Fed sets the stage for a September rate cut as more job market data shows growing weakness

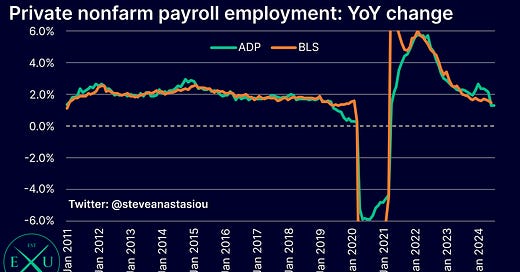

Changes to the Fed's FOMC statement and Fed Chair Powell's press conference have reinforced market expectations for a September rate cut, whilst the latest ECI and ADP data showed a further weakening.

To have the opportunity to access this report and upcoming releases in full, please be sure to check your inbox for an email sent earlier this week that contains a link to a subscriber survey — all survey respondents will receive a free two-week paid subscription, while current paid subscribers will receive a free two-week extension of their subscription. Those who have already completed the survey have had the two week bonus applied to their account — thank you for your feedback!

Fed paves the way for a September rate cut

As expected, the July FOMC statement and Fed Chair Powell’s press conference have set the stage for an initial rate cut to be delivered in September.

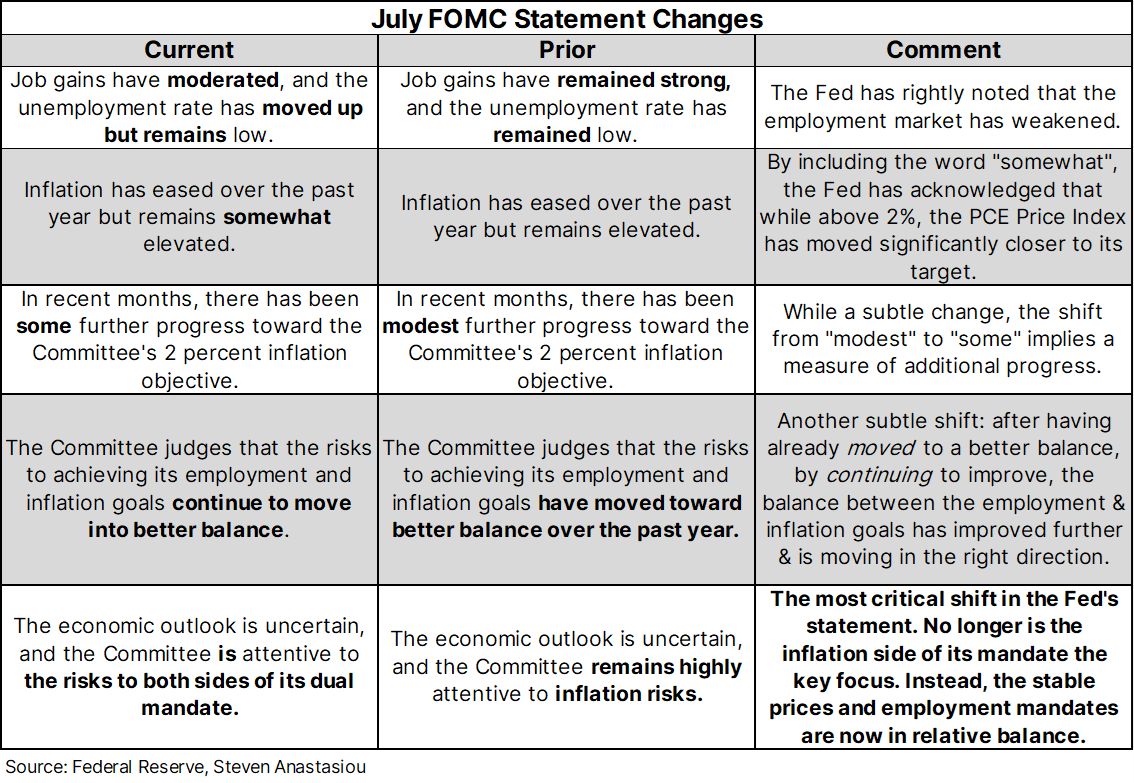

The Fed’s latest FOMC statement saw several revisions, which are shown in the table below with an accompanying comment. The biggest revision was in regards to the Fed indicating a shift towards a more even focus between both sides of its dual mandate (“the Committee is attentive to the risks to both sides of its dual mandate”), as opposed to a prevailing focus on the price stability side of its mandate (“the Committee remains highly attentive to inflation risks”).

Fed Chair Powell emphasised this shift towards a better balance of risks between its employment and inflation goals in his FOMC press conference and clearly articulated that there’s a significant chance of a September rate cut. The below list details some of the most important quotes from the press conference, with emphasis added to make the key points clear (see the Appendix for additional relevant quotes):

“Overall, a broad set of indicators suggests that conditions in the labor market have returned to where they stood on the eve of the pandemic — strong but not overheated.”

“As the labor market has cooled and inflation has declined, the risks to achieving our employment and inflation goals continue to move into better balance. Indeed, we are attentive to the risks to both sides of our dual mandate.”

“We have stated that we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent. The second-quarter’s inflation readings have added to our confidence, and more good data would further strengthen that confidence.”

“On September, let me say this, we have made no decisions about future meetings and that includes a September meeting. The broad sense of the committee is that the economy is moving closer to the point at which it will be appropriate to reduce our policy rate…. We will be data dependent but not data point dependent.… The question will be whether the totality of the data … are consistent with rising confidence on inflation and maintaining a sold labour market. If that test is met a reduction in our policy rate could be on the table as soon as the next meeting in September.

“If we were to see inflation moving down quickly or more or less in line with expectations [and] growth remains … reasonably strong and the labour market remains … consistent with its current condition, then I would think that a rate cut could be on the table at the September meeting.”

“I can imagine a scenario in which there could be everywhere from zero [2H24] [interest rate] cuts to several [2H24] cuts, depending on the way the economy evolves.”

“I think you’re back to [labour market] conditions that are close to 2019 conditions and that was not an inflationary economy.”

“I don’t now think of the labour market in its current state as a likely source of significant inflationary pressures, so I would not like to see material further cooling in the labour market”

“We think we don’t need to be 100 percent focused on inflation because of the progress we’ve made. 12-month headline at 2 1/2 and core at 2.6 … it’s way down from where it was. The job is not done on inflation but nonetheless we can afford to begin to dial back the restriction in our policy rate”.

“We’re also now seeing progress in the other two categories, non-housing services and housing services … I would say the quality of this [disinflation] is higher [than in 2H24] and it’s good, but so far it’s only a quarter.”

“12-month now is 2 1/2 percent headline and 2.6 percent core. This is so much better than where we were even a year ago…. the job is not done, I want to stress that and we’re committed to getting inflation sustainably to 2 percent, but we need to take note of that progress and we need to weigh the risks to the labour market and the risks to our inflation target now more equally than we did a year ago.”

“I think the upside risks to inflation have decreased as the labour market has cooled off … inflation is probably a littler farther from its target than employment, but I think the downside risks to the employment mandate are real now. So we have to weigh all that … we have a restrictive policy rate, it’s clearly restrictive … and the time is coming as other central banks around the world are facing this same question, the time is coming at which it will begin to be appropriate to dial back that level of restrictions, so that we may address both mandates.”

“There was a real discussion back and forth of what the case would be for moving at this meeting”

“We’re aware of that [the Sahm] rule, which is really, you know, a statistical thing that has happened through history, a statistical regularity is what I’d call it. It’s not like an economic rule where it’s telling you something must happen. So again … we’re seeing … a normalising labour market”.

“Let’s also remember that this pandemic era has been one in which so many, you know, apparent rules have been flouted, like the inverted yield curve … [which] just haven’t worked and it’s because this situation really is unusual or unique.”

“Anything that we do before, during or after the election will be based on the data, the outlook and the balance of risks, and not on anything else.”

“Overwhelmingly, the sense of the committee was [to not move interest rates at] this meeting, but as soon as the next meeting, depending on how the data come in … we think that the time is approaching and if we do get the data that we hope we get, then … a reduction in our policy rate could be on the table at the September meeting.”

“The judgement of the committee is that … time is drawing near [to cut interest rates], that time could be in September if … the data support that.”

“I think [the chances of a hard-landing] are low.”

All-in-all, I continue to expect the Fed to deliver an initial rate cut at the September meeting. I also continue to expect that a total of three 25bp interest rate cuts will be delivered in 2H24.

Given the ongoing weakening that’s been seen in employment market data (including the latest ADP data, which showed a further softening in July and is analysed below), I currently expect that risks are slightly slanted towards 100bps of rate cuts in 2H24, as opposed to rate cuts of 50bps or less — the upcoming monthly employment report will give us additional detail on which way risks are slanted.