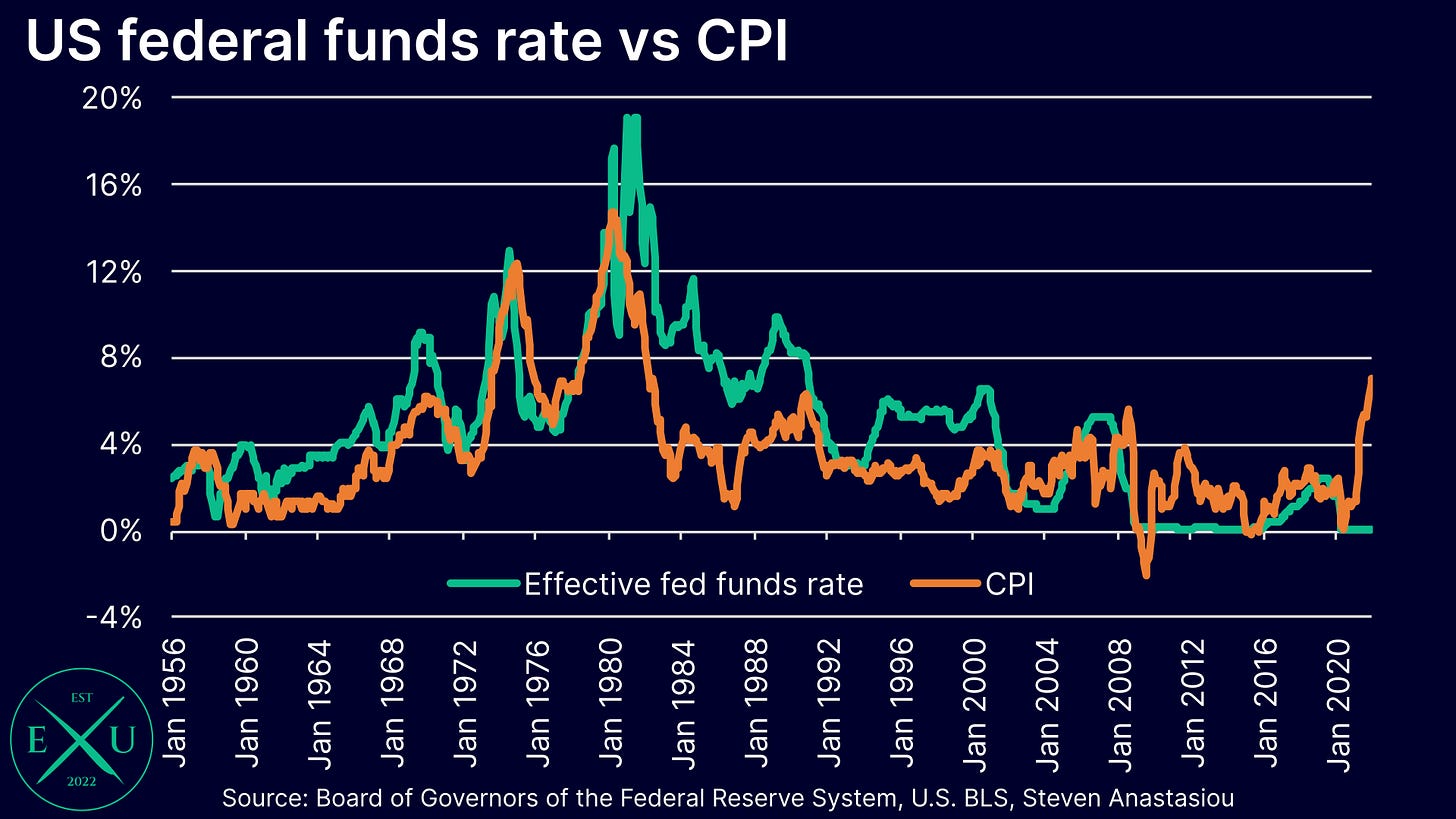

With inflation scaling 40-year peaks, and the Federal Reserve belatedly responding by unleashing its most aggressive tightening campaign in just as long, the world of economics and finance saw its fair share of important moments in 2022 — let’s revisit some of them now, as we look back upon the year that was.

26 January: Fed telegraphs that rate rises are on the way

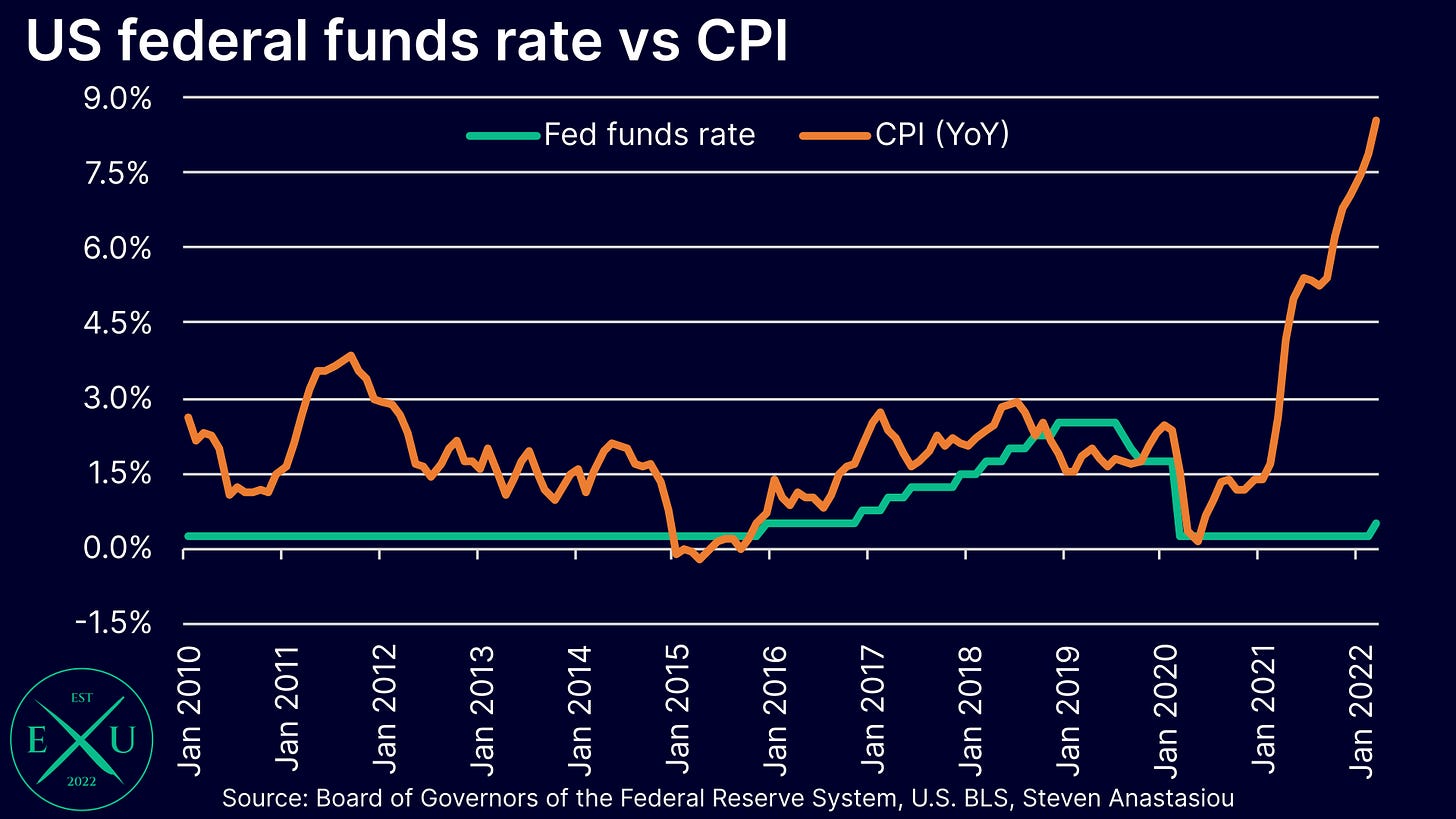

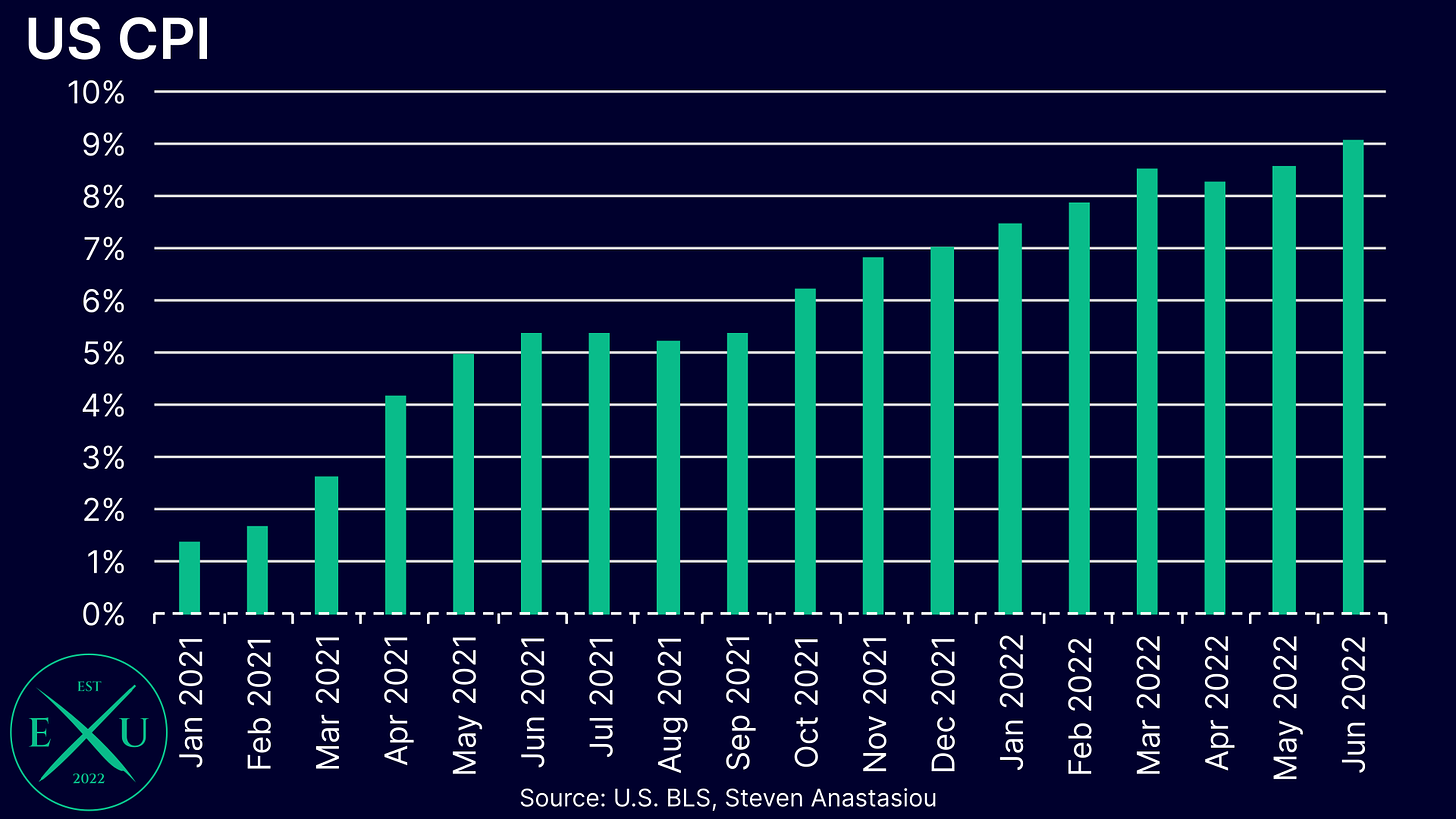

After huge federal government budget deficits, and extraordinarily loose monetary policy from the Fed in the wake of the COVID pandemic, the Fed’s first FOMC meeting of 2022 kicked off amidst a CPI that was running at 7%.

The Fed’s minutes noted that “with inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.”

You don’t say!

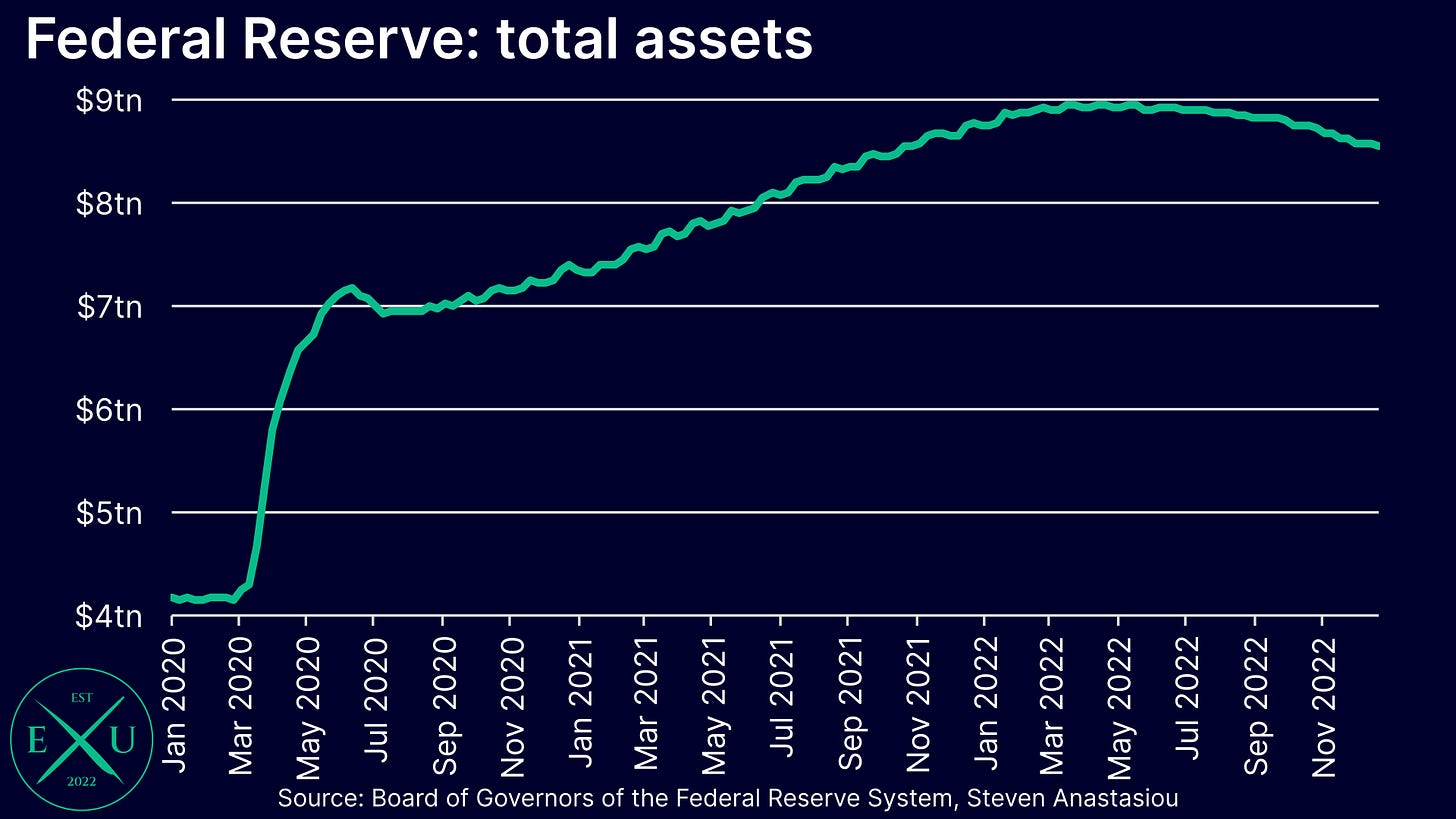

Additionally, the FOMC stated that it will bring its asset purchases to an end in early March, concluding its latest installment of QE, which this time around added $4.8tn of assets to its balance sheet.

Given what’s played out over the course of 2022, it’s hard to imagine how the Fed were so asleep at the wheel, with both QE and ZIRP continuing to take place whilst inflation had risen to 7%.

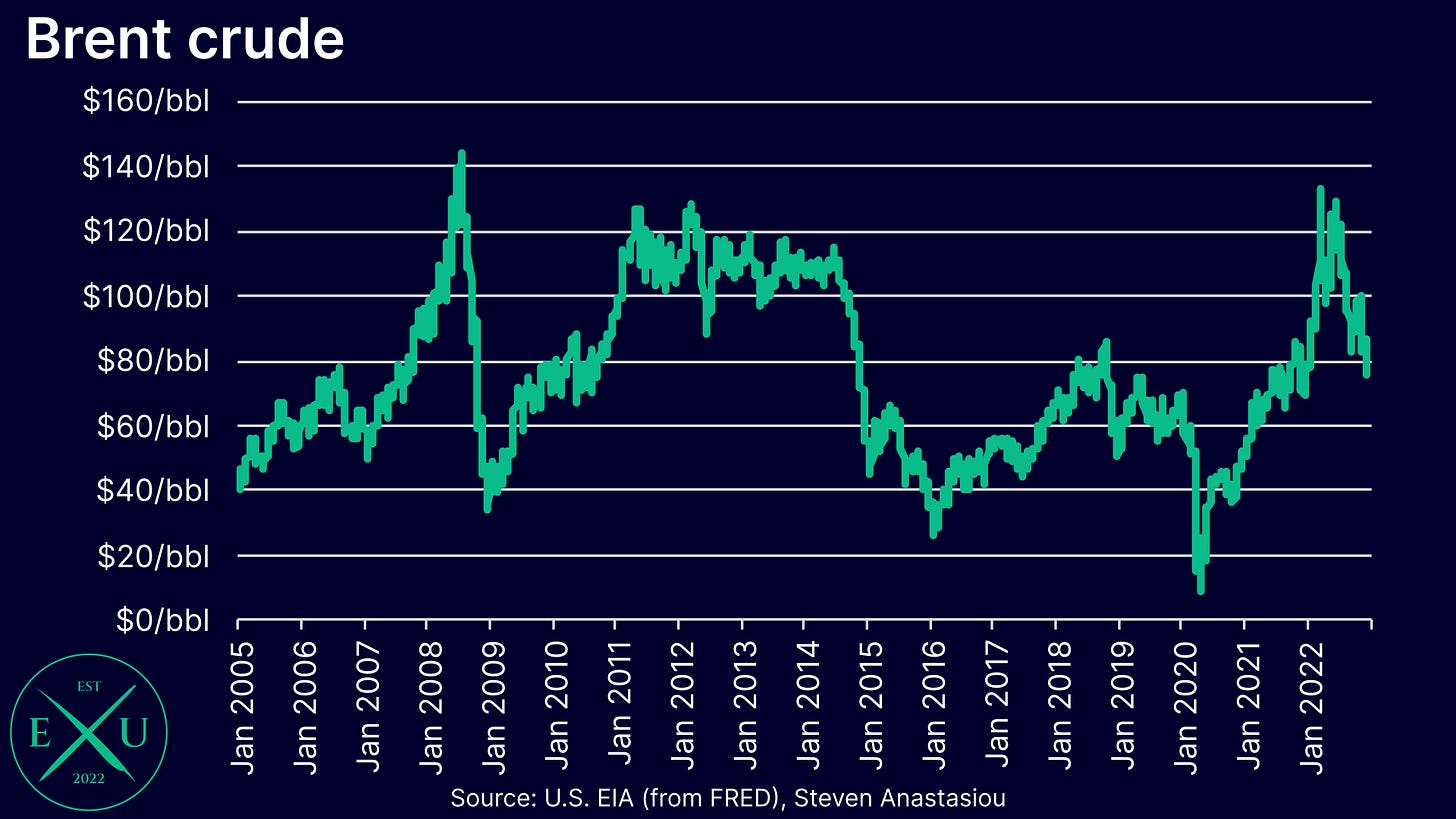

8 March: Oil peaks above $130/bbl following Russia’s invasion of Ukraine

In the lead up to, and following Russia’s invasion of Ukraine that began on 24 February 2022, energy prices surged as commodities traders fretted about the outlook for energy supply amidst a protracted conflict and Western sanctions on Russian energy.

Amidst talk of $150/bbl oil, prices for brent crude ultimately peaked on 8 March 2022 at a few dollars above $130/bbl.

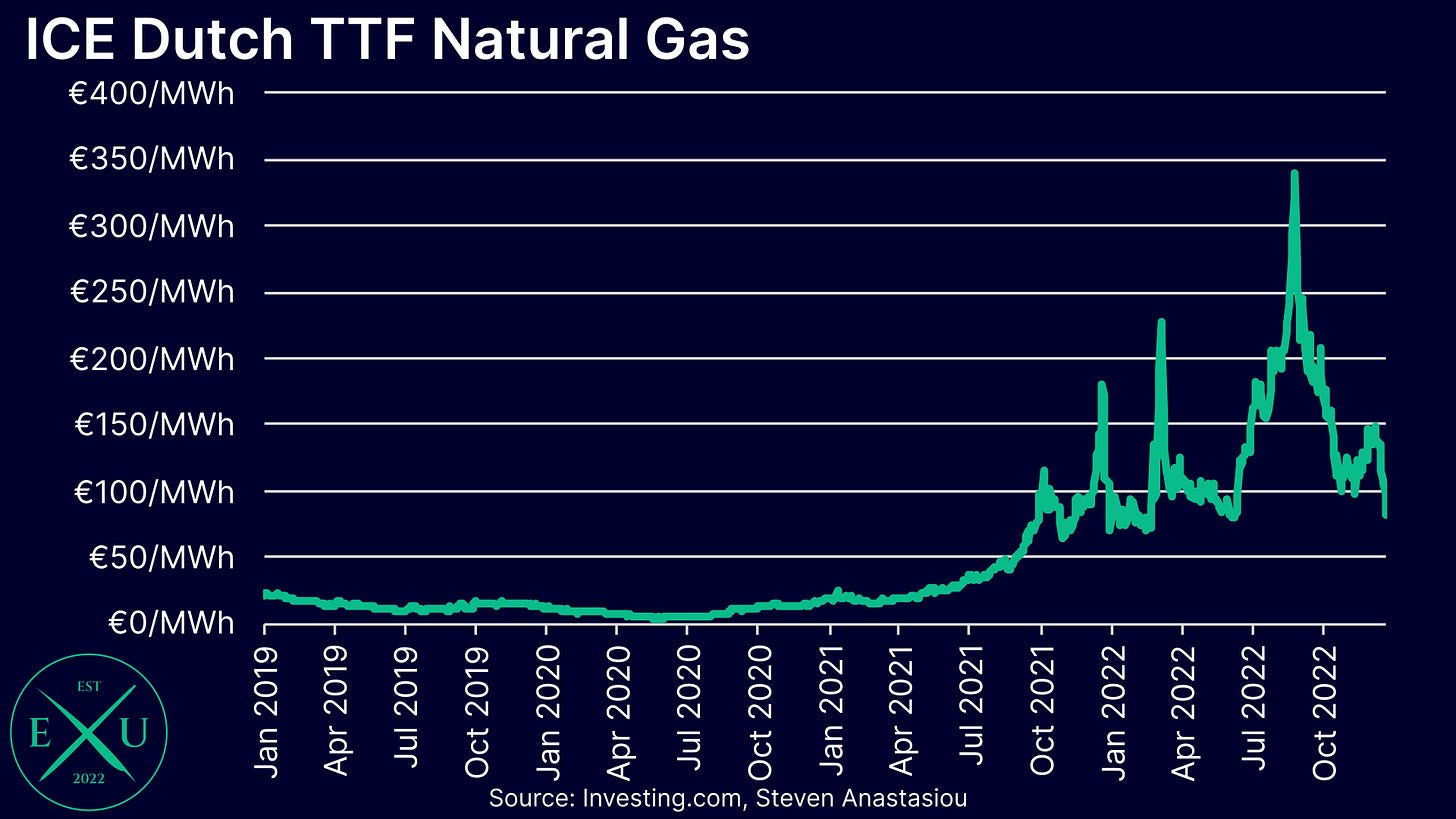

With the West articulating a raft of sanctions on Russian energy, oil wasn’t the only form of energy that saw its price surge. Coal and gas prices also rose significantly — though these commodities would see another surge later in the year as European nations rushed to fill up their natural gas reserves ahead of the winter.

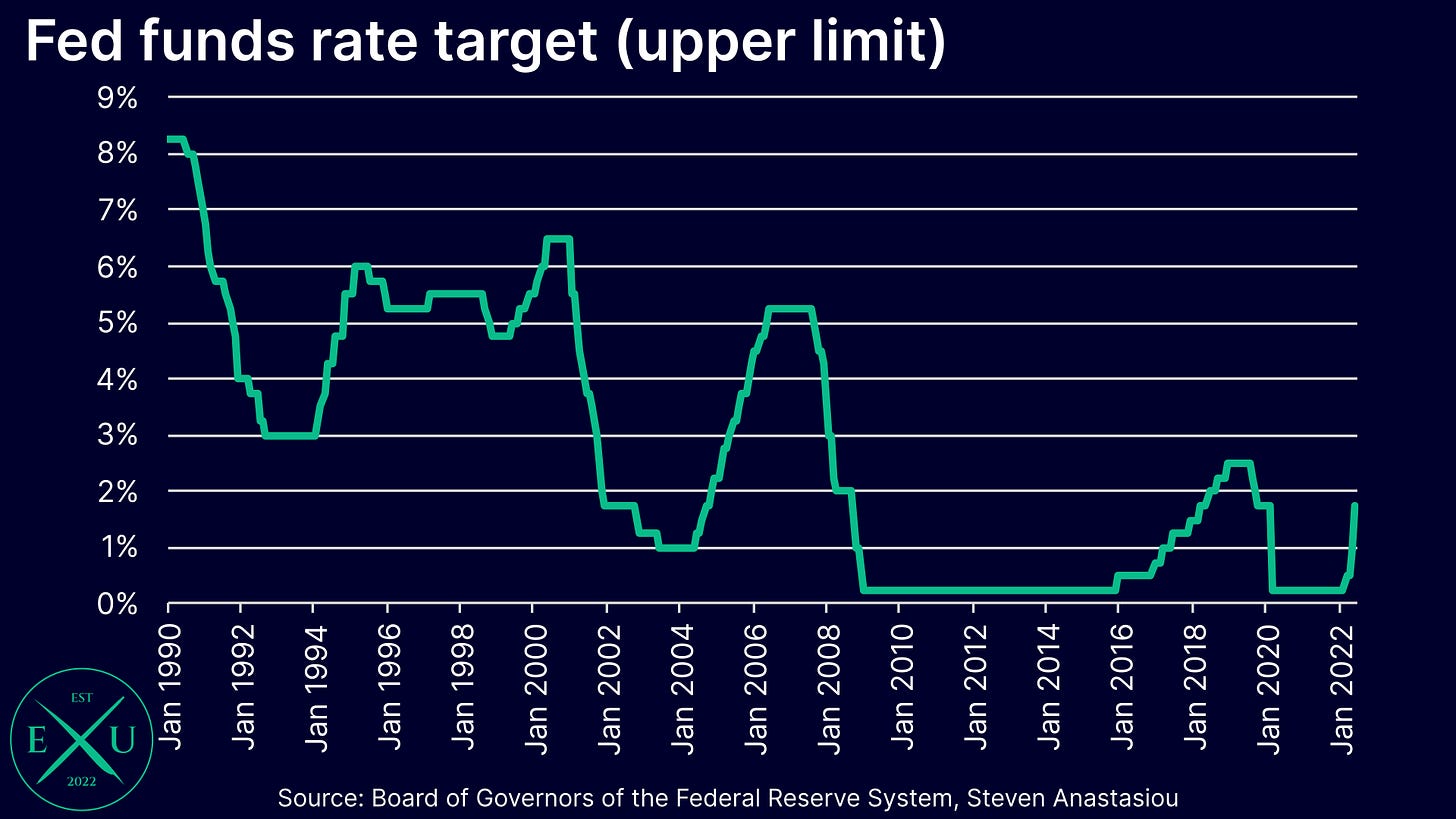

16 March: Fed raises rates 25bps

After watching inflation surge from 1.4% in January 2021 to 7.9% in February 2022, the Fed FINALLY decided to raise interest rates, taking them from 0.0-0.25% to 0.25-0.50%. March also coincided with the Fed ending its latest installment of QE.

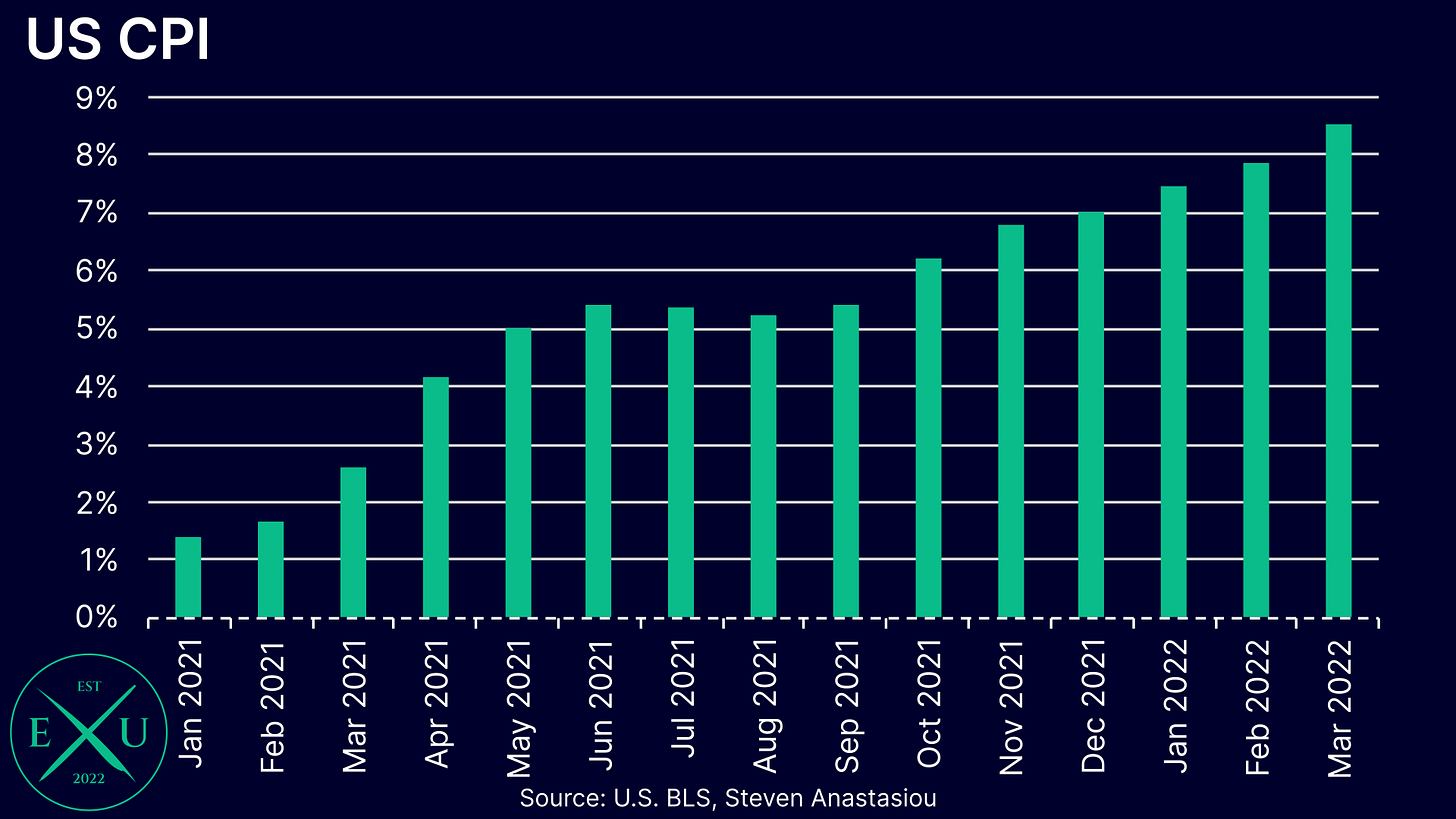

12 April: US CPI above 8% for the first time in 40 years

March’s CPI report revealed that for the first time since January 1982, US inflation was above 8%.

In a warning to those who think that inflation will remain stubbornly high for years to come, 12 months earlier in March 2021, the CPI was at 2.6%. While it can take some time to move to a higher or lower gear, once it does, inflation generally moves quickly.

4 May: Fed announces plan to reduce its balance sheet

Alongside its May FOMC meeting, the Fed announced its plans for the tapering of its balance sheet. Beginning on 1 June, Treasuries were scheduled to runoff at a maximum pace of $30bn per month, increasing to $60bn per month after three months. For agency debt and agency mortgage-backed securities, the cap was set at $17.5bn, increasing to $35bn after three months.

The S&P 500 responded by rising 2.99%. The next day it erased all those gains and more, falling by 3.44%.

So far, the Fed’s balance sheet has declined by ~$400bn since its peak level, which was reached in mid-April.

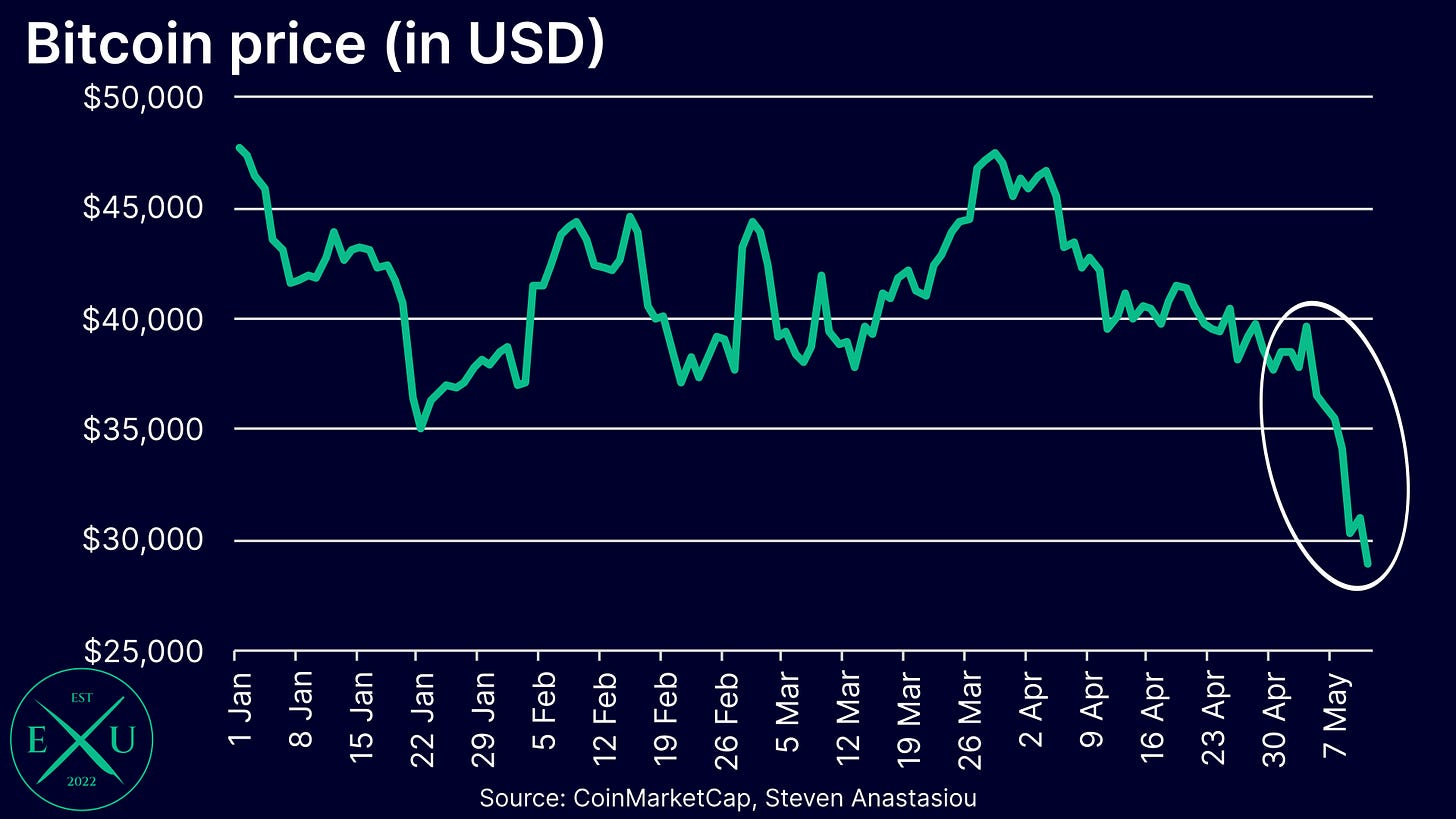

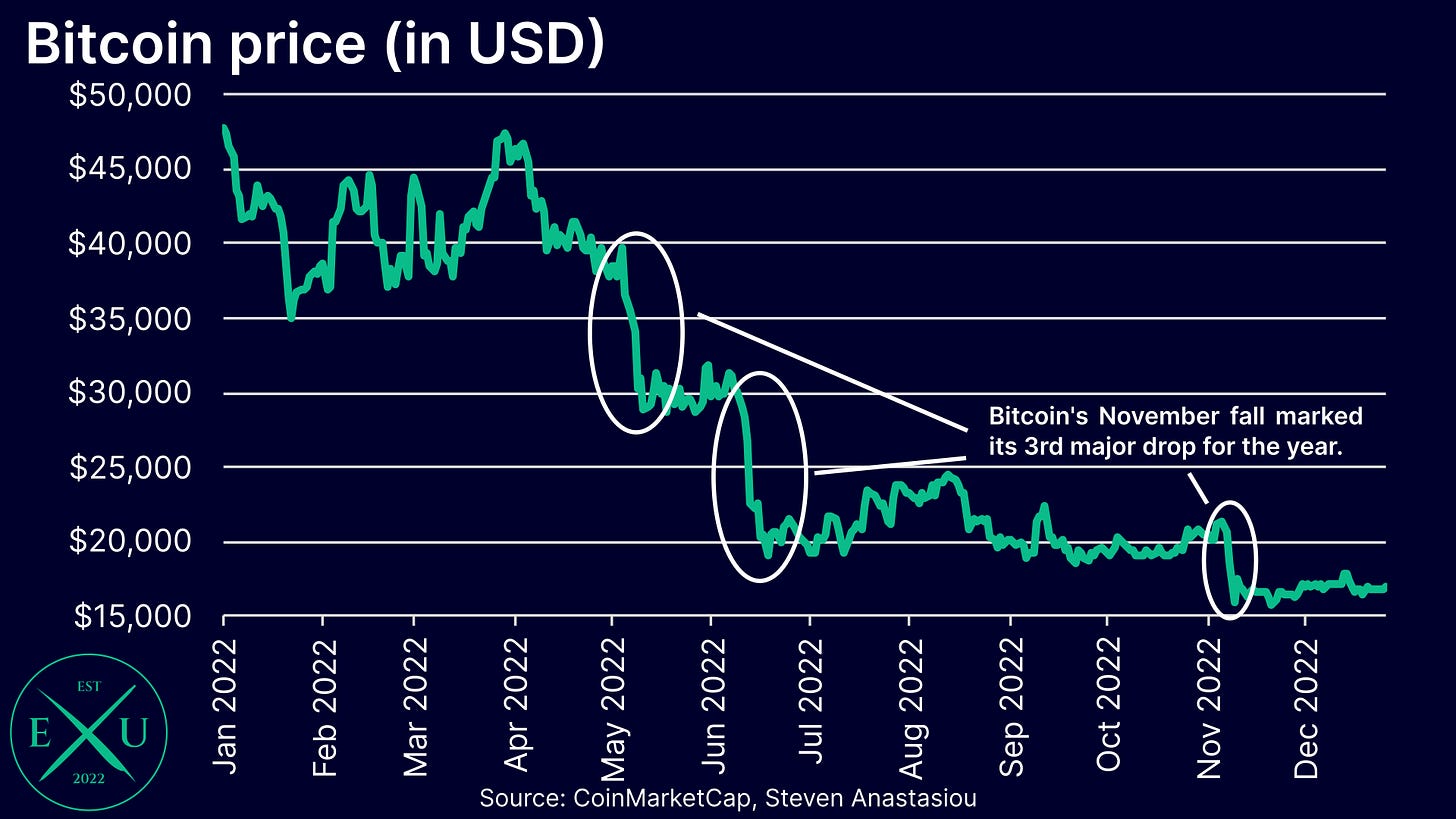

5 May: Bitcoin’s 2022 plunge begins in earnest

Following the reversal in stock markets post the Fed’s decision to begin reducing the size of its balance sheet, bitcoin prices TANKED. From a closing price of $39,698 on 4 May, Bitcoin fell 27.1% to $28,936 on 11 May.

This marked the beginning of 2022’s major decline in bitcoin prices, which would go on to see another two significant weekly declines over the remainder of the year.

15 June: Fed raises rates by an historic 75bps

After Fed Chair Powell stated at his May FOMC press conference that the Fed was not actively considering a 75bps hike … the FOMC decided to raise rates 75bps at the very next meeting. This was the first time that the Fed had raised rates by 75bps since November 1994.

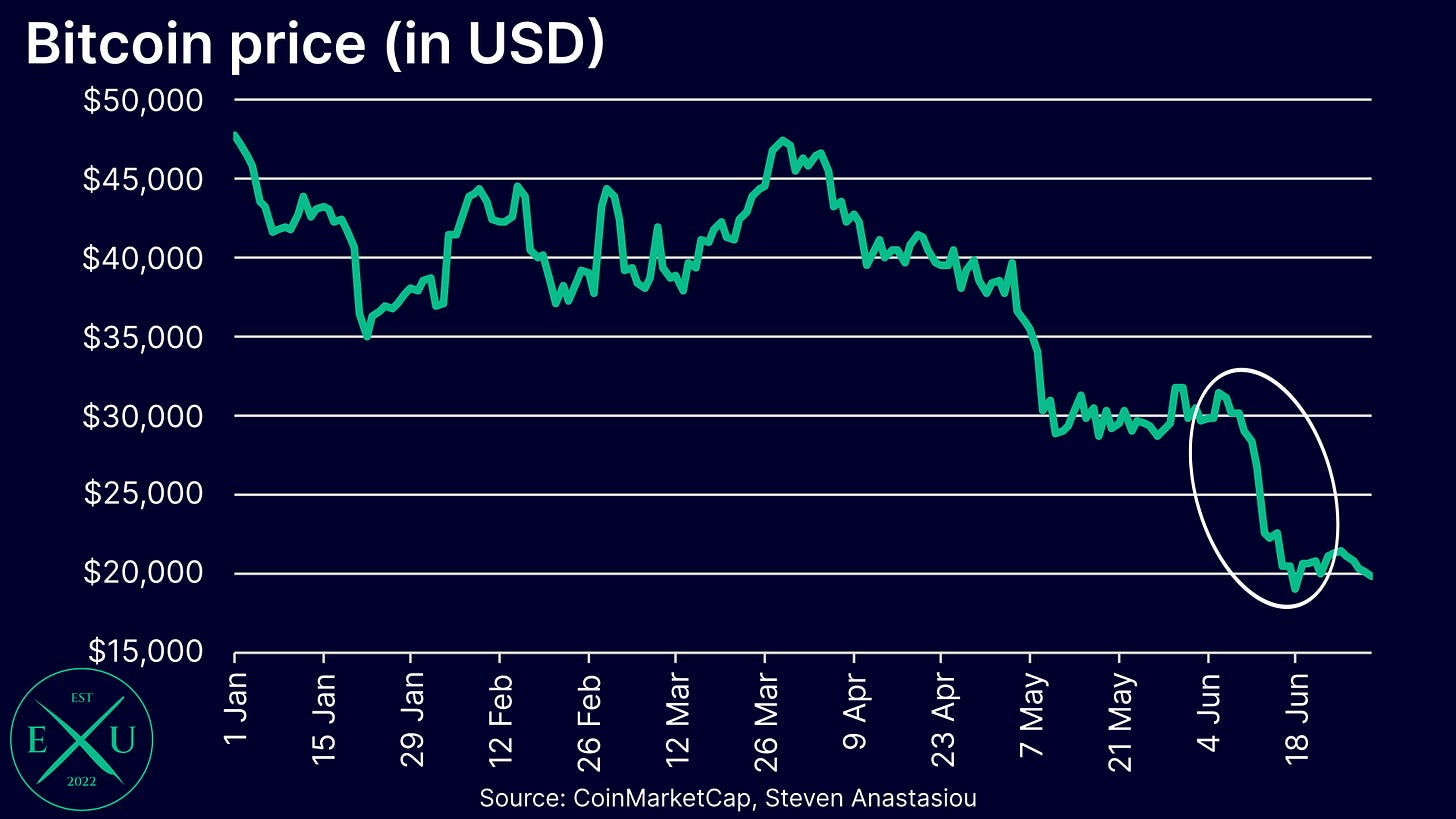

18 June: Bitcoin falls below $20k amidst stock market rout

After seeing its first major and sustained decline for the year in May, bitcoin saw its second major decline in June. With bitcoin above $30,000 on 10 June, its price breached not only $20,000, but $18,000 at its low on 18 June.

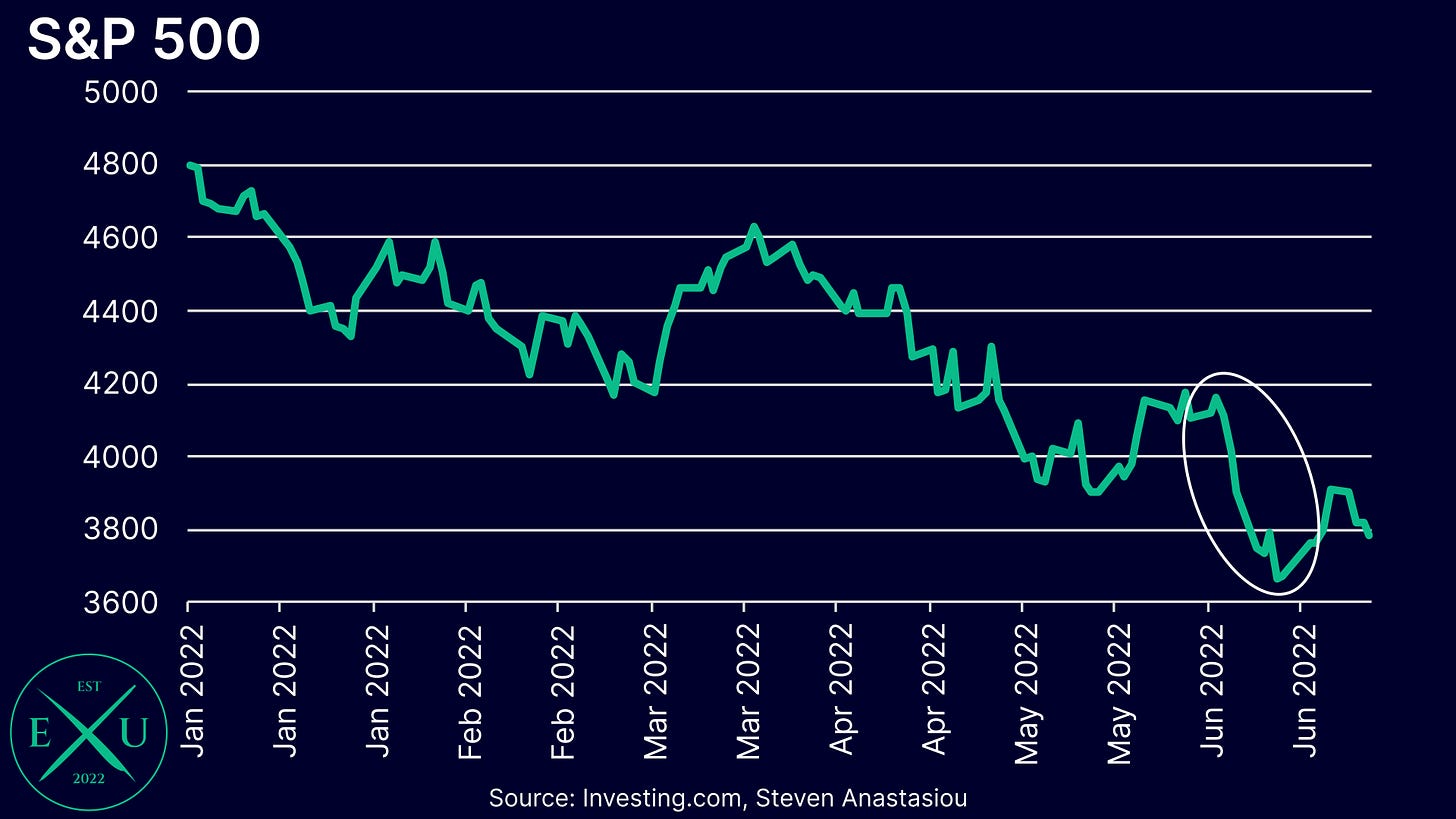

Bitcoin’s decline came amidst a major decline in the S&P 500, which occurred in the lead-up to the Fed’s June meeting that saw the index fall from 4,160 on 7 June, to under 3,700 on 17 June.

13 July: US CPI peaks at 9.1% YoY

After months of continued growth in inflation, the release of June’s CPI data saw inflation hit 9.1%. This represents the peak of the current high inflation cycle, and was the highest CPI reading since November 1981.

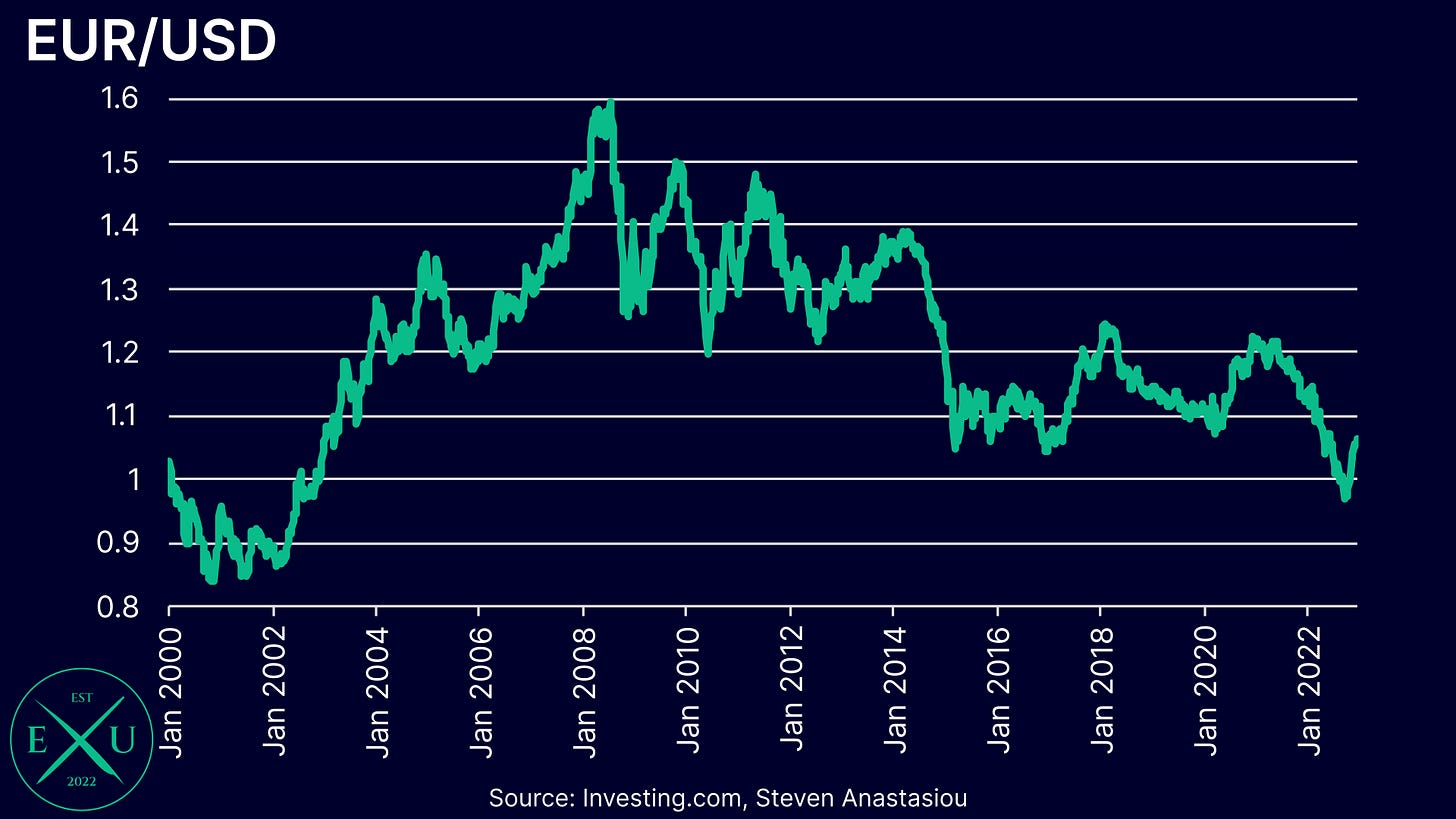

22 August: Euro/USD begins an extended period below parity for the first time in 20 years

With the Fed continuing to aggressively raise interest rates, the USD stormed higher versus many currencies in 2022. With Europe impacted by surging energy costs in the wake of its decision to reduce its reliance on Russian energy, the euro was one of the currencies that the USD moved higher against for much of 2022. On 22 August the EUR/USD pair fell below 1 for the first time since December 2002.

26 August: European natural gas prices surge as nations rush to fill up reserves

With most European nations looking to eliminate Russian supplies from their energy mix, the race was on to fill gas storages before cold winter temperatures arrived. With Europe needing to turn significantly to the spot market in order to secure supplies like LNG and coal, prices surged.

Europe’s TTF natural gas benchmark peaked at just under €340/MWh on 26 August, a whopping 383% higher than the level it was a year prior. As European storages filled, natural gas prices have fallen, though they remain well above pre-COVID levels.

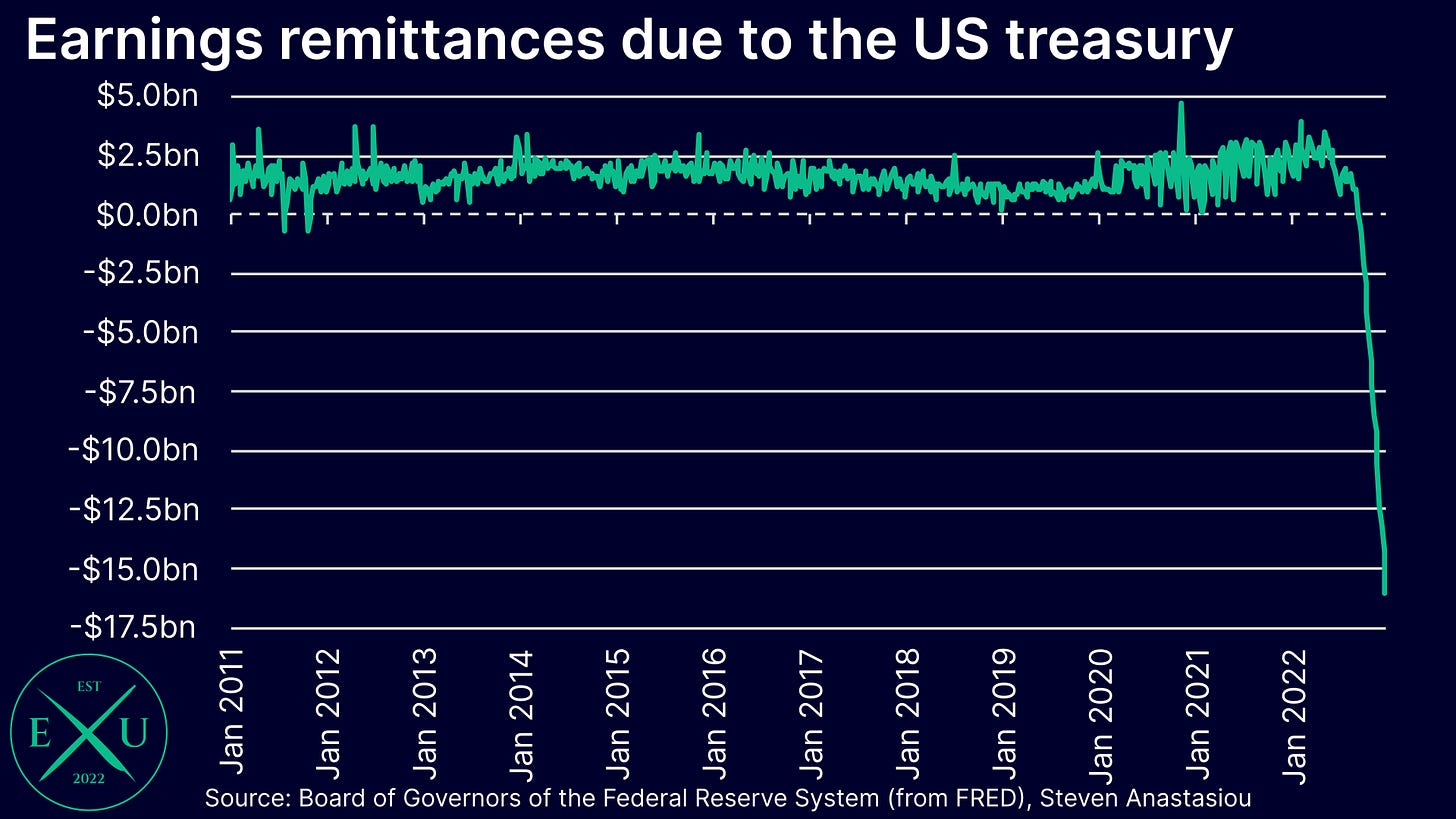

7 September: Fed records its first weekly operating loss since November 2011

As the Fed ramped up its interest rate increases, so to did the interest expense that it pays on reserve balances. With the Fed’s interest income including trillions of dollars of assets purchased at historically low rates, the Fed began to record weekly operating losses in September. Those losses have now accumulated to over $16bn.

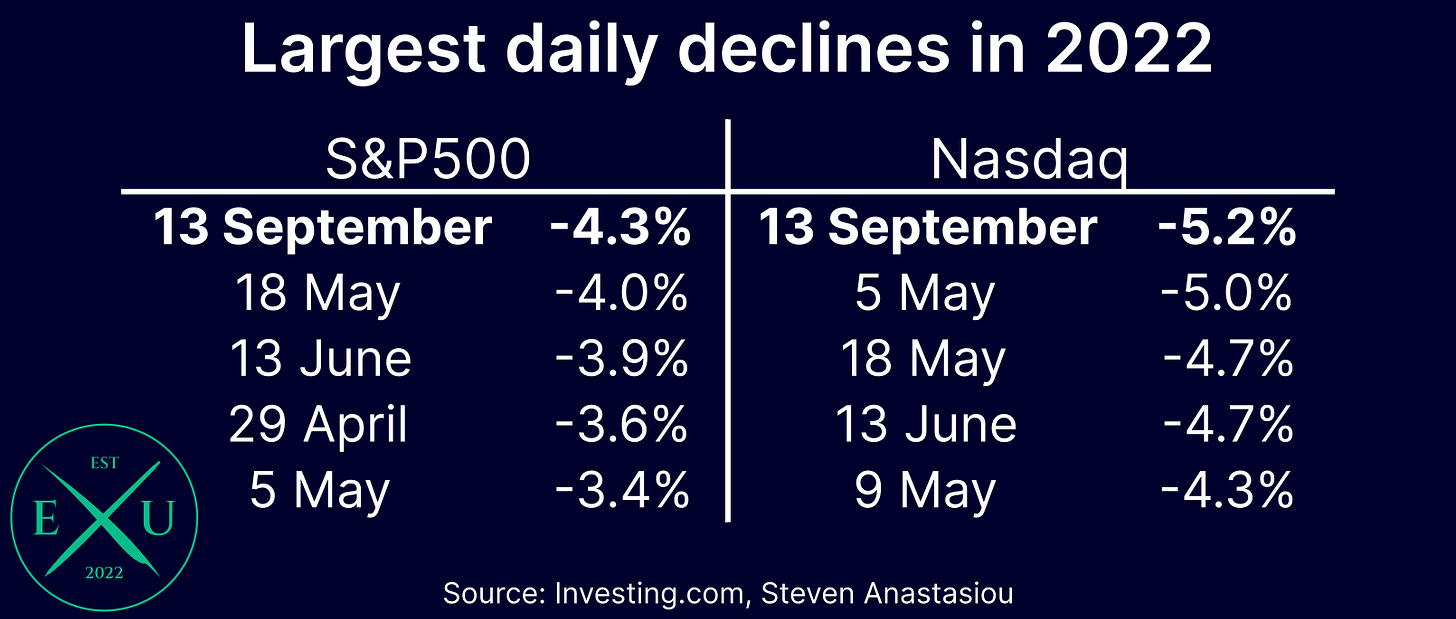

13 September: S&P 500 plunges 4.3%, Nasdaq down 5.2% on hotter than expected CPI report

After the stock market rallied in each of the prior 4 days, the conditions were set for a negative CPI surprise to deliver a major shock for equity investors. With the CPI coming in hot at 8.3% (vs 8.1% market consensus), and core CPI coming in at 6.3% (vs 6.1% market consensus), a major shock for equity investors was indeed what occurred.

The S&P 500 plunged 4.3%, whilst the Nasdaq saw an even larger fall, declining by 5.2%. These were the largest declines seen in 2022 (unless either Thursday or Friday’s trading sessions manage to top it!)

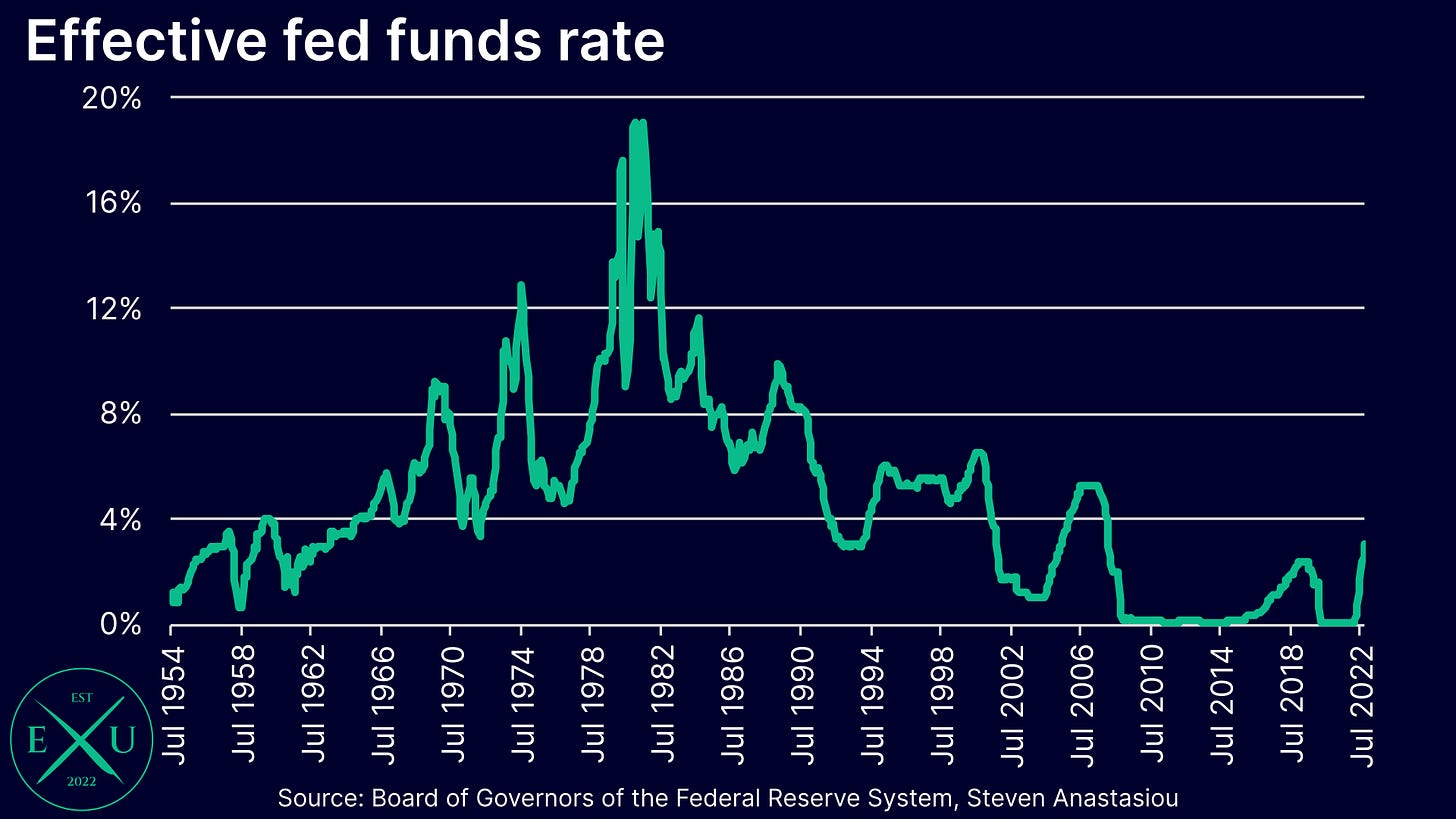

21 September: Fed raises rates above the peak of the previous rate cycle for the first time in ~40 years

After raising interest rates again in September, for the first time in over 40 years, the federal funds rate EXCEEDED the peak of the previous cycle.

This is yet another mark of how significant the Fed’s current round of tightening is, for an inflationary monetary policy that encourages more and more debt generally necessitates lower and lower interest rates in order to ensure that debt burdens do not become overly burdensome.

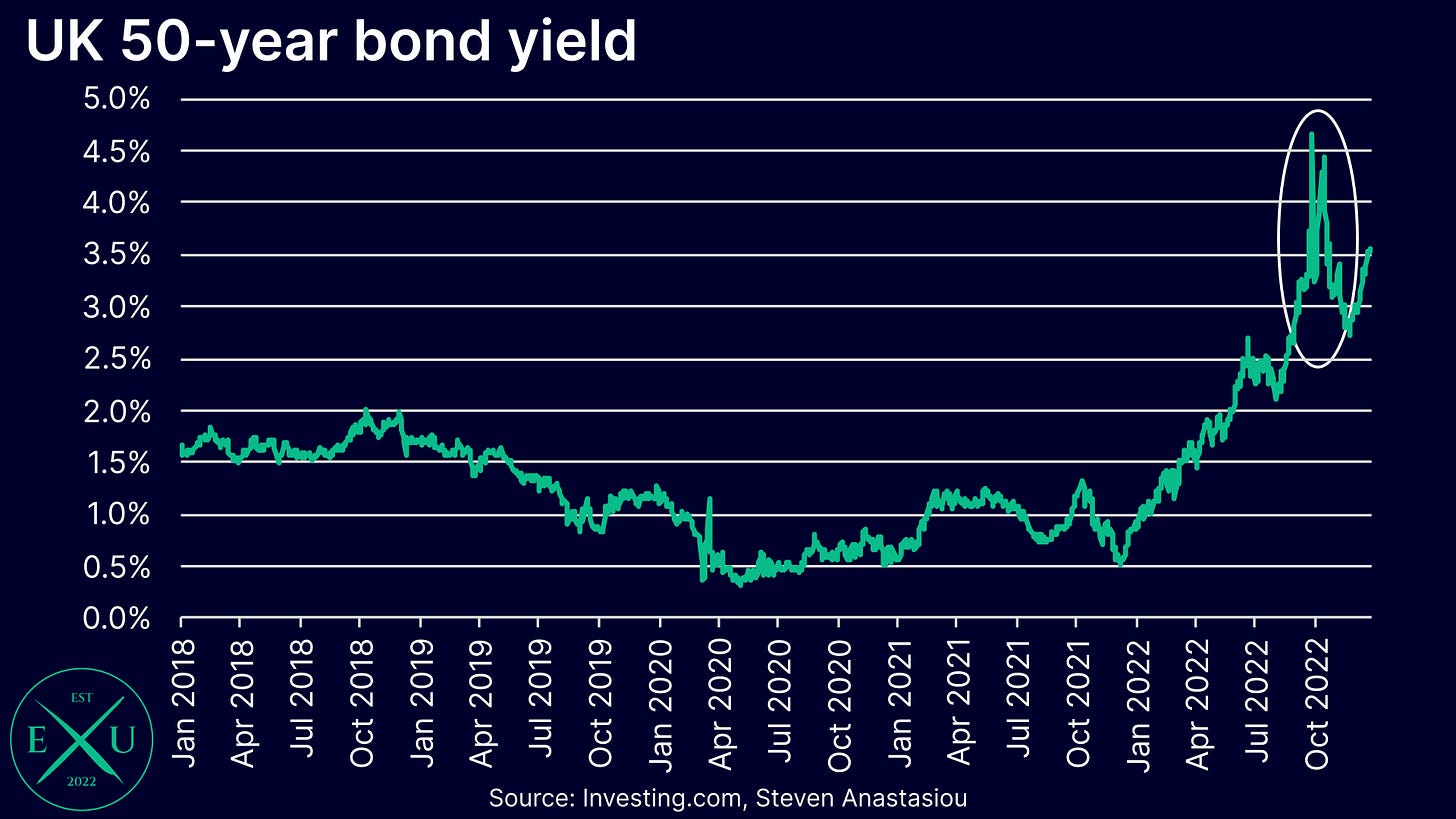

28 September: BoE intervenes to prevent contagion from plunging bond prices

Amidst spiraling energy prices and a new UK government budget that spooked markets, England had a mini-crisis on its hands. With financial markets fast losing confidence, the pound was plunging, and bond yields saw an enormous spike.

It wasn’t long before the BoE intervened. In order to stem the bleeding in long-dated bond prices, the BoE committed to purchasing bonds with maturities of more than 20 years in the secondary market. In so doing, the BoE was able to lower yields, helping British pension funds that were at risk of calamitous outcomes as a result of employing leverage in their investment schemes.

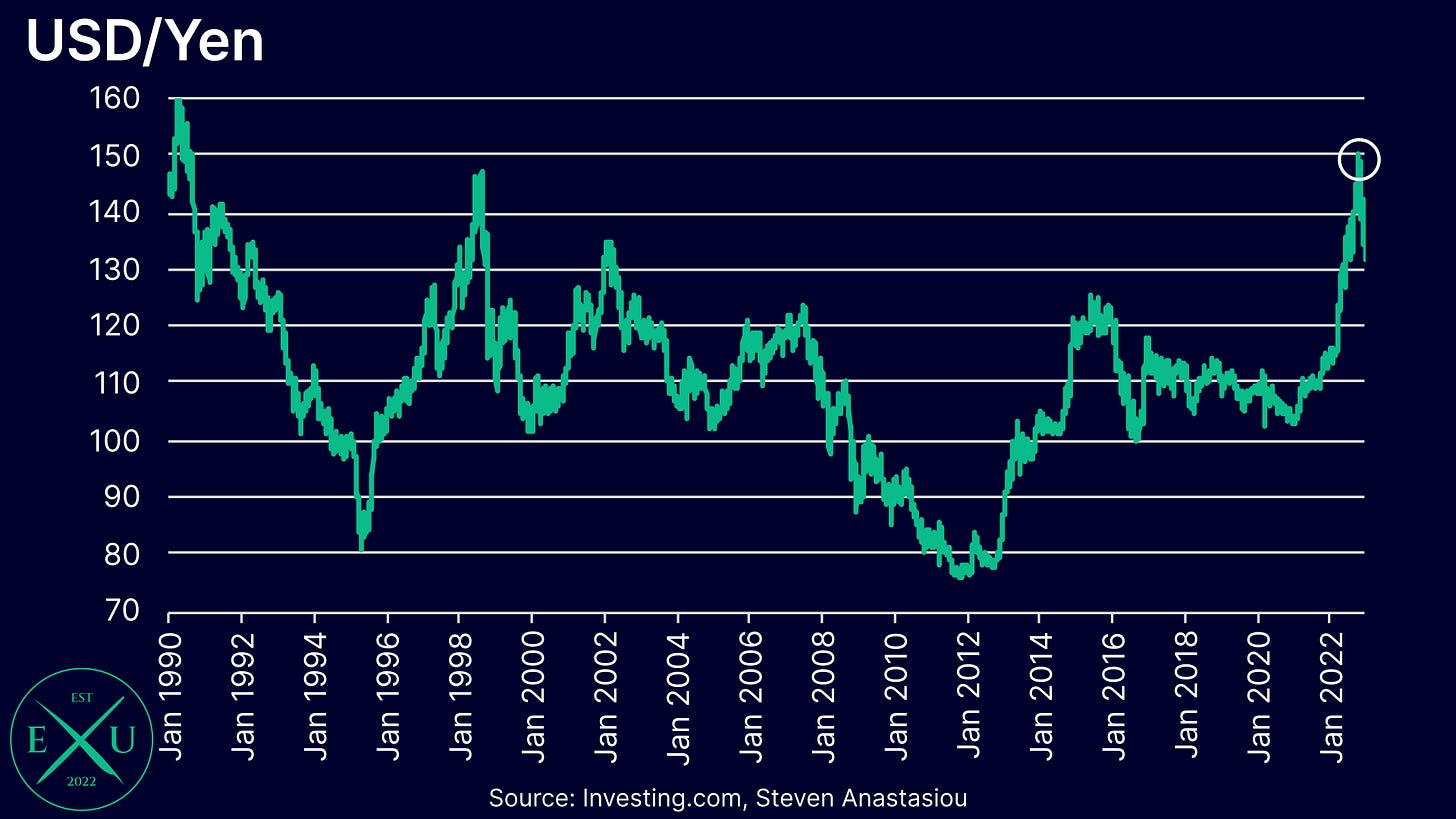

20 October: USD/Yen breaches 150 for the first time since 1990

With the Fed aggressively tightening interest rates, and the Bank of Japan maintaining some of the most dovish monetary policy in the world, the yen has depreciated significantly against the USD during the past ~year.

This depreciation culminated in the USD/Yen breaching 150 in October for the first time in over 30 years.

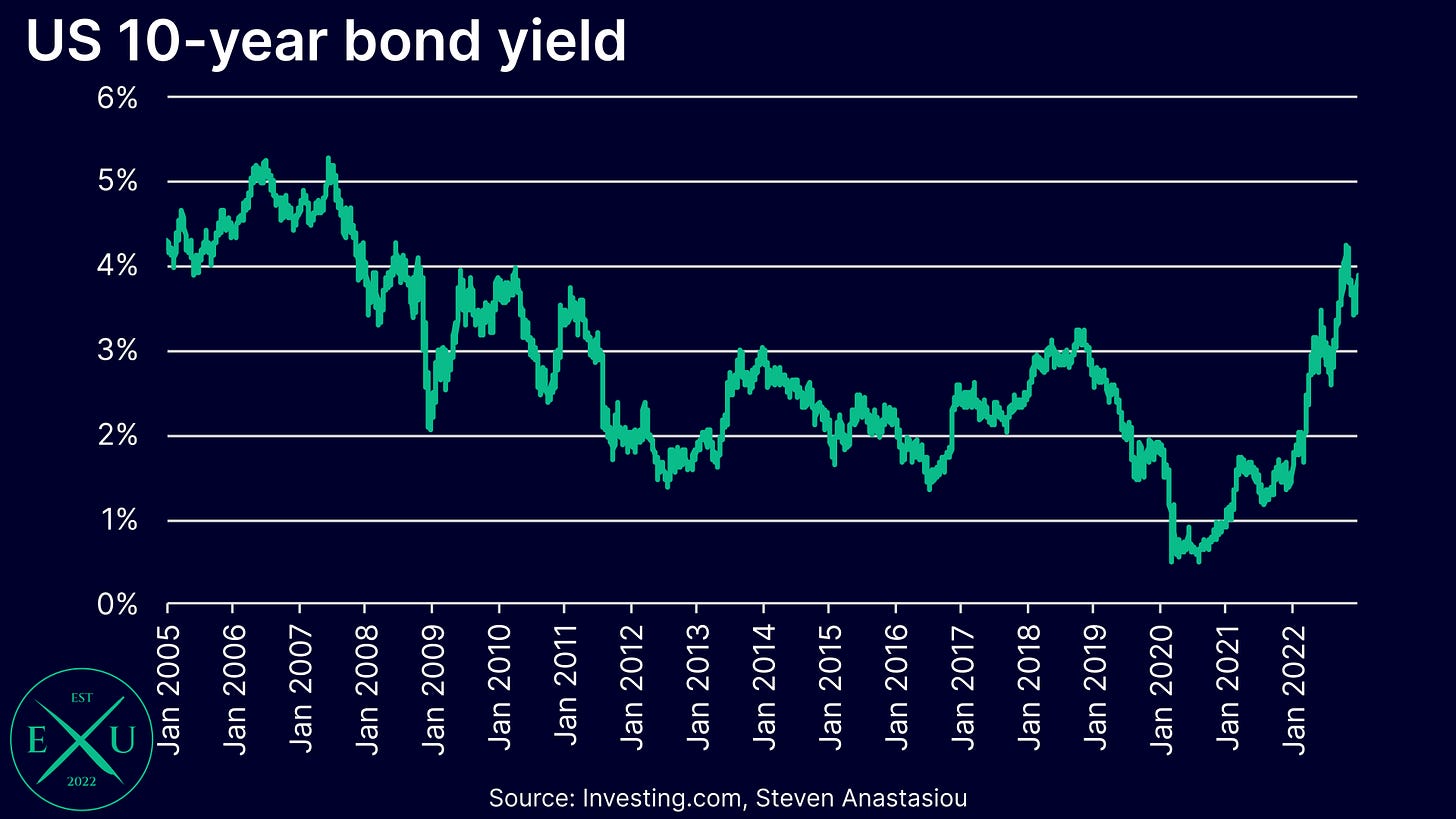

24 October: US 10-year bond yield breaches 4.2% — levels not seen since 2008

A major reason for the USD’s strength in 2022 was the surge in US bond yields that came alongside the Fed’s hawkish actions and rhetoric. The most recent peak in 10-year bond yields was on 24 October, where yields closed at 4.24% — the highest level seen since 2008.

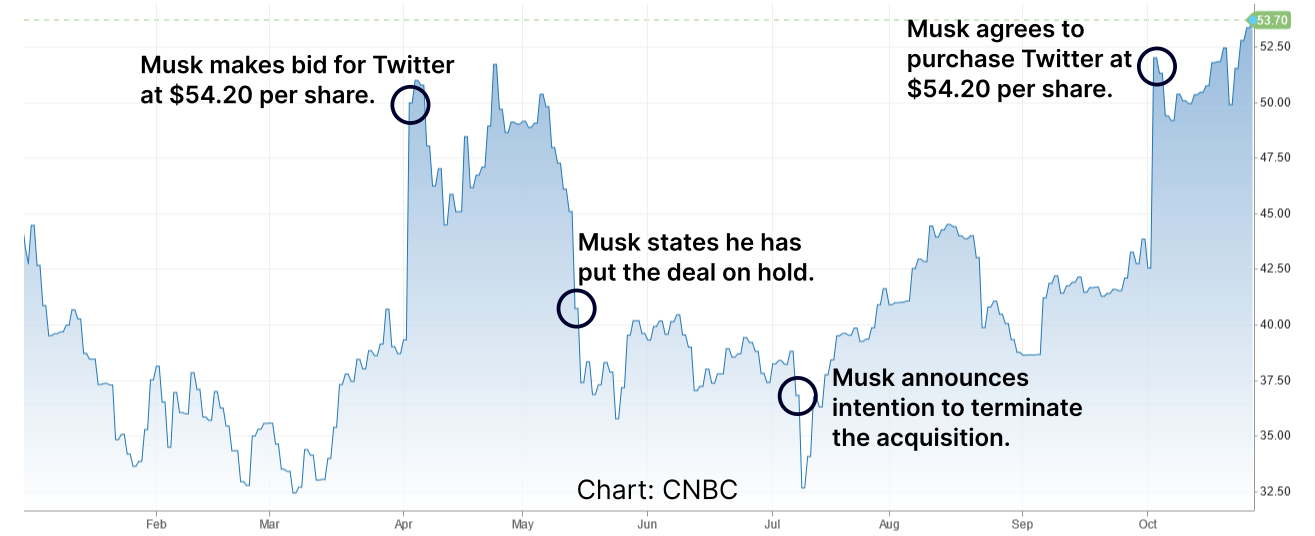

27 October: Twitter acquired by Elon Musk

An article about the biggest stories in economics & finance for the year would generally not be complete without a major IPO or M&A transaction. 2022’s biggest such event was clear: Elon Musk’s acquisition of Twitter.

After making an initial bid in April, Musk then attempted to terminate the acquisition, only to later change course again, with Musk completing the $44bn acquisition in October.

9 November: Bitcoin falls below $16k as crypto exchange FTX collapses

One of the biggest financial news stories of the year was the collapse of crypto exchange FTX. With FTX’s long-list of celebrity affiliations and endorsements (and political donations), FTX’s collapse caught many off-guard. It set Twitter alight, and has sparked ongoing criminal investigations in the US.

The news sent Bitcoin plunging for the third time this year, this time falling from just under $20,600 on 7 November, to firmly breach the $20,000 barrier, closing below $16,000 on 9 November. Bitcoin has traded well below $20,000 ever since.

Meanwhile, the FTX Token declined 89.7% over the same two days, from $22.1 to $2.3. It has since continued to fall, and is now under a dollar at $0.88. Though in spite of all that has gone on, somehow, the FTX token is still valued at ~$290m according to CoinMarketCap data?

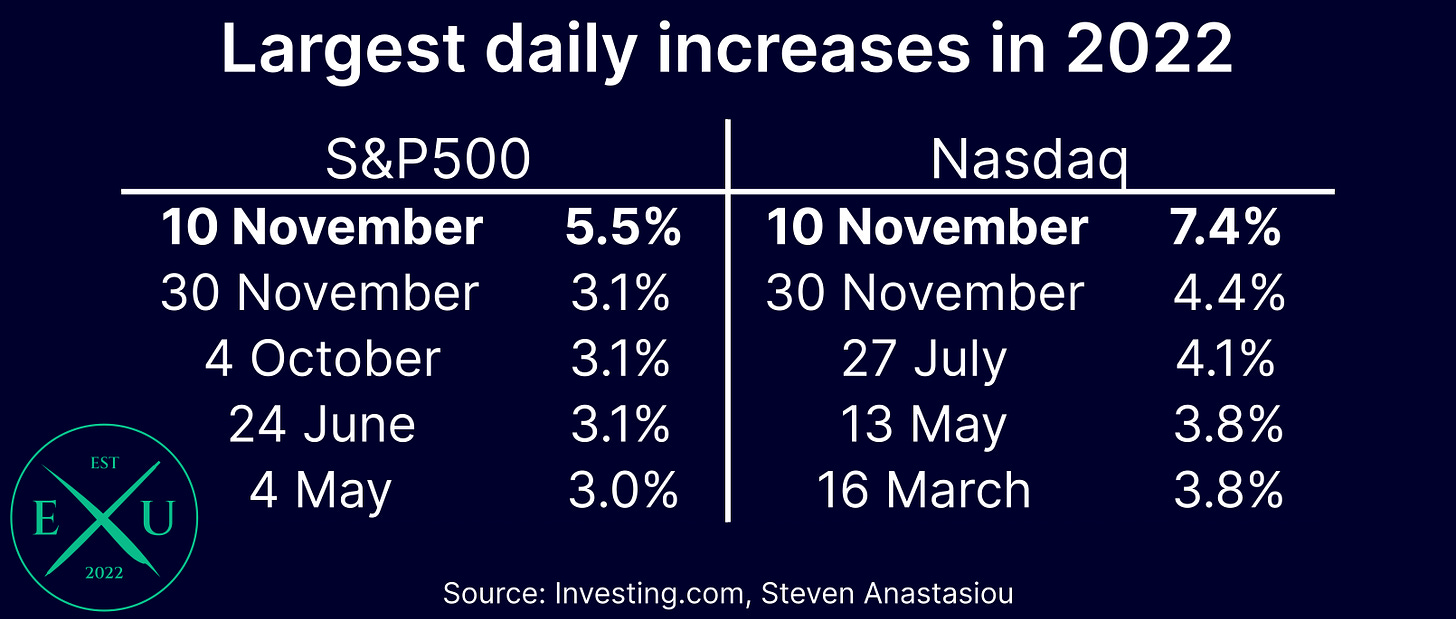

10 November: Lower than expected inflation sees the S&P 500 surge 5.5%, Nasdaq up 7.4%

After a string of hot inflation reports as the Fed and market participants continually underestimated inflation, October’s CPI report delivered a positive surprise!

The report came in softer than expected at 7.7% (versus 8% consensus forecast), while core CPI came in at 6.3% (vs 6.5% consensus forecast).

Stock markets surged, reveling in a positive CPI surprise. The S&P 500 rose by 5.5% (its largest one day increase since the depths of the COVID market volatility in March and April 2020), whilst the Nasdaq saw an even larger increase — rising 7.4%!

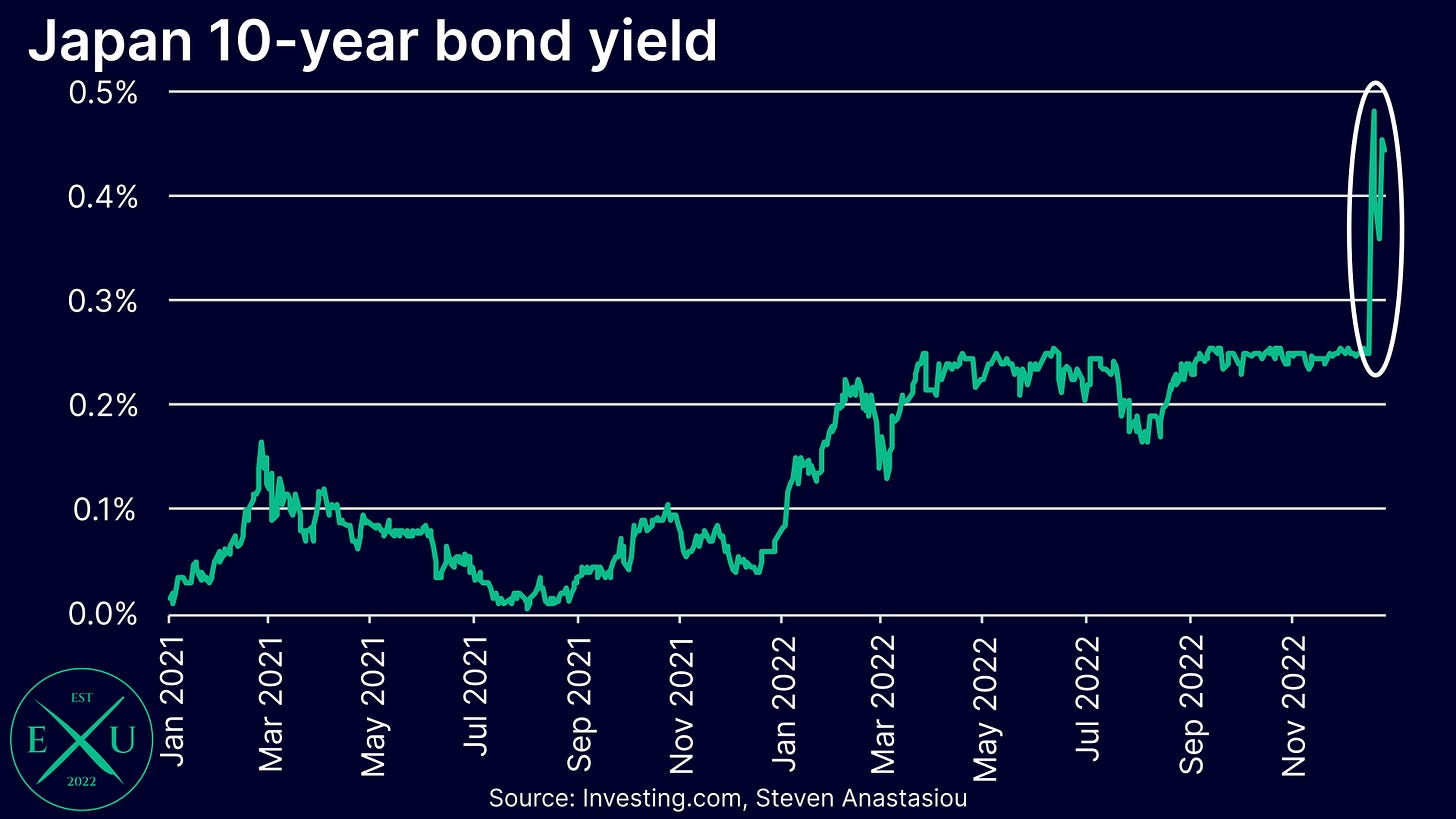

20 December: BoJ widens its YCC

With Japan’s yield curve suggesting that the BoJ’s 10-year yield target band was widely out-of-step with market pricing, the BoJ decided to widen its YCC band. The BoJ will now tolerate the 10-year bond trading within a 50bps range of its 0% target, up from 25bps previously.

Indicating how out-of-step the 25bp cap was with market expectations, in response to the widening of the band, the 10-year yield rocketed higher, closing up 64.5% on the day of the announcement.

Any key events that you think I missed? Feel free to share them in the comments below!

Merry Christmas to all of my followers and thank you all for continuing to read and support my work!

I wish you all a happy new year ahead, and look forward to providing you with many more important updates across 2023!

In order to help support my work, please consider liking and sharing this article. If you haven’t already, please also consider subscribing — it’s free!