US economic growth remained robust in Q1 and could accelerate in Q2 — but a very different story may emerge in 2H24

A deeper look at the latest US GDP data reveals continued robust growth, while 2Q24 GDP is set to be materially supported by a favourable comparable — though growth could materially weaken in 2H24.

Despite the negative headlines, the latest GDP data once again shows robust US economic growth

While many headlines have been focused on a “slowdown” of economic growth, a deeper look at the data actually reveals another quarter of relatively strong growth.

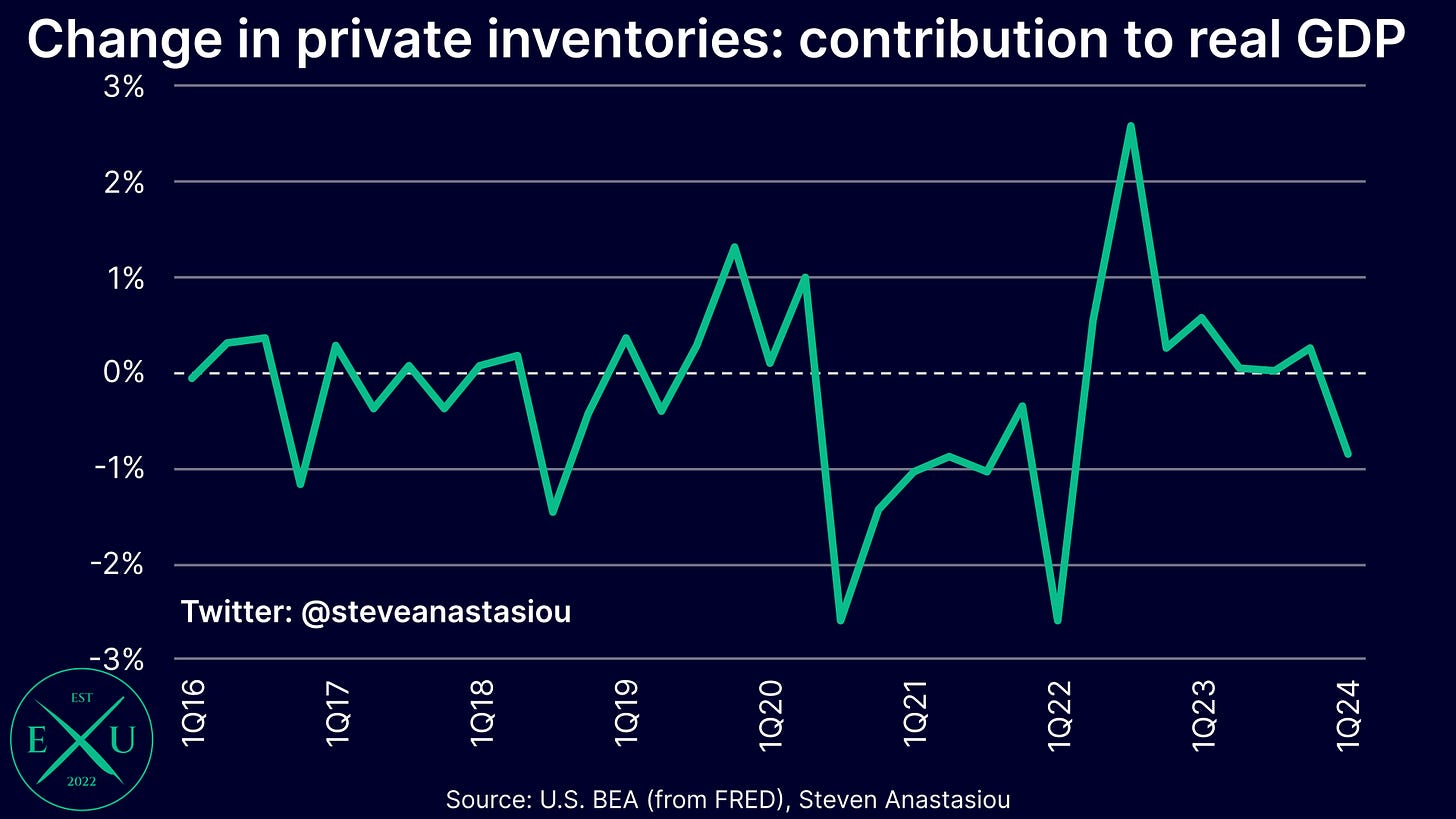

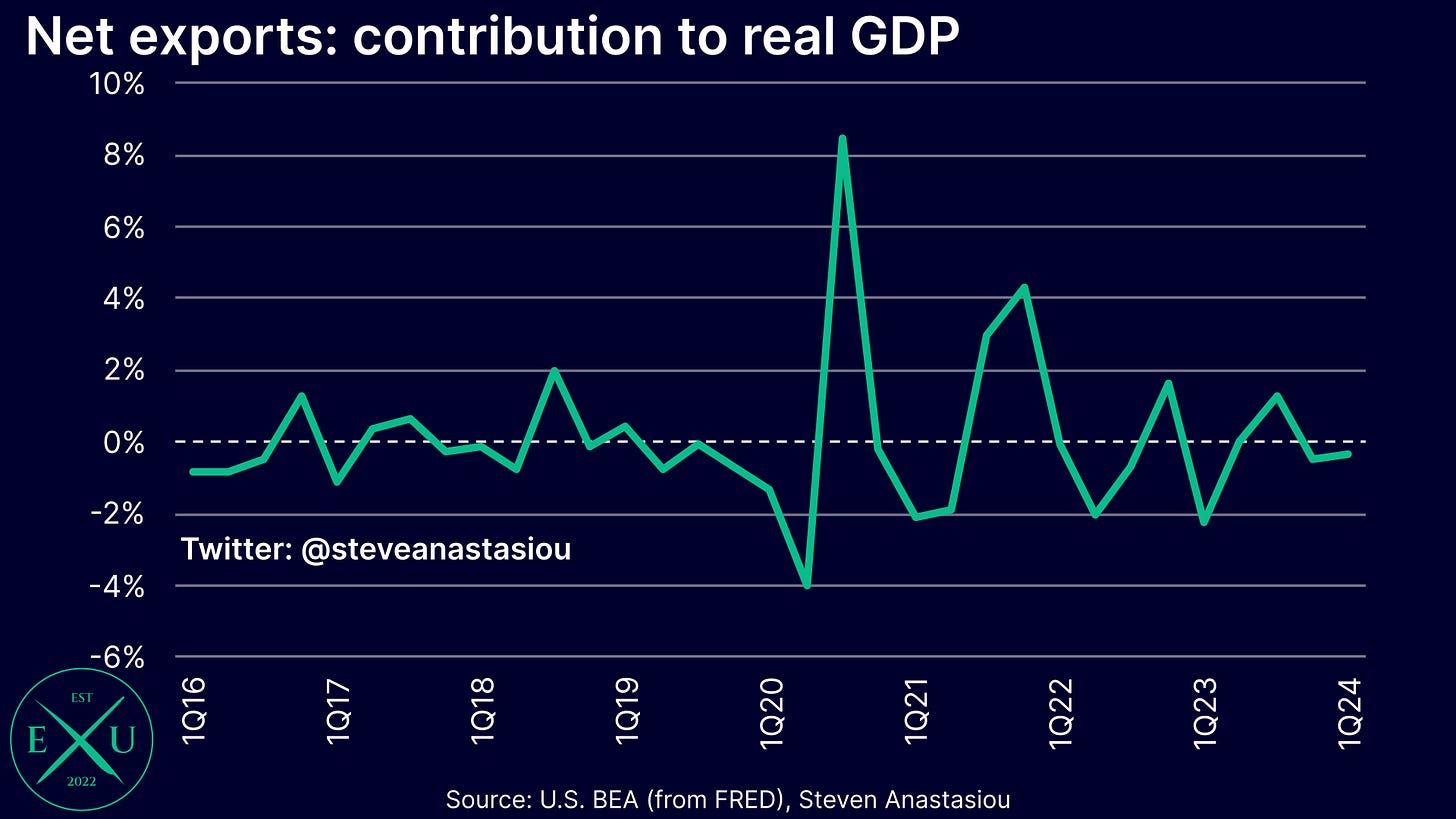

The divergence between these two narratives primarily lies in the fact that in order to gain a better picture of underlying economic growth, one needs to exclude the volatile private inventories and net export components. For in addition to their significant volatility, which often results in these components delivering very significant impacts to quarterly GDP growth (either positive or negative), the average contribution to GDP from these two components since 2010, is -0.04 percentage points — i.e. they practically net out to zero over time.

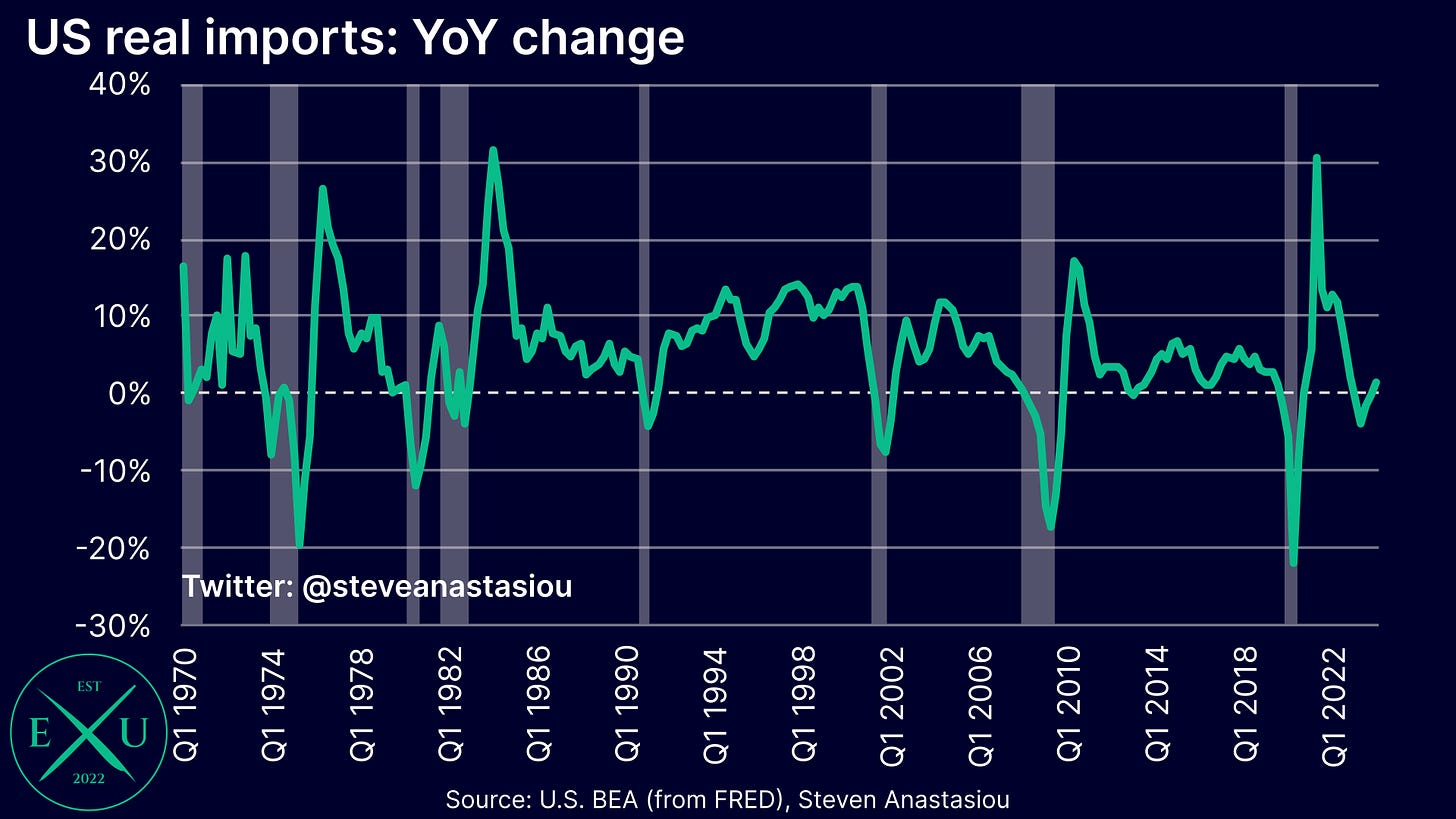

In 1Q24, the change in private inventories subtracted 35bps from real GDP, while the change in net exports subtracted a whopping 86bps from real GDP, as real imports surged, with YoY growth turning positive for the first time since 4Q22 — note that while higher real imports subtract from real GDP, as opposed to being a recessionary signal, significant increases in real imports instead point to strong domestic demand, while falling imports, which act to increase GDP, actually indicate recessionary type conditions.

Combined, these two volatile factors subtracted 1.2 percentage points from real GDP in 1Q24. Note that just as this 1.2 percentage point subtraction should be excluded to gain a better picture of underlying GDP growth, so should any future material contribution that these two volatile factors deliver to real GDP growth.

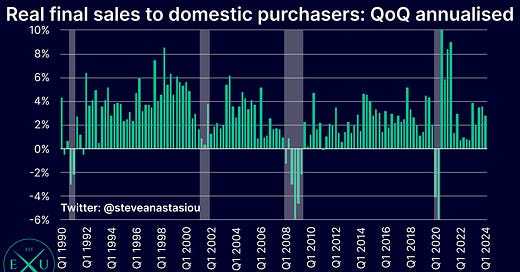

Subtracting these two components from real GDP in order to gain a better picture of underlying growth is made easy, as the BEA calculates a metric called real final sales to domestic purchasers, which is equivalent to real GDP excluding private inventories and net exports.

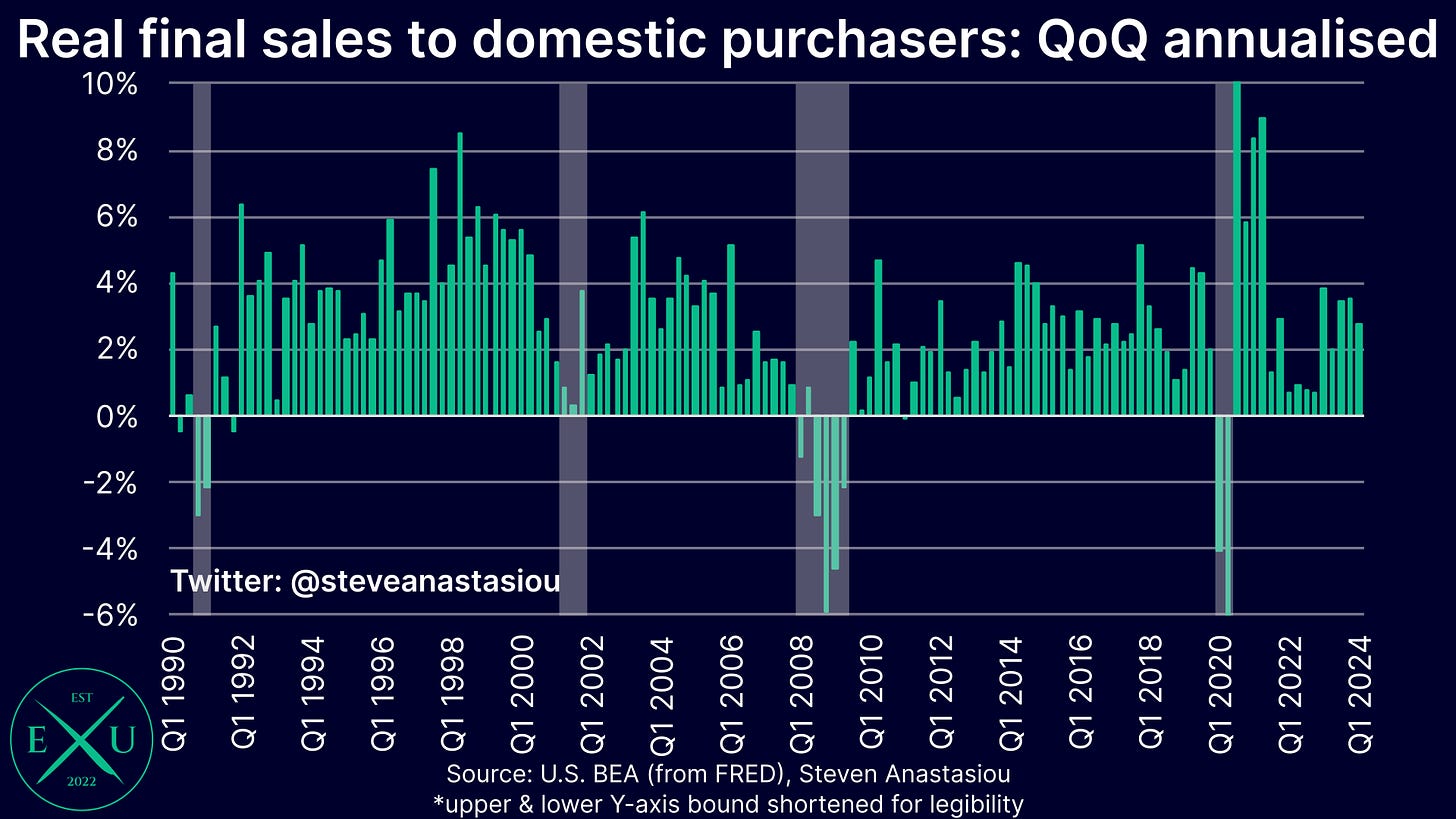

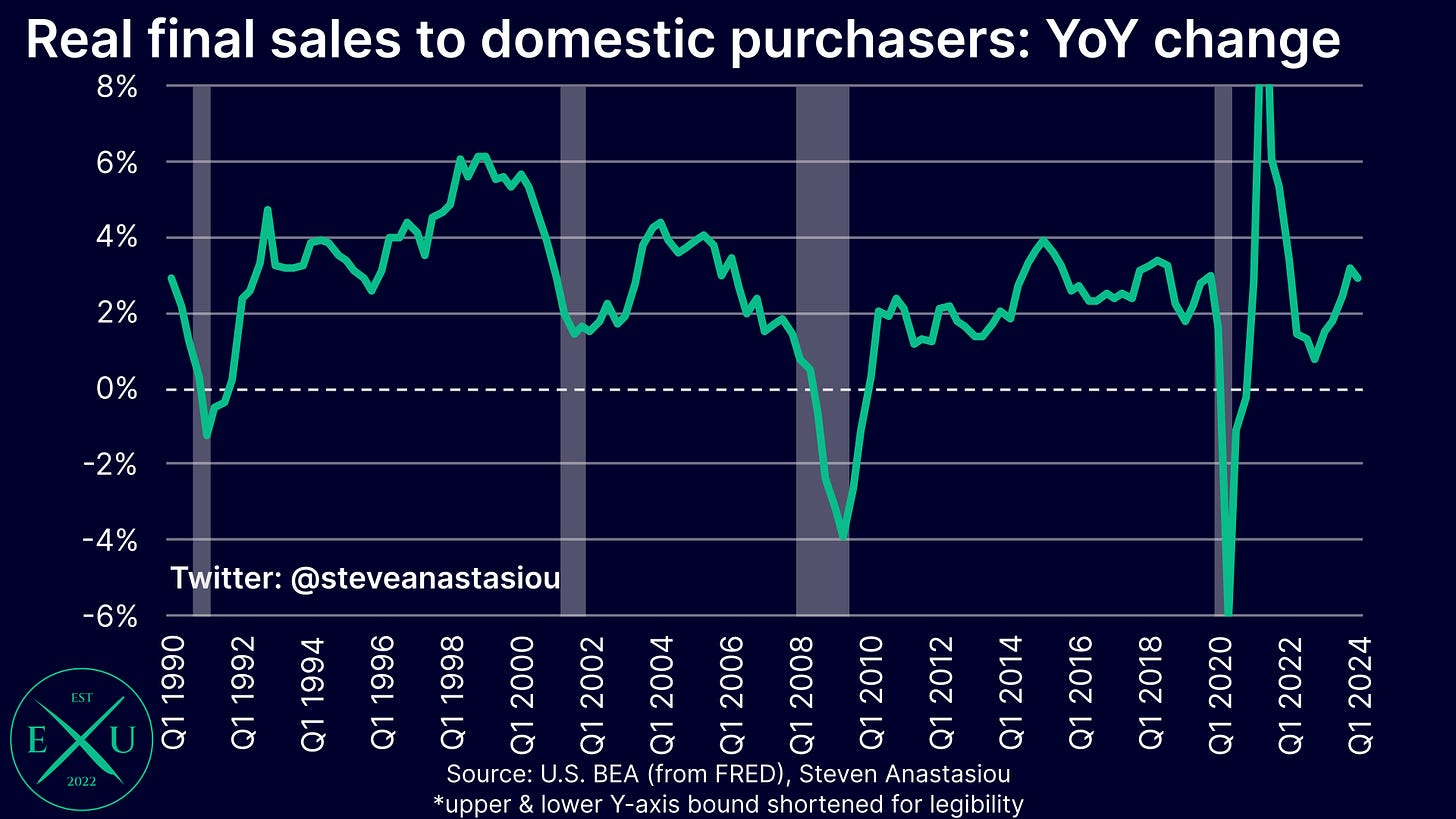

While down slightly from the strong growth recorded in the past two quarters, real final sales to domestic purchasers saw another quarter of robust growth in 1Q24, rising by 2.8% annualised. This extends a lengthy period of relatively strong growth, where since 1Q23, quarterly growth in real final sales to domestic purchasers has averaged 3.1% annualised. This compares to the 2015-19 average of 2.7%.

On a YoY basis, growth remained solid at 2.9%, down slightly from 3.2% in 4Q23.

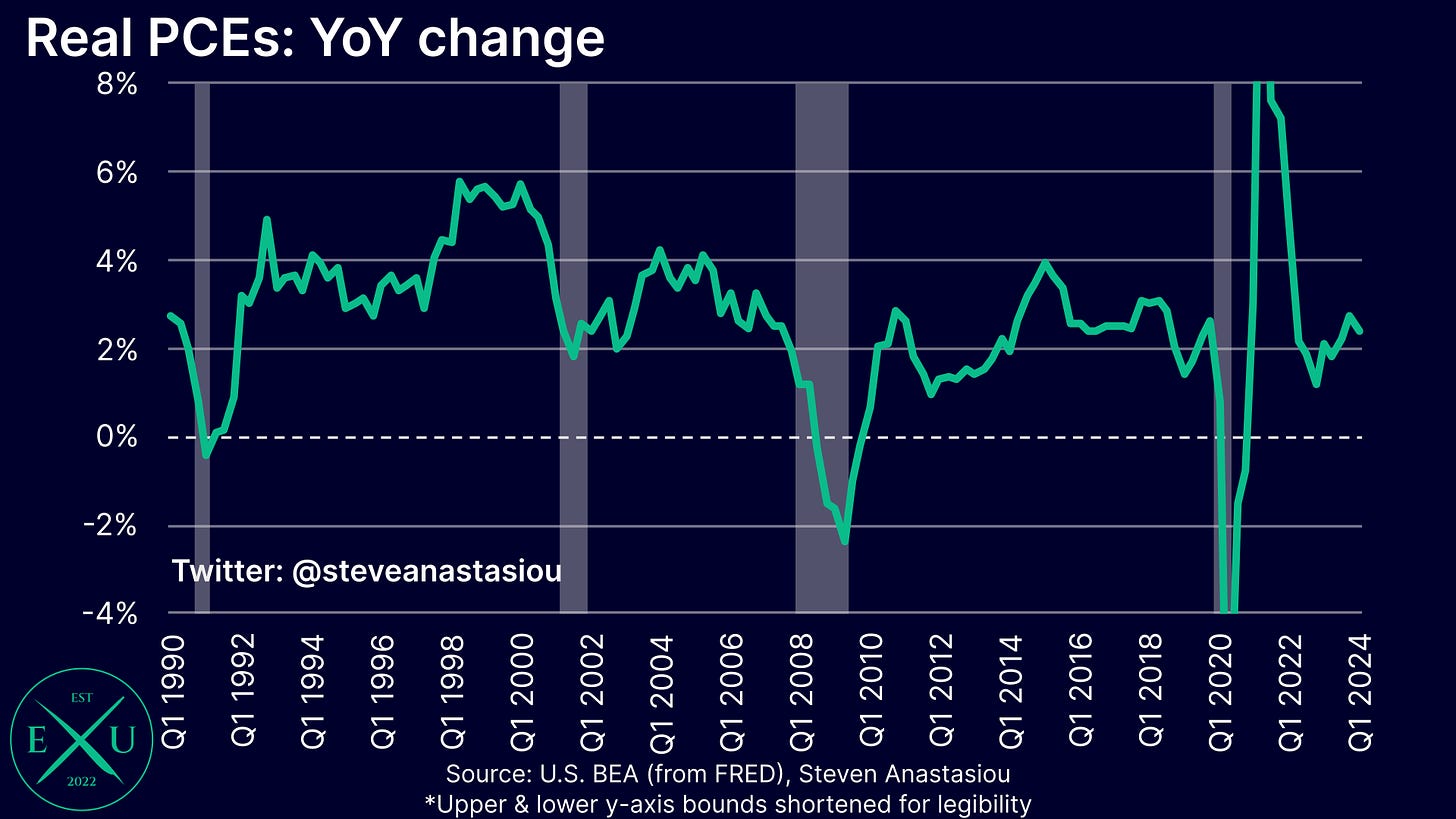

Unpacking the subcomponents of GDP, growth was once again underpinned by robust personal consumption spending, which grew by 2.5% annualised in 1Q24, which is only slightly below the 2015-19 average of 2.6%.

On a YoY basis, growth moderated to 2.4%, but this remains relatively solid.

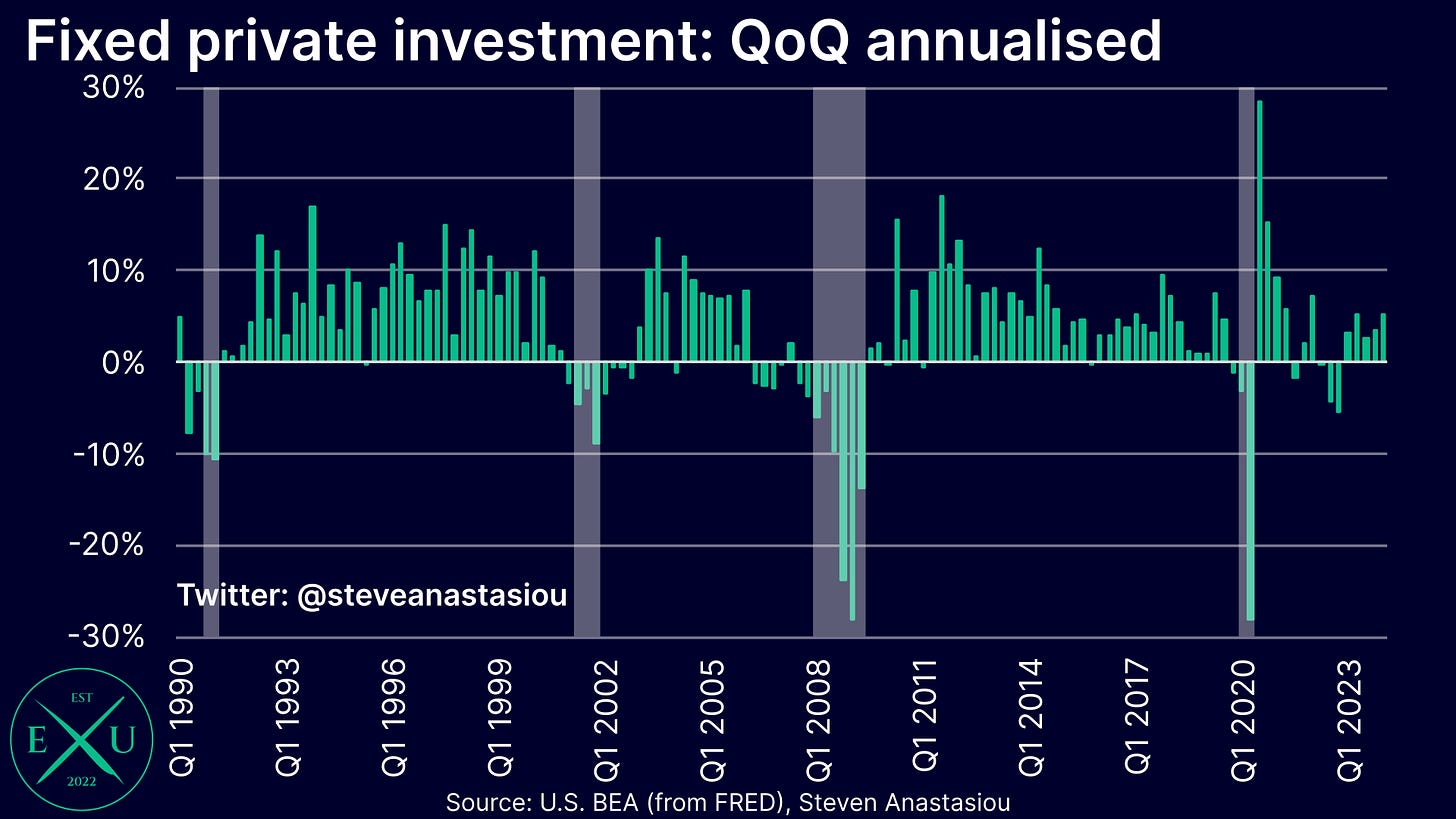

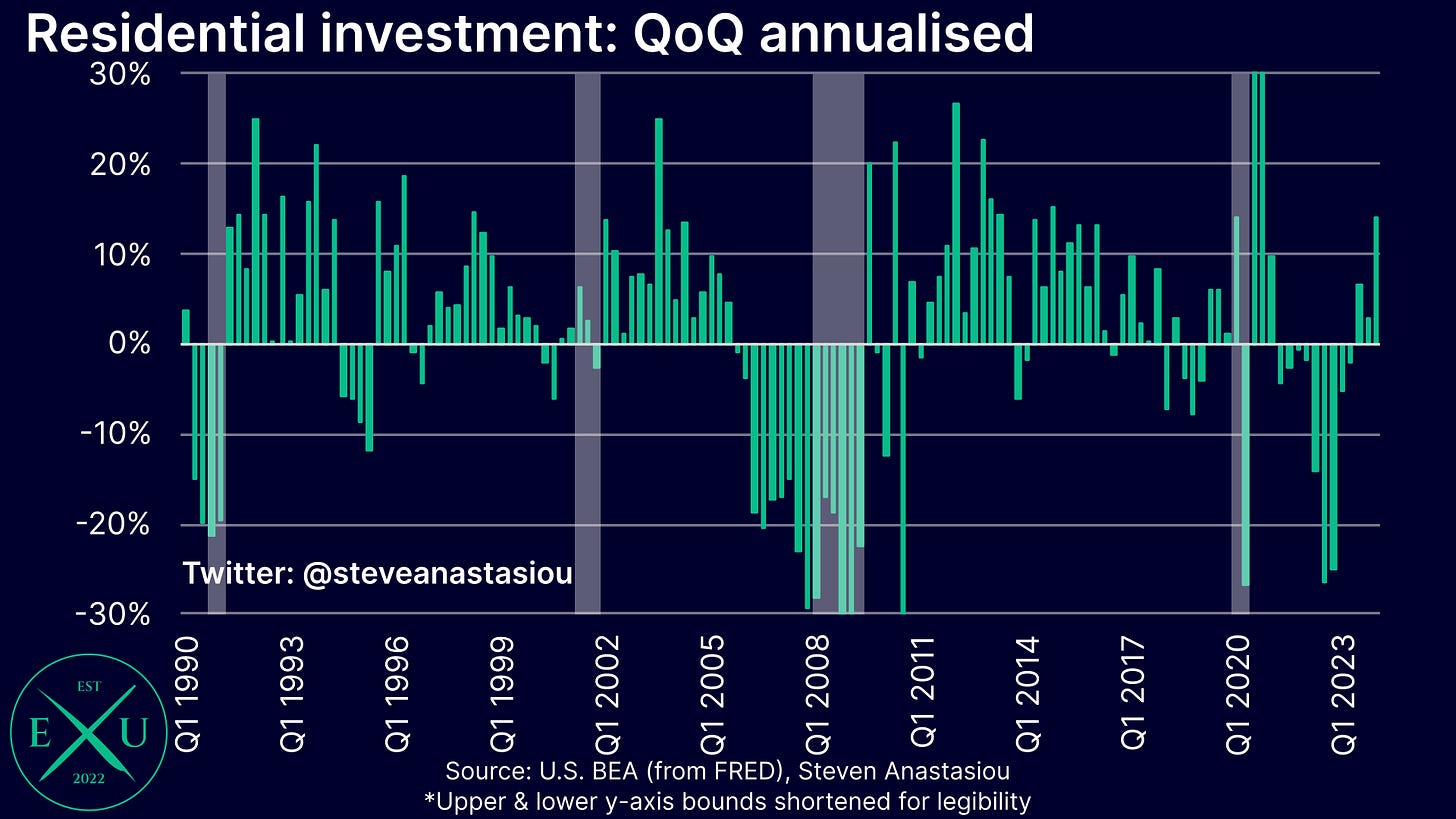

Fixed private domestic investment rose by a strong 5.3% annualised, marking the strongest pace of growth seen since 1Q22 and a rate of growth that is notably above the 2015-19 average of 3.6%.

Underpinning this growth was residential investment, which after seeing nine consecutive quarters of declines, recorded a third consecutive quarter of growth, rising by a strong 13.9% annualised. The BEA noted that “the increase was led by brokers’ commissions and other ownership transfer costs as well as new single-family housing construction” — it is the last of these factors that is of primary importance.

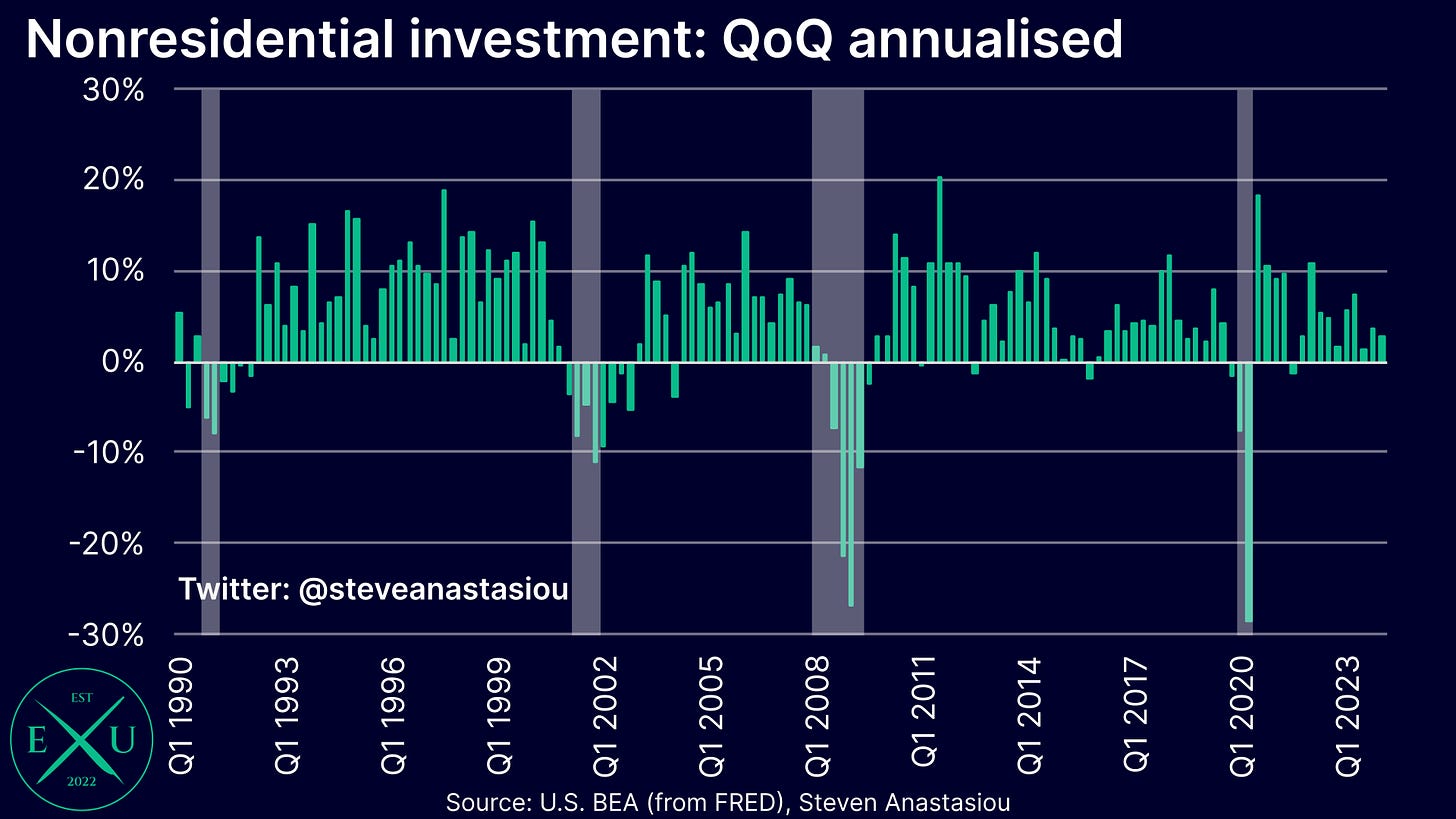

Nonresidential investment also rose, increasing by 2.9% annualised, which is somewhat subdued compared to the 2016-19 average of 3.7%. Here, growth was supported by intellectual property products, and the software category in particular.

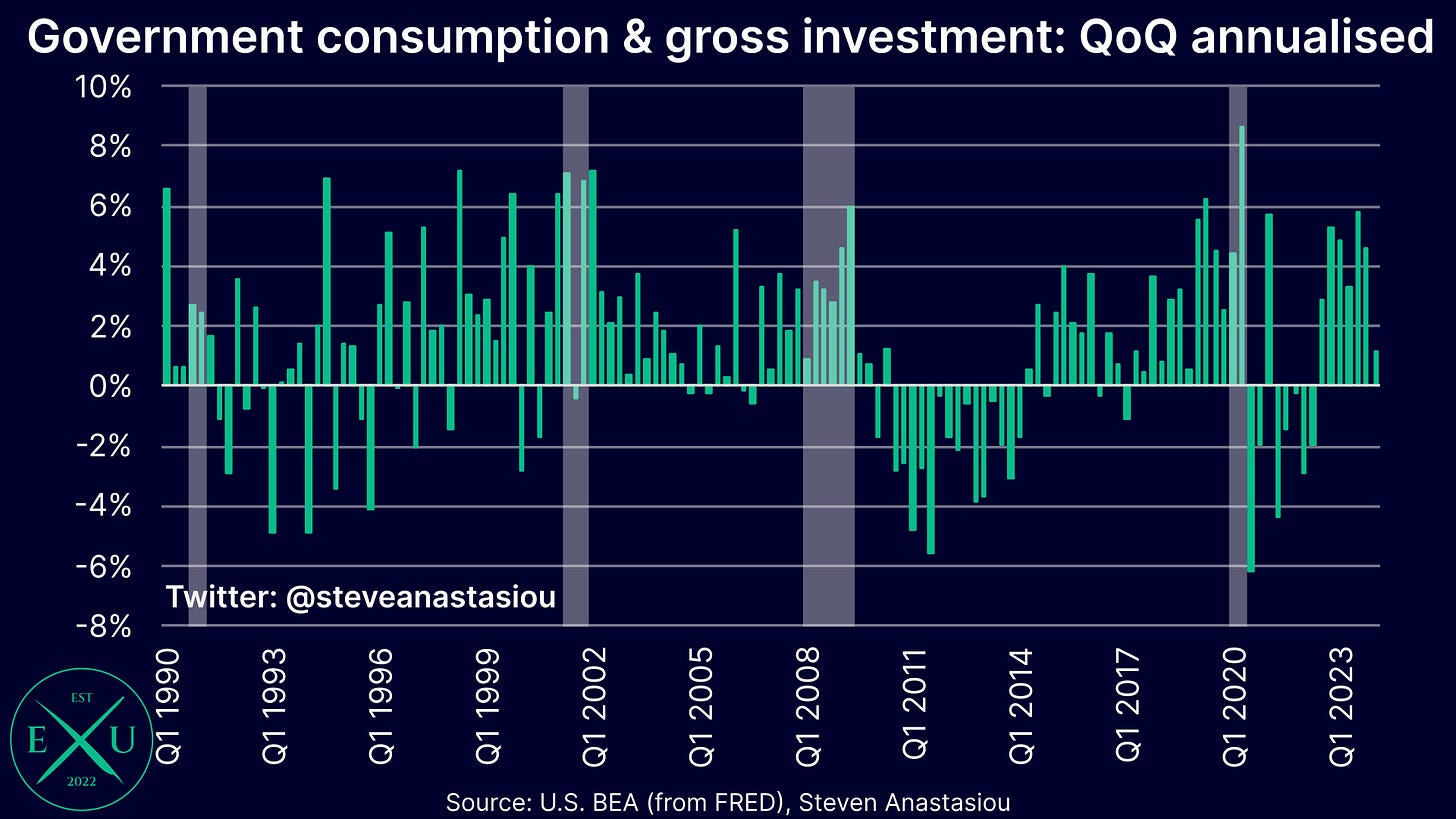

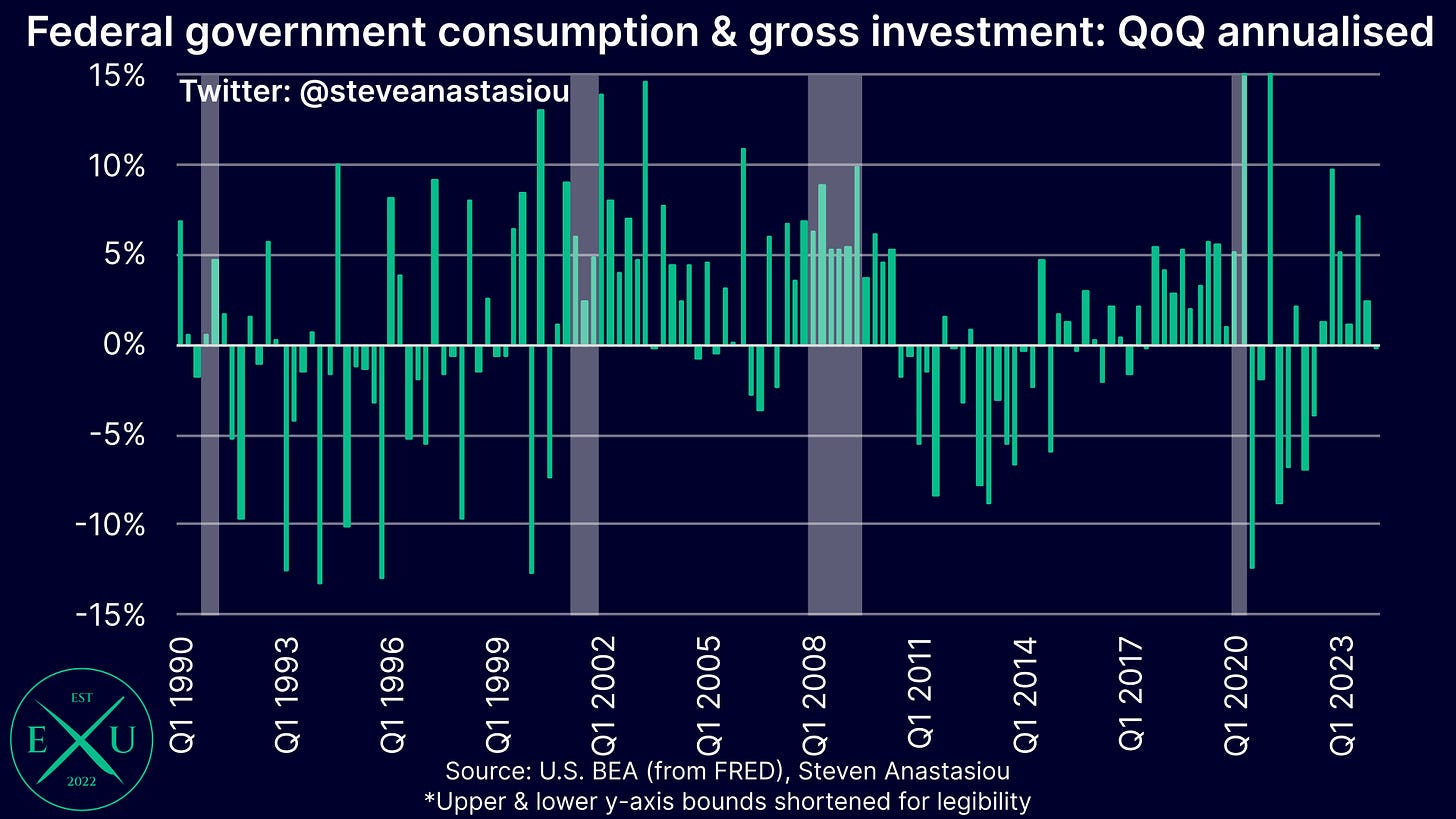

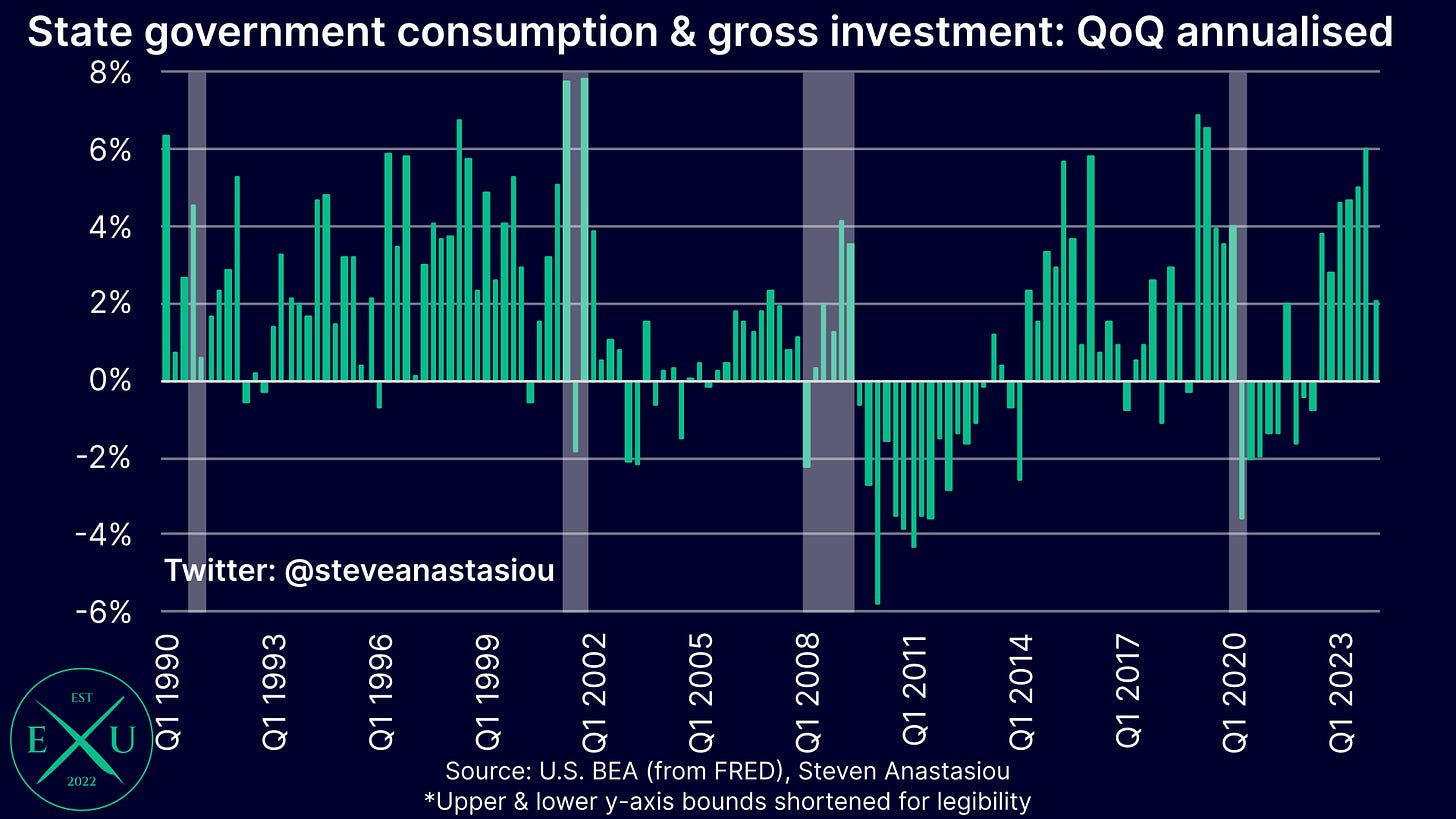

Finally, government consumption, which has been a strong contributor to GDP growth since 3Q22, saw a significant moderation in growth, with quarterly annualised growth falling to 1.2%, down from 4.6% in 4Q23 and a quarterly average of 4.8% across 4Q22-4Q23.

A slowdown was seen in both federal and state and local government spending. Quarterly federal government spending growth was actually negative, coming in at -0.24% annualised, down from growth of 2.4% in 4Q23. State and local government spending growth remained positive at 2.0% annualised, but this was a significant slowdown from average quarterly annualised growth of 5.1% over the four prior quarters.

All-in-all, the latest GDP data was again relatively solid, with growth yet again underpinned by robust PCE growth. Though as opposed to the government sector being the second key driver of GDP growth, 1Q24 economic growth was more significantly driven by private sector fixed investments.

Favourable comparable sets up 2Q24 to potentially be even stronger

After another quarter of robust growth in 1Q24, a favourable comparable suggests that real final sales to domestic purchasers could see even stronger growth in 2Q24.

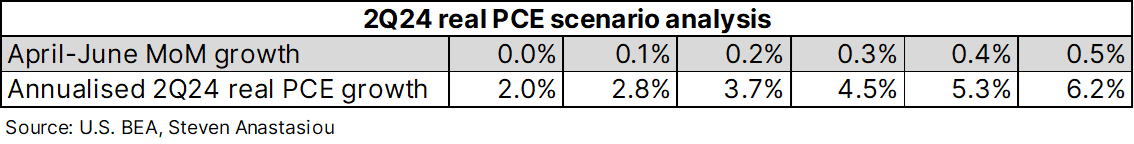

The reason for this, is that real personal consumption expenditures, which account for the bulk of real GDP and real final sales to domestic purchasers, recorded negative MoM growth in January and strong MoM growth in February in March. As a result of this combination, and remembering that the GDP report takes the quarterly average of monthly PCE data, January’s drop acted to drag down PCE growth in 1Q24, but the subsequently strong MoM growth in February and March means that the level for 2Q24 is starting on a much stronger relative footing when compared to the 1Q24 average.

Given this tailwind, if real PCEs record no MoM growth across April-June, quarterly growth would still come in at 2.0% annualised. If growth comes in at 0.30% MoM in each month (which would be largely in-line with the average MoM growth rate of 0.28% that’s been recorded over the past six months), then annualised QoQ PCE growth would equal 4.5%.

Given that PCE drives overall GDP/real final sales to domestic purchasers, it is easy to see why US economic growth could accelerate materially in 2Q24.

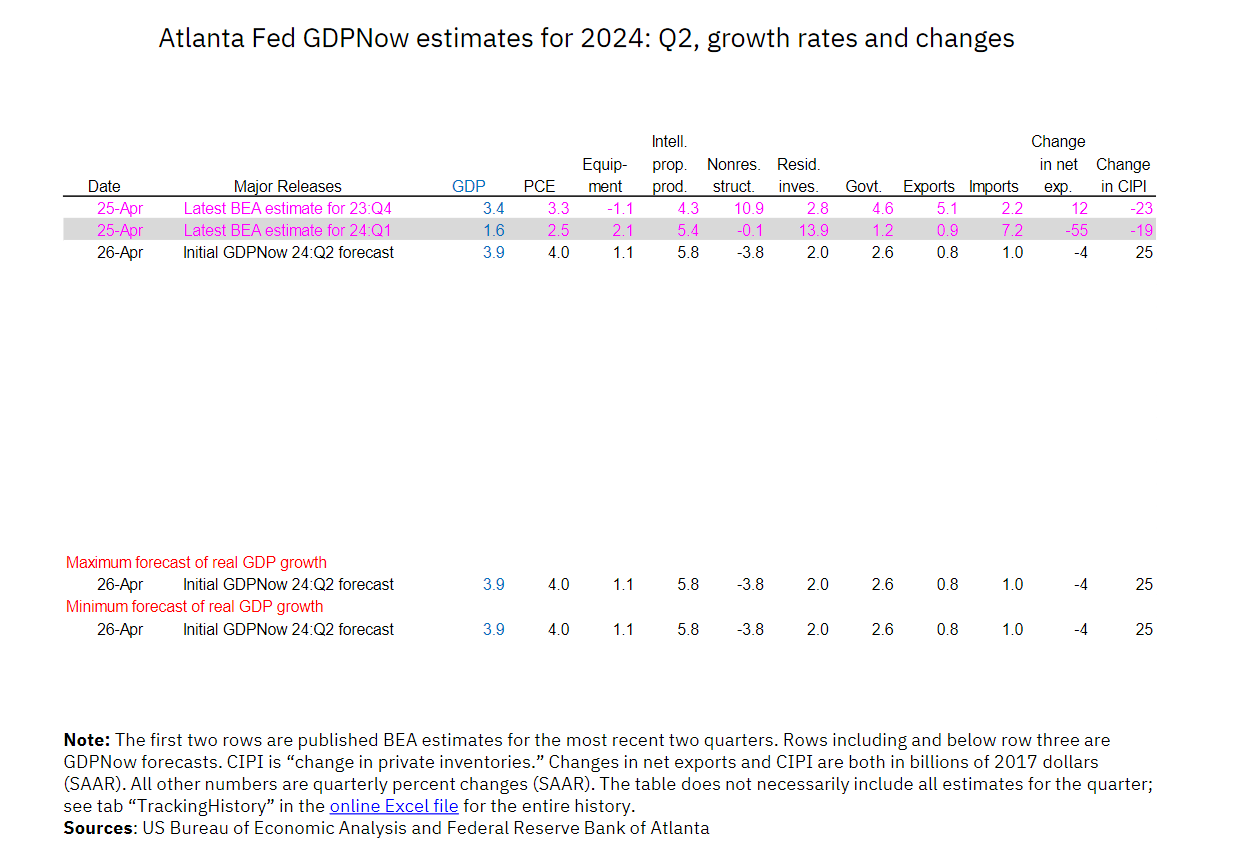

Such a phenomenon is what underpins the Atlanta Fed’s current GDPNow estimate of 3.9% in 2Q24, which currently assumes real PCE growth of 4.0% annualised.