Finely balanced

While historical norms suggest that job growth is strong, the US economy is struggling to create enough new jobs to match higher population growth. An inflection point could be near.

Executive summary

While the broader trend in nonfarm payroll growth continues to suggest that the US employment market remains strong, it’s critical to understand that much of this apparent strength is being driven by higher levels of immigration. As opposed to being unequivocally strong, the current pace of job growth instead reflects an economy that is struggling to keep up with increases in the size of the labour force, leading to rising unemployment and underemployment rates.

With slack in the labour market building, average hourly earnings growth has softened significantly, supporting my prior analysis on the outlook for wage growth, which contended that a major moderation was likely to be seen during 2024. This links in with my expectation that services price growth, and inflation more broadly, will slow significantly in 2H24, opening up the potential for multiple rate cuts to be delivered, of which I currently expect the first to be delivered in September — see my latest medium-term US CPI update for more detail on each of these points.

Given that the current rate of job growth is already failing to keep unemployment and underemployment rates from rising, the US economy could be near an inflection point, particularly as the Fed’s tightening ensures that growth in the M2 money supply remains relatively constrained.

Job growth softens in April, but keep in mind the broader trend

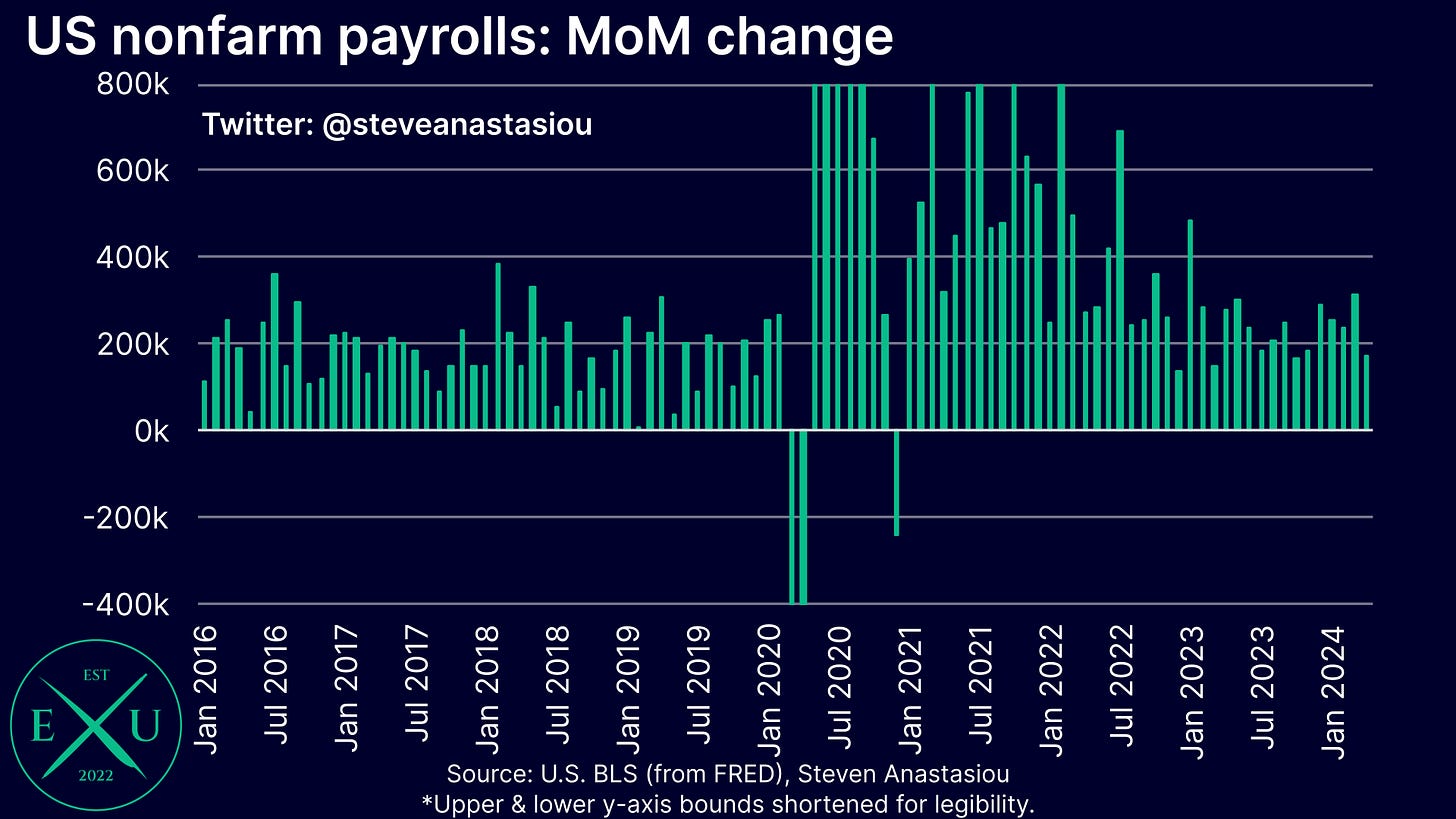

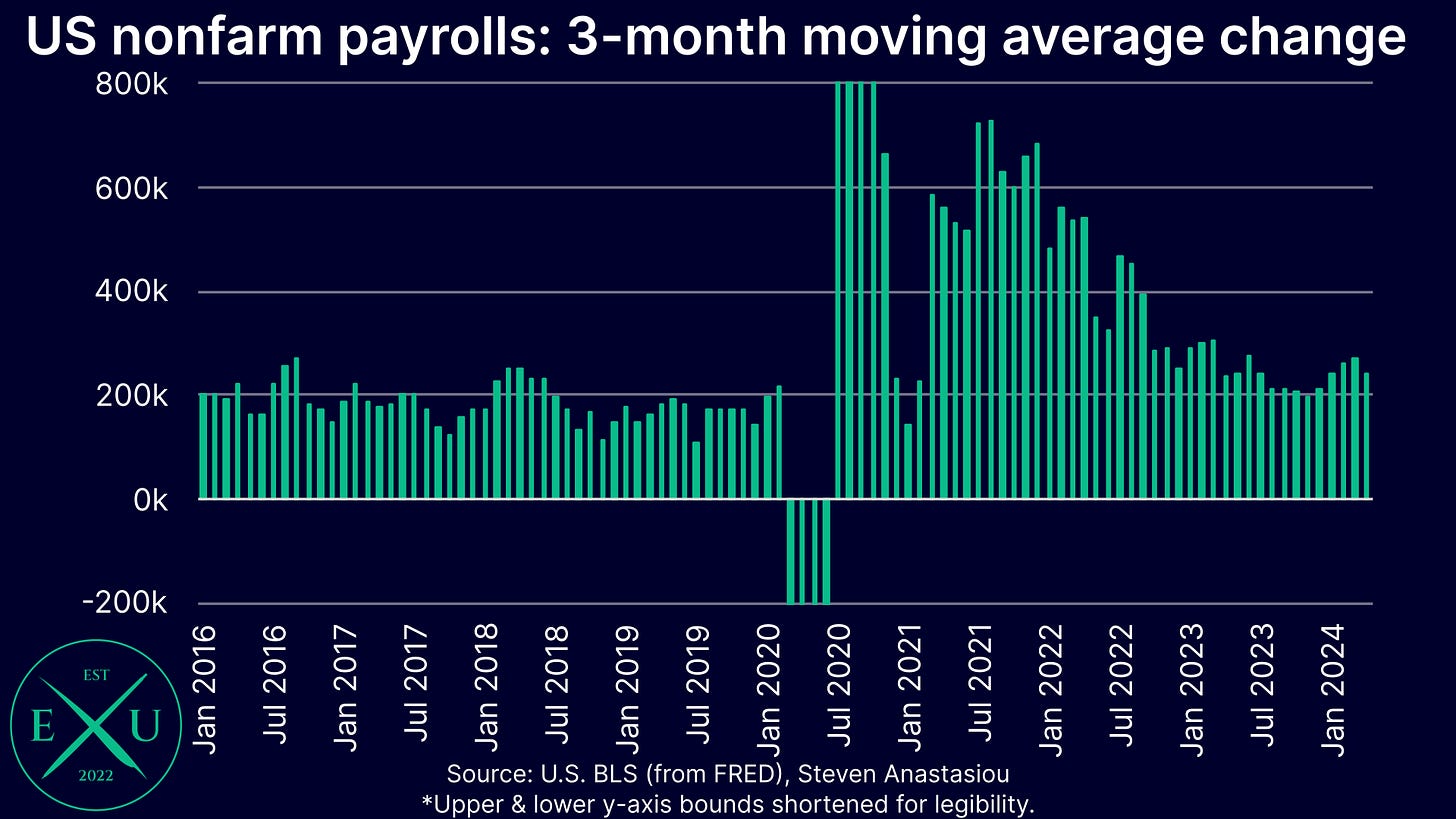

Job growth softened in April, with nonfarm payrolls increasing by 175k, marking the smallest increase since October. Though it’s important to note that this followed strong nonfarm payroll growth of 315k in March.

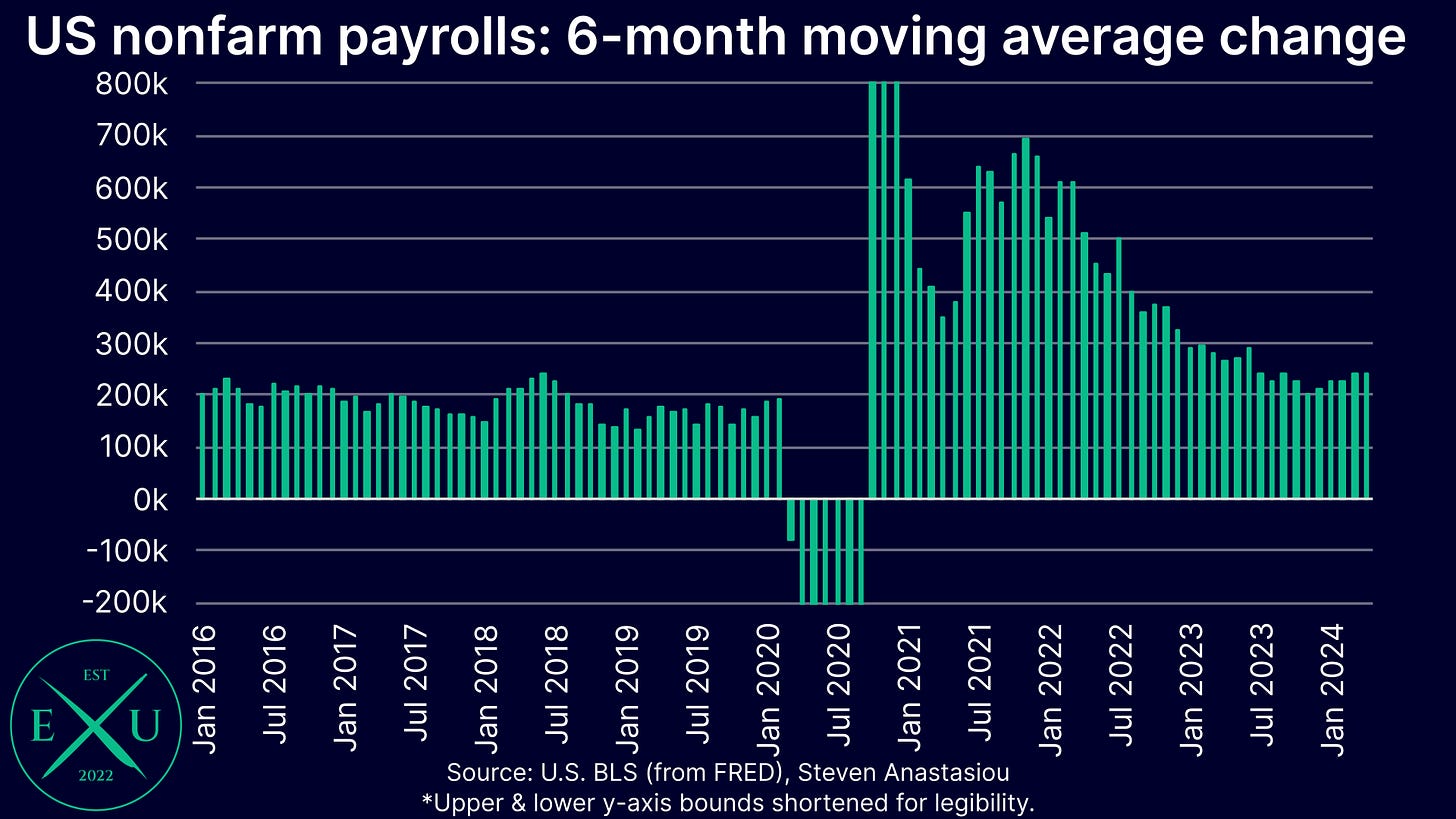

Given the stronger growth that’s been seen in recent months, 3-month annualised growth remained solid at 242k (but below the 269k recorded in March), while 6-month annualised growth rose slightly, to 242k.

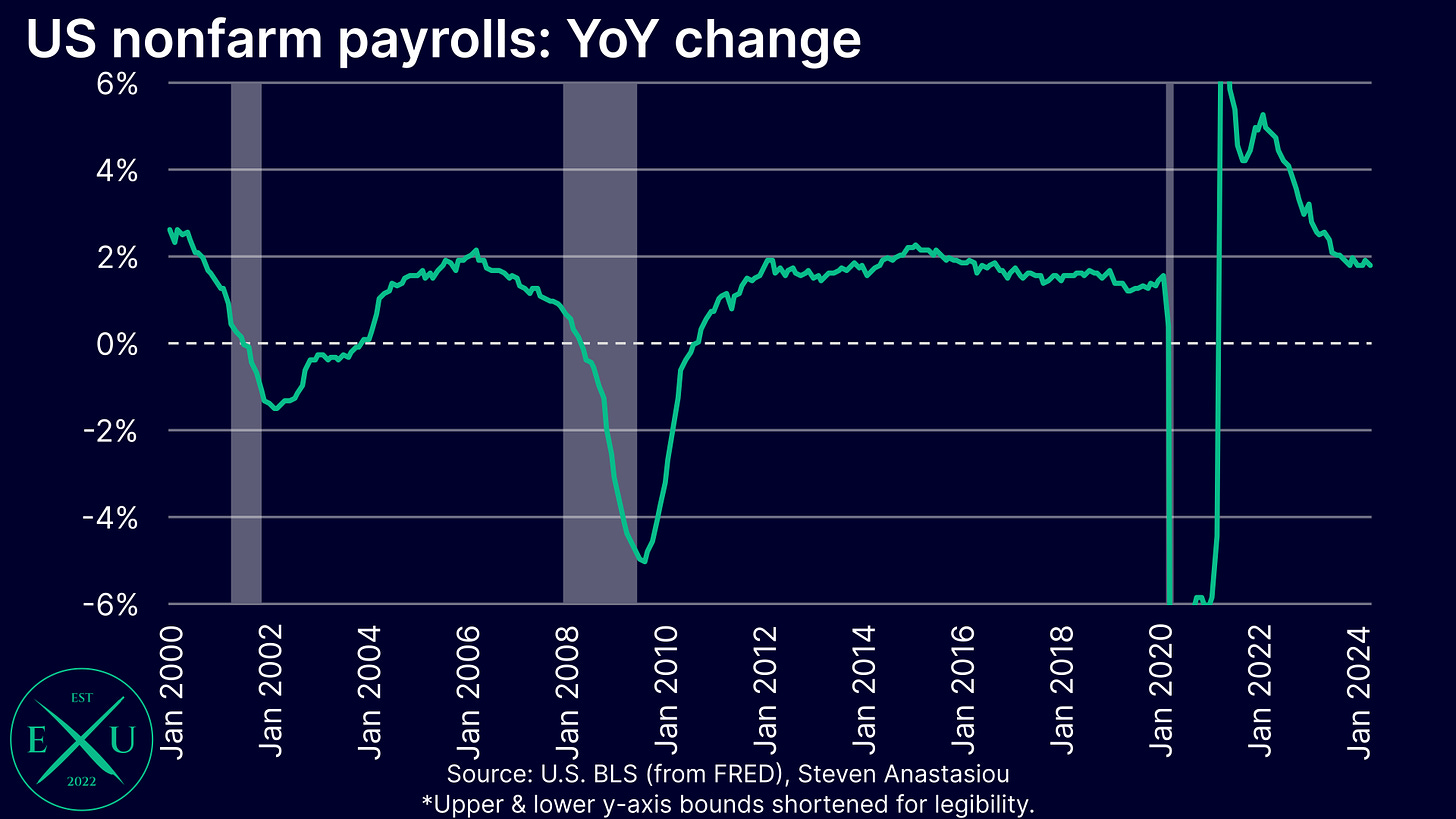

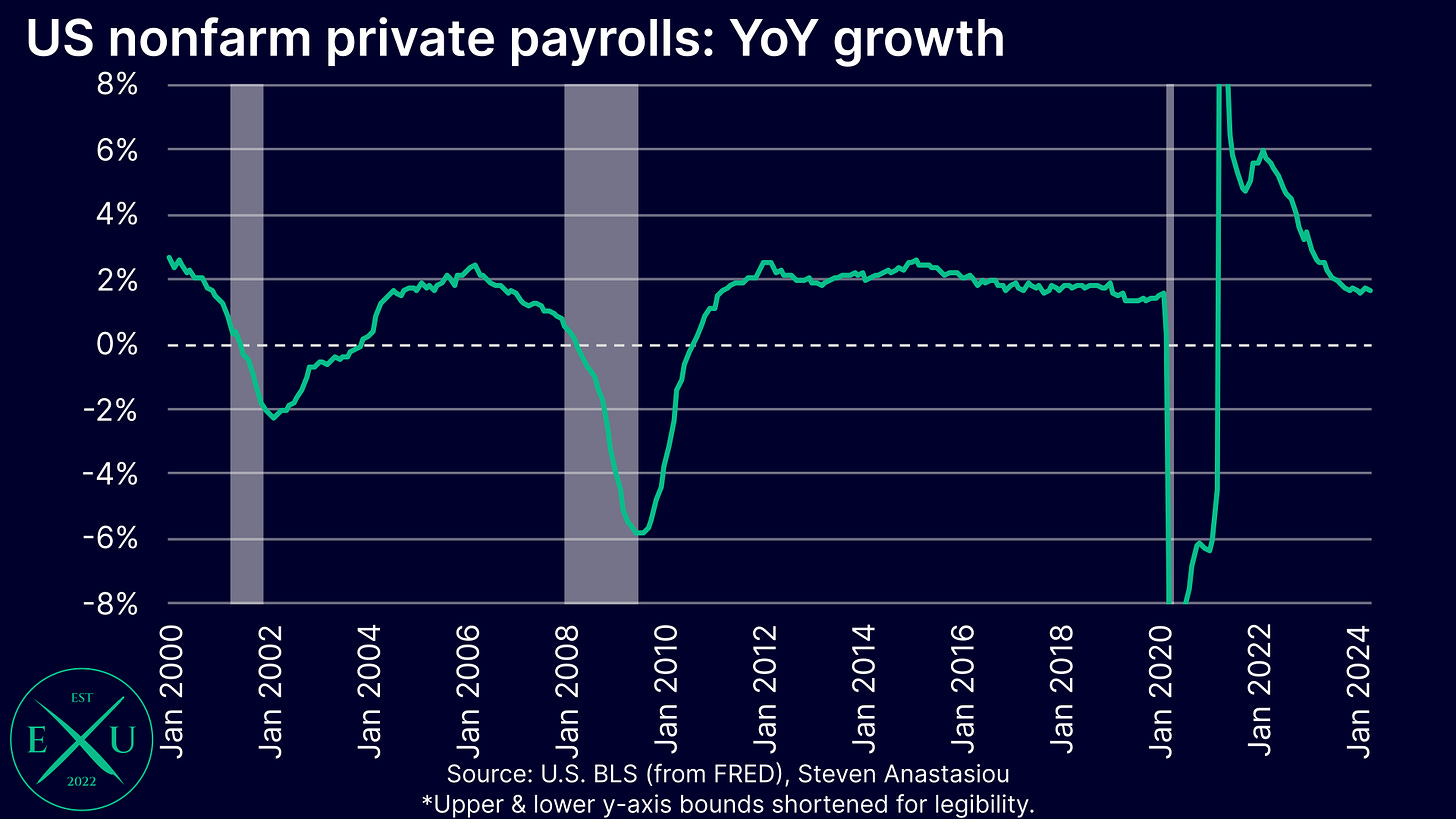

YoY growth dipped slightly to 1.8%. YoY growth has remained range-bound between 1.8%-1.9% since October, which remains above its 2016-19 average of 1.6%.

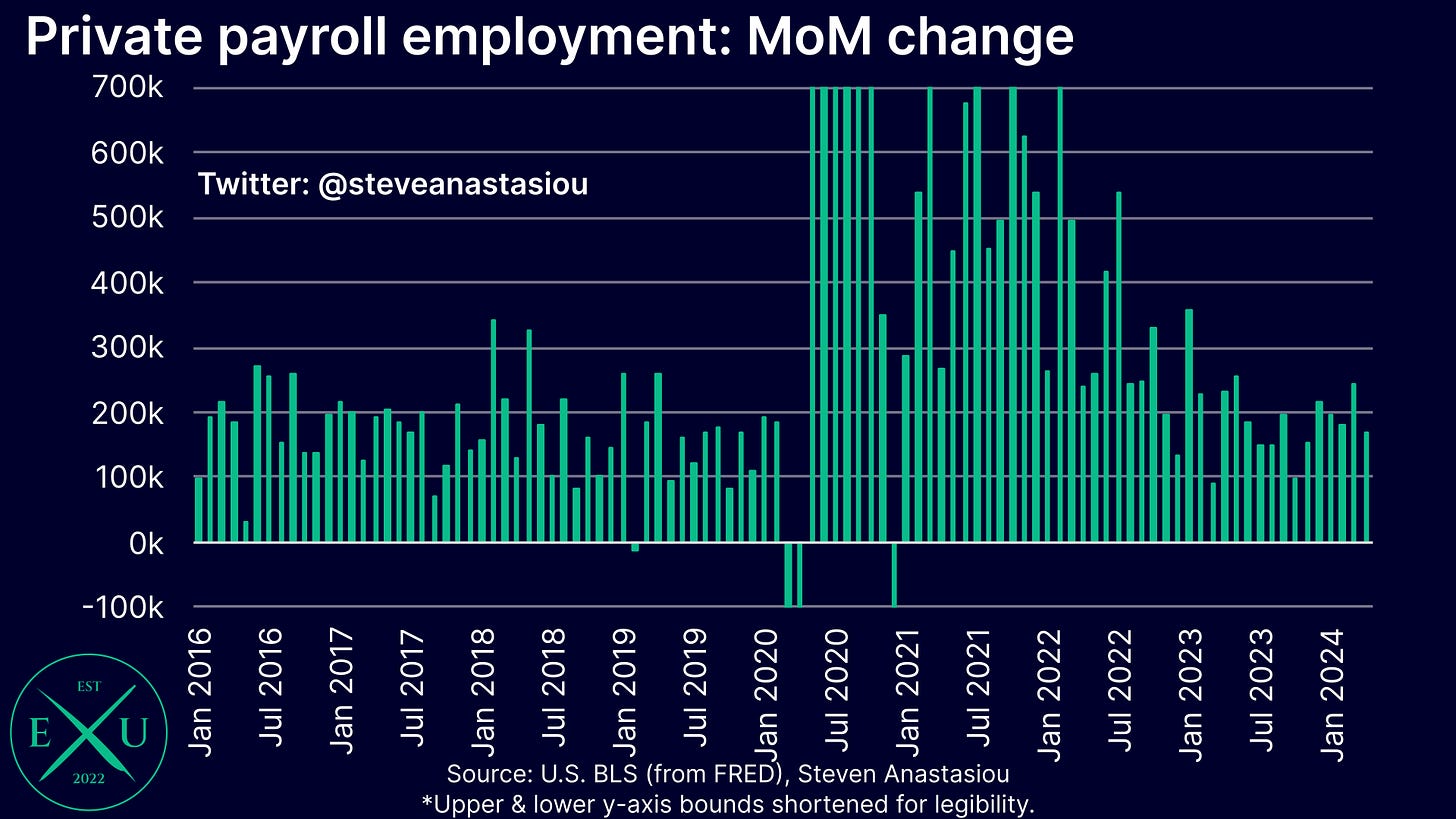

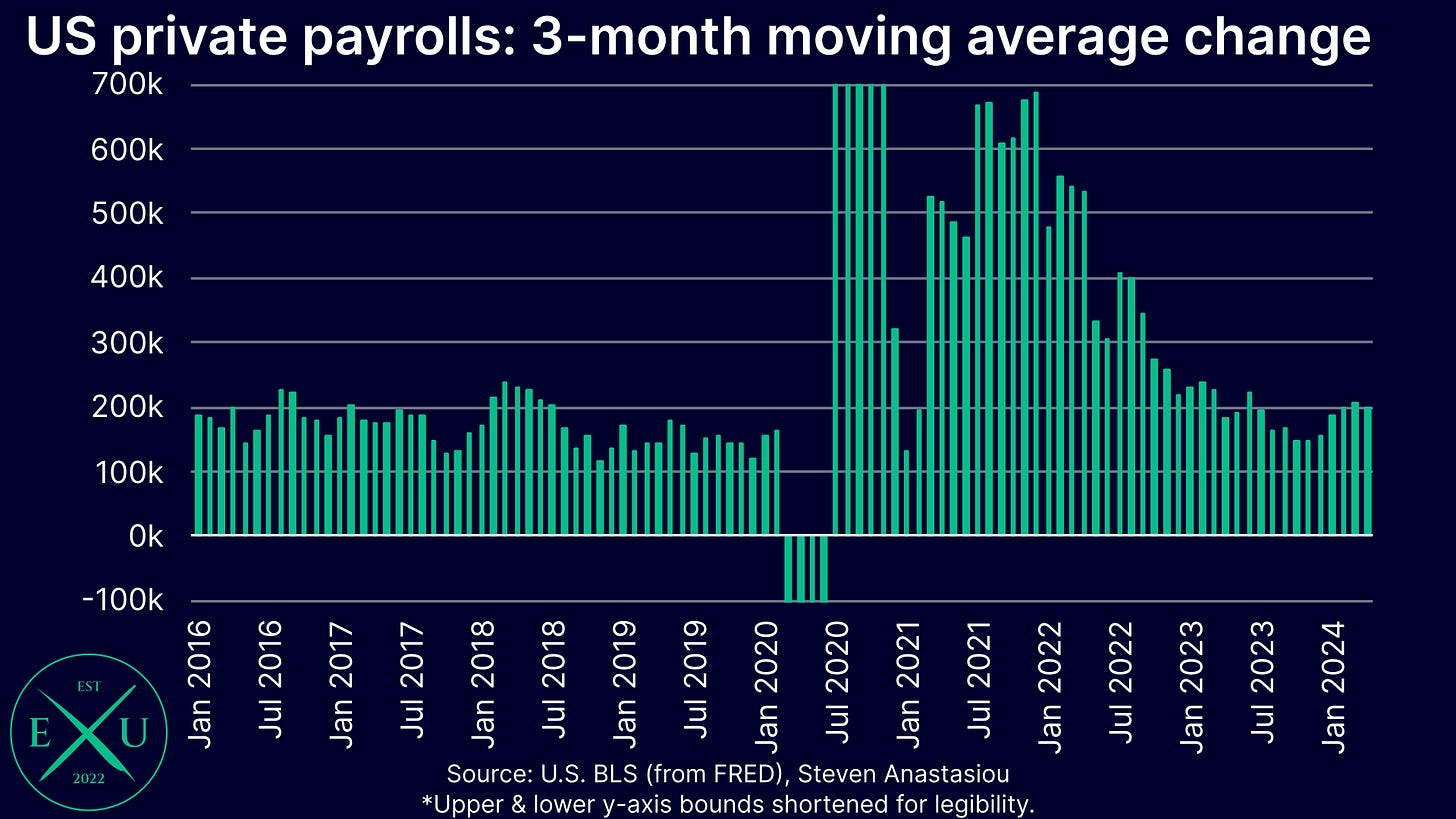

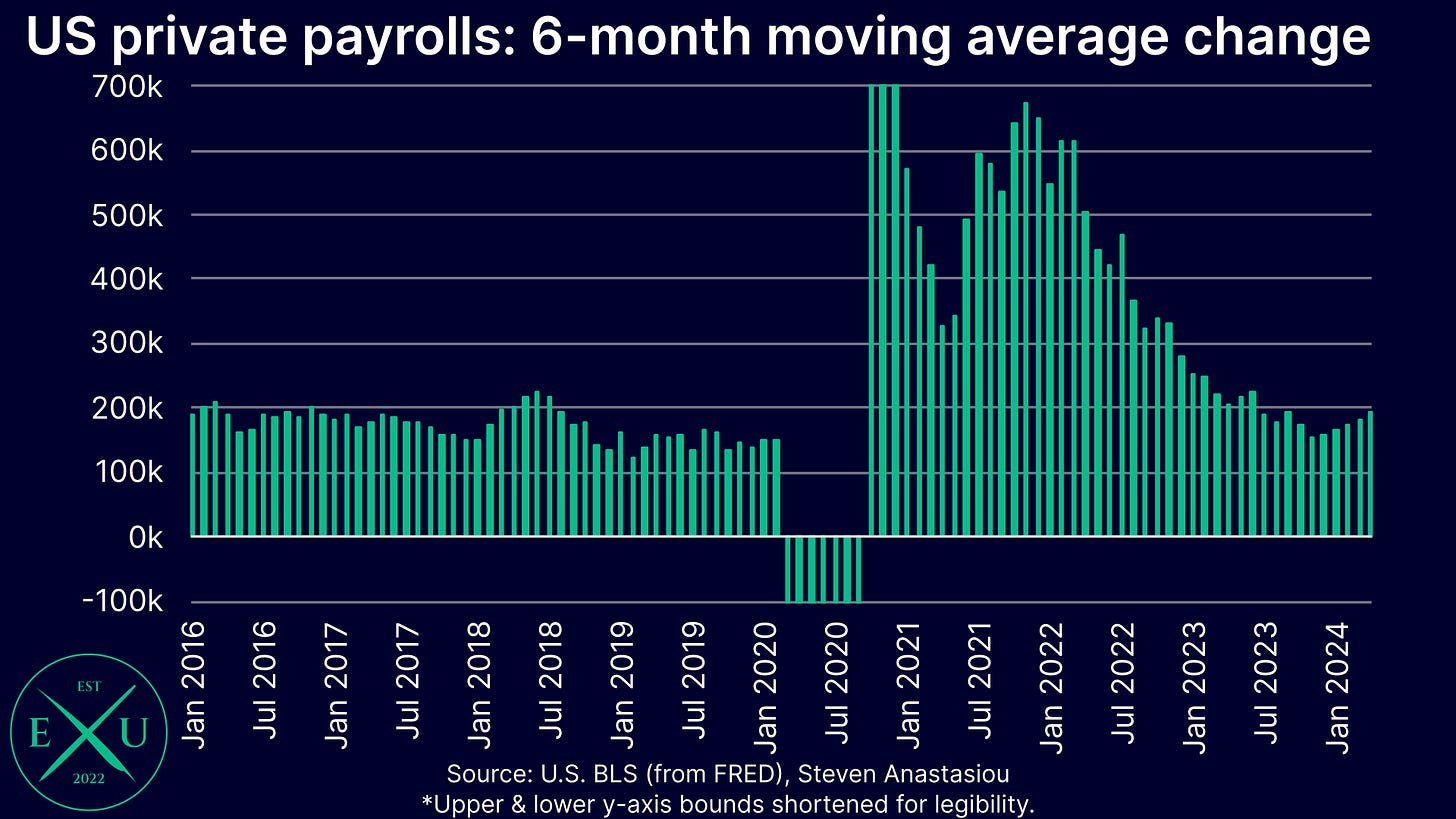

Focusing on private nonfarm payroll growth, shows MoM growth of 167k in April, the weakest result since November, though this follows relatively solid growth of 243k in March.

3-month annualised growth fell back below 200k to 197k, while 6-month annualised growth rose to 192k, its highest level since September.

YoY growth remained at 1.7%, which is in-line with its 2016-19 average. This shows that the relative outperformance in annual nonfarm payroll growth is being driven by government, as opposed to private payrolls.

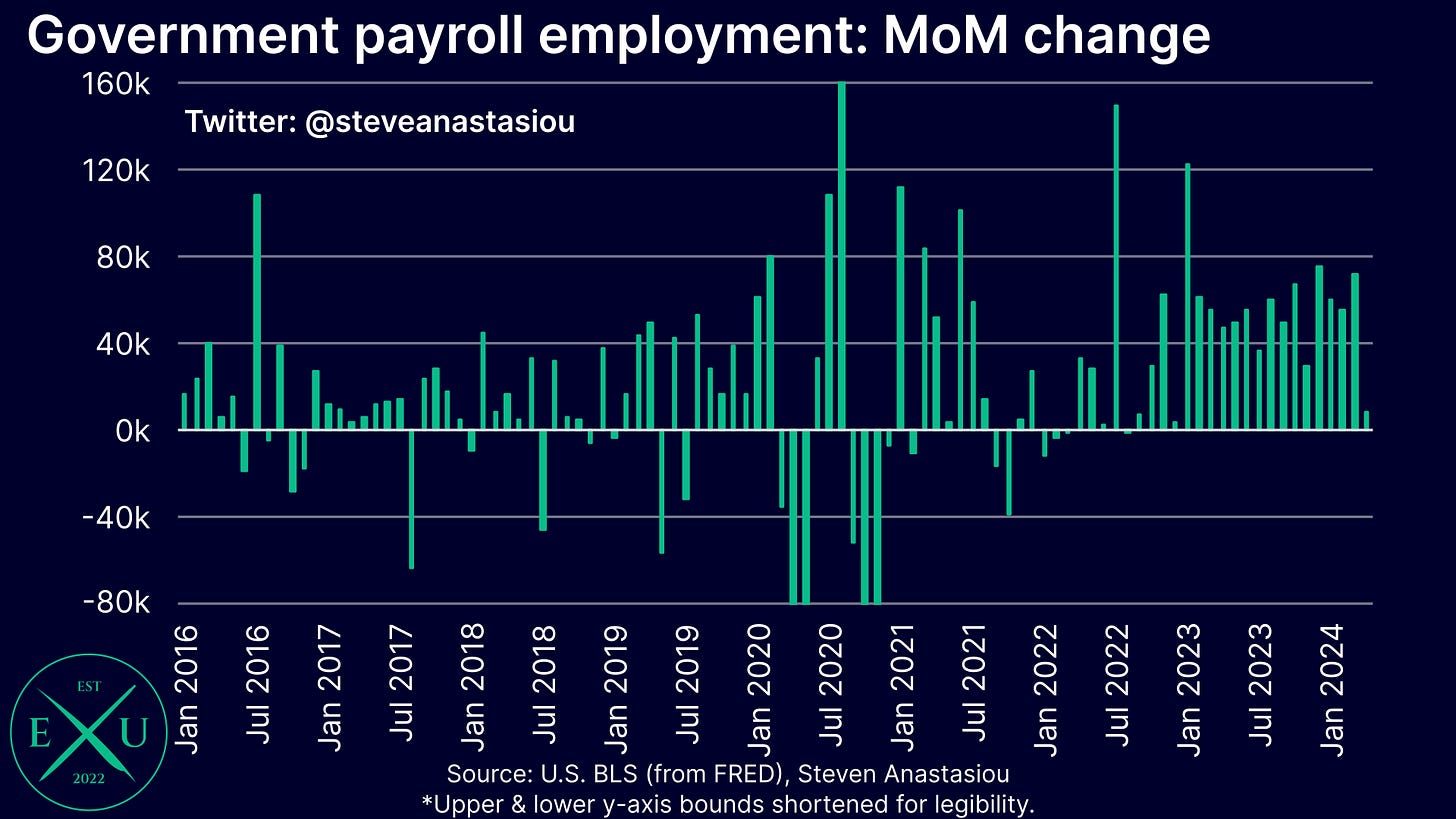

Turning to government payrolls, MoM growth moderated to just 8k, the lowest rate of increase since December 2022 and down sharply from the 72k government jobs added in March.

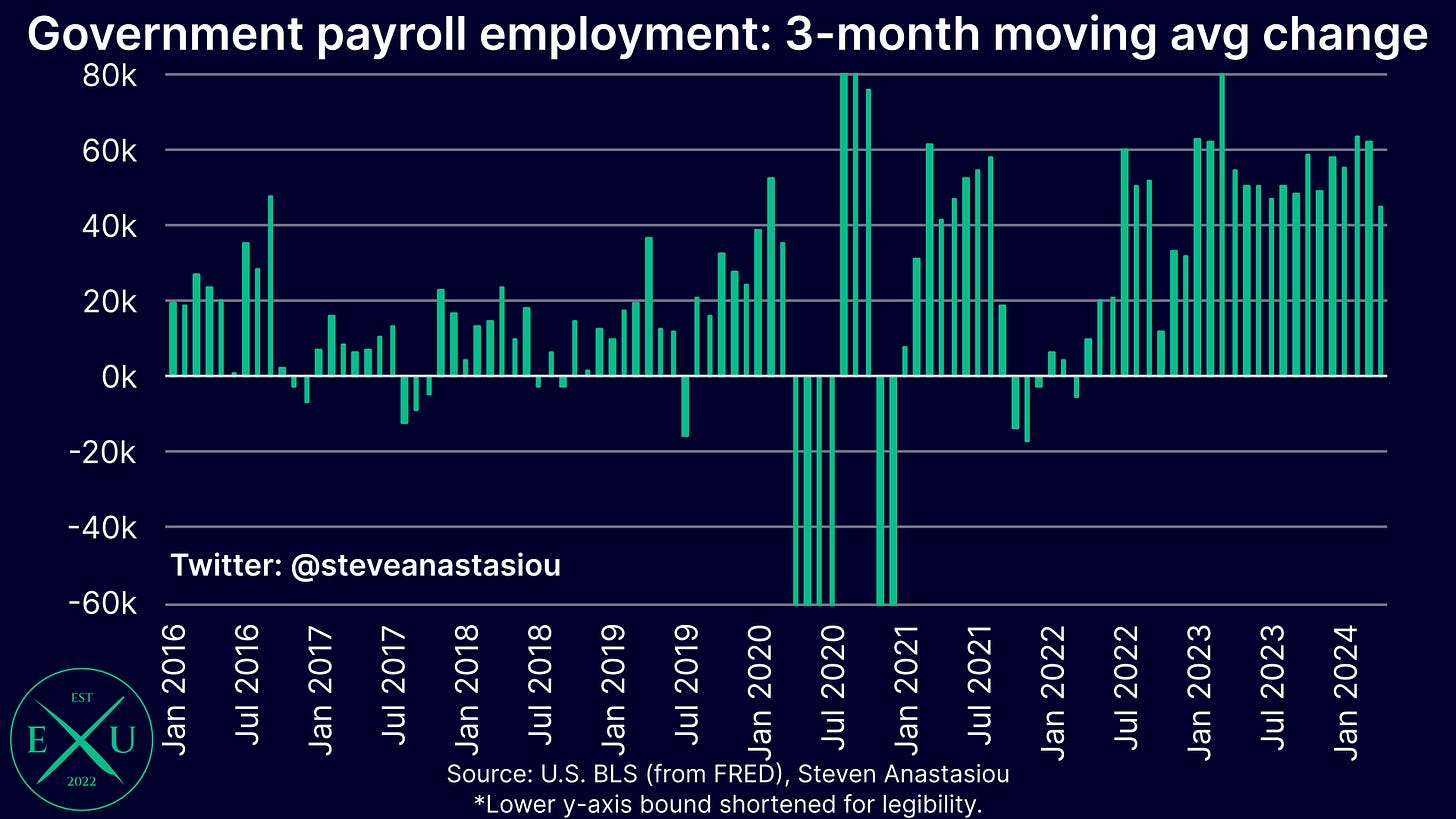

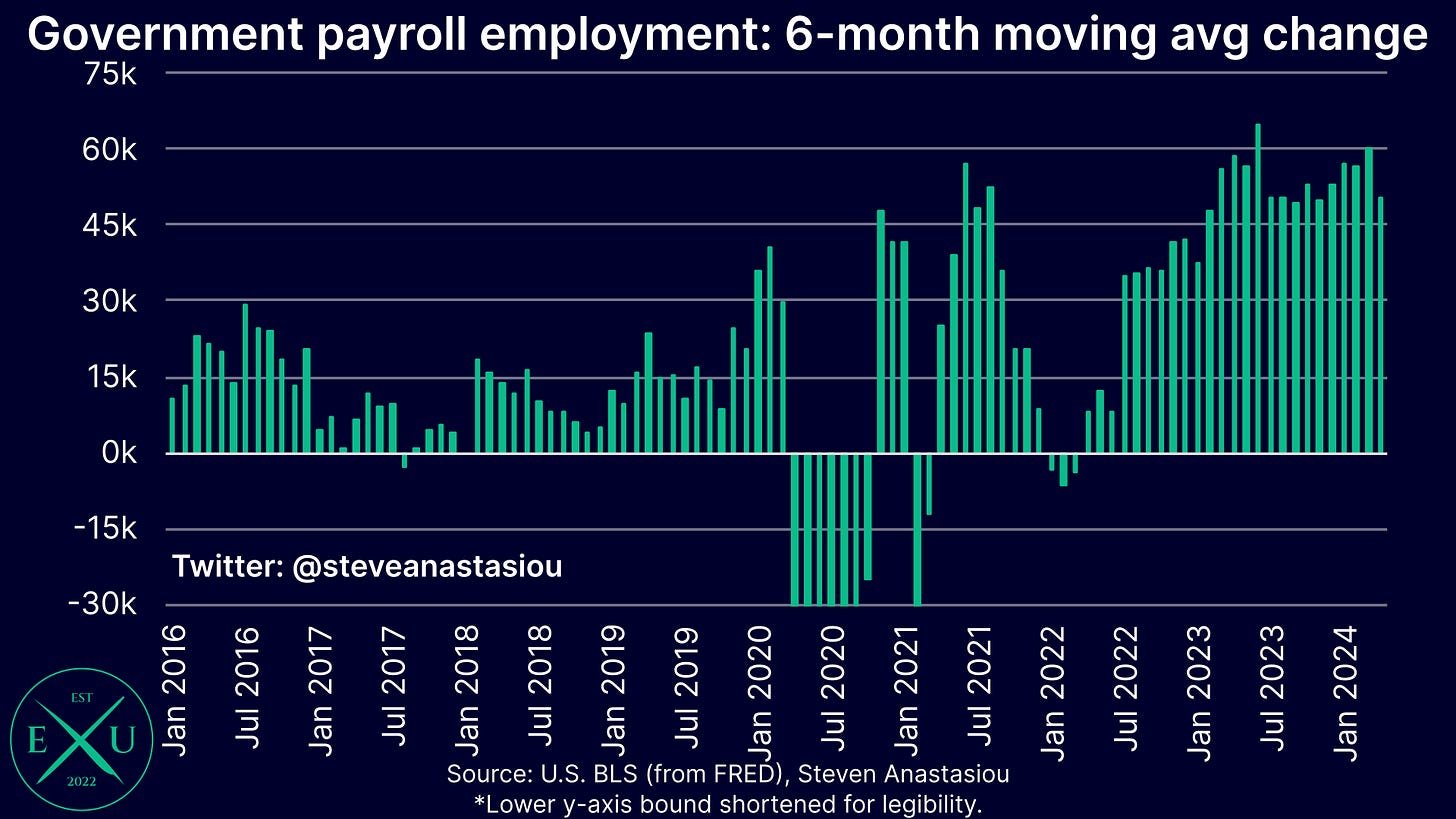

3-month annualised growth moderated to 45k, while 6-month annualised growth moderated to 50k.

While the moderation in MoM growth was major, it’s important to note that from 2016-19, MoM government sector job growth averaged only 13k.

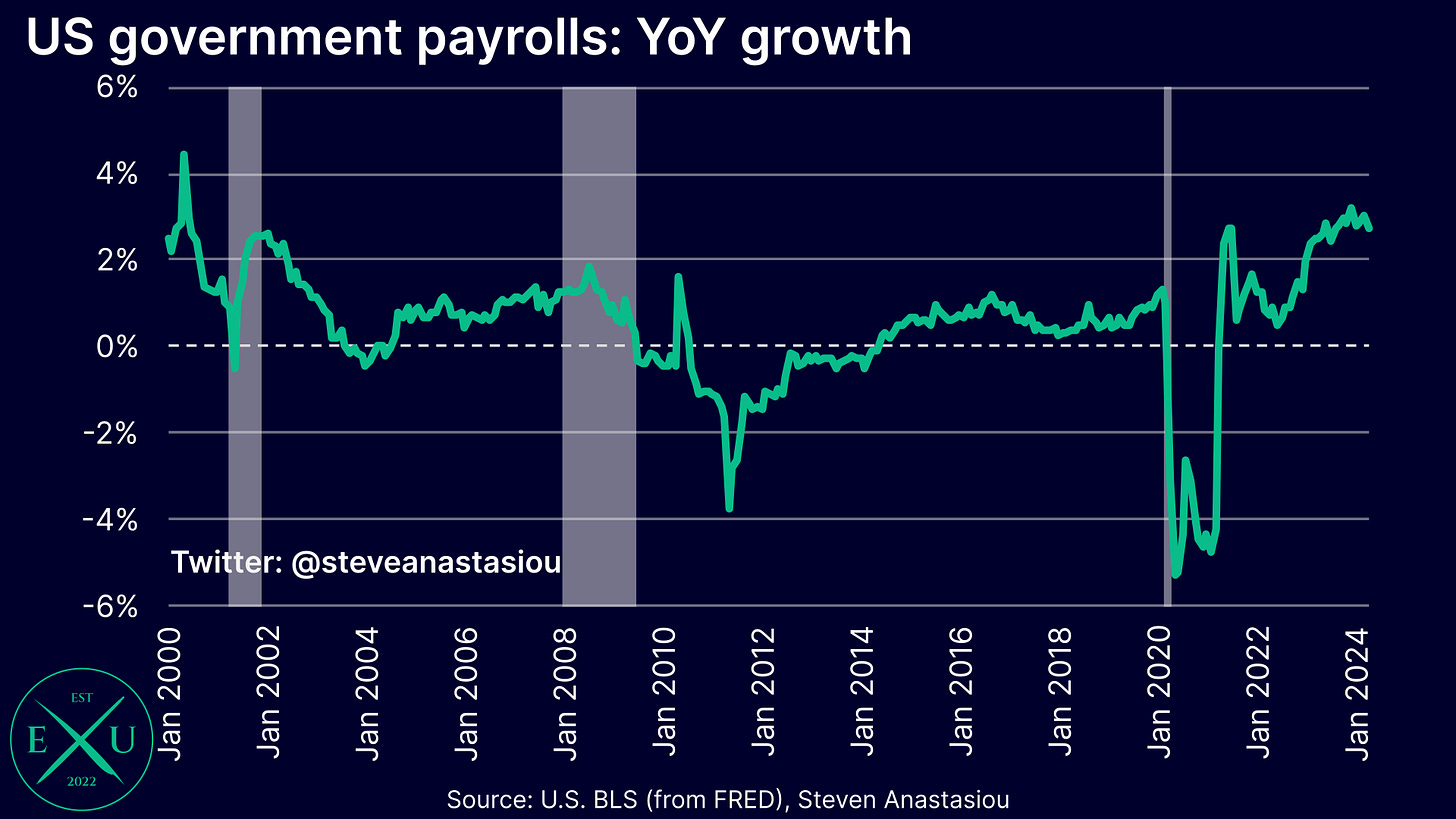

Government sector employment growth, which was 2.8% YoY in April, has thus been running far above its historical average, with YoY growth averaging just 0.7% across 2016-19.

Whether April’s lower MoM growth represents the beginning of a new trend, with government job growth returning back towards historical norms, or is a temporary blip, with government job growth set to remain well above its historical average, will prove important for the broader employment market outlook.

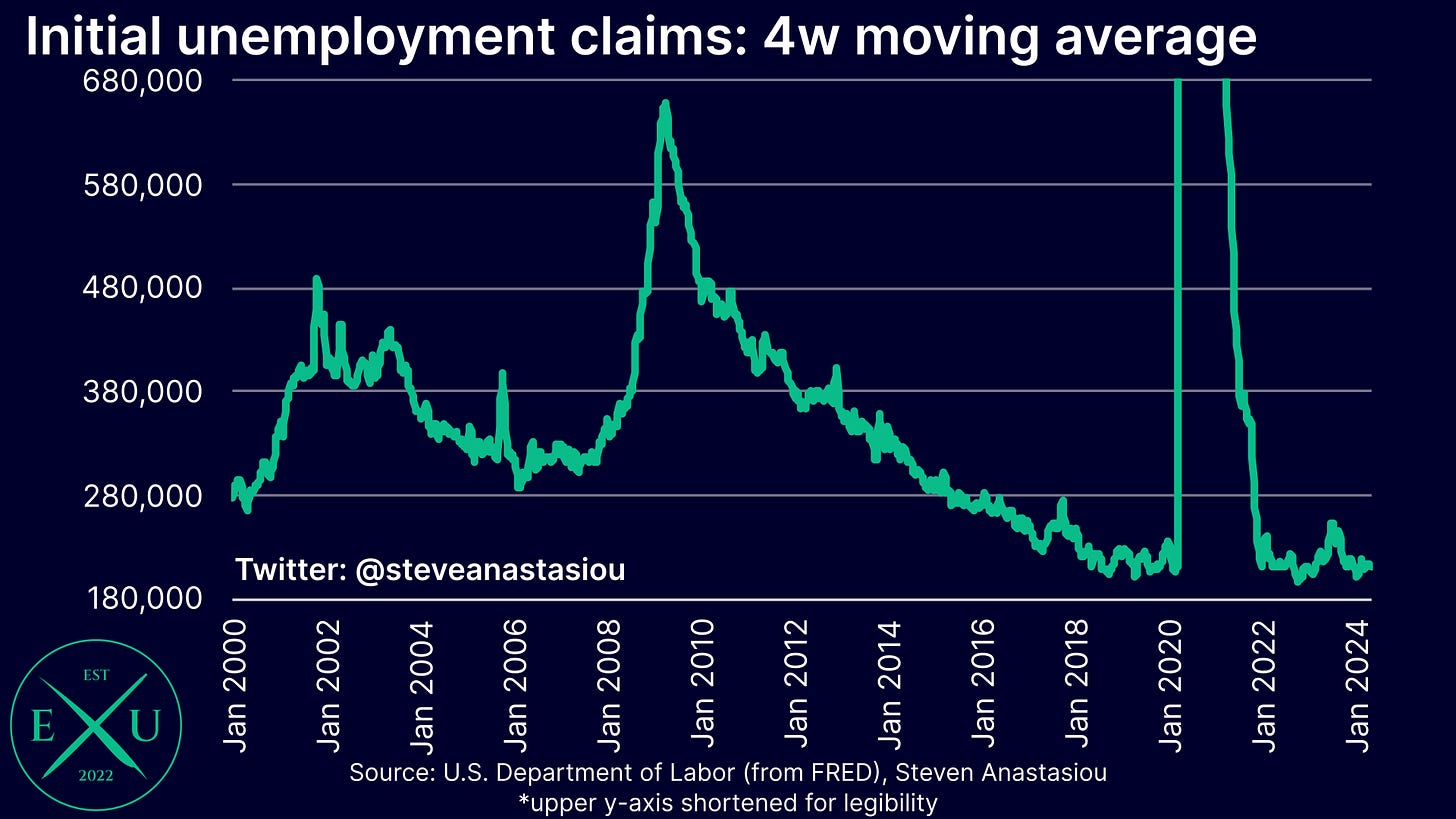

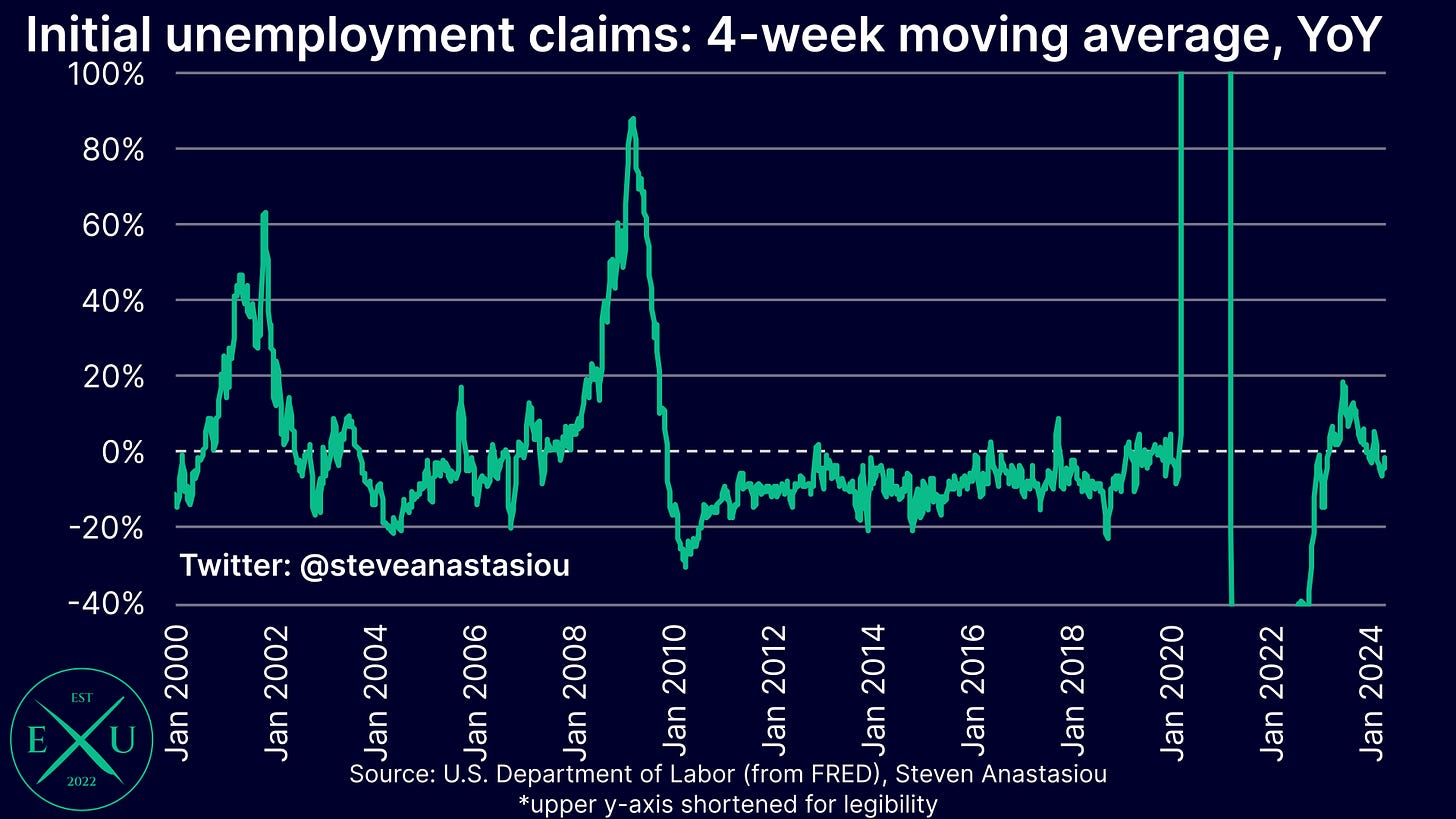

Providing further support to the narrative that the US employment market remains relatively strong, is that initial claims continue to remain around the lowest levels seen this century, with the 4-week moving average falling to 210k in the week to 27 April. This is down 2.4% on the same time last year.

To help improve the reach of this research update, please consider “liking” this article by clicking the heart icon at the top of this post/email.

Jobs market is finely balanced as 200k is the new 100k amidst stronger immigration

While the broader trend in nonfarm private payroll growth appears to be relatively strong, it’s critical to realise that as a result of significant increases in immigration, more than 200k jobs likely need to be created each month to simply keep up with increases in the size of labour force, which is roughly double the pace which was needed pre-COVID.

This shift was noted within the Economic Policy Statement that accompanied the Treasury’s most recent quarterly refunding announcement.