US CPI Preview: September 2023

Annual headline CPI inflation is expected to be broadly flat, but core inflation is expected to record its 6th consecutive month of deceleration.

Executive summary

For September, I forecast headline CPI growth of 3.7%, unchanged from the prior month. While this is slightly above the consensus forecast of 3.6%, to two decimal places, my forecast is 3.67%, indicating that a rounded reading of 3.6%, also has a material chance of occurring.

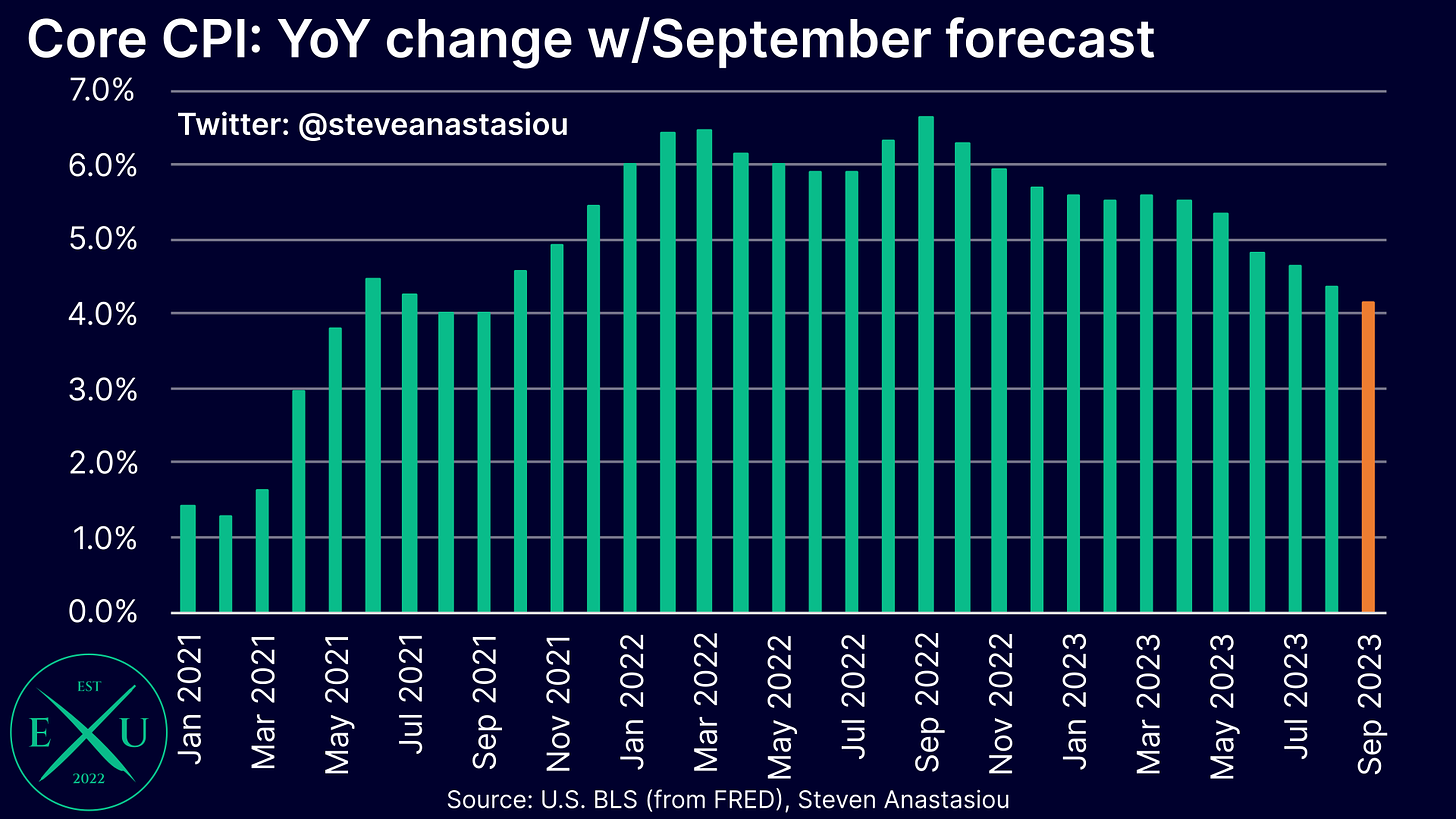

For the core CPI, I expect annual growth of 4.1%, down from 4.3% in August and in-line with the consensus forecast. This would represent the sixth consecutive month of decelerating annual core CPI growth. To two decimal places, my forecast is 4.14%, indicating the potential for core CPI growth to come in at a rounded 4.2%, which would be slightly above the consensus estimate.

For both the headline and core CPI, I expect MoM growth to be largely in-line with their respective historical averages for September.

While gasoline prices drove the CPI higher in August, the two categories that are most likely to be the key swing factors in September, are used car and truck prices, and airline fares.

While prior moves in wholesale used car prices point to a large decline in CPI used car and truck prices in September, the CPI’s retail prices have seen three consecutive months of a growing relative price gap to wholesale prices. In September, this recent dynamic of relatively stronger retail versus wholesale prices, comes up against what is historically the weakest month for retail used car prices.

Meanwhile, after seeing very large relative price declines across May — July, a resurgence in jet fuel prices over recent months suggests that airfares could see a significant spike higher in September.

With used car prices and airfares already some of the most volatile CPI categories, recent dynamics increase the difficulty in forecasting their monthly movement.

Used car prices expected to fall materially

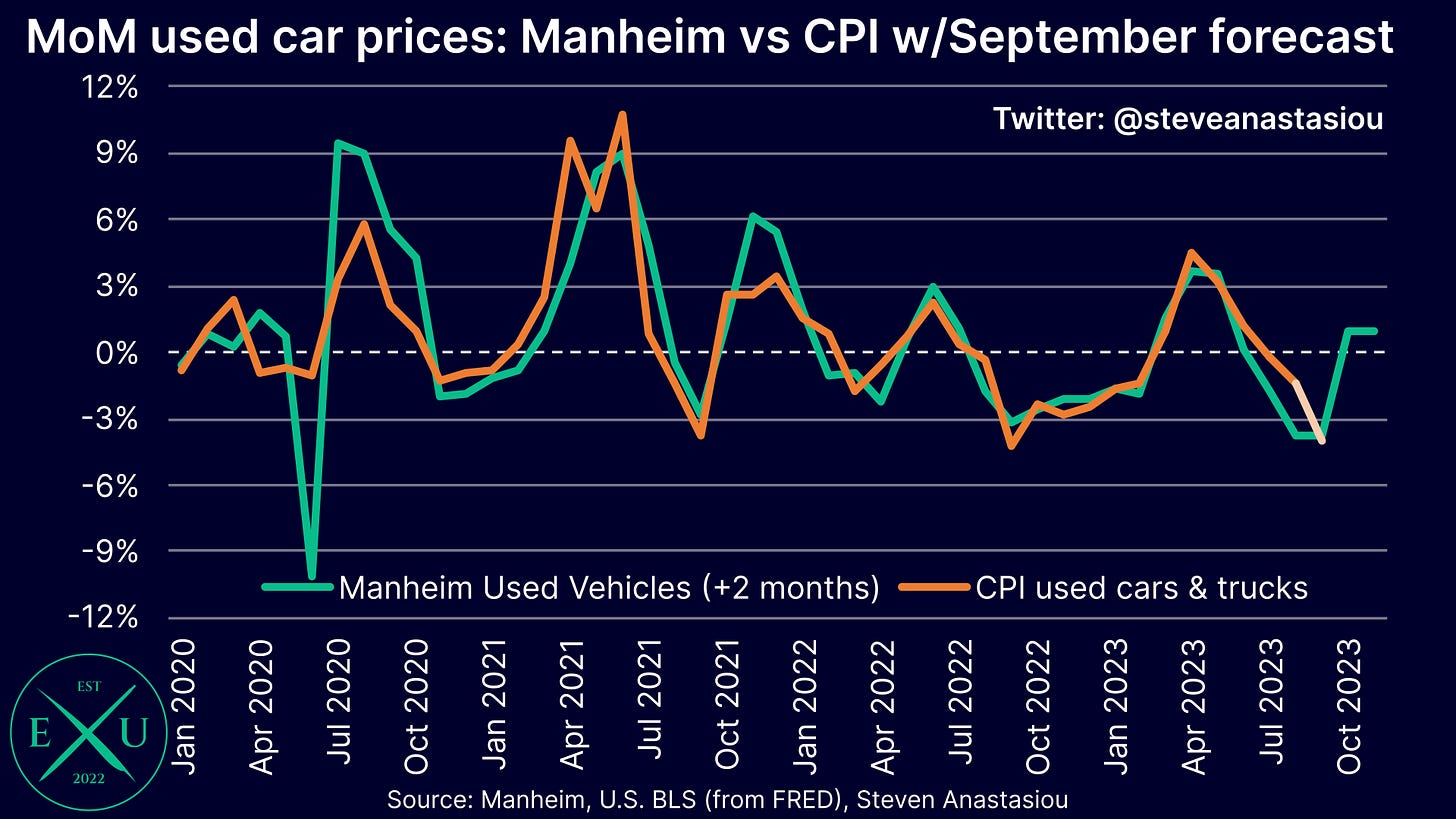

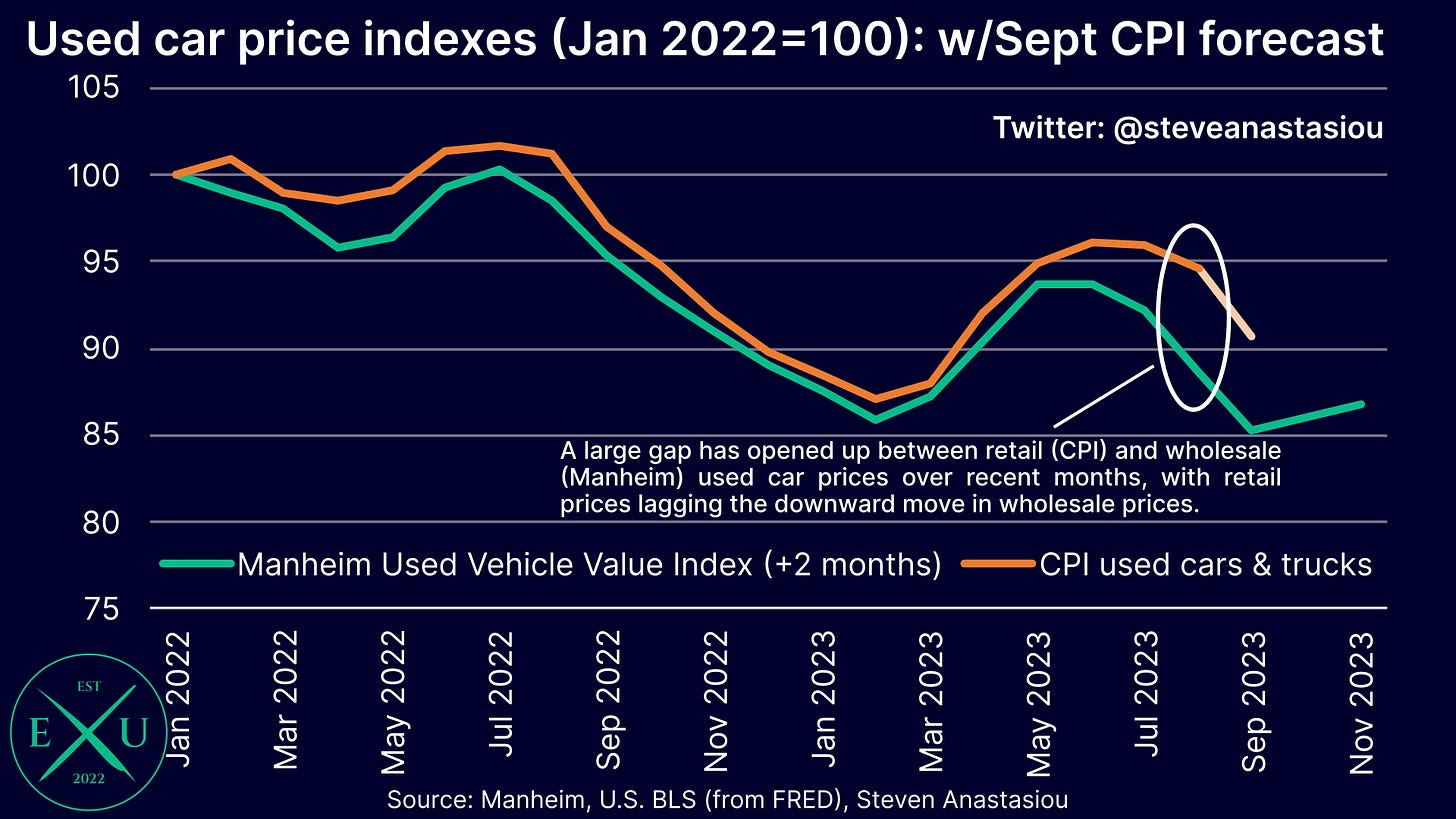

I expect CPI used car and truck prices to record a material fall in prices in September. This expectation is driven by the significant decline in the Manheim Used Vehicle Value Index in July (the CPI’s retail prices tend to lag Manheim’s wholesale prices by two months).

While tending to be relatively closely correlated, material deviations between the CPI’s retail prices and Manheim’s wholesale prices on 2-month lagged basis, do occur.

Over recent months, the divergence has been particularly significant, with retail prices materially lagging the decline that has been seen in wholesale prices, resulting in a significant gap opening up between retail and wholesale used car prices.

Given that this gap would be expected to close over time, and with September being the seasonally weakest month for CPI used car and truck prices, I am forecasting a larger MoM fall in CPI used car and truck prices, than is implied by a 2-month lag of the Manheim Index.

While I am forecasting a MoM decline that is greater than what a 2-month lag of the Manheim Index implies, the forecast deviation for September is materially less than the long-term trend for September (-0.2% vs -1.4% average across 2010-22).

While the longer-term trend suggests that an even larger MoM decline would not be overly surprising, a more conservative forecast is used on account of the recent trend of more stubborn retail prices, and a shift to higher wholesale used car prices in August and September (as can be seen in the above chart), indicating that dealers may be less reluctant to materially discount inventory.

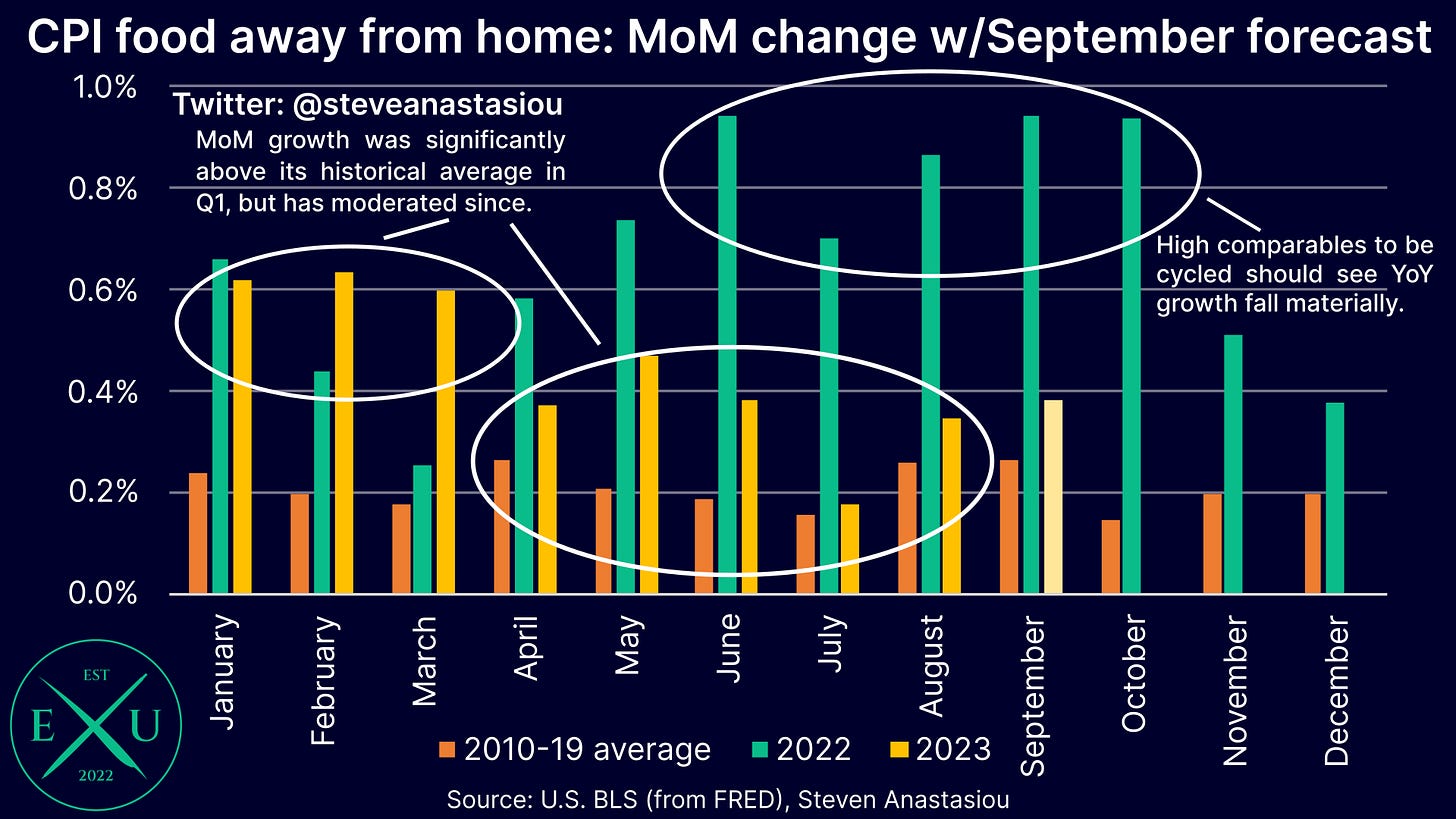

Food price growth expected to keep decelerating

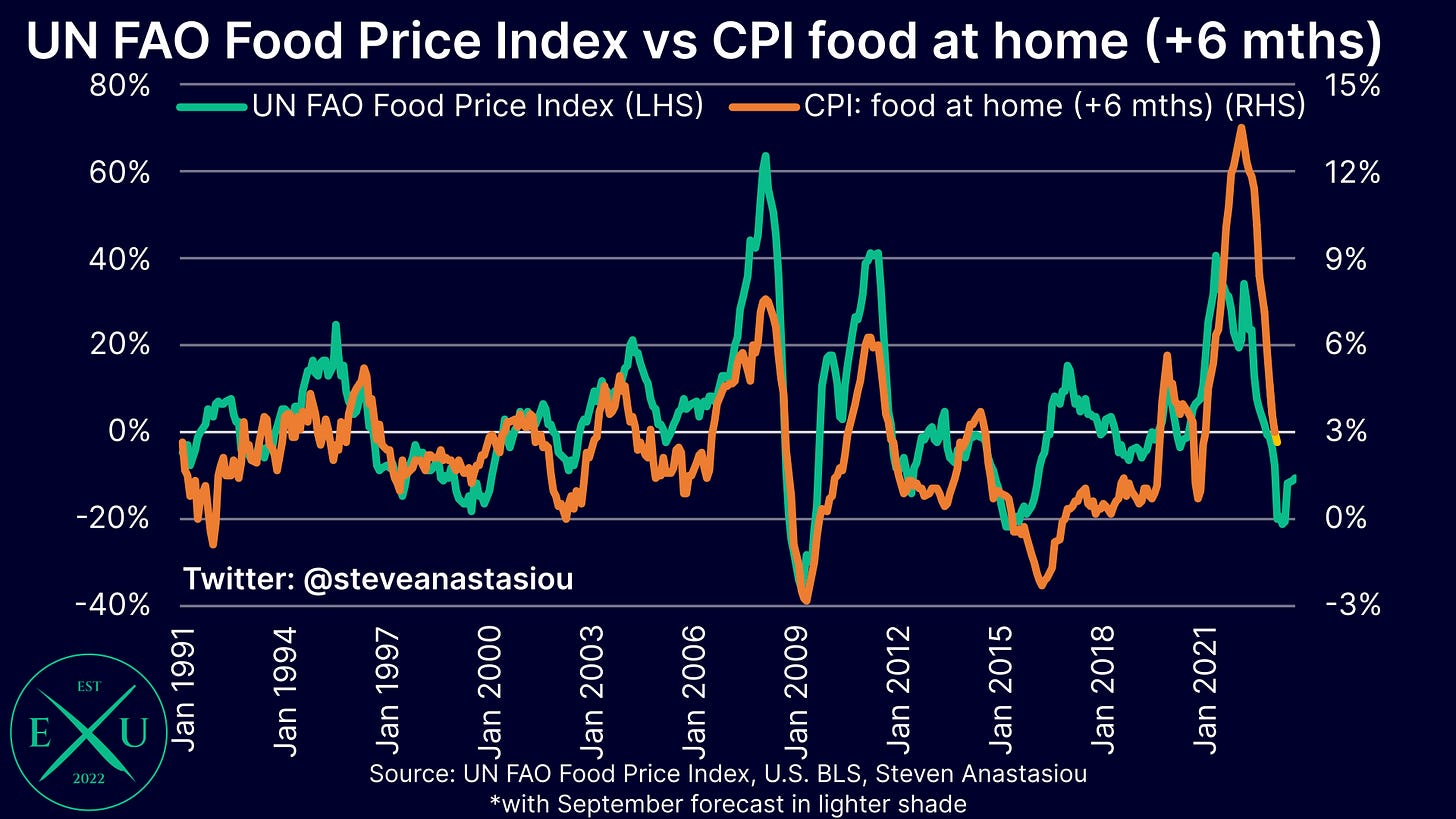

Both CPI food at home and CPI food away from home prices are expected to show a further moderation of price growth in September, continuing the trend that has been seen in recent months.

CPI food at home prices are expected to see YoY growth fall to 2.6%, down from 3.0% in August. This would mark the lowest rate of growth since July 2021.

Given the move that has already taken place in underlying food commodity prices, and the fact that MoM growth has largely decelerated towards its historical average, I anticipate that annual CPI food at home price growth will decelerate further over the months ahead.

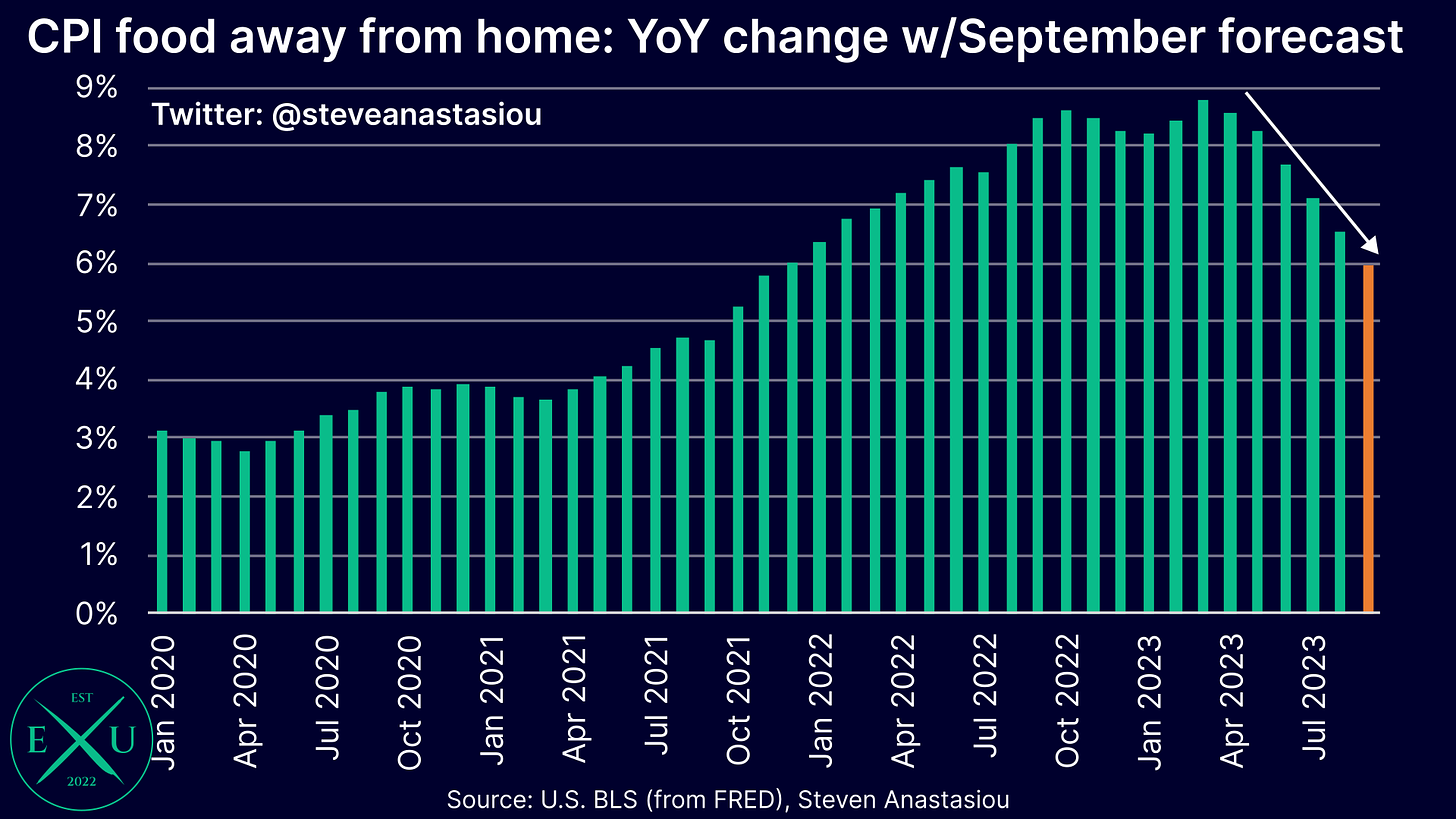

For CPI food away from home prices, I forecast annual growth to fall to 5.9%, down from 6.5% in August.

The recent trend of lower YoY growth comes as MoM growth has shown a material deceleration since April. Given this deceleration, I currently expect a material further decline in annual price growth over the remainder of 2H23, as higher prior comparables are cycled.

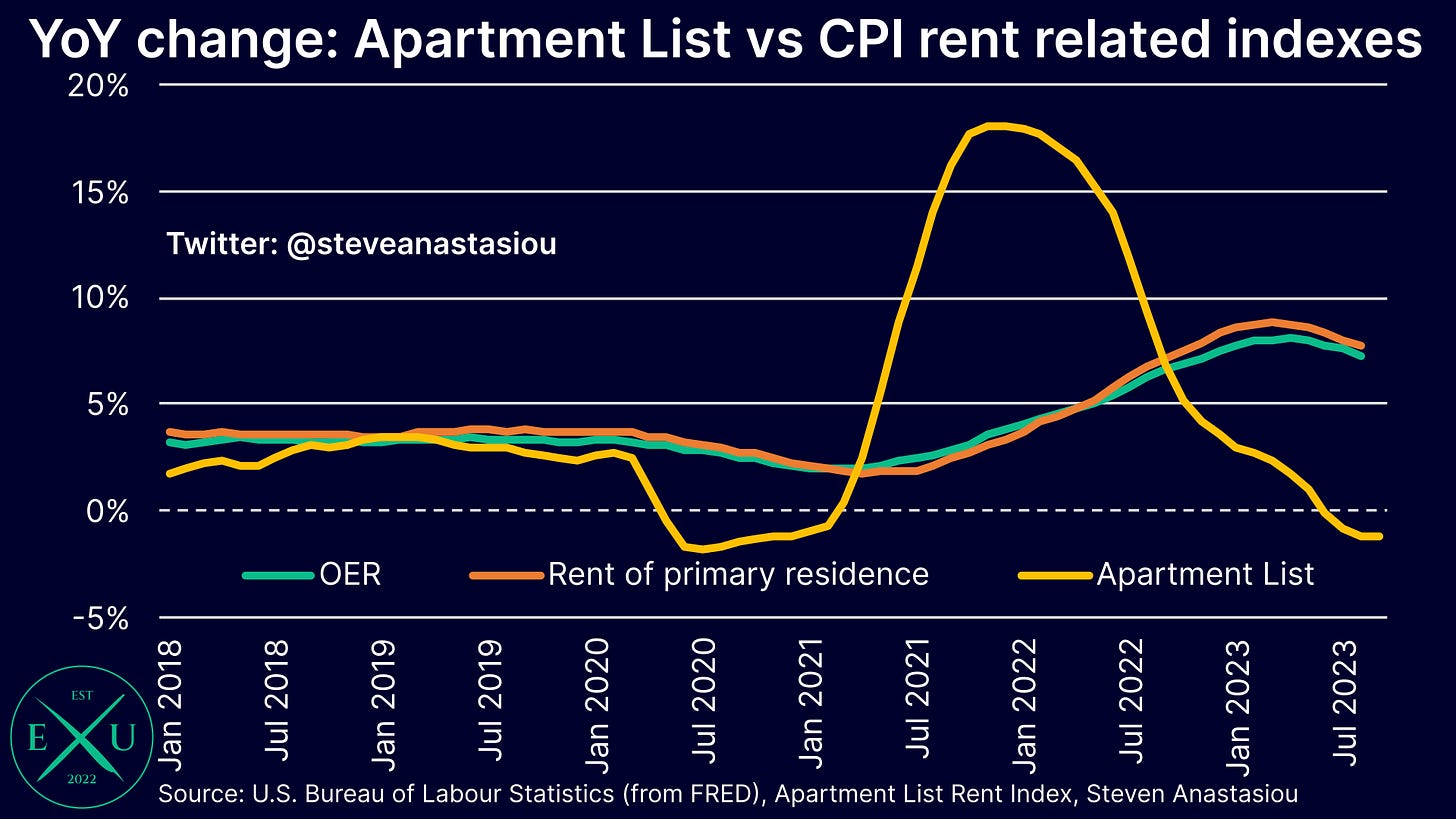

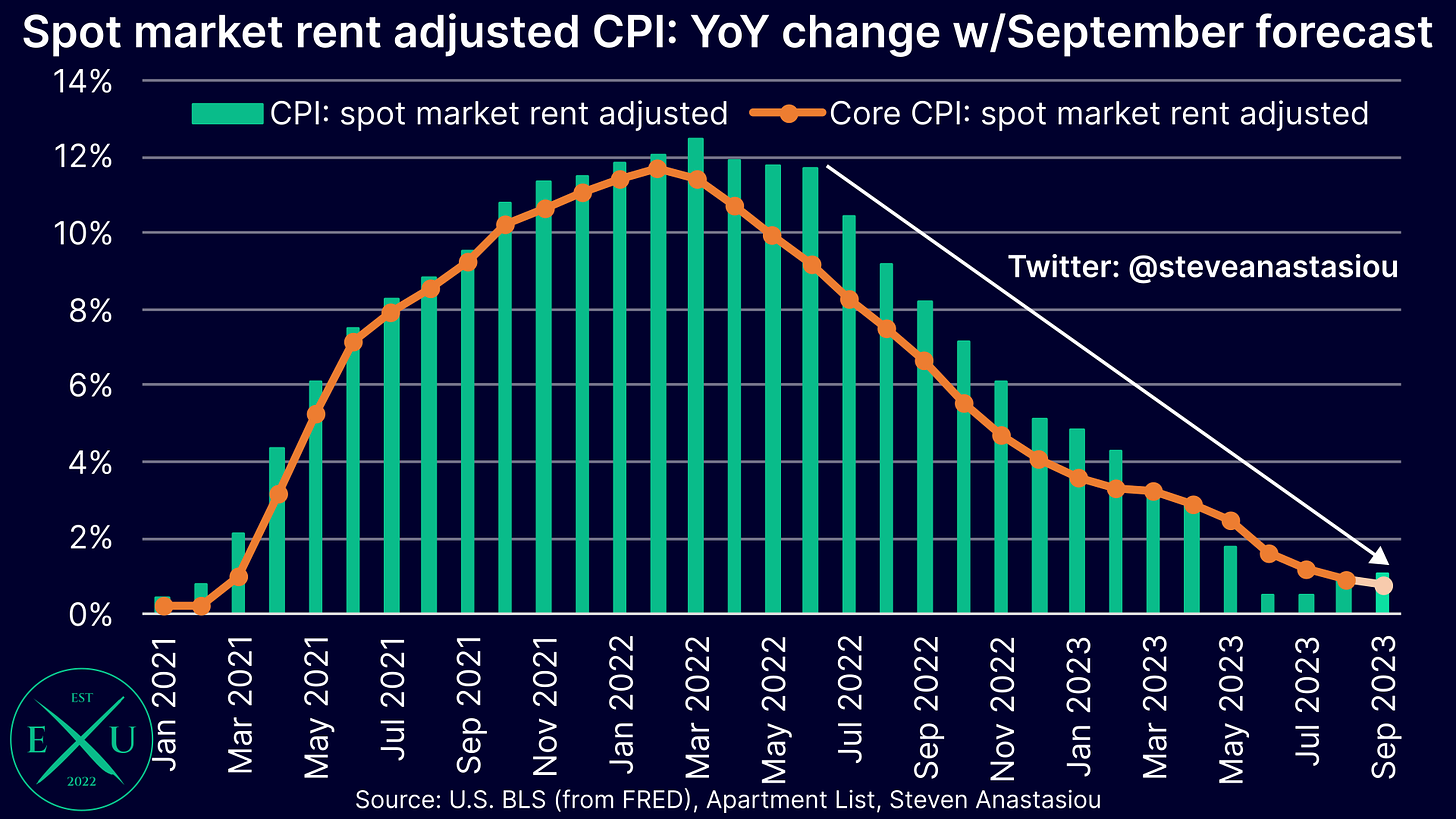

Apartment List data records a further contraction in rents, but OER and RPR expected to remain elevated in September

For the 22nd consecutive month, spot market rents, as measured by the Apartment List Rent Index, recorded lower YoY growth than in the previous month. This has seen annual growth fall from 18.1% in November 2021, to outright deflation, with an annual change of -1.2% recorded in September.

This is well below the CPI’s lagging rent of primary residence (RPR) and owners’ equivalent rent (OER) components, which rose by 7.8% and 7.3% respectively, in August.

The dramatic shift in underlying spot market rental growth is expected to result in a continued deceleration in the CPI’s rent based measures over time. The deceleration is expected to be gradual, as in addition to being lagging, on account of most of the CPI’s rental sample consisting of fixed-term lease agreements, changes are also smoothed in nature.

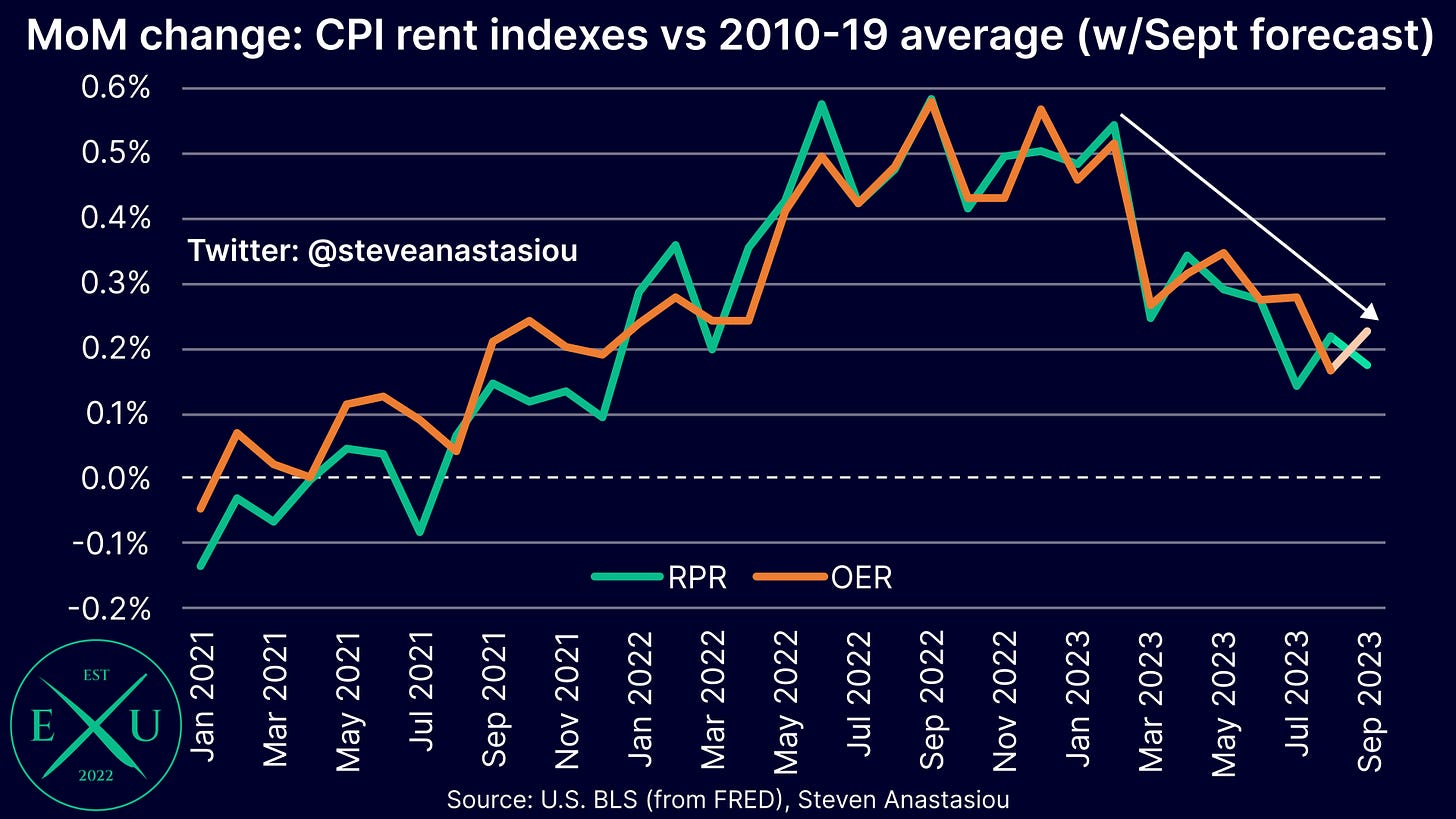

In comparison to the historical monthly average, I expect MoM growth in RPR to moderate in September. This comes after MoM growth in RPR rose in comparison to its historical average in August, after a large moderation in July.

Given that OER saw a relatively large fall in August, I forecast a bounce back in September versus its historical monthly average — a relatively abrupt fall followed by a bounce back reflects what was seen in RPR over the past two months.

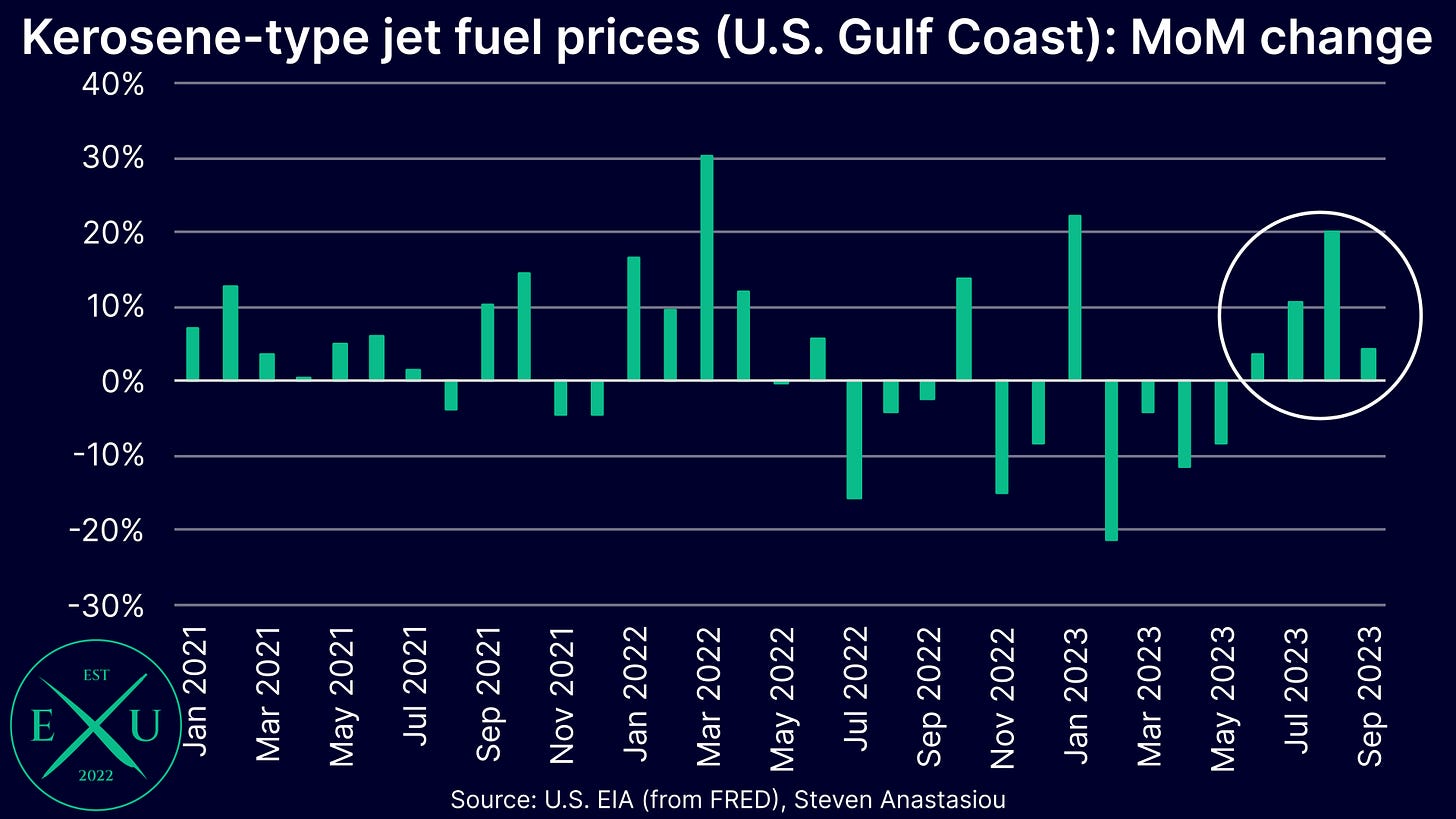

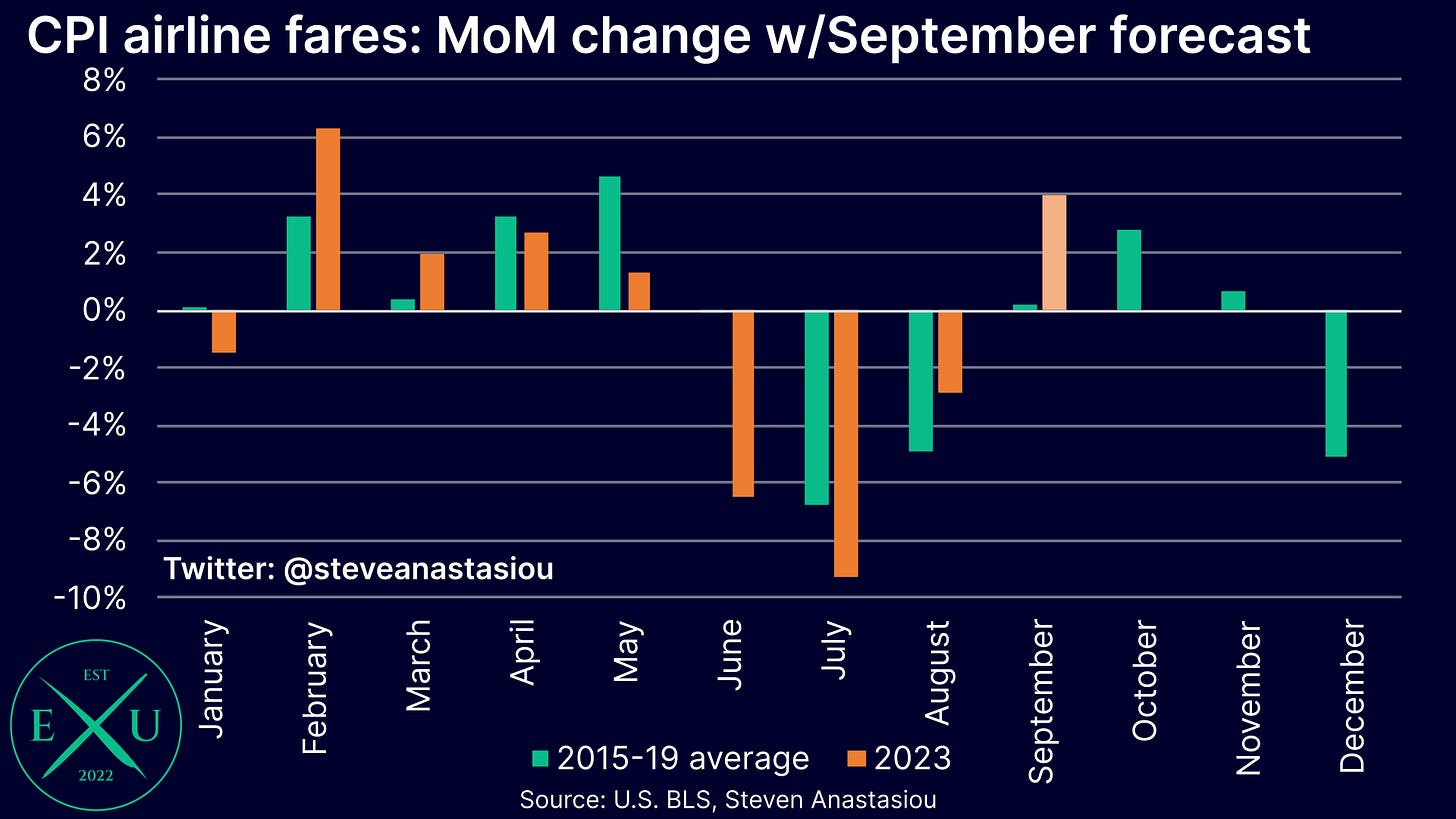

Given moves in jet fuel prices, airline fares could see a major jump

In recent months, kerosene-type jet fuel prices have risen significantly: by 3.5%, 10.6%, 20.1%, and 4.4% across June to September, respectively.

As a result of these large increases, airfares would generally be expected to rise significantly. Yet in recent months, they have instead continued to fall.

While this may seem strange, there are two key factors to consider.

Firstly, airfares generally lag the change in jet fuel prices. As jet fuel prices fell significantly from February to May, and only began to rise more significantly in the back end of July, the full impact of the rise in jet fuel prices on airfaires, is unlikely to have yet been felt.

Secondly, airfares have been moving through their cyclically weak period, where material MoM declines are typically seen. Therefore while airfares fell by 2.8% MoM in August, this was materially less than the average August decline of 5.0% across 2015-19. This marks a significant turnaround from the previous four months, where MoM growth was well below the historical average.

On account of an expectation that the recent surge in jet fuel prices begins to more materially impact airfares in September, I forecast another increase in MoM growth versus the historical average, and a material outright MoM increase of 4.0%.

It’s important to note that airfares are already a volatile price category, and the recent moves in jet fuel prices further complicate the picture, elevating the degree of uncertainty surrounding this estimate, which could end up being materially higher or lower than forecast.

In conjunction with used car prices, airfares are likely to be the second key potential swing factor for September’s CPI report.

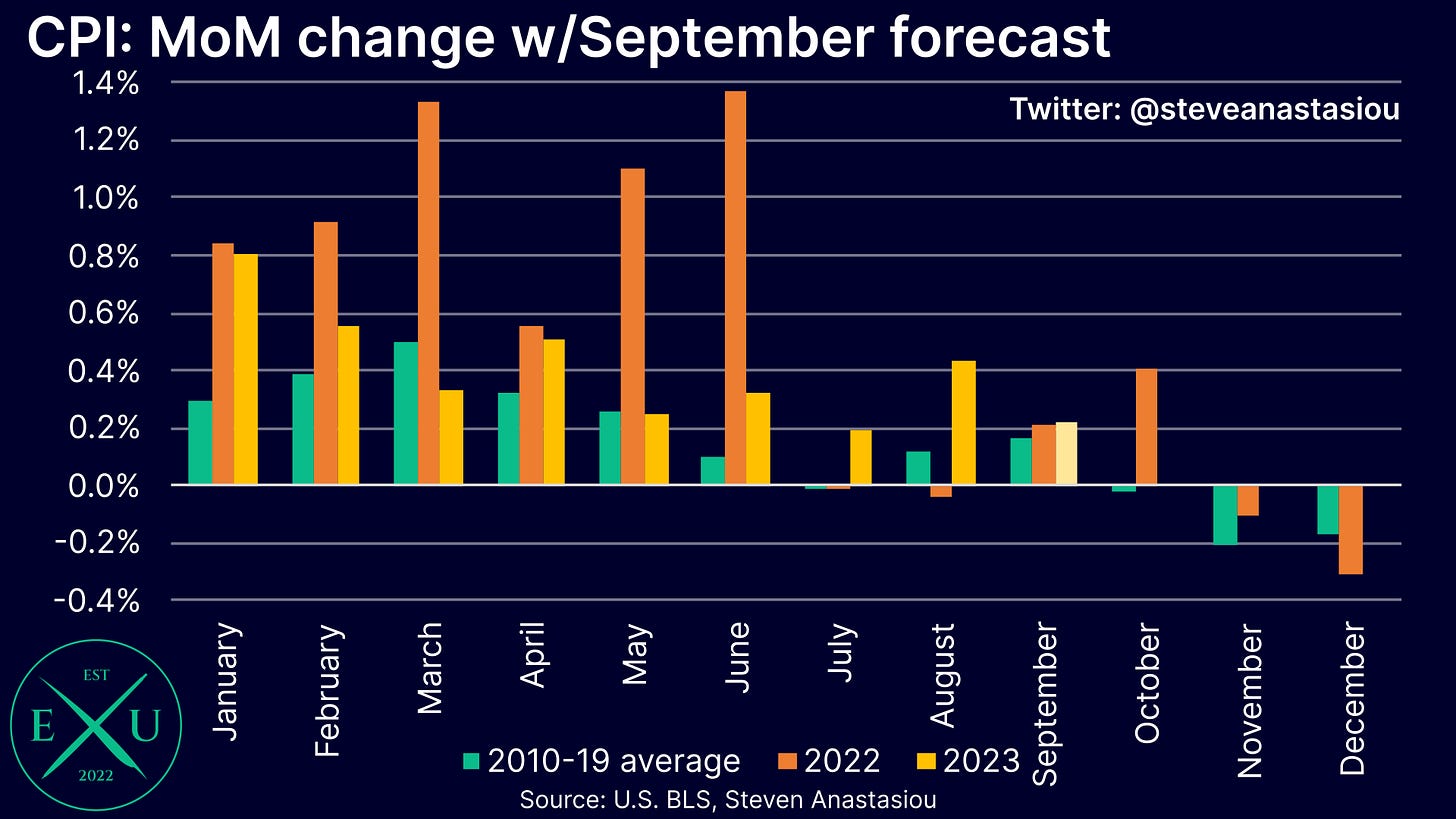

MoM headline CPI growth forecast to be largely in-line with its historical average

At 0.2%, headline CPI growth is expected to record MoM growth that is largely in-line with its historical (2010-19) average in September. Should headline CPI growth come in-line as forecast, this would represent the most modest growth in relation to the historical monthly average since May.

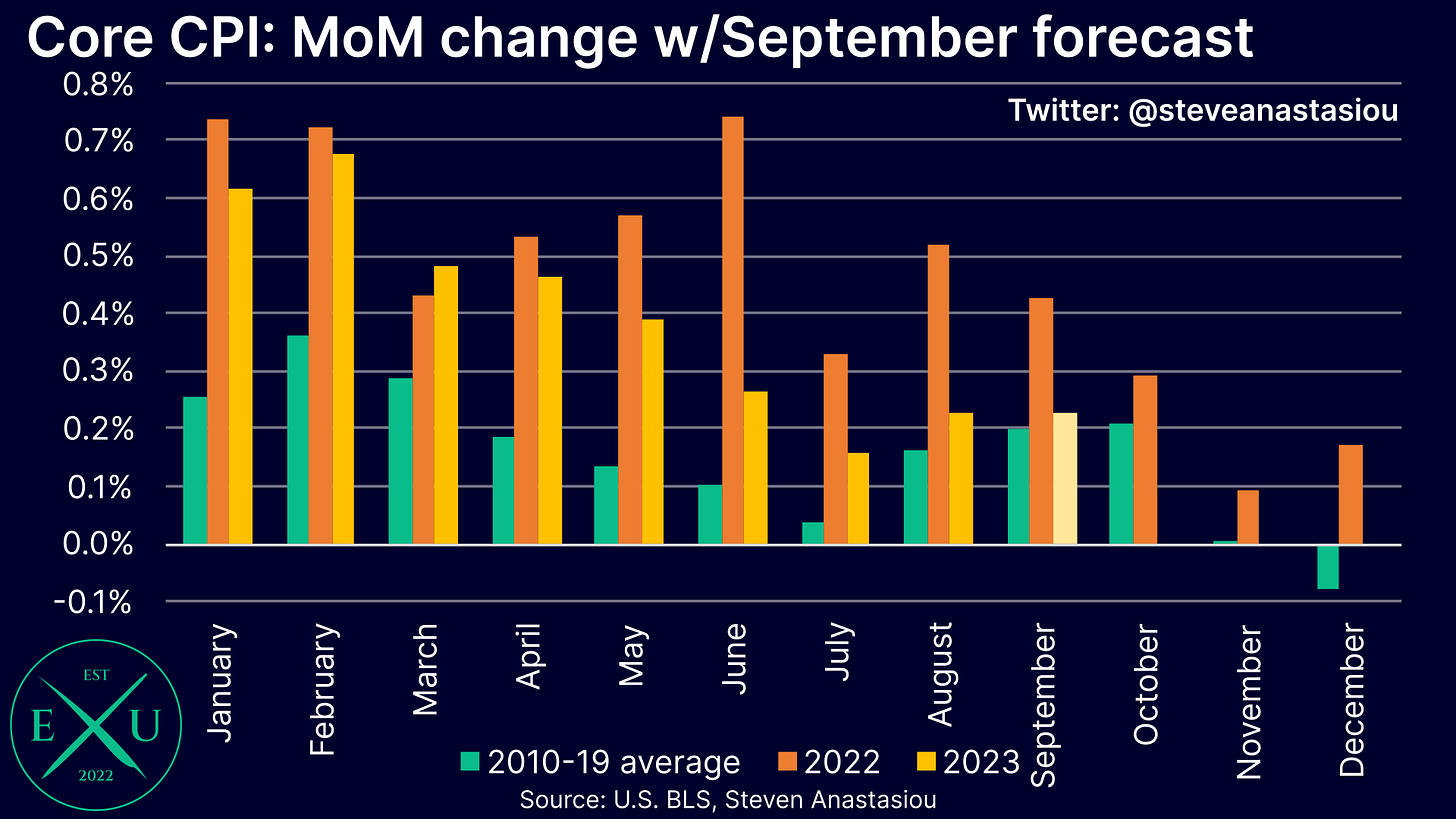

Core CPI expected to also see MoM growth that is largely in-line with its historical average

Like the headline CPI, the core CPI is also expected to record MoM growth that is largely in-line with its historical average in September.

Should growth come in as forecast, this would represent the fifth consecutive month of lower MoM growth in relation to its historical monthly average — while growth has remained modestly above the historical average over the past few months, trends therefore continue to be consistent with a normalisation of inflation pressures.

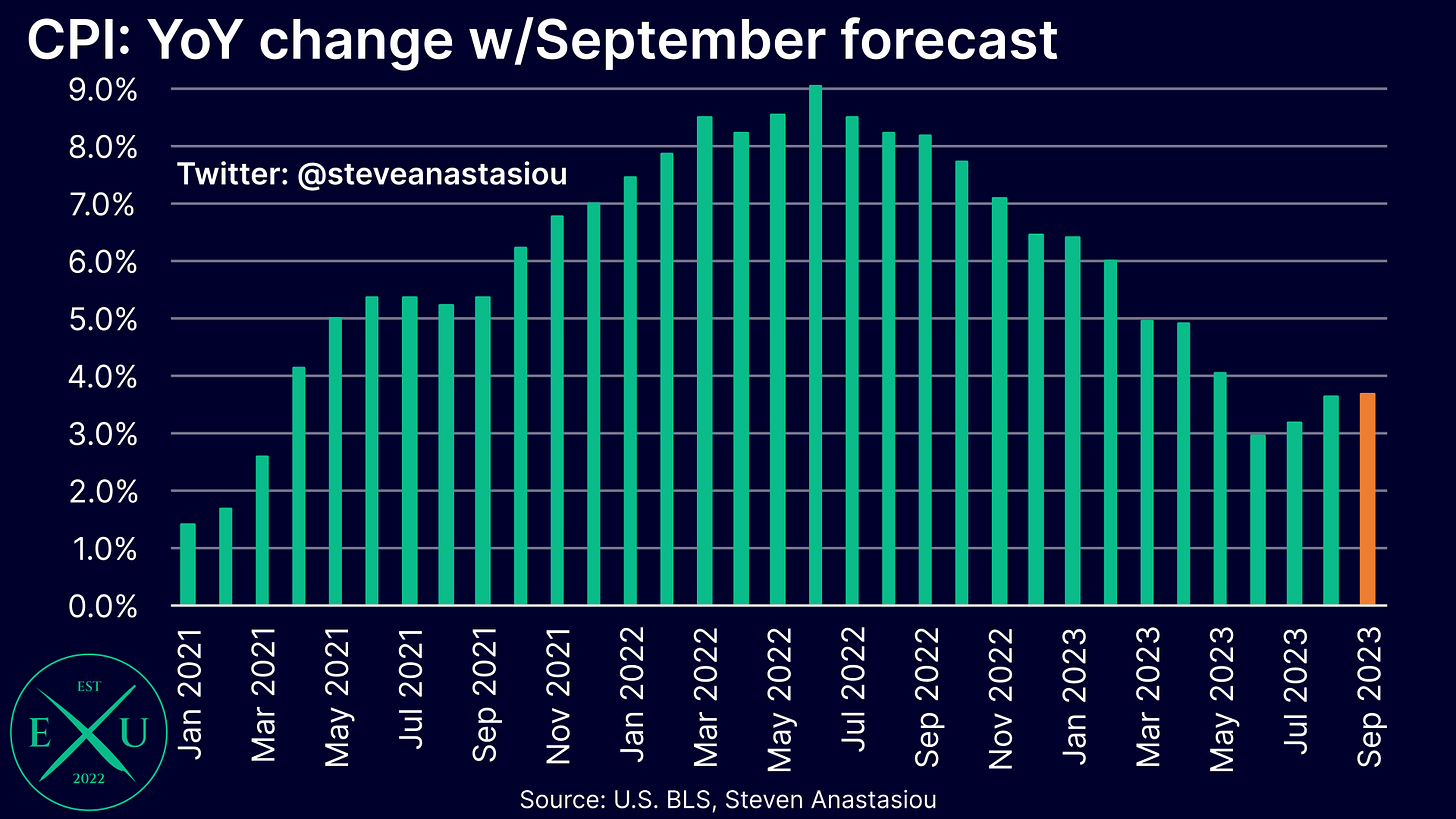

Headline CPI forecast to come in at 3.7% — but it’s not too far away from consensus of 3.6%

In terms of YoY growth, I forecast annual headline CPI growth of 3.7% in September, unchanged from August. This is slightly above the 3.6% consensus forecast.

While my forecast is slightly hotter than the consensus expectation, on a two decimal place basis, my forecast is 3.67%, which is not too far away from being below 3.65%, and thus rounding to 3.6%.

With the potential for large movements in used car prices and airfares in September, and their exact quantum difficult to predict, this could swing annual headline CPI inflation between 3.6%/3.7%.

Core CPI growth expected to moderate for the 6th consecutive month

The core CPI is expected to record YoY growth of 4.1% in September (vs 4.1% consensus), down from 4.3% in August. This would mark the 6th consecutive month of lower YoY growth.

On a two decimal place basis, my estimate is 4.14%, suggesting that there’s also a material chance that the core CPI rounds to 4.2%, which would be above the consensus estimate.

Spot market rent adjusted CPI measures expected to be below 2% for the 4th consecutive month

Turning now to the spot market rent adjusted CPI measures (adjusted to Apartment List data), I expect annual headline CPI growth to come in at 1.0% (vs 1.0% in August), and core CPI growth to come in at 0.8% (vs 0.9% in August).

This would represent the fourth consecutive month that both spot market rent adjusted headline and core CPI inflation is below 2% YoY, and the second consecutive month that both headline and core CPI inflation would be at, or below, 1% YoY.

Thank you for reading my latest research piece — I hope that it provided you with significant value.

Should you have any questions, please feel free to leave them in the comments below!

In order to help support my independent economics research, please consider liking and sharing this post and spreading the word about Economics Uncovered. Your support is greatly appreciated and goes a long way to helping make Economics Uncovered a sustainable long-term venture that can continue to provide you with valuable economic insights for years to come.

If you haven’t already subscribed to Economics Uncovered, subscribe below so that you don’t miss an update.