US economy enters a concerning phase as recessionary employment indicators continue to pile up

There's a strong argument to be made that the latest US jobs data is broadly recessionary, increasing pressure on the Fed to deliver a major reduction in interest rates over the months ahead.

This report has been compiled under a new formatting approach, which aims to provide a more concise review and analysis, saving you time and making the content much more easily digestible.

In addition to a review of the key information from the latest jobs report — including the numerous recessionary indicators — this report contains an analysis of the related implications for monetary policy and financial markets.

The full report is available to premium subscribers. A premium subscription can be purchased for just $10/month or $99/year (equivalent to just $8.25/month) — all prices in USD.

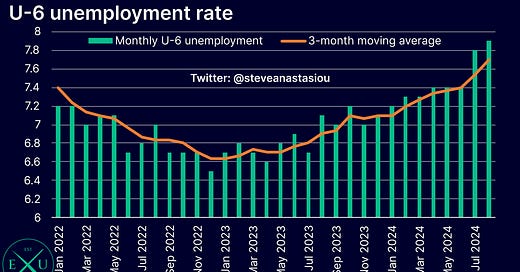

Unemployment rate drops, but the underemployment rate hits a new cycle peak as job growth slows sharply

After jumping to 4.3% in July, the unemployment rate edged down slightly to 4.2% in August. Nevertheless, the 3-month moving average unemployment rate rose to 4.2%, its highest level since November 2021.

The U-6 unemployment rate, which is a broader measure that incorporates underemployment, rose to 7.9%. This is now 1.4 percentage points above its cycle trough and the highest level seen since October 2021. The 3-month moving average rate rose to 7.7%.

The additional increase in the underemployment rate comes after major downward revisions were made to nonfarm payroll growth in June (-61k) and July (-25k), with the 3-month moving average of nonfarm payroll growth falling to just 116k in August. Furthermore, these significant downward revisions do not incorporate the preliminary benchmark revision, which showed that job growth in the year to March 2024 was overestimated by an average of 68k per month.

The picture is even worse when the focus is kept on private payrolls, which saw 3-month moving average growth of just 96k — excluding the COVID recession, this is the lowest rate of growth since June 2012.

This saw 3-month annualised growth fall to just 0.86%, which excluding the COVID recession, is the lowest rate of growth seen since March 2010.

Recessionary indicators continue to mount

Given the ongoing weakening in nonfarm payroll growth — which the preliminary benchmark revision suggests is being overstated — and increases in the unemployment rate, the number of recessionary indicators stemming from US employment data are continuing to grow.

The latest key indicator to suggest that the US economy could already be in a recession, is the YoY change in household survey employment, which turned YoY negative in August.

A further six key recessionary indicators have now also been triggered, being: