US Jobs Report Preview: growing potential for a significant negative surprise

With most believing that the US labour market remains strong, a host of weak/recessionary indicators point to the potential for a negative surprise - which could have material market ramifications.

While the consensus view is that the US labour market remains in strong shape — which is supported by strong nonfarm payroll growth over the past two months, a relatively low unemployment rate, and relatively low initial claims — there’s also a growing list of indicators that point to significant weakness in the US employment market.

Looking back to last month’s employment report, the host of weak/recessionary data points included: household employment growth plunging over the last several months; a significant decline in full-time employment; hours worked plunging to GFC levels; a material increase in underemployment from its cycle trough; falling average weekly earnings; and a continued YoY decline in cyclical employment.

In addition to these weak/recessionary indicators from the last employment report, we now also have an additional batch of employment data from a range of providers, that points to a further weakening of the US employment market — some of these data points suggest that overall private sector job growth is set to fall to a pace that is barely above 0.

Despite these weak/recessionary indicators, given the general belief that the US jobs market remains in solid shape, consensus expectations are for nonfarm payroll growth of 200k in February, and for the unemployment rate to remain unchanged at 3.7%.

While the host of weak/recessionary employment indicators certainly doesn’t guarantee that February’s jobs report will reveal a significant weakening in nonfarm payroll growth, which may instead remain solid for several more months, given consensus expectations and the many weak/recessionary contradictions in the employment data, I believe that risks are firmly skewed to the potential for a significant negative surprise.

Given consensus expectations, and the shifts in interest rate cut expectations following January’s inflation data, a weak jobs report would likely have significant implications for the rate cut outlook and asset prices.

Before delving into the potential market implications in greater detail, let’s first analyse the more recently released employment indicators.

In contrast to the recent uptick in nonfarm payrolls, a suite of employment indicators point to a continued weakening in the US labour market

Let’s start firstly with job openings.

While the BLS’ latest JOLTS survey showed little change in job openings in January, Indeed’s more timely measure of job openings (which the BLS’ measure tends to closely track over time) points to a more material weakening in January and February.

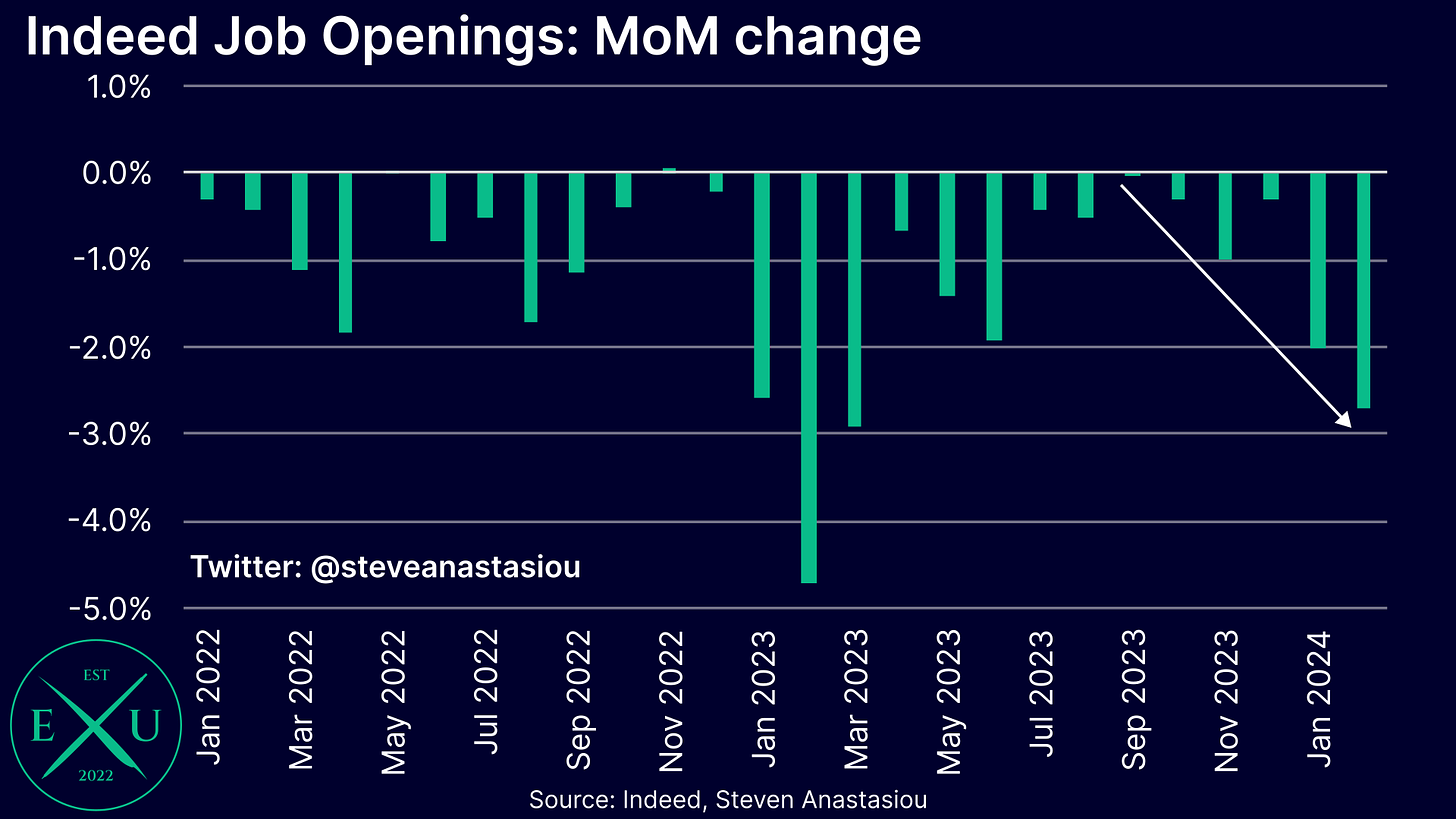

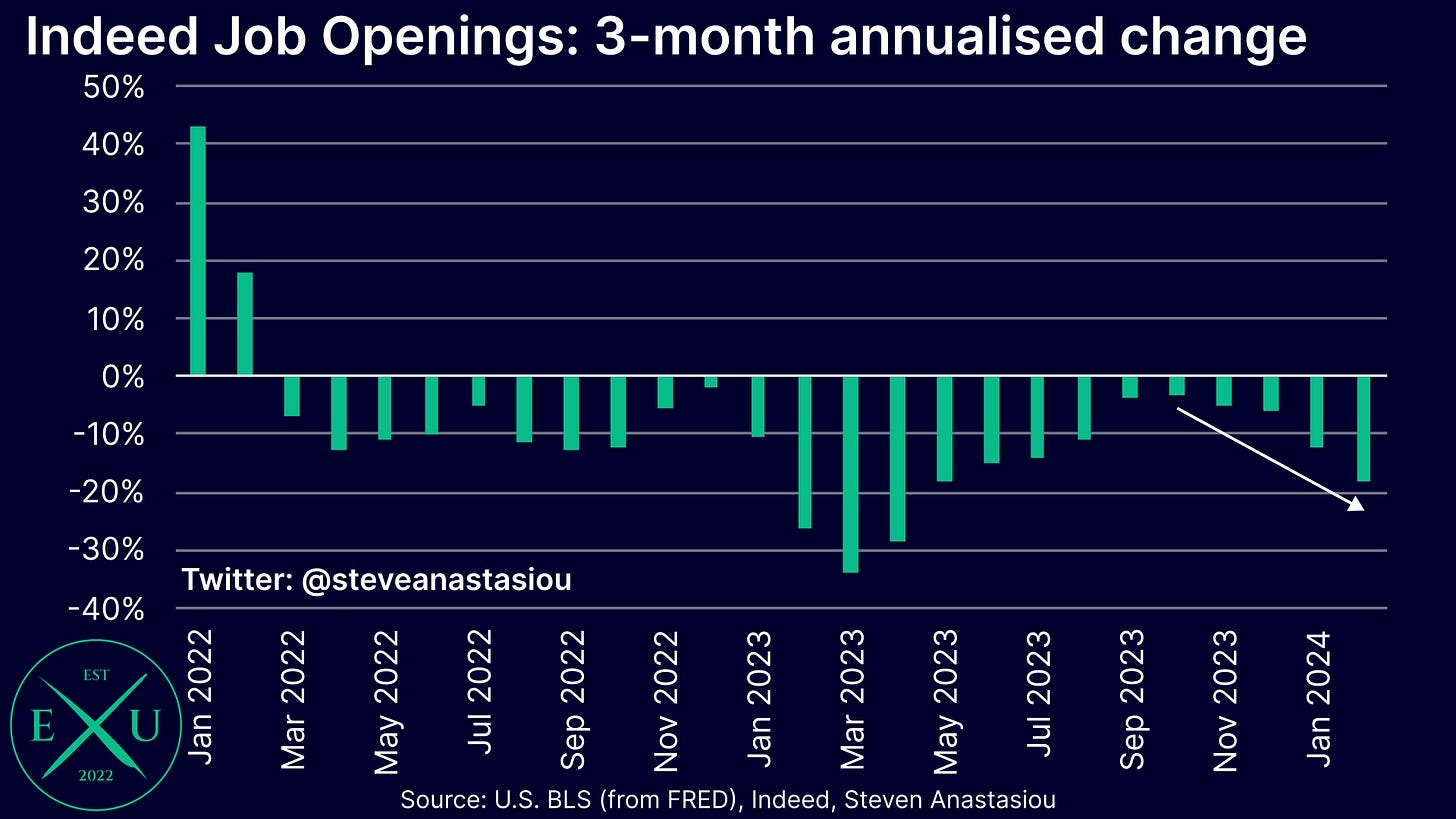

After seeing the pace of the decline in job openings moderate significantly in 2H23, Indeed’s measure of job openings declined by 2.0% in January and 2.7% in February.

This has seen the 3-month annualised decline reach 18.4% in February, up from just 3.3% in October.

While the latest JOLTS report didn’t show a material change in job openings, it did reveal a further decline in the rate of quits, with the moderation from its cycle peak pointing to a major reduction in the strength of the US jobs market, and a likely significant further reduction in wage growth over the coming quarters.