June PCE inflation: deepening services disinflation paves the way for rate cuts

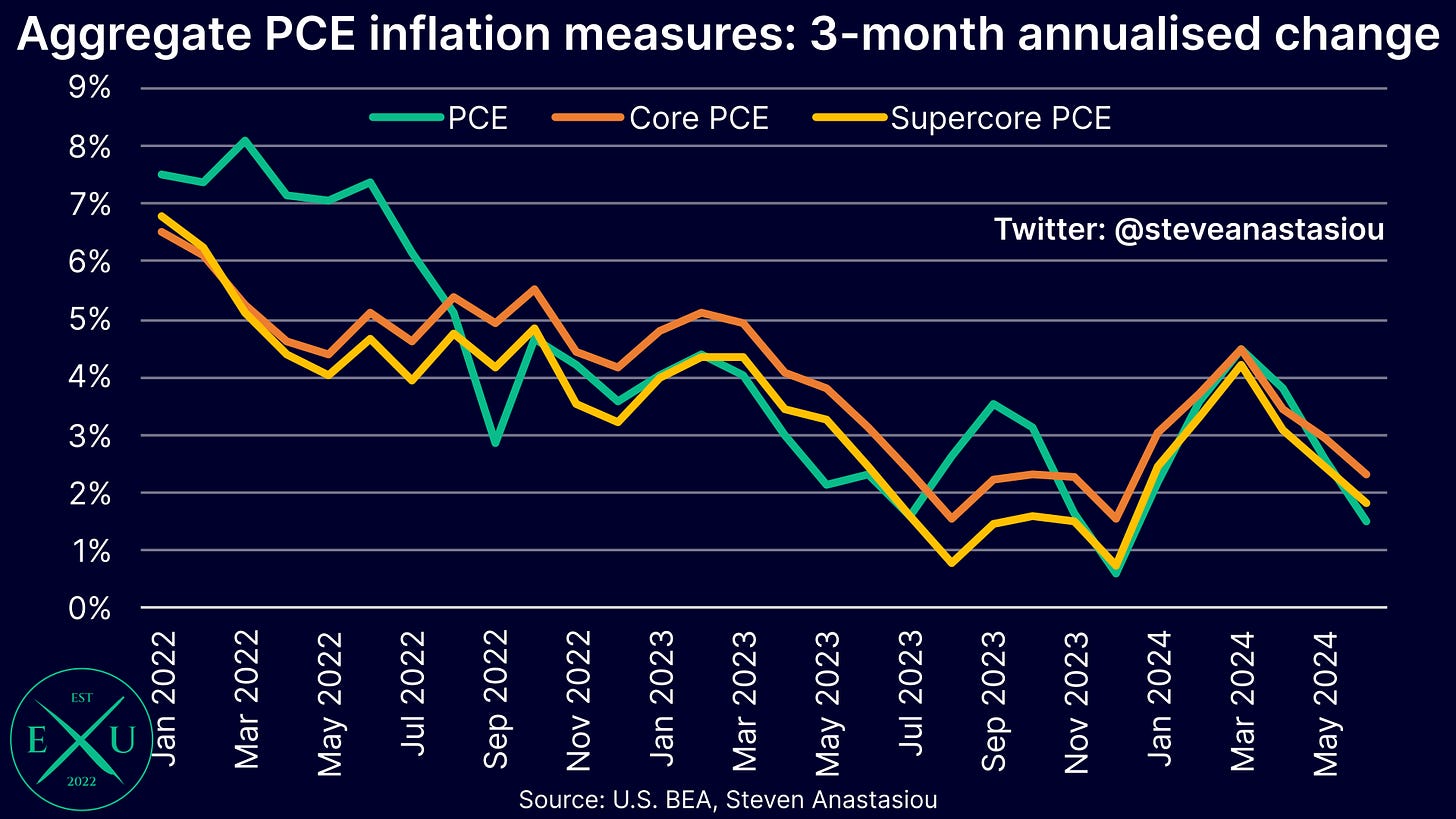

Broad based services disinflation saw 3-month annualised services price growth plunge to its lowest level since December 2020, highlighting how the disinflationary price cycle is spreading.

The next report to be released will be an update on the latest GDP and personal income and spending data.

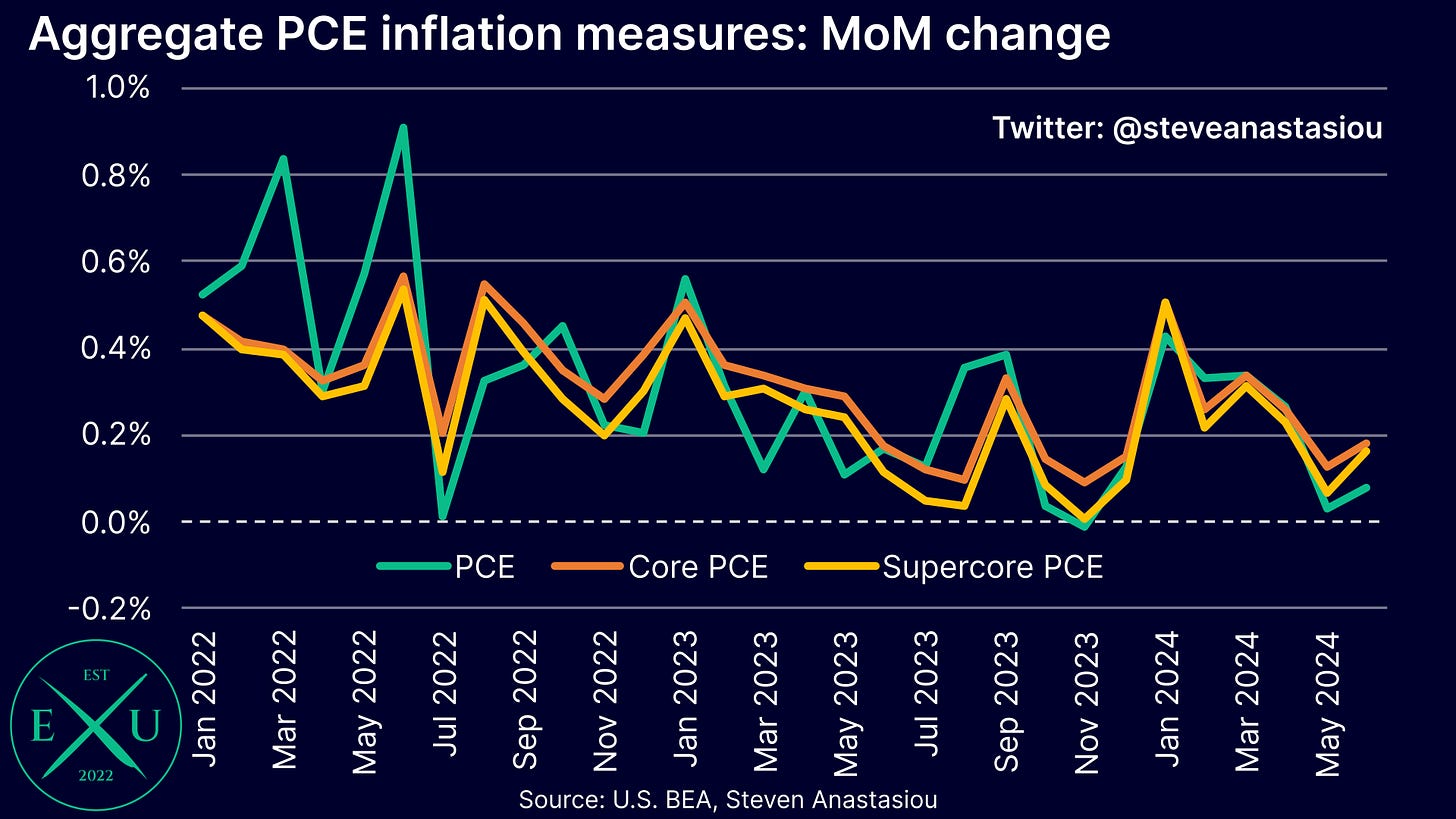

Another month of relatively modest price growth

MoM growth was fairly modest across all key PCE Price Index (PCEPI) aggregates in June:

Headline: 0.08% (0.95% annualised);

Core: 0.18% (2.2% annualised); and

Supercore (i.e. core excluding lagging shelter): 0.16% (2.0% annualised).

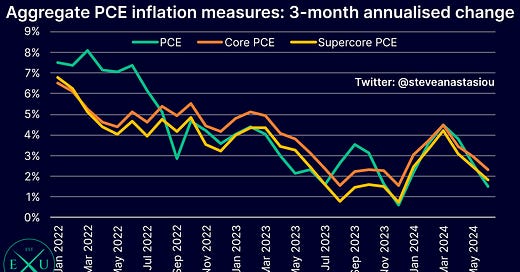

3-month annualised growth declined across all key aggregates in June:

Headline: 1.5% (from 2.6%);

Core: 2.3% (from 2.9%); and

Supercore: 1.8% (from 2.5%).

6-month annualised growth was fairly stable, but rose slightly on a core and supercore basis:

Headline: 3.0% (from 3.1%);

Core: 3.4% (from 3.3%); and

Supercore: 3.0% (from 2.9%).

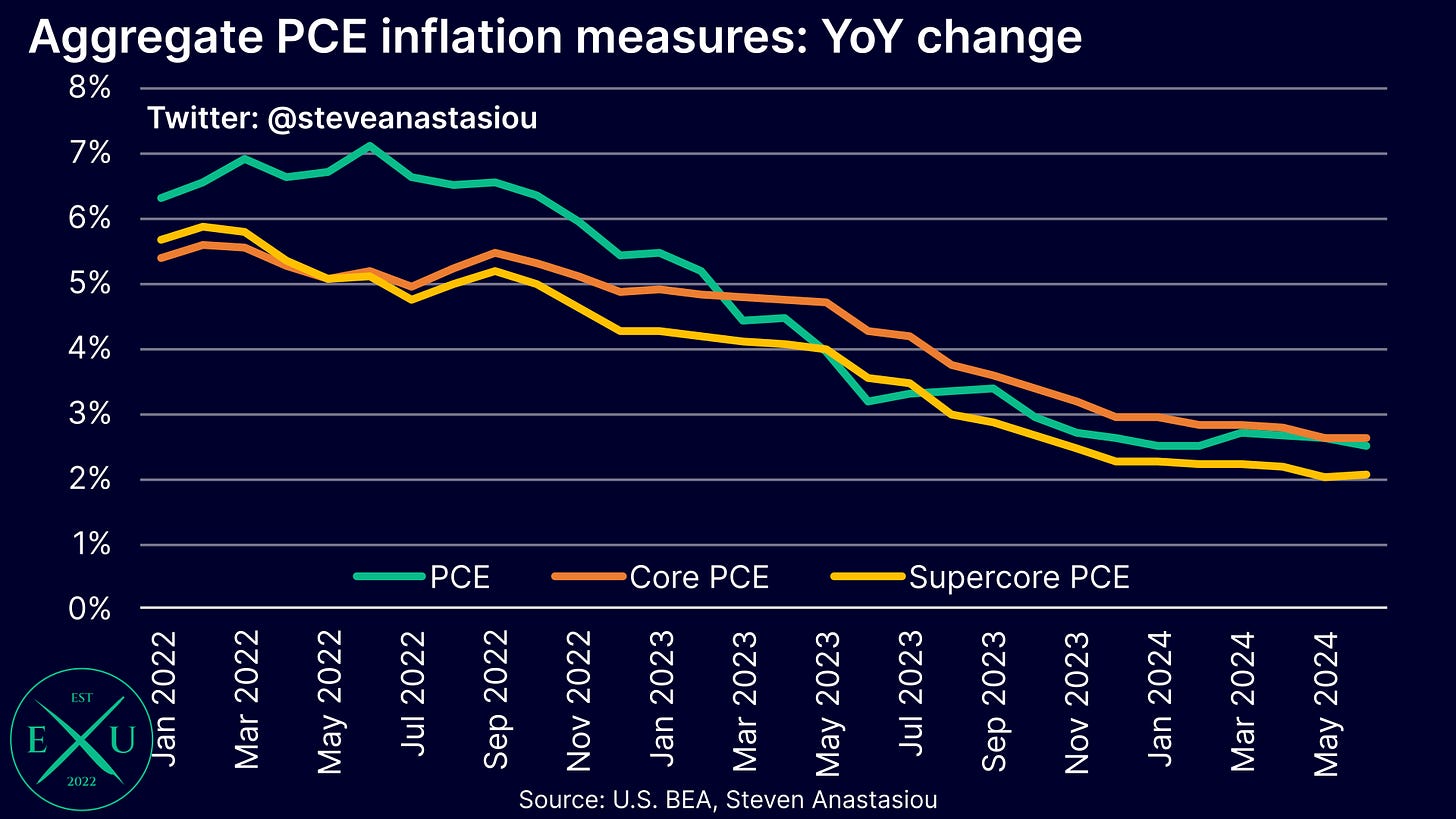

YoY growth was also fairly stable in June, with some modest rises and falls seen across the three key PCEPI aggregates:

Headline: 2.5% (from 2.6%);

Core: 2.6% (from 2.6%); and

Supercore: 2.1% (from 2.0%).