Retail sales, jobless claims, manufacturing data and the NAHB housing survey

A slew of US economic data was released Thursday, with a mix of economic signals contained within the various data points — read on below for all of the key points.

Retail sales post strong growth in July, but the broader trend remains consistent with a slowdown

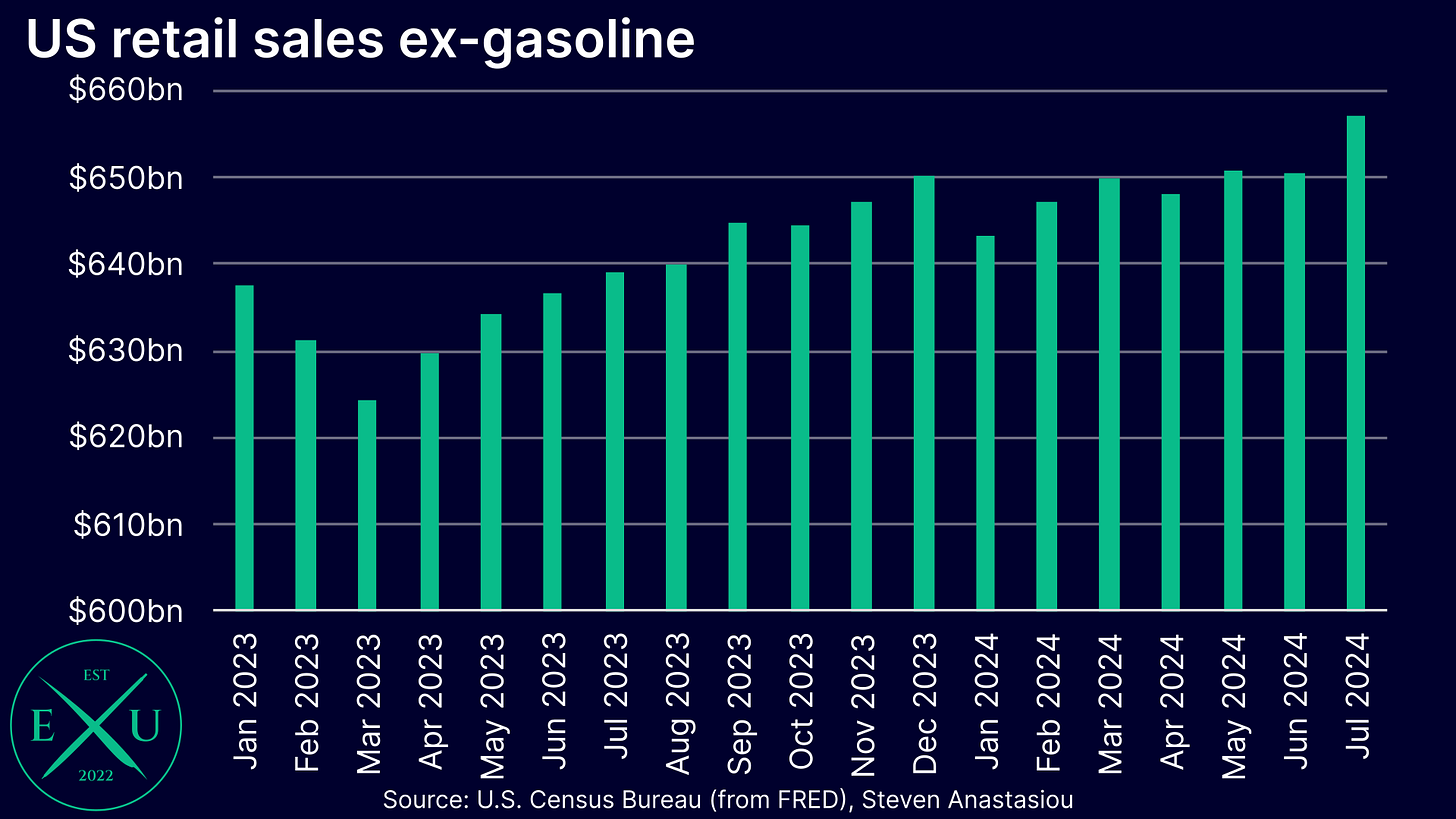

Given the volatility of gasoline prices and that retail sales data is a nominal data series, to gain a better understanding of underlying growth, I prefer to look at retail sales on an ex-gasoline basis.

In July, retail sales ex-gasoline rose 1.0% MoM, the largest increase since January 2023.

After remaining range bound between ~$640bn-$650bn over much of the past year, July’s growth saw retail sales ex-gasoline break notably above $650bn.

While July’s MoM growth was strong, the longer-term trend remains one of deceleration, with the 3-month moving average of YoY growth 2.5% in July, down significantly from the year-ago level of 5.3% and well below the 2015-2019 average of 3.9% YoY.