US PCE Inflation Update: A bumpier ride ahead

With the first two phases of the disinflationary cycle now largely complete, lagging services price growth is likely to see the road to 2% get bumpier over the months ahead.

Executive summary

After three consecutive months of relatively modest MoM growth, monthly core PCE inflation accelerated to its highest level since January 2023.

While elevated levels of seasonality may have played a part, the size of the spike in services prices (including on an ex-energy and housing basis), will add to concerns about the inflation outlook.

As discussed in detail below, the key concern that stems from elevated services price growth is not the prospect of a second wave of high inflation, but instead, how long it will take for inflation to return to 2%.

Given that the first two phases of the disinflationary cycle have now largely completed, the moderation in YoY growth is likely to now become slower and bumpier — this may lead to a resurgence in inflation concerns at some point over the months ahead.

The ultimate impact that this phase of the disinflationary cycle has on the outlook for interest rate cuts, will depend on how the employment market evolves over the months ahead.

Given that the M2 money supply remains relatively constrained, and more leading components of the price cycle continue to show that the disinflationary cycle remains intact, any potential resurgence in inflation concerns over the months ahead, is likely to dissipate as the disinflationary cycle strengthens over time.

The combination of a potential short-term uplift in inflation concerns, but continued disinflation over the longer-term, could create several opportunities for investors over the months ahead.

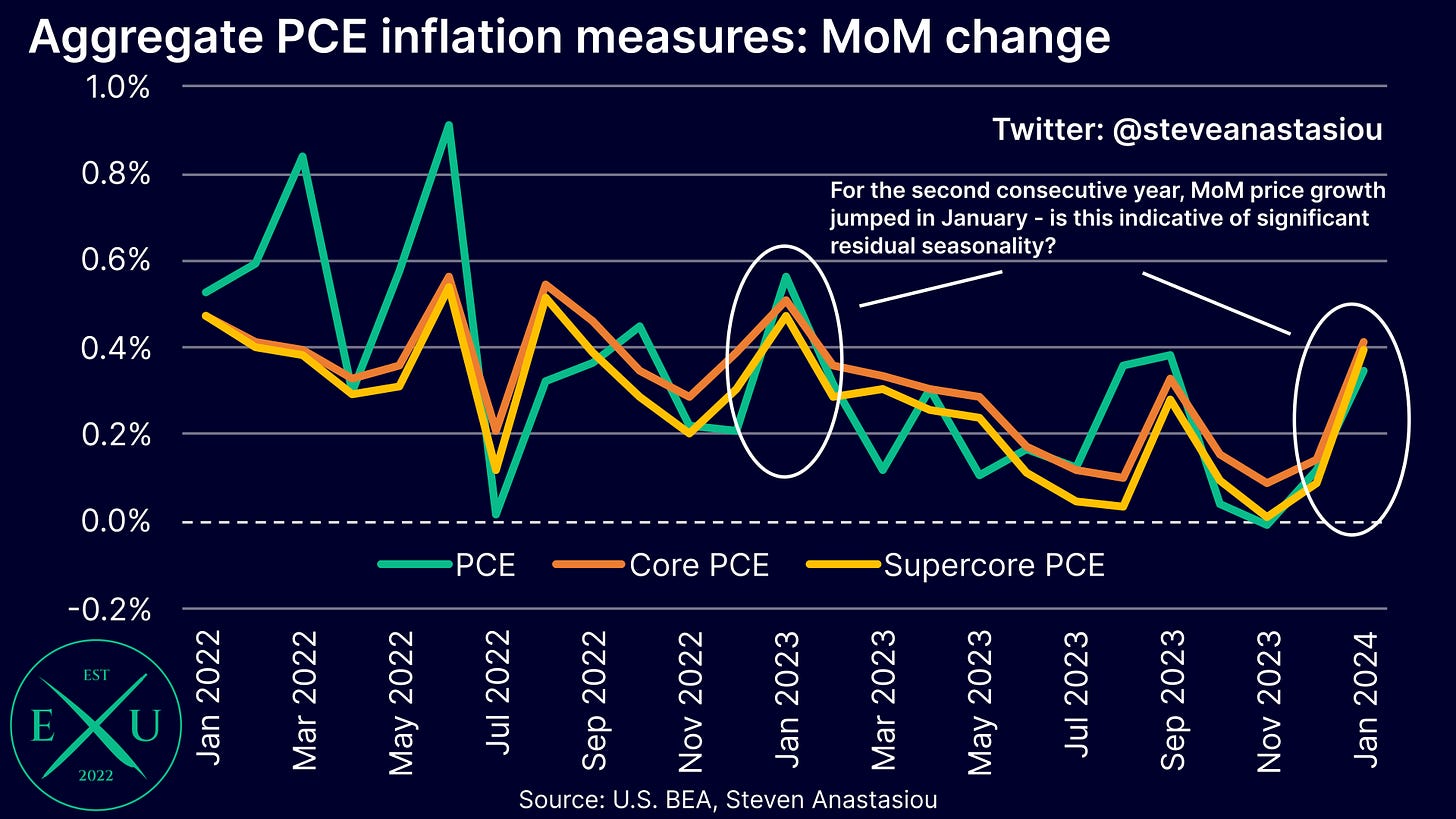

MoM growth jumps to the highest level seen in many months — as it did in January 2023

After three consecutive months of relatively modest MoM growth, PCE Price Index (PCEPI) growth accelerated in January.

On a headline basis, MoM growth rose 0.34%, its fastest rate of increase since September.

On a core basis, growth rose 0.42%, its fastest rate of increase since January 2023.

On a supercore basis (defined here as the core PCEPI less the lagging housing component), prices rose 0.39%, which was also the fastest pace of growth seen since January 2023.

The current jump in MoM growth thus largely reflects what was also seen in January 2023, indicating that this latest jump may be reflecting elevated levels of new year seasonality.

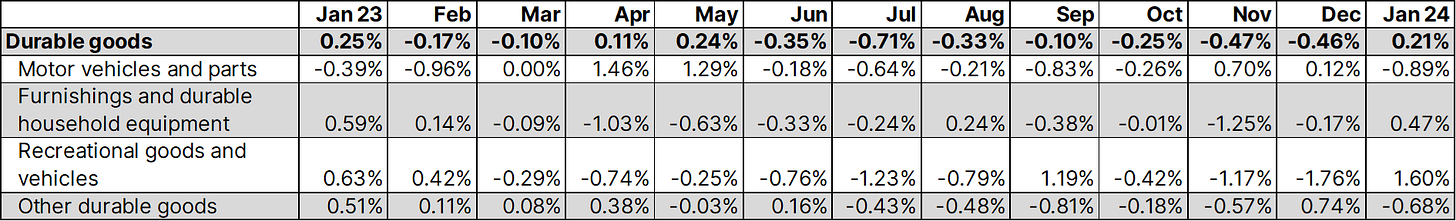

Breaking down the monthly data, durable goods prices recorded their first MoM increase since May 2023, rising by 0.21%. The increase was driven by the furnishings and durable household equipment, and recreational goods and vehicles categories.

Meanwhile, the motor vehicles and parts, and other durable goods categories, both recorded large MoM declines.

For the fourth consecutive month, nondurable goods prices fell, with prices declining by 0.38%.

In addition to a significant decline in gasoline and other energy goods, clothing and footwear prices declined for a fifth consecutive month, while the other nondurable goods component fell for a third consecutive month.

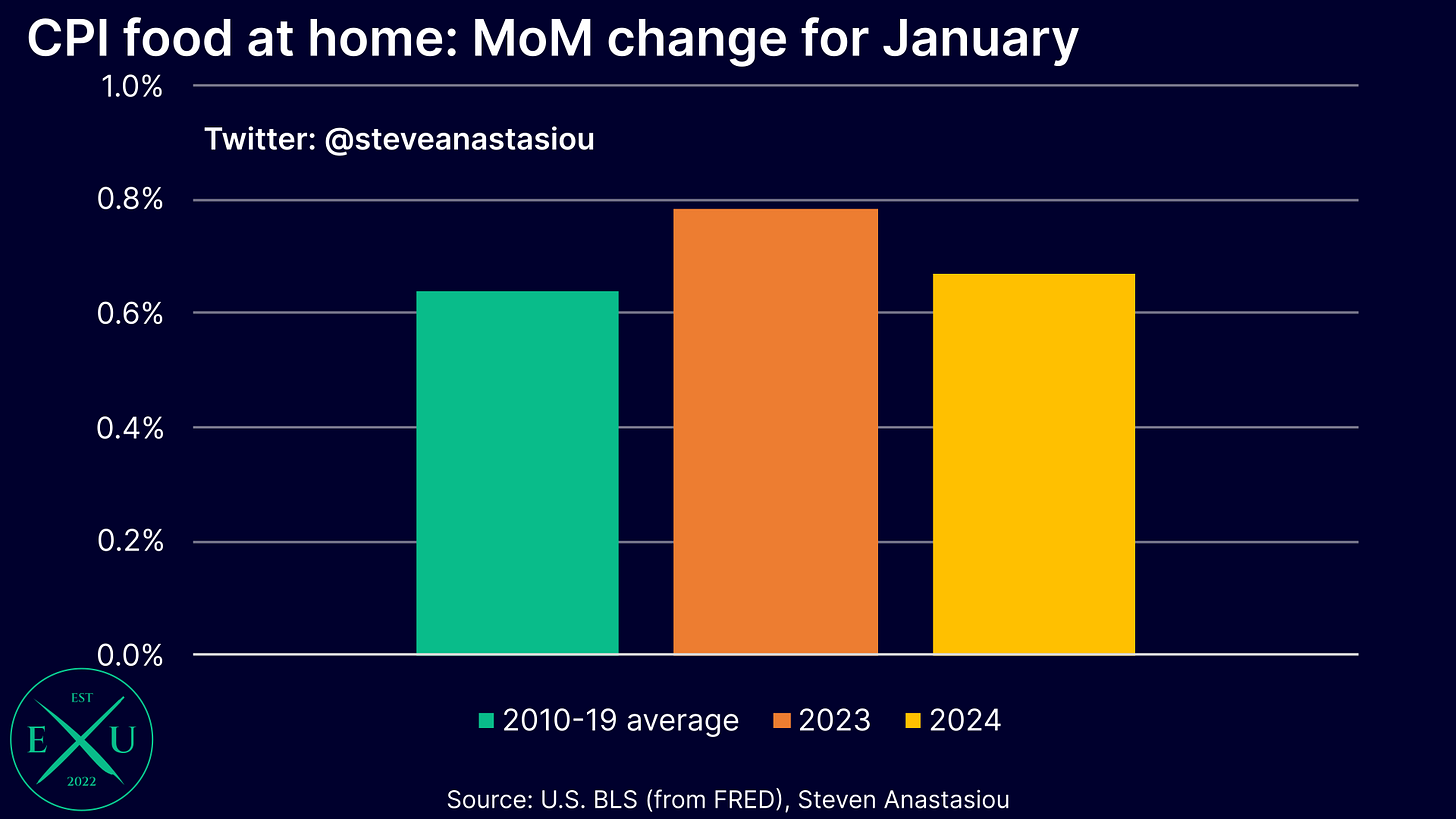

While there was a significant MoM increase in prices for food & beverages for off-premises consumption (0.47%), there’s evidence to suggest that this is largely a quirk of the seasonal adjustment process.

To illustrate, a large MoM increase in CPI food at home prices was also recorded in January (0.37%). Despite this significant seasonally adjusted increase, on a non-seasonally adjusted basis, CPI food at home price growth increased 0.67%, which was effectively in-line with its historical (2010-19) average for January, of 0.64%.

With durable goods prices in a broader deflationary trend, and nondurable goods prices seeing their own deflationary trend over recent months, the key concern from January’s PCEPI report came from services prices, which rose by 0.60% MoM, marking the largest increase since June 2022.

Excluding energy services and the lagging housing component, prices also rose by 0.60% MoM, marking the largest increase since December 2021.