US CPI Review: June 2024

June's CPI data showed material further disinflationary evidence. Importantly, adjusted core services prices again saw below average MoM growth, paving the way for a further dovish pivot from the Fed.

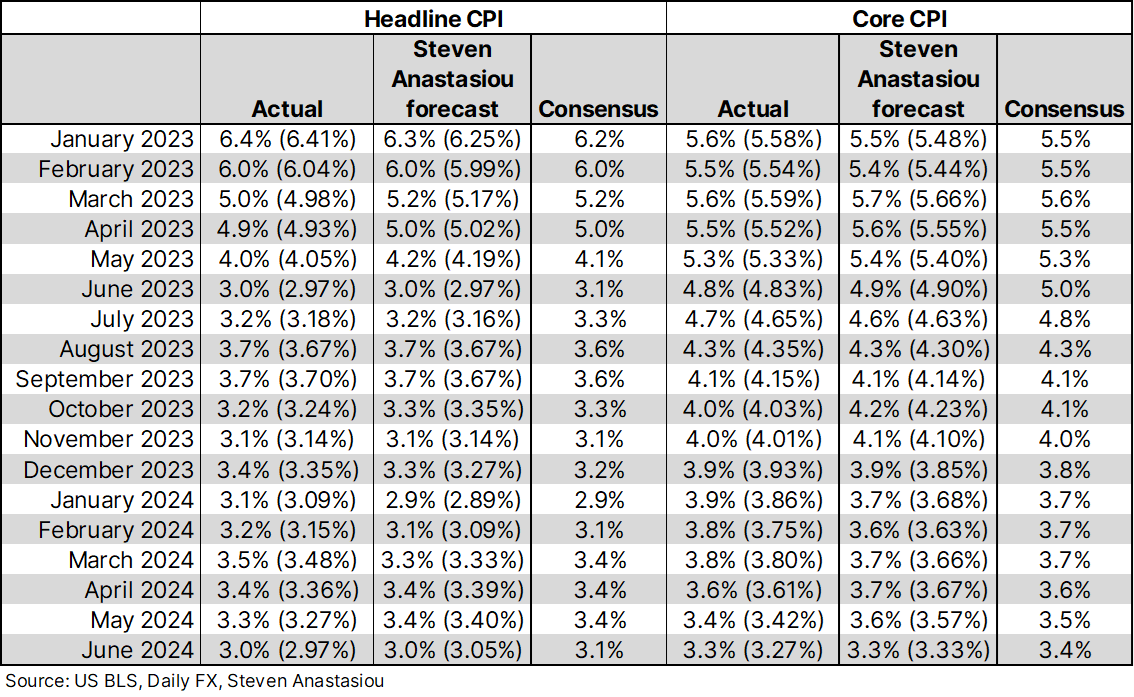

US CPI growth was largely in-line with my forecasts (as outlined in my US CPI Preview), but below consensus expectations for the second consecutive month.

With core CPI growth just 0.06% MoM, significant further disinflationary evidence was seen in June. June’s Producer Price Index (PPI) data also revealed significant further disinflationary evidence.

The strength of the disinflationary evidence seen within June’s inflation data was significantly enhanced by the fact that adjusted core services price growth saw a second consecutive month of MoM growth that was below the historical average. The CPI’s rent based measures also saw significant additional disinflation in June (see my latest medium-term US CPI forecast for further details on my expectation for material 2H24 disinflation in the CPI’s rent based measures).

While subject to change, as a result of June’s inflation data, I have revised my expectation from multiple 2H24 rate cuts, to a more precise expectation for three 2H24 interest rate cuts.

Given my expectation for material further disinflation in June, I had articulated for premium subscribers in my US CPI Preview (published 9 July), that “should inflation come in largely as I expect in June, then I believe the discussion is likely to significantly shift from when the first interest rate cut will be delivered, to whether there will be three 2H24 interest rate cuts.

I expect such an outcome to place further downward pressure on Treasury yields, which despite some volatility, have trended materially lower since the release of my latest medium-term US CPI update”.

With CPI growth coming in below consensus expectations and largely as I had forecast, 10-year Treasury yields saw another notable decline and have now fallen by almost 50bps since the release of my latest medium-term US CPI update, where amidst a rise in concerns about the inflation and interest rate outlook, I explained why multiple rate cuts in 2024 shouldn’t be ruled out and why material 2H24 disinflation was likely to occur.

Please note that I intend to release an update to my medium-term US CPI forecasts next week — be sure to keep an eye on your inbox!

In addition to the summary sections provided below, please see the “Breaking down the details” section of this report for key additional information on the further disinflationary evidence that was seen in the CPI’s rent based measures and a number of core services price categories in June.

CPI growth largely in-line with my below consensus forecasts

Headline CPI growth fell to 3.0% (2.97%) YoY in June versus my forecast of 3.0% (3.05%) and the consensus forecast of 3.1%.

Core CPI growth fell to 3.3% (3.27%) versus my forecast of 3.3% (3.33%) and the consensus forecast of 3.4%.

On an ex-shelter basis, headline CPI growth moderated from 2.1% to 1.8% (versus my 1.9% forecast). Core CPI growth moderated from 1.9% to 1.8%, which was in-line with my forecast.

On a MoM basis the headline CPI saw growth of -0.06% versus my forecast of 0.02%. This was the lowest rate of growth since May 2020. 3-month annualised fell to just 1.1% (its lowest level since June 2020), while 6-month annualised growth fell to 2.8%, its lowest level since December 2022.

The core CPI recorded MoM growth of just 0.06%, slightly below my forecast of 0.12%. This was the lowest rate of growth since January 2021. 3-month annualised growth fell to 2.1% (its lowest level since March 2021), while 6-month annualised growth fell to 3.3%, its lowest level since December.

On an ex-shelter basis, headline CPI growth was -0.19% MoM, slightly below my forecast of -0.13%. This was the second consecutive month of negative MoM growth, which saw the 3-month annualised growth rate fall to -0.51%, its lowest level since September 2022. 6-month annualised growth fell to 1.6%, its lowest level since July.

Core CPI ex-shelter growth was -0.02% MoM, largely in-line with my forecast of -0.01%. This also marked the second consecutive month of negative MoM growth, which saw 3-month annualised growth fall to 0.64%, its lowest level since June 2020. 6-month annualised growth fell to 2.0%, its lowest level since December.

Producer Price Index also sees material disinflation in June

The PPI excluding trade services fell by 0.18% in June, its second consecutive MoM decline. This resulted in 3-month annualised growth slowing to 0.32% and 6-month annualised growth slowing to 2.5%.

The core PPI excluding trade services rose by just 0.04% in June, its slowest rate of growth since May 2023. This resulted in 3-month annualised growth slowing to 2.6% and 6-month annualised growth slowing to 3.7%.

Pleasingly, the slowdown in core PPI growth was driven by services prices, which on an ex trade, transportation & warehousing basis, rose by just 0.07% MoM. This is the slowest rate of growth since May 2023 and aligns with the major disinflation in services prices that was seen in the CPI (discussed in detail below).

This took 3-month annualised growth to 4.1%, its lowest level since December, while 6-month annualised growth fell to 5.0%.