Fed turns increasingly dovish, adding further fuel to financial markets

Not only did the Fed maintain its outlook for three rate cuts in 2024, but it announced that QT is likely to be tapered "fairly soon" - the latter is likely to provide further fuel for asset prices.

While the significantly hotter inflation data to begin 2024 suggested that the Fed may strike a more hawkish tone at its March FOMC meeting, that didn’t occur. Instead, the Fed delivered a further dovish tilt, resulting in a broad-based rally across financial markets, with equities, gold, silver and bitcoin all rallying significantly.

This latest research piece breaks down what you need to know, under the following headings:

Fed maintains projection for 3 interest rate cuts, despite revising inflation & GDP estimates higher;

The major weakening in the household survey stands in stark contrast to the Fed’s lower unemployment rate projection — nevertheless, the Fed is aware of warning signs in the jobs market and laid the groundwork for potentially more material 2024 interest rate cuts; and

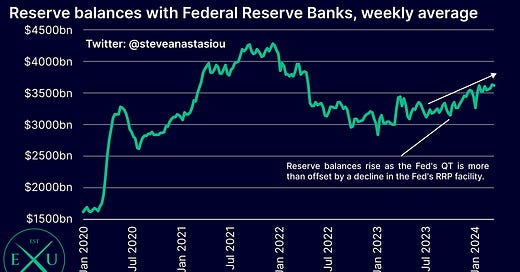

Near-term slowing of balance sheet runoff despite abundant reserves, provides significant further fuel for asset prices.

Before I start this breakdown, I would like to note that over the coming days and weeks, I plan to release the following research reports:

A two-part special on the most important part of the inflation outlook, being services prices;

Part 1 will examine the outlook for core services prices more broadly and attempt to answer: when will core services prices materially disinflate, and by how much?

Part 2 will focus on the outlook for the CPI’s rent based measures in-light of the latest data, delving into whether a major deceleration in owners’ equivalent rent (OER) and rent of primary residence (RPR) will actually occur during 2024, and whether some spot market rent measures may not be providing a good leading indicator of OER/RPR.

My monthly US PCE Price Index Review; and

My medium-term US inflation update, which will include an update to my medium-term US CPI forecasts that cover all of 2024, and which will incorporate insights gleaned from my upcoming two-part special on services prices.

While free subscribers may receive snippets from some of these reports, only premium subscribers will get full access to each of these reports.

Fed maintains projection for 3 interest rate cuts, despite revising inflation & GDP estimates higher

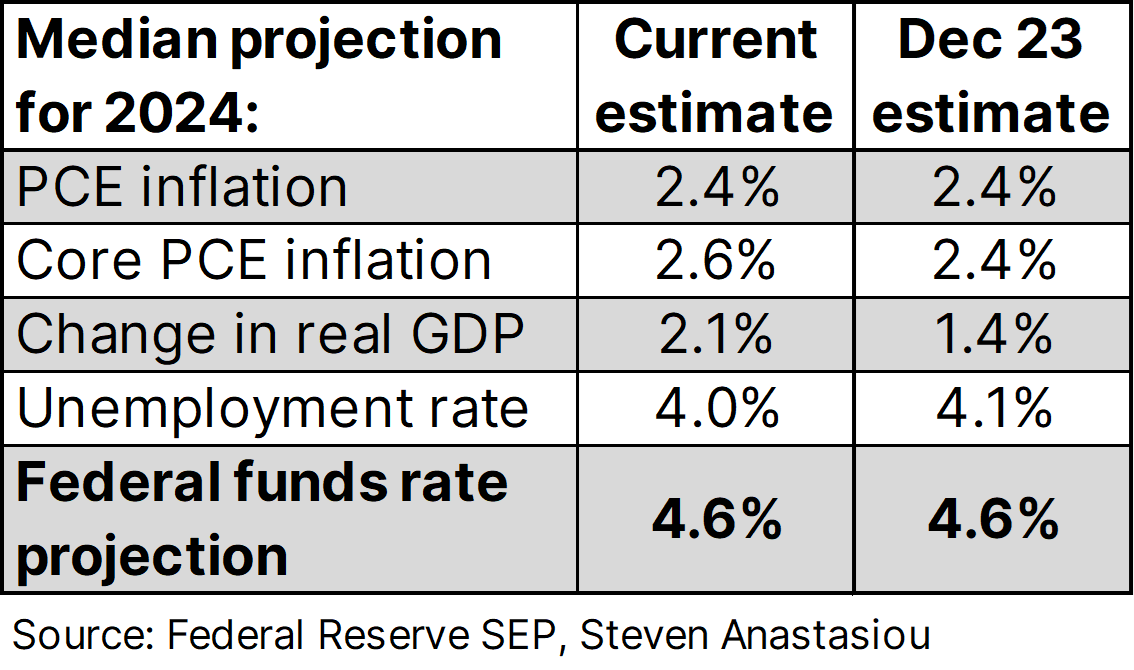

In its latest Summary of Economic Projections (SEP), the Fed maintained its median expectation for the federal funds rate to end the year at 4.6%. This was despite the hotter inflation readings to begin 2024, which saw the Fed’s median estimate for 4Q24 core PCE inflation revised higher, to 2.6% YoY, from 2.4% previously.

In addition to the hotter inflation estimate, the Fed’s median projection for GDP growth materially increased, with it now expecting 4Q24 GDP growth to be 2.1% YoY, up from 1.4% in its December projection. Its median projection for the unemployment rate was also revised modestly lower to 4.0%, from 4.1% previously.

Given that the Fed’s median expectation for three rate cuts was maintained despite an expectation for higher inflation and stronger economic growth, this implies that the Fed has grown more comfortable in loosening policy.

While some may argue that this relatively looser policy projection was offset by the Fed’s median projection for one less interest rate cut in 2025, and a slightly higher longer run federal funds rate (2.6% vs 2.5% previously), given that these estimates are so far out into the future, they likely hold relatively little importance for financial markets, with such long dated projections likely to see major revisions as economic data evolves.

The major weakening in the household survey stands in stark contrast to the Fed’s lower unemployment rate projection — nevertheless, the Fed is aware of warning signs in the jobs market and laid the groundwork for potentially more material 2024 interest rate cuts

A potential reason for the Fed’s further dovish tilt, is the major weakening that’s been seen in many employment indicators, which I explained in detail within my latest comprehensive update on the US employment market.

This includes a particular weakening in the household survey of employment, with household survey employment growth falling to just 0.4% YoY.