US CPI Review: May 2024 (plus a Fed & PPI update)

Material CPI disinflation comes a month earlier than forecast, reinforcing my expectation for multiple 2H24 rate cuts.

This US CPI Review includes the following sections and subheadings:

Materially beating expectations

Moderating inflation reinforces my 2H24 outlook for significant disinflation and multiple rate cuts

PPI data provides more positive news on inflation

Analysing the Fed’s updated projections in light of the latest inflation and jobs data

Breaking down the details of the latest CPI report

Durables price growth in-line with forecast

Food at home price growth in-line with expectations but food away from home prices see hotter MoM growth

Apparel price growth weakens materially

Rent based measures see an expected (albeit slightly stronger) uptick in relative MoM growth, but a disinflationary trend remains

Adjusted supercore services price growth unexpectedly plunges in May as broad based services price disinflation is seen

Materially beating expectations

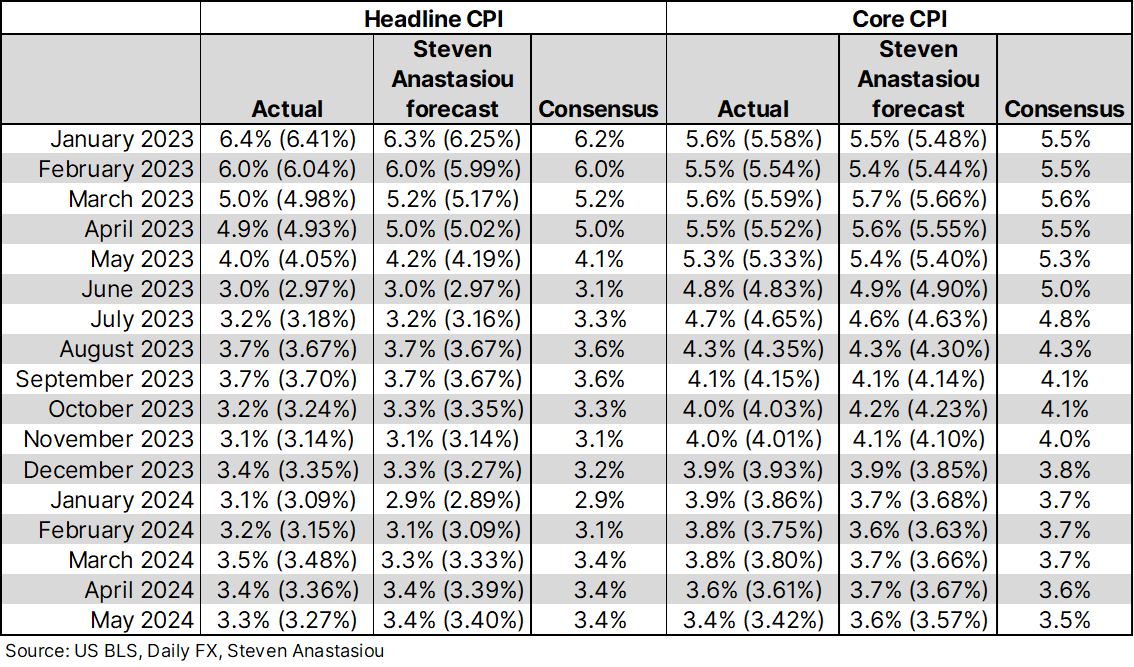

Note that while I quote my forecasts on a two decimal place basis, the consensus forecasts that I utilise are only available to one decimal place.

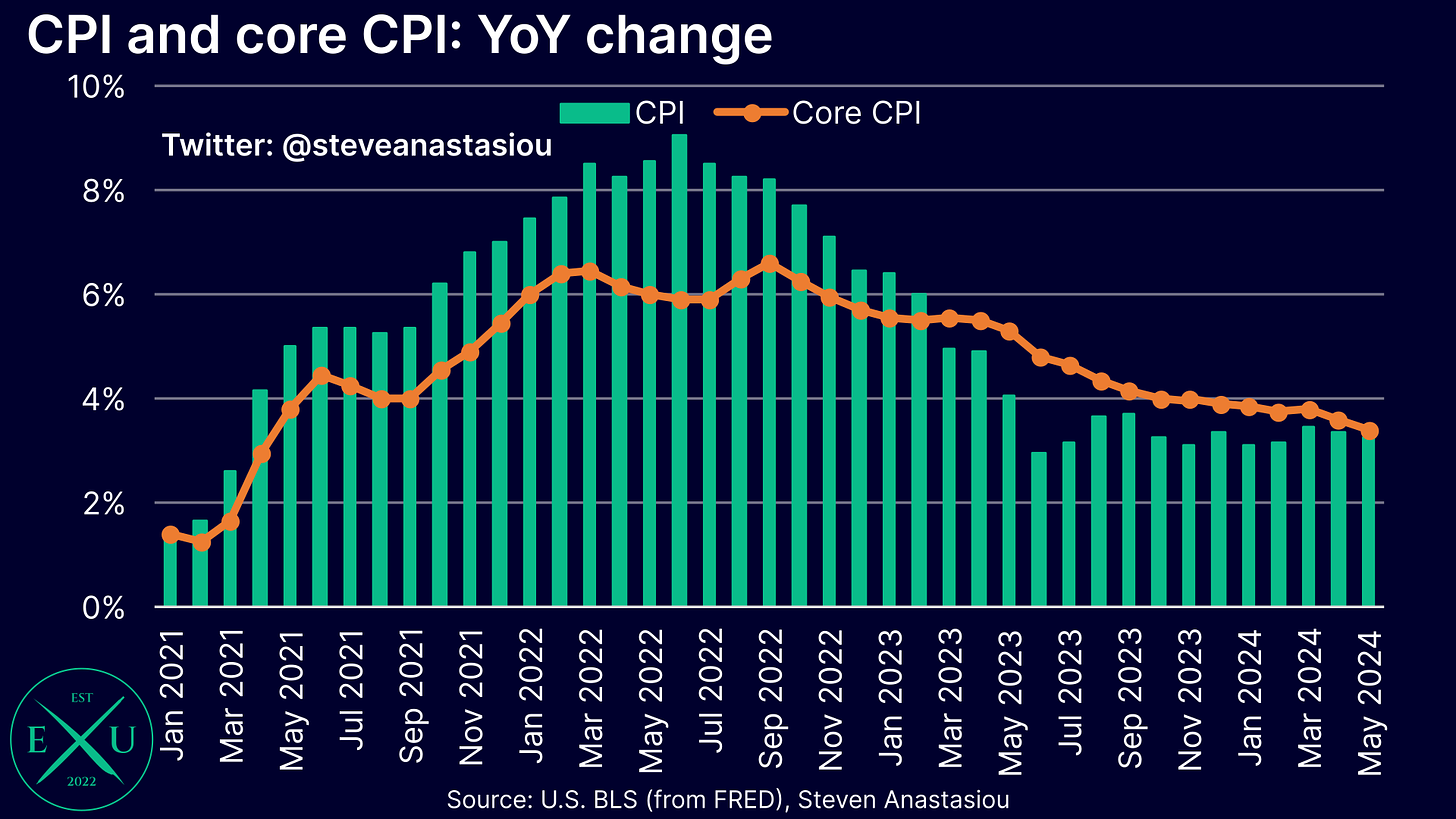

Headline CPI growth came in at 3.27% YoY versus my forecast of 3.40% and consensus expectations of 3.4%. Core CPI growth was 3.42% YoY, below my expectation of 3.57% and the consensus expectation of 3.5%.

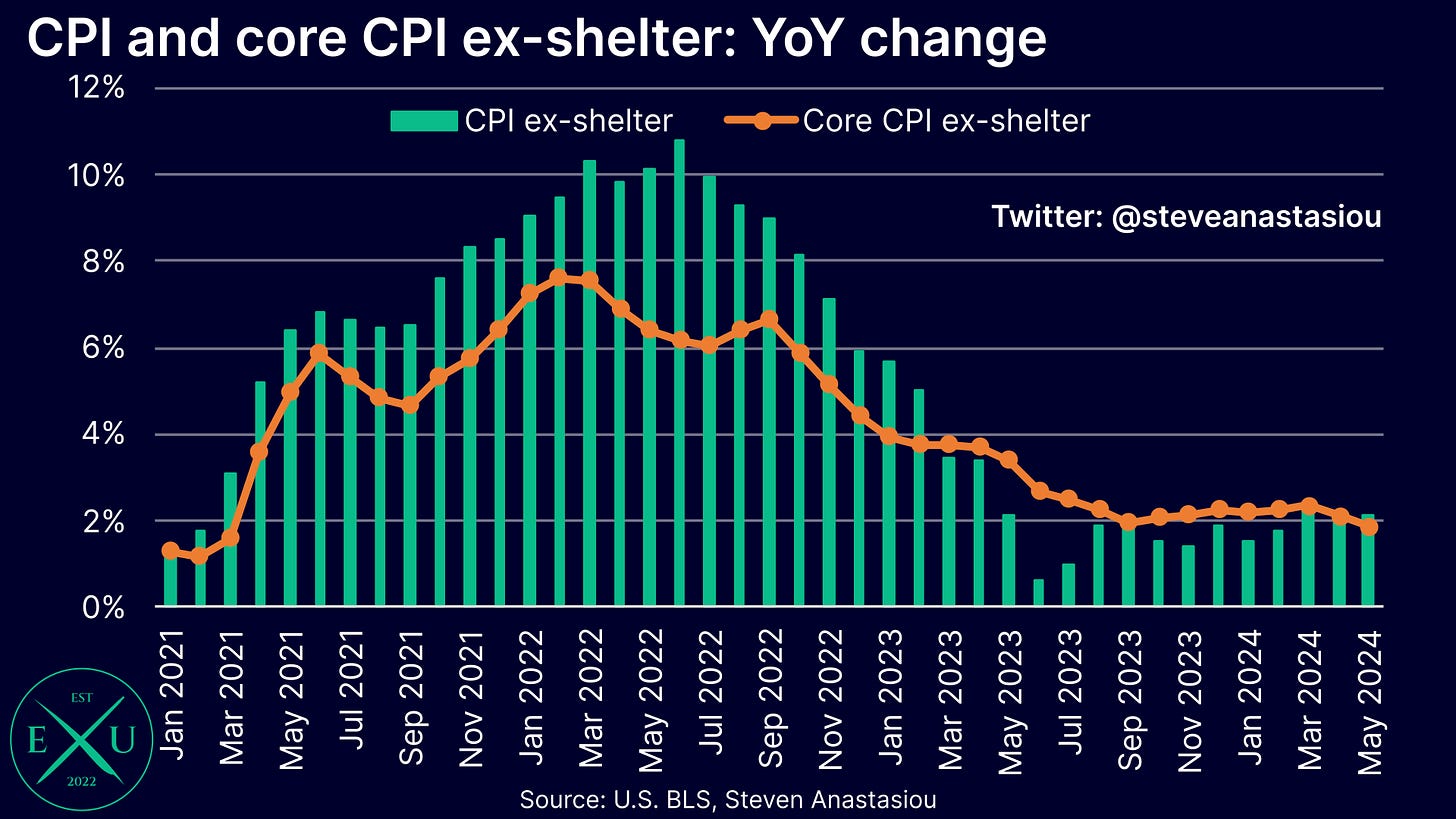

On an ex-shelter basis, headline CPI growth came in at 2.13% YoY versus my expectation for growth of 2.33%, while core CPI growth came in at 1.87% YoY versus my expectation of 2.13%.

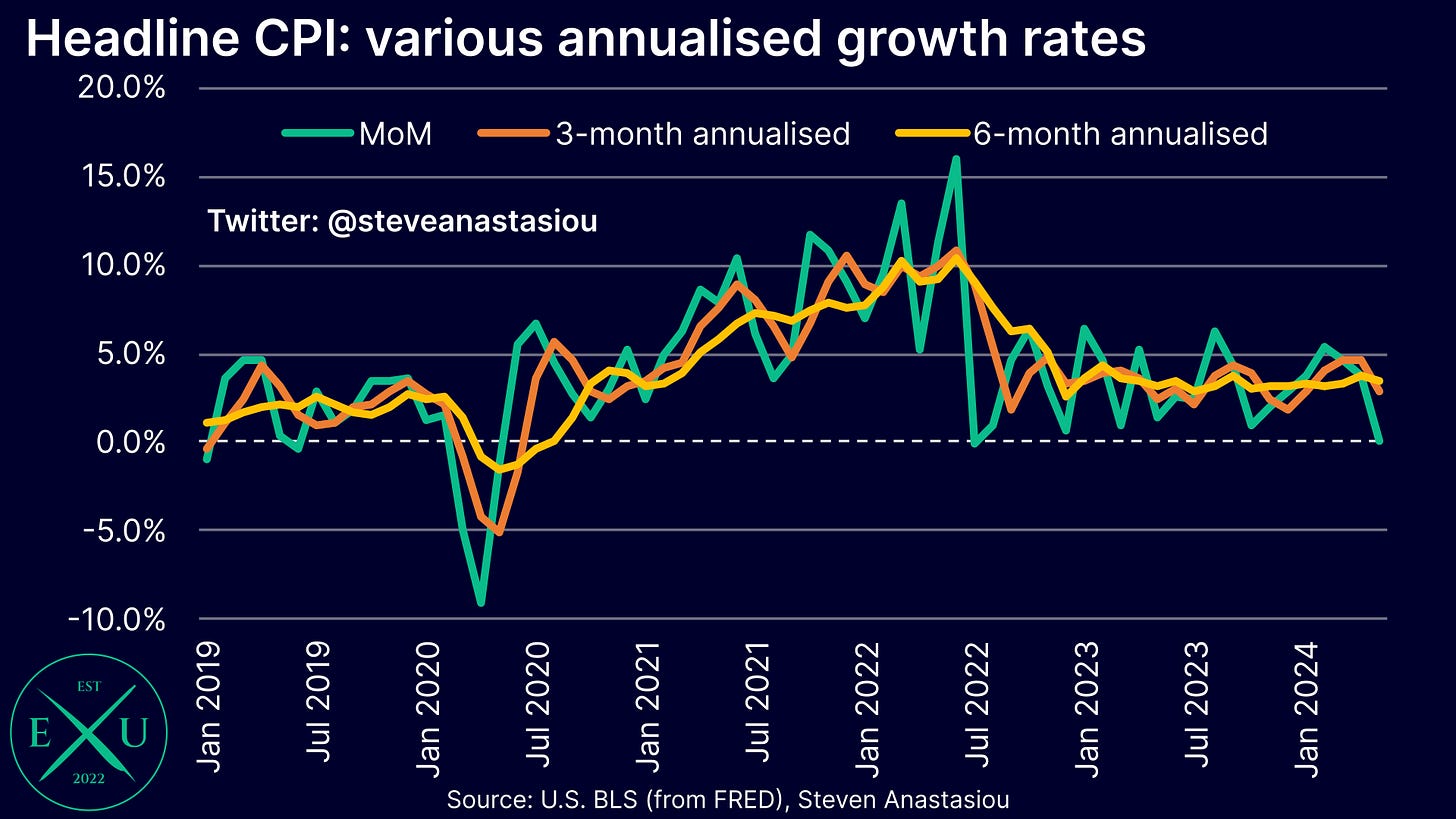

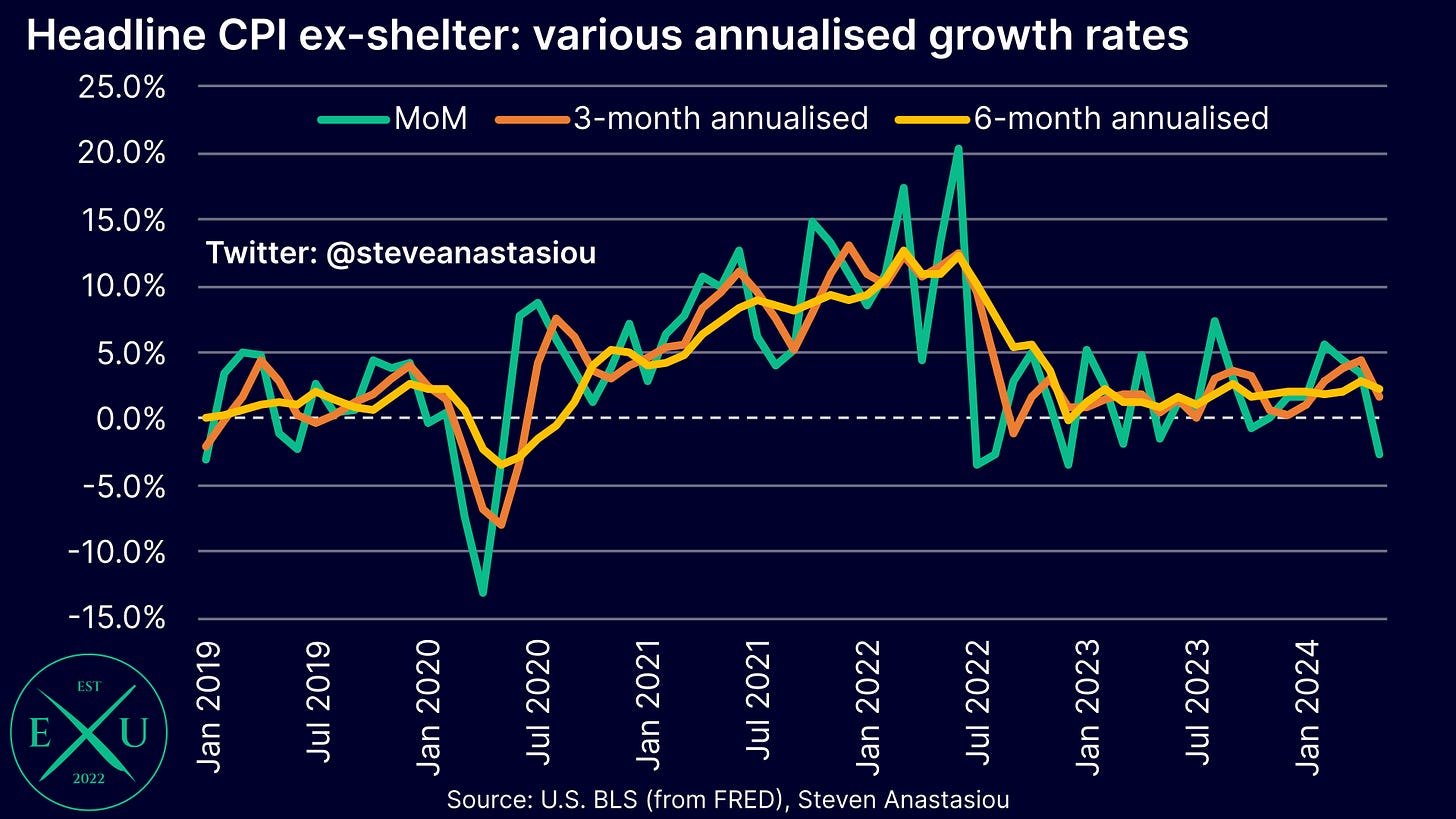

On a monthly basis, headline CPI growth came in at 0.01% MoM, below my expectation for growth of 0.15% and the consensus estimate of 0.1%. This resulted in 3-month annualised growth falling to 2.8% (from 4.6%) and 6-month annualised growth falling to 3.4% (from 3.7%).

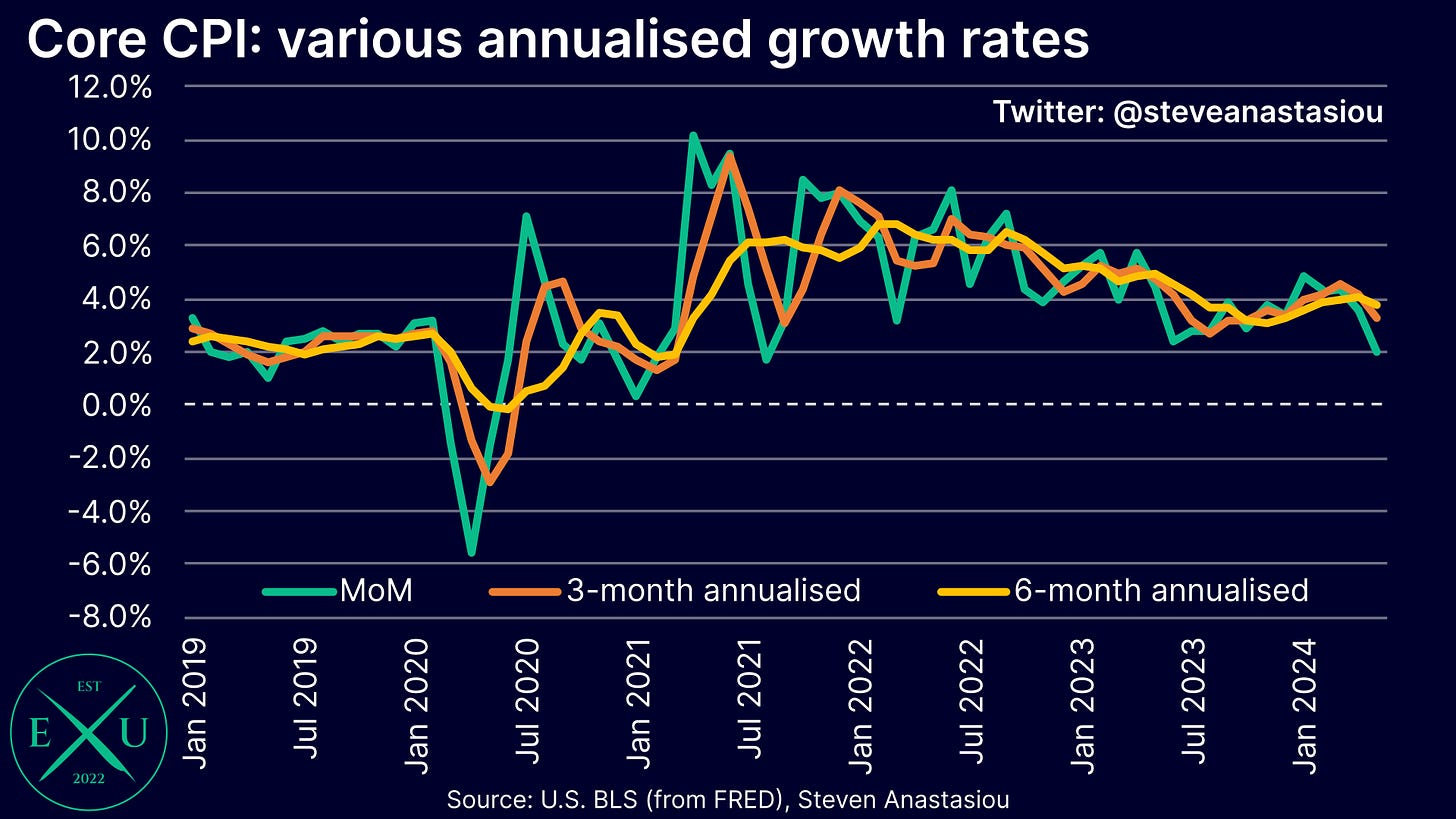

Monthly core CPI growth came in at 0.16% MoM or 1.97% annualised, below my expectation of 0.32% and the consensus estimate of 0.3%. This was the lowest MoM growth rate that’s been seen since August 2021, which was the last time that monthly annualised growth had come in below 2%. This resulted in 3-month annualised growth falling to 3.3% (from 4.1%) and 6-month annualised growth falling to 3.7% (from 4.0%).

On an ex-shelter basis, headline CPI growth came in at -0.22% MoM, its lowest level since December 2022. This resulted in 3-month annualised growth falling to 1.7% (from 4.4%) and 6-month annualised growth falling to 2.3% (from 2.8%).

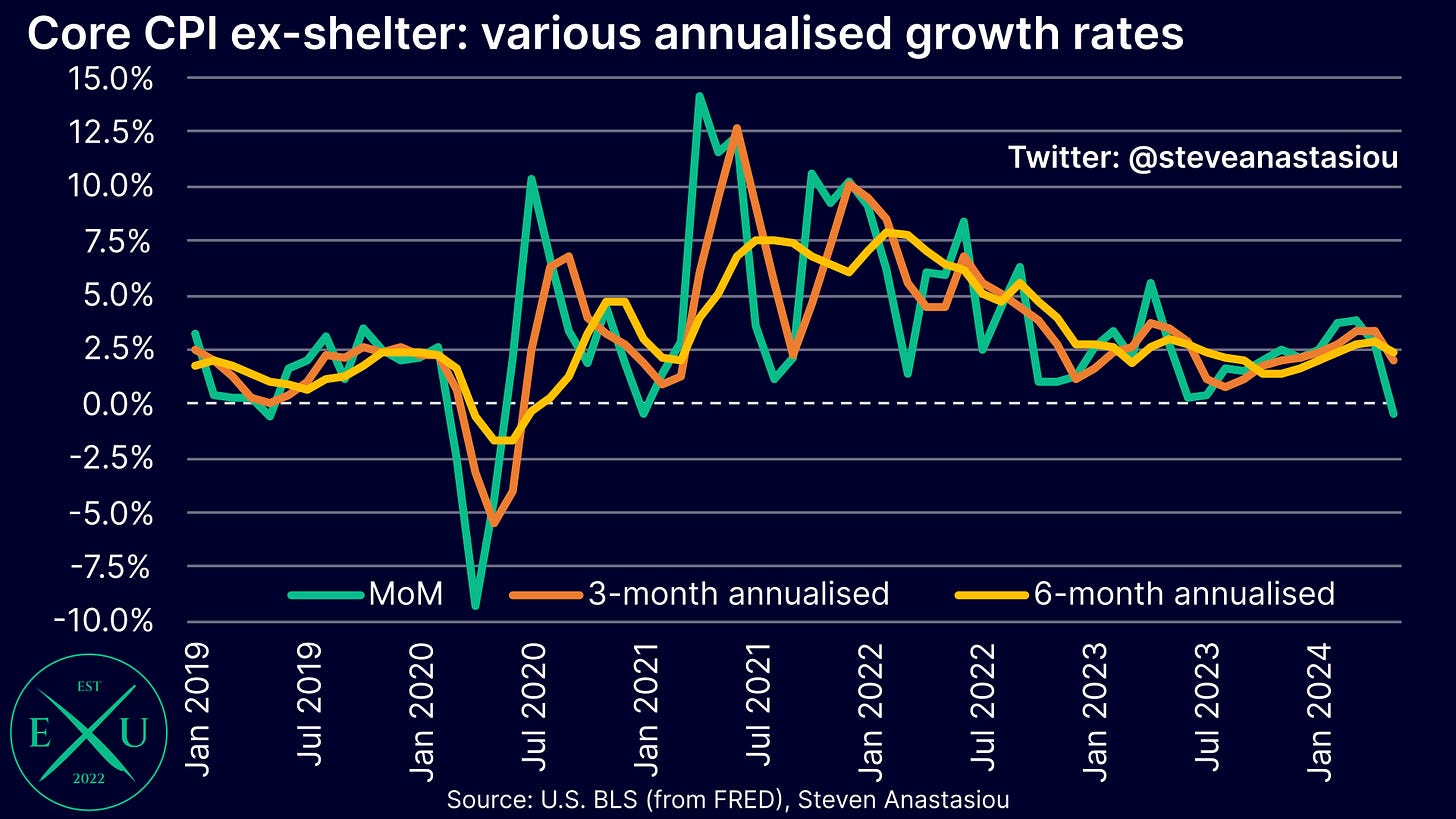

On a core CPI ex-shelter basis, growth also came in negative, at -0.04% MoM, a rate last seen in January 2021. This took the 3-month annualised growth rate down to 2.0% (from 3.4%) and the 6-month annualised growth rate down to 2.4% (from 2.9%).

Across all key aggregate measures there was a major step down in MoM growth, with inflation coming in notably below both mine and consensus forecasts.

Though what made the inflation beat all the more significant, was that as opposed to it being driven by durables or nondurables prices, it was largely driven by a major moderation in supercore services (i.e. core services less shelter) price growth. While one month of good data doesn’t make a trend, the wide breadth of material services price disinflation (which is analysed in detail within the “Breaking down the details of the latest CPI report” section of this report) was a major positive.

As Fed Chair Powell noted in his latest FOMC press conference, May’s US CPI report was “a better inflation report than almost anybody expected”.

Moderating inflation reinforces my 2H24 outlook for significant disinflation and multiple rate cuts

While I have been regularly articulating my expectation for material 2H24 disinflation on account of several key factors, May’s inflation data was a significant positive surprise, as I had not expected a material moderation in MoM growth to begin until June.

While the Fed will likely want to see a couple more good inflation reports before cutting interest rates, the latest CPI data provides significant support to my expectation for material 2H24 disinflation and multiple 2H24 rate cuts. This is a consistent outlook that I have been regularly outlining, with my latest medium-term US CPI forecasts published on 26 April containing a detailed analysis of why material 2H24 disinflation is likely, and for why I expect multiple 2H24 rate cuts.

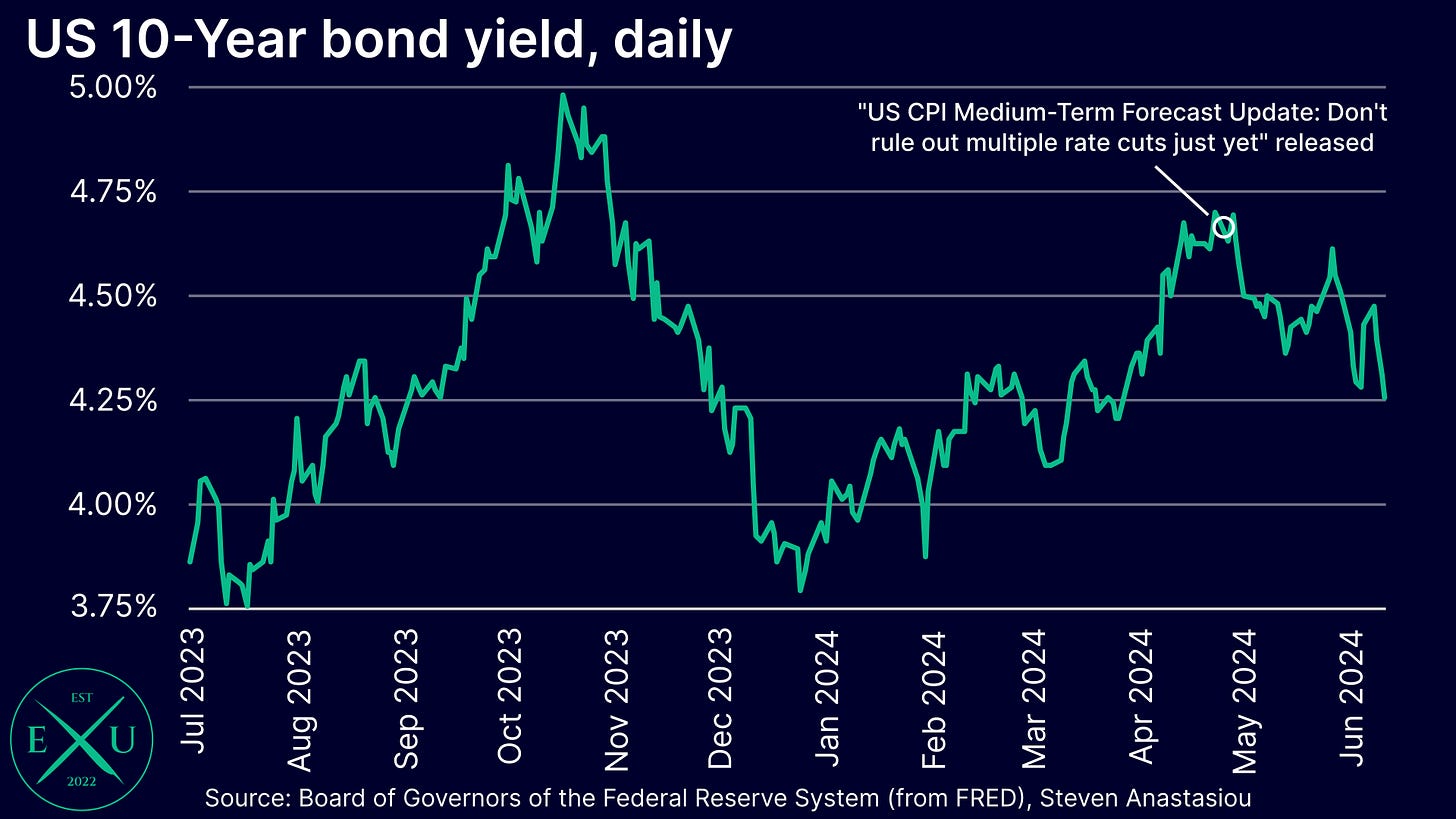

Note that this report, entitled “US CPI Medium-Term Forecast Update: Don't rule out multiple rate cuts just yet”, was published near the height of recent concerns surrounding the inflation and interest rate outlook, with 10-Year bond yields closing at 4.67% on 26 April versus their current intraday level of 4.20% at the time of writing.

PPI data provides more positive news on inflation

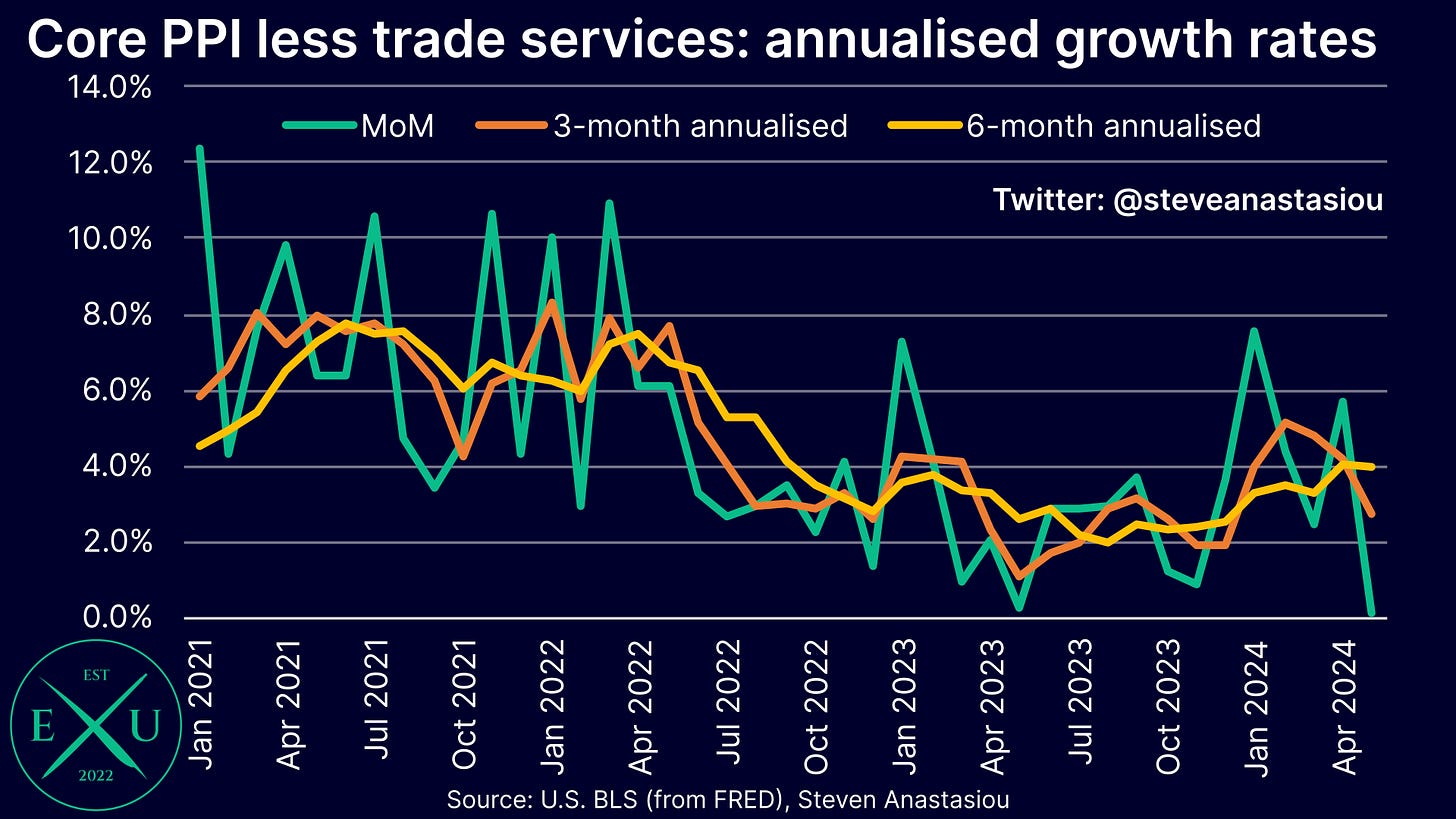

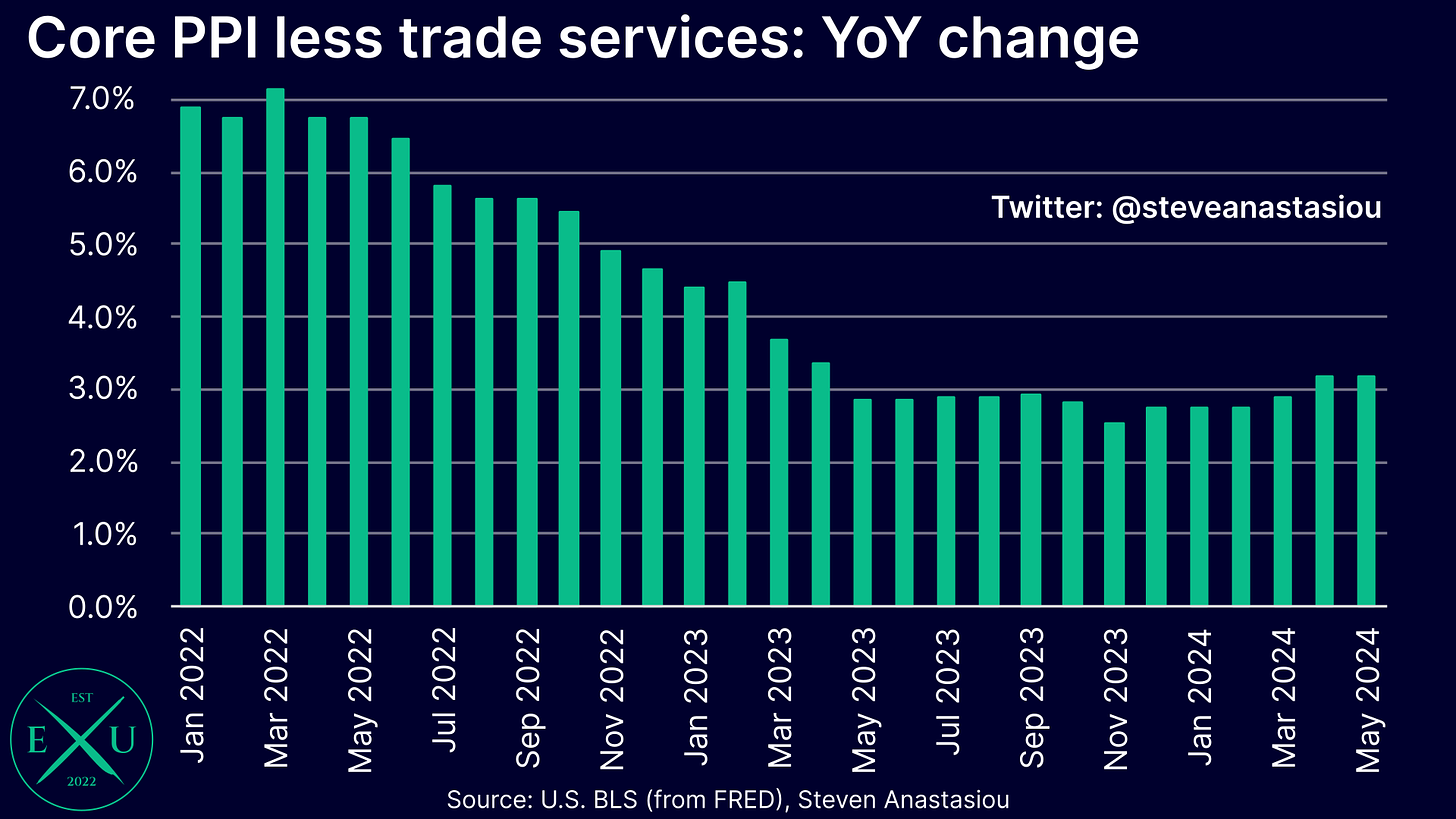

In addition to the positive CPI data, the latest Producer Price Index (PPI) data also revealed a major moderation in MoM growth, with the core PPI less trade services recording MoM growth of just 0.01%. This resulted in 3-month annualised growth falling to 2.8% (from 4.2%) and 6-month annualised growth falling to 4.0% (from 4.1%).

Despite the moderation in MoM growth, YoY growth remained at 3.2%.

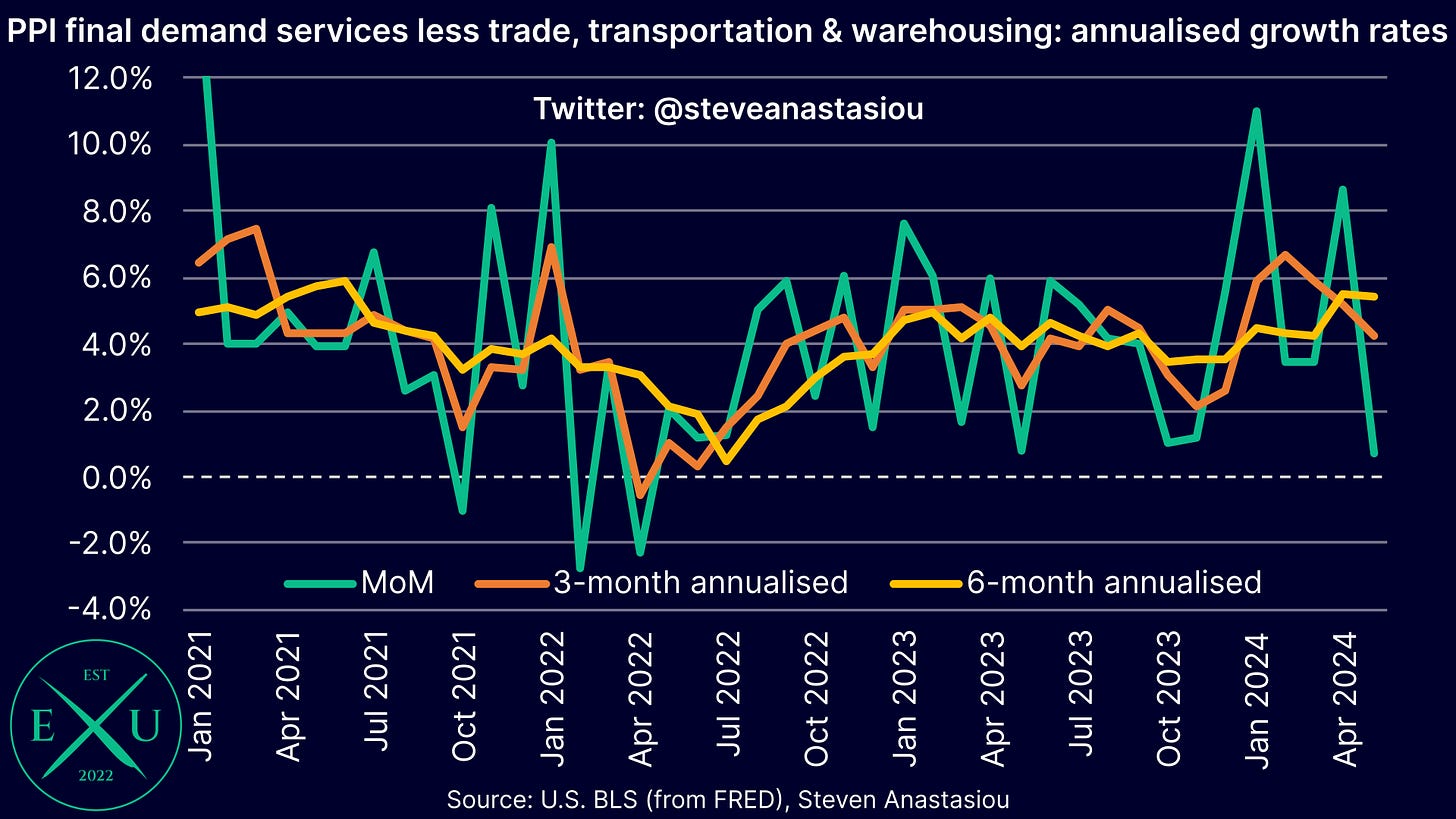

Importantly, May’s PPI data reinforced the major moderation in MoM growth that was seen in supercore CPI services prices, with PPI final demand services less trade, transportation and warehousing price growth falling to just 0.06% MoM, the lowest rate seen since May 2023. This saw 3-month annualised growth fall to 4.2% (from 5.2%) and 6-month annualised growth fall to 5.4% (from 5.5%).

Though as was the case with the overall core PPI less trade services, YoY growth remained stable, coming in at 4.5%.

While the significant moderation in MoM growth was a positive sign, it’s important to note that given that YoY growth remained unchanged to one decimal place, a similarly significant month of disinflation was seen this time last year, only for monthly growth in the final demand services less trade, transportation and warehousing component to record elevated growth from June to September. The Fed will thus be looking for lower MoM price growth to be repeated, in order to gain greater confidence that inflation is sustainably headed back towards 2% YoY.