US CPI Preview: February 2024 — a critical report for the interest rate & market outlook

With January's US CPI report seeing a large spike in MoM growth, February's US CPI report carries outsized importance — a repeat of January's higher MoM growth could have major ramifications.

While my prior US CPI Previews were already highly in-depth, in attempting to best fulfill my commitment to provide you with some of the most comprehensive inflation analysis available, this latest edition takes it several steps further.

Across more than 3,100 words and with the help of 26 charts, within this report you will find:

My proprietary US CPI forecasts for February, consisting of various MoM, 3-month annualised, 6-month annualised and YoY forecasts across the:

headline and core CPI;

headline and core CPI ex-shelter;

headline and core CPI adjusted for spot market rents;

adjusted core services; and

various other CPI subcomponents.

A discussion of the impact of lagging services prices on the broader disinflationary picture.

An analysis of what the latest US CPI data may mean for the Fed;

An analysis of what the latest US CPI data may mean for interest rate expectations and financial markets, including how the set-up differs to that from last week’s US jobs report; and

An in-depth breakdown of some of the key subcomponents of the US CPI, including used cars and the CPI’s rent based measures (i.e. OER and RPR).

Before moving onto my latest monthly US CPI Preview, I’d like to send a big thank you to those of you who have decided to become premium subscribers of Economics Uncovered — I hope that this latest update further strengthens your decision to support my independent economic research, and further highlights my commitment to providing you with high quality, institutional grade insights, for only a retail grade price.

While I intend to continue to provide some snippets of my research publications for all subscribers, given that premium subscribers help to ensure the ongoing future and growth of Economics Uncovered, and that my monthly US CPI Preview represents a flagship report for Economics Uncovered, this report will sit behind the paywall — though to continue with my transparent forecasting track record, I intend to move the paywall below my headline and core CPI forecasts, closer to the release of the latest US CPI data.

This research update is to be read with the disclaimer contained at the very bottom of this report.

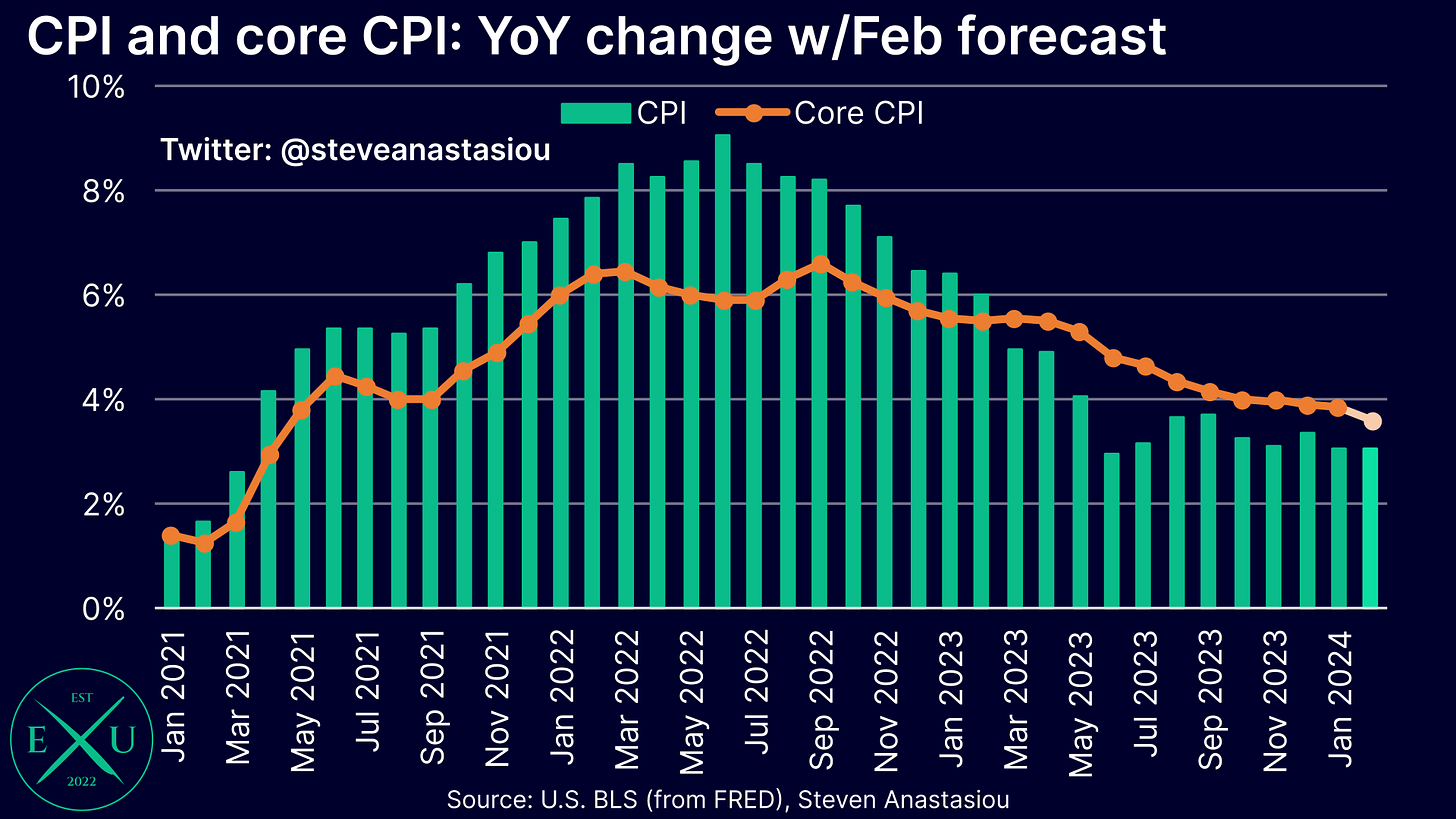

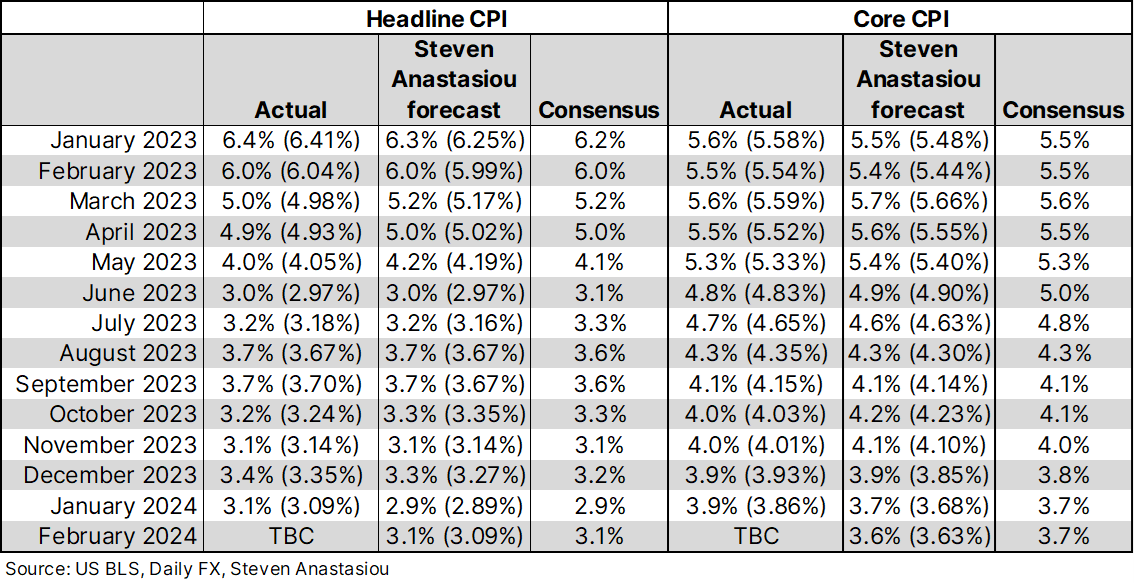

Headline CPI expected to remain unchanged at 3.1% YoY, core CPI expected to fall to 3.6% YoY

I forecast headline CPI inflation to remain unchanged in February at 3.1% YoY (3.09%). This is in-line with the consensus forecast.

I expect the core CPI to record its 11th consecutive monthly moderation in YoY growth, falling to 3.6% YoY (3.63%). This is slightly below the consensus estimate of 3.7%, and would represent a material decline in the core CPI from January’s level of 3.9% YoY.

Though it’s important to emphasise that on a two decimal place basis, my core CPI forecast is 3.63%, indicating the potential for core CPI growth to come in at a rounded 3.7%, which would be in-line with the consensus forecast.