Is food price relief on the way?

The increasing cost of food is being acutely felt across the globe, with many people struggling to make ends meet. It’s also a key driver behind a higher consumer price index (CPI), which is leading central banks like the Fed to aggressively raise interest rates.

While the US CPI is recording that food prices are up 10.9% over the past year, there are some signs that food price inflation should slow over the months ahead.

Underlying food commodity prices have been falling

In order to ascertain the likely direction of consumer food prices, we need to look at the movement in the prices of underlying food commodities. Fortunately, indexes exist that allow this job to be made much easier.

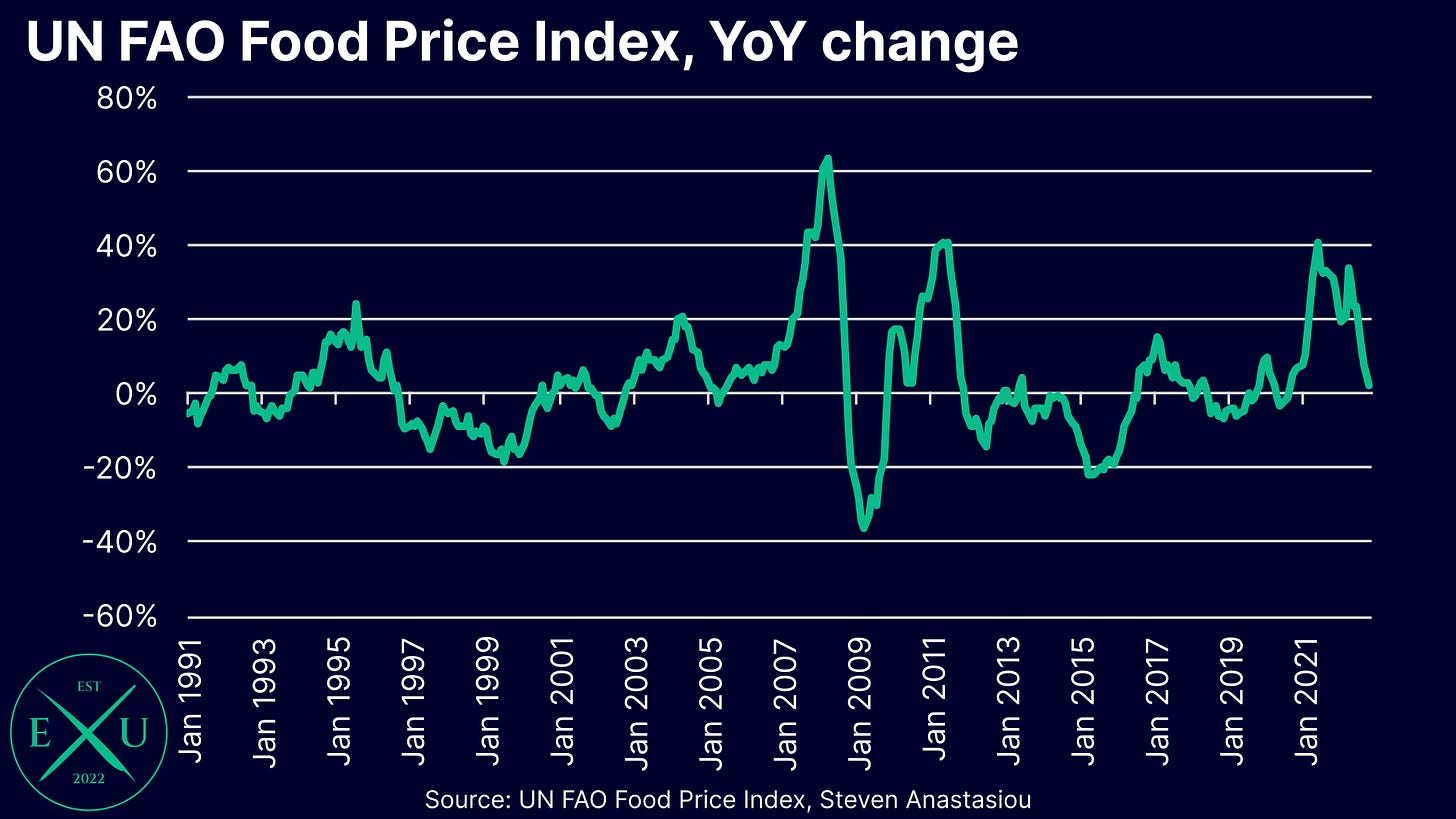

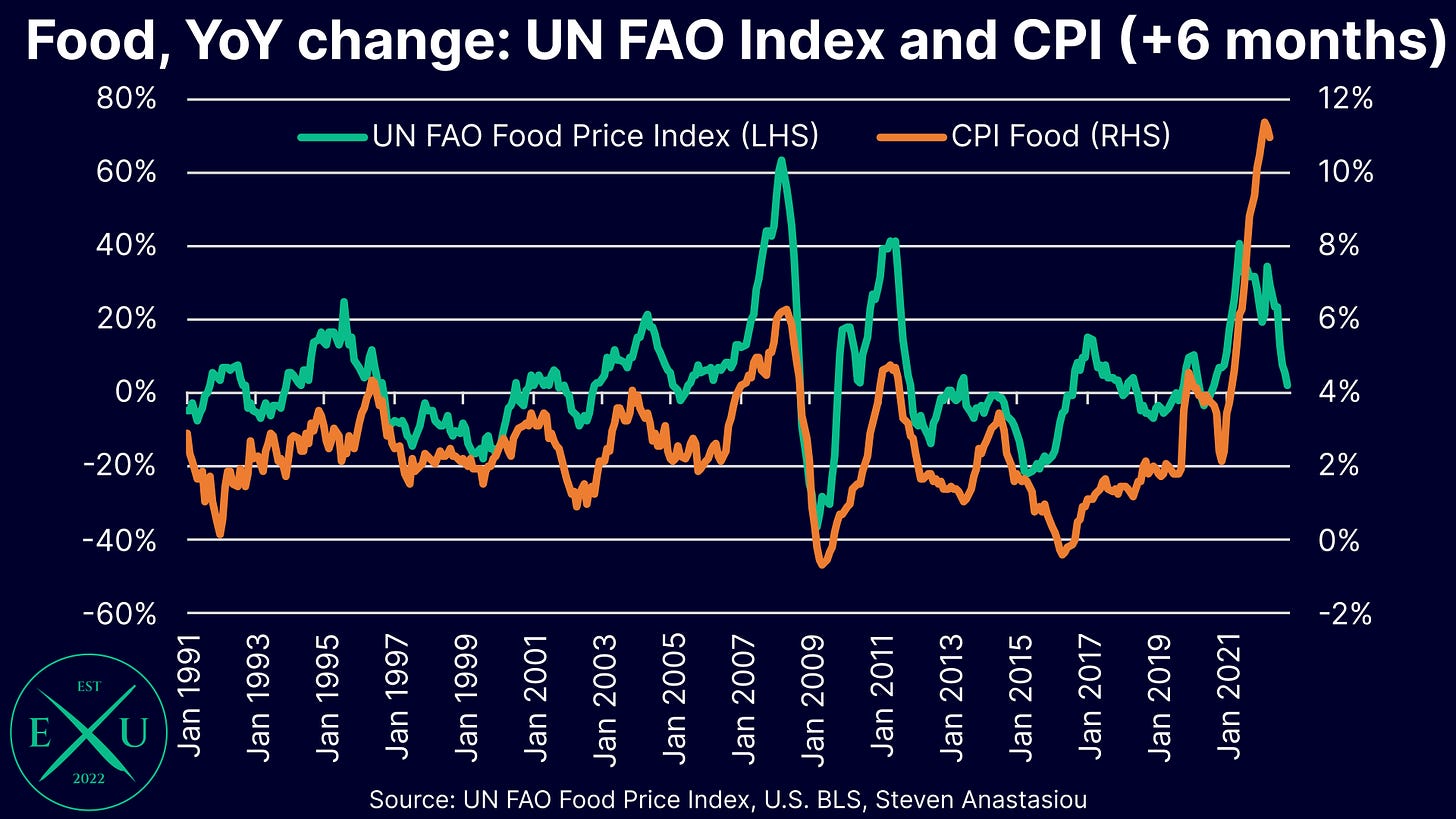

One such index is the UN FAO’s Food Price Index. This index includes price data on key agricultural commodities within the key categories of meat, dairy, cereals, oils and sugar. The overall index value combines price data across each of these categories.

Since 1991, the index has seen several major spikes & troughs, with most major spikes generally shortly followed by major price decelerations, or outright declines. One can see that the most recent period is no exception, with YoY price growth decelerating sharply in recent months.

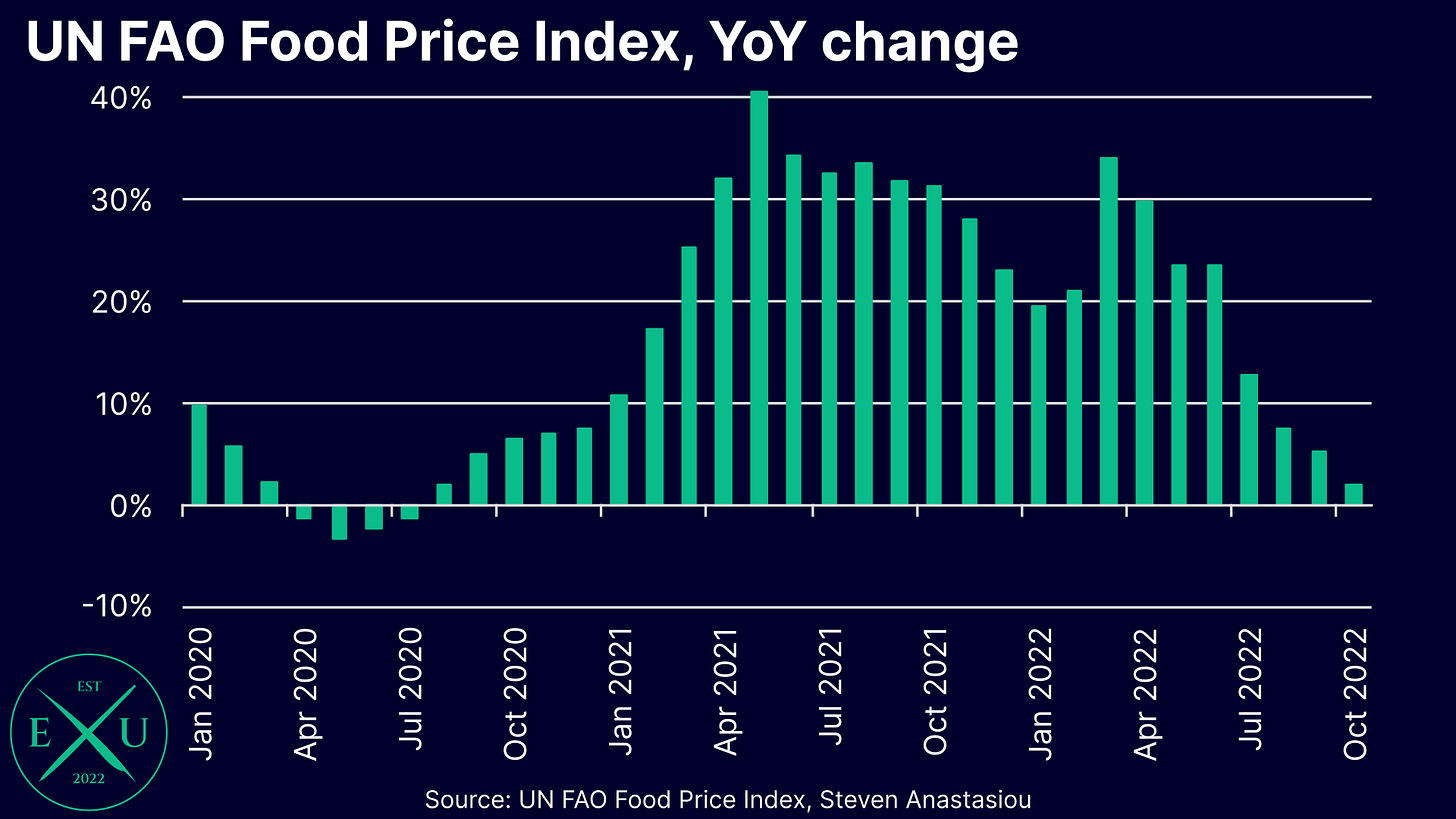

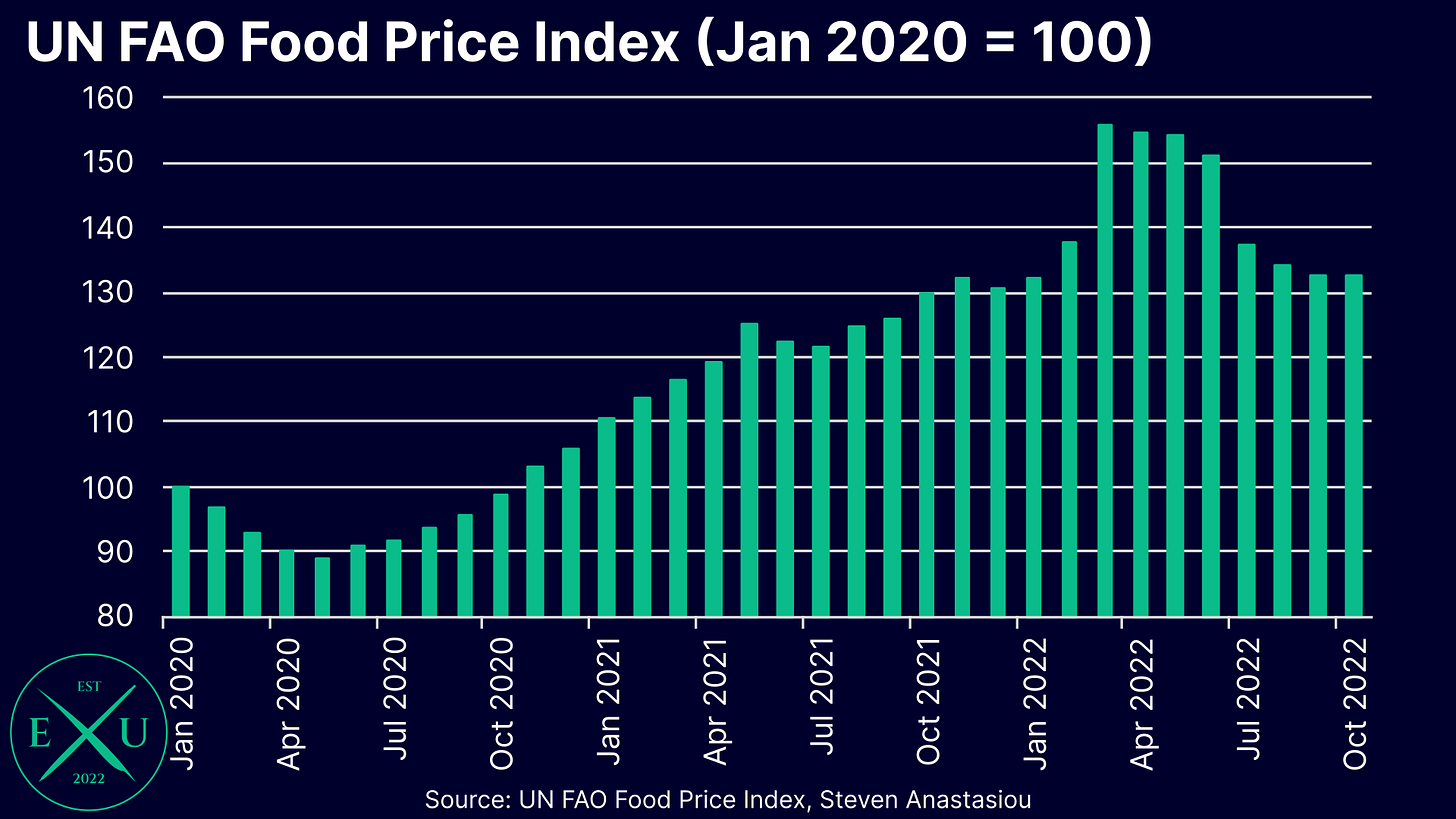

Zooming into this data and beginning at January 2020, we can see that YoY growth peaked in May 2021 at 40.6%. Another spike occurred on the Russian invasion of Ukraine, with YoY price growth hitting 34.0% in March 2022. Price growth has sharply decelerated since.

The deceleration in YoY price growth has occurred on account of the index recording seven consecutive MoM declines. This has taken the index back to levels first seen in November 2021. Should food commodities remain at current levels over the months ahead, the YoY rate will turn negative by February 2023.

How does this translate to food prices in the CPI?

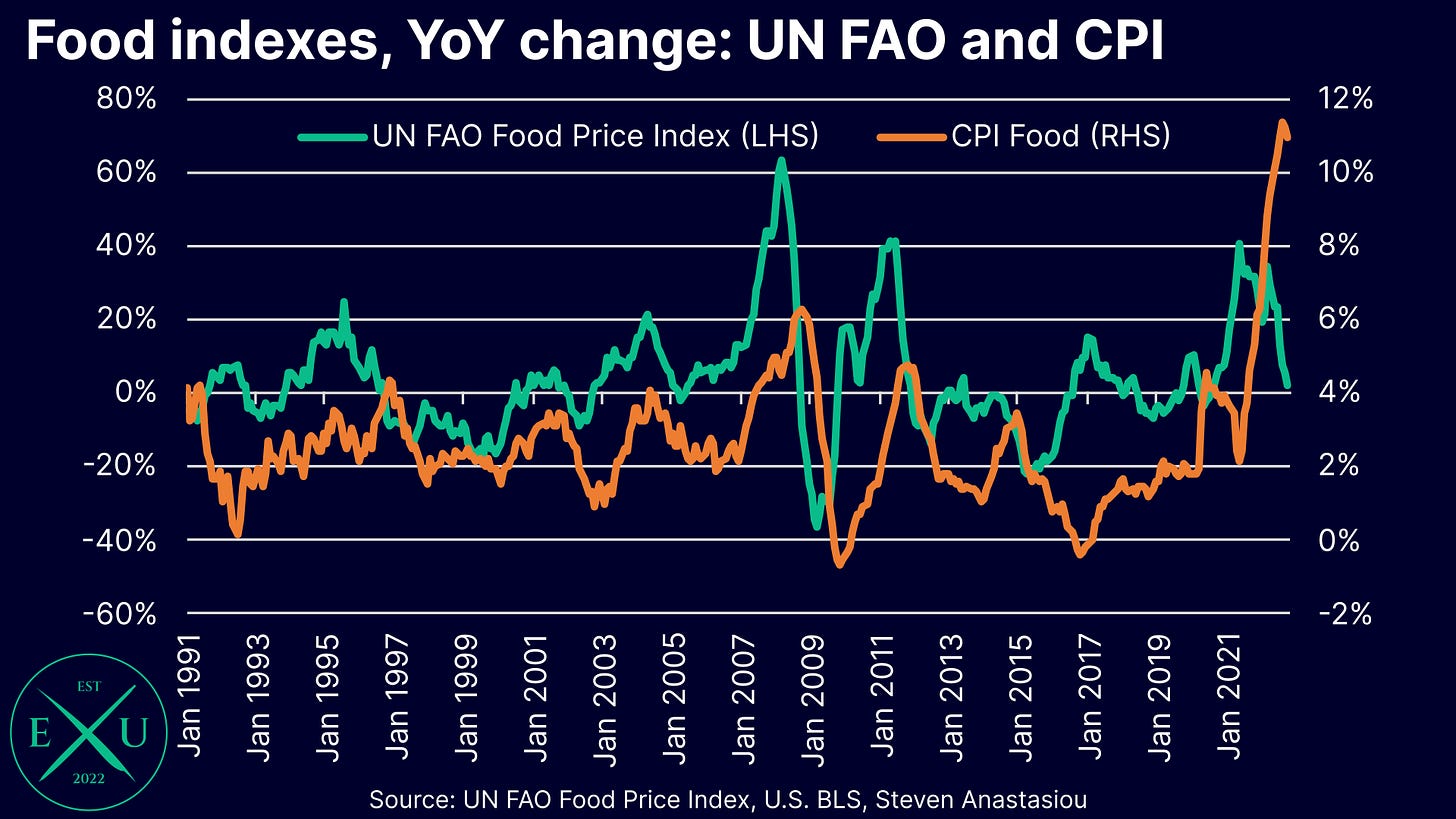

While it is all well and good that the prices of underlying food commodities have been declining, what most will want to know, is how does this translate to the cost of food that they actually go and purchase? We will analyse this question by comparing the historical relationship between the UN FAO Food Price Index, to the CPI food index.

Historically, the relationship has been very solid in terms of directional movements. The strength of the movement between the UN FAO Food Price Index, and the CPI food index, had also been fairly consistent over the past thirty years. Though in terms of more recent changes, we can see that the strength of the relationship has definitively delinked versus historical norms, with CPI food prices rising much more than they did historically, for the change observed in the UN FAO Food Price Index. This speaks to the broader set of inflation pressures that are currently present, and which are impacting consumer prices.

The other critical point to note is that consumer food prices lag changes in underlying food commodities. We can see that the relationship between the two indexes is much more aligned when consumer food prices are brought forward by 6 months. This is a critical point to make, as the UN FAO Food Price index has now been recording MoM declines for the past seven months. While only a modest tilt, and one which could stall or periodically reverse as some more modest comparables are cycled over the next two months, we can see that the YoY change in the CPI food index has recently turned lower.

Disaggregating the CPI food index tells a better story

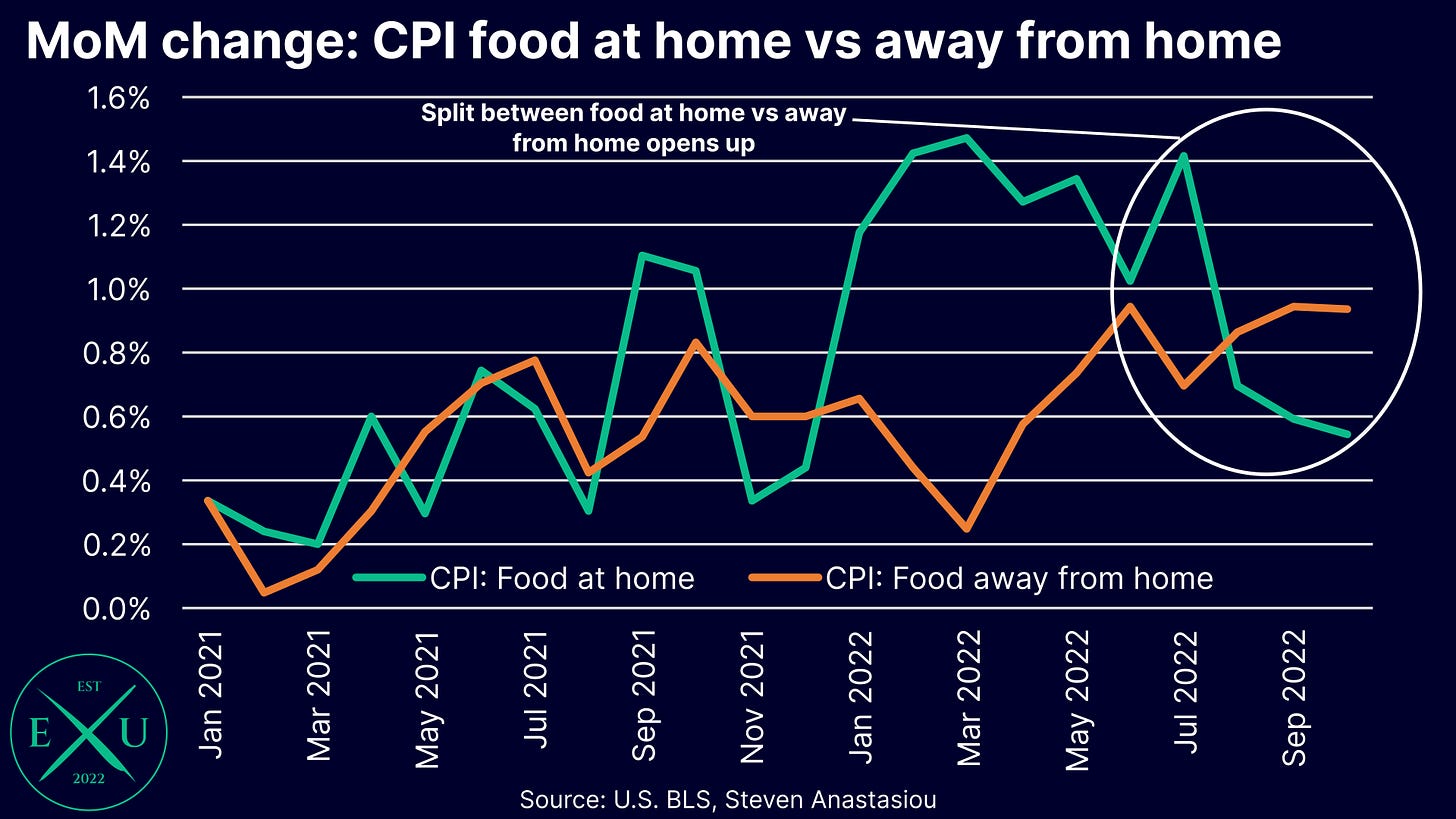

It is important to note that the CPI food index is composed of two distinct categories - food at home and food away from home.

The food at home component is more clearly linked to changes in the prices of underlying food commodities, whilst the food away from home component also draws relatively more significant influences from other factors that are important to businesses like restaurants, such as wages, energy costs and rent.

The MoM changes between the food at home vs food away from home categories, reveals a stark divergence over recent months, with the food at home category seeing a significant deceleration in MoM growth, whilst the more services orientated food away from home component has continued to see growth at around recent peaks.

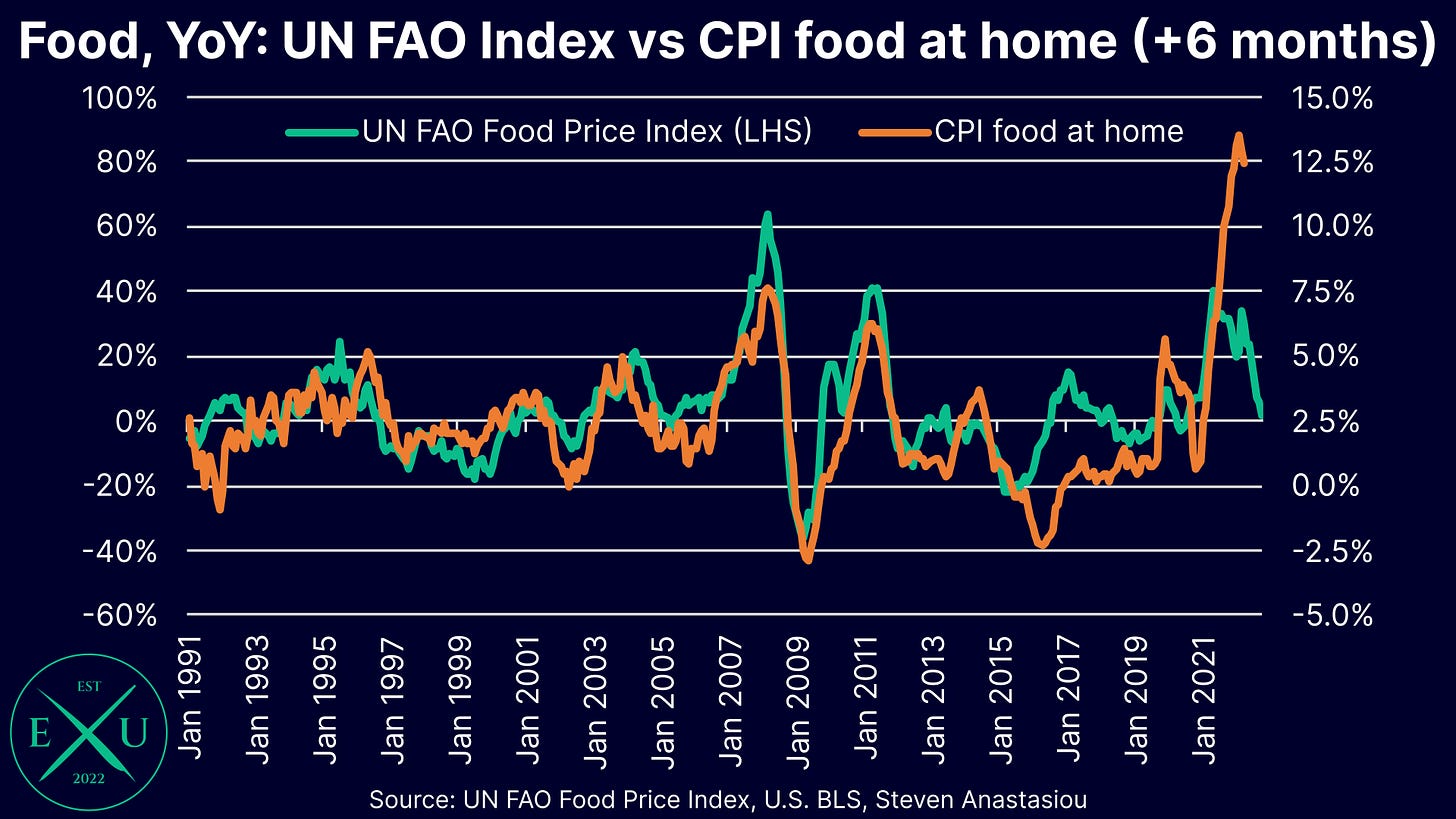

2.5% YoY growth likely a fair way off, but deceleration likely

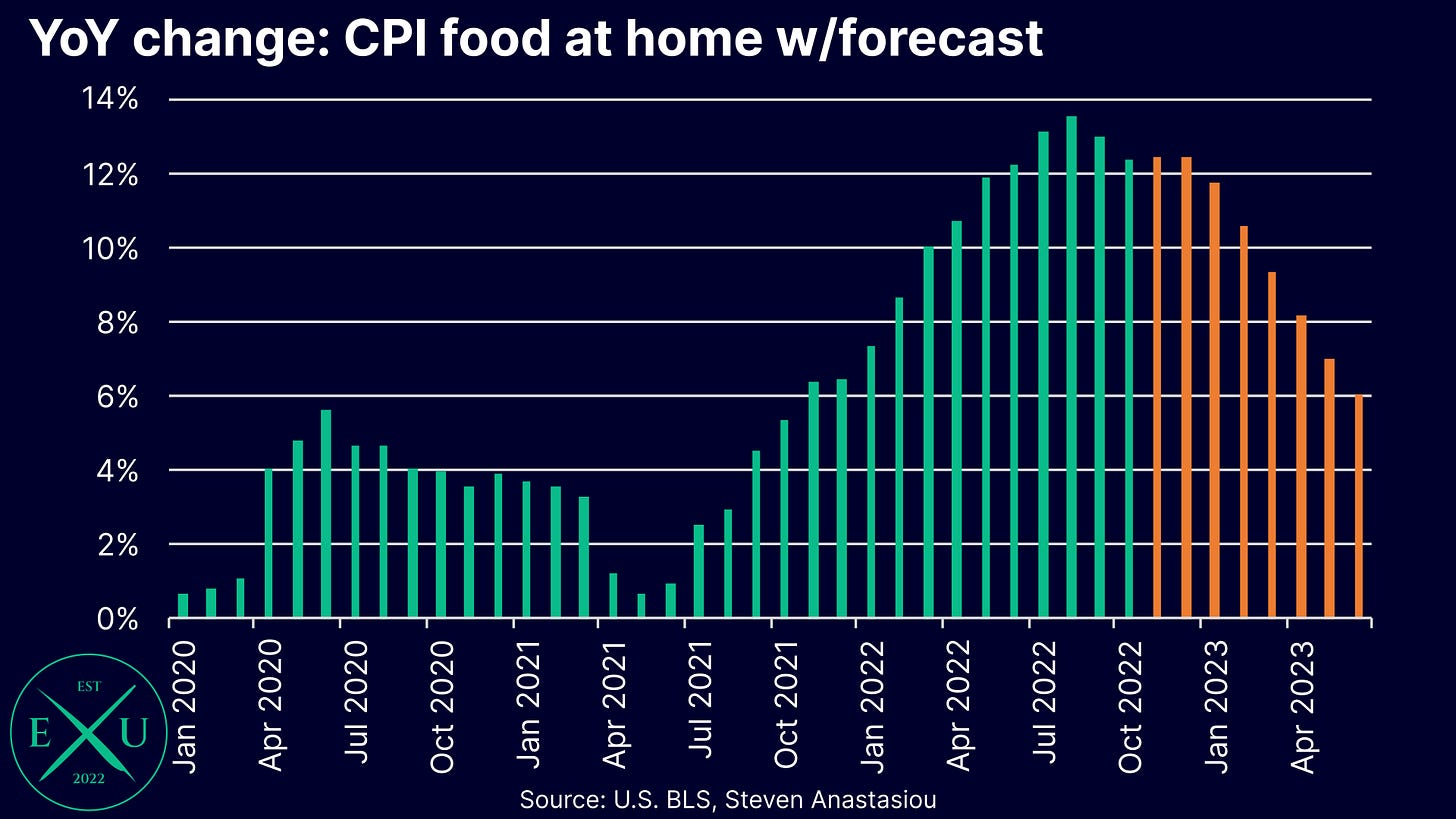

If we isolate the food at home component, and look at it on a YoY basis (again with consumer food prices being advanced by 6 months), we see a similar relationship versus the overall food index, though one which shows a slightly larger tilt towards lower YoY price growth. Again, there has been a clear delinking in terms of the strength of the correlation between the two variables. So whilst the historical relationship suggests that YoY food at home price growth should be ~2.5% in six months time, right now the prospect of this eventuating is remote. The biggest reason? Too many very high MoM figures will still be in the YoY calculation until July 2023.

In saying that, should the food price index remain at current levels, YoY food at home price growth is likely to decelerate significantly over the quarters ahead. One reason for this will simply be the gradual cycling of those very high MoM numbers across January to July 2023.

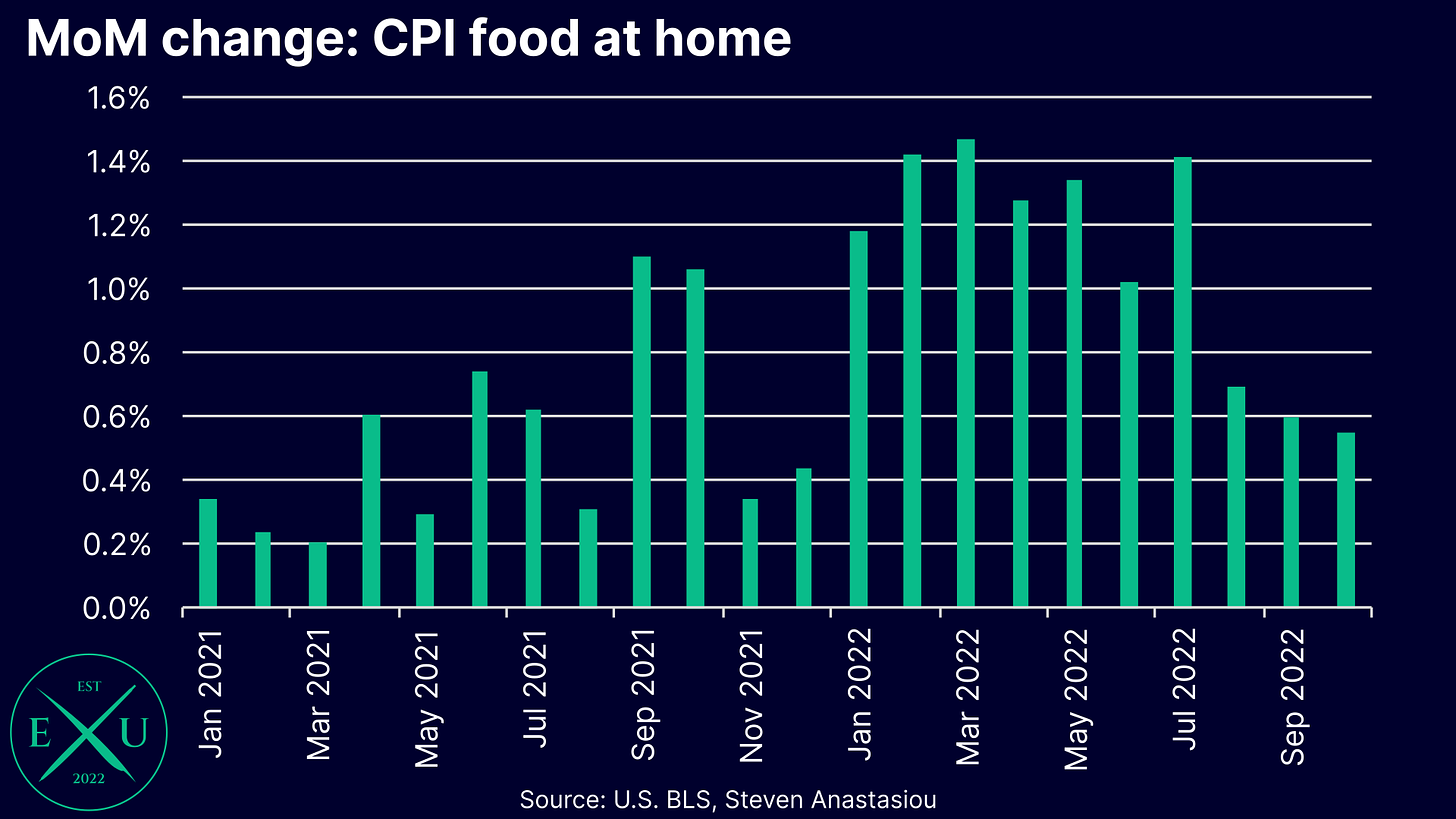

In-line with the declining UN FAO index, CPI food at home has seen a consistent deceleration in MoM price growth over the past several months, from 0.69% in August, to 0.60% in September, to 0.55% in October. This has solidified the step-down from the very high MoM growth rates that had occurred from January-July 2022.

Assuming that this gradual deceleration continues, including a likely more significant drop-off in November given that it is a historically weak month of price growth, forecasting a halving of the YoY rate of growth from its current level of 12.4%, to 6.1% by June 2023, looks reasonable.

Given the Fed’s continued tightening, which is resulting in the M2 money supply seeing recent MoM declines, a significant weakening in the US and global economies has the potential for a more material price deceleration to occur, just as it did during the GFC. While I am personally of the view that such a scenario has a significant chance of unfolding at some point during the next 12 months, this would represent further downside to price growth versus my personal forecasts, as opposed to being a base case modelling assumption.

While the above sample forecast incorporates a more noticeable MoM price deceleration in November to 0.35%, it has historically been a month of much weaker price growth, with the 2010-19 average price change being -0.3%. This creates the potential for a more significant MoM fall in next month’s data, and remains something to keep in mind when analysing the November print.

In summary

Price changes for underlying food commodities over the past seven months suggest that consumer food price should decelerate significantly over the months ahead.

Some evidence of this has already been seen, with CPI food at home prices decelerating significantly over the past three months from the MoM growth rates that were recorded from January-July 2022.

Whilst the historical correlation between the UN FAO Food Price Index and CPI food at home prices suggests that YoY food at home price growth should fall to ~2.5% in six months time, such a significant deceleration is unlikely to occur within that timeframe without a severe recession, and a more broad based fall in prices across the economy.

Nevertheless, what I view as a realistic forecast, which assumes a continued deceleration in MoM CPI food at home price growth, shows that a halving of the YoY growth rate by June 2023 is imminently feasible.

I hope you enjoyed this latest piece. If you would like to help support my work, please subscribe, and help me spread the word by liking and sharing this article.

My work on a longer-term inflation forecast continues, with this analysis forming just one part of my larger CPI forecast. I hope to be in a position to have my full CPI forecast ready to publish right here, for FREE, in the near future. In order to ensure that you receive this important research as soon as it is released, make sure that you are subscribed to Economics Uncovered.

As the readership of Economics Uncovered continues to grow, please feel free to also leave questions & comments below - I intend to nourish & build a community whereby we can all improve our knowledge and understanding of the important economic issues that impact our day-to-day lives. A healthy debate & conversation is the best way to help achieve that.

Thank you for continuing to read and support my work.