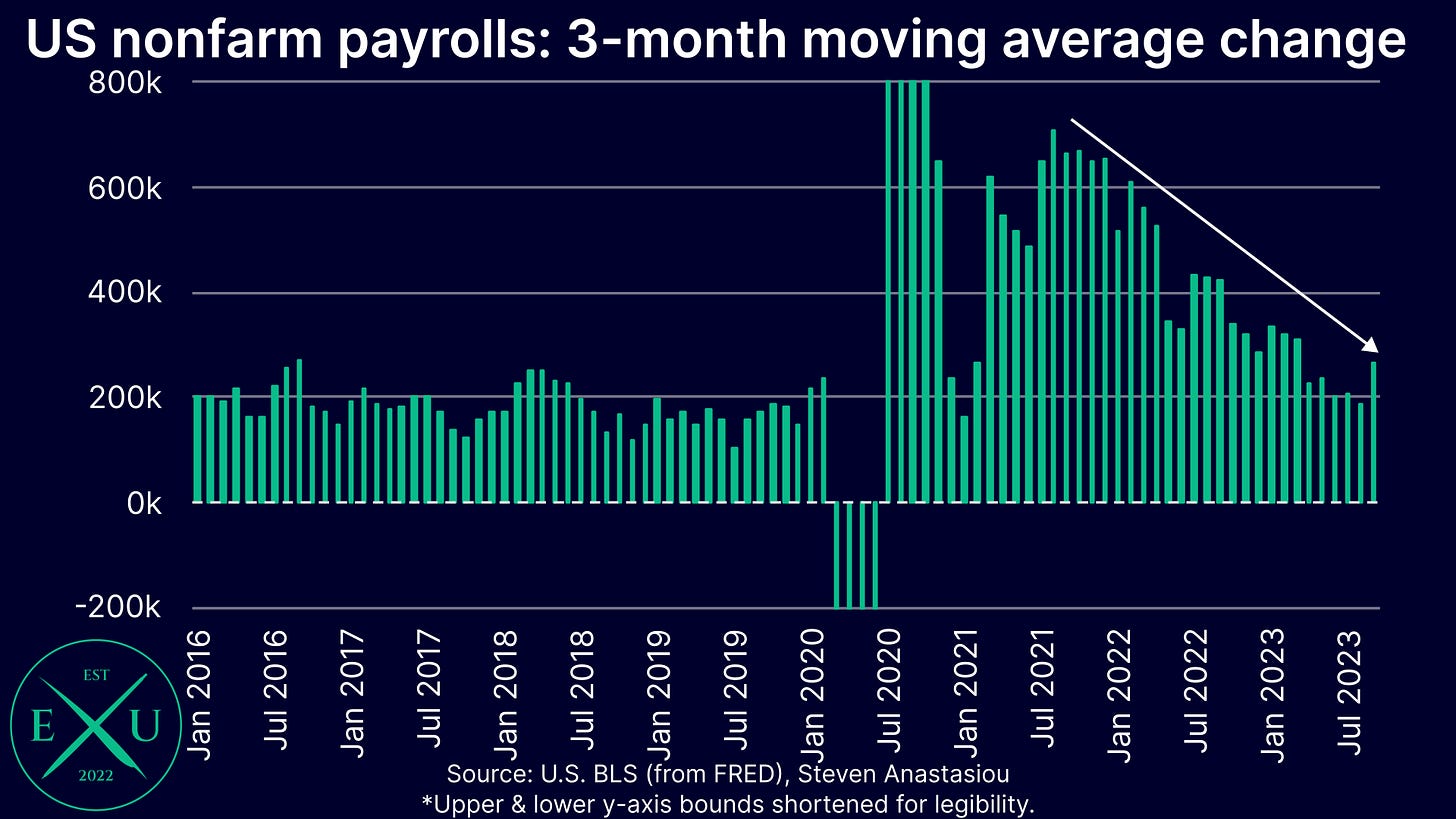

In terms of monthly employment growth, total nonfarm payroll employment rose by 336k, marking the highest MoM growth that has been seen since January 2023.

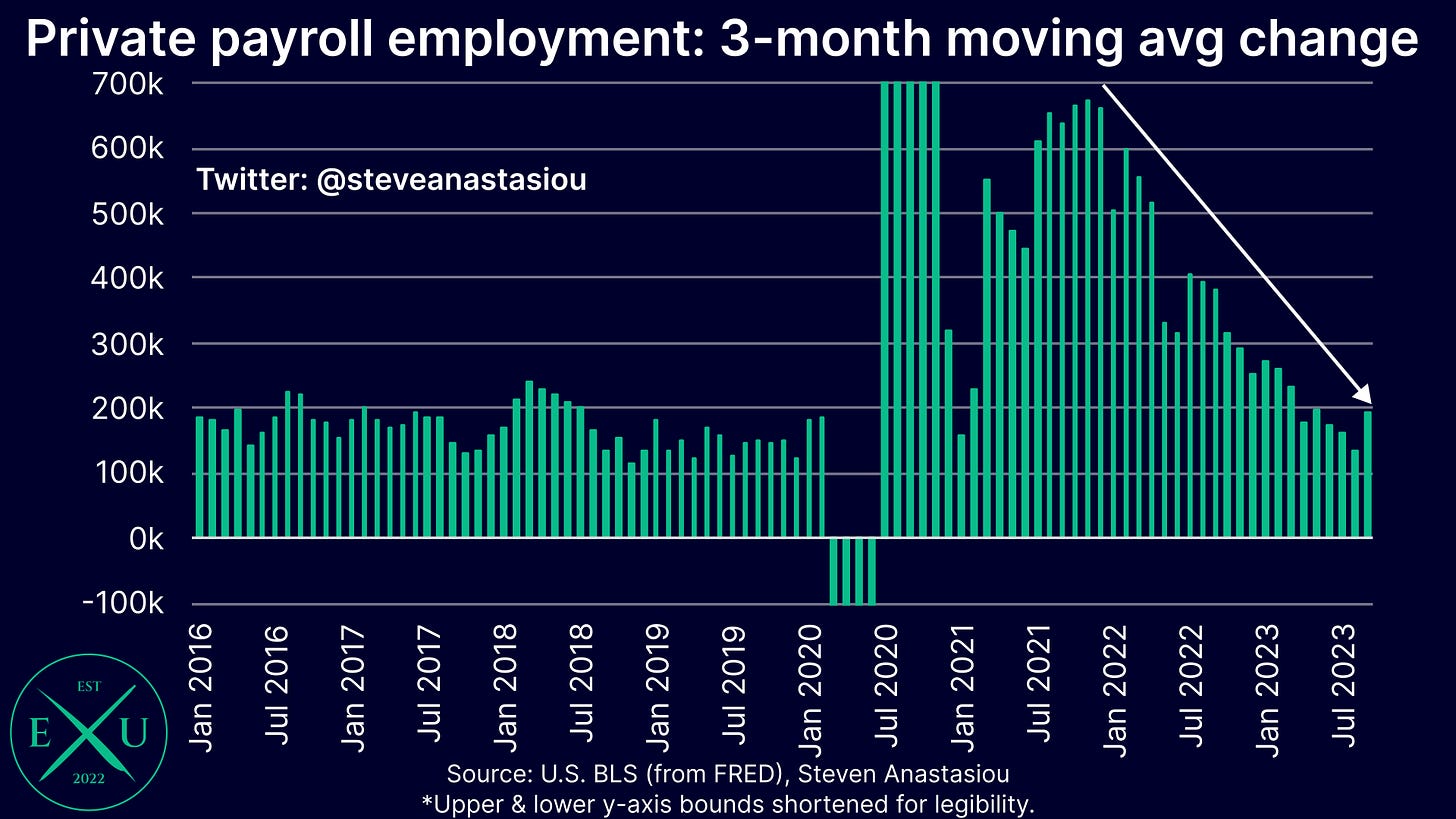

This saw 3-month average growth rise to 266k, marking a material increase from the 189k recorded in August.

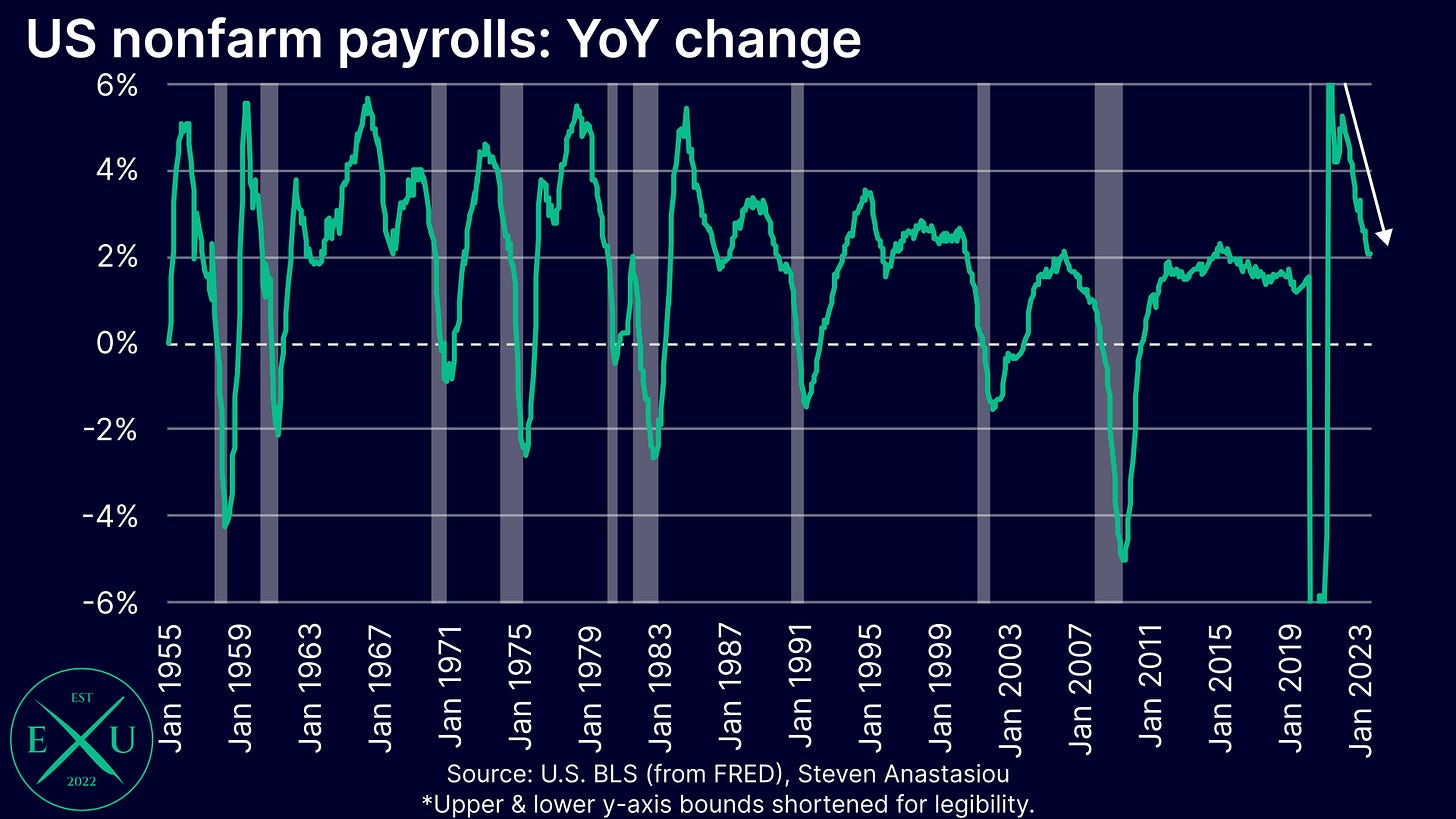

The annual growth rate ticked up slightly to 2.1% in September, from 2.0% in August. While a significant slowing from year ago levels, YoY growth thus remains above its immediate pre-COVID level.

Breaking the overall nonfarm payroll numbers down into their private and government components, we can see that private payroll employment rose by 263k in September, also the fastest pace since January.

3-month moving average growth rose to 195k, up from 136k in August. While a sharp MoM jump, the longer-term trend currently remains a downward one, with growth now in-line with pre-COVID levels.

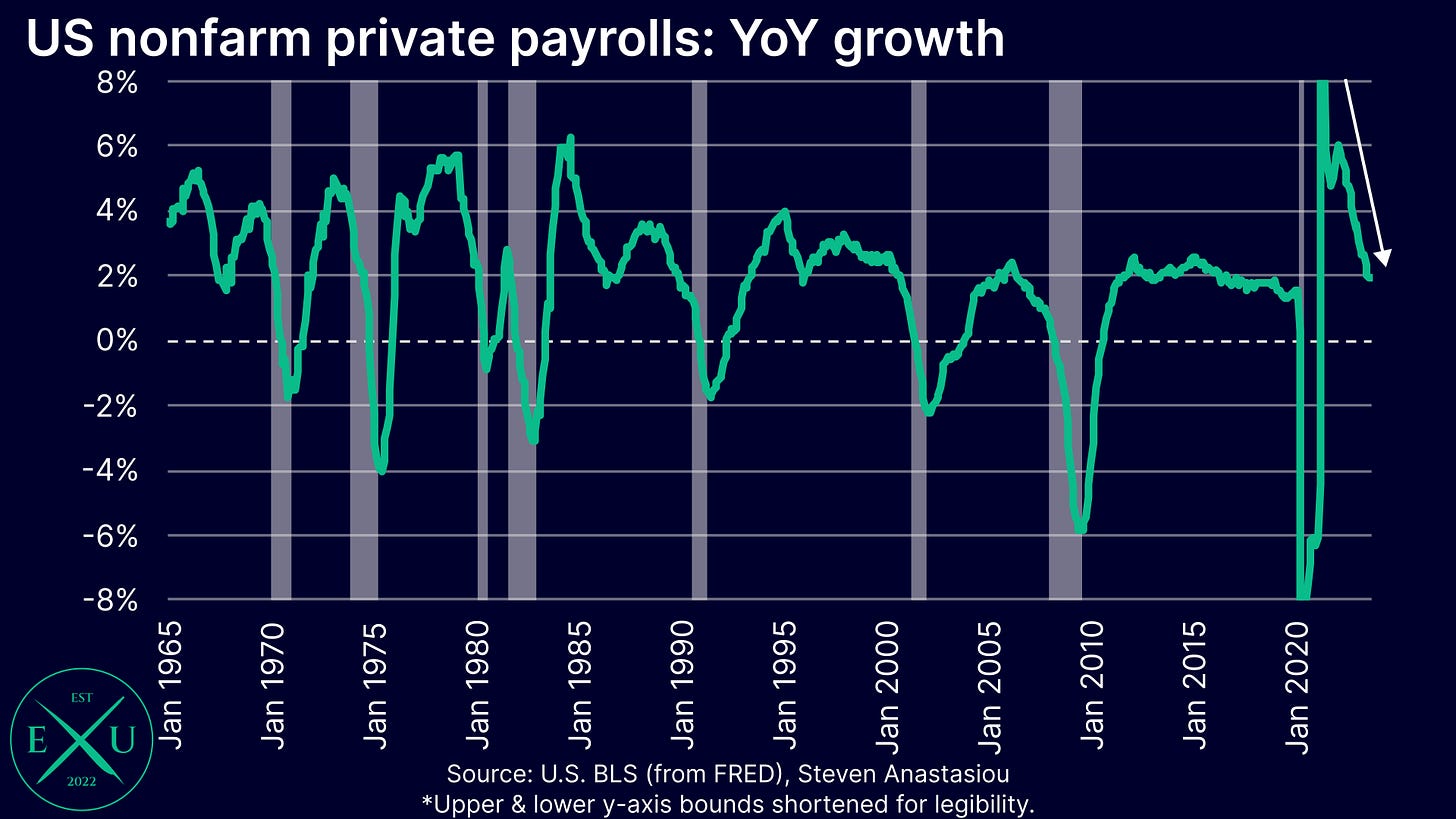

YoY growth fell slightly to 1.9%, down from 2.0% in August, which is also in-line with pre-COVID levels.

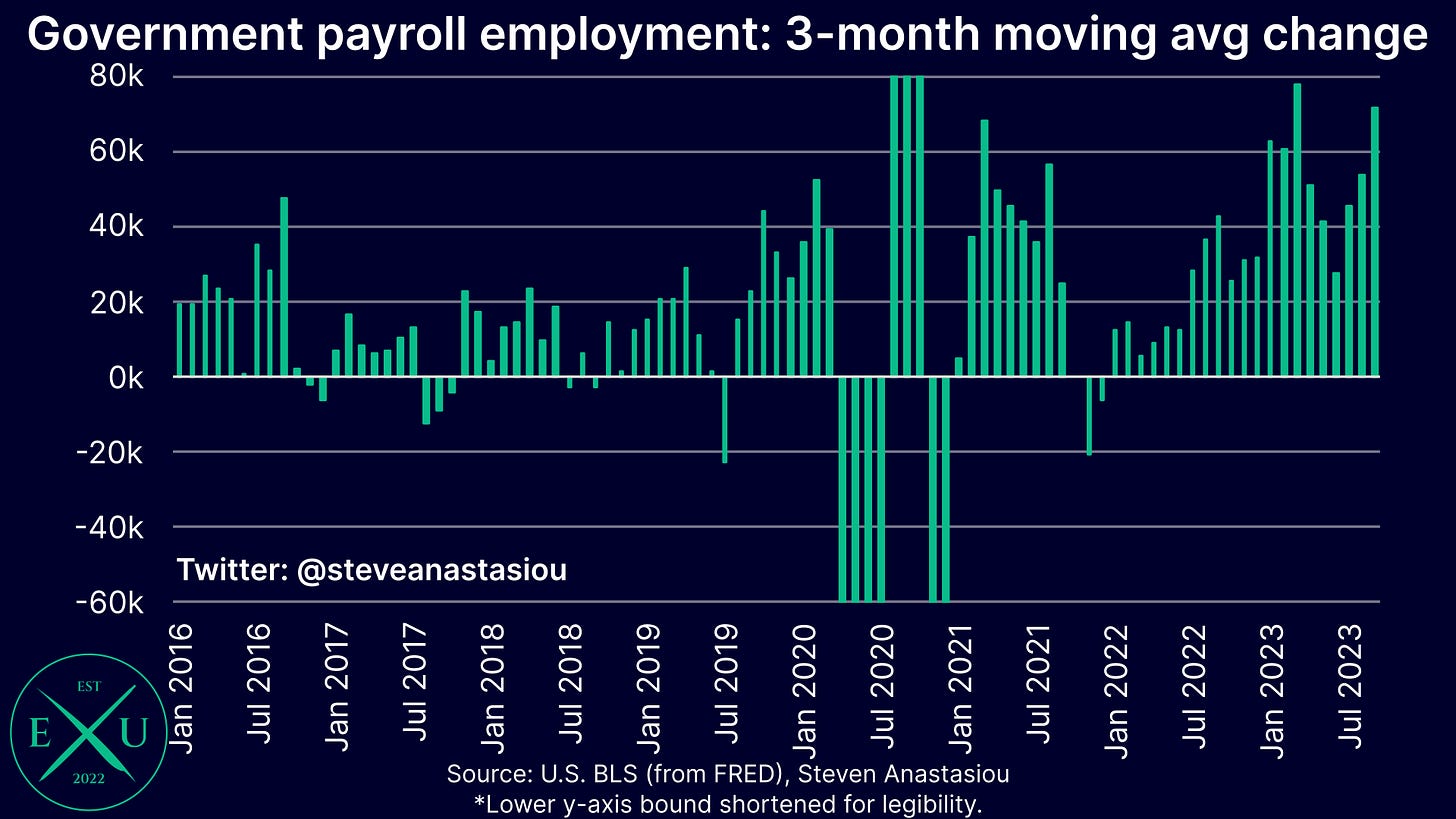

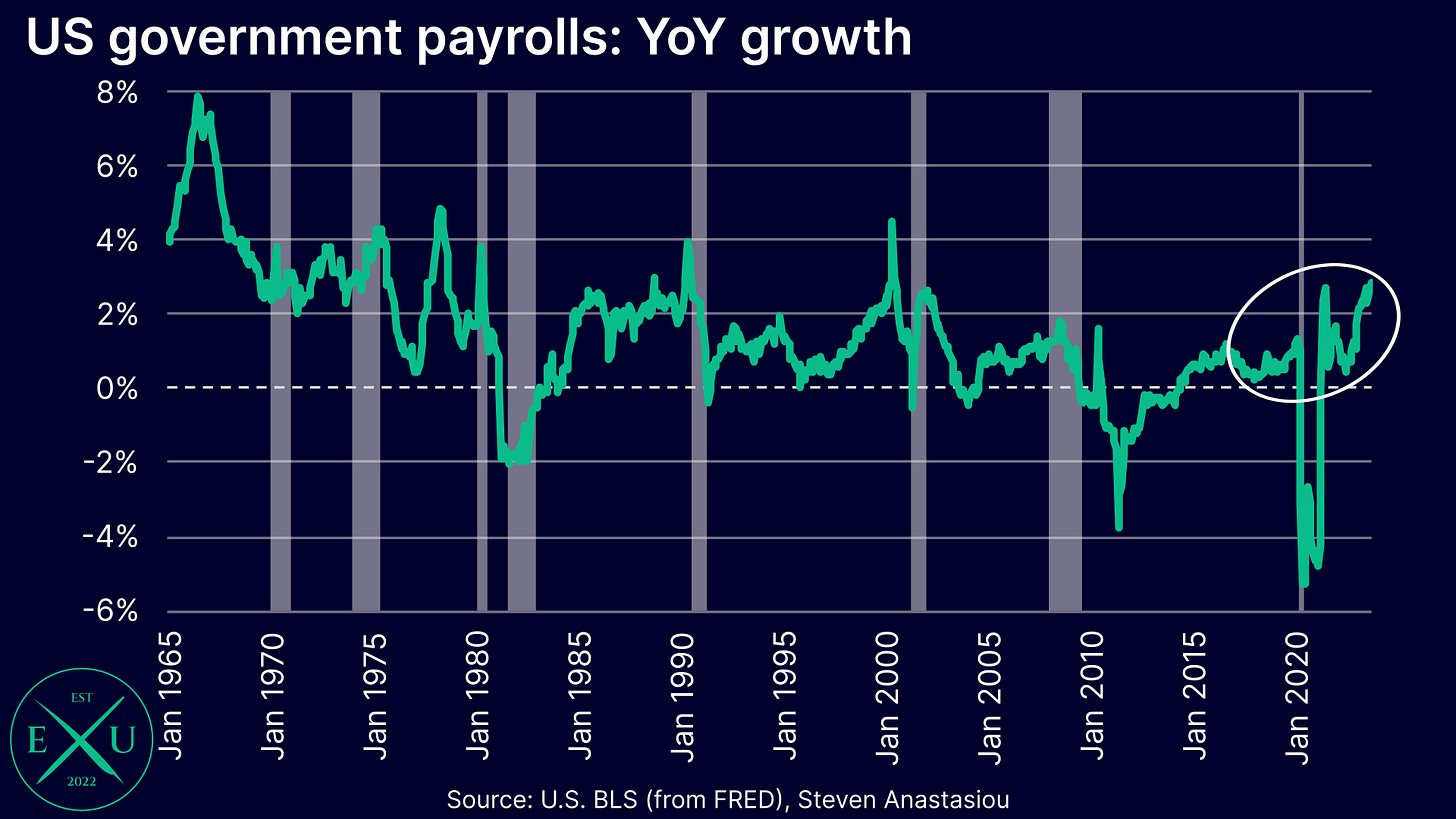

In contrast to the significant moderation in the growth rate of private payrolls that has been seen over the past year, government payrolls continue to record growth at around record post-COVID levels, with another 73k jobs added in September. This takes 3-month average growth to 71k.

On an annual basis, government payroll growth is 2.8%, well above its pre-COVID growth rate, and well above current YoY private payroll growth of 1.9%.

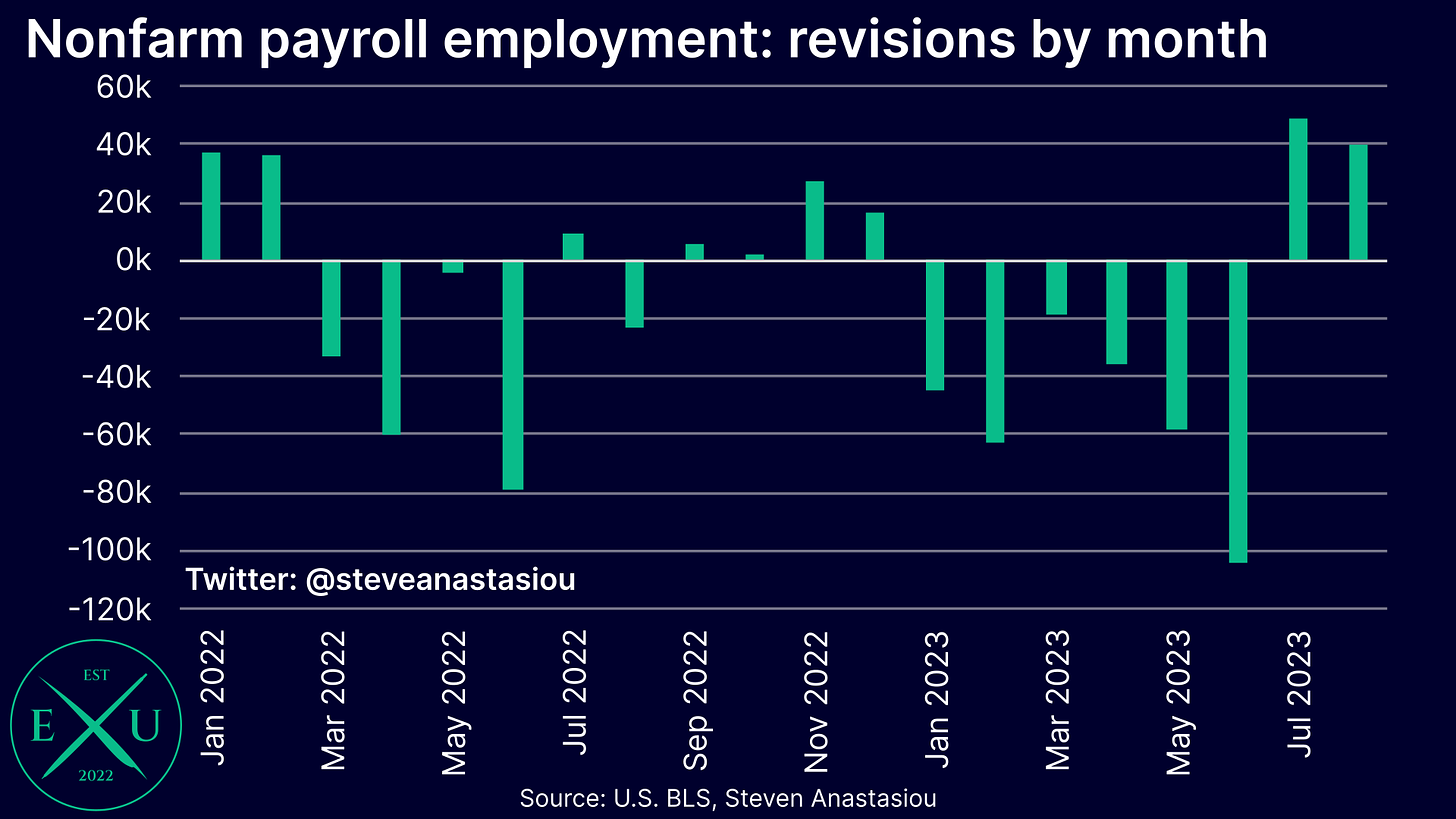

What’s more, for the first time in seven months, net positive revisions were made to a month’s employment estimates, with July’s nonfarm payroll employment revised higher by 49k. The first revision to August’s nonfarm payrolls also saw growth revised up by 40k, with a second revision to follow in next month’s employment data.

A concerning trend emerges in regards to full-time employment — this is one to watch closely

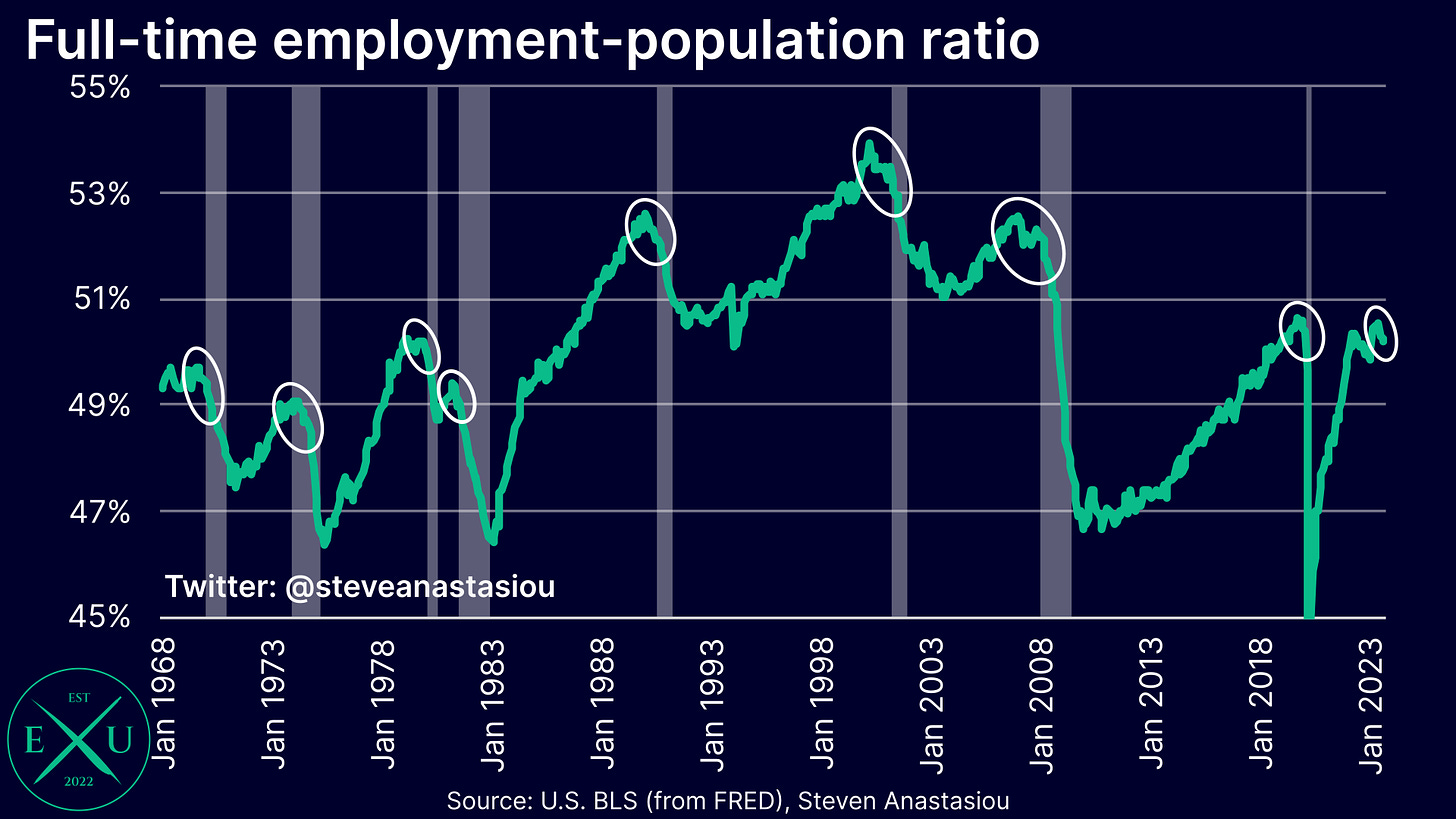

While nonfarm payroll growth rebounded in September (albeit with the strength supported by significantly above average government payroll growth), a concerning trend has emerged in regards to full-time employment, which for the third consecutive month, recorded a decline.

History generally shows that once the full-time employment-population ratio begins to turn lower, a recession is either already at hand, or generally not too far away.

This will therefore be an important indicator to watch closely over the months ahead, to see if declines persist.

Household and establishment survey data are split, but only modestly

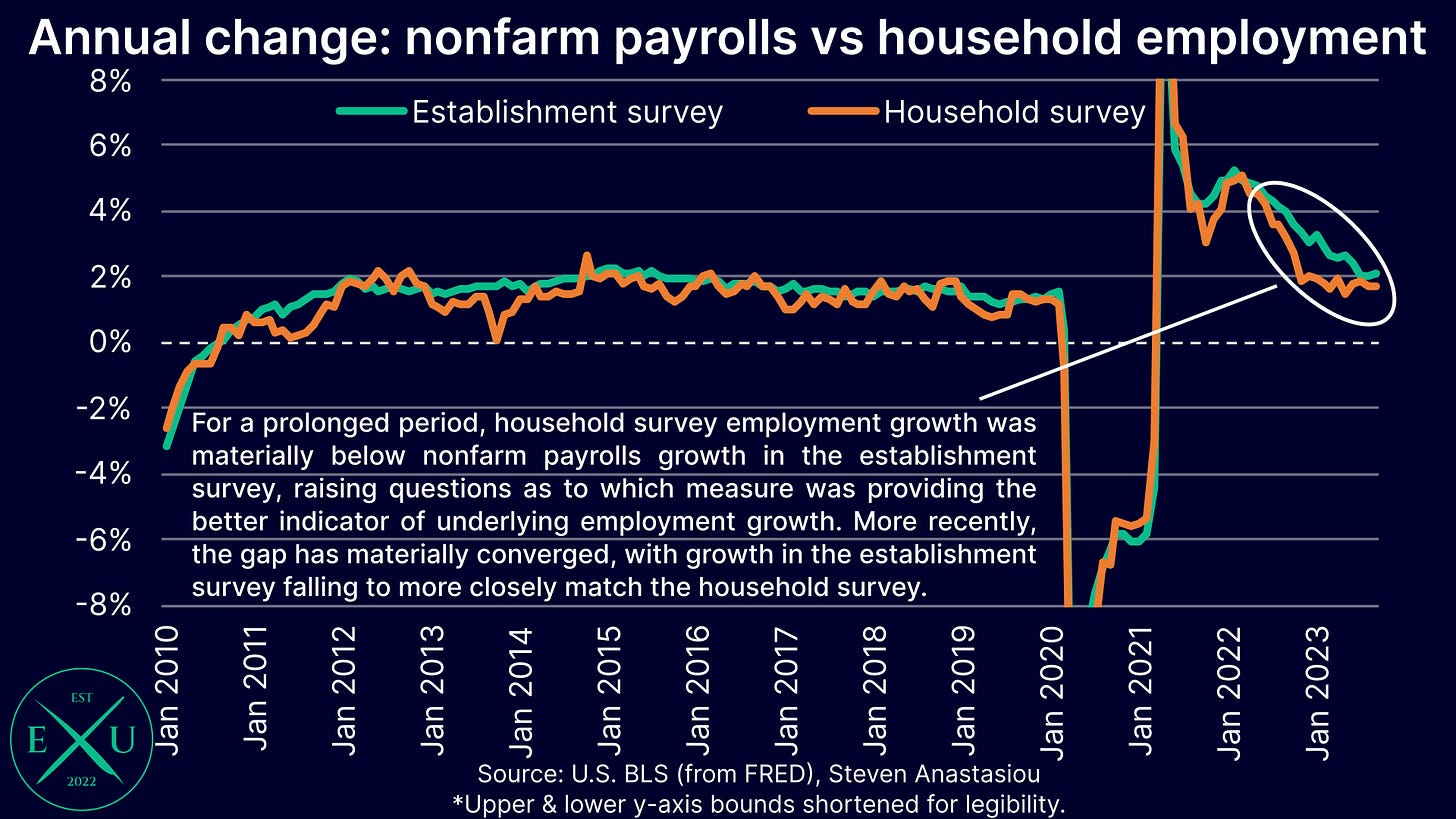

Given that the household survey can be a better indicator of employment growth around significant turning points in the economy, after a major divergence between household and establishment survey employment took place in 2022, many continue to scrutinise any monthly divergence between the two measures of employment — i.e. in September, the establishment survey of nonfarm payrolls rose by 366k, while the household survey of employment rose by just 86k.

Though given that the household survey is particularly volatile, this is not a good way to scrutinise divergences between the two measures.

Instead, one should look at growth on a longer time-frame — while nonfarm payrolls continue to record higher annual growth (2.0%), it is not overly above growth recorded by the household survey (1.7%), with the major gap that had opened up in 2022 having now been materially bridged.

Temporary help services employment falls, but overall cyclical employment rises

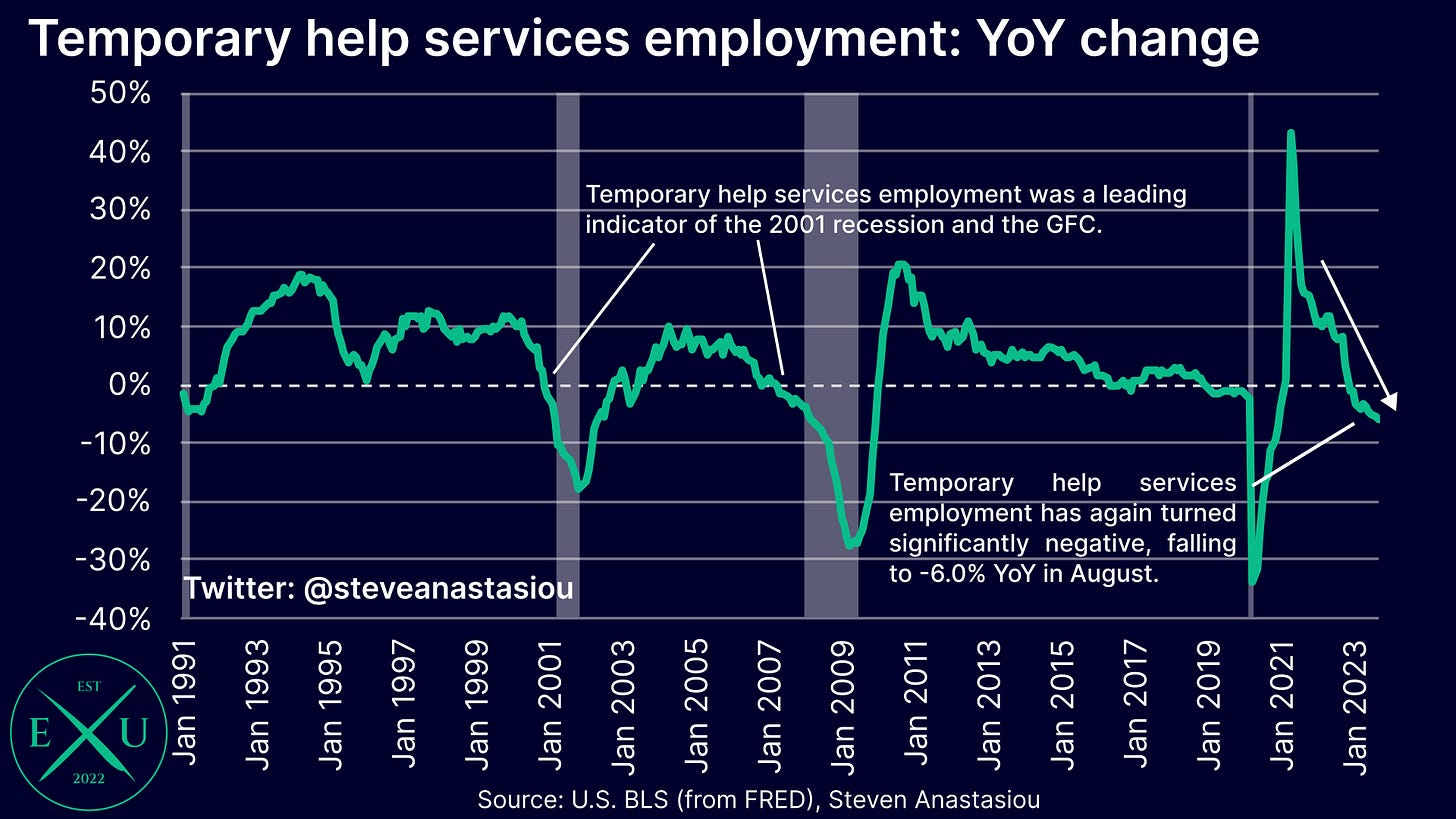

Temporary help services employment, a key leading indicator of the employment market and the wider economy, saw a further decline in September, with YoY growth now -6.0%.

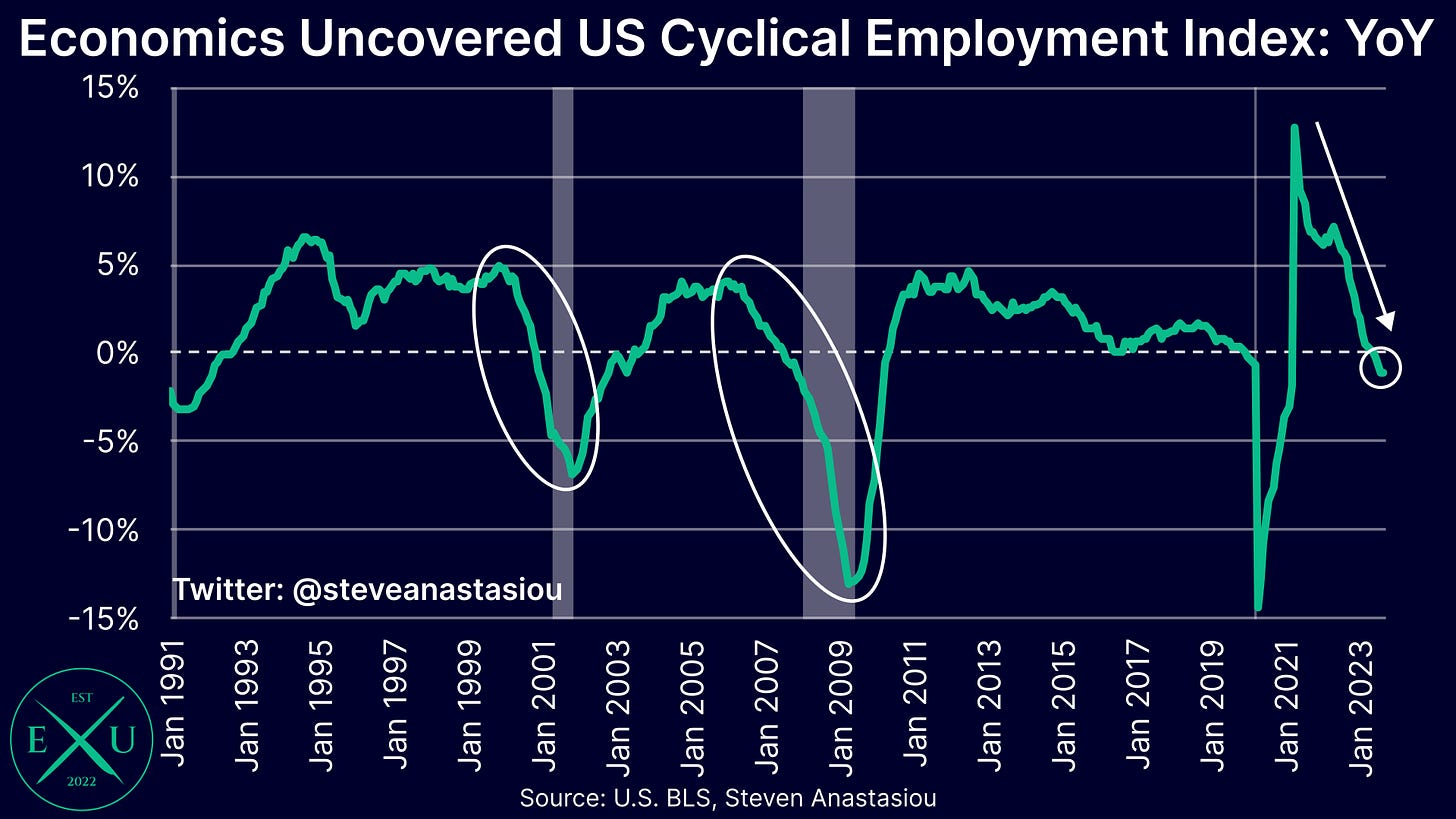

Though in terms of the wider cyclical employment market, the Economics Uncovered Cyclical Employment Index saw an uptick in employment in September, with MoM growth rising by 0.2%. This saw the decline in YoY growth moderate slightly, from -1.1% in August, to -1.0% in September.

Average weekly hours flat, but growth in aggregate hours worked falls

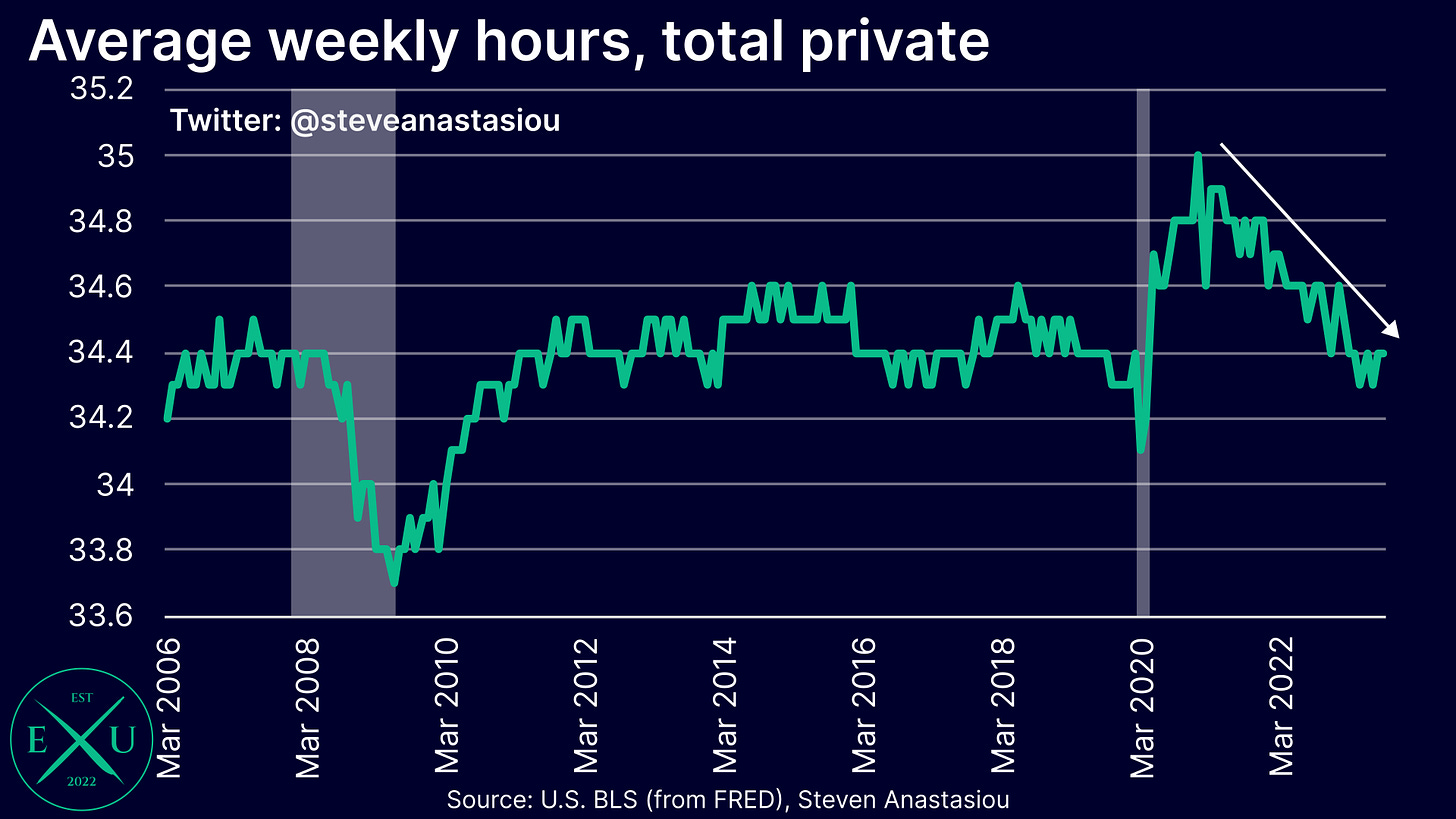

Average weekly hours remained flat in September, at 34.4. While falling significantly from the January 2021 peak, average weekly hours have stabilised and remained between 34.3-34.4 for the past seven months — these are levels that were seen pre-COVID.

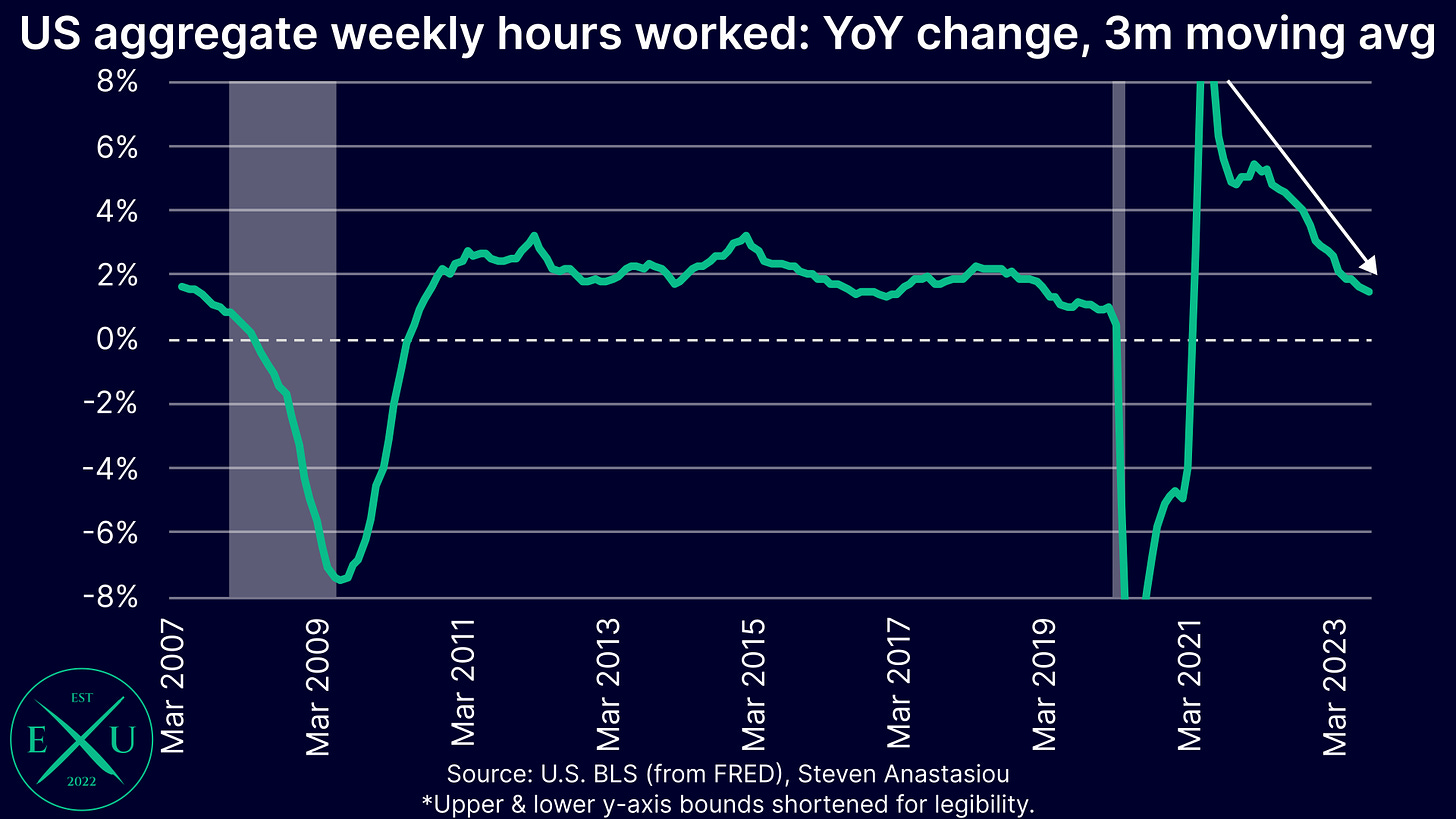

The growth rate of aggregate hours worked has continued to slow, falling to YoY growth of 1.4% on a 3-month moving average basis. This is the slowest rate of growth that has been recorded since March 2021 — though as with most measures, this slowdown comes from very elevated levels, meaning that growth remains slightly above the immediate pre-COVID level.

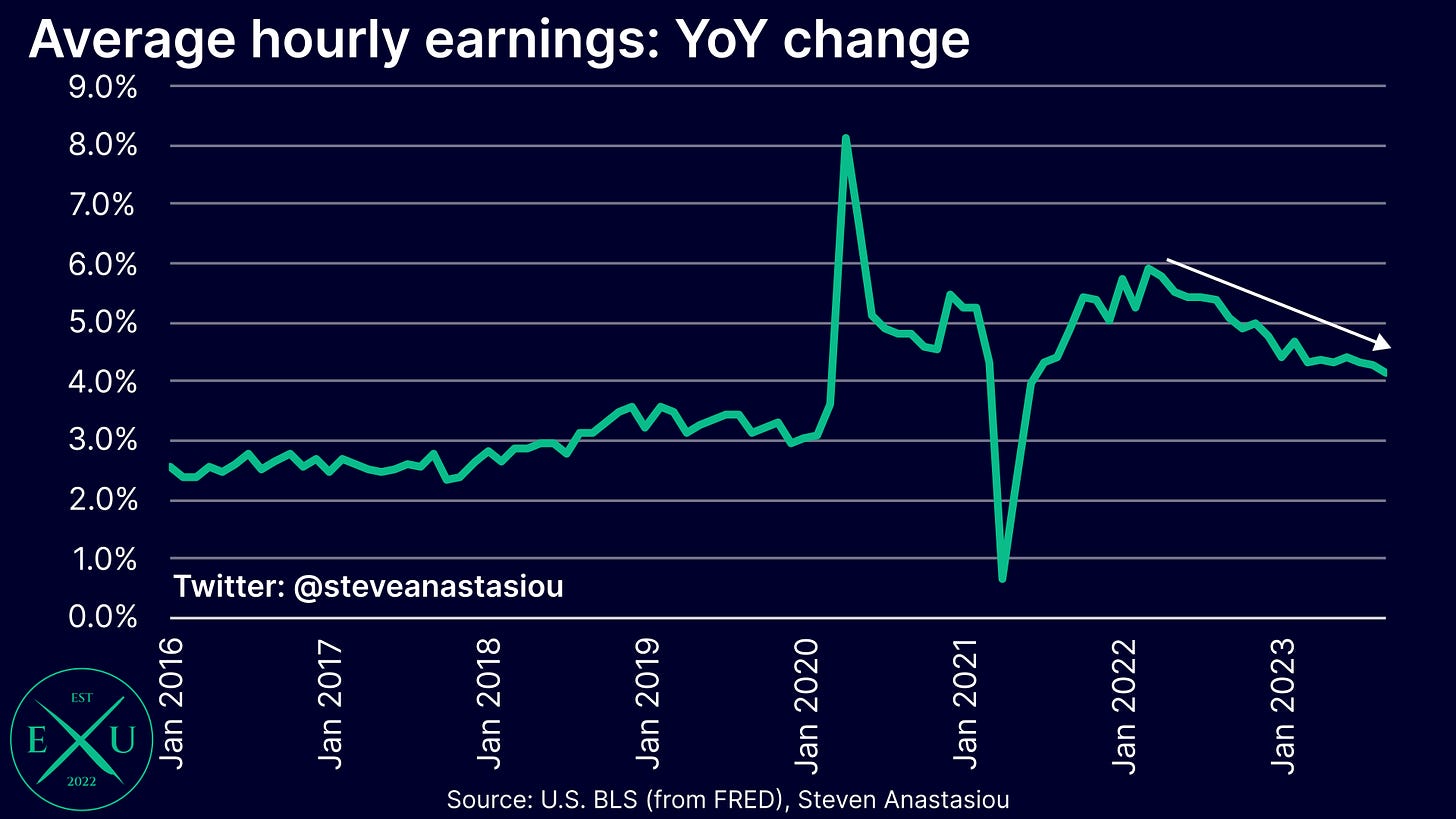

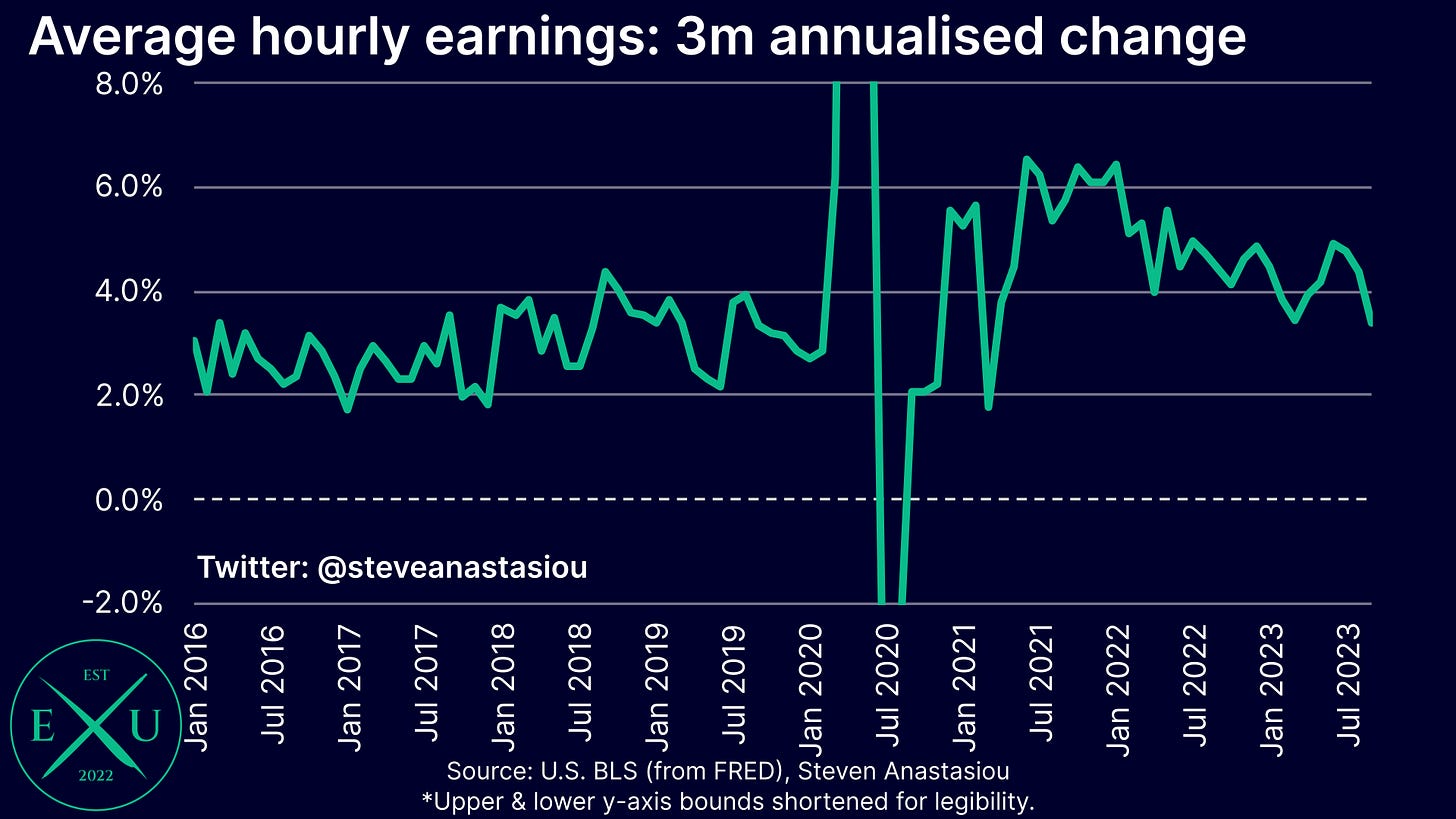

Average hourly earnings growth continues to moderate

In addition to a decline in the growth rate of aggregate hours worked, average hourly earnings also continue to moderate, with YoY growth falling to 4.2% in September, from 4.3% in August.

MoM growth of 0.2% was the lowest that has been recorded since February 2022, with 3-month annualised growth falling to 3.4% — the lowest since March 2021.

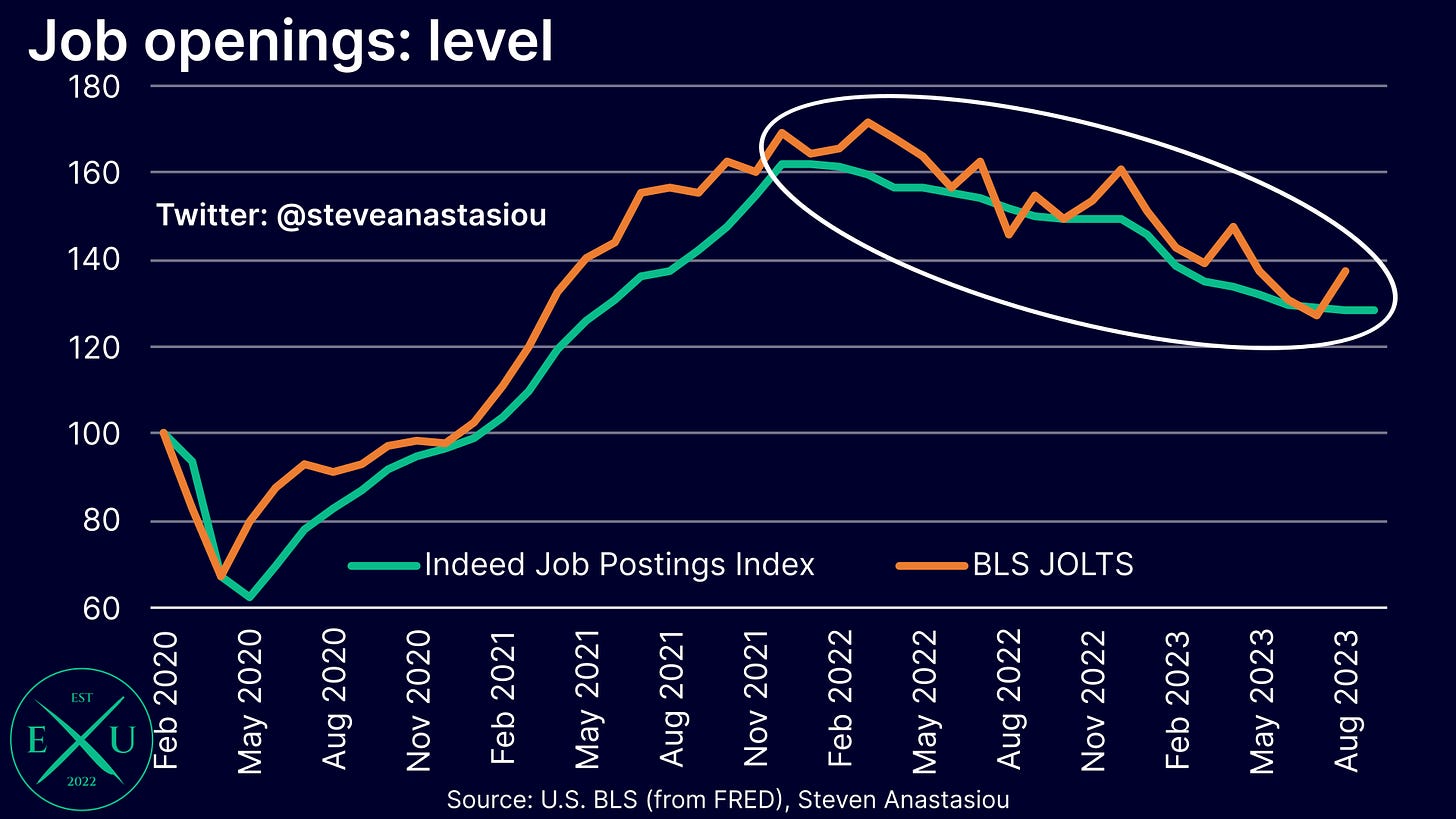

Job openings rise in August, but Indeed doesn’t concur

Looking a little further afar from the BLS’ monthly Current Employment Statistics (CES) report, earlier in the week the BLS released its updated Job Openings and Labor Turnover Survey (JOLTS) for the August period.

The JOLTS report includes an update to job openings data, with the BLS recording an increase of 690k in August. It’s important to note that this data series is particularly volatile and often sees sharp moves higher or lower on a month-to-month basis.

A less volatile and more timely measure of job openings, is the Indeed Job Postings Index, which hasn’t shown an uptick in openings in either August or September.

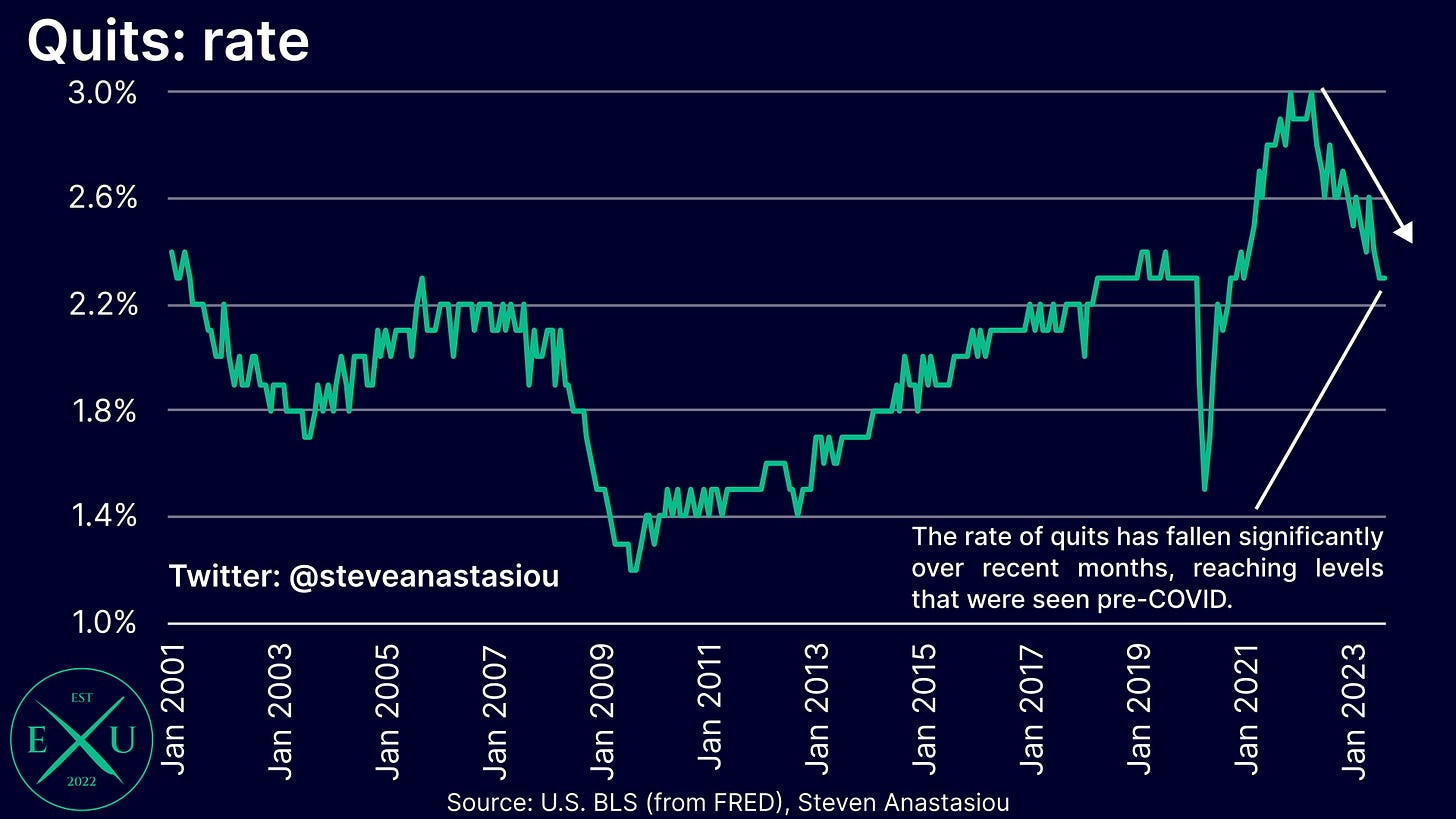

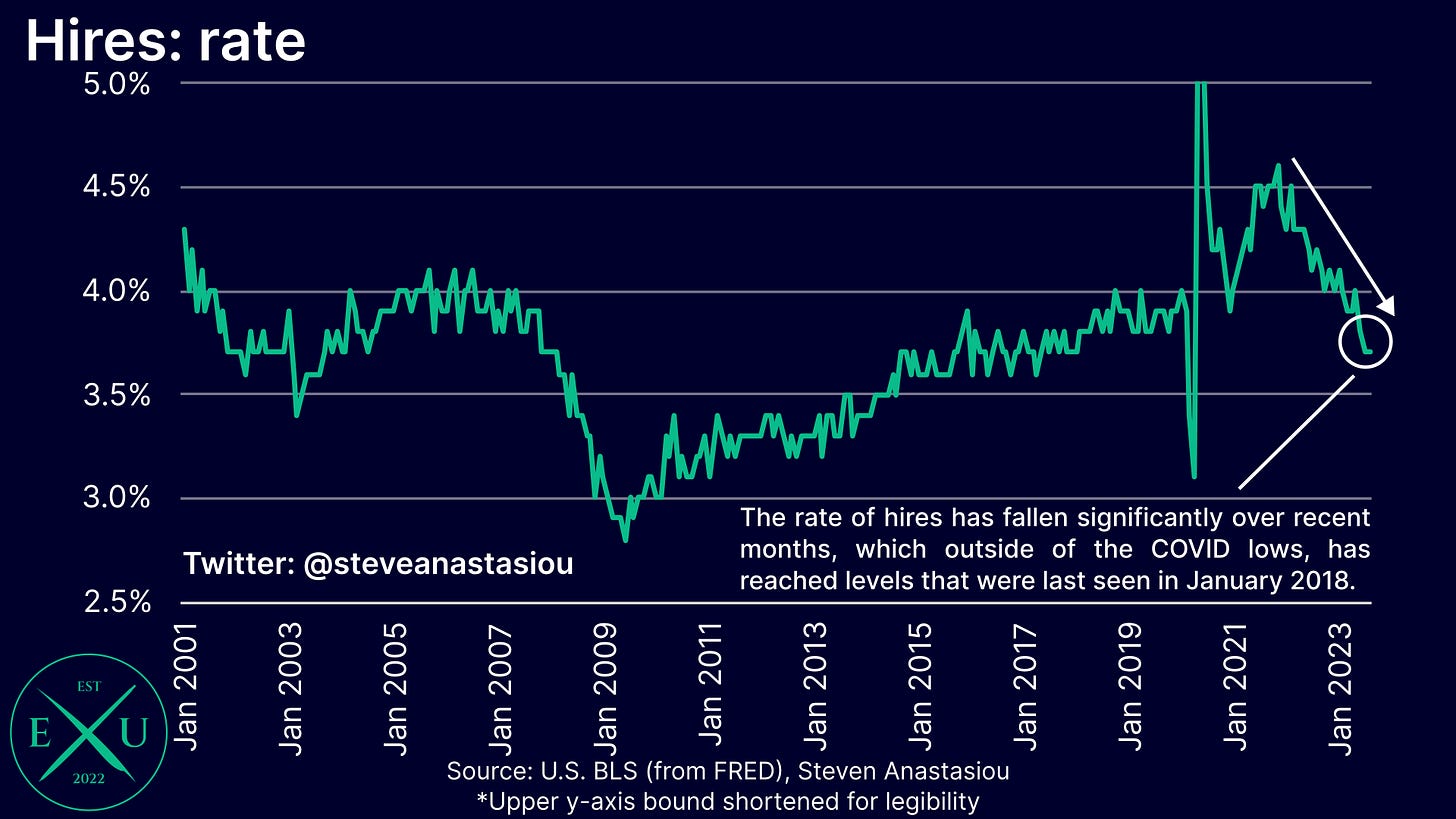

Hires & quits point to a gradual weakening in employment markets

The BLS’ JOLTS report also provides updated data on the rate of hires and quits. While the rate recorded for both measures was flat versus the prior month in September, they have both declined significantly over the past year.

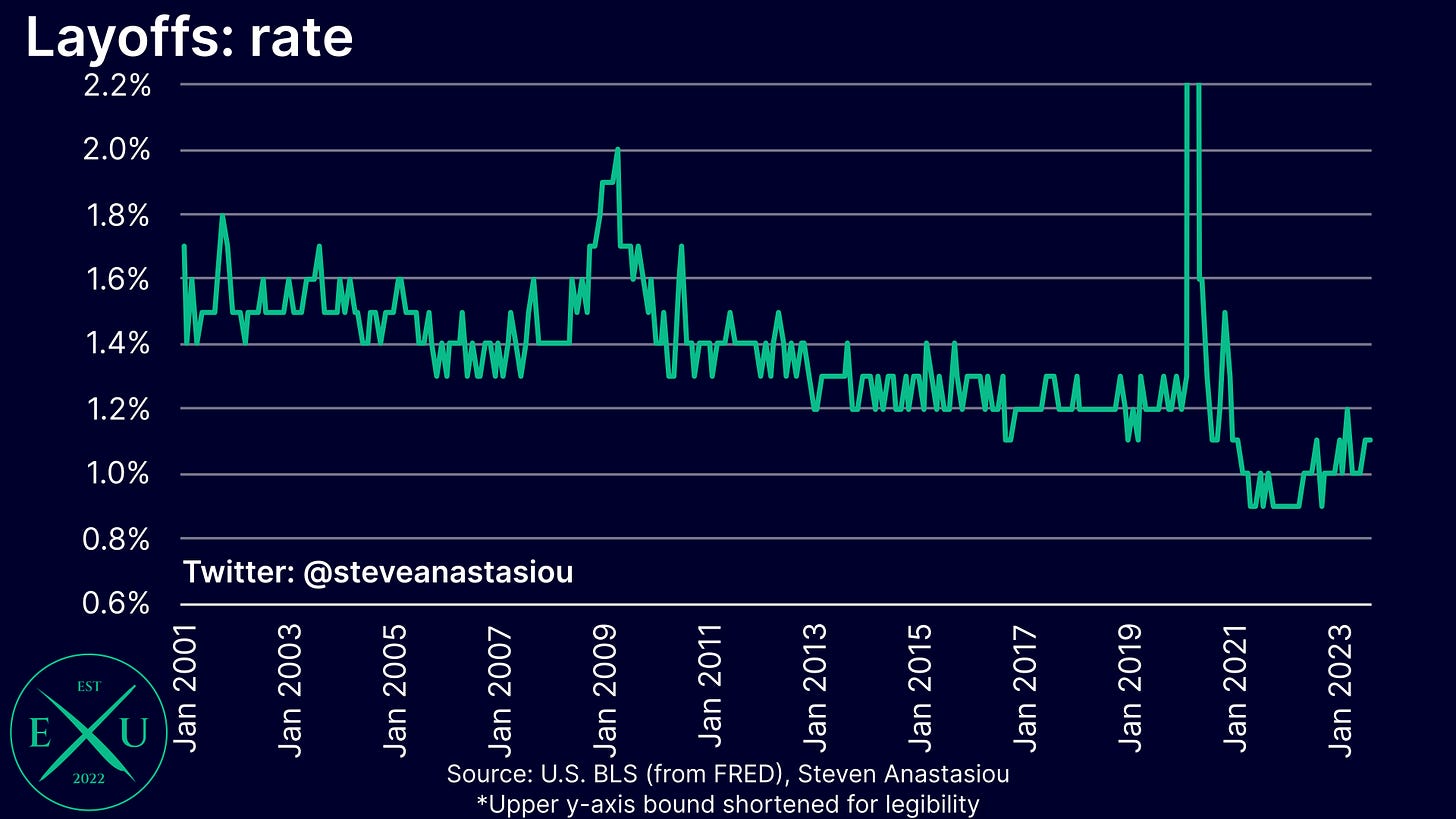

Claims and layoffs show that the weakening remains in its early stages

While the reduction in the rate of hires and quits both point to a moderation in the strength of the employment market, layoffs continue to remain relatively low.

It’s important to note the broader context here — before laying off staff, companies are likely to firstly stop hiring, and then reduce hours, with layoffs taken as a last resort.

As a result, layoffs are generally a lagging indicator of the employment market. This is likely to be particularly true in the current economic cycle, given the prior difficulties that companies had in finding staff to meet an artificial surge in demand, that was driven by the enormous increase in the money supply.

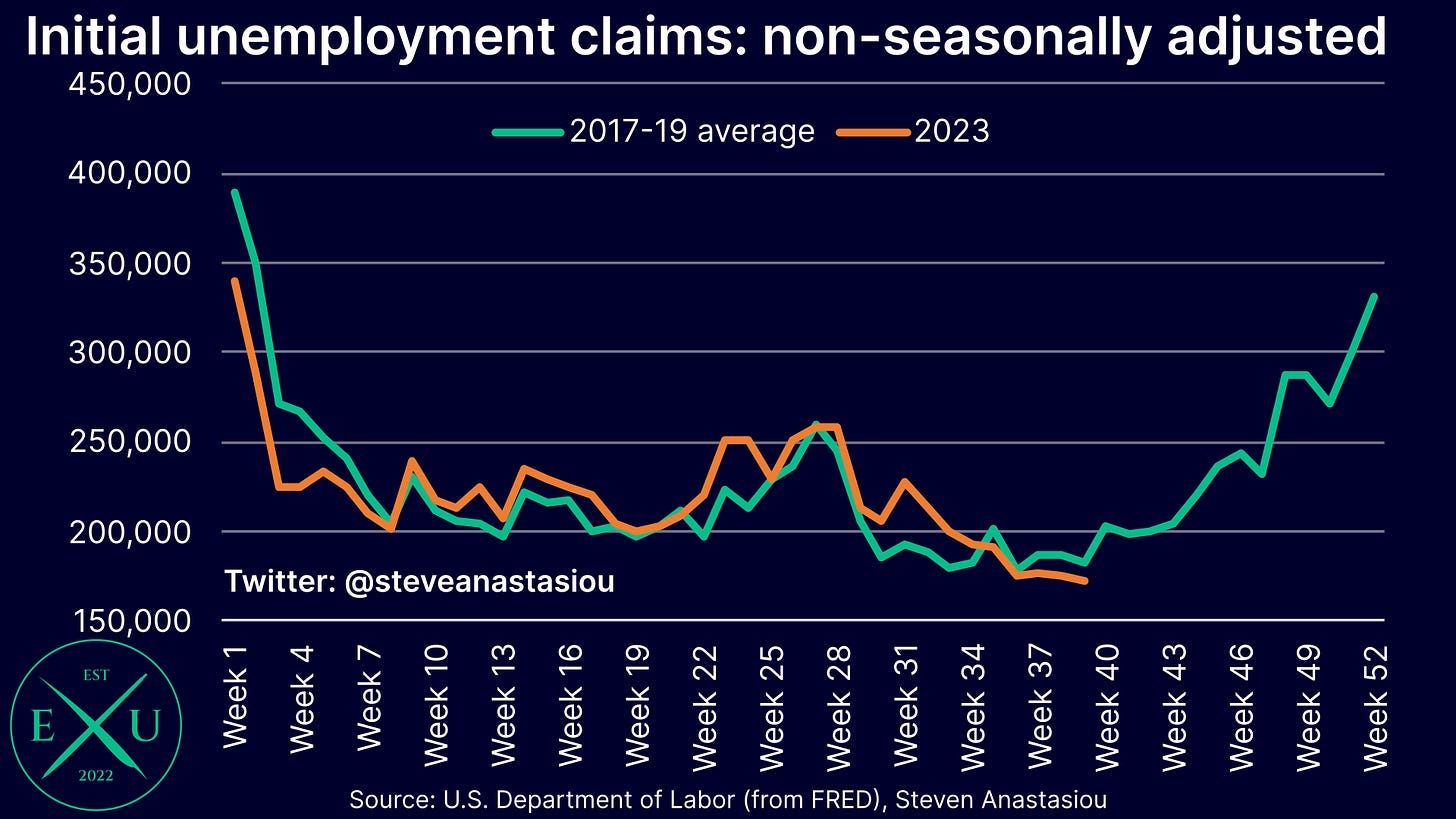

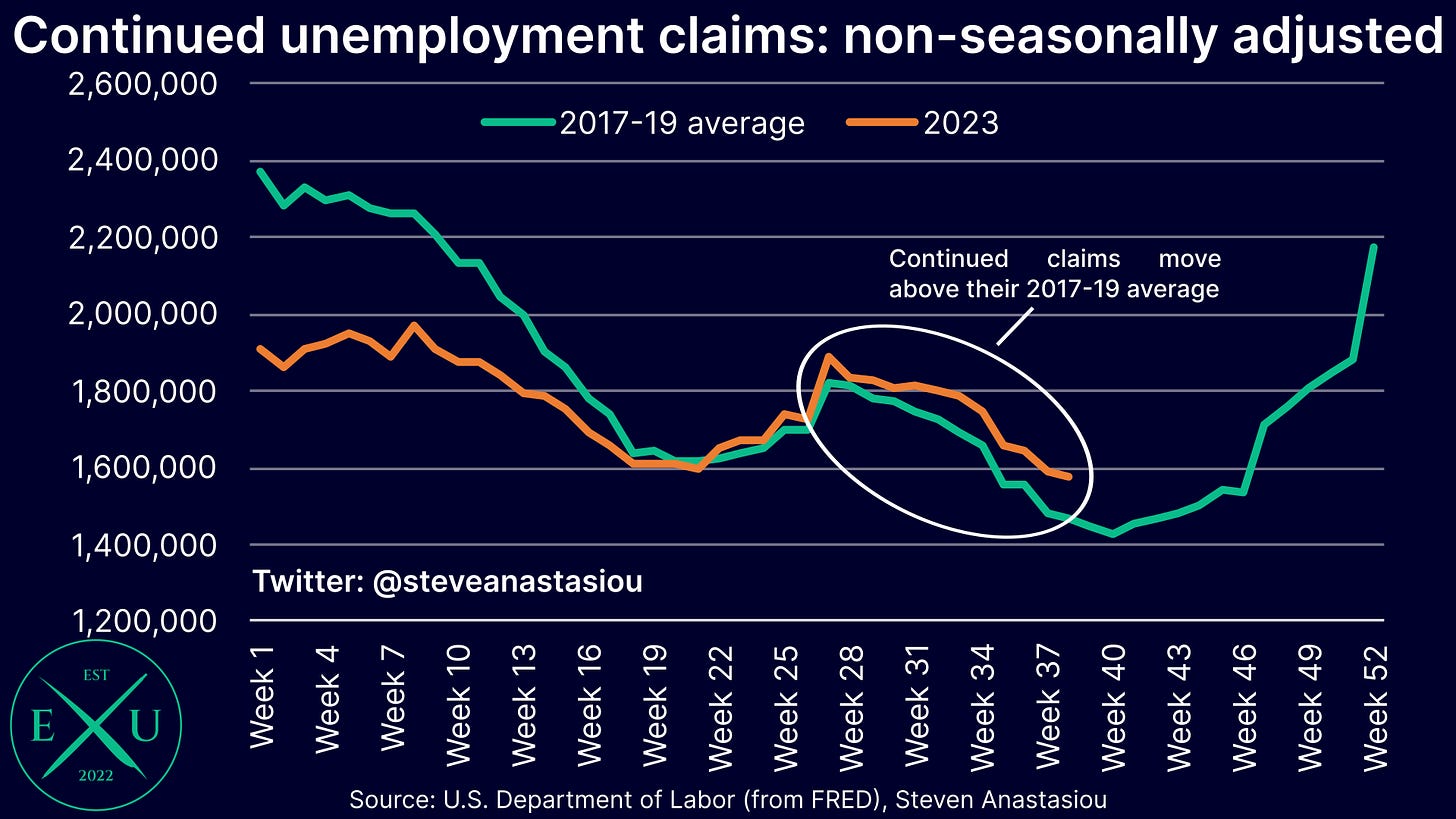

As a result of the relatively low rate of layoffs, initial jobless claims also remain relatively low.

Though continued claims have risen above their 2017-19 average, which is likely on account of the decline in the rate of new hires, which makes it harder for those who do lose their job, to find a new one.

In summary

Taken as a whole, the latest US employment data continues to show that the jobs market remains relatively solid.

The unemployment rate remains relatively low.

The prime-age employment ratio remains above its pre-COVID level and at levels that hadn’t been seen since 2001.

While having seen a material moderation back towards pre-COVID levels, nonfarm payroll employment continues to grow at solid pace, with the 3-month moving average increasing to 266k in September.

Though this isn’t to say that a material moderation in the strength of the employment market hasn’t been seen.

Overall nonfarm payroll growth is being assisted by very high relative growth in government payrolls, which are recording growth that’s well above their pre-COVID level.

Private payroll growth has instead shown a material moderation over the past year — while 3-month moving average growth rose to 195k in September, prior to this jump, 3-month moving average growth had fallen to the lowest level seen since June 2020.

The rate of hires and quits have both moderated significantly. Outside of the COVID lows, the rate of new hires has fallen to levels that were last seen in January 2018.

The slower hiring rate is likely driving the rise in continued claims versus the 2017-19 average.

Both average weekly hours, and the growth rate in aggregate weekly hours worked, have fallen significantly.

Growth in average weekly earnings also continues to moderate, indicating less intense demand from employers for staff, which also corresponds with a falling rate of quits.

Though in-spite of the many signs of a weakening employment market, this largely only represents the first stage of a slowdown, where as opposed to clearly reaching recessionary levels, most metrics have simply fallen back to around their pre-COVID levels — remember, employment growth was previously running at very strong levels on account of the artificial stimulus that also drove high inflation.

Nevertheless, in addition to the Fed’s significant ongoing tightening, which is likely to put further downward pressure on the economy over time, there are warning signs within the employment data that point to a further weakening of the employment market and the wider economy.

Firstly, full-time employment has declined for 3 consecutive months. Historically, a sustained decline in the level of the full-time employment-population ratio has signaled that a recession is either at hand, or likely to soon occur, irrespective of the level of this ratio.

Secondly, temporary help services employment, a leading indicator of overall employment and the economy, has continued to decline, with YoY growth falling to -6.0% in September.

Thirdly, the Economics Uncovered Cyclical Employment Index, a wider measure of cyclical employment and another leading indicator of overall employment and the wider economy, has been YoY negative for four consecutive months.

Given these warning signs, and the broad slowing that has been seen, in employment metrics, it’s reasonable to maintain a cautious outlook in light of the Fed’s aggressive tightening. A cautious outlook is likely to be particularly appropriate as the federal government begins to significantly increase its coupon issuance, which will, in isolation, increase pressure on long-term government bond yields, and in-light of QT, draw capital from the private sector in order to fund it.

Ultimately, as things stand right now, a comprehensive analysis of the latest jobs data shows a US employment market that remains in relatively solid shape, but amidst the broader trend of moderating employment growth, warning signs from leading employment indicators, and the backdrop of aggressive Fed tightening, there are many reasons to suggest that a further weakening in the US employment market, likely lies ahead.

Thank you for reading my latest research piece — I hope it provided you with significant value.

Should you have any questions, please feel free to leave them in the comments below!

In order to help support my independent economics research, please consider liking and sharing this post and spreading the word about Economics Uncovered. Your support is greatly appreciated and goes a long way to helping make Economics Uncovered a sustainable long-term venture that can continue to provide you with valuable economic insights for years to come.

If you haven’t already subscribed to Economics Uncovered, subscribe below so that you don’t miss an update.

Thanks, that's very interesting !