5 key take-outs from Fed Chair Powell's latest speech

On 30 November, Fed Chair Powell delivered a speech entitled, Inflation and the Labor Market, at the Hutchins Center on Fiscal and Monetary Policy. Markets surged on the back of this speech, with the S&P 500 closing over 3% higher. Gold and many government bond prices also saw strong gains.

After reviewing Powell’s speech and the market reaction, here’s my 5 key take-outs:

1) Powell did not outline a more aggressive terminal rate tilt

While other Fed speakers have spoken about the potential need for a much higher terminal rate in recent weeks, Powell instead reiterated his previous vague commentary, again simply stating that he believes that the terminal rate will likely be higher than thought at the time of the Fed’s September Summary of Economic Projections (SEP). The FOMC’s September projections had outlined a median terminal rate forecast of 4.6% in 2023.

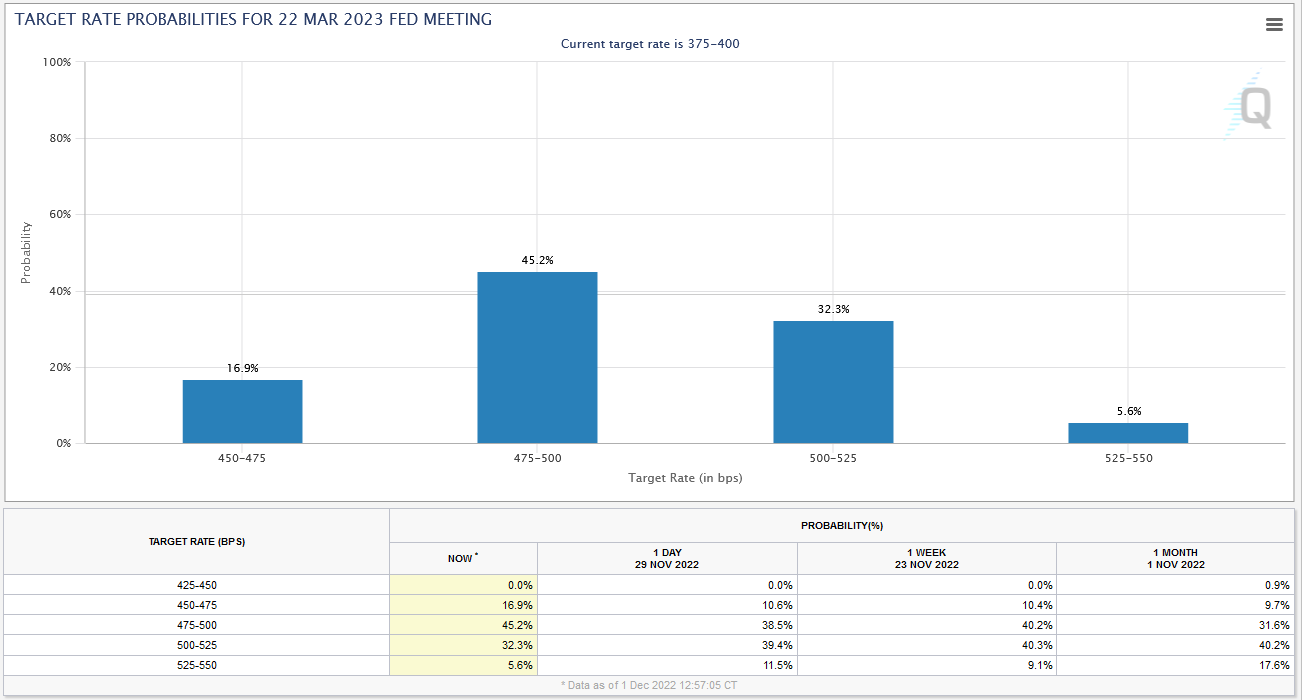

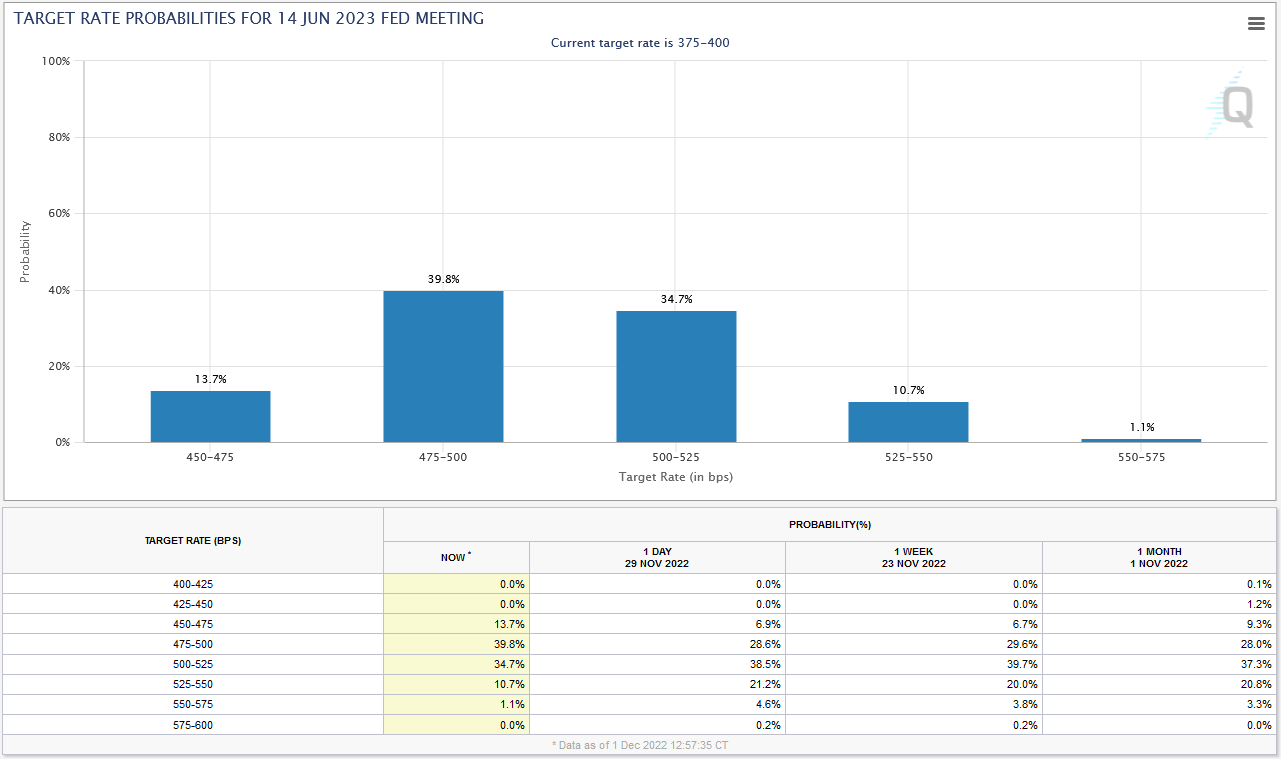

The market has thus already been pricing in a higher terminal rate than the September FOMC projection for some time. Before Powell’s speech yesterday, the market had assigned the greatest probability to a peak fed funds rate of 5.00-5.25%. Powell chose not to provide more specific detail on where he saw the level of the terminal rate, such as whether or not he believed it would need to be above 5%. In conjunction with the rest of Powell’s speech, markets responded by lowering their terminal rate expectation, with the greatest probability now assigned to a terminal rate of 4.75-5.00%.

2) Powell did not specifically state a preference to overtighten

In particularly hawkish remarks at his November FOMC press conference, Powell noted that whilst the Fed doesn’t want to overtighten, he is much more comfortable with overtightening than undertightening, given his belief that the Fed has the necessary tools to deal with such a scenario.

Given that I strongly disagree with such rhetoric, as the Fed’s “tools” only serve to increase inflation, wealth inequality and the accumulation of debt, the absence of this rhetoric in Powell’s latest speech was something that I thought was important.

3) Powell laid the groundwork for looking at inflation ex-shelter

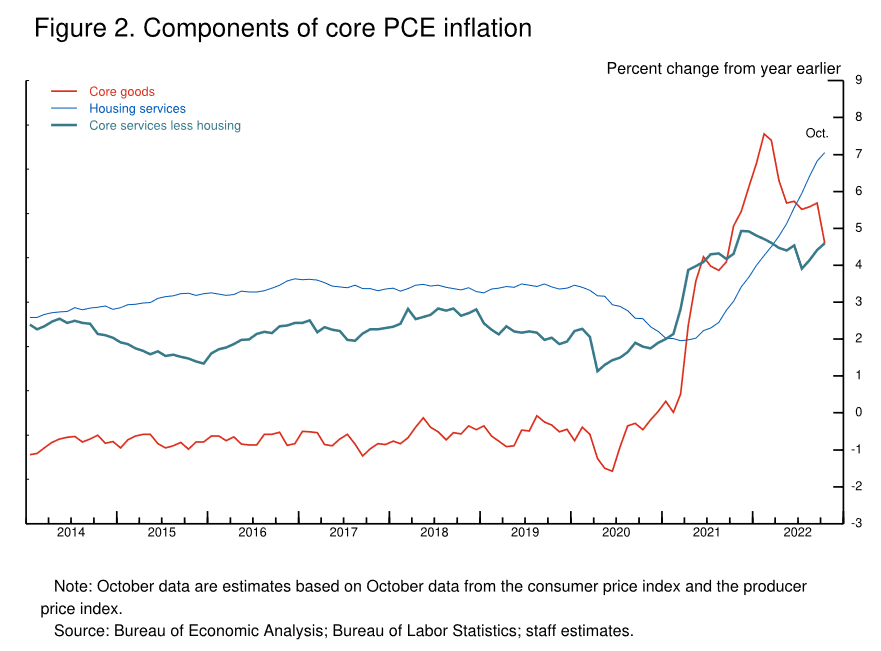

What I viewed as the most critical piece of information from Powell’s speech, was the manner in which he broke down core PCE inflation into three key categories: core goods, housing services, and core services ex housing. This is a similar approach to the manner in which I analyse inflation, and one which lays the groundwork for shifting Fed policy in the future, should lagging shelter costs not reflect the change in broader prices over the next 12 months.

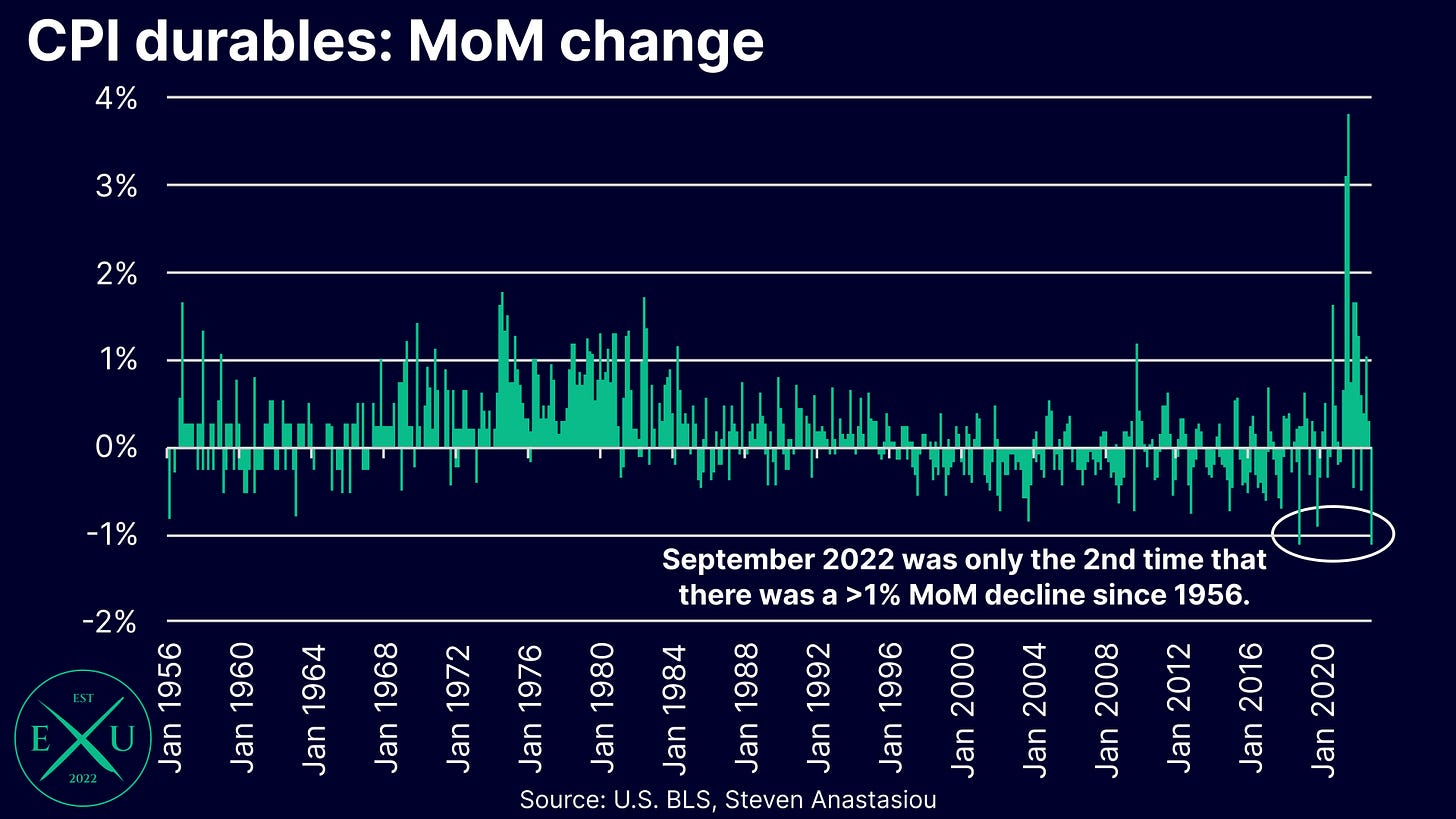

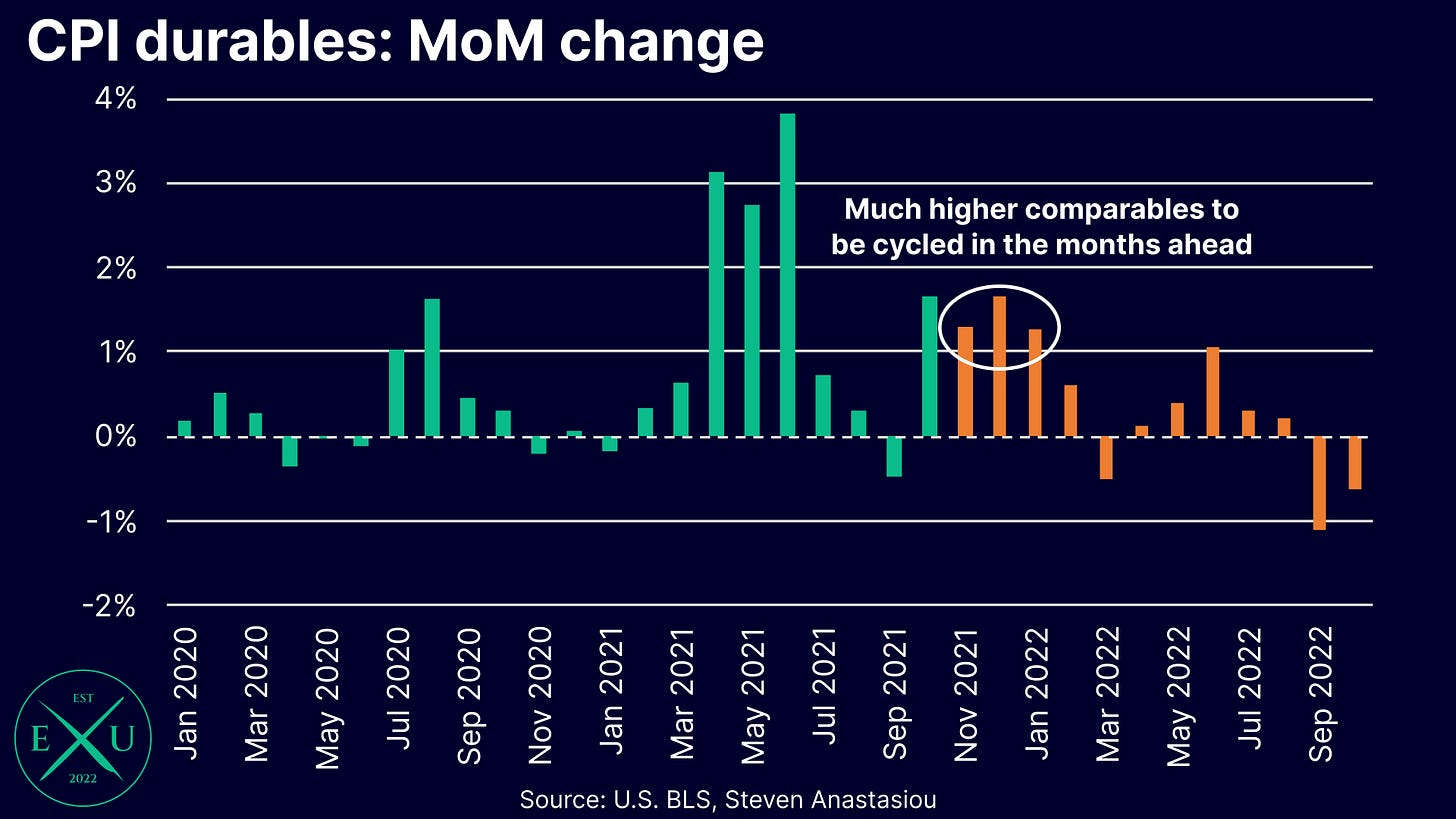

Powell rightly noted that goods inflation has moved down from very high levels and that “if current trends continue, goods prices should begin to exert downward pressure on overall inflation in coming months.”

The decline in CPI goods prices has been particularly notable in recent months, where some MoM price DECLINES have been amongst the largest ever recorded.

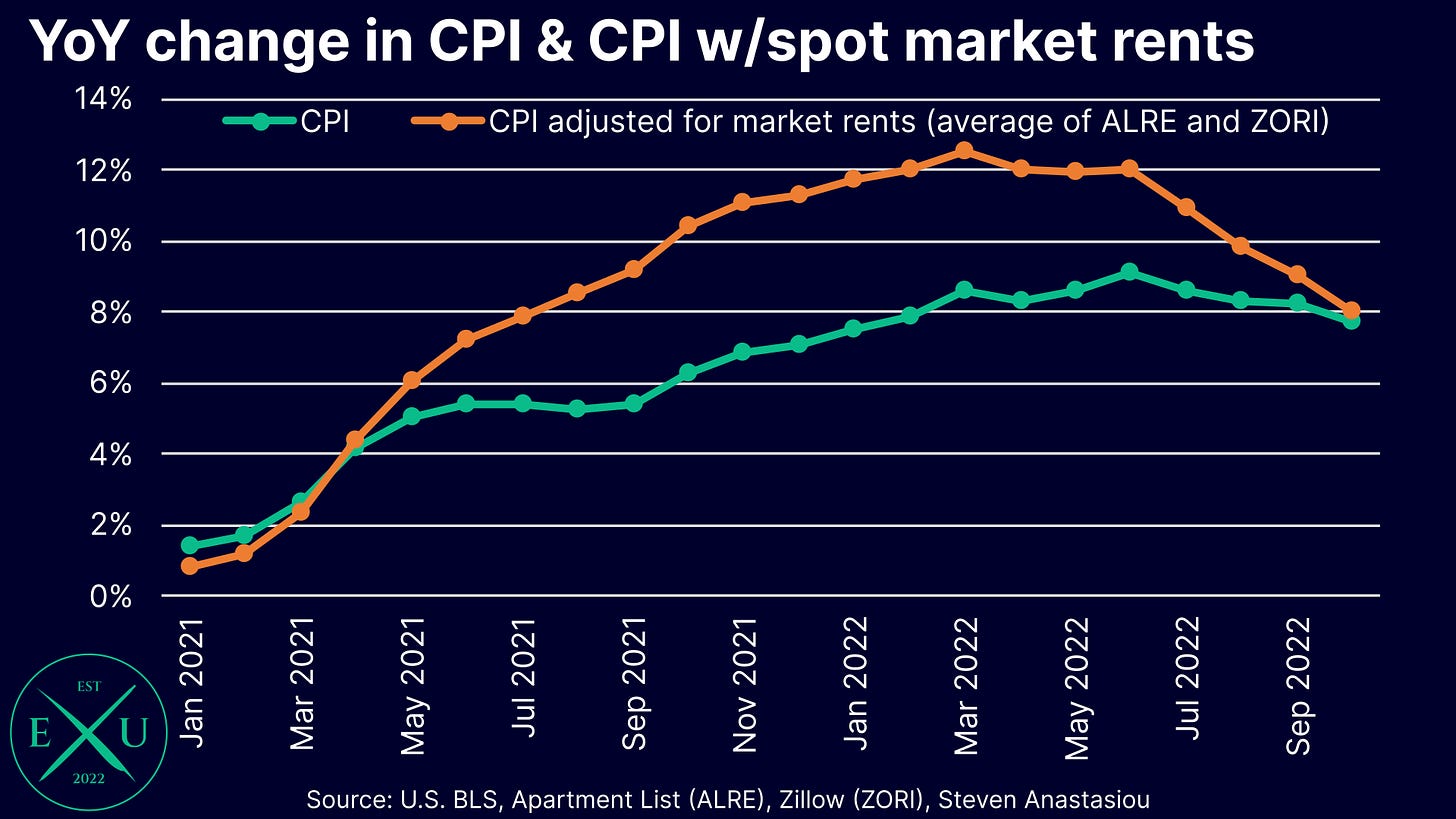

Powell also VERY CRITICALLY noted that while housing services inflation has continued to rise, that it “tends to lag other prices around inflation turning points” and that “the market rate on new leases is a timelier indicator of where overall housing inflation will go over the next year or so”.

For many months now I have been stating that by ignoring the lagging nature of shelter costs, the Fed risks major overtightening and a severe recession. As recently as the November FOMC press conference, Powell noted the following in response to a question on the topic of rental price measurement:

"The measure that’s in the CPI and the PCE, it captures rents for all tenants, not just new leases. And that makes sense … that’s sort of the right target for monetary policy…. I would say that in terms of the right way to think about inflation, really, is to look at the measure that we do look at [i.e. PCE/CPI]”.

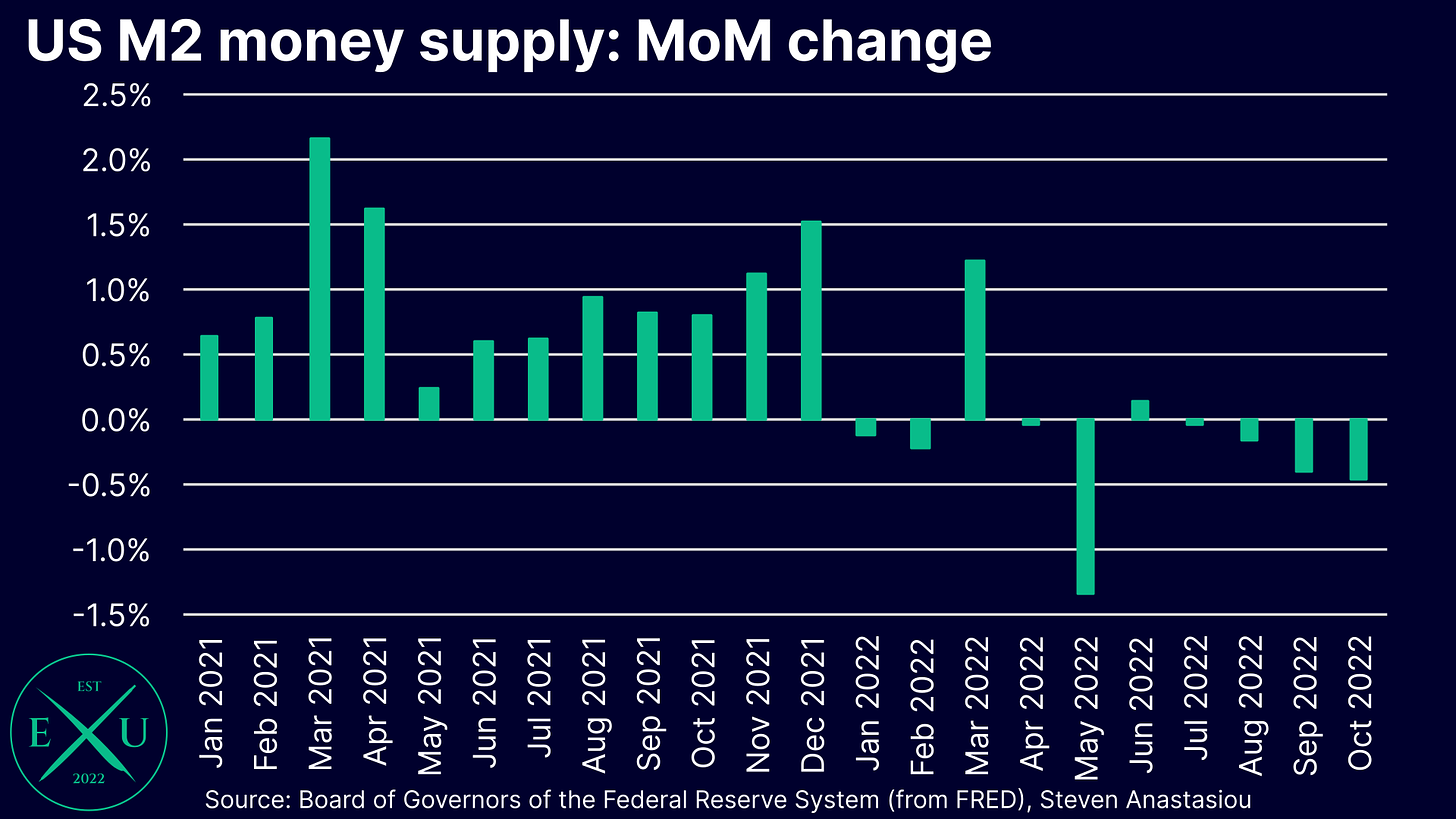

By changing his tune to now explicitly analyse inflation by given housing services its own category, Powell has now laid the groundwork for articulating inflation rates EXCLUDING shelter costs over the months ahead. This is likely to be VERY important, as when an adjustment is made to the CPI for market rents, one can see a significant deceleration in price growth from the YoY peak recorded in March. With M2 contracting and the US economy weakening, I expect this disinflationary trend to broadly continue over the year ahead. Focusing too much on lagging measures of rental prices instead risks overtightening by responding to underlying inflation with a lag.

4) Powell thinks a significant decline in labour demand is needed

Moving on to the third component of the inflation equation that Powell outlined — PCE core services ex housing. Powell points out that price changes here have not shown a clear trend over the past year. Instead, the YoY rate has largely moved sideways.

In order to reduce price growth for core services ex shelter, Powell believes that wage growth needs to fall significantly.

Powell notes that the primary mechanism which the Fed can use to achieve such an outcome, is to reduce demand. Powell noted that:

“With slower GDP growth this year, job gains have stepped down from more than 450,000 per month over the first seven months of the year to about 290,000 per month over the past three months, but this job growth remains far in excess of the pace needed to accommodate population growth over time — about 100,000 per month by many estimates.”

What’s the implication here? Powell is looking for jobs growth to not just fall to 100,000 per month, but to fall below this level in order for the ratio of available jobs to available workers, to return to a level that Powell envisages will be better aligned with wages growth that would be “consistent with 2% inflation over time”.

5) While both stocks and bonds rallied, I think that only the move in bonds makes sense

Ultimately, I agree with the markets interpretation of Fed Chair Powell’s speech as being more dovish than previous commentary. Instead of pushing back on the declining bond yields and higher stock prices that have been seen over the past month with aggressively hawkish commentary, Powell instead either 1) reiterated what the market had already heard, or 2) added/tweaked/removed elements from his November FOMC press conference, which created the ability for dovish interpretations to be formed.

Again, the most important of these points was Powell’s analysis of inflation, which included a separation of prices ex-housing services. This is likely to allow the Fed to shift its hawkish rhetoric in the event that other prices begin to broadly decelerate before shelter costs, which has a significant chance of occurring given the lagging nature of rent measurement.

Given this, and in light of the declines in the M2 money supply that will both 1) lead to lower inflation and 2) potentially cause a severe recession, I agree with markets bidding up long-term government bond prices.

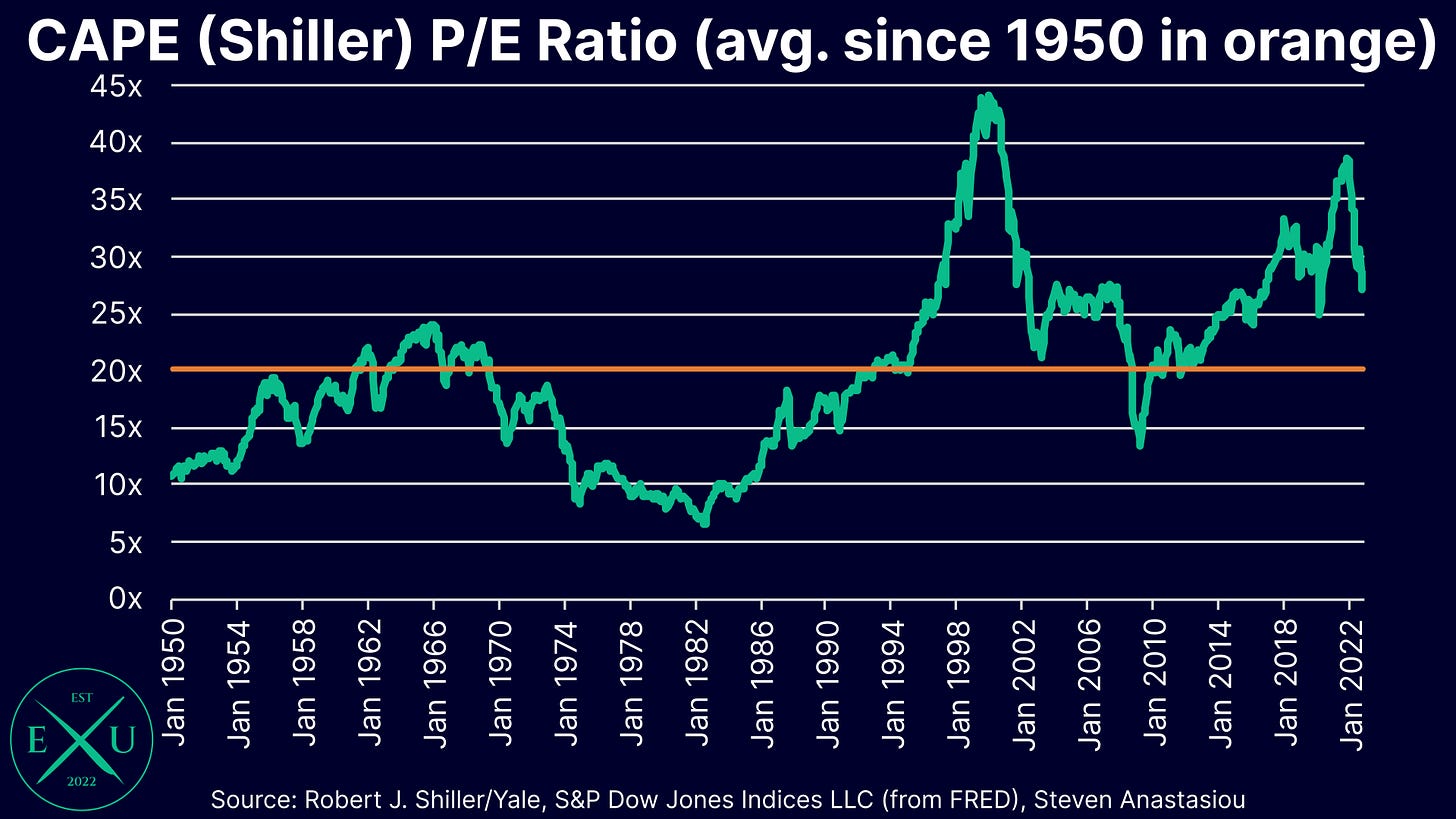

Though given the economic implications of a falling M2 money supply, and Powell’s belief that restoring a greater balance in the economy “is likely to require a sustained period of below-trend growth”, I believe that the outlook for cyclical assets looks ominous. When current valuations are added into the equation, including a CAPE for November that was 41.7% above its long-term average since 1950, it looks downright terrible.

Whilst equity market participants have bid up stock prices since mid-October on “pivot” hopes, I thus continue to remain of the view that the fundamental economic outlook is not supportive of cyclical risk-assets like stocks. Though after one of their worst years on record, I believe that the prices of many long-term government bonds are likely to drastically “pivot” higher across 2023.

Thank you for continuing to read and support my work — I hope you enjoyed this latest piece.

If you would like to help support my work, please subscribe, and help me spread the word by liking and sharing this article.