Latest jobs data adds support to the soft landing narrative

While important warning signs remain, when looked at as a whole, the latest US jobs data indicates a relatively robust picture.

While there continue to be some warning signs — which are predominately seen within the household survey — all-in-all, the latest US employment data strengthens the case that the US economy may experience a soft landing.

In analysing the latest US employment data across 50 different charts, I will firstly provide a breakdown of the establishment survey, before moving to the household survey. I will then provide a breakdown of the latest JOLTS data, unemployment claims data, and a range of alternative employment market related indicators.

Included within this analysis is a breakdown of the significant increase in part-time employment, including an analysis of the factors driving this shift, and what they suggest about the health of the employment market.

An overarching summary is provided at the end of this report.

Establishment survey

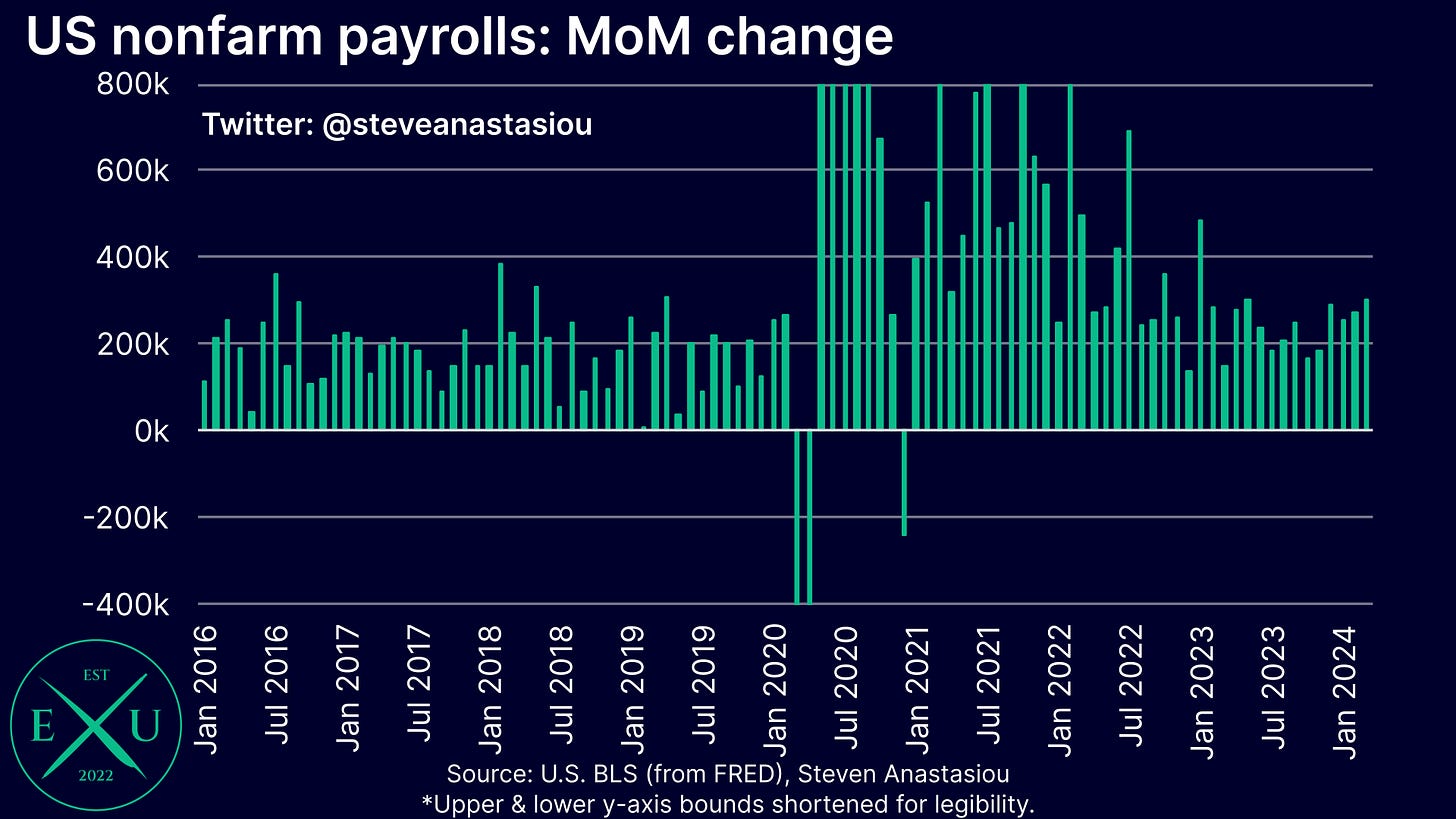

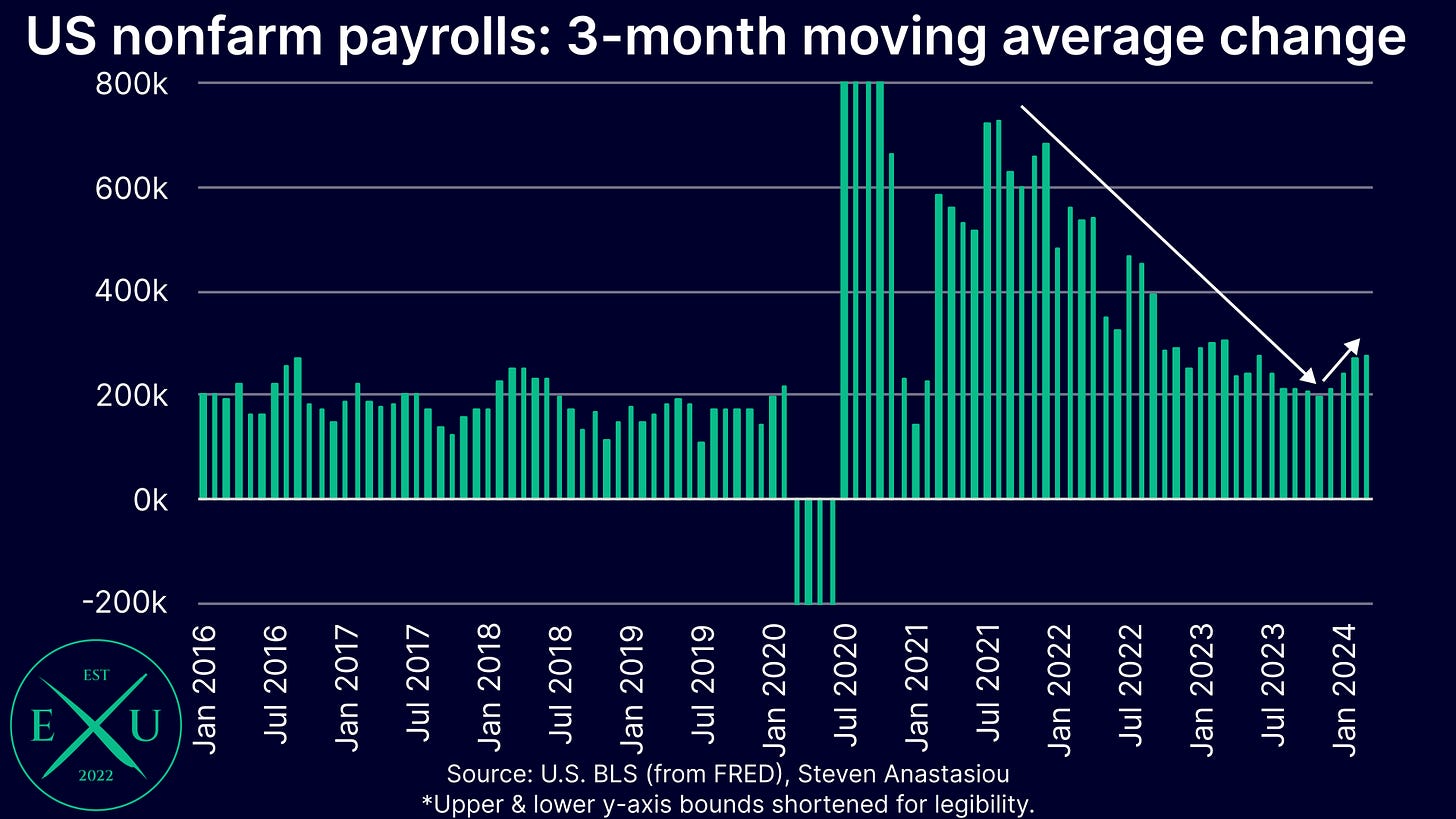

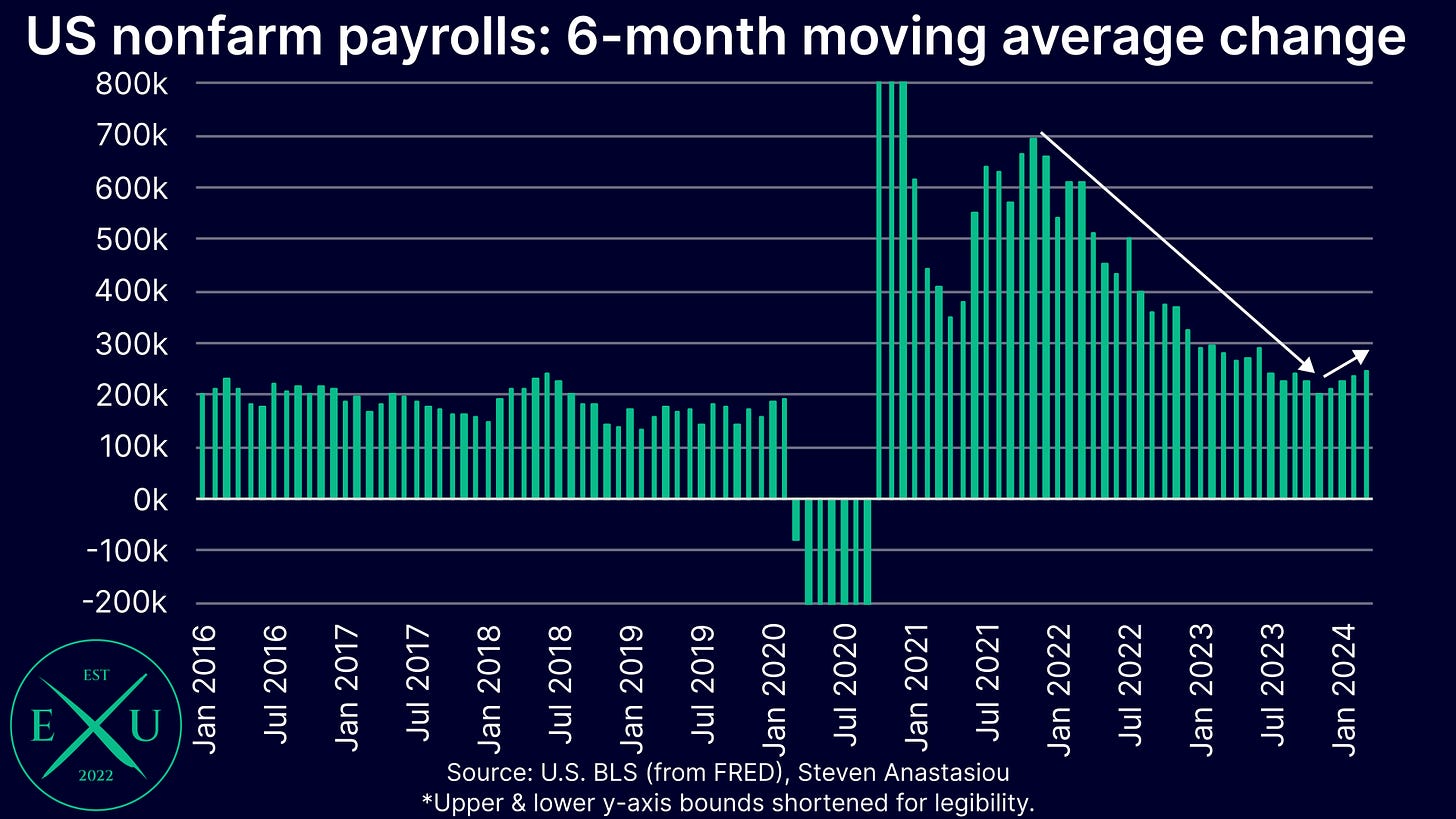

For the fourth consecutive month, overall nonfarm payroll employment rose by over 250k MoM, with March’s gain of 303k the highest that has been recorded since May 2023.

This took 3-month average growth to 276k, its highest level since March 2023, while 6-month average growth rose to 244k, its highest level since September. Growth is notably above pre-COVID levels on both a 3- and 6-month moving average basis.

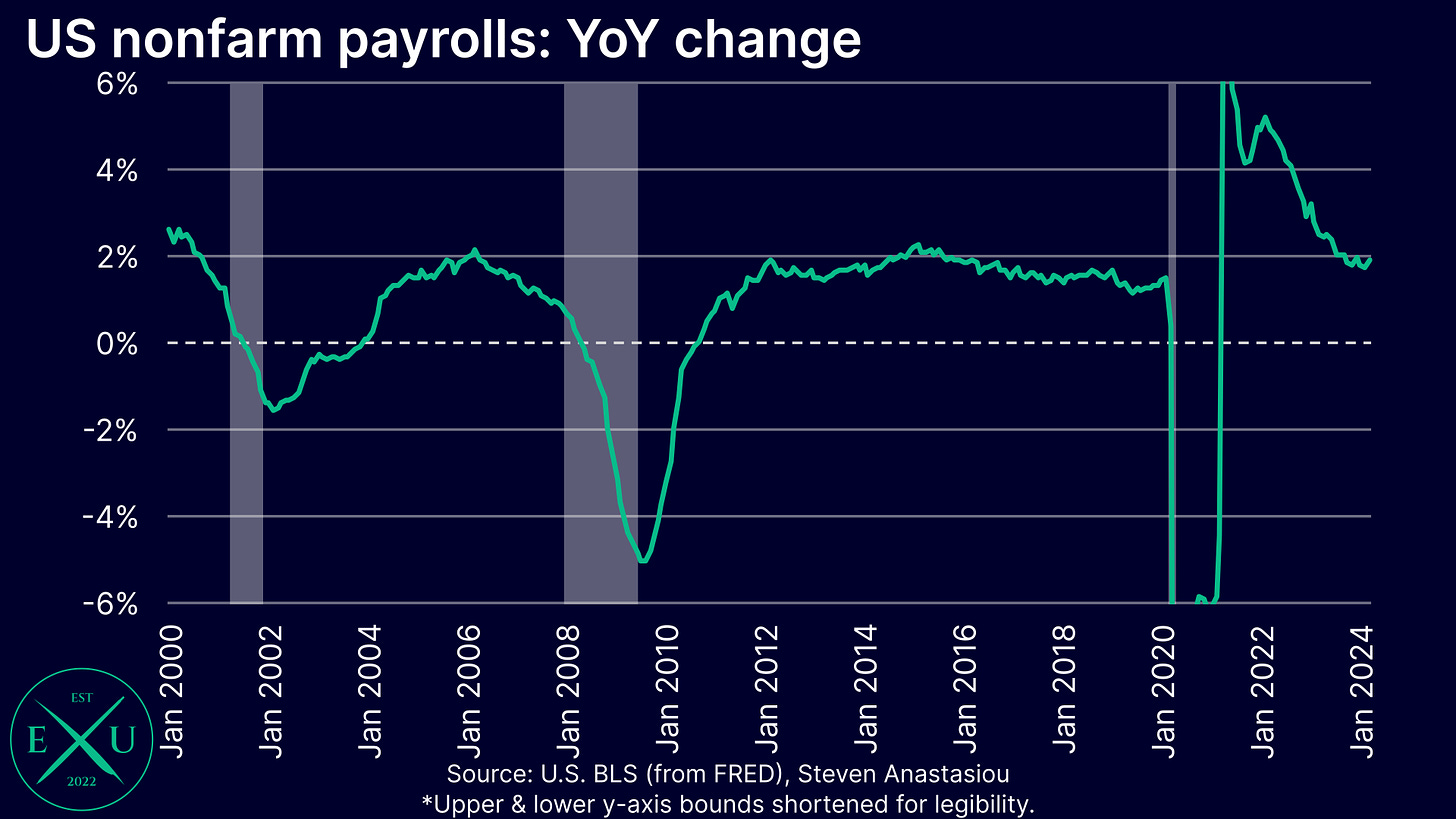

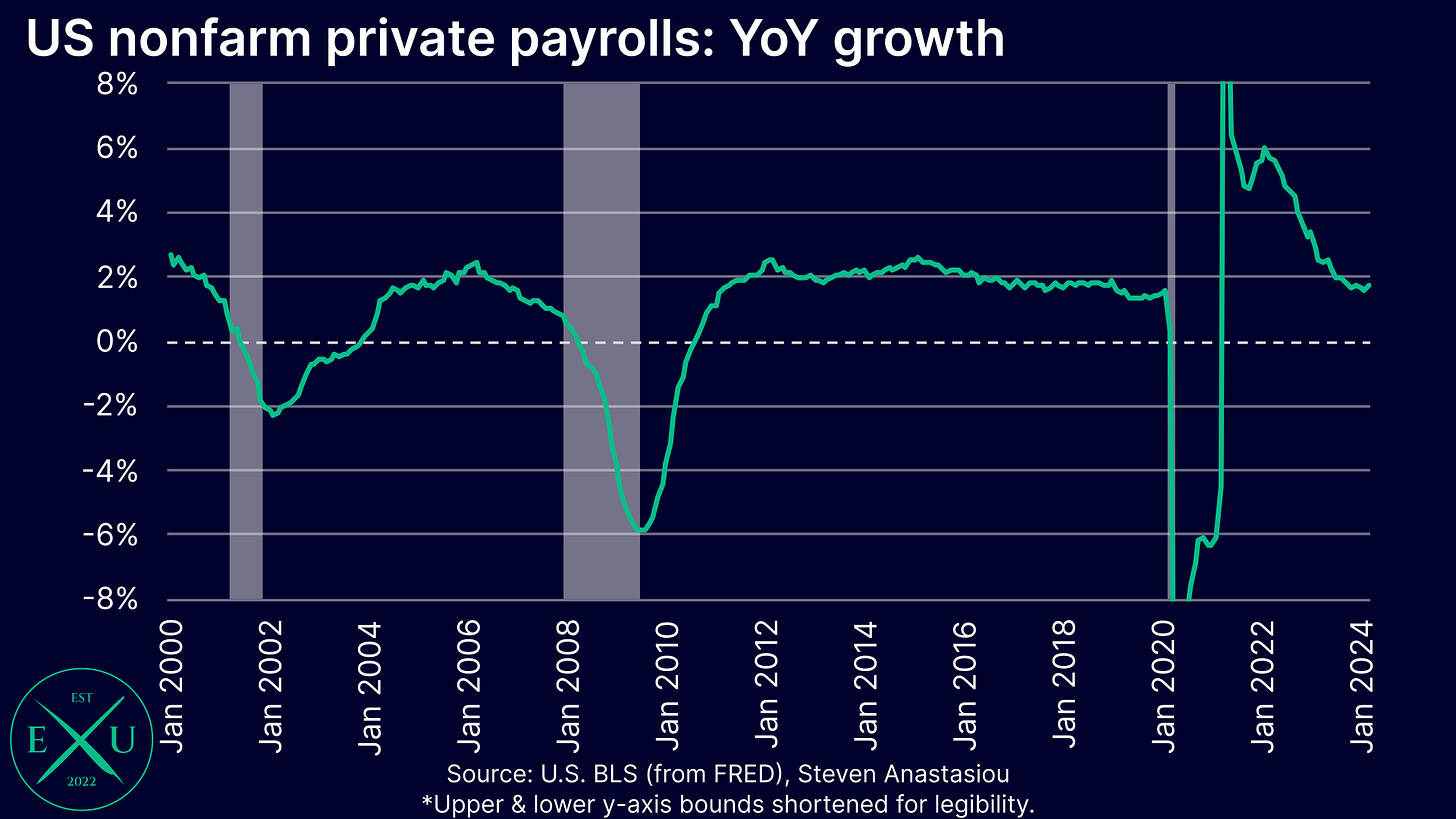

As a result of the improvement in MoM growth, overall YoY growth has increased to 1.9% YoY, which also remains notably above the pre-COVID growth rate and indicates a robust jobs market.

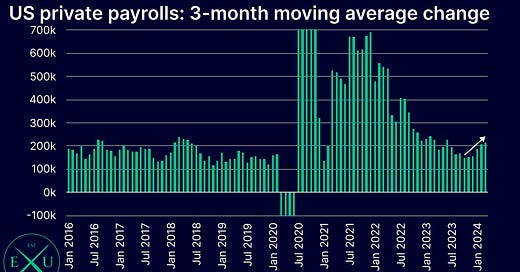

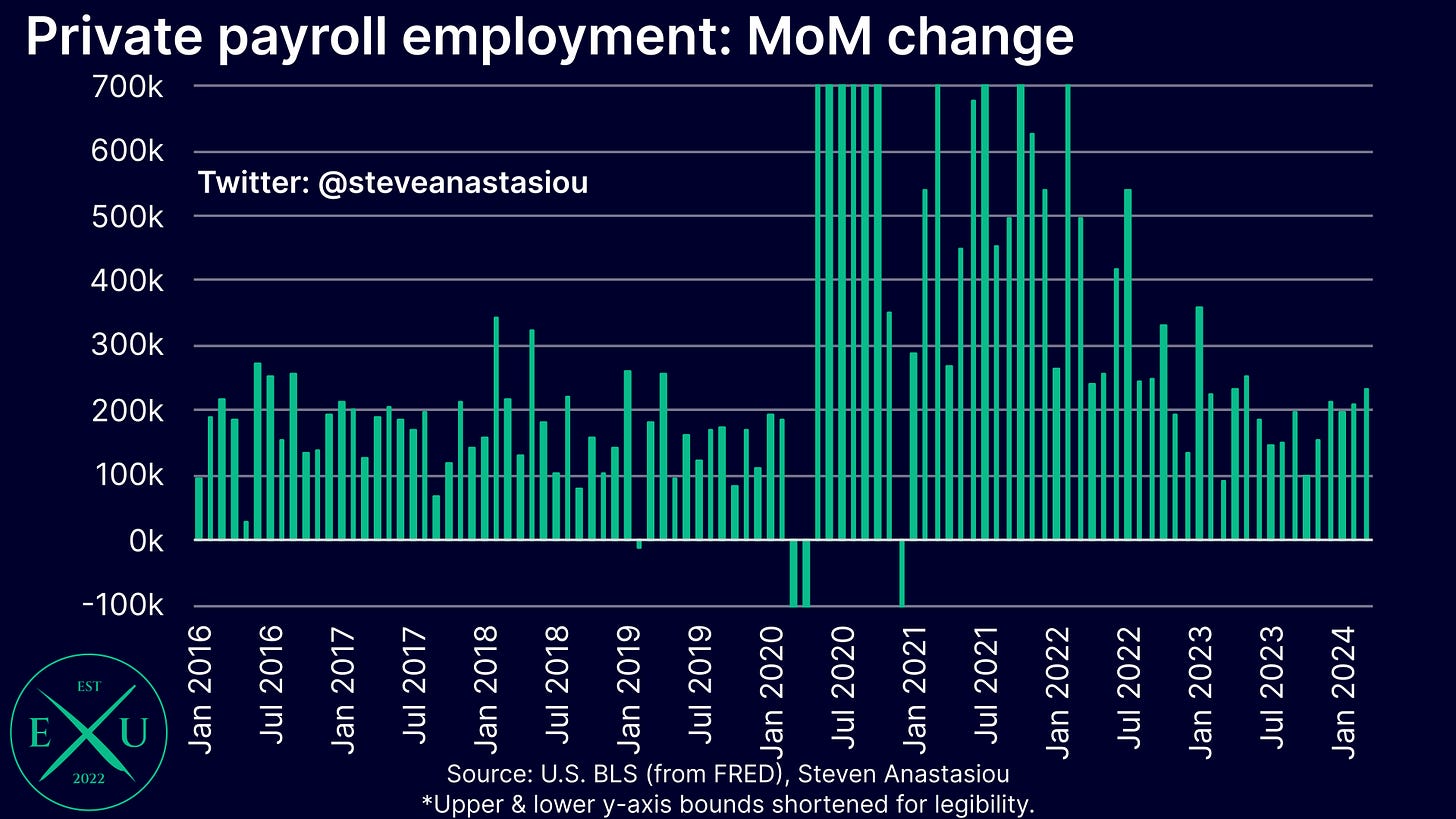

Focusing now on private payroll growth, for the third time in the past four months, MoM growth was above 200k.

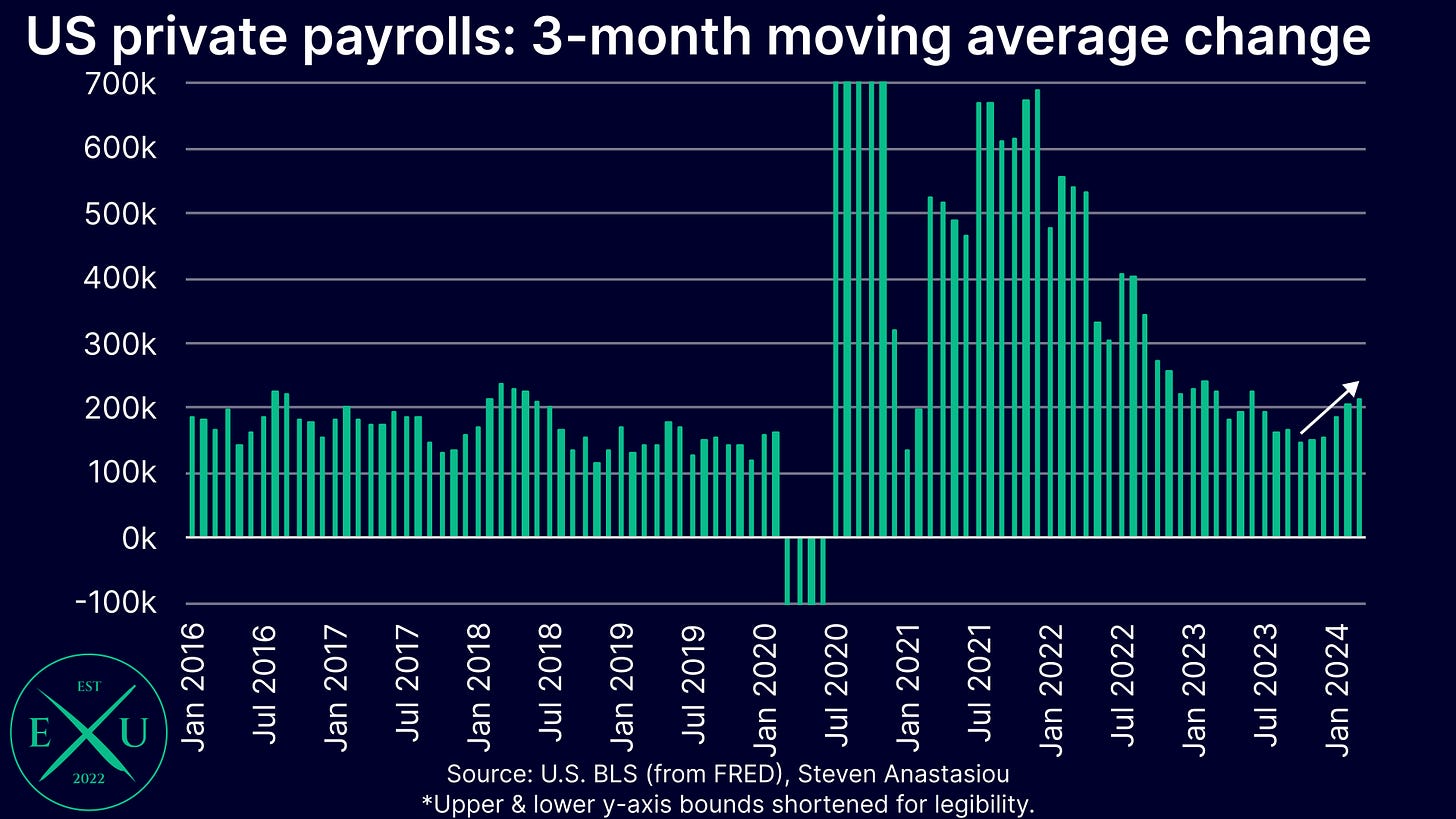

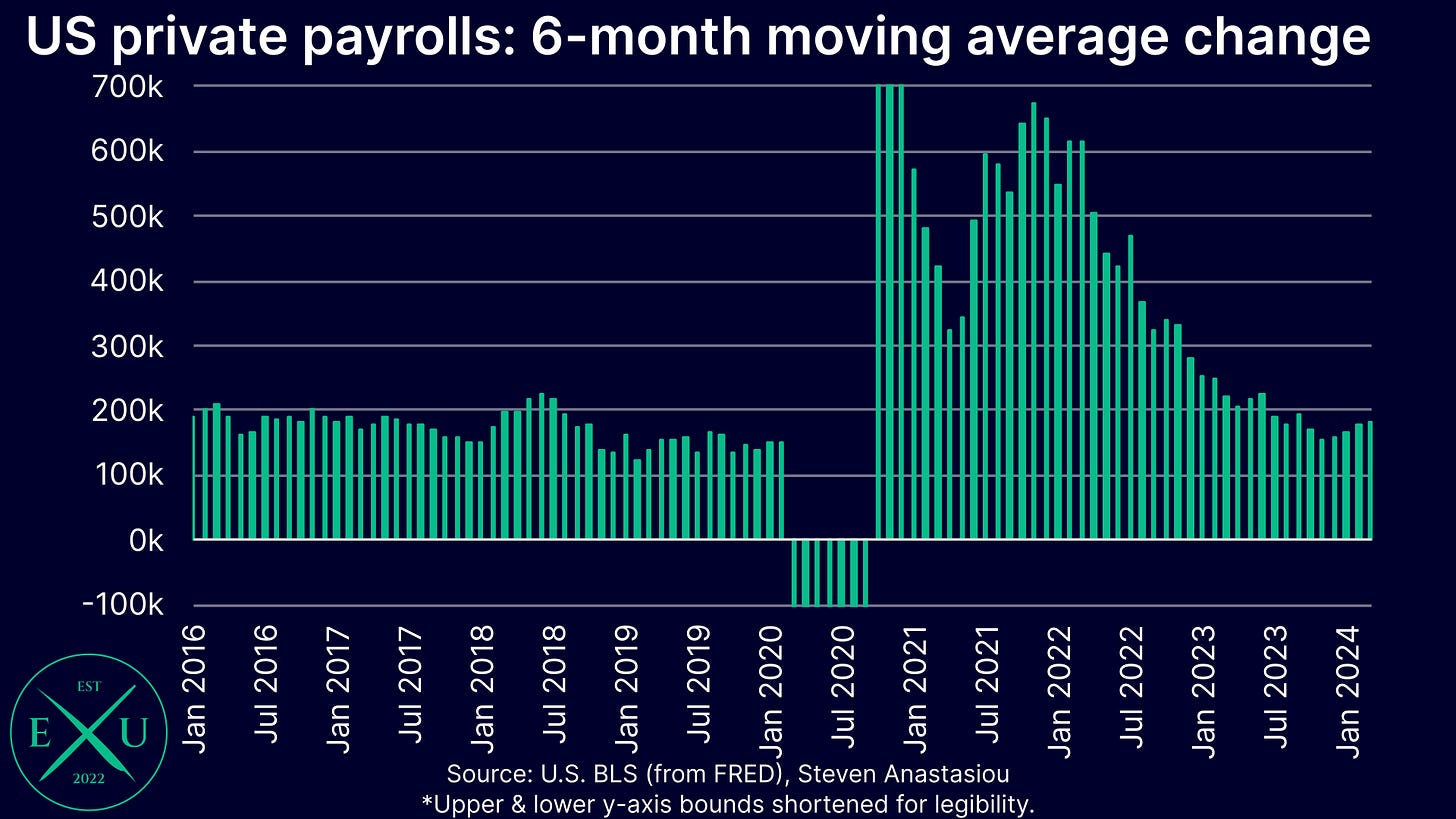

This took 3-month moving average growth to 212k, its highest level since June. 6-month moving average growth rose to 183k, its highest level since September.

On an annual basis, private nonfarm payroll growth increased to 1.7% YoY, which is broadly consistent with pre-COVID growth rates.

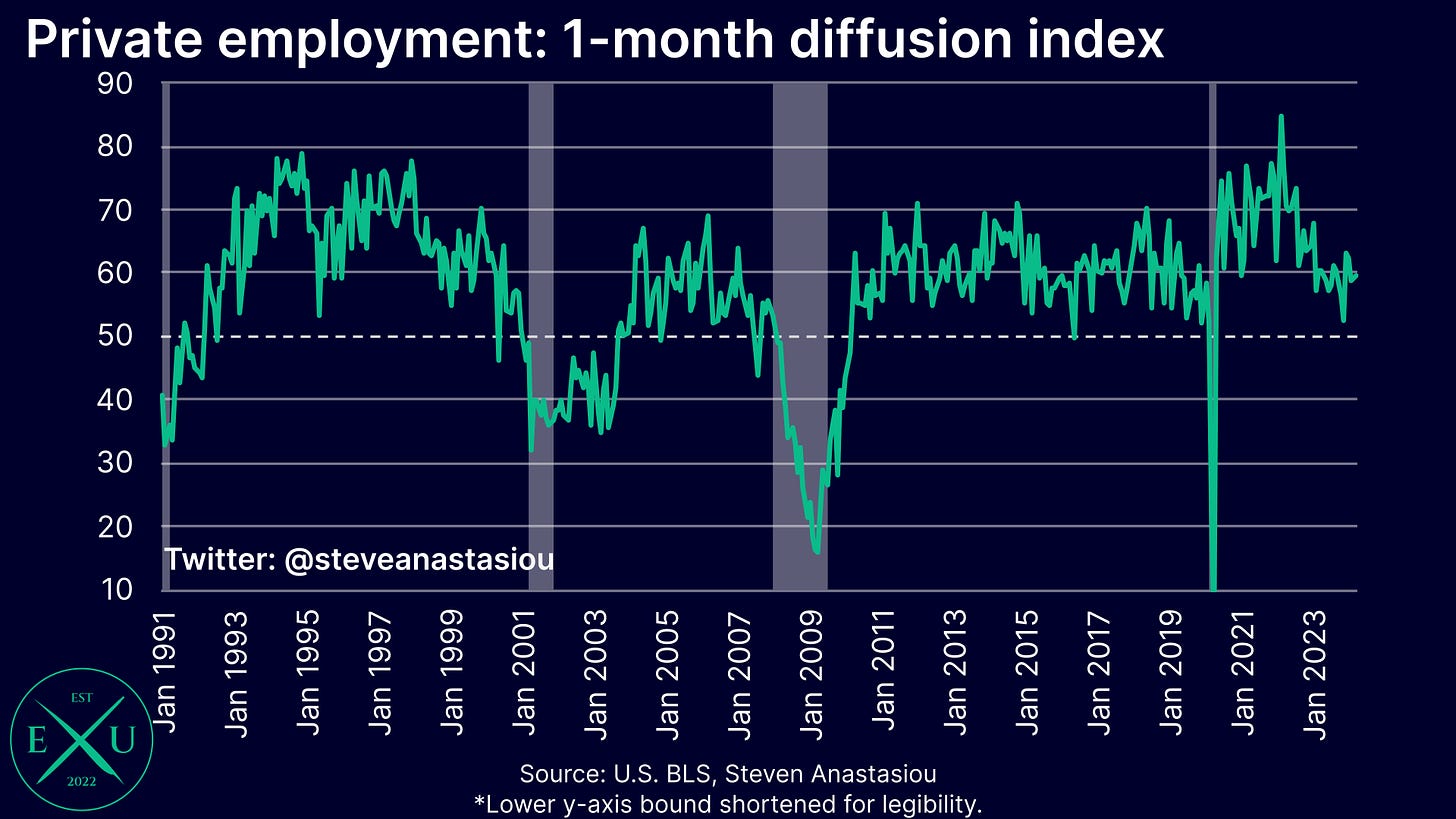

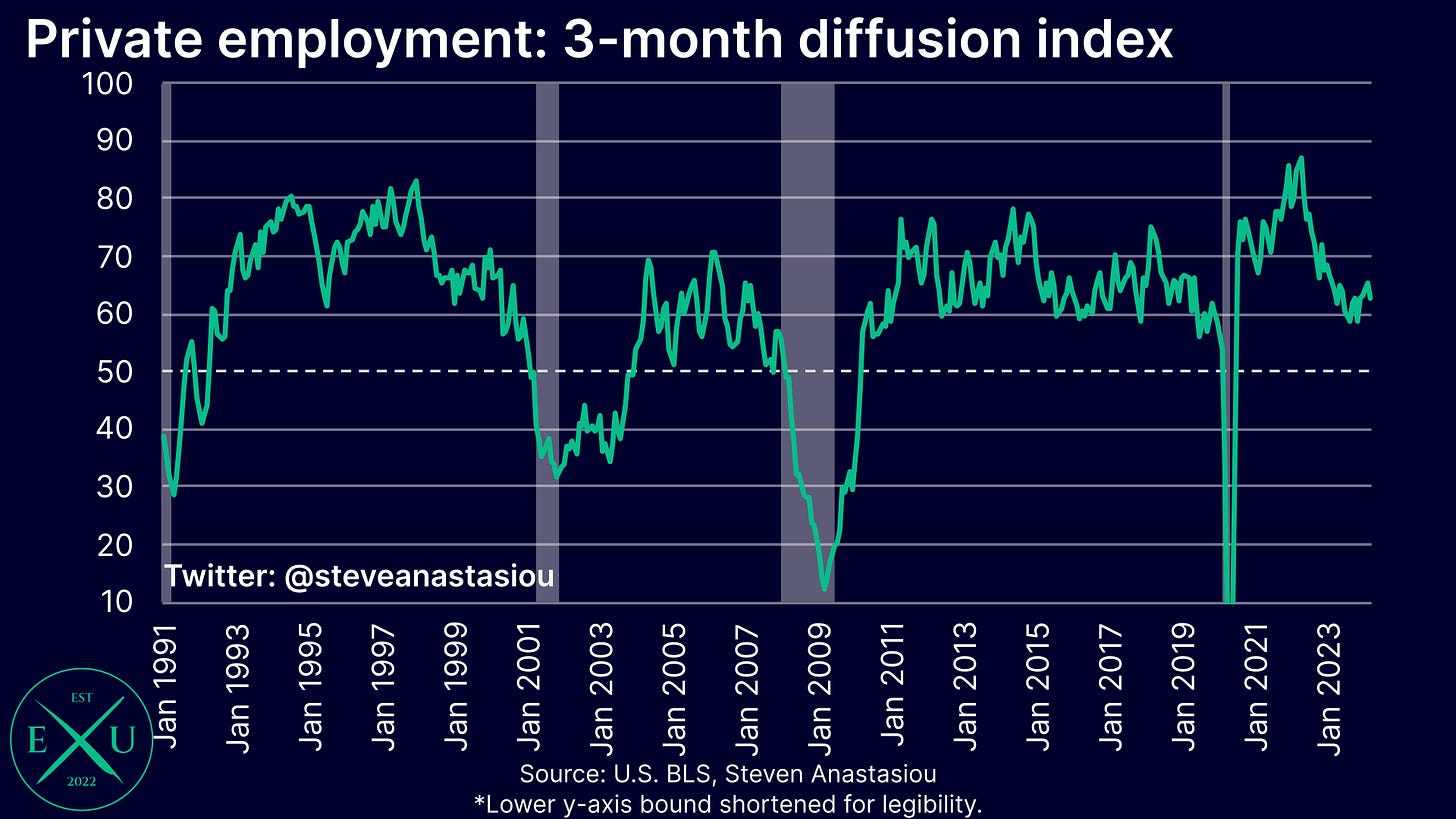

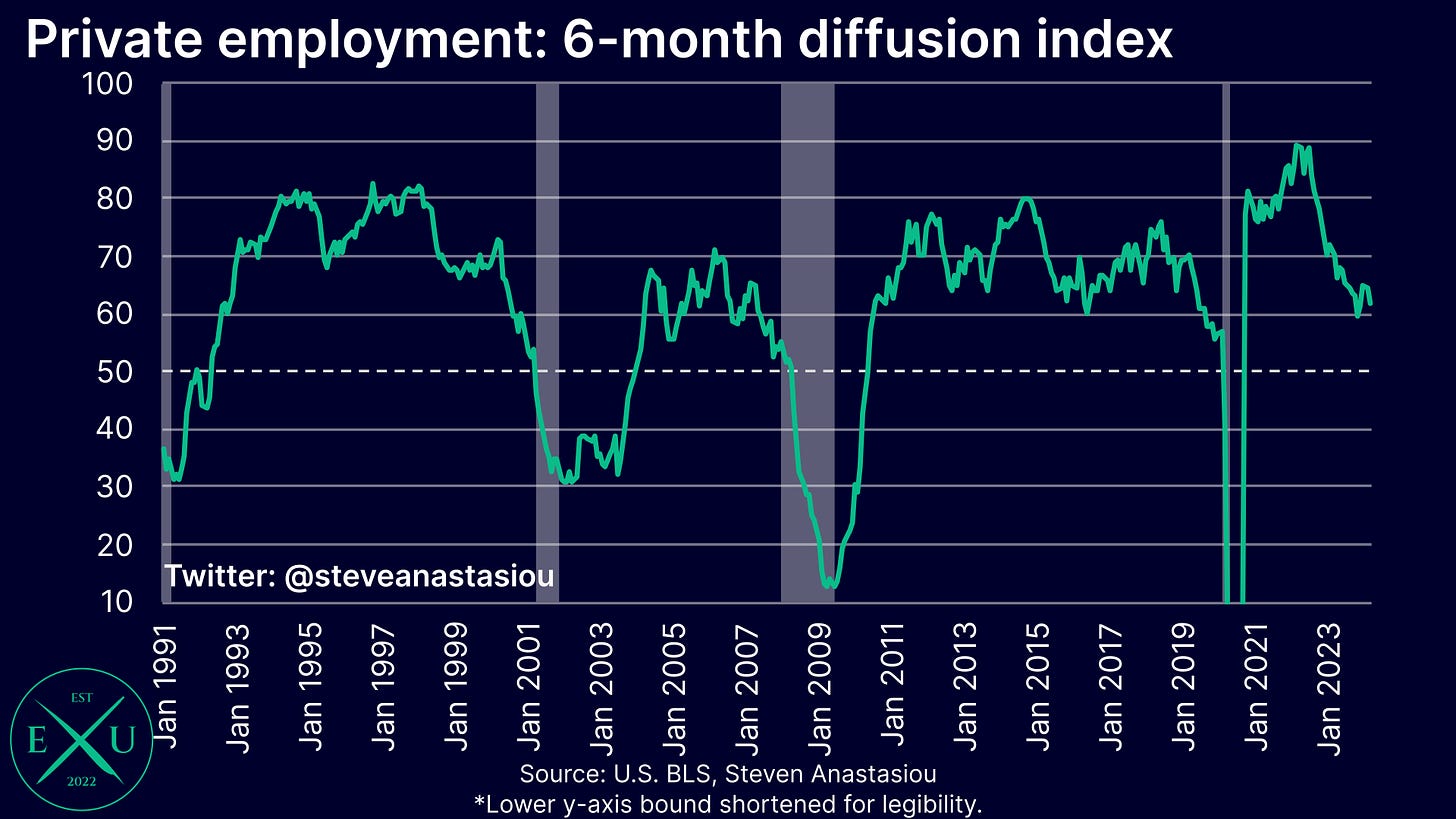

Looking at the breadth of job growth, the private diffusion index rose slightly, to 59.4 in March (a reading above 50 indicates that a majority of private sector industries recorded job growth).

The 3- and 6-month diffusion indexes moderated to 62.6 and 62, respectively. Despite moderating, such levels indicate that job growth remains fairly widespread.

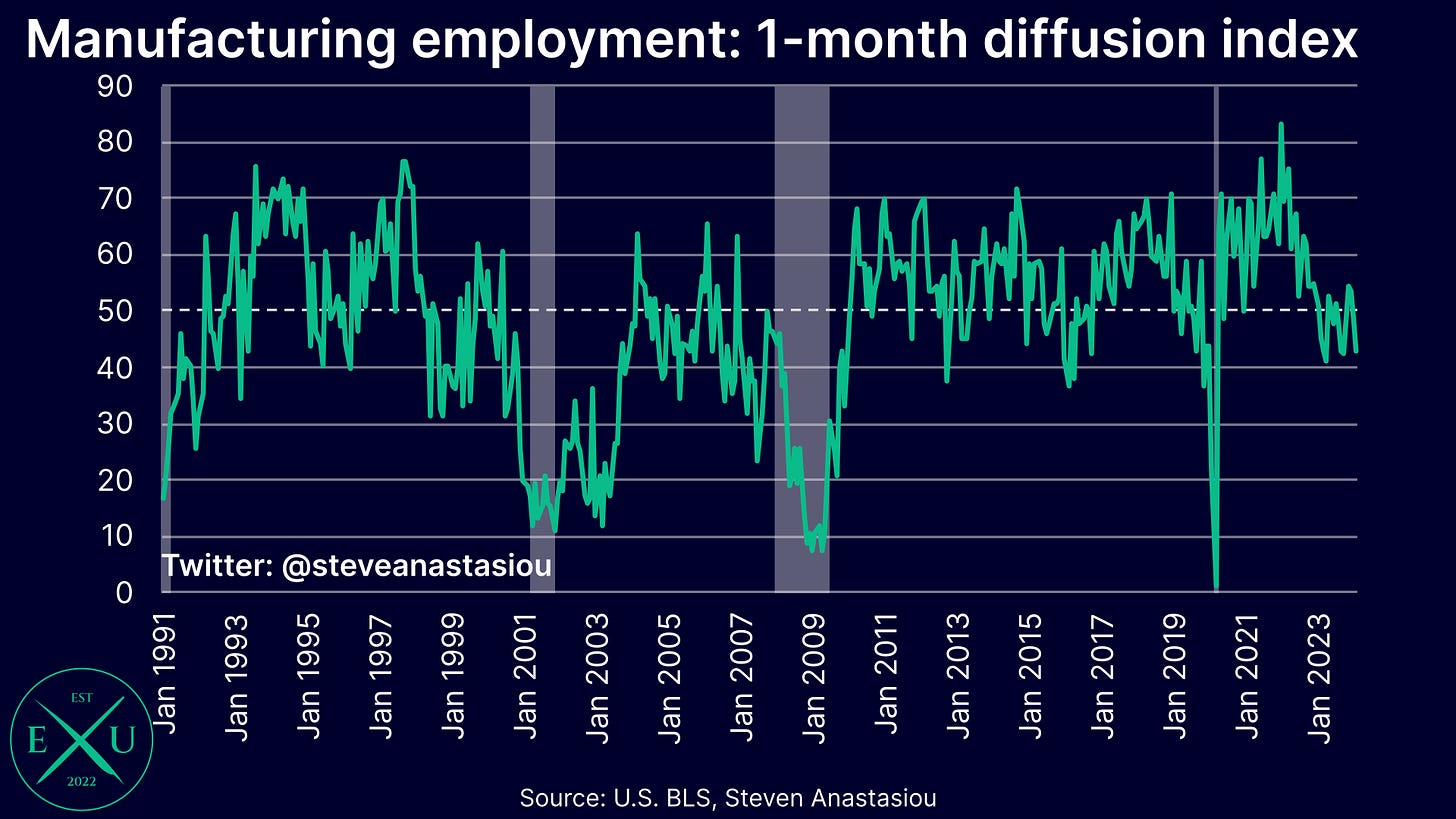

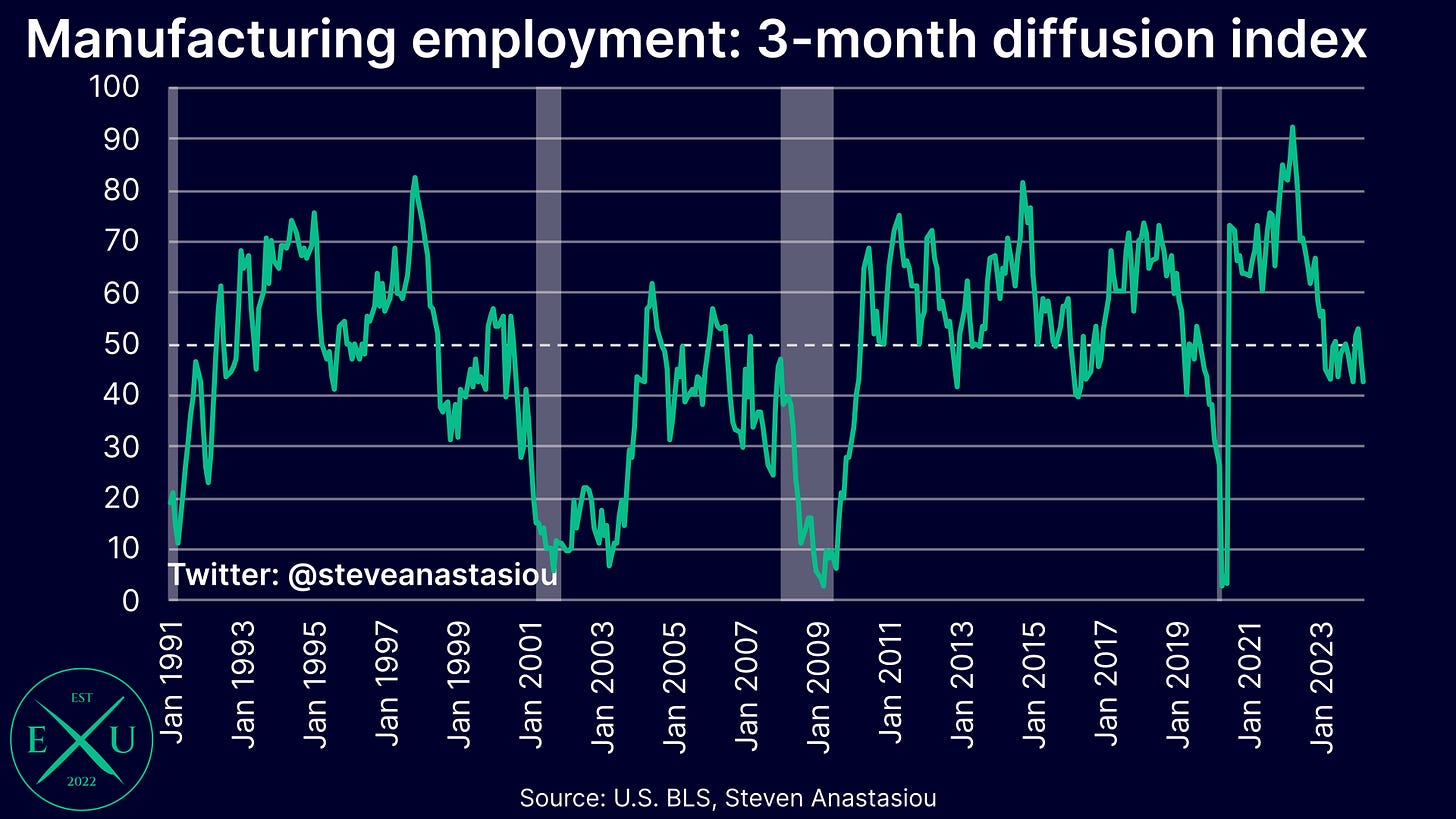

While private nonfarm payroll growth is robust, the manufacturing sector remains weak, with the manufacturing employment diffusion index plummeting to 43.1 in March, its lowest reading since November.

The 3- and 6-month diffusion indexes fell to 42.4 and 43.8, respectively.

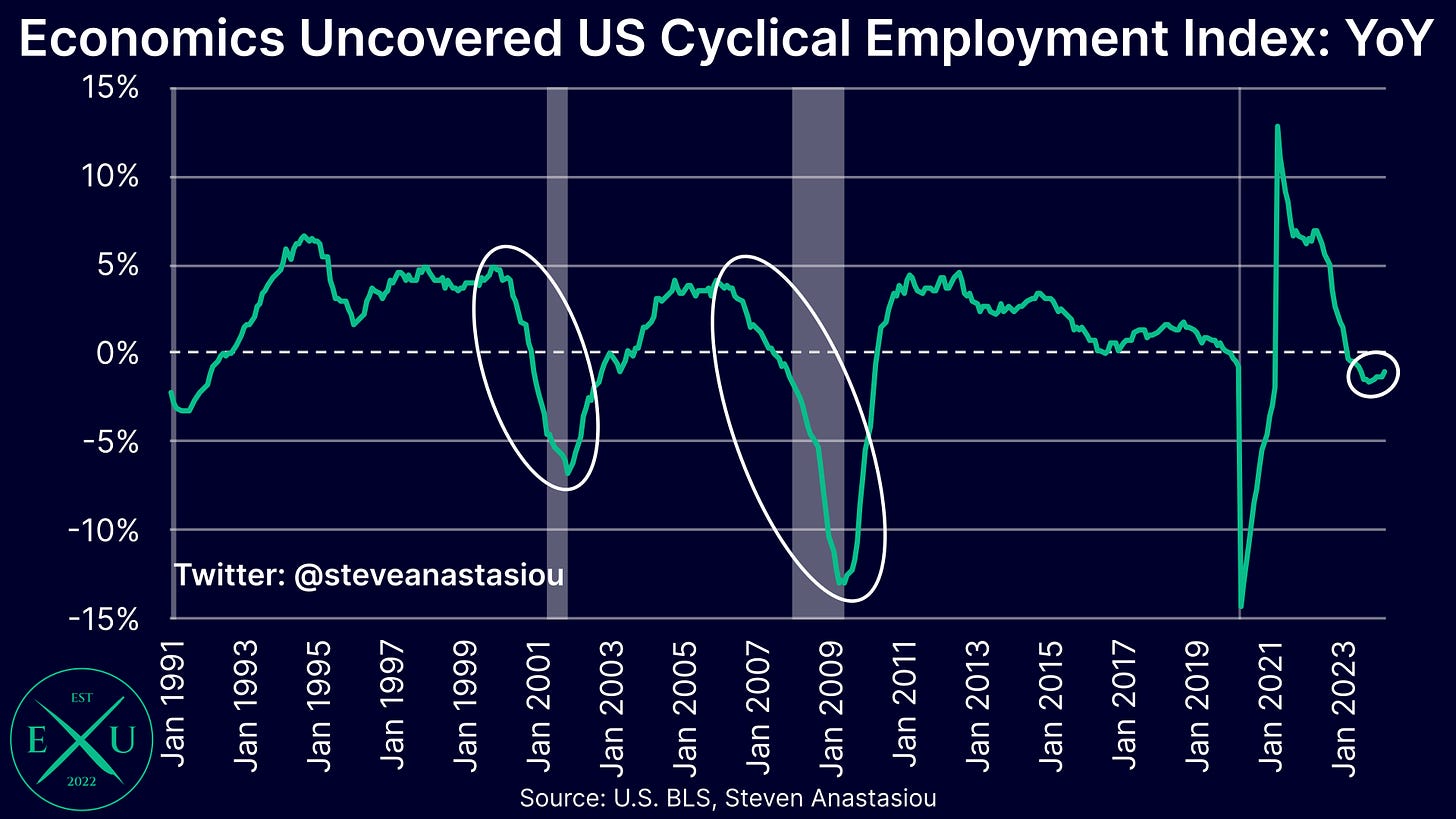

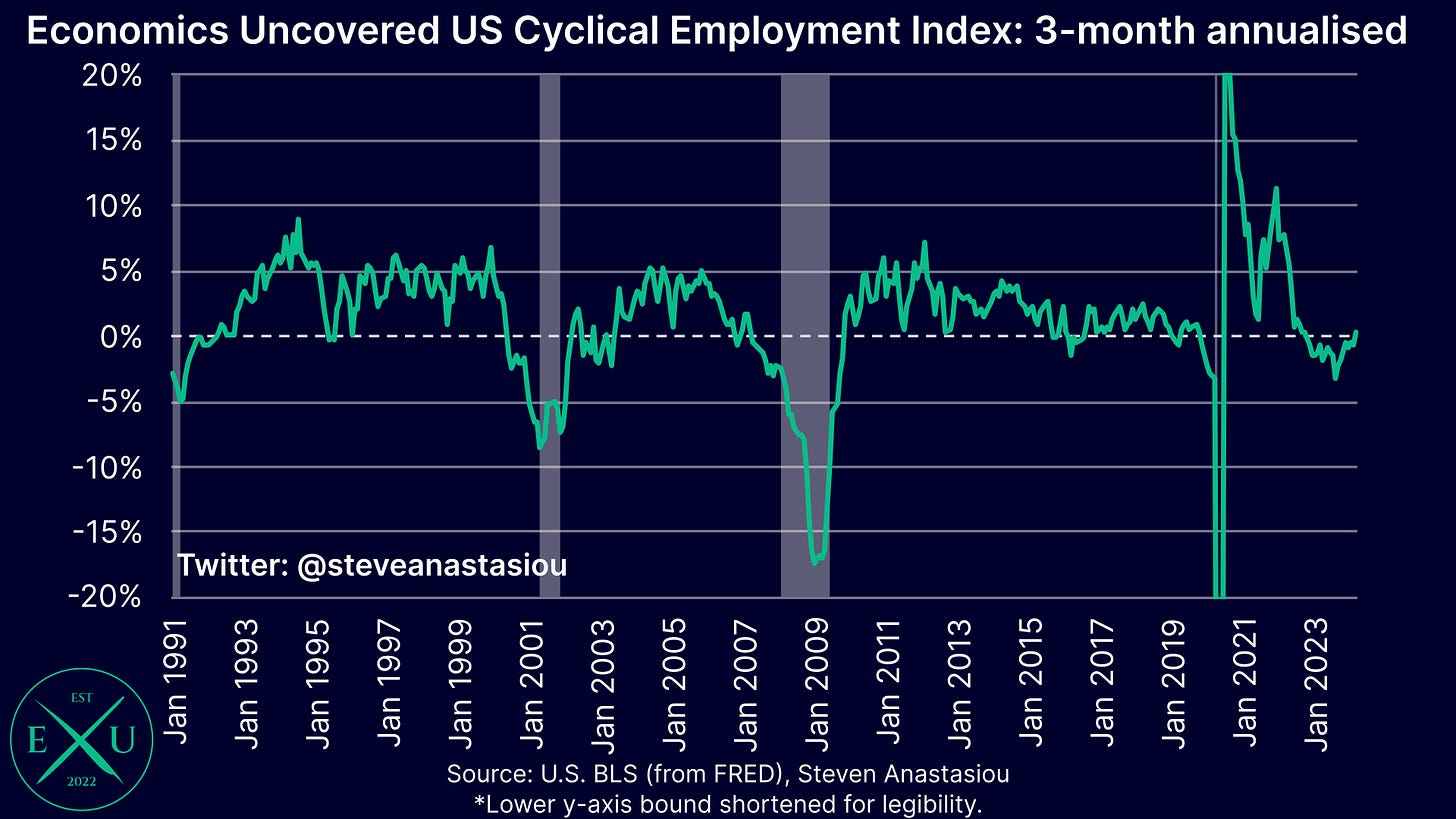

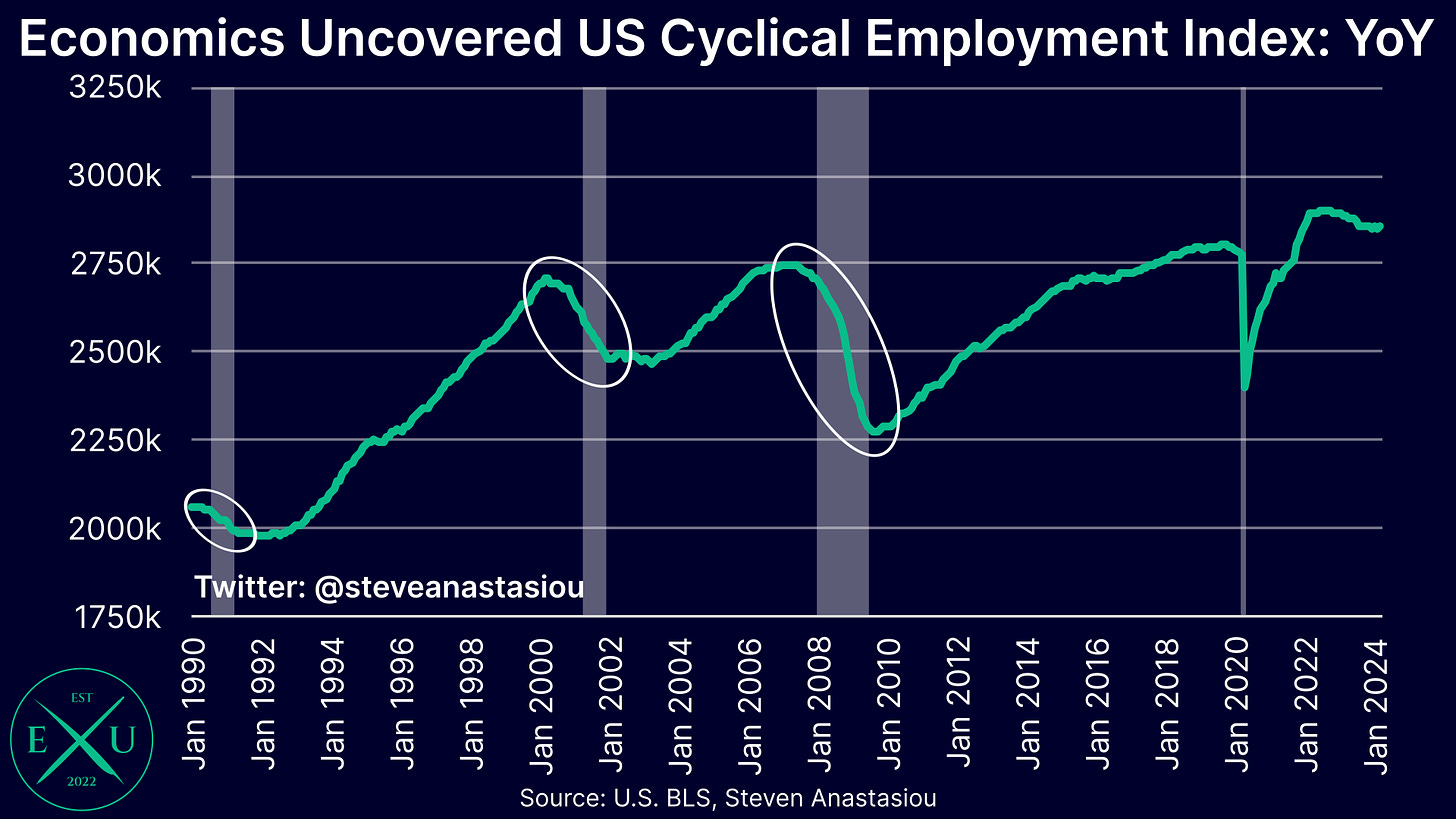

The weakness in manufacturing employment correlates with weakness in the Economics Uncovered Cyclical Employment Index, which recorded growth of -1.1% YoY in March.

Though on a shorter-term basis, 3-month annualised growth in the Economics Uncovered Cyclical Employment Index turned positive for the first time since October 2022. Though given that 3-month annualised growth was only modest (0.3%) and that there continues to be a significant negative trend in nonfarm payroll revisions, this figure remains vulnerable to being revised to a negative outcome over the months ahead.

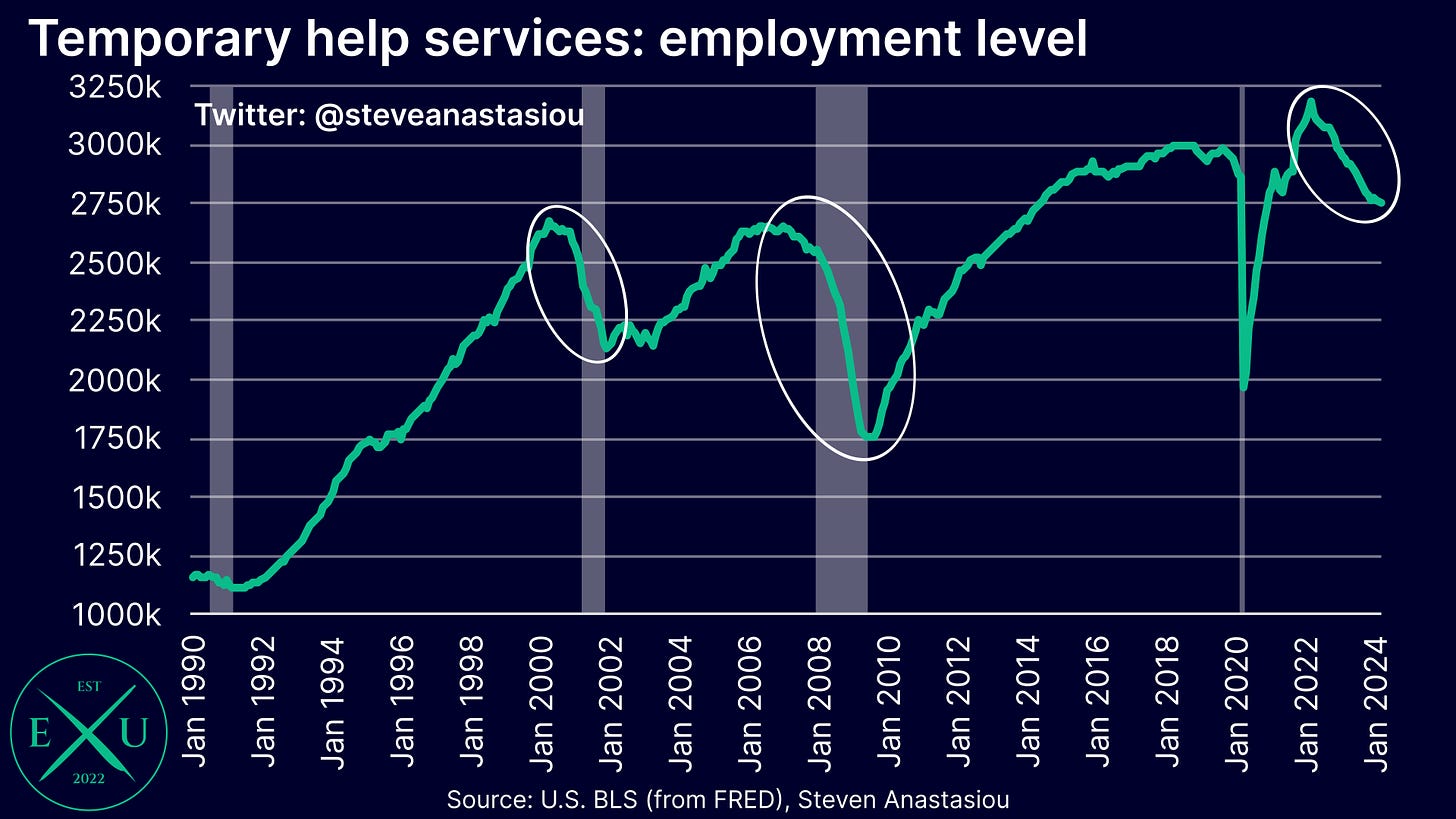

While plunging temporary help services employment is strongly indicating recessionary type conditions, the broader Economics Uncovered Cyclical Employment Index is thus recording a stabilisation in cyclical employment levels, and is not clearly signalling a recession.

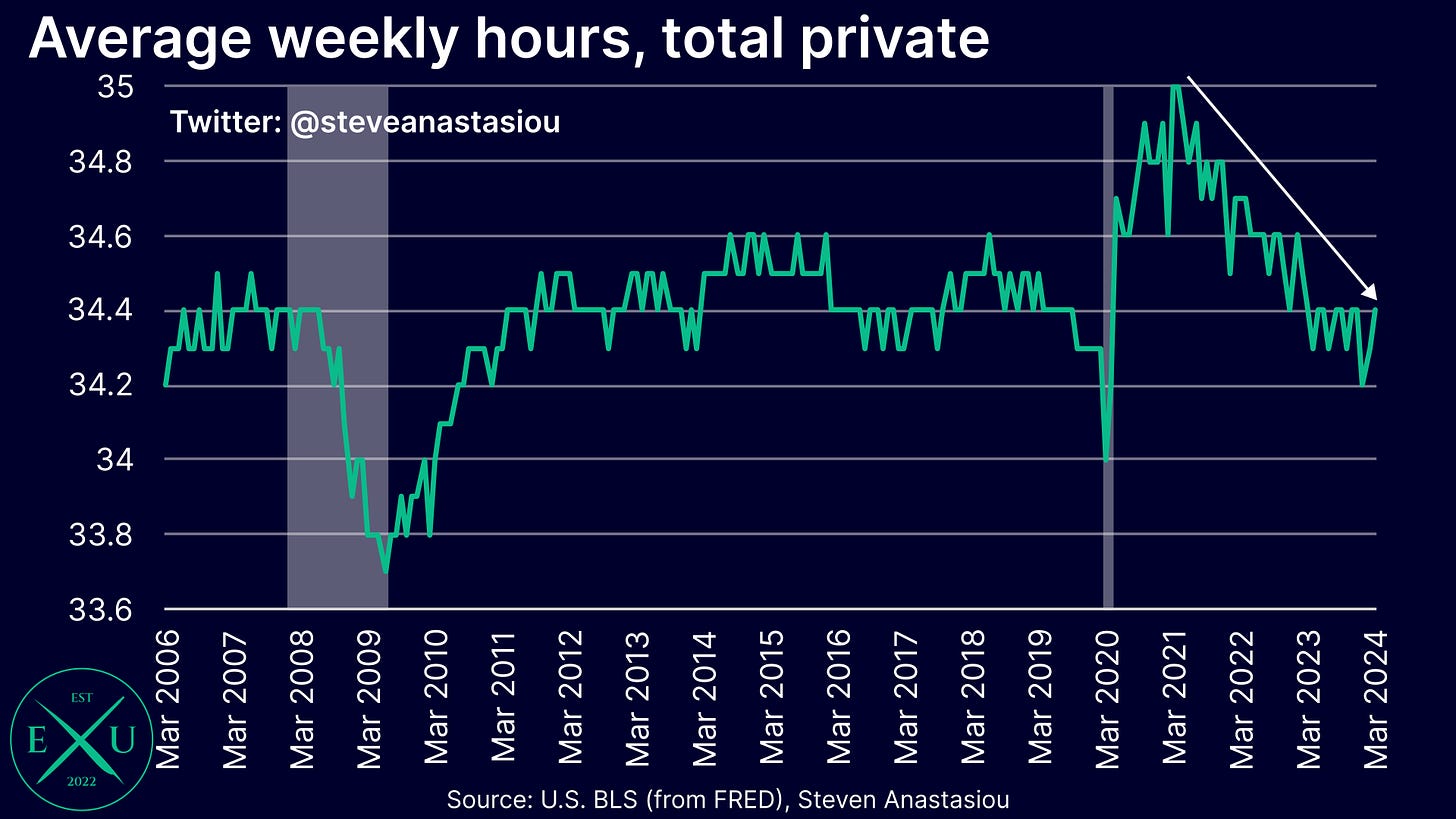

Average weekly hours also bounced back to 34.4 in March, which has seen average weekly hours fully recover from the drop to 34.2 hours that was seen in January.

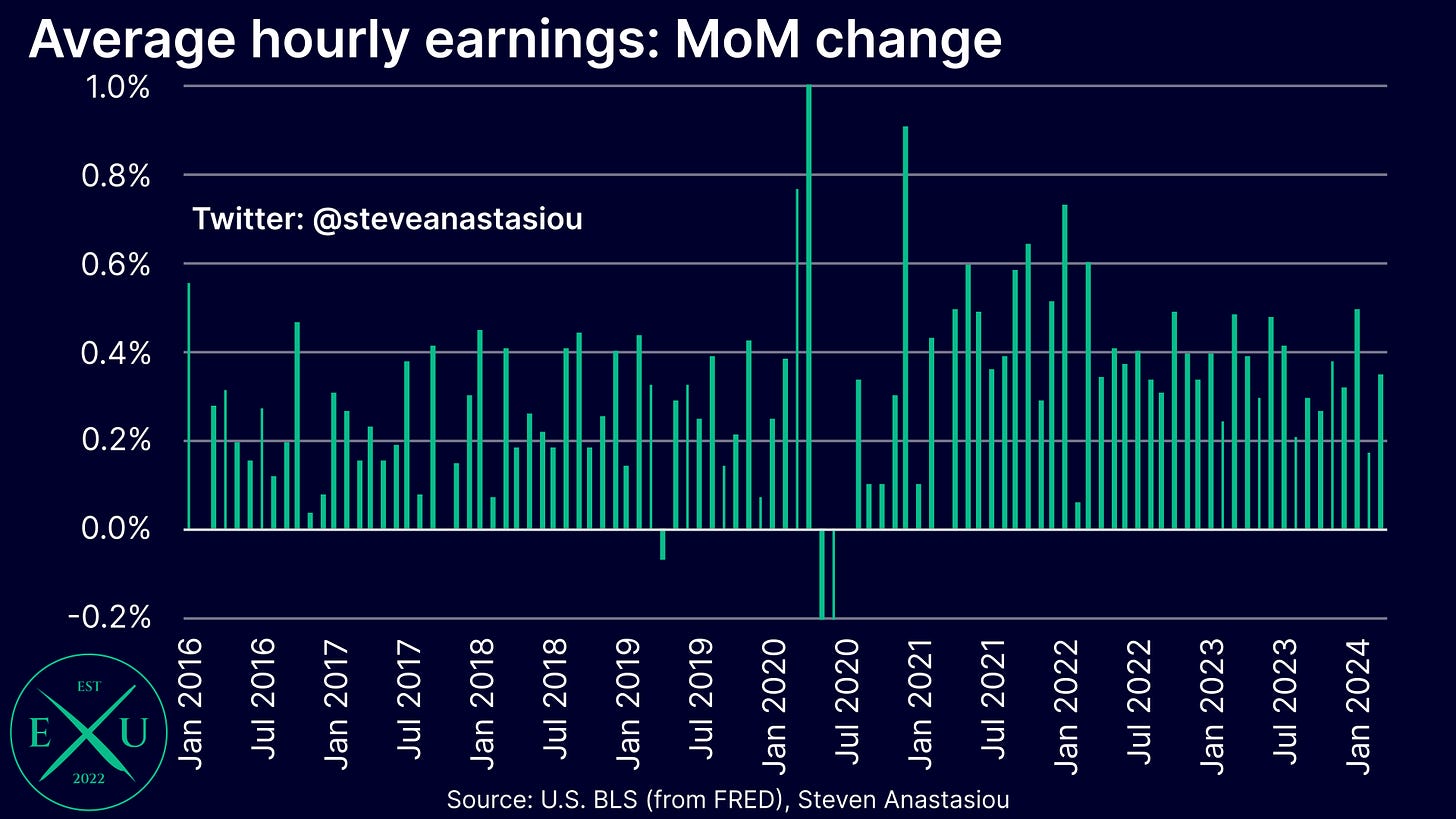

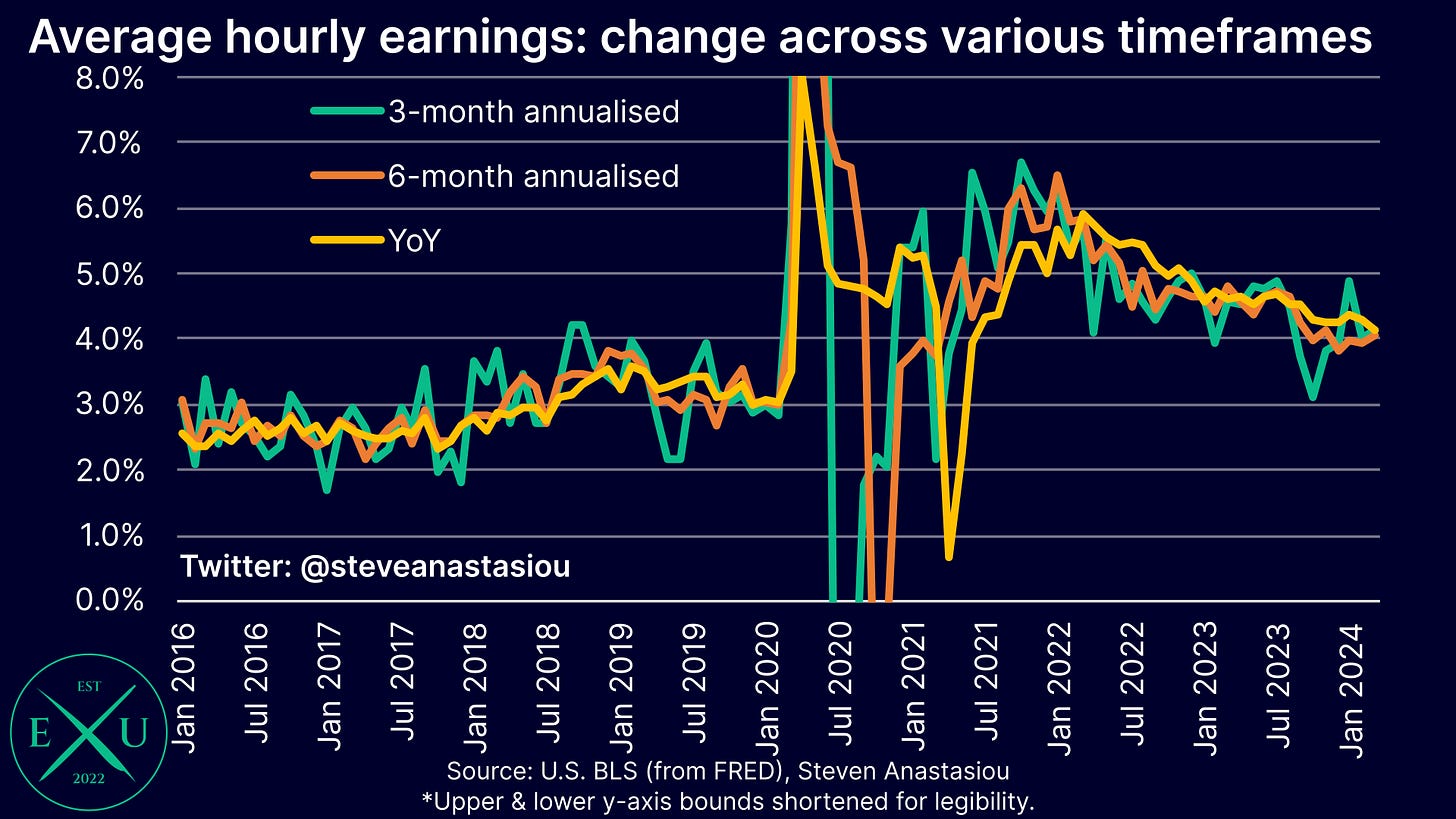

Turning to average hourly earnings, MoM growth rebounded to 0.35% in March, up from 0.17% in February.

3- and 6- month annualised growth increased to 4.1% and 4.0% respectively, while YoY growth moderated to 4.1%. Given that each of these three measures have converged to 4.0%-4.1%, wage growth appears to be showing signs of stabilising at around these levels.

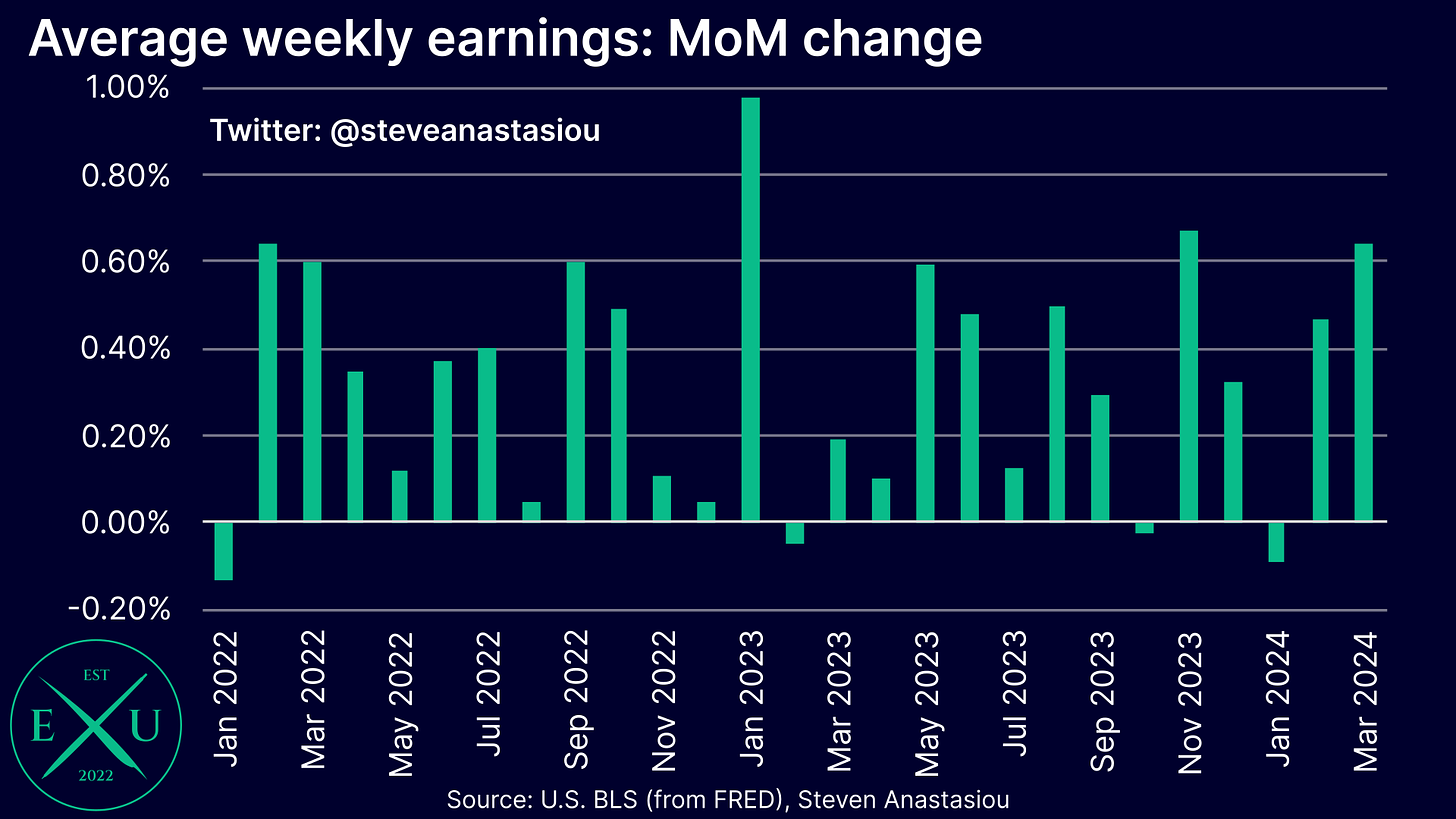

After incorporating the change in average weekly hours, average weekly earnings rose by 0.64% MoM in March, the highest monthly growth rate recorded since November.

In a similar manner to average hourly earnings, average weekly earnings growth has converged to 4.0%-4.1% across various time periods.

Household survey

Turning now the household survey, after rising to 3.9% in February, the unemployment rate dipped back down to 3.8% in March.