US CPI Review: February 2024 — stalling disinflation raises recession risks

Just as soft/no landing hopes have grown materially, stalling disinflation is set to complicate matters, with it potentially keeping the Fed tighter for longer and raising the odds of a recession.

Thank you to all of you who have already become premium subscribers — I hope that this latest report provides you with significant value!

Outlining this US CPI Review

Across more than 4,000 words and 41 charts, in what may be one of the most comprehensive US CPI Review’s that you will find, this report covers:

The actual CPI results and the initial market reaction versus my expectations and the consensus forecasts;

How US CPI disinflation has clearly stalled at above 3% and why;

The implications of stalling disinflation and a weakening jobs market on the outlook for Fed policy, the US economy and financial markets;

A detailed breakdown of the current run rates across key CPI aggregates, being:

headline and core;

headline and core ex-shelter;

headline and core adjusted for spot market rents; and

adjusted core services; and

An in-depth breakdown of the CPI’s key subcomponents, including an analysis of:

Used and new car prices;

Food prices;

Energy commodities;

Owners’ equivalent rent and rent of primary residence;

Education & communication services;

Medical care services;

Motor vehicle related expenses;

Airline fares;

Recreation services; and

Other personal services.

While I have kept some of this report available to all subscribers, the full report is reserved for premium subscribers.

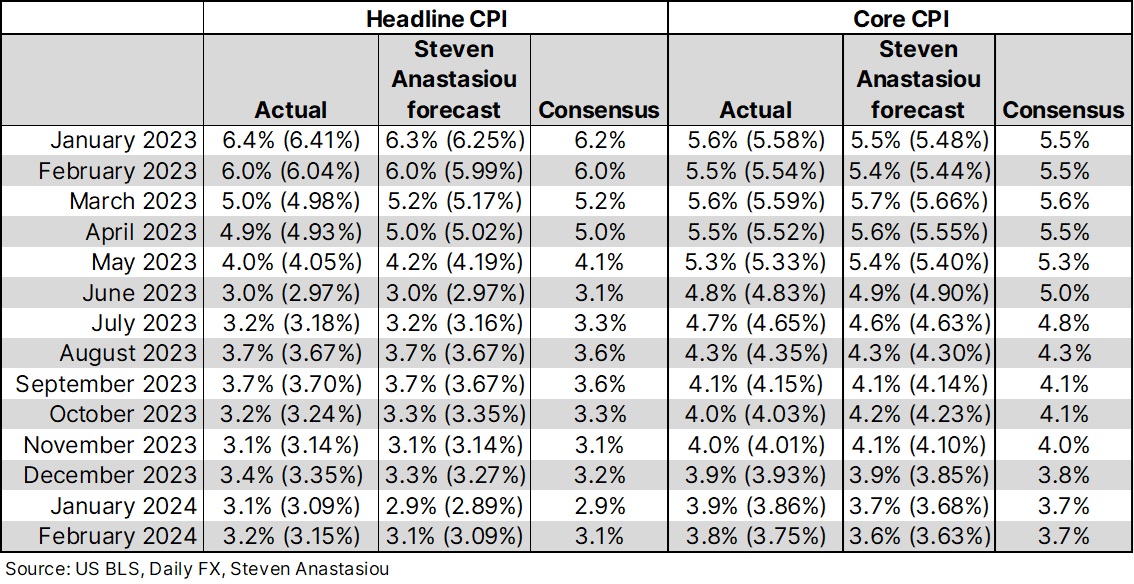

In February, the headline CPI rose by 3.2% YoY, up from 3.1% in January. The core CPI rose by 3.8%, down from 3.9% in January.

For the second consecutive month, both of these figures were above my forecasts and consensus expectations.

Unpacking the initial market reaction

Despite having a core CPI estimate that was slightly below consensus expectations, given my expectation for another month of materially elevated services price growth, the volatility in CPI data, and the market movements leading up to the CPI report, I saw the more pertinent risk as being slanted towards a reversal of recent interest rate cut expectations.

Here’s the key extract from my latest US CPI Preview:

A difficult market reaction to gauge — I see the greater risk as slanted towards a potential reversal of recent interest rate cut expectations & related trades

While an expected moderation in annual core CPI growth — including my estimate for slightly stronger core CPI disinflation than the consensus forecast — suggests that both bond and gold prices may rally further on the back of the upcoming CPI data, I believe that the market implications are more nuanced and difficult to gauge, with the following points serving as important considerations:

Services price growth is expected to remain well above its historical average in February;

Headline CPI growth is expected to remain bound between 3.0%-3.7% for a ninth consecutive month; and

Despite an expected decline in YoY growth, I forecast seasonally adjusted core CPI growth to remain elevated on a 3- and 6-month annualised basis, at 3.7% and 3.6% respectively.

Each of these factors may lead to growing concerns surrounding the potential for CPI growth to sustainably hit 2% YoY, and whether disinflation may instead be stalling at a YoY growth rate of 3% or above.

Unlike the US jobs report, where I clearly saw the odds in favour of a negative result versus consensus forecasts, given the volatile and elevated nature of services price growth, there is also a significant risk that inflation once again comes in ahead of my forecasts/consensus expectations.

In light of such a backdrop, with expectations for interest rates to be below their current level following the Fed’s June FOMC meeting increasing from a 57.93% likelihood on 27 February, to a 73.2% likelihood as of the time of writing (according to the CME FedWatch Tool), and interest rate related trades moving in-turn — since 27 February to the time of writing, the: US 10Y yield has fallen from 4.315% to 4.081%, while gold prices have risen 6.9% and reached new record highs — I see the greater short-term risks as being skewed towards a material reversal of these recent trends.

For even if core CPI growth comes in better than the consensus forecast (which is what my 3.6% YoY forecast suggests), given the shifts that have already been seen in interest rate expectations, and both US bond and gold prices over the past two weeks, markets appear to have already priced in a much better inflation report for February versus January. This may act to limit the extent of any further short-term upside in US bond and gold prices in the event of a positive inflation surprise.

With services price growth also expected to remain elevated — even in the event that core CPI growth is slightly better than expected — this may also act to temper any additional short-term pricing of future interest cuts.

On the flipside, should inflation again surprise to the upside, with markets seemingly not positioning for such an outcome, this may see a more material market move, including a material near-term reversal of rate cut expectations, and in-turn, a material reversal of the recent rally in US bond and gold prices.

While growing liquidity from further net T-bill issuance and a declining RRP facility is likely to continue to support equity prices through the remainder of March in the event that CPI growth comes in around consensus expectations, another hotter than expected CPI report may see a near-term pullback in equities.

Remember, this does not represent personal investment advice, and simply represents my general assessment of the potential implications of the upcoming US CPI data under various potential scenarios. This research update must be read with the disclaimer contained at the very bottom of this report.

Extract from US CPI Preview: February 2024

While again emphasising the general nature of any market related commentary, which is provided purely for informational and educational purposes in order to help explain the potential impact of economic policies and data releases, and does not represent investment advice to any person — see the full disclaimer below — the above analysis ultimately turned out to be well founded, with the price of both 10Y Treasuries and gold falling on the back of the latest CPI report, while expectations for interest rates to be below their current level by June, have fallen to a 65.6% probability as at the time of writing.

Important disclaimer—this may affect your legal rights:

This report is an economics research publication and is not investment advice. This economics research represents my own analysis, opinions and views, is general in nature, and does not constitute personal advice to any person.

While my research may make mention of potential financial market implications, this analysis is general in nature, is not investment advice and is only provided for informational and educational purposes in order to explain the potential impacts of potential economic policy and data outcomes. Any mention of potential financial marker implications does not constitute personal advice to any person.

While this research utilises data which is considered to be reliable, I have not independently verified the accuracy of the data utilised in this research.

While I have taken care to try and ensure that the figures, data and information presented in this research are accurate and free of errors, I am not perfect, and the report may contain errors or omissions that may become apparent after this research has been published.

Furthermore, this report may contain forward-looking statements, which are subject to inherent variability and are subject to risks and uncertainties. Forward-looking statements may be identified by the use of terminology, including, but not limited to, ‘anticipate’, ‘estimate’, ‘expect’, ‘may’, ‘forecast’, ‘trend’, ‘potential’ or similar words. Forward-looking statements are based on current expectations and reflect judgements, assumptions and estimates and other information available as at the date made. Forward-looking statements in this presentation do not represent guarantees and are subject to significant uncertainties which may cause actual results to differ materially from the forecasts expressed in this report. As such, I caution against reliance on any forward-looking statements.

I do not represent, warrant or guarantee expressly or impliedly, that the data and information contained in this research is complete or accurate. I do not accept any responsibility to inform you of any matter that subsequently comes to my attention, which may affect any of the information contained in this research. I do not accept any obligation to correct or update the information or opinions contained in this research. I do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omissions in this document or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this document or any other person.

Disinflation has stalled at 3% as services price growth continues to remain elevated

Despite the shift in interest rate expectations directionally following the script that would be expected in the event of a slightly hotter CPI report versus consensus, I am somewhat surprised that there wasn’t a larger market reaction, as CPI disinflation has clearly stalled at above 3% YoY.

As discussed in my most recent US PCE Inflation analysis — “US PCE Inflation Update: A bumpier ride ahead” — the stalling of US disinflation is being driven by the fact that the US is now in the third and final stage of the disinflationary cycle.

In short, with durables and nondurables disinflation already largely complete, the last leg of the disinflationary stretch back to 2% is now largely dependent on services prices, which are a far more lagging component of the price cycle, and are yet to show clear disinflationary trends.

While continued constraints in M2 growth suggest that there won’t be any near-term ‘second wave’ of inflation, and that services price growth will eventually disinflate, given that a clear disinflationary trend would require several months of better data, the point at which the Fed is likely to become comfortable with the inflation outlook, could still be many months away.

Stalling disinflation and a weakening jobs market puts the Fed in a bind, raising a number of important implications for the economic and market outlook

While PCE inflation is not running as hot as CPI inflation, with core CPI growth running at a highly elevated 3- and 6- month annualised growth rate of 4.2% and 3.9% respectively, this is not a backdrop that would ordinarily warrant a loosening of monetary policy.

Indeed, despite shifting to an easing bias over recent months, the latest string of inflation data is likely to result in a renewed wave of caution from the Fed. Should monthly core PCE inflation also come in at a rate that is well above 2% for a second consecutive month, then this may result in a notable hawkish pivot from the Fed.

Focusing on inflation alone (i.e. forgetting the employment market for the time being), clearly suggests a growing risk that the first rate cut may not come until 2H24, and that there may be fewer than three rate cuts delivered in 2024 — this points to the potential for a significant revision to the market’s expectations for rate cuts.

With the potential for Fed policy to remain tighter for longer, this materially raises the odds of a recession in the US, as well as its potential severity, just as market expectations for a soft (or no) landing have been steadily rising.

While the above analysis reflects a focus on inflation, in order to try and determine the path for Fed policy, it is also vitally important to incorporate an analysis of the employment market.