Quarterly US Inflation Update

With disinflation strengthening, the Fed needs to be focused on the risk of overshooting.

My latest quarterly US inflation update, which includes an update to my medium-term US CPI forecasts, and an analysis and extrapolation of the latest PCE inflation data, is available to download at the bottom of this page — at 34 pages in total, I hope that you find significant value in this report!

Posted below, is the front-page summary of the report, with relevant charts included.

If you find significant value in this report, please consider liking and sharing this post, to help me spread the word about Economics Uncovered — thank you!

If you are new to Economics Uncovered, be sure to subscribe below, so that you don’t miss an update!

UPDATE — The impact of CPI weight revisions on my medium-term forecasts

While many were focused on the BLS’ recent revisions to their seasonal adjustments, the more important update was the change to CPI weights.

In summary, there has been a significant reduction in the weight applied to durables (10.3% vs 12.1% for the December CPI report) and a significant increase in the weight applied to services (64.0% vs 62.3% for the December CPI report). Nondurables categories have seen a modest increase (25.7% vs 25.6% for the December CPI report).

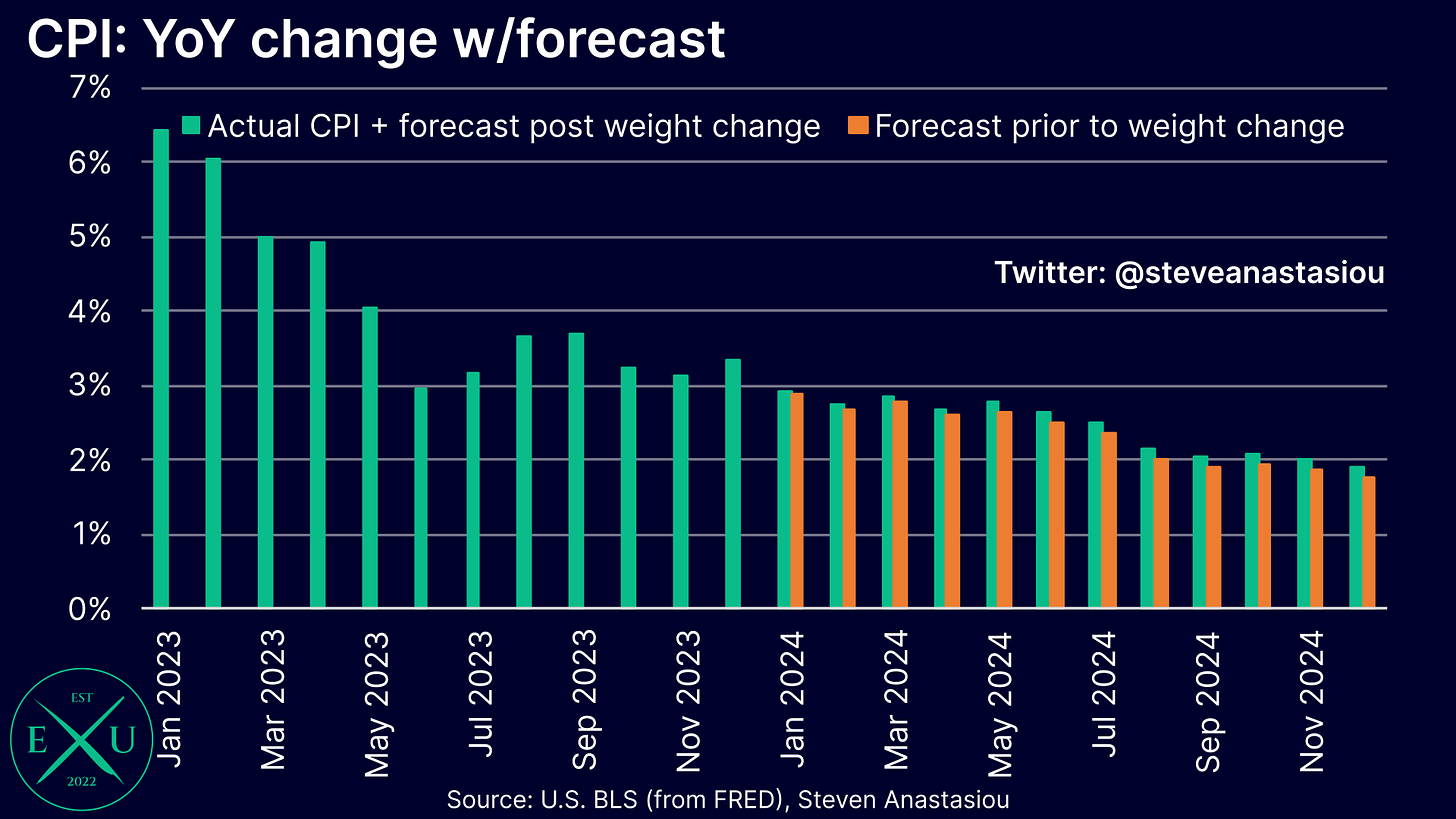

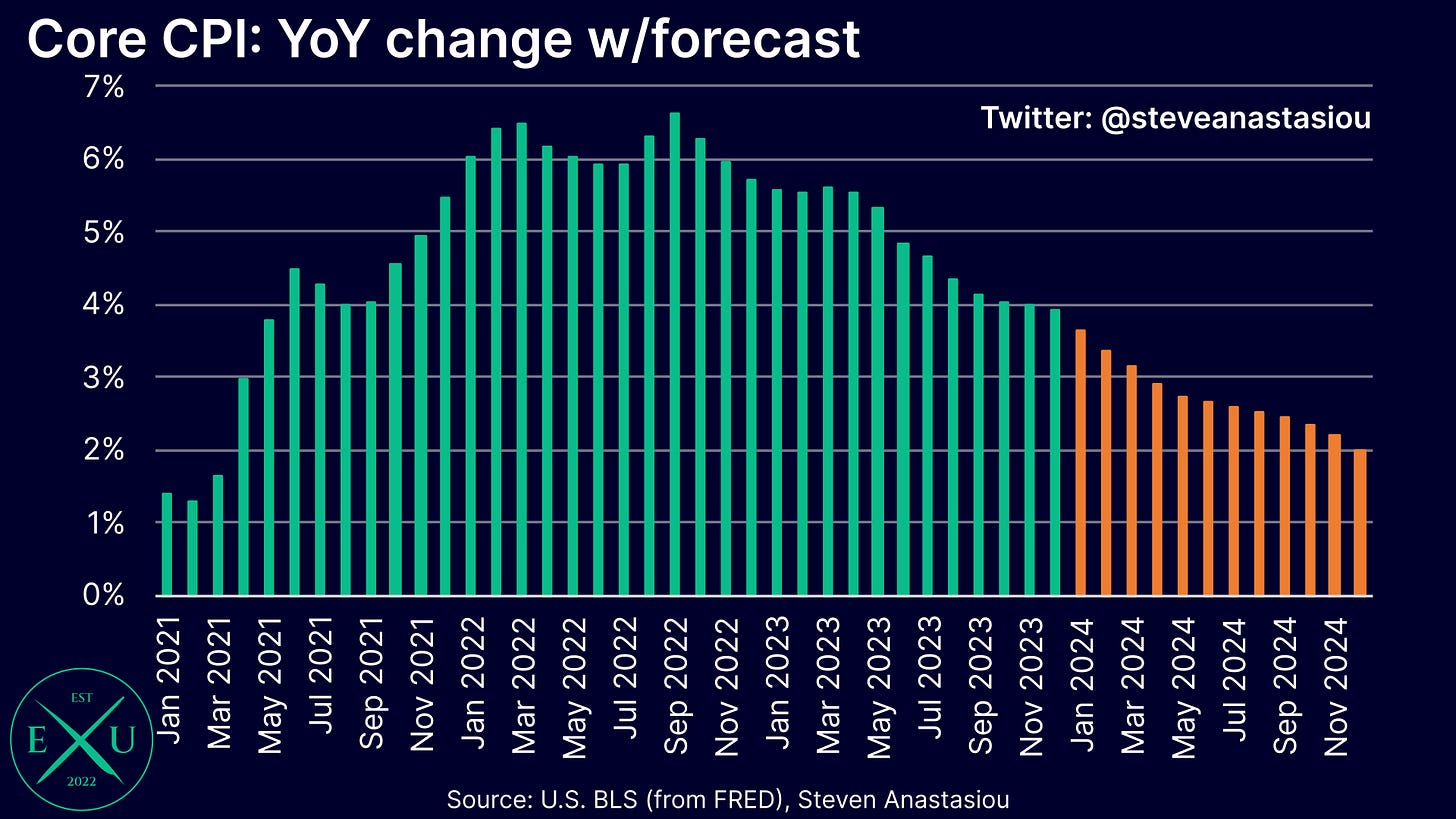

Given that durables prices have been seeing significant deflation, and that recent durables price trends have weakened further, the new CPI weights result in slight upward revisions to my latest medium-term US CPI forecasts.

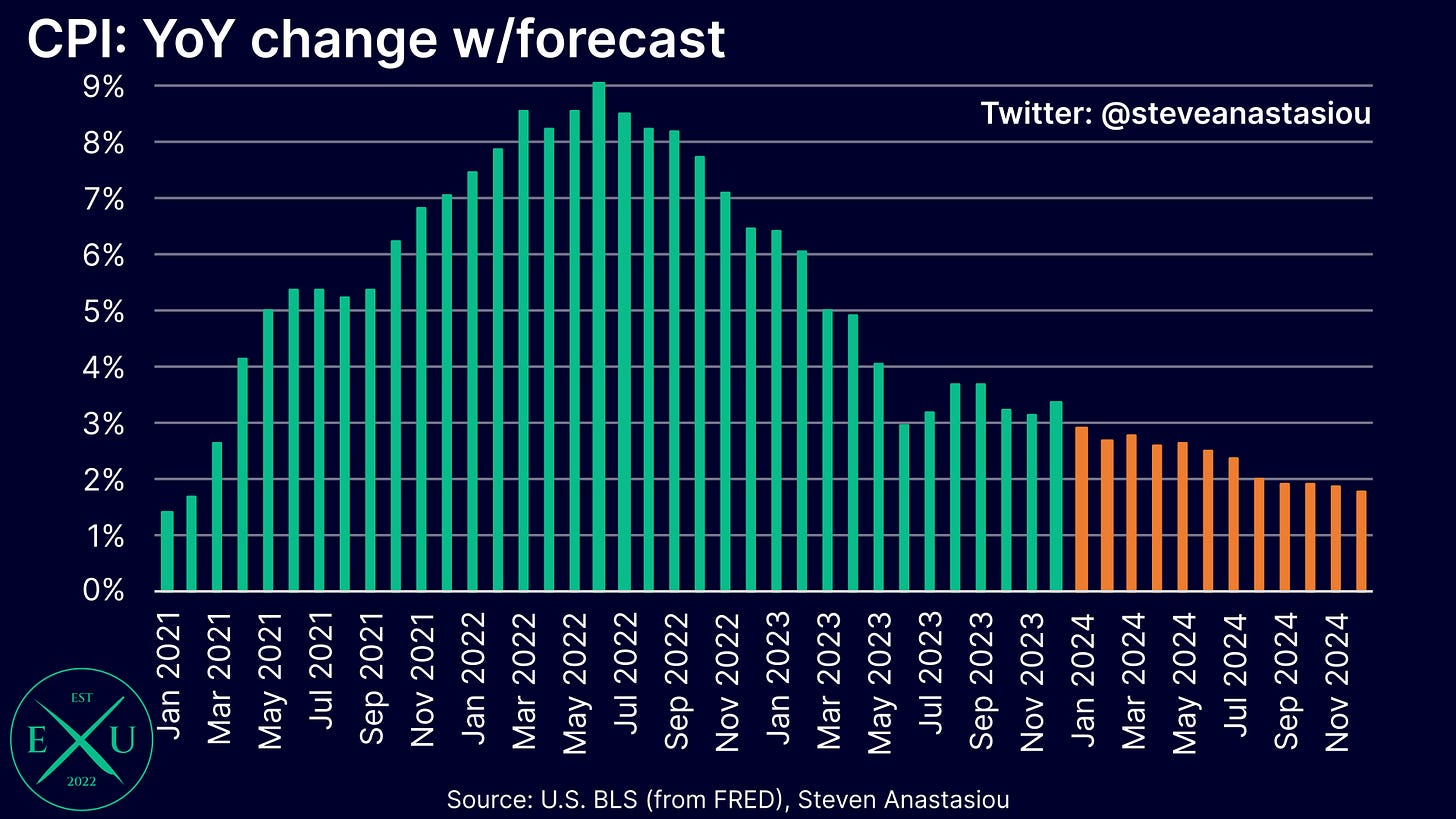

The impact of the weight adjustment on my medium-term headline US CPI forecast, is an increase to YoY growth estimates of 0.1% across February to December. A YoY growth rate of 2% is now expected to be hit in September (previously August).

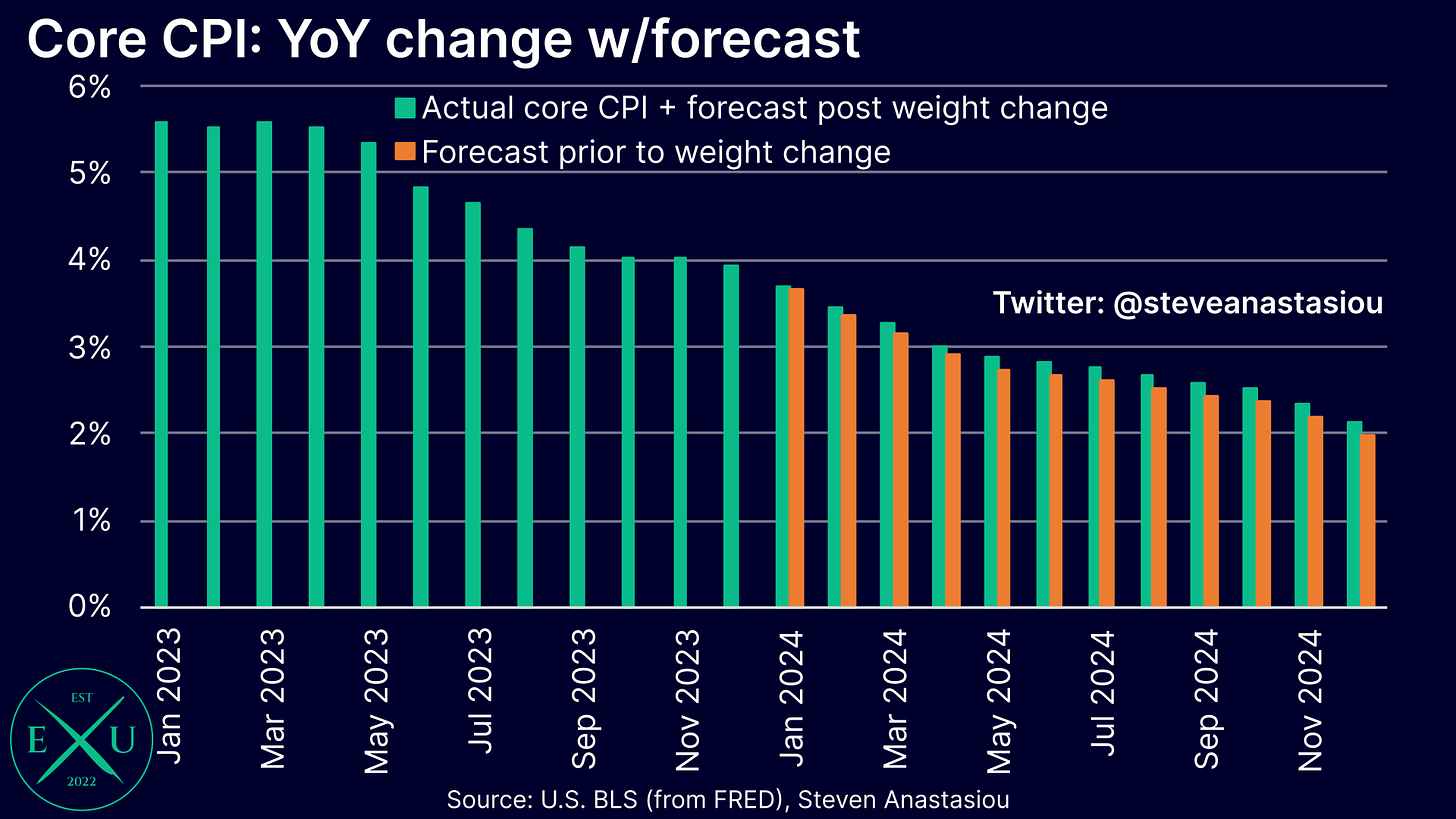

For the core CPI, the weight adjustment has resulted in similar upward revisions, though with some months seeing YoY growth revised higher by a rounded 0.2%. Instead of the core CPI being estimated to fall to 2% YoY in December, the weight revision results in a revised December estimate of 2.1%.

Note that this update has been provided purely to illustrate the impact of the revised CPI weights on my current medium-term US CPI forecasts, which were published on 30 January — i.e. this illustration does not incorporate any underlying price change assumptions that have been made to my CPI model, since publishing the latest medium-term US CPI forecasts on 30 January.

Given that I currently intend to update my medium-term US CPI forecasts on a quarterly basis, I next envisage releasing an update to my medium-term US CPI price forecasts, post the release of US CPI data for March.

Further note that the underlying Quarterly US Inflation Update report included at the bottom of this page, has not been updated to reflect the change in weights, and remains as published on 30 January.

My CPI forecasts are not impacted by the BLS’ adjustments to seasonal factors, as I build my forecast on non-seasonally adjusted data, and conduct my own adjustments for seasonality based upon historical averages.

Overall policy backdrop remains conducive to lower inflation

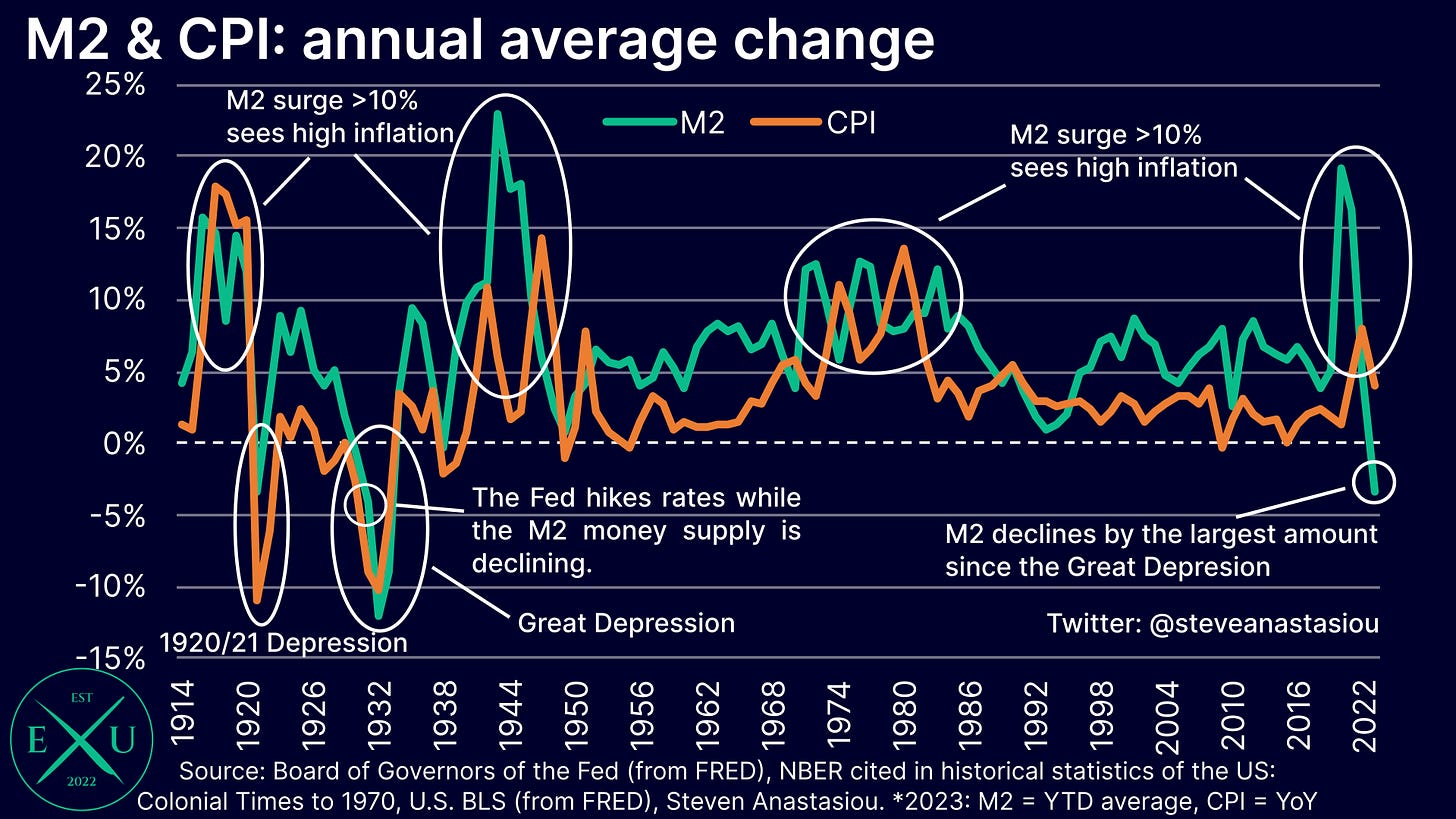

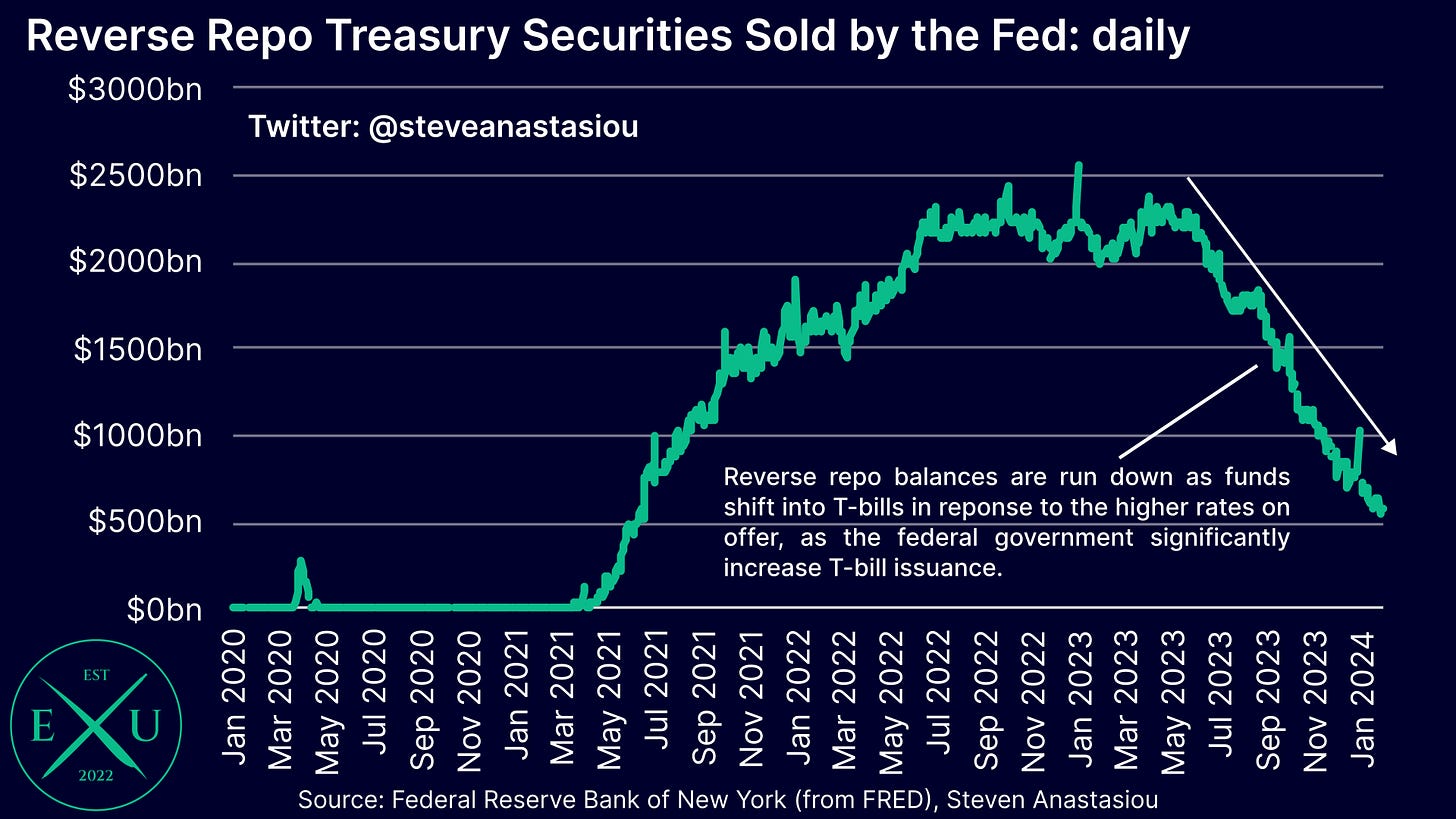

While Fed tightening has been somewhat offset by the federal government’s very large T-bill issuance and the associated draining of the Fed’s RRP facility (which has resulted in “idle” funds entering the “real” economy), M2 has remained constrained. Indeed, with M2 coming off its largest annual average decline since the Great Depression, the economic backdrop remains conducive to lower inflation.

Inflation expected to hit 2% across an array of measures in 2024

With disinflationary trends strengthening in recent months, and a policy backdrop that’s expected to continue to promote disinflation, I now expect annual headline CPI growth to hit 2% in August, and the core CPI to hit 2% in December.

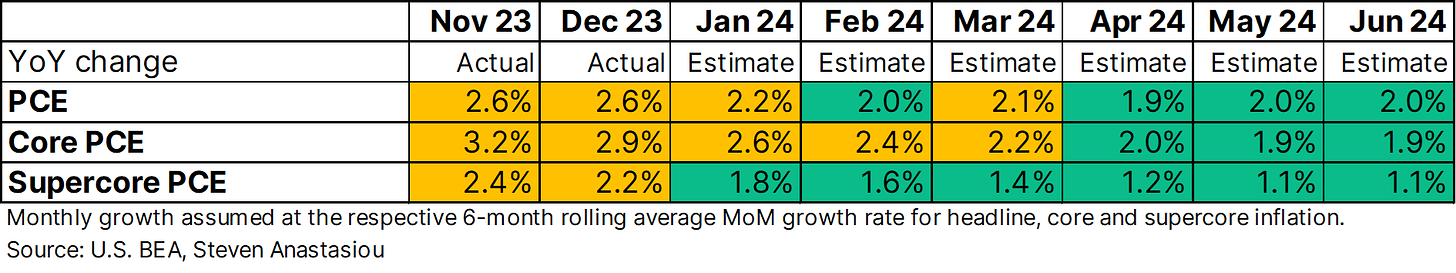

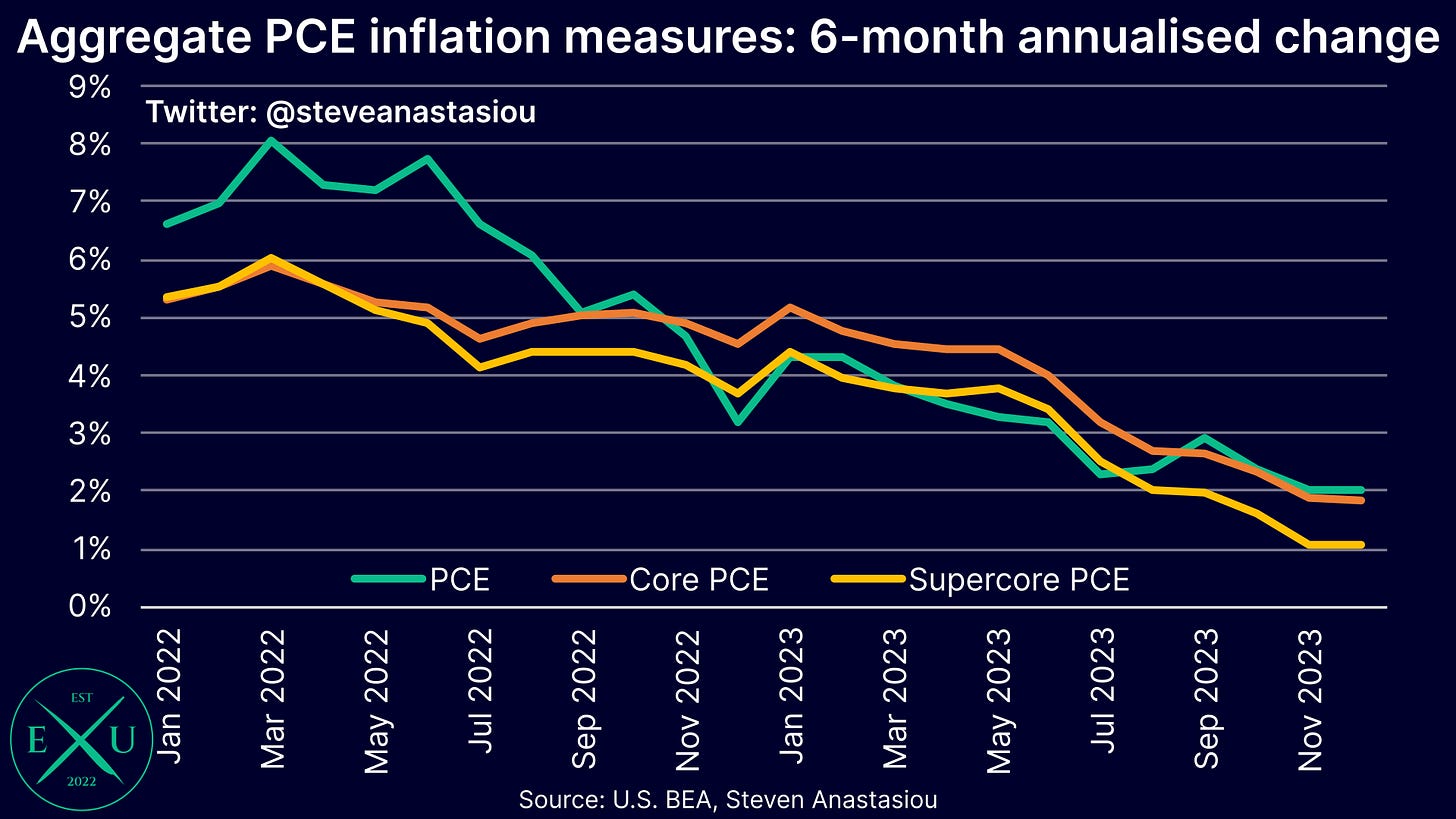

Should current 6-month moving average growth rates continue, headline PCE Price Index growth is on track to first reach the Fed’s 2% target in February.

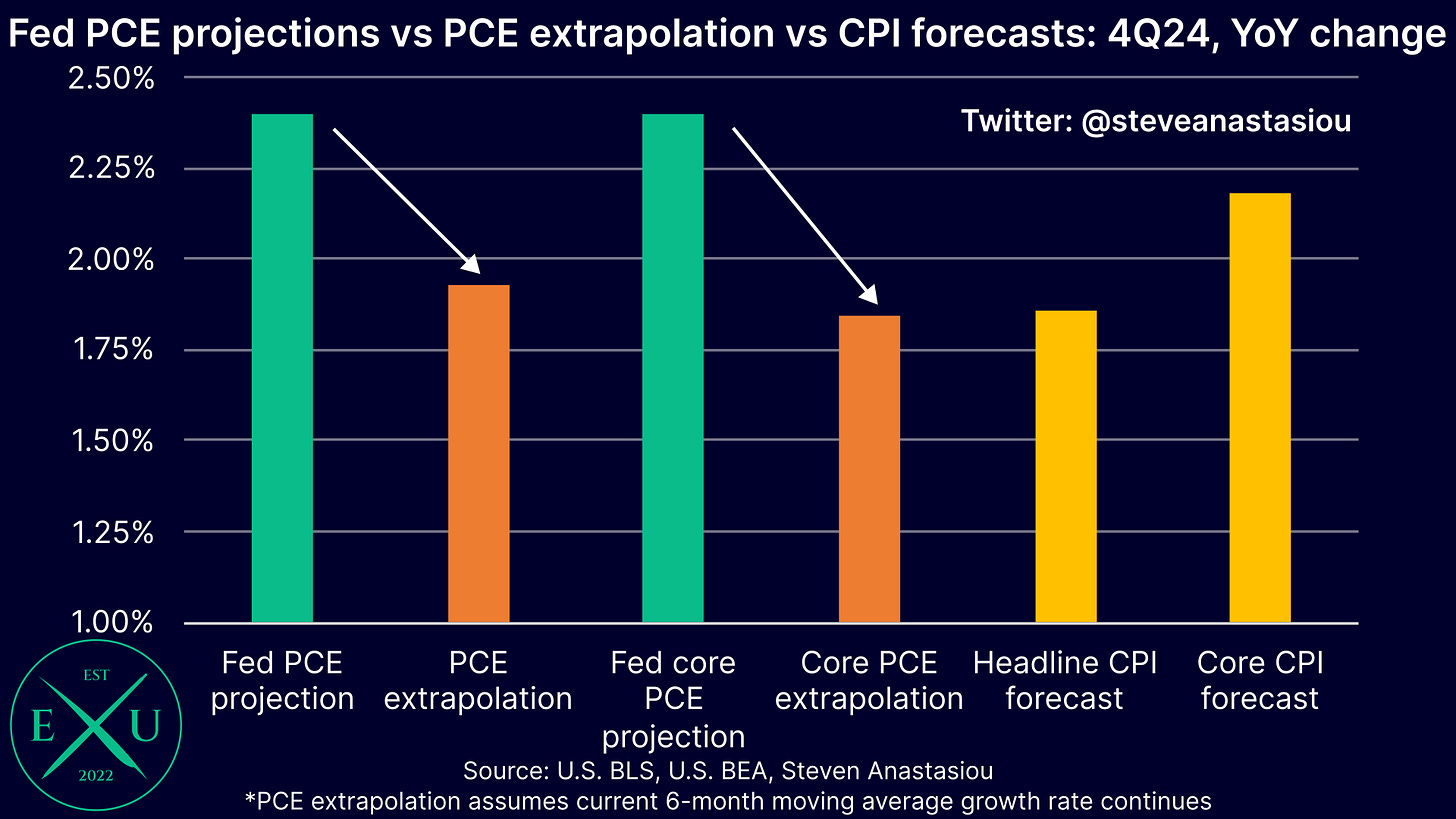

Current forecasts suggest material downside to the Fed’s projections

For 4Q24, the Fed is projecting headline/core PCEPI growth of 2.4%/2.4% YoY. This compares to my headline/core CPI forecast of 1.9%/2.2%, and extrapolated headline/core PCE growth of 1.9%/1.8% (at current 6-month moving average growth rates). Across all four forecasts, the average is 2.0% — in order for the Fed to deliver a CY24 end real rate of ~2.2% (as it currently projects) under such a scenario, the Fed will need to deliver ~five 25bp rate cuts, versus its current median projection of three.

With a March cut far from clear, the Fed ought to be cognisant of overshooting

With 6-month annualised growth across the headline, core and supercore PCEPI at 2% or below in December, there’s clear justification for a March rate cut, which the market views as a live meeting. While robust GDP growth and higher CPI and services price growth may see an initial cut delayed beyond March, with current trends saying that the Fed’s 2% YoY PCE target will be hit in February (note that February PCE data won’t be released before the March meeting), an initial cut would be expected in 1H24.

With M2 remaining constrained, bank lending slowing sharply, and 6-month annualised supercore PCE inflation falling to just 1.1% in December, the Fed ought to be highly cognisant of the risk that it loosens too slowly, with underlying trends pointing to a material risk that the Fed’s 2% PCE target is overshot to the downside.

To view the full 34-page report, click the download link below!