The US jobs market is weakening significantly

While job growth has remained strong enough to keep the unemployment rate low, signs of a significant weakening in the US employment market continue to grow.

Another jobs report, another historically low unemployment rate — this time falling to 3.4% in April. While the Fed’s aggressive tightening has meant that many have been expecting the US jobs market to imminently roll over, it’s important to remember that employment is a lagging indicator.

During the current cycle, it’s likely to be a particularly lagging indicator as many businesses experienced significant difficulty in reaching their required staffing levels, on account of enormous money printing having artificially stimulated the US economy.

Yet that doesn’t mean that employment data can’t provide important signals about turning points in the economy. One just needs to look a little deeper than the unemployment rate. When doing so, one can see that the US jobs market has been weakening significantly.

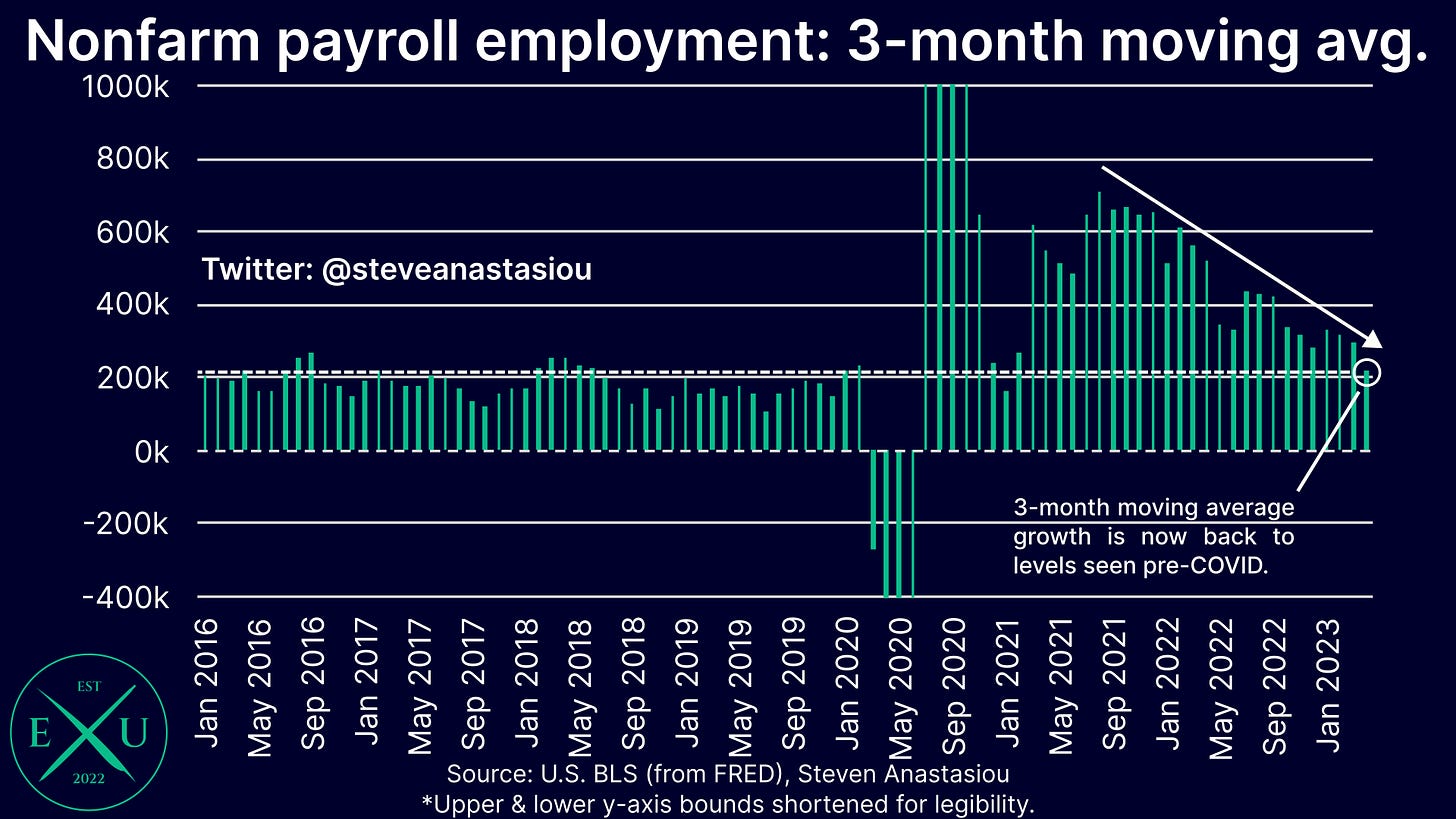

Headline job growth was relatively strong, but significant revisions were made to prior months

In April, the BLS recorded nonfarm payroll growth of 253k, which again significantly beat market expectations. Though behind the headline, there were big downward revisions made to job growth in February and March, of 78,000 and 71,000 respectively.

This meant that on a 3-month moving average basis, nonfarm payroll growth fell to 222k in April, down from a revised 295k in March, and the lowest rate recorded since January 2021.

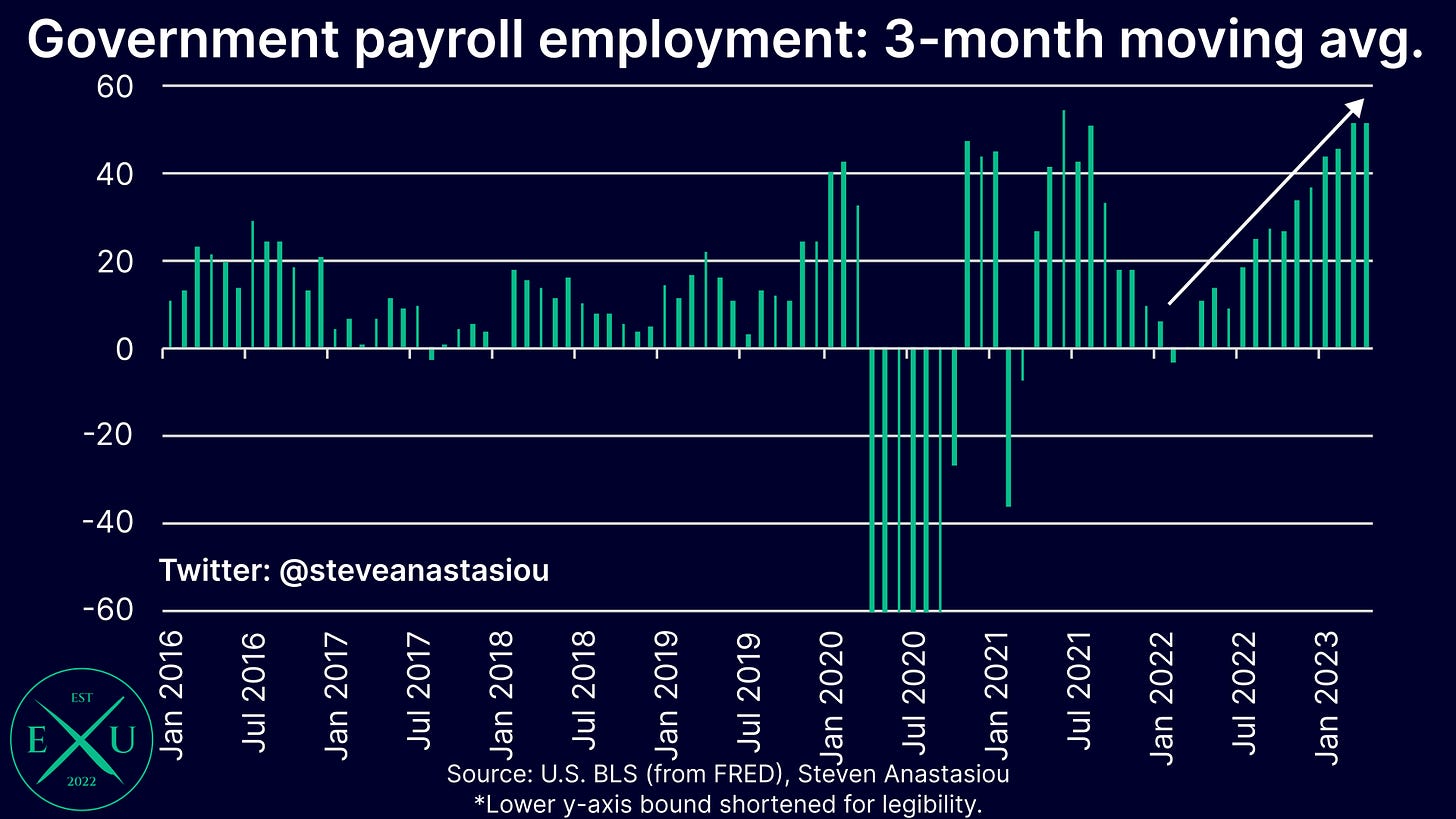

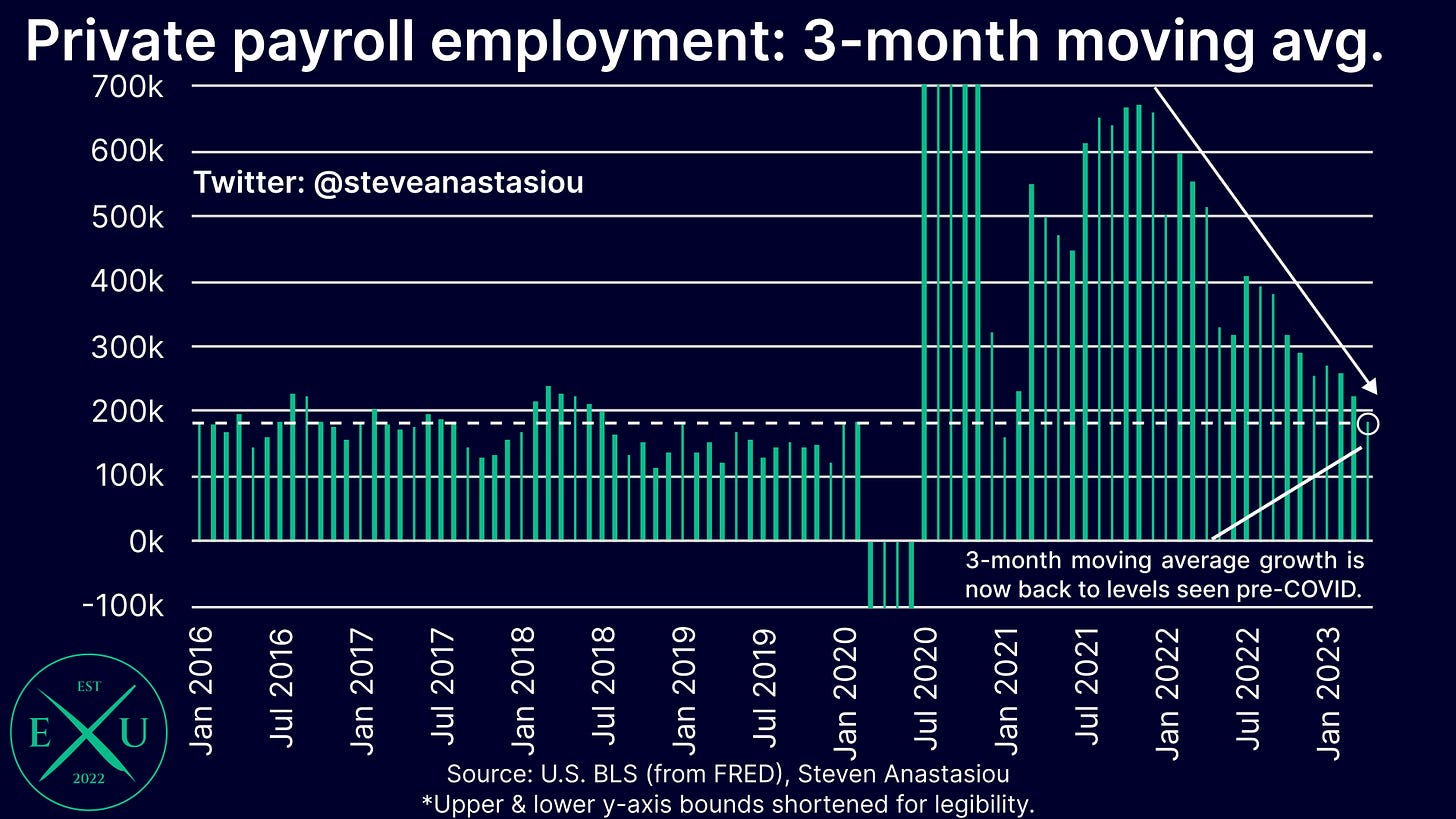

Private payroll growth shows an even sharper moderation

Despite the significant tapering in overall nonfarm payrolls growth, it doesn’t speak to the full extent of the job market’s moderation. To see that picture more clearly, we need to focus on the change in private employment.

Why? Because the government has been accelerating its job growth in recent months. So much so that on a 6-month moving average basis, government job growth has been running up against peak COVID rehiring levels.

Looking at just private employment, shows that 3-month moving average payroll growth has fallen to 182,000. This is the lowest level since January 2021, and represents a more than halving of the 3-month growth rate that was recorded in September 2022. Private payroll growth is now back to levels that were seen pre-COVID.

The slowdown is showing up big time in cyclical employment categories

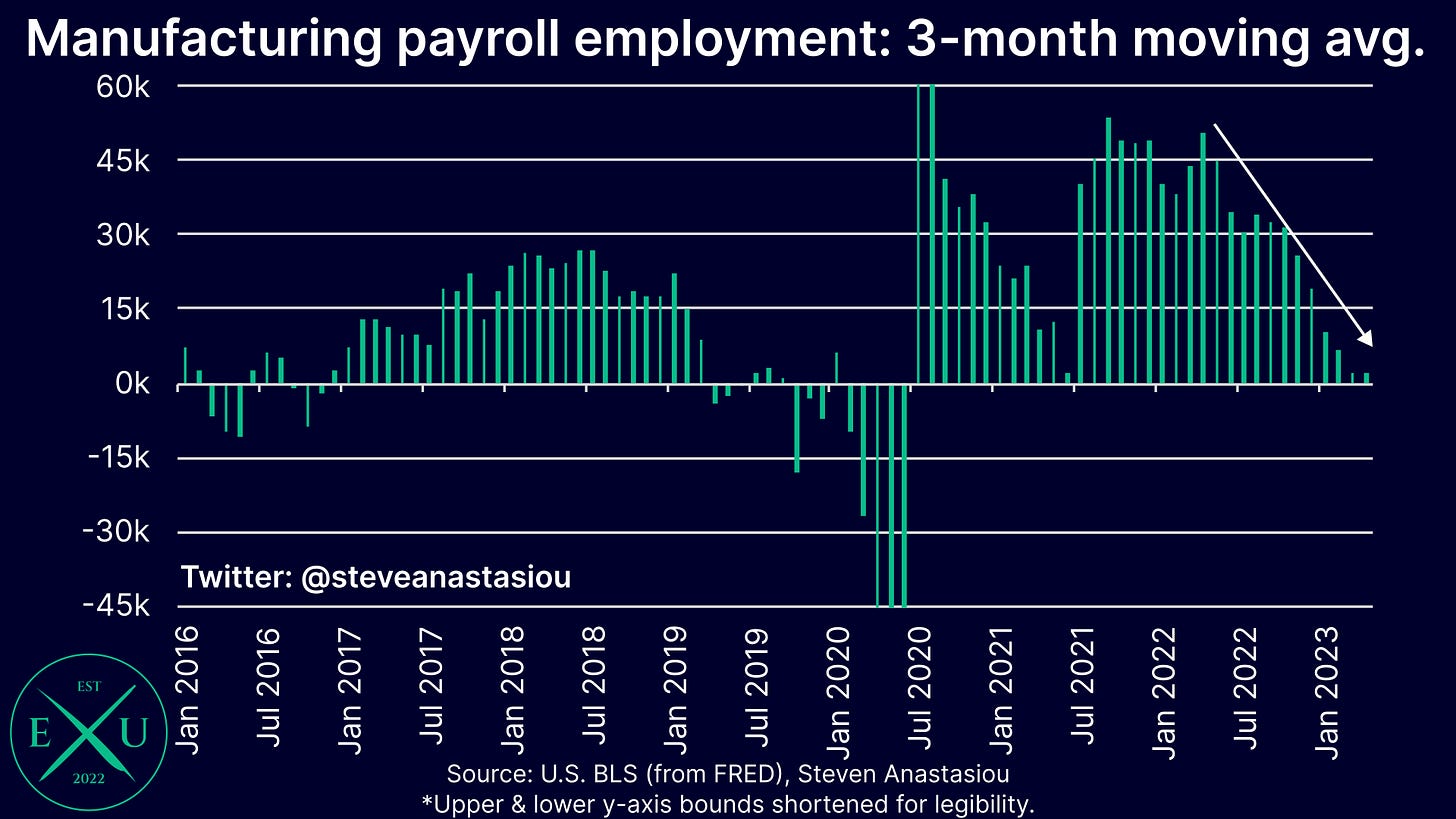

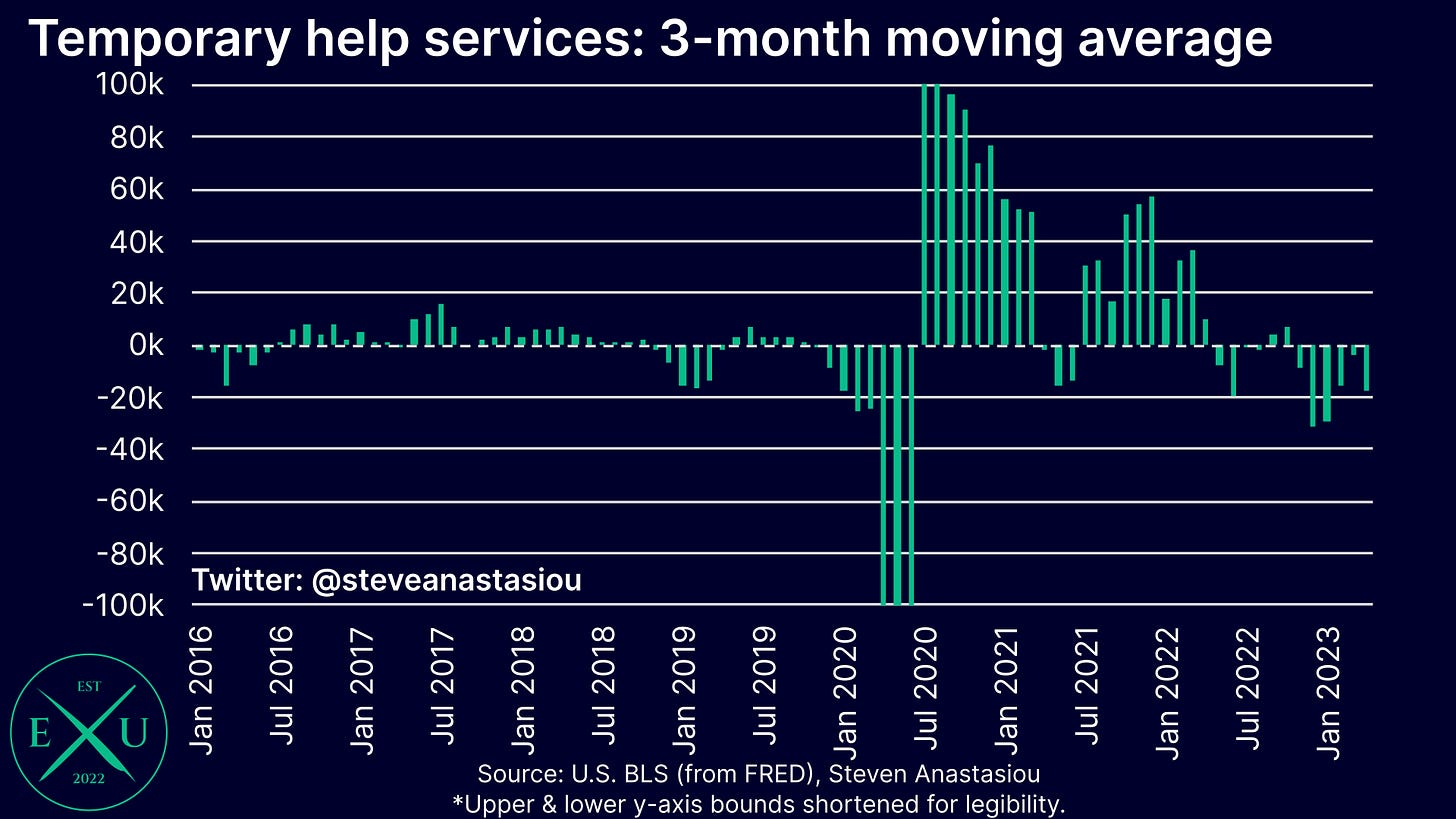

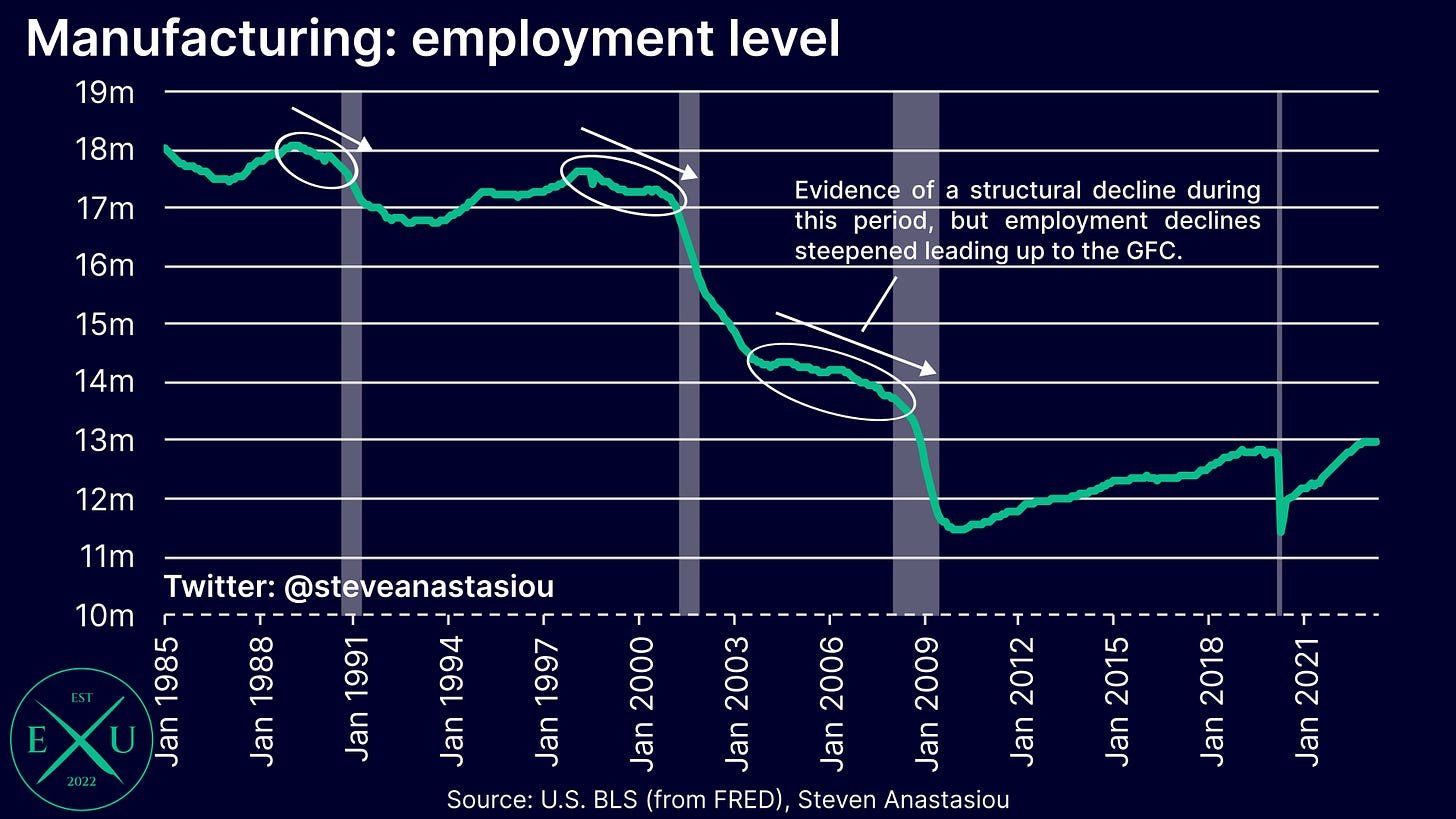

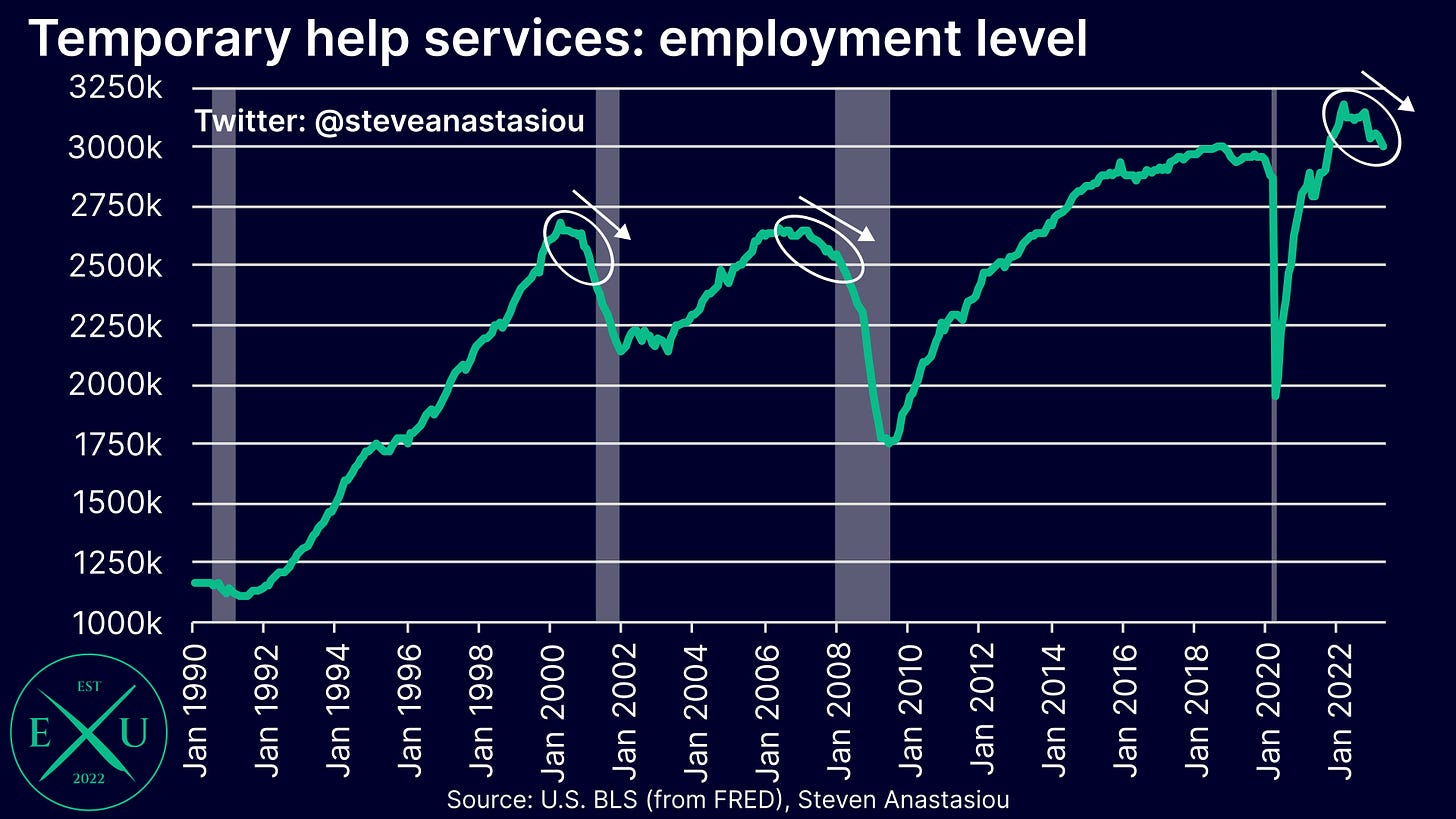

Cyclical employment industries, including manufacturing and temporary help services, are providing a further indication of a slowdown in the US employment market.

After the latest revisions, the BLS recorded manufacturing job losses of 8k in March, and growth of 11k in April. On a 3-month average basis, manufacturing employment growth was just 2k jobs, with the major slowdown clear to see.

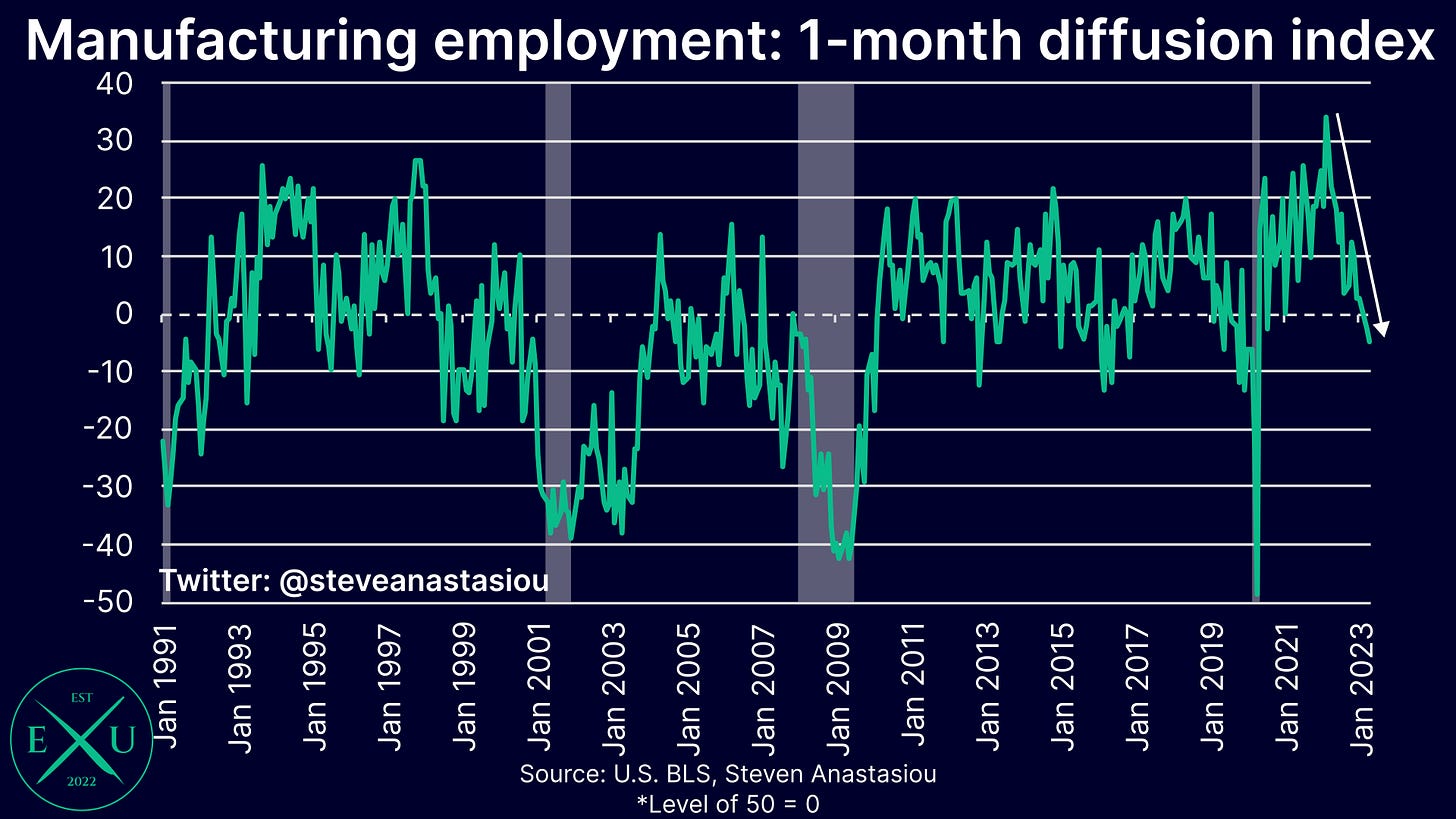

Looking at the BLS’ manufacturing diffusion index, we can see an even more significant weakening, with the index recording a value of 45.1 in April.

With readings below 50 meaning that a majority of manufacturing industries saw MoM employment declines, a deepening in the extent of the below 50 reading shows that while the BLS recorded manufacturing job growth in April, it’s being recorded by an increasingly smaller minority of manufacturing industries, with broad manufacturing industry subcomponents seeing employment weakening.

Temporary help services employment fell by 23k in April, marking its third consecutive monthly decline, and the fifth month of declines in the past six. 3-month moving average growth fell to -17k.

Historically, both manufacturing and temporary help services employment have proven to be good indicators of upcoming recessions.

While the unemployment rate remains low, the job markets underlying strength is clearly weakening

While employment growth has so far continued to be strong enough to avoid a higher unemployment rate, it’s clear that the jobs market is weakening.

Given the lagged impact of the Fed’s aggressive tightening, and the weak signals that the more leading cyclical components are sending, it appears likely that the employment market will weaken further over the months ahead, eventually leading to a material rise in the unemployment rate.

Thank you for reading!

I hope you enjoyed my latest research piece. In order to help support my independent economics research (with further reports, including the next US CPI preview installment on the way), please consider liking and sharing this post. Please feel free to also leave any comments below, to which I will endeavour to respond.

If you haven’t already subscribed to Economics Uncovered, subscribe below so that you don’t miss an update.