Economics Uncovered Chart Pack: July 2023

With 86 charts in total, this latest edition to Economics Uncovered covers the global money supply and inflation, the US banking sector, US GDP, US employment and more.

Since beginning Economics Uncovered, I have been committed to continually improving the research product that I provide, so that I can better help YOU to get ahead.

With this in mind, I am excited to announce the latest edition to Economics Uncovered — a comprehensive chart pack!

With 86 charts in total, this chart pack represents a comprehensive overview of key subjects, including:

the global money supply & inflation;

the US banking sector;

US GDP; and

US employment.

Included in the chart pack are three proprietary indicators:

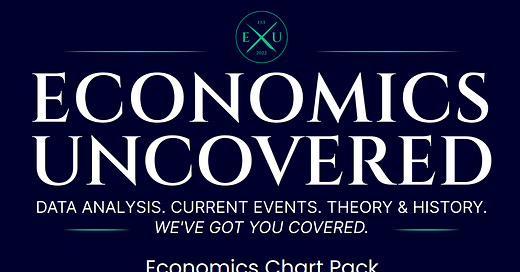

1) Economics Uncovered Global M1 Proxy (YoY change)

With most central banks around the globe aggressively tightening monetary policy, it’s no surprise to see that the Economics Uncovered Global M1 Proxy is in deeply negative territory. This is likely to result in a sharp reduction in inflation in many nations around the globe over the year ahead — it also means that risks for economic activity are firmly to the downside.

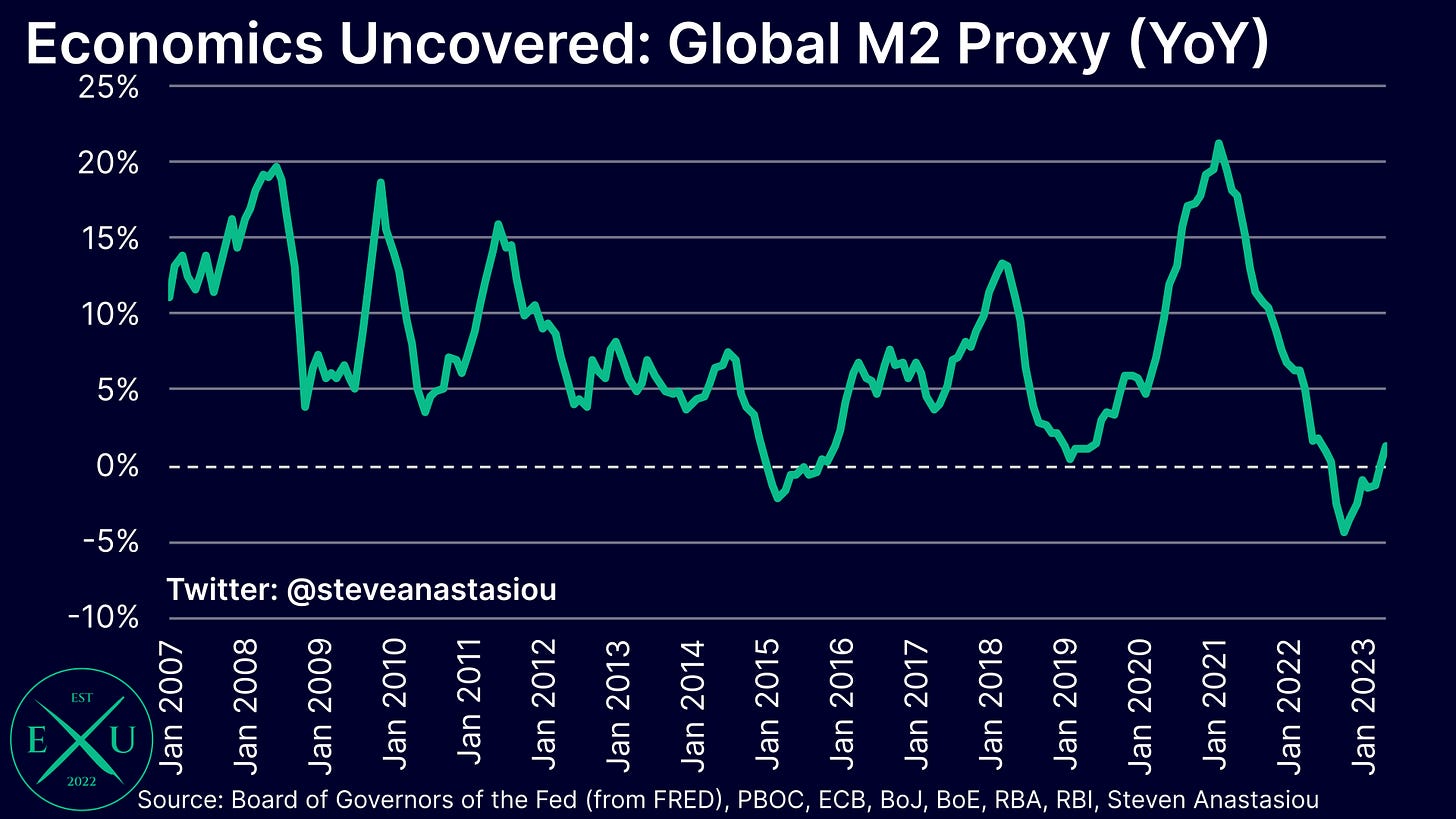

2) Economics Uncovered Global M2 Proxy (YoY change)

While the Economics Uncovered Global M1 Proxy remains in deeply negative territory, the Economics Uncovered Global M2 Proxy has recently returned to YoY growth. A key reason for this divergence, is that the broader definition of M2 means that it captures a wider array of deposits, such as longer duration time deposits, which have generally risen as individuals have responded to the higher interest rates on offer.

Despite returning to positive territory, the very modest annual growth in the Economics Uncovered Global M2 Proxy again points to much lower inflation over the year ahead, in many nations around the globe.

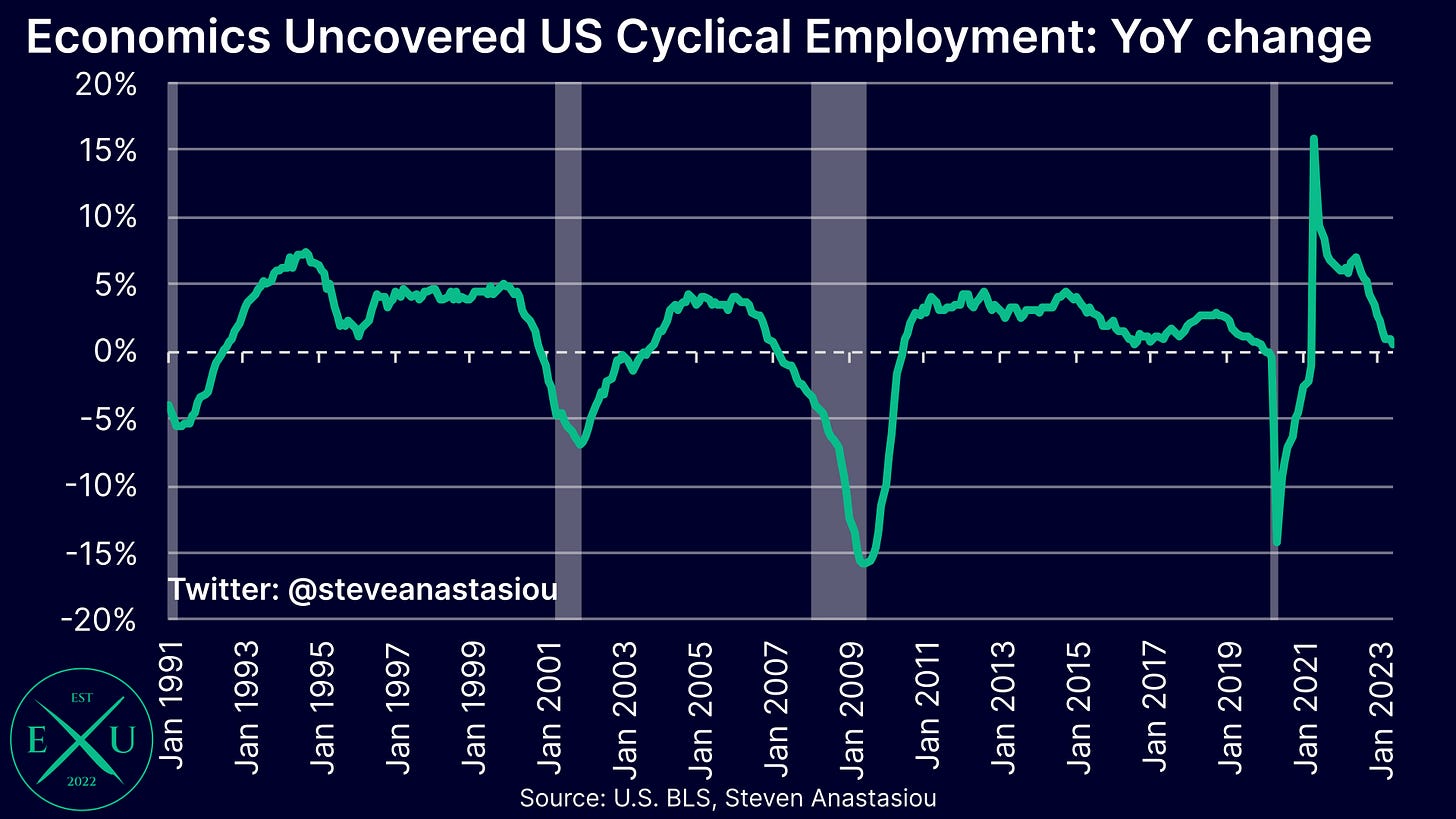

3) Economics Uncovered US Cyclical Employment

While the annual change in overall nonfarm payrolls doesn’t usually decline until a recession has already been well underway, there are certain areas of the employment market that provide a leading indicator of economic activity.

The Economics Uncovered US Cyclical Employment indicator groups these key categories together. While it hasn’t yet turned negative on an annual basis, its message is clear — the US employment market is weakening.

As with all of my research, I am committed to revising this chart pack over time to ensure that it delivers the best insights possible. I hope to include more proprietary economic indicators over time and evolve the charts included to reflect the key economic circumstances/indicators of the time.

I’d love to know what you think of this chart pack — is it useful to you, and would you like to see it updated on a monthly/quarterly basis? Please let me know in the comments below!

The link to the full chart pack is below:

Thank you for reading my latest research piece, in which I hope you found significant value.

Should you have any questions after reading this latest research report, please feel free to leave them in the comments below!

Given that my focus is on providing you with vital insights and explanations on the economic topics that matter, with a particular aim to have unrivaled coverage on all things inflation and the money supply, please feel free to also suggest ways in which I can tailor my economics research content, to better help you get ahead.

In order to help support my independent economics research (remember, everything you see — the forecasts, the charts, the analysis, the in-depth explanations of economic history — is all completed independently, by me, for you), please consider liking and sharing this post and spreading the word about Economics Uncovered.

Your support is greatly appreciated and goes a long way to helping make Economics Uncovered a sustainable long-term venture that will be able to continue to provide you with valuable economic insights for years to come.

If you haven’t already subscribed to Economics Uncovered, subscribe below so that you don’t miss an update.

I truly appreciate your insightful analysis and the invaluable guidance it provides in assessing the significance and trends in the monthly data releases. Your research is a valuable tool that helps us navigate the complexities of the economy. It would be wonderful to have access to updated insights on a monthly basis, as your expertise and comprehensive understanding of economic dynamics greatly contribute to our decision-making process. Thank you for your exceptional work in providing us with such valuable information.

Excellent. Informative. Thank you.