GDP revision paints a notably more modest picture as anticipated economic slowdown may have arrived

Downward revisions to personal income and spending in the 2nd estimate of 1Q24 US GDP data have revealed a more modest picture, raising questions as to whether a US economic slowdown has arrived.

Before delving into this latest research update, which covers the second revision to 1Q24 US GDP data, I’d like to let you know that I will be releasing additional updates following the release of the latest PCE Price Index, personal income, and personal consumption data.

Once these updates are released, keep an eye out for a BIG update — a detailed review and outlook of the US economy and financial markets — which I have been preparing over recent weeks, and intend to release in the relatively near future.

As it may be difficult to determine my overarching thoughts and outlook for the US economy from across the many different research pieces that I publish here at Economics Uncovered, this report is intended to bring together my research across the money supply, liquidity, Fed policy, GDP, the jobs market and inflation, into a single report, with clear overarching conclusions for the US economy and the potential ramifications for financial markets.

Turning now to this current research update, the second revision to 1Q24 US GDP data revealed a notable slowdown in several key areas. In analysing this latest data, I have broken down this update into six key subheadings, being:

2nd revision sees real GDP growth fall to just 1.3% annualised, but this doesn’t provide a good underlying picture

Stripping out volatile items shows higher growth, but a notable downward revision

Downward revision driven by moderating personal consumption growth

Slower PCE growth comes as wages and salaries were revised lower — has the anticipated 2H24 slowdown already arrived?

While the PCE Price Index may draw the most attention, the latest update to personal income and spending data may be even more important

The key driver of the downward revision to PCE growth points to a continued deflationary impulse from vehicle prices as higher interest rates bite

2nd revision sees real GDP growth fall to just 1.3% annualised, but this doesn’t provide a good underlying picture

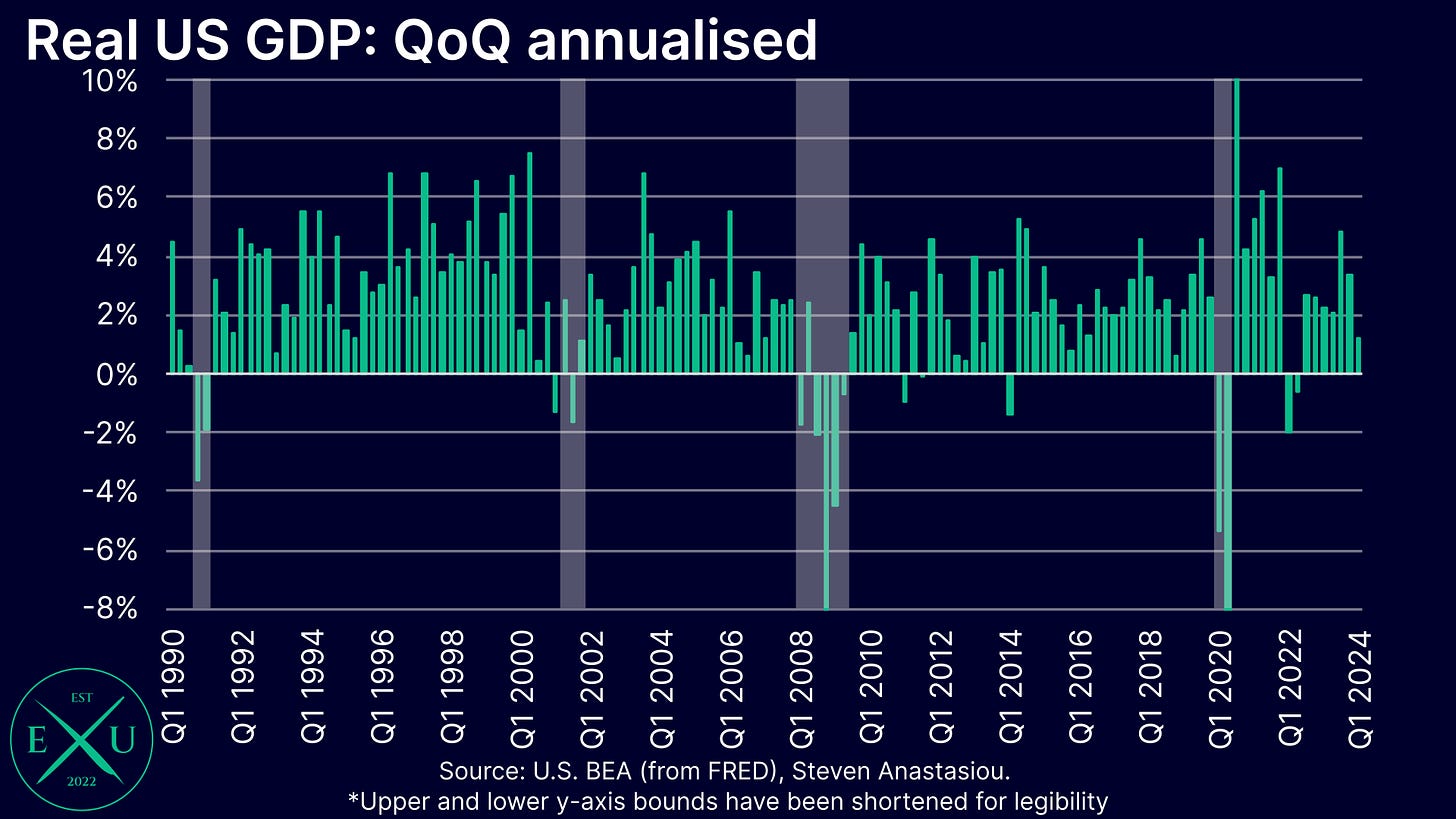

The BEA’s second revision of US GDP data resulted in real GDP growth being revised to a quarterly annualised pace of 1.3%, down from 1.6% in the advance estimate.

This marked the slowest pace of quarterly growth that has been seen since 2Q22, and is less than half of the average annualised pace of 3.1% that was recorded over the four quarters to 4Q23.

Stripping out volatile items shows relatively robust growth, but a notable downward revision

While the latest GDP revision points to a potentially concerning slowdown, it’s important to note that GDP growth is often heavily impacted by volatile items that can cloud the underlying economic picture, and which occurred to a major extent in 1Q24.

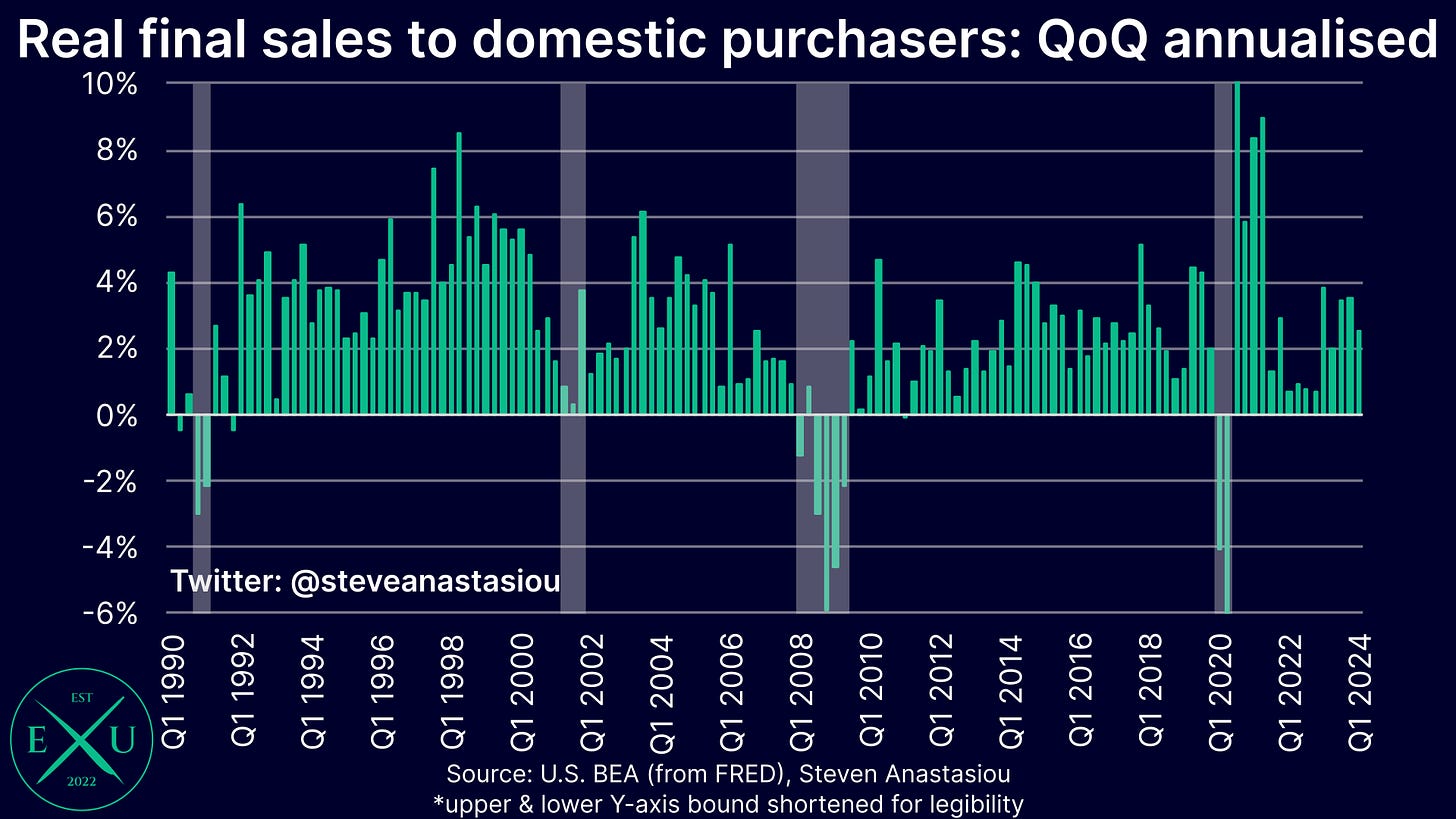

The two key volatile components that I am referring to are net exports and changes in private inventories. In addition to being volatile, net exports can provide misleading signals about the economy as a result of the imports component. The reason for this, is that while rising imports generally point to consumption growth, rising imports subtract from GDP. Meanwhile, changes in the volatile private inventories component tend to smooth themselves out over time, with the average quarterly contribution to GDP from this component being 0.03 percentage points since 2000.

It is thus generally best to exclude these components from GDP in order to gain a better picture of the underlying strength of the economy.

Doing so results in a metric called real final sales to domestic purchasers. In the advance estimate of GDP, this metric grew at a robust pace of 2.8% annualised. In the second revision, real final sales to domestic purchasers growth was revised down to 2.5% annualised. While this still represents a relatively robust figure, it is a notable moderation from the initial estimate and is below the average quarterly annualised growth rate of 2.7% that was recorded across 2015-19.

To fully benefit from your subscription to Economics Uncovered and to help support an independent, institutional grade, reader-supported research publication, please consider becoming a premium subscriber.

Downward revision driven by moderating personal consumption growth

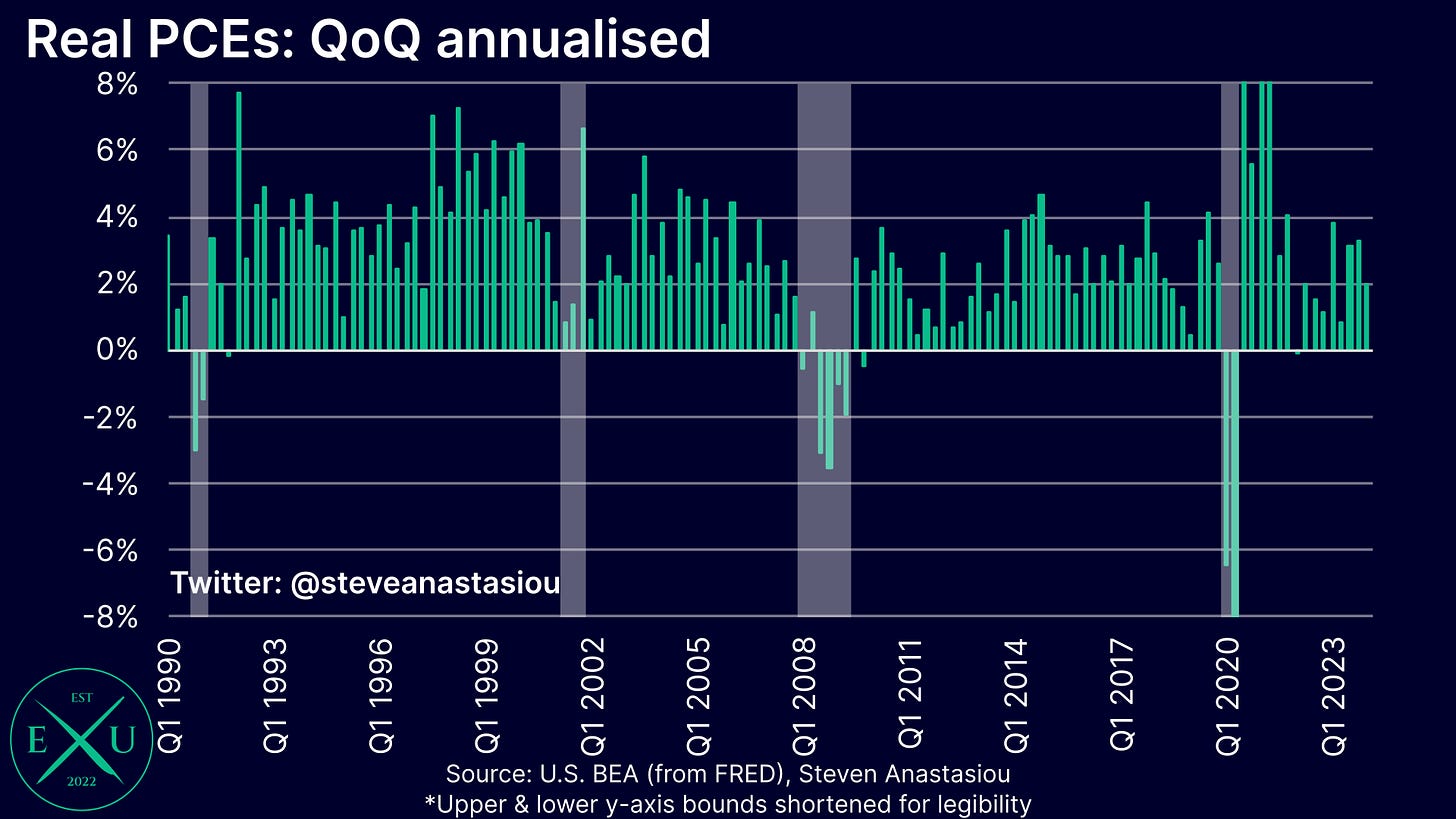

While quarterly annualised real final sales to domestic purchasers growth of 2.5% remains relatively solid, digging deeper into the data continues to present reasons for concern regarding the 2H24 outlook.

One of the key points to note is that the downward revision to real final sales to domestic purchasers was primarily driven by softer growth in real PCEs, with quarterly annualised growth revised to 2.0% in 1Q24, down significantly from the 2.5% recorded in the advance estimate and well below the average quarterly annualised growth rate of 2.6% that was recorded across 2015-19.

While the two prior quarters saw relatively strong PCE growth, quarterly annualised PCE growth of 2.0% or less has now been recorded in six of the nine quarters since 1Q22.

To help improve the reach of this update, please consider liking this article by clicking the heart icon at the top of this post/email or by sharing it via the link below.

Slower PCE growth comes as wages and salaries were revised lower — has the anticipated 2H24 slowdown already arrived?

What makes the slowdown in personal consumption growth more concerning for the economic outlook, is that it comes amidst a weakening of the employment market (see: “Finely balanced”), significant declines in savings rates and now, a downward revision to wages and salaries.