US CPI Preview: September 2024

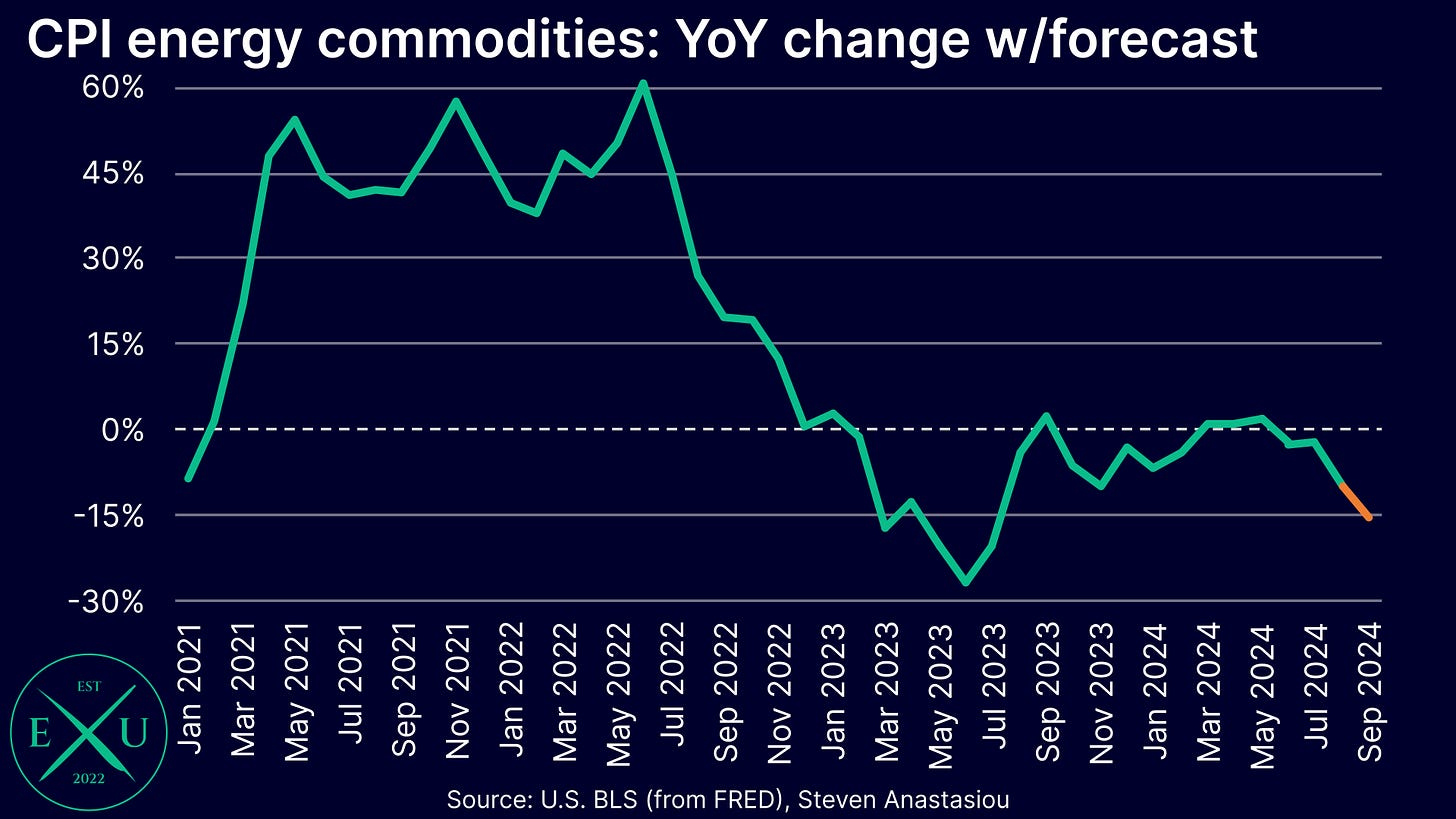

Another large decline in gasoline prices is expected to see annual headline CPI growth move materially lower in September, but the core CPI is anticipated to remain elevated.

Significant headline disinflation expected in September, but not on a core basis

The headline CPI is expected to record a second consecutive month of significant additional disinflation, falling to 2.3% (2.26%) YoY, from 2.5%. This is in-line with the consensus estimate.

Given that much of this anticipated moderation is expected to again be driven by the CPI energy commodities index, the core CPI is not expected to see significant disinflation and remain at 3.2% YoY (3.16%), which is also in-line with the consensus estimate.

Excluding the lagging shelter component, the CPI ex-shelter is expected to fall to 0.81% YoY (from 1.1%), while the core CPI ex-shelter is expected to rise to 1.7% YoY (from 1.6%).

Monthly ex-shelter CPI growth expected to further reinforce that underlying price pressures have normalised

On a MoM basis, the headline CPI is expected to record growth of 0.04%, which would see both 3- and 6-month annualised growth well below 2%.

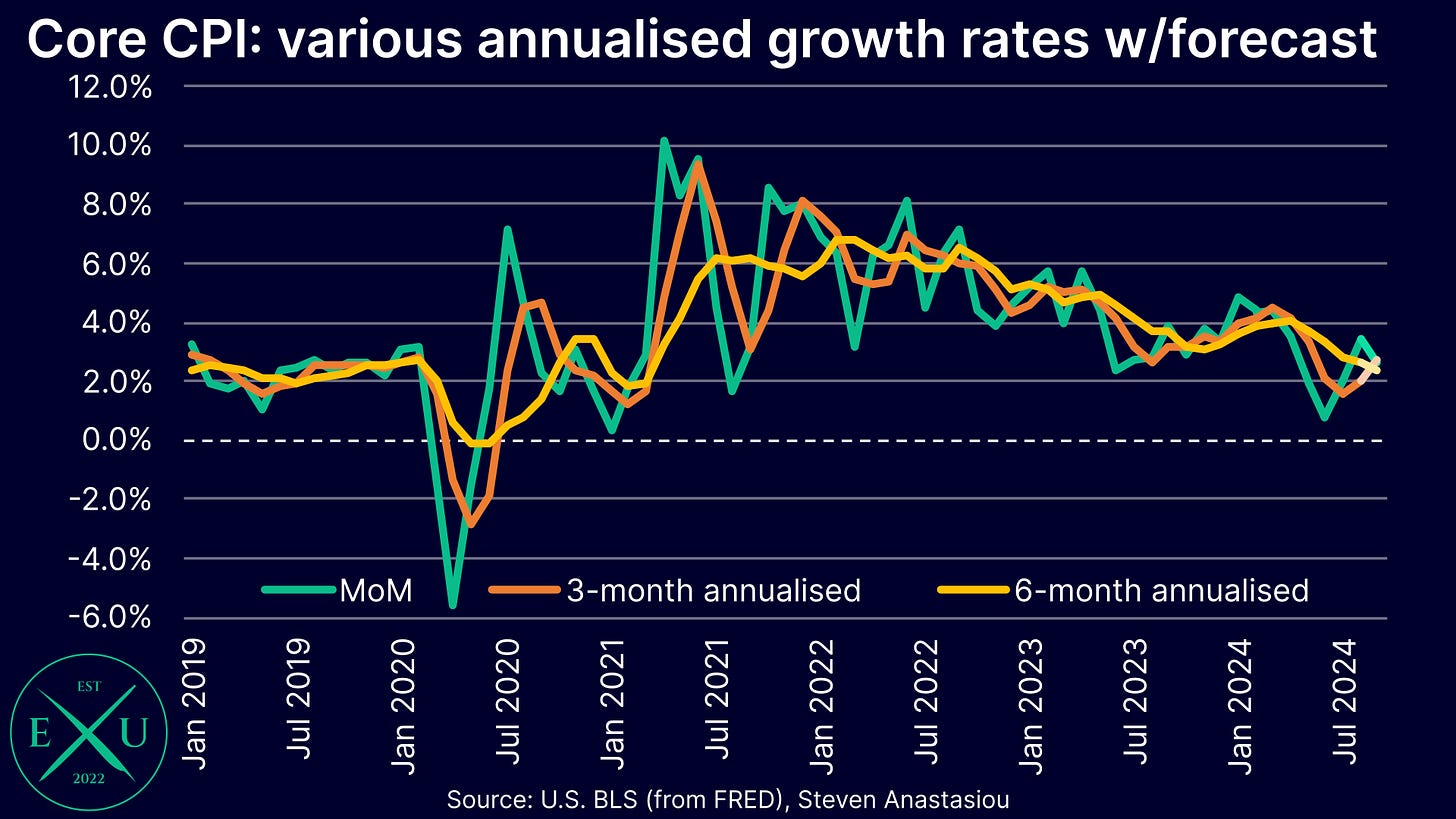

The core CPI is expected to record growth of 0.22% MoM, which equates to an annualised rate of 2.7%. This would result in 3-month annualised growth rising to 2.7% and 6-month annualised growth falling to 2.4%, its lowest level since March 2021.

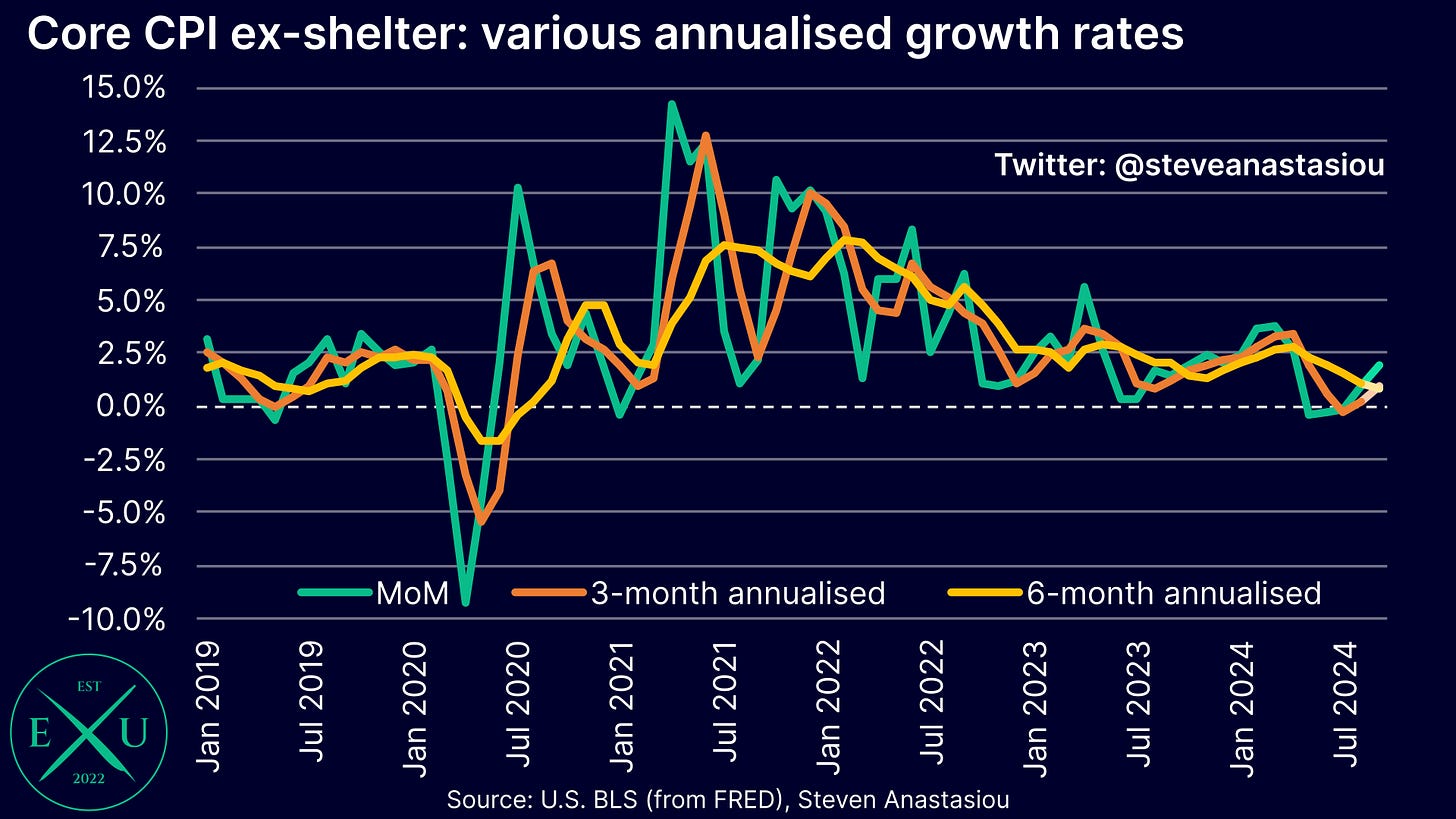

On an ex-shelter basis, the headline CPI is expected to decline by 0.11% MoM, with both 3- and 6-month annualised growth also expected be negative.

The core CPI ex-shelter is expected to record MoM growth of 0.16% (1.9% annualised), which would mark the fifth consecutive month of annualised growth below 2%. This is expected to see both 3- and 6-month annualised growth fall below 1%, further indicating that underlying inflation pressures have normalised, with this expected to be reflected in the broader core CPI over time, as lagging rent based measures continue to gradually moderate.

Durables prices expected to record a more moderate YoY decline

Please note that unless otherwise stated, the below sections of this research report refer to non-seasonally adjusted data.

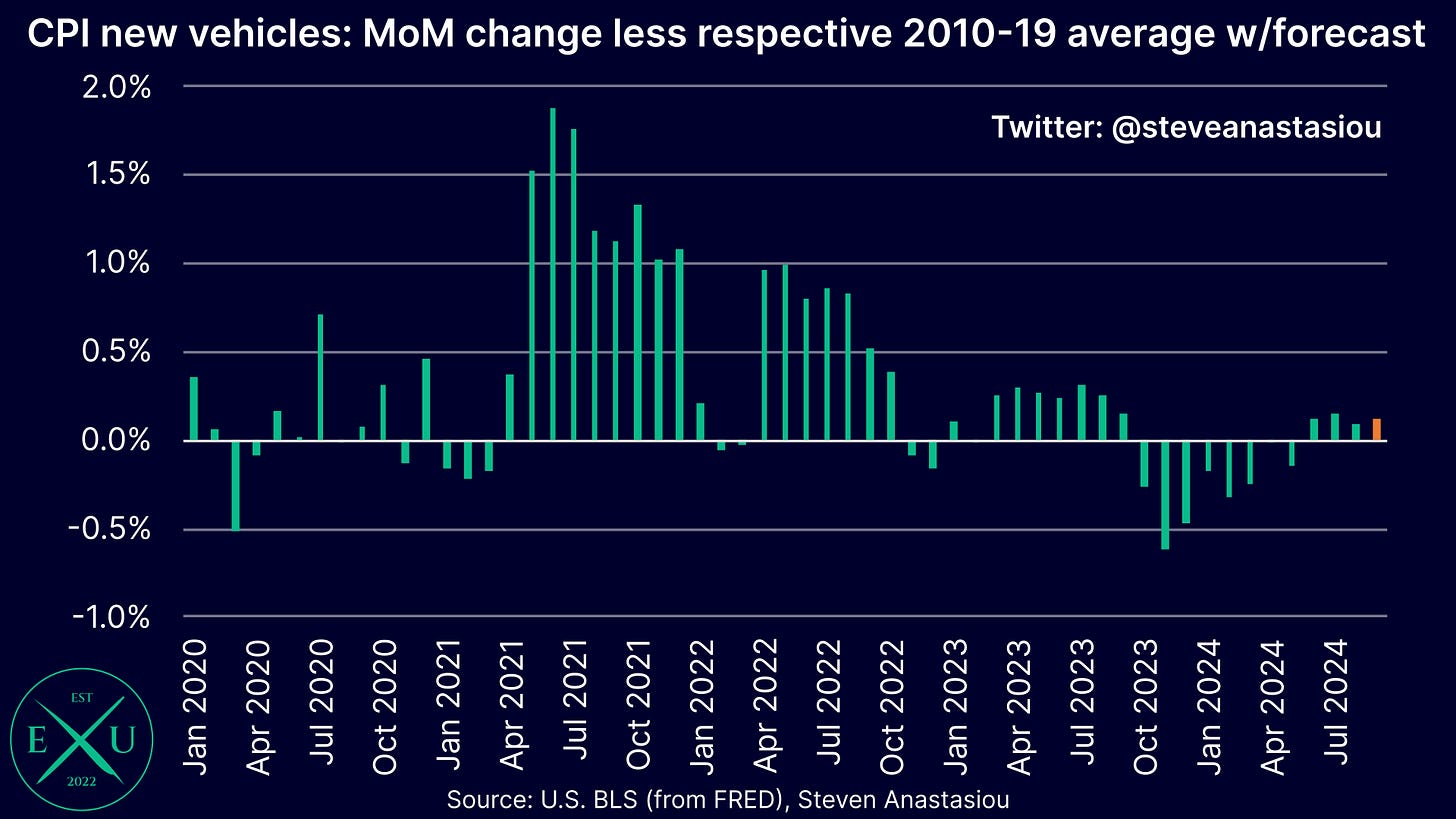

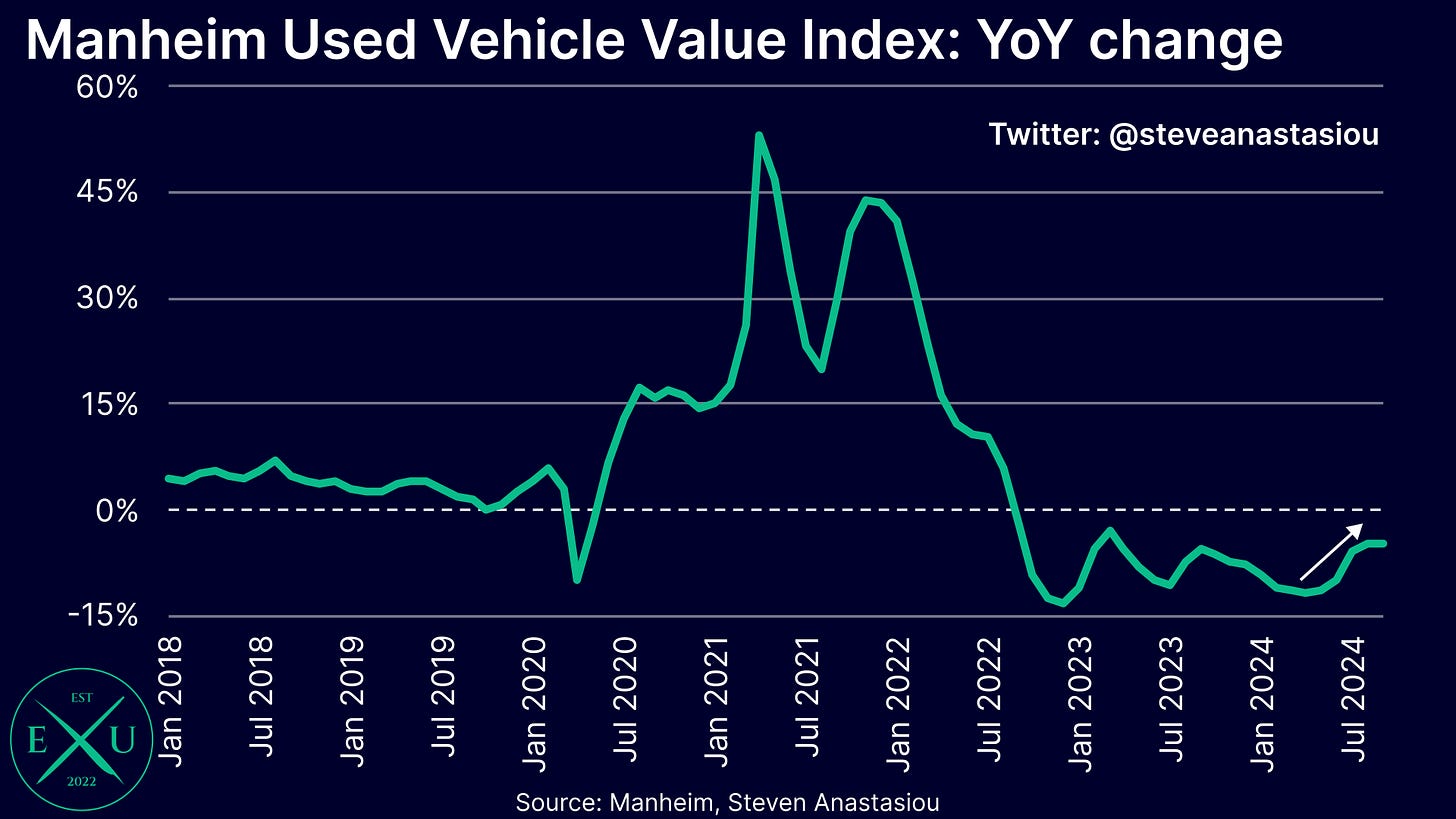

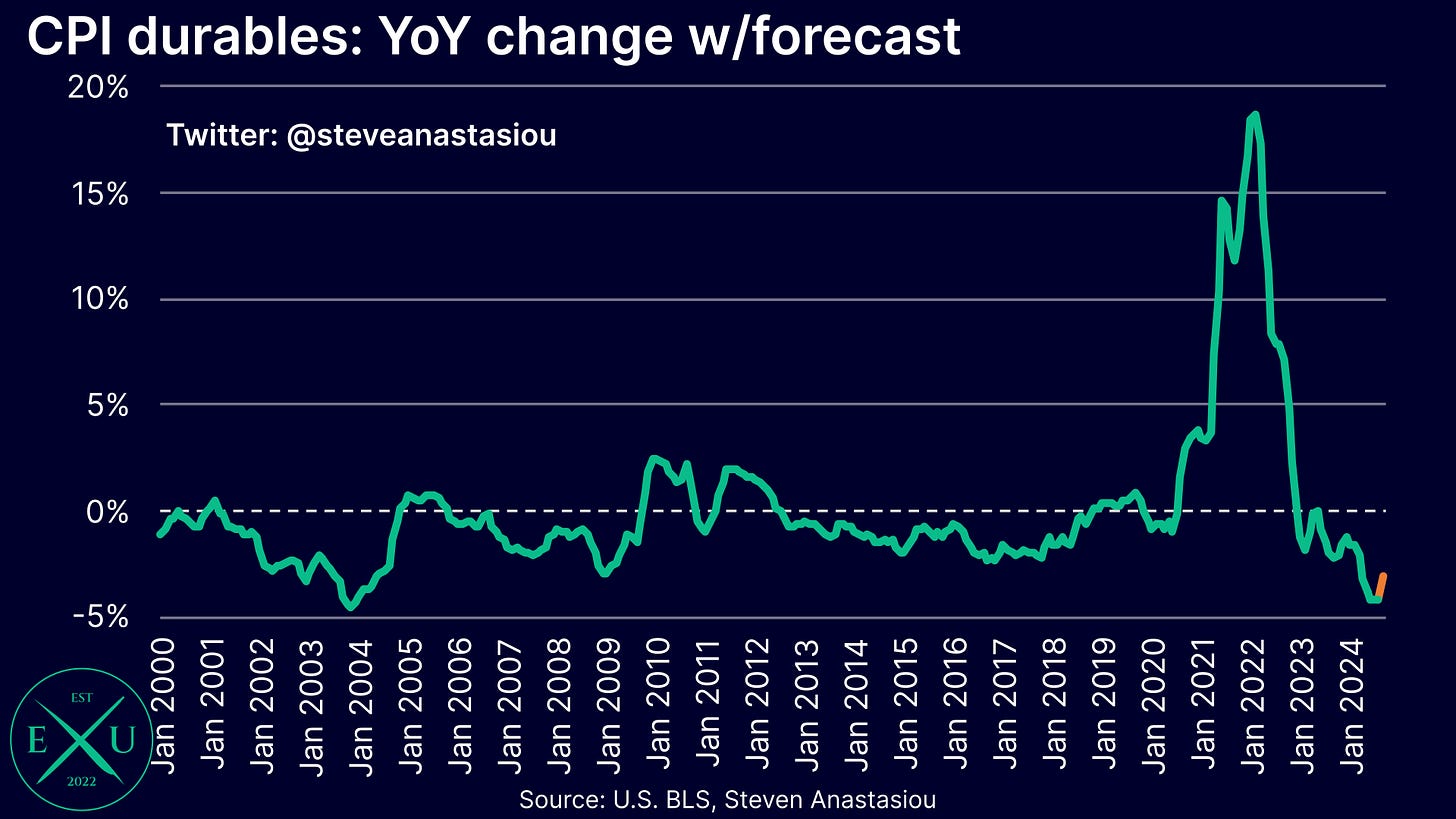

As noted in my latest comprehensive US Economic Update, durables prices have shown some signs of shifting to a more moderate pace of price declines: new vehicle prices have recorded three consecutive months of modestly above average price growth; the YoY decline in wholesale used car prices has moderated significantly; and other durables prices have seen above average price growth over the past two months.

As a result of these trends, I expect the overall CPI durables index to see a moderation in the pace of its YoY decline in September, with YoY growth of -3.1% expected, from -4.2% in August.

Energy commodities expected to see another large decline, but base effects to come into play from October

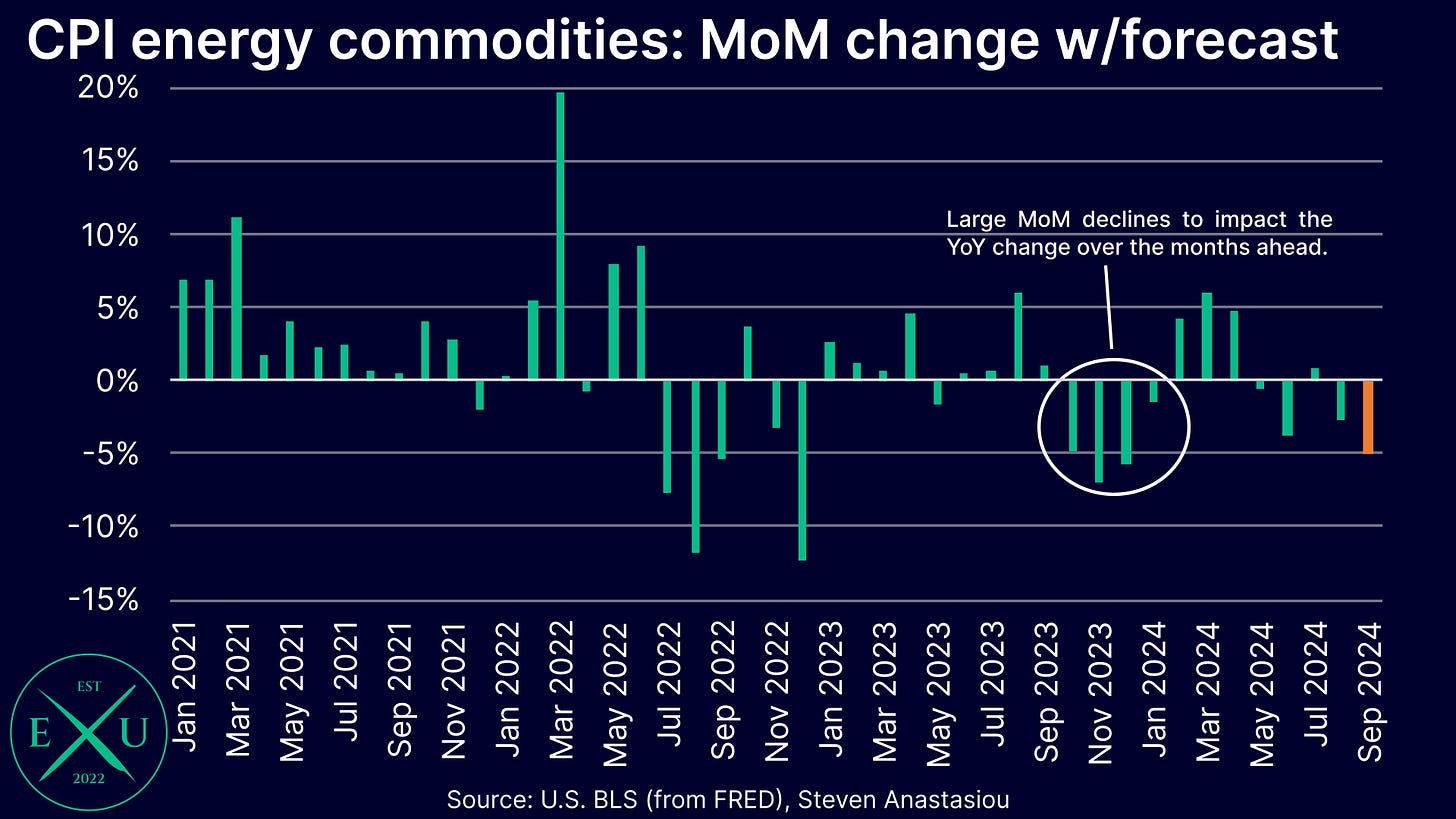

With AAA data showing that regular average gasoline prices fell 5.0% MoM, this is expected to translate into an even larger YoY decline in the CPI energy commodities index (Economics Uncovered estimate: -15.4% YoY, from -10.1%), which is largely expected to drive the forecast additional moderation across headline CPI measures in September.

Though moving forward, it’s important to note that base effects may reverse some of the significant headline CPI tailwinds that have been seen over the past two months, with large MoM declines in the CPI energy commodities to be comped from October to January.

Adjusted core services prices expected to show significant further disinflation

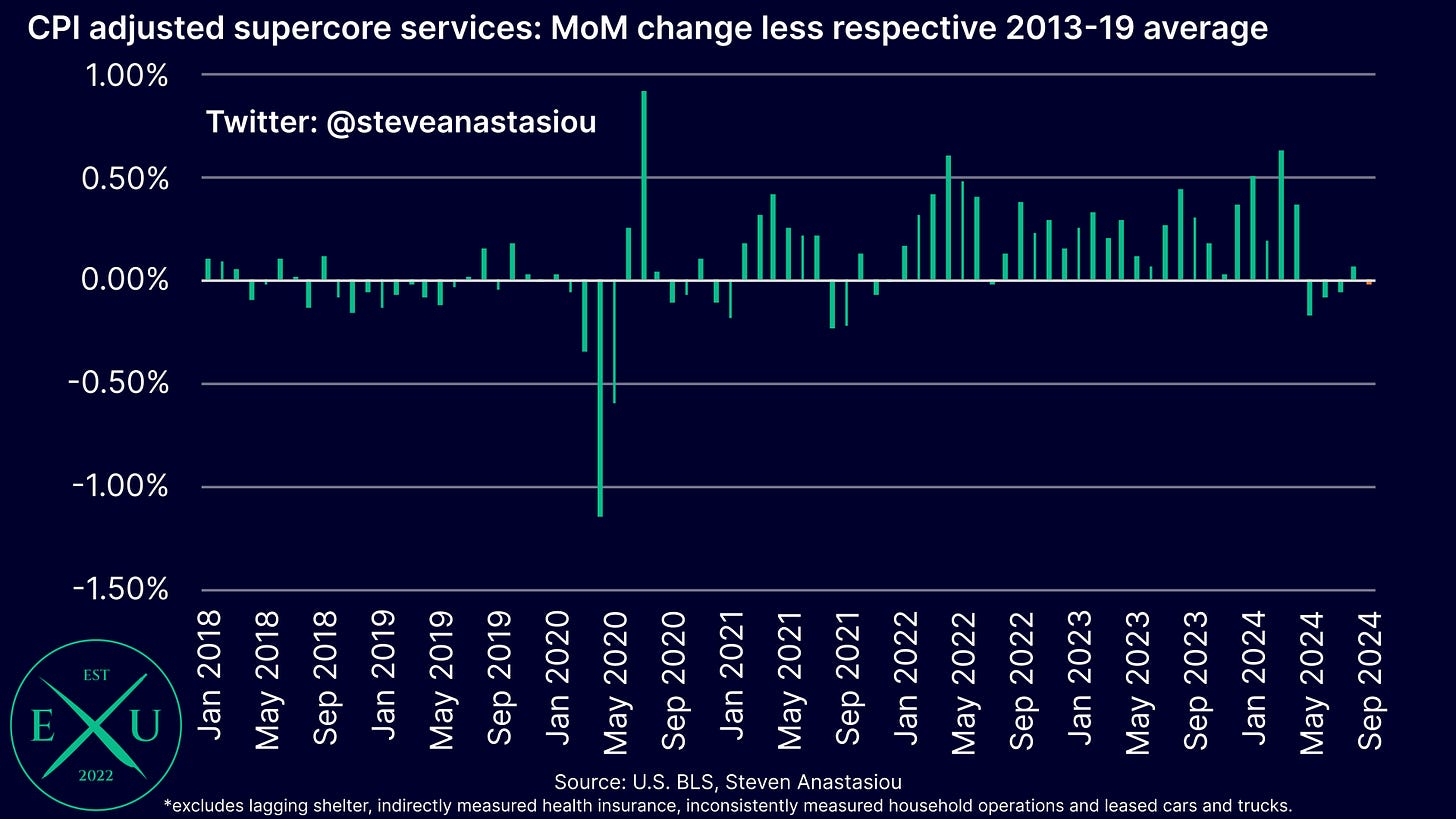

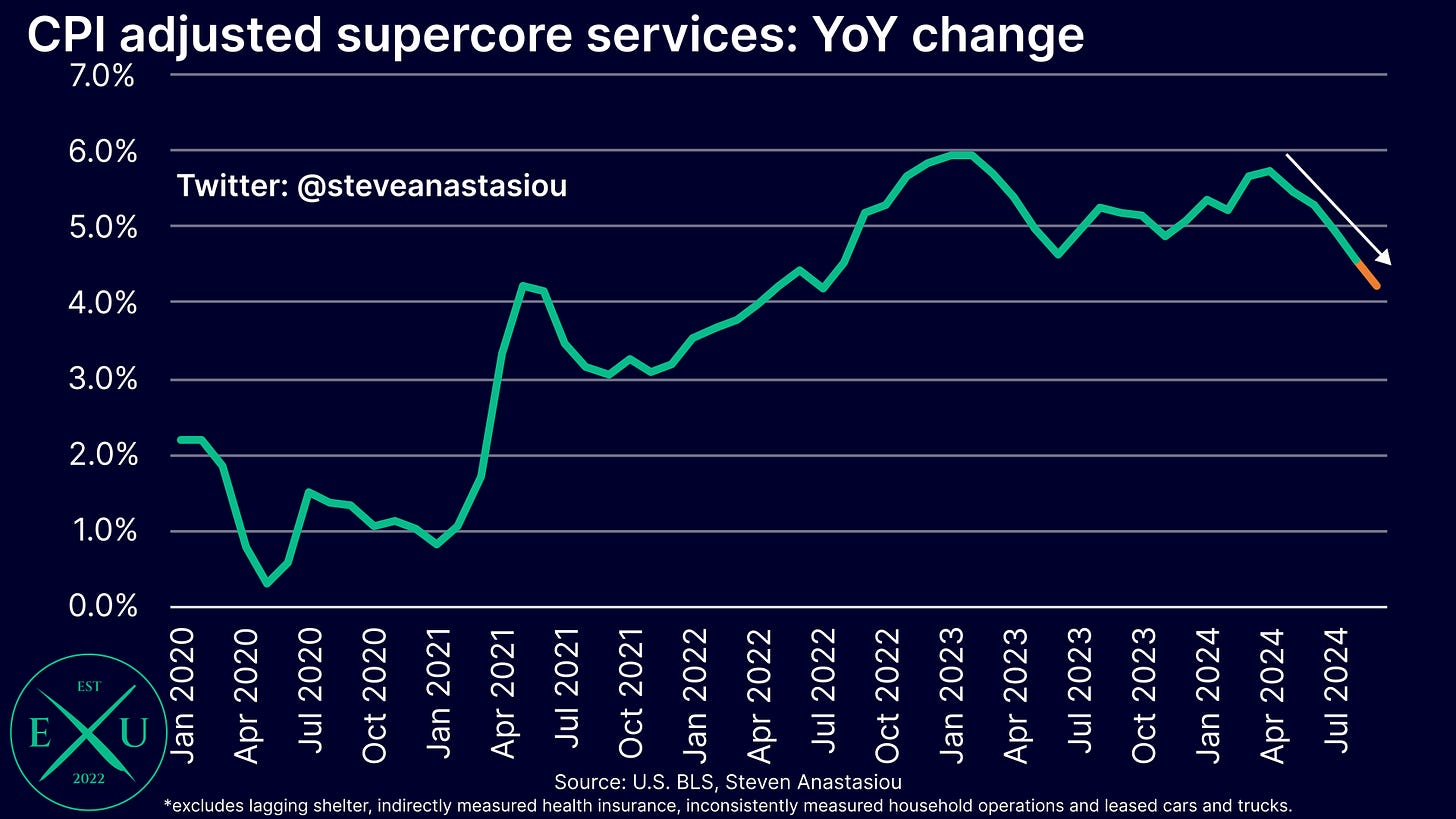

Adjusted core services prices — a critical component of the medium-term inflation outlook — are expected to show further additional disinflationary evidence in September. I adjust for lagging shelter, indirectly measured health insurance and inconsistently measured household operations and leased cars & trucks.

I expect MoM growth to come in below its historical average for the fourth time in the past five months.

This would see YoY growth decline to 4.2% (from 4.6%) to the lowest level since July 2022.

Monetary policy & financial market implications

Given that my CPI estimates are in-line with the consensus forecasts and that I expect September’s CPI report to continue to suggest that the US remains within a broader disinflationary trend, I don’t expect the September CPI report to have a material impact on the near-term monetary policy and financial market outlook.

While a softer than expected inflation reading may further support equity markets, I wouldn’t expect it to result in market pricing shifting in favour of a 50bp rate cut at the next FOMC meeting, with the potential for such a shift to instead likely require future economic data points to indicate a broader weakening of the US economy.

Should inflation come in well above estimates, then this could lead to a material further rise in bond yields and reduction in interest rate cut expectations, including the potential for a significant increase in expectations for the Fed to only cut rates once more this year.

Thank you for supporting an independent economics research alternative via your premium subscription to Economics Uncovered.

I hope that this latest research piece provides you with significant value.

If you have any questions regarding this latest update, ideas for future research pieces, or for how Economics Uncovered could be improved to provide you with even more value, feel free to send me a message using the button below, or by emailing me at steven@economicsuncovered.com