US CPI Preview: March 2024

After hotter CPI readings to begin 2024, expectations for interest rate cuts have been drastically reduced and 10-year bond yields have jumped higher — could March's CPI data reverse this trend?

Following on from my medium-term US CPI update that was released last week, and my comprehensive US Jobs Report Review (which includes 50 charts, of which many were kept above the paywall), the time has arrived for my next monthly US CPI Preview.

In addition to my proprietary US CPI forecasts, this update breaks down the potential ramifications of the upcoming US CPI data for the Fed and financial markets.

While I intend to continue to make some snippets of my research publications available for free subscribers, given that premium subscribers help to ensure the ongoing future and growth of Economics Uncovered, and that my monthly US CPI Preview represents a flagship report for Economics Uncovered, this report will sit behind the paywall — though to continue with my transparent forecasting track record, I intend to move the paywall below my headline and core CPI forecasts, closer to the release of the latest US CPI data.

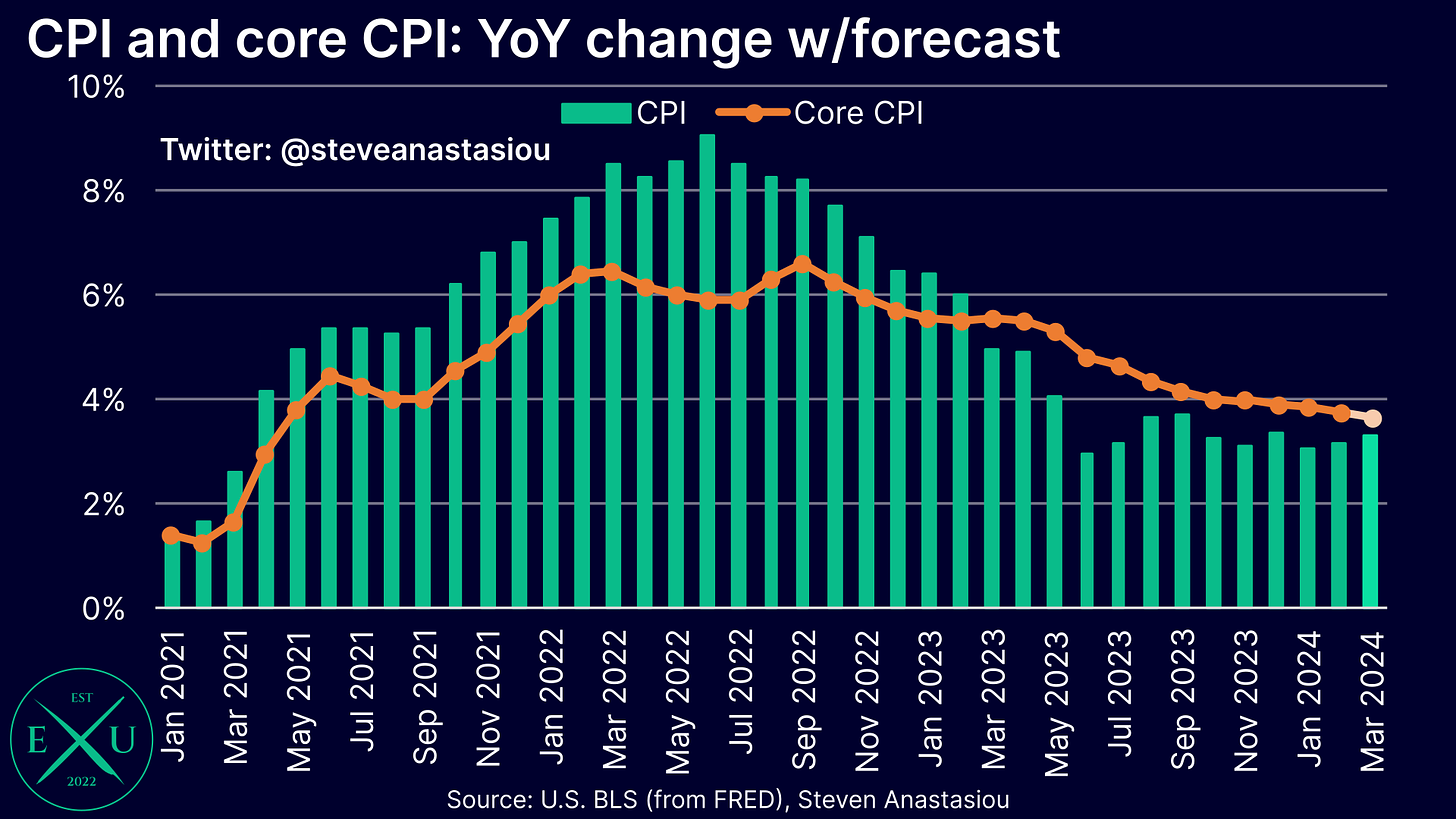

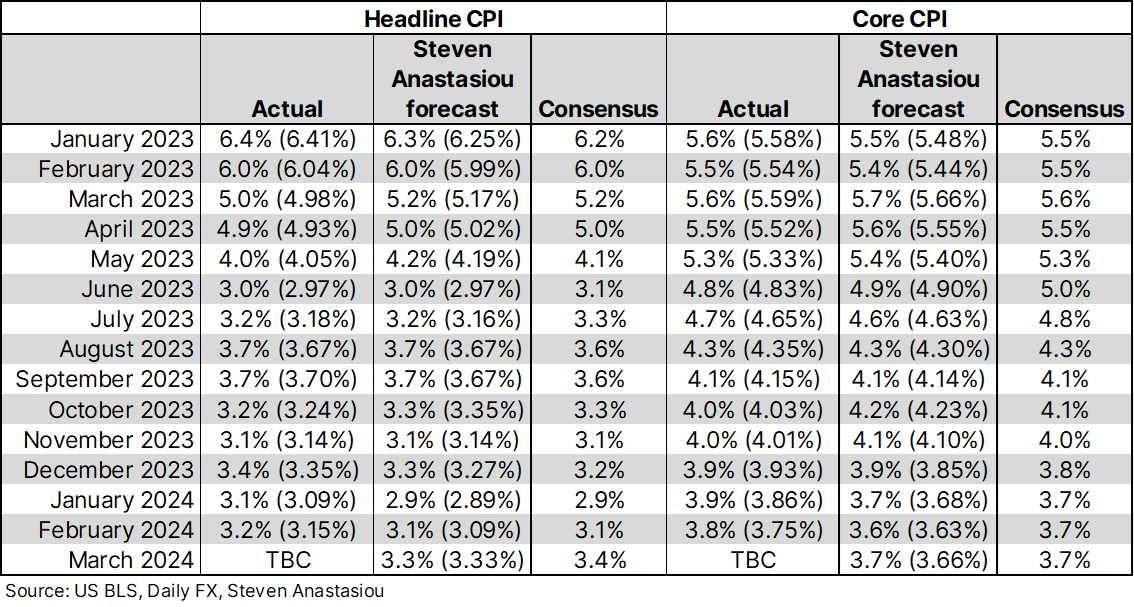

Headline CPI growth expected to rise, but core CPI growth expected to moderate

In March, I expect headline CPI growth of 3.3% (3.33%) YoY, up from 3.2% in February. This is slightly below the consensus estimate of 3.4% YoY.

For the core CPI, I expect YoY growth of 3.7% (3.66%), down from 3.8% in February. This is in-line with the consensus estimate and would mark the 12th consecutive month of decelerating YoY growth.

While my core CPI estimate is in-line with the consensus estimate, given that my two decimal place estimate is not far off from rounding down to 3.6%, my forecast points to the significant potential for core CPI growth to come in slightly below consensus expectations. Note also that my headline CPI forecast is not far away from rounding down to 3.4% YoY, which would be in-line with consensus expectations.