US jobs report points to the growing risk of a recession

June's employment data pointed to a significant further weakening of the US jobs market, with multiple 2H24 rate cuts looking increasingly likely.

My latest US Economic and Market Summary & Outlook outlined my expectation for a material economic weakening in 2H24, which alongside material disinflation, is expected to result in multiple 2H24 rate cuts. June’s jobs report significantly reinforces this outlook.

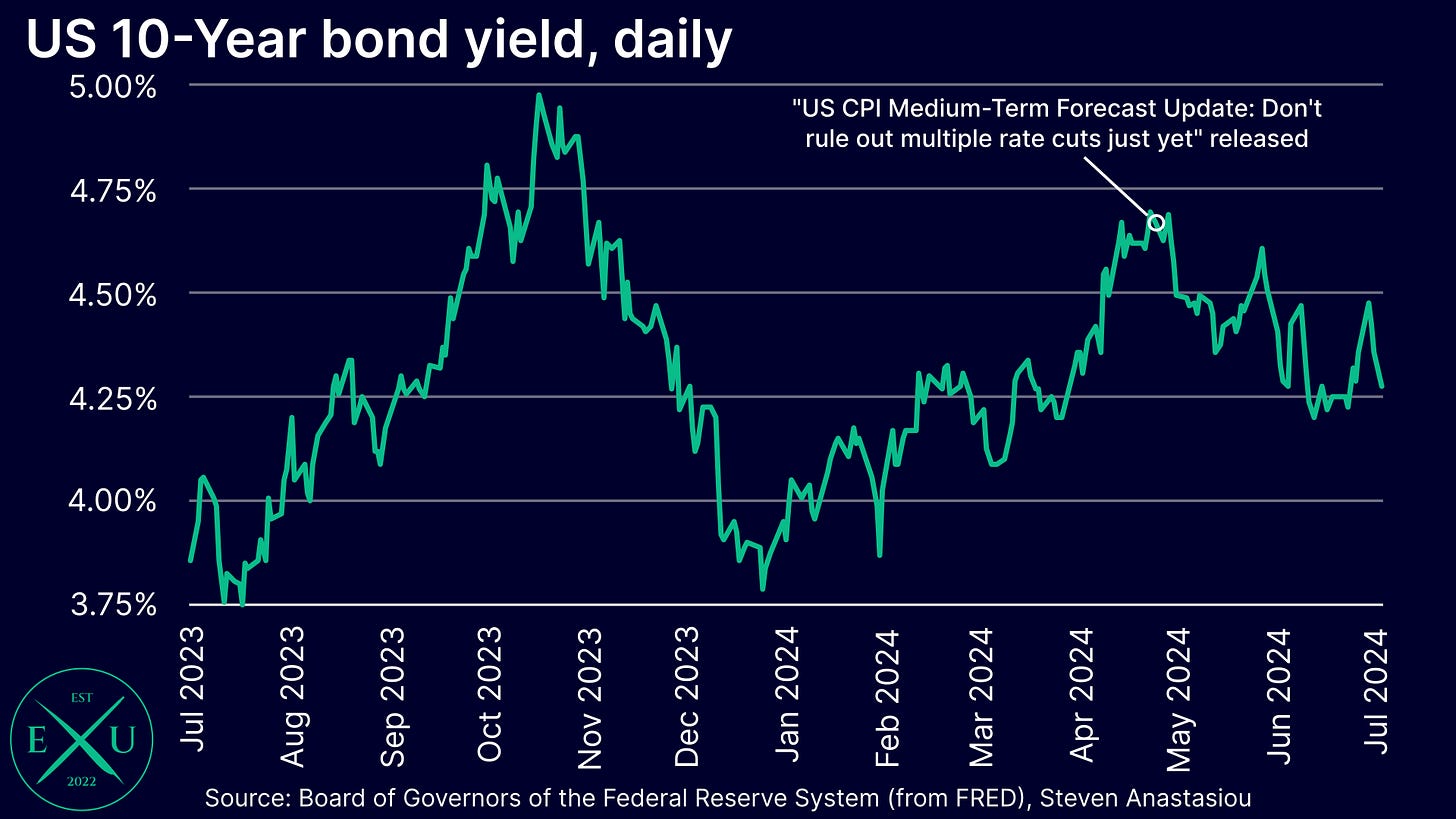

My expectation for material disinflation and multiple 2H24 interest rate cuts was also outlined in my latest medium-term US CPI update that was published on 26 April: “Don’t rule out multiple rate cuts just yet”. At the time of publishing this report, market concerns surrounding the inflation and interest rate outlook had seen another significant increase, with 10-year Treasury yields ending the trading session at 4.67% on the day that the report was released. Following the latest jobs data, which as discussed below, highlighted a further weakening of the US employment market, the 10-year yield closed at 4.28%, marking a near 40bp decline since the release of my latest medium-term US CPI update. Across the same time period, the CME FedWatch Tool has gone from pricing in a 40.3% probability of multiple 2024 rate cuts, to a 76.5% probability of two or more rate cuts.

In addition to my latest monthly review of the US jobs data contained within the report below, in order to gain a clearer picture of the current state of, and outlook for the US economy, please see the latest revision to my US Economic and Market Summary & Outlook, which now reflects the latest money supply, personal income and personal spending data. The full report and latest revision is available to premium subscribers at any time, at this link. As part of my commitment to ensuring that Economics Uncovered subscribers receive the best service possible, I intend to regularly revise this report in order to reflect the latest economic data. You can therefore expect to see further near-term revisions to incorporate the June jobs report and the upcoming CPI data.

Please note that I will also be releasing an update to my medium-term US CPI forecasts following June’s CPI report.

Let’s now delve into the details of the latest US jobs data.

Major downward revisions paint a much weaker picture of nonfarm payroll growth

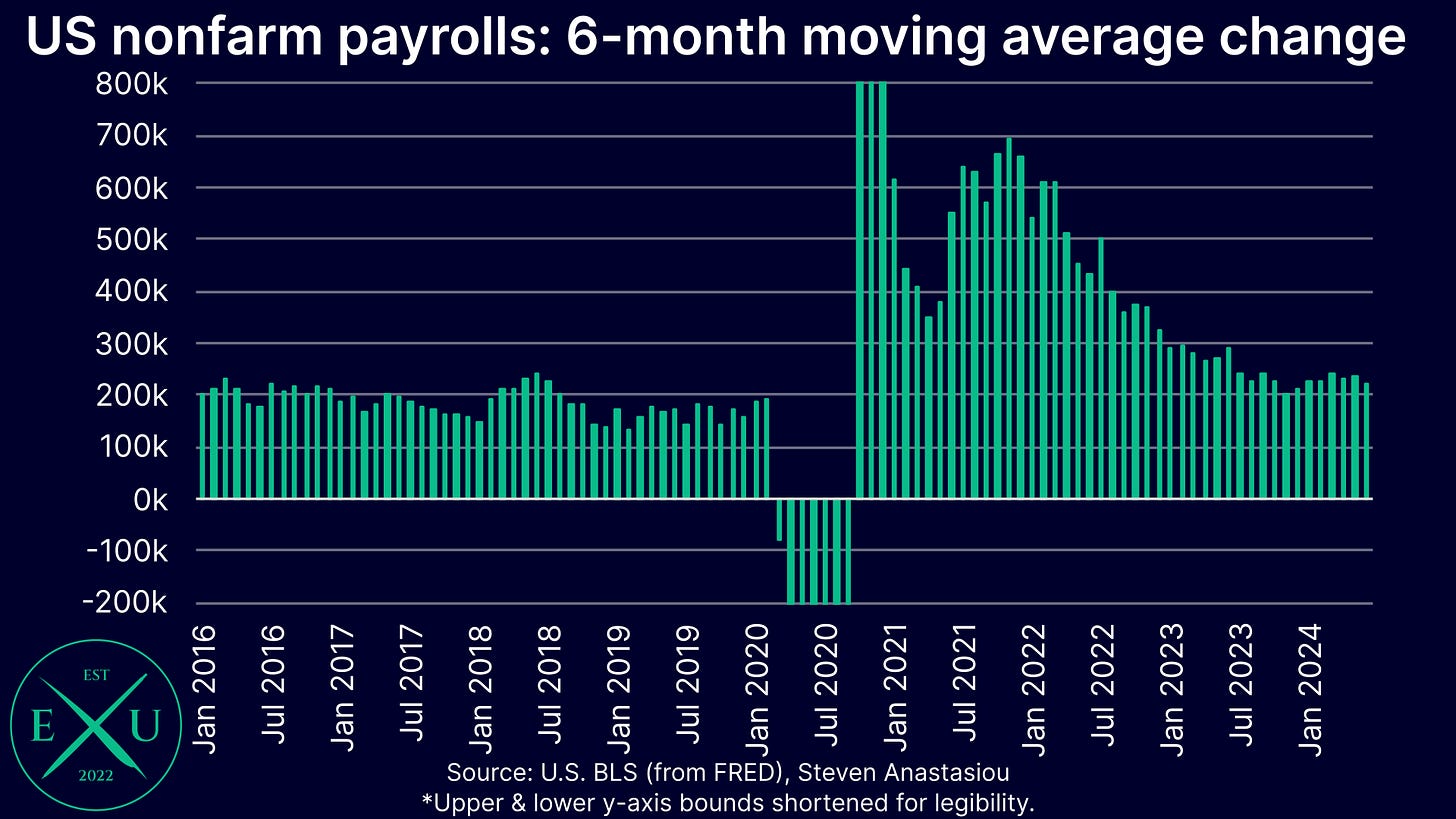

After 3- and 6-month moving average nonfarm payroll growth rose to 249k and 255k in May respectively, major downward revisions to April (-57k) and May’s (-54k) nonfarm payroll growth have significantly altered the picture of the US employment market.

With nonfarm payroll growth of 206k recorded in June, 3-month moving average growth is now just 177k, its lowest level since January 2021, while 6-month moving average growth is now 222k, its lowest level since December.

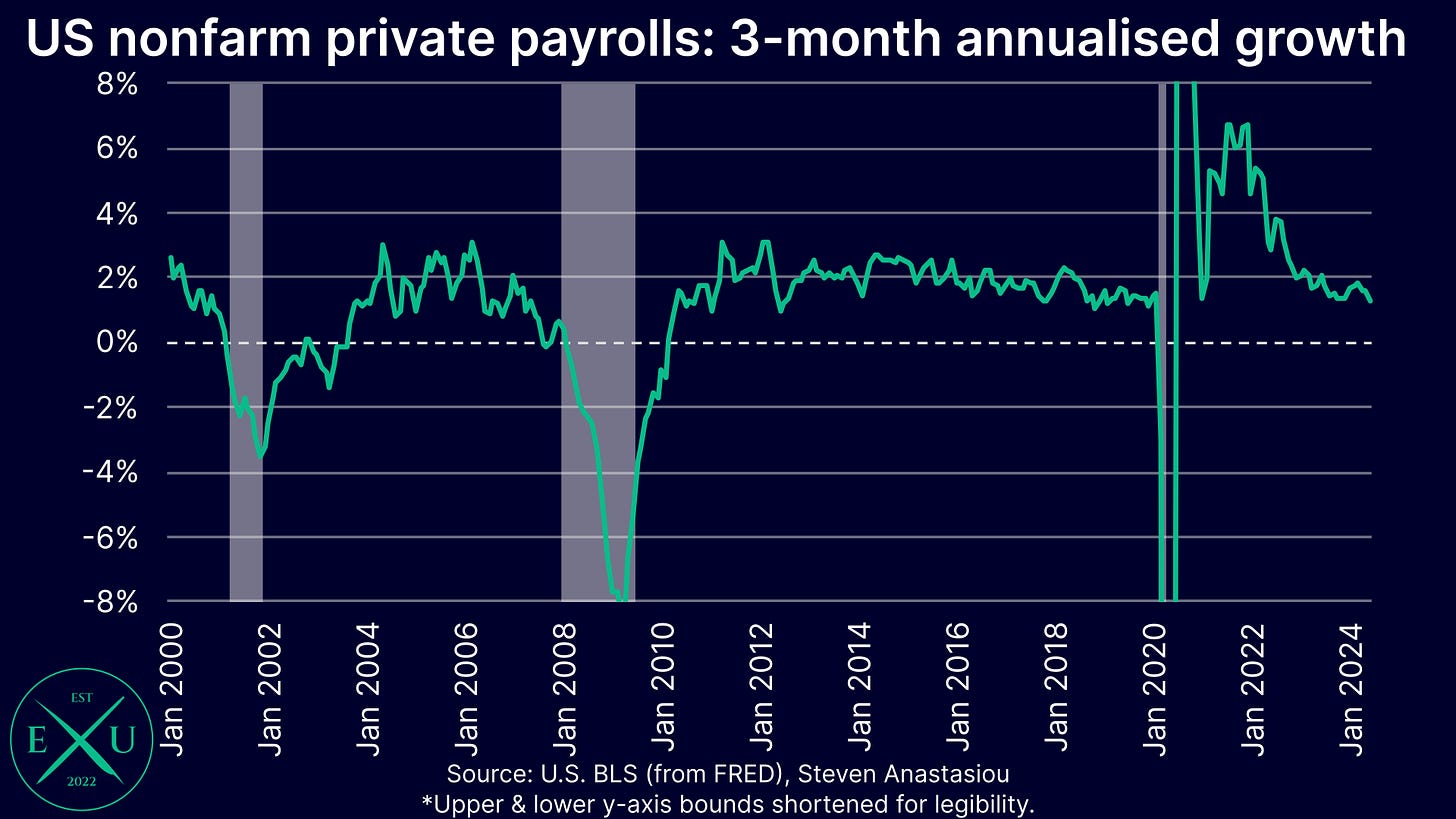

This has resulted in 3-month annualised nonfarm payroll growth falling to 1.4%, also its lowest level since January 2021. YoY growth has fallen to 1.6%, its lowest level since March 2021.

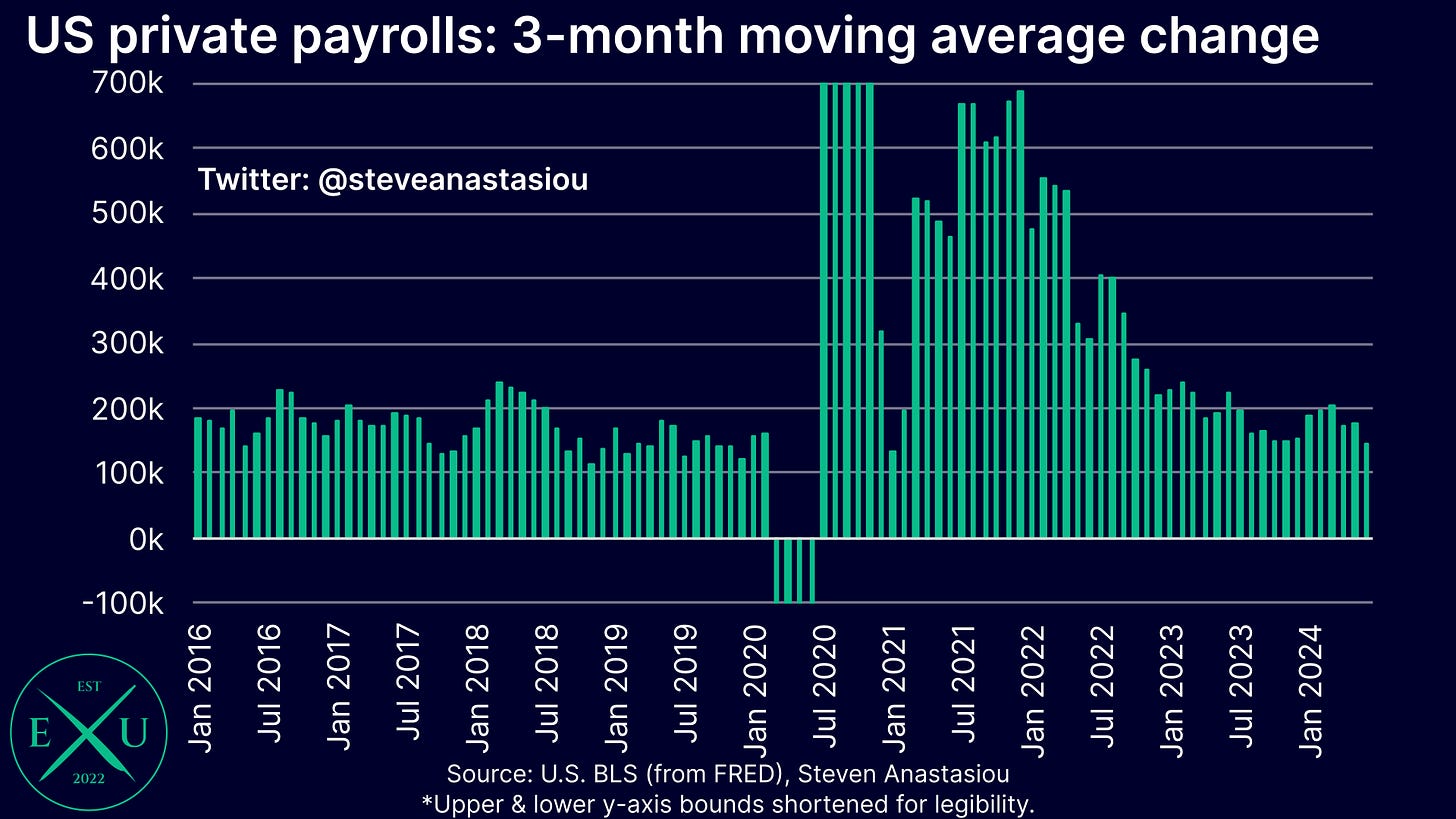

Private nonfarm payroll growth is even weaker, where after 136k private payrolls were added in June, the 3-month moving average growth rate fell to 146k. This is the slowest pace of job growth that’s been recorded since January 2021.

3-month annualised growth has now fallen to 1.3%, its lowest level since June 2020. YoY growth has fallen to 1.5%, its lowest level since March 2021.

With job growth failing to keep pace with elevated immigration, the unemployment rate continues to rise

While monthly nonfarm payroll growth of ~200k would have been broadly regarded as being relatively strong pre-COVID, the current pace of job growth must be considered within the context of elevated immigration levels, which has likely boosted the breakeven rate of job growth to above 200k jobs a month. This was highlighted by Eric Van Nostrand within the Economic Policy Statement that accompanied the Treasury’s most recent quarterly refunding announcement.

Given that 3-month moving average nonfarm payroll growth has fallen to 177k (i.e. below some estimates of the current breakeven rate of job growth), it’s no surprise to see that the unemployment rate rose for the third consecutive month in June to reach 4.1%, its highest level since November 2021. The unemployment rate is now 0.7 percentage points above its cycle trough.

On a 3-month moving average basis, the unemployment rate rose to 4.0%, which is 0.5 percentage points above its cycle trough.

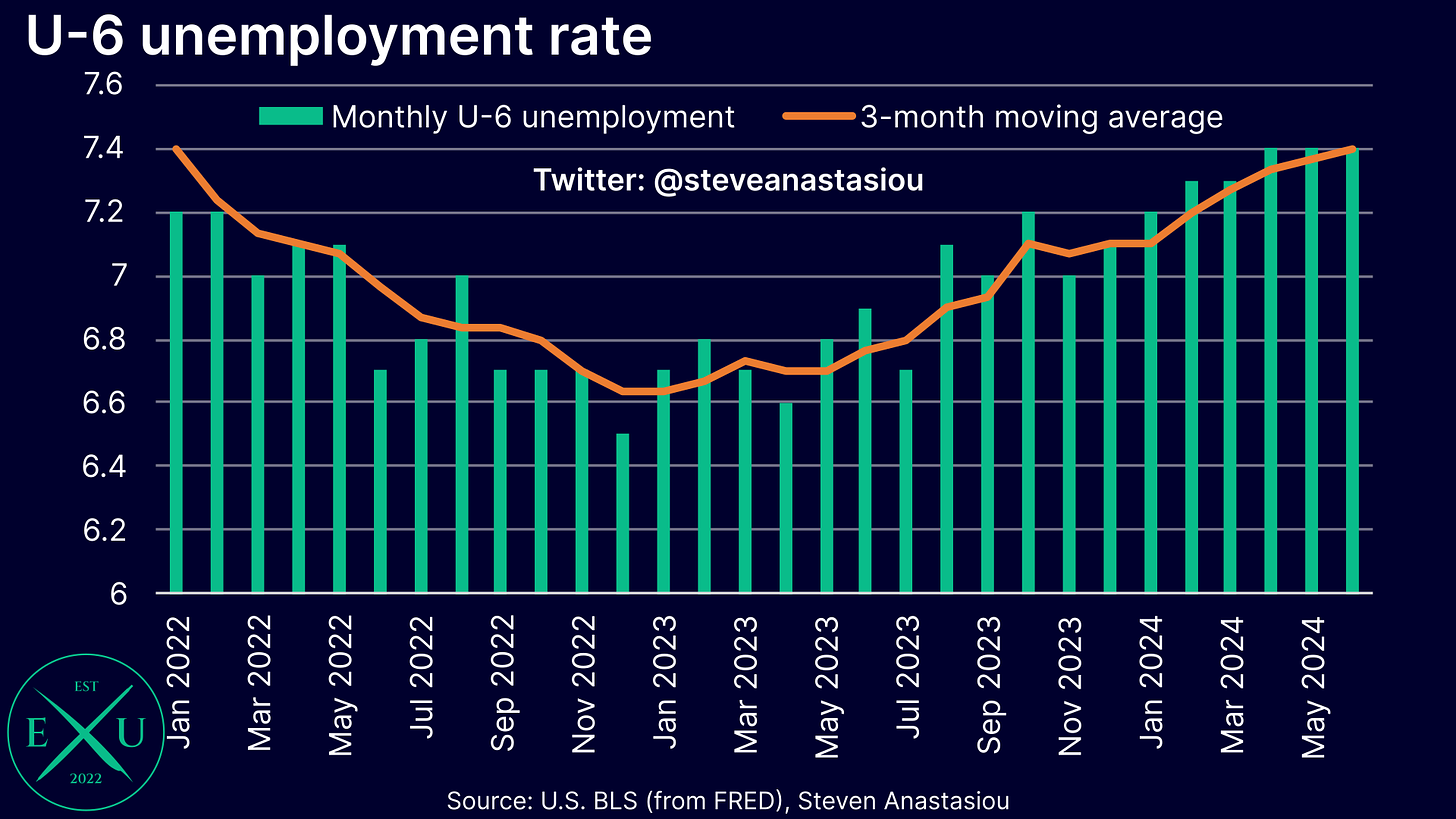

The U-6 unemployment rate, which also measures underemployment, remained at 7.4% for a third consecutive month, which is 0.9 percentage points above its cycle trough. This resulted in the 3-month moving average U-6 unemployment rate rising to 7.40% (up from 7.37%), a level that was last seen in January 2022.

From the household survey to cyclical employment, a number of indicators are suggesting that the US could already be in a recession

In addition to nonfarm payroll growth that is failing to keep pace with higher immigration, a broad array of labour market indicators are suggesting that there has been a significant weakening of the US employment market. In some cases, key indicators are suggesting that the US economy could already be in a recession.