US CPI Preview: April 2024

With the core CPI expected to record another month of elevated growth, the Fed is unlikely to gain significant additional confidence in the inflation outlook from April's US CPI report.

Key YoY aggregates expected to show some moderation in April

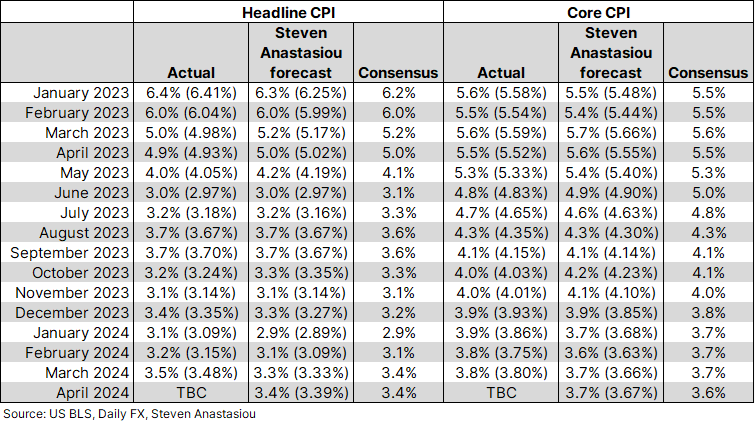

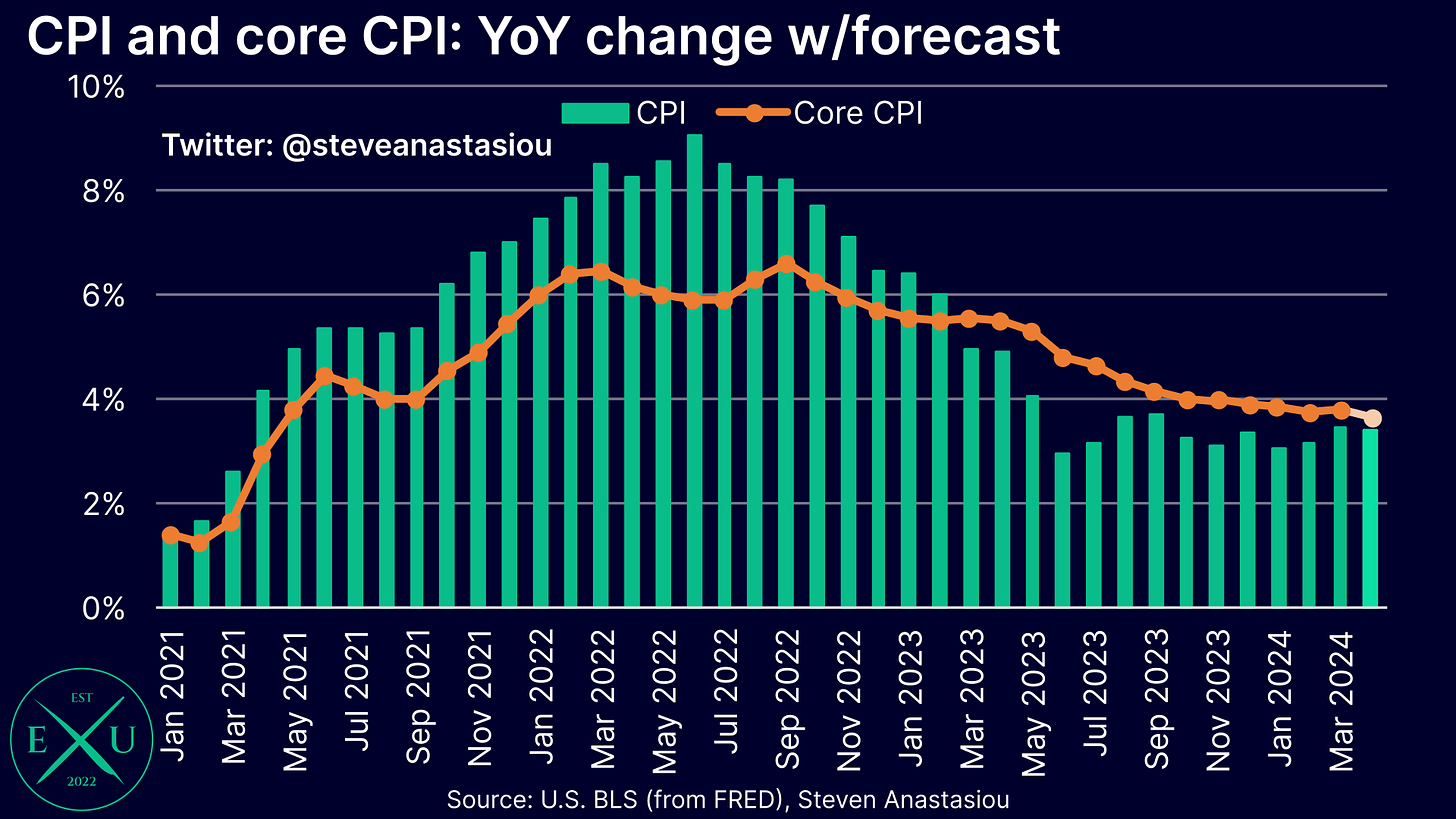

In April, I expect headline CPI growth to moderate to 3.4% (from 3.5%) and core CPI growth to moderate to 3.7% (from 3.8%). This compares to consensus forecasts of 3.4% for the headline CPI and 3.6% for the core CPI.

While my core CPI estimate is above the consensus forecast, it’s important to note that my core CPI forecast is 3.67% on a two-decimal place basis, which is not far away from rounding down to 3.6%.

As an independent, reader-supported research publication, full access to this report is reserved for premium subscribers. To gain full access to this report, as well as the full Economics Uncovered research catalogue (which includes my recent medium-term US CPI forecast update, in-depth jobs report analysis and the market implications of the Fed’s decision to reduce the pace of QT), you can subscribe below on a month-to-month basis, or receive a ~15% discount by choosing an annual plan.

Given the lagging nature of the CPI’s rent based measures, it’s also important to analyse inflation on an ex-shelter basis in order to gain a better grasp of underlying inflation pressures.