2023 outlook: plunging inflation & a recession

Unpacking my expectations for the US economy & its financial markets in 2023.

2023 begins with US inflation last recorded at an annual pace of 7.1% (as per the CPI), and an unemployment rate that remains low, last recorded at 3.7%.

2023 also comes after 2022 saw major asset price declines. The S&P 500 fell by 19.4%, whilst 10-year Treasuries saw their worst total return since at least 1928.

Focusing on the US, this report seeks to provide insights into the following questions: will inflation remain high? Will unemployment remain low? Will stocks and bonds see another year of significant negative returns, or will they rebound?

In order to try and answer these important questions, it is necessary to first outline the key factors and data points that are likely to be particularly important over the year ahead, and what they suggest is in store for the economy.

IMPORTANT DISCLAIMER: This economics focused research represents my own analysis, opinions and views and is not personal investment advice. This research is general in nature, and does not constitute personal advice to any person. This research publication must be read in conjunction with the full disclaimer contained at the end of this publication.

The Fed’s tightening campaign

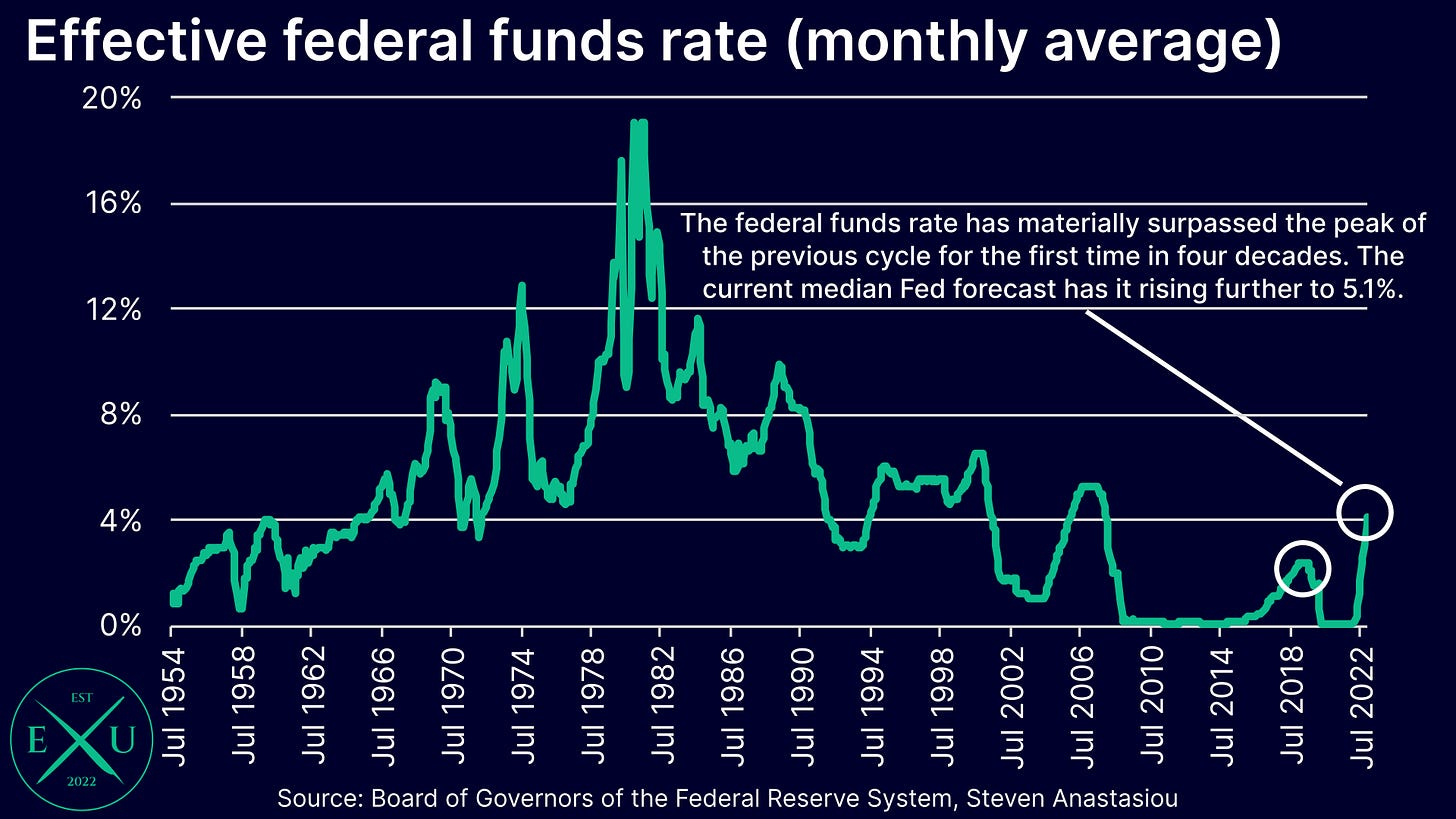

With the Fed undertaking its most aggressive tightening campaign in 40 years, this is the key factor that will impact the economy and markets over the year ahead.

The economic impact of these rate hikes is clear — lower growth. This is the very essence of what the Fed wants to achieve as it seeks to rein in inflation. Though the huge extent of the Fed’s rate hikes means that as opposed to a simple slowing of demand growth, the chances of a significant recession are significant.

For the first time in 40 years, the Fed has increased rates to levels above the peak of the previous rate cycle. This is problematic as the inflationary fiat monetary system encourages more & more debt. In order for debt burdens to be manageable, they thus generally require lower & lower rates.

By flipping the script, the Fed is now encouraging less credit growth, and debt deleveraging for those who already have a significant debt load. While such incentives will aid the long-term sustainability of the US economy, it significantly raises the risk of major short-term economic damage. With much of the Fed’s tightening occurring over recent months, the full impact of the Fed’s tightening is yet to be felt.

The money supply

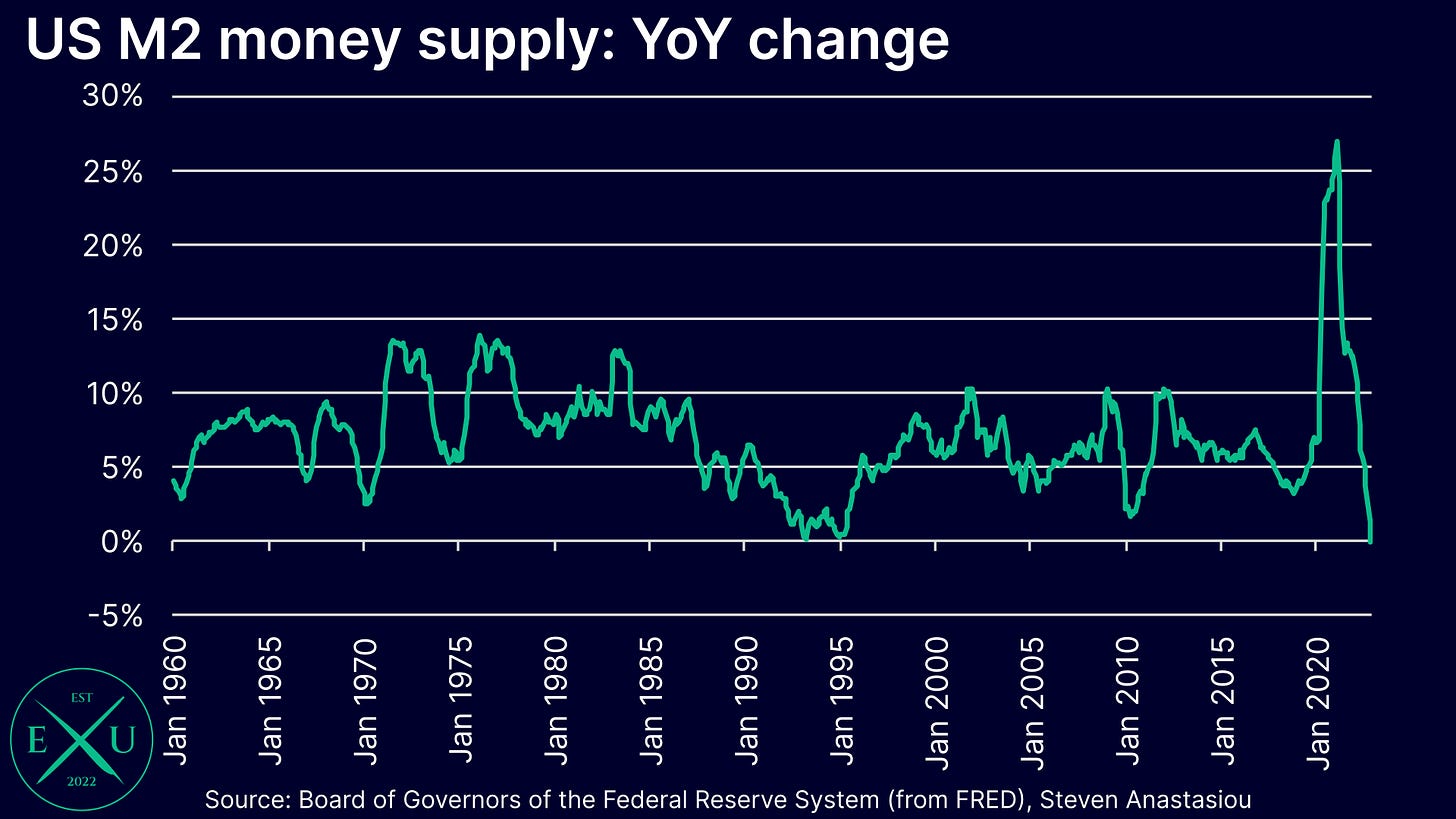

A flow-on of the Fed’s aggressive tightening, and a measure which showcases its impact, is the rate of change in the M2 money supply. It is this indicator which I view as being the most important for the economy and markets in 2023.

The combination of the federal government deficit falling from its COVID highs, and the Fed’s aggressive tightening, has meant that for the first time in 60+ years, M2 is recording YoY DECLINES.

Why is this so important? It’s fairly straightforward. Money is used to satisfy ones consumption of goods and services. When the money supply expands, all else equal, the aggregate demand for goods and services will also rise. When the money supply declines, all else equal, the aggregate demand for goods and services will fall.

When the money supply is artificially altered, over time, the initial impact on aggregate demand will be offset by a change in prices — if the money supply rises, all else equal, prices too will rise. The inverse is also true. Why? Remember that altering the money supply in isolation, doesn’t involve a commensurate change in supply in the real economy. Because of this, the impact on the real economy of artificially altering the money supply is temporary, and will be corrected for over time through a change in prices.

This was seen clearly over the past few years, with the ENORMOUS surge in the money supply post-COVID initially leading to a surge in demand for durable goods that wasn’t commensurate with a change in supply. This thus eventually resulted in a broad increase in prices. While the rise in prices would ordinarily be expected to reduce real demand, that hasn’t happened yet (more on that below). Now that the money supply is FALLING, there will be even stronger pressure for real demand, and inflation, to fall.

Note that this is already true for conditions as they exist right now. Though remember that the Fed expects to raise rates further still (above 5%), and to hold them there for an extended period (its current expectation is to do so for all of 2023). Each additional increase in interest rates, plus the extended period that the Fed currently wants to keep rates at higher levels, as well as its ongoing quantitative tightening (QT), will see continued pressure on M2 over the months ahead.

How significant of an impact should we expect on the economy, and on inflation?

The economy

Starting with the economy, with US GDP rebounding from two successive quarterly declines in Q3, and the Atlanta Federal Reserve’s GDPNow indicating a solid increase in GDP in Q4, many believe that the US economy is in relatively solid shape, and that it may avoid a recession in 2023.

They point to an unemployment rate that is at historically very low levels, a high level of job openings vs unemployed people, and continued robust consumer spending as reasons to suggest that 2023 may not be such a bad year for the US economy.

It is the latter of these points — robust consumer spending — that I point to, although for very different reasons. While many believe that this suggests the US economy will be OK, I instead believe that this is one of the very reasons why the US may see a SEVERE recession in 2023.

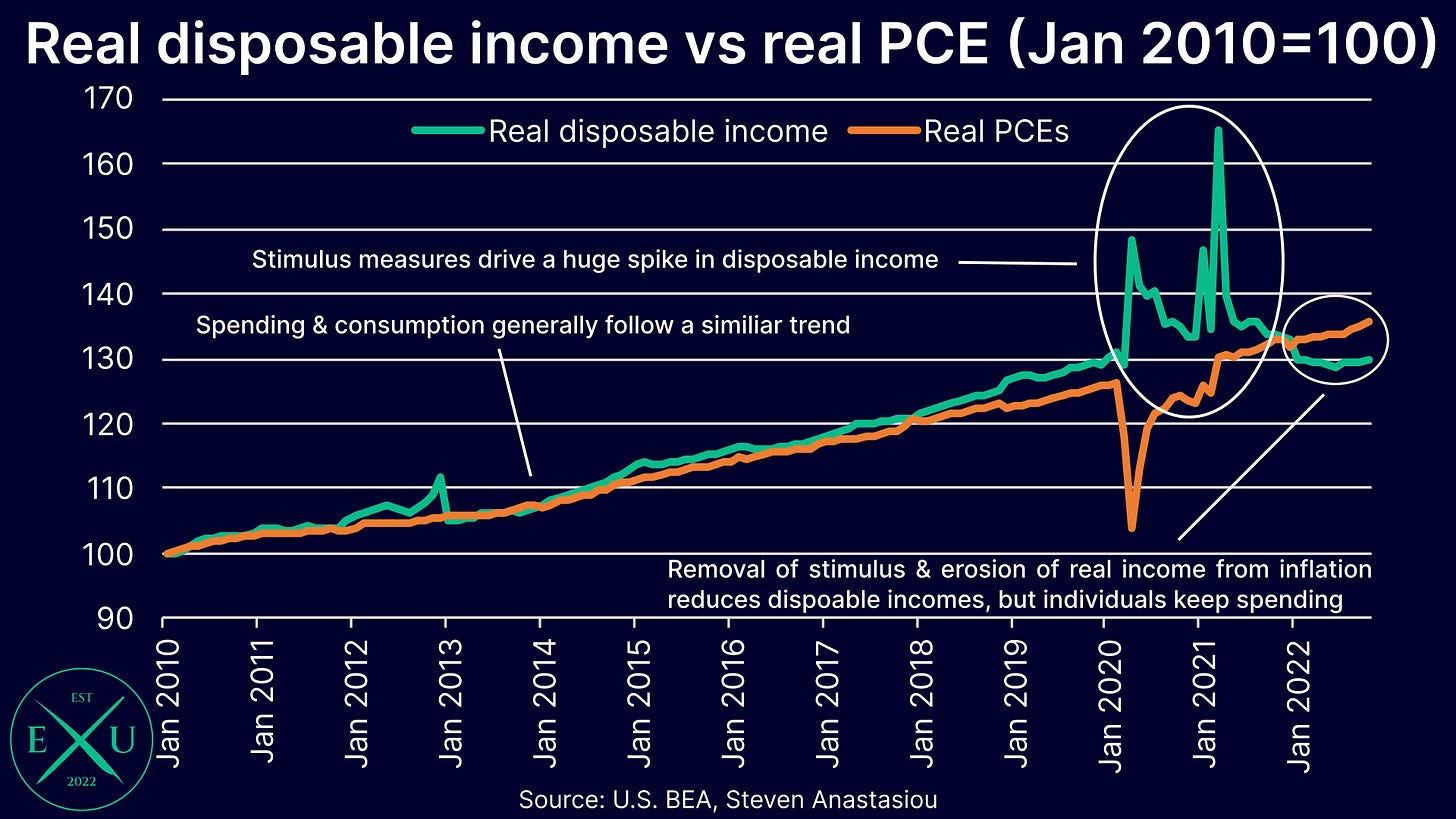

Remember, with the money supply falling, there should be pressure on real demand to fall. Not only is the money supply now falling, but real incomes have been eroded over the past two years by high inflation.

Real disposable income for October was 0.8% BELOW it’s pre-COVID (February 2020) level, whilst real durable goods spending in October was 26.5% HIGHER than its pre-COVID level. Overall PCEs (personal consumption expenditures) were 7.4% above their pre-COVID level. In November, these figures remained 24.7% and 7.4% higher respectively.

This is significantly out of whack with the historical correlation between real disposable income and real spending, which have traditionally moved in relatively close sync (which makes intuitive sense).

How did spending get so out of whack versus disposable income?

After initially falling post the onset of COVID as unemployment rose and the economic outlook remained highly uncertain, PCEs eventually rose (and surged in the case of durable goods), as disposable income spiked alongside the federal government handing out stimulus checks and enhanced unemployment benefits. Savings rates also surged.

With these stimulus measures now ceased, and inflation eroding away incomes as prices rose in response to higher demand and an increased money supply, real disposable income fell. Though instead of responding by deciding to reduce their consumption, most individuals seemingly decided that they can’t accept any form of social deflation — the spending must continue.

Though here’s the problem. Increasing your real spending by 7.4% if your real disposable income has DECLINED, can only be done by reducing your rate of saving, outright drawing down on your savings, and/or increasing your debt.

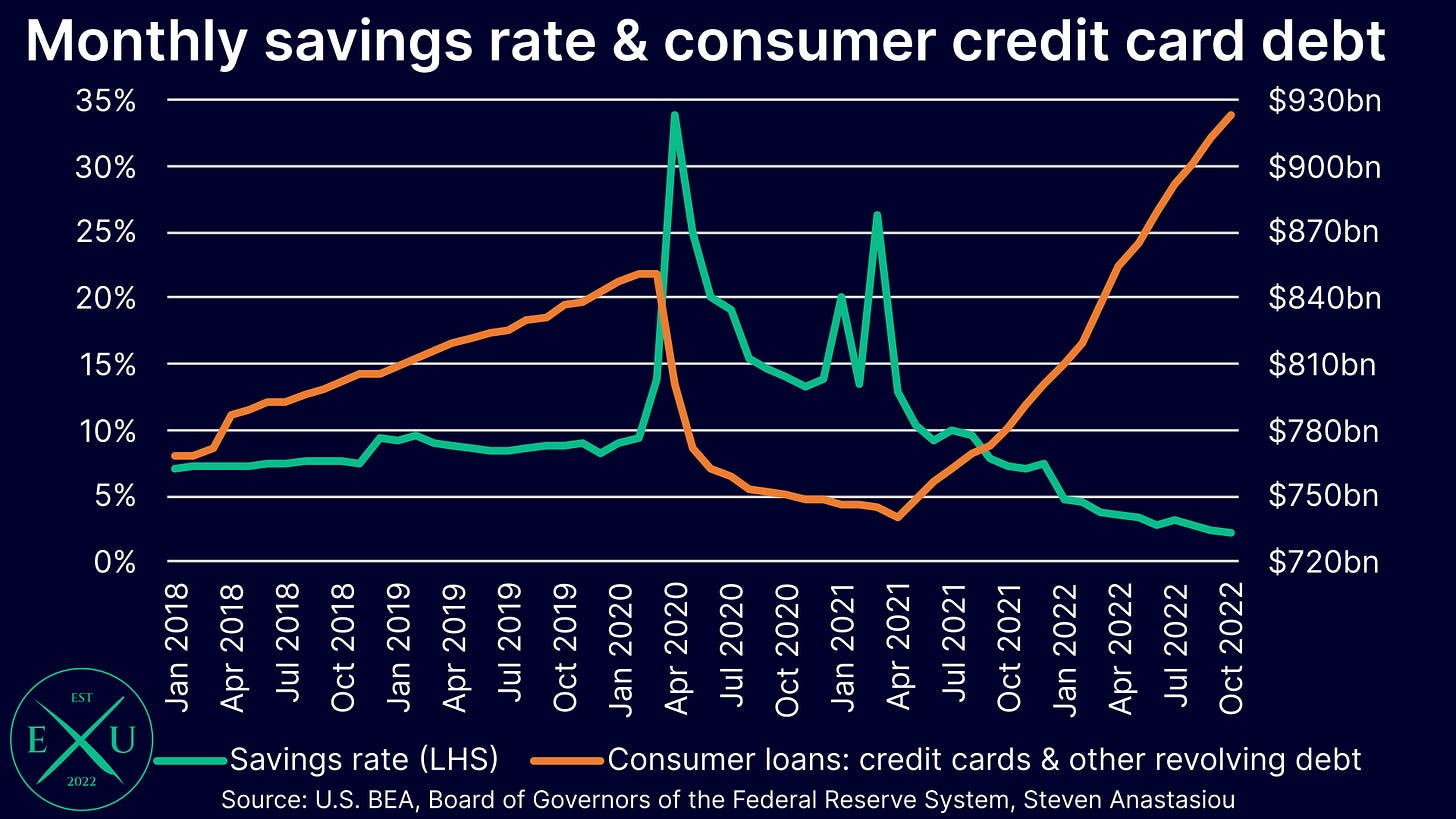

Lower savings rates and higher consumer credit card debt is exactly what has been happening.

Obviously, this is not sustainable. Something must give. Either real incomes must rise, real spending must fall, or a combination of these things must occur.

With the Fed aggressively raising rates as it seeks to reduce demand, the key factor that is likely to occur, is a decline in real spending. When will this occur? Seemingly not until individuals run out of savings, and run out of credit card debt to spend. In other words, slowly, and then all at once.

The current resilience in consumer spending thus likely raises, not lessens, the severity of a future economic decline. For instead of an orderly decline, consumer behaviour looks ripe to result in a more abrupt fall in spending. This risks both 1) the Fed more significantly overtightening as it assumes the economy is holding up OK; and 2) individuals being left with little to no safety net alongside a major economic downturn.

We won’t know exactly when the penny will drop, and the savings buffer built during COVID may extend until 2H23, but I expect a decline to occur during 2023, and for a recession to occur. Given the hugely out of whack current spending, and the Fed’s aggressive tightening, more likely than not, I expect that an economic correction will be severe.

Inflation

Remembering the Fed’s aggressive policy stance, and the ongoing decline in M2, the very likely direction of inflation over 2023 is clear — down.

Remember, the reasoning here is relatively simple. When you artificially increase the supply of money, you get an increase in demand without a corresponding increase in supply. Overtime, businesses thus adjust their prices higher, eventually leading to a broad increase in prices and higher inflation — as we have seen over the past two years.

When the supply of money falls, you have the opposite pressure — pressure for prices to fall. With the money supply now recording ongoing MoM declines, the pressure being placed on prices to fall is growing each month. Indeed, we are already seeing signs of this in multiple areas, including:

durables prices;

food commodities (as measured by the UN FAO Food Price Index);

spot market rents; and

oil & gasoline.

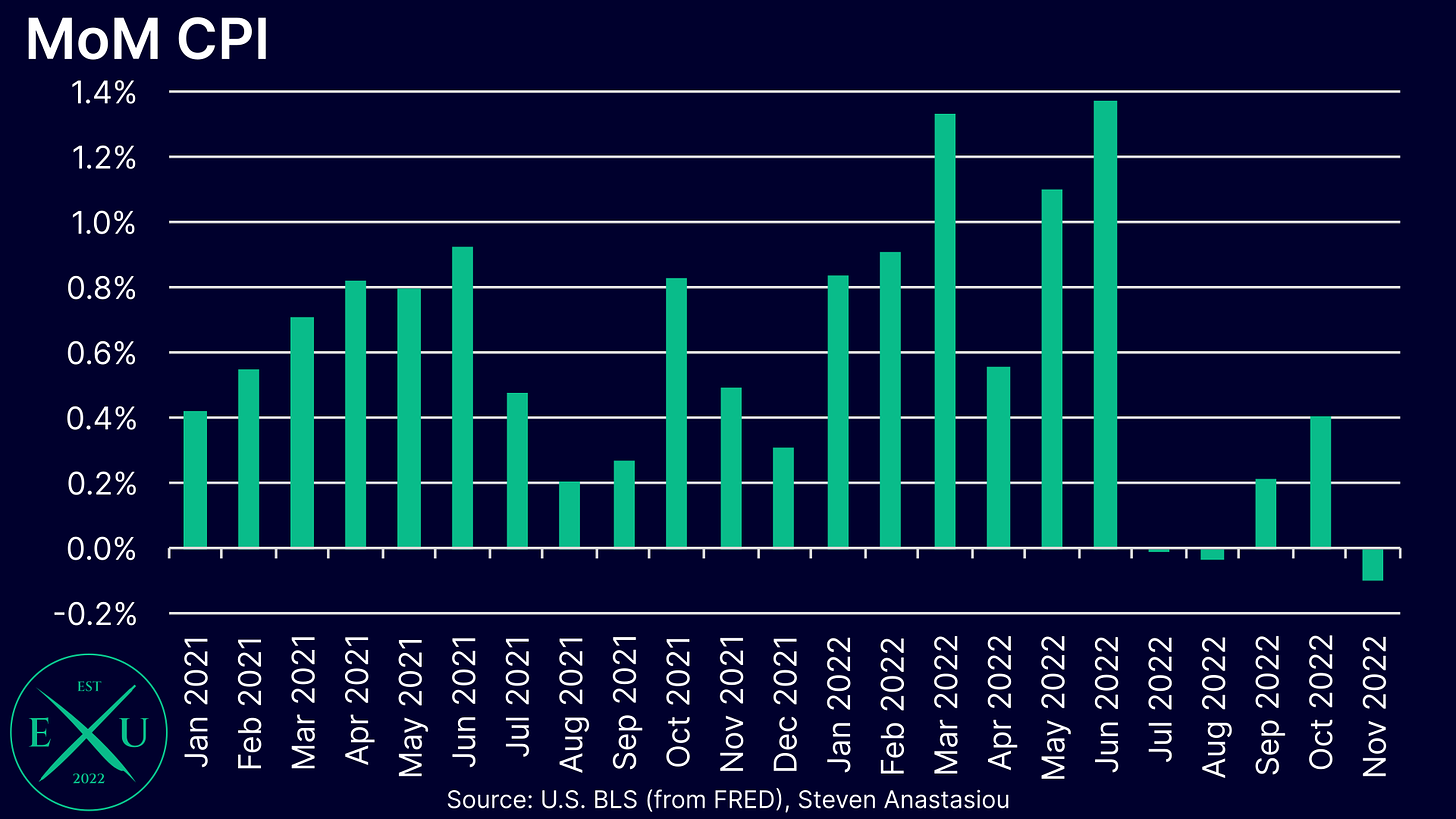

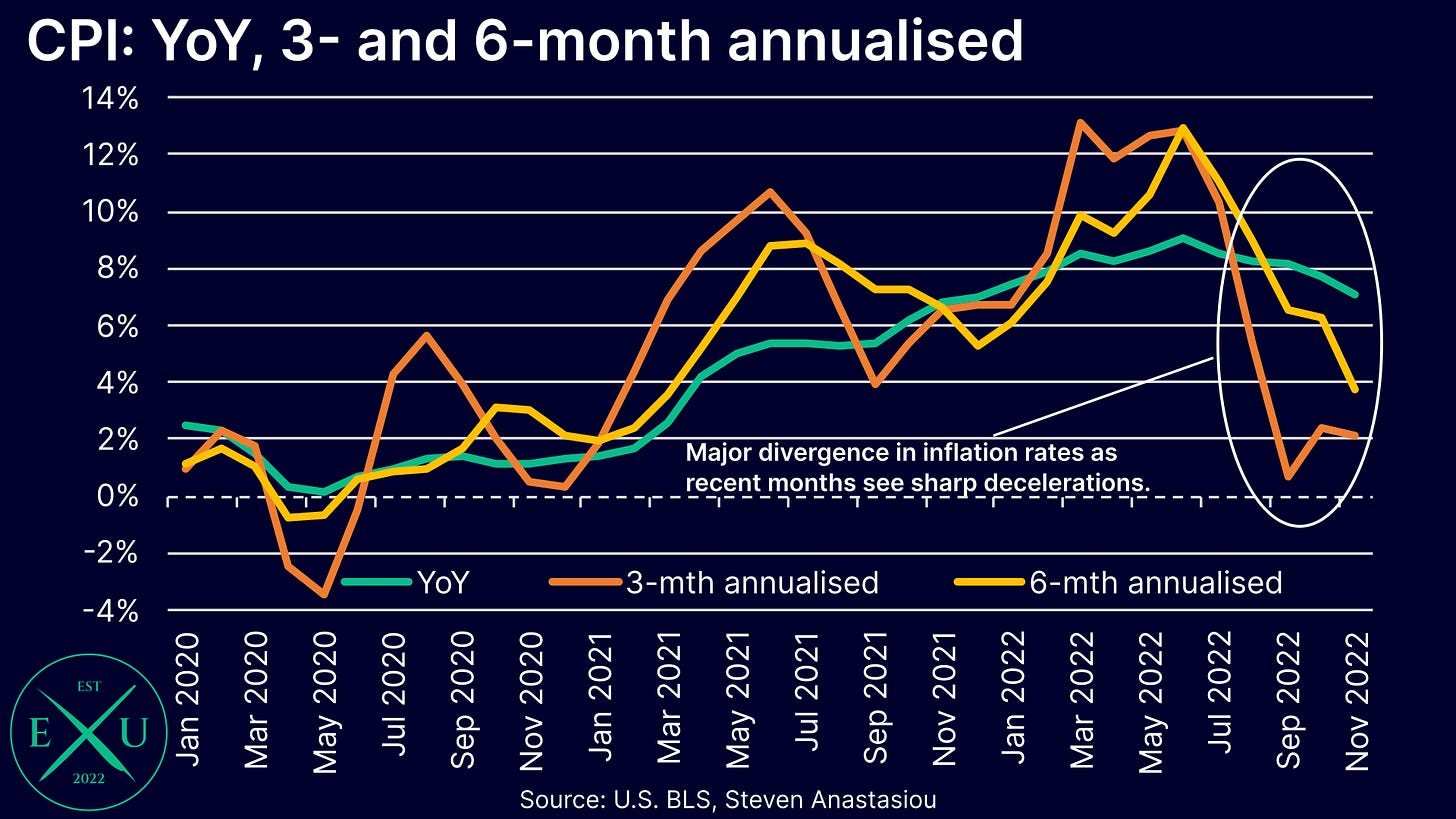

Not only are we seeing tangible signs of price declines in particular areas, but we are also seeing this significant deceleration of price growth in the CPI itself, where over the past 5 months, MoM CPI growth has downshifted significantly. Indeed, 3 of the last 5 months have seen a NEGATIVE MoM change.

This has seen the 3-month annualised inflation growth rate fall from 12.8% in June to 2.1% in November.

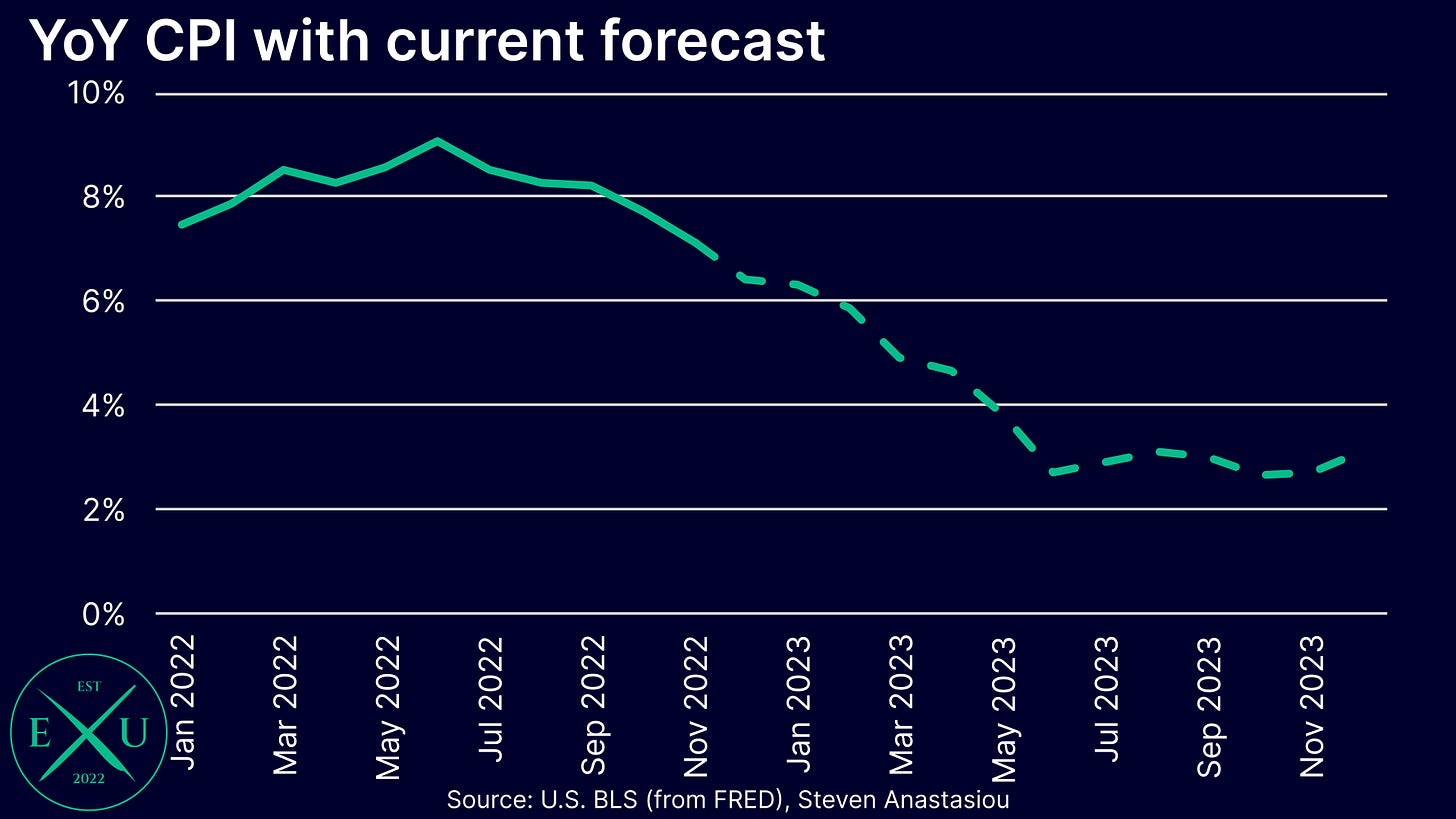

With high MoM comparables to be cycled from January to June 2023, I expect there to be a MAJOR decline in YoY CPI growth over the next 6 months.

While inflation is incredible difficult to accurately forecast, and my CPI forecast is thus subject to ongoing revision, particularly noting volatile gasoline prices, as well as the BLS’ annual re-weighting that will come with January’s CPI data, I am currently forecasting YoY CPI inflation to fall below 3% in June 2023, and to remain around ~3% for the remainder of 2023.

This is assuming that gasoline prices rise 5% from their average December level in January, and remain there throughout 2023.

While many may rush out and say that’s above the Fed’s 2% target, there’s several important points that must now be expanded upon.

PCE inflation generally undershoots the CPI

The first thing to remember is that the Fed targets PCE inflation, not CPI inflation. Differences between the two indexes include the weights, and formula’s used. As a result of the differences between the two indexes, the PCE Price Index generally records a lower rate of growth than the CPI.

The difference between the average monthly YoY growth rate between the two indexes over different time periods is as follows:

1960-now: PCE 3.3% vs CPI 3.8%

2000-now: PCE 2.1% vs CPI 2.5%

2020-now: PCE 3.7% vs CPI 4.6%

Given recent trends, YoY CPI growth of ~3% thus has a significant likelihood of being largely consistent with the Fed’s 2% inflation target. Another key reason that a ~3% CPI is likely to be largely consistent with a 2% PCE, is that the CPI has a much higher weighting to lagging shelter costs, a point which I will now expand upon.

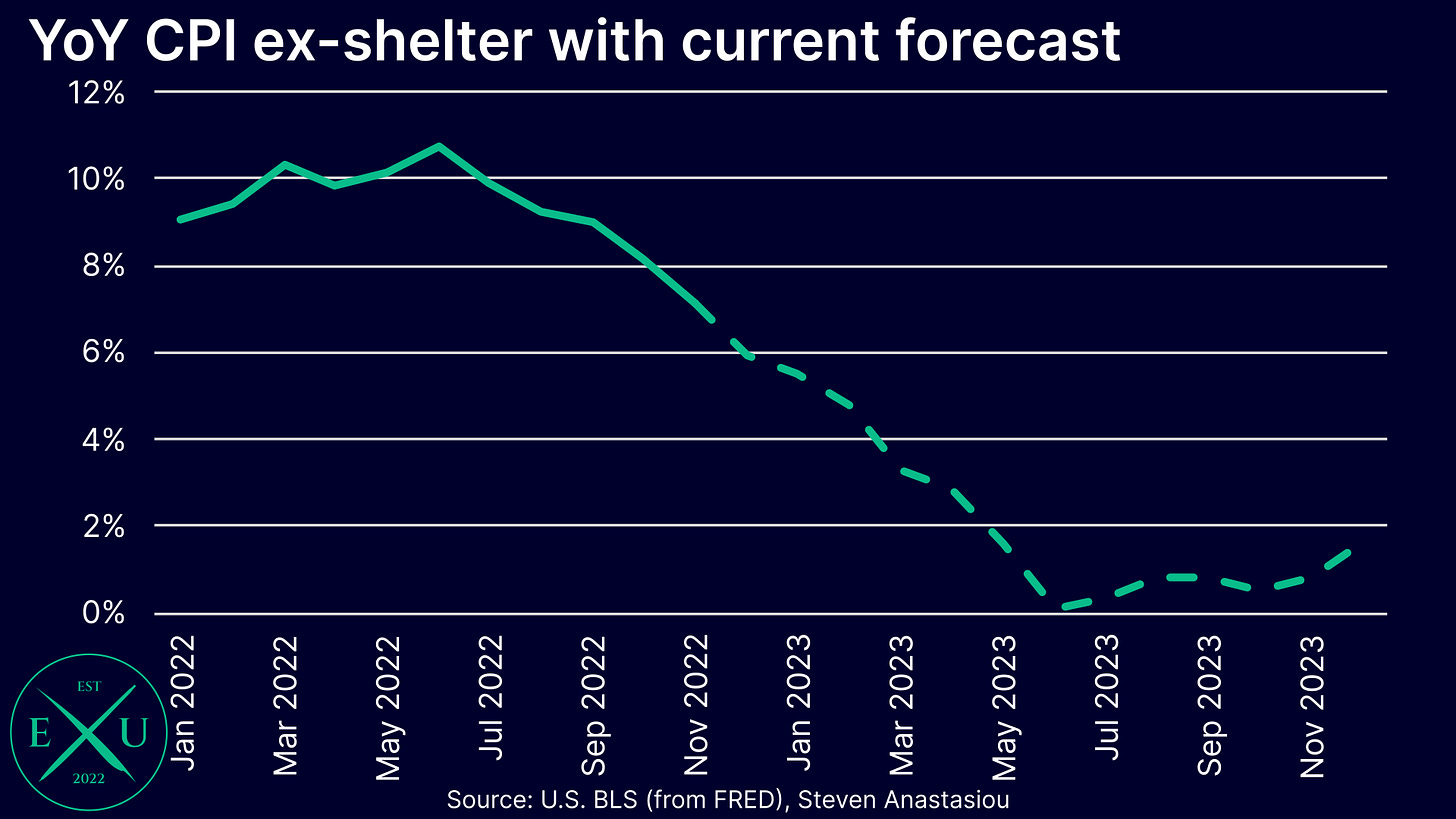

CPI ex-shelter points to a SIGNIFICANT potential for YoY DEFLATION in 2023

A point which I have been highlighting for many months, is that unless the Fed adjusts the CPI/PCE for lagging shelter costs, it is likely to significantly overtighten monetary policy.

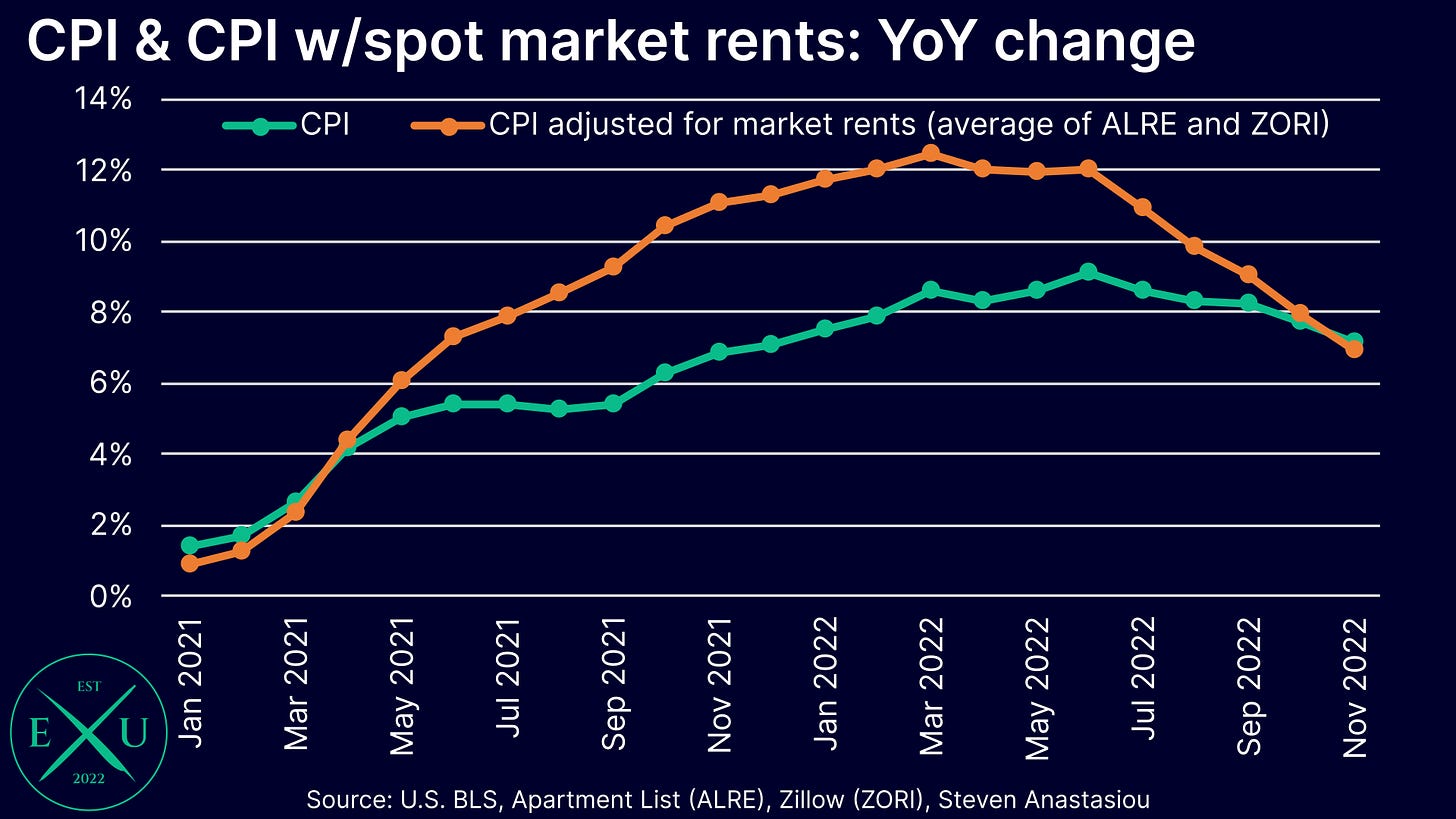

A lag occurs on account of rental samples consisting of continuing lease agreements, most of which are subject to fixed terms, of which 12-months is the most common. The CPI/PCE rental data is thus significantly lagged versus spot market rental price movements (i.e. rents on new leases).

Substituting spot market rents for the CPI’s shelter component shows how the CPI initially significantly UNDERSTATED inflation as spot market rents recorded drastic increases. With market rents now declining in recent months, and the CPI’s shelter index continuing to record large MoM gains as it lags the move in spot market rents, the CPI is now OVERSTATING inflation. The level of overstatement is likely to widen in the months ahead.

The lagging nature of shelter cost measurement is a key driver behind why my CPI forecast currently remains above 2% for 2023. In addition to being lagging, just how long the CPI’s shelter measurements will lag and remain elevated is also unclear, adding increased uncertainty to an economic variable that is already very difficult to accurately predict.

If we remove shelter from the CPI, my inflation forecast changes dramatically, with my CPI forecast moving below 2% from May 2023 and remaining below that point throughout the rest of 2023. My forecast nears outright DEFLATION in June 2023.

Importantly, Fed Chair Powell has recently articulated an approach to measuring inflation that excludes shelter costs, recognising the significance of the lag that exists. Such an approach to monitoring inflation is likely to prove vital to limiting the damage caused by aggressive monetary policy tightening, and allow for a loosening of monetary policy in 2H23 (which I discuss further below).

A recession

A further consideration that must be taken into account is the earlier discussed likelihood of a recession in 2023. This is vital, as during recessions, inflation often falls significantly, as demand drops and the demand for money increases.

A severe recession likely represents significant further downside to 2023’s inflation rate versus my current estimates. As an example, gasoline prices could see significant further declines from current levels in the event of a severe recession, versus my current forecast which has gasoline pegged at 5% above December’s average, noting risks that continue to exist in regards to supply.

A severe recession would significantly increase the chances of outright deflation, particularly when excluding shelter, or adjusting shelter for market rents.

Interest rates

Given the above outlook for the economy and inflation, the next thing to articulate is my expectation for when the Fed will pivot and cut interest rates — for make no mistake, in the event of a recession and a major fall in inflation, the Fed will very likely be cutting rates in 2023.

As per the Fed’s Summary of Economic Projections that was released less than a month ago, the Fed’s median federal funds rate projection to end 2023 is now 5.1%. If delivered in 25bp increments, this would entail another three rate increases, which would see rate rises continue until May 2023.

Whether or not the Fed delivers another ~75bps of tightening, or delivers 50, or even just 25bps of additional tightening, is unlikely to be the key concern. The key instead lies in how long the Fed will keep rates at an elevated level.

While the Fed is talking tough now, remember how quickly the Fed changed its tune last year: the Fed maintained ZIRP & QE until March 2022, at which point CPI inflation was last recorded at 7.9%! Shortly afterward it delivered a series of successive 75bp hikes, rocketing rates higher.

With another rate rise a near certainty in February, and another currently considered highly likely by markets in March, it would appear unlikely that rate cuts occur in 1H23. Instead, in the event that inflation continues to decline significantly as I expect, the Fed would likely gradually shift its language over time, laying the groundwork for rate cuts in 2H23.

Given my outlook for both inflation and the economy, I expect a minimum of one 25bp rate cut in 2H23, and in the event of a severe recession, a likely more drastic reversal of rates, to once again quickly approach zero.

Stocks (S&P 500)

With my view that lower inflation is likely to clear the way for the Fed to cut rates in 2H23, many would then be inclined to think that this would surely set stocks up for a much stronger 2023. Not so fast.

While there may be a valuation tailwind from lower interest rates in 2H23, I expect this to be more than offset by the earnings declines that will stem from my expectation of a recession, indeed a likely severe recession.

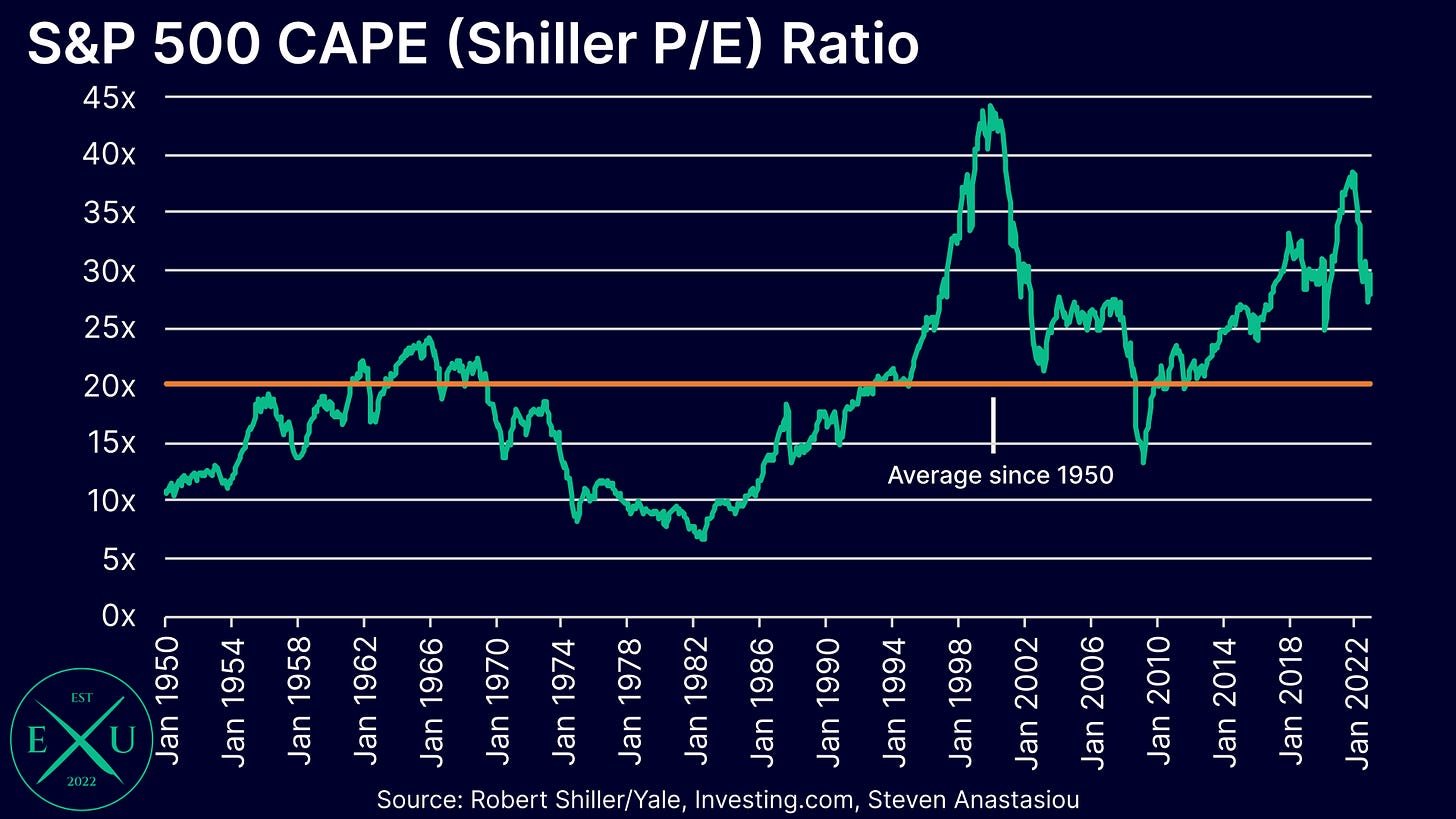

Further still, despite the large decline in 2022, S&P 500 valuations remain relatively full, or significantly stretched, on just about any key metric — whether it be the S&P 500’s P/E, CAPE, or its market cap divided by GDP.

As the Fed continues to tighten during 1H23, and as earnings likely take a significant hit throughout 2023, I thus expect further declines in the S&P 500, as well as for most stock markets around the globe.

Given where valuations currently sit, I would not be at all surprised to see the S&P 500 deliver a second consecutive year of double digit declines — indeed, a double-digit decline in 2023 represents my base case, as I anticipate that a significant recession looms on the horizon.

Government bonds

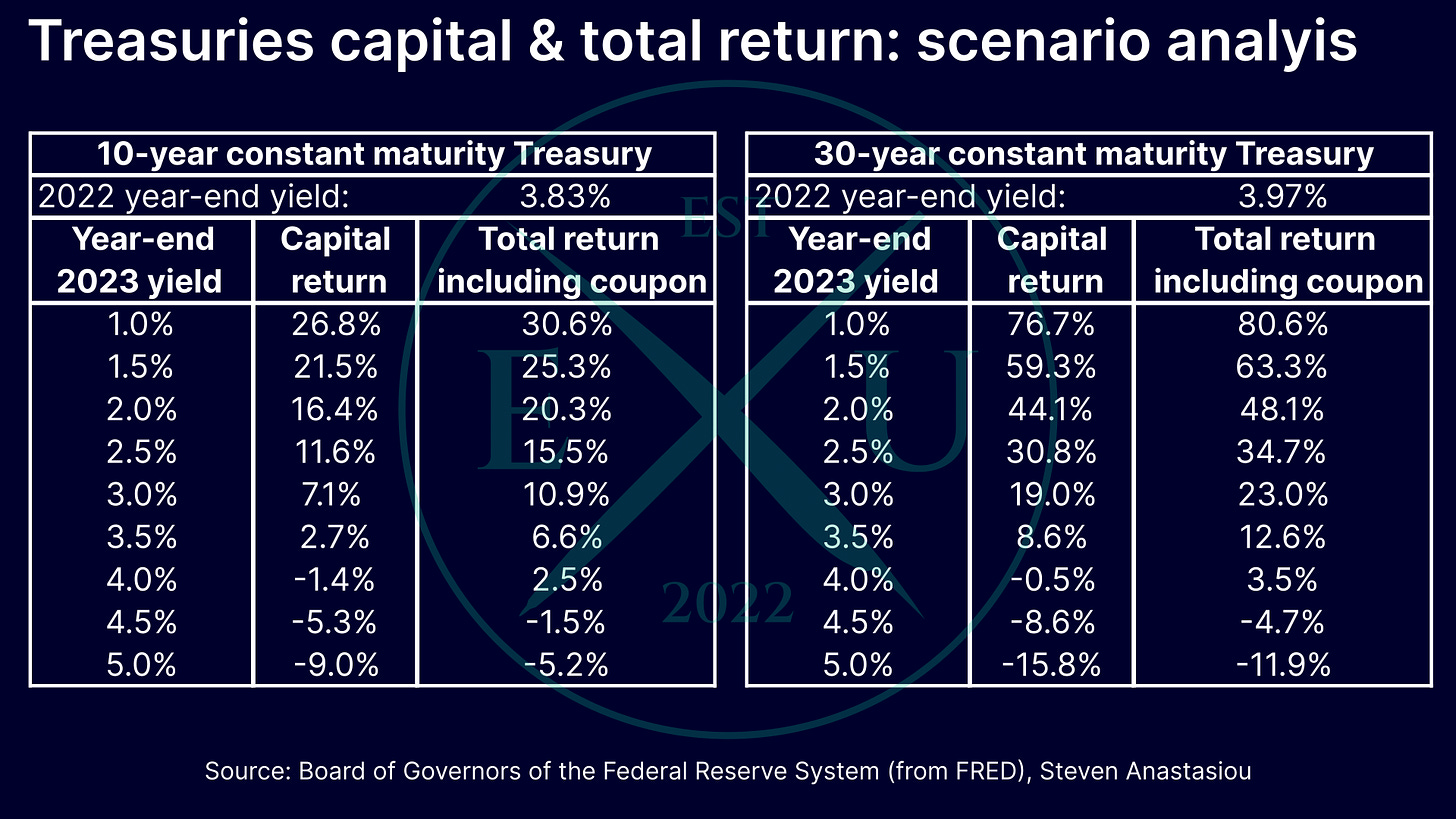

As opposed to further price declines (and thus a further increase in yields), I expect US government bonds to have a far stronger year in 2023.

As opposed to stocks, all of my key expectations, being: a likely severe recession; a major fall in inflation; the material chance of deflation ex-shelter; and 2H23 rate cuts, are likely to be significantly price supportive for Treasuries.

Given such significant drivers, I believe there is a significant likelihood that US Treasuries instead see their prices yo-yo from one of the largest yearly price declines ever recorded in 2022, to delivering a major yearly price increase in 2023, as yields move back towards the levels seen from 2019-2021, as it becomes increasingly clear that inflation is falling rapidly, and recession fears grow.

In the figure below I show what the capital returns would look like under a range of scenarios for constant maturity 10- and 30-year Treasuries, based upon their respective year-end closing yields for 2022. The below scenario analysis also shows the returns that would occur under a scenario such as inflation being stickier than I expect, and the Fed maintaining its tightening, resulting in yields rising to 5%.

In summary

To summarise my 2023 outlook:

I expect the Fed’s aggressive tightening, of which the impact can be seen via the first YoY declines in the US’ M2 money supply in at least 60+ years, to lead to a recession. More likely than not, it will be severe.

As opposed to supporting the US economy and limiting downside, I believe that continued strong consumer spending will make the downturn WORSE, as consumers choose to spend through their savings buffers now, leaving them, and the wider economy, extremely vulnerable once individuals run out of savings/hit credit card limits, and a recession arrives.

The declining M2 money supply will lead to a MAJOR decline in inflation. While my current CPI forecast is around ~3.0% for 2H23 (and is subject to ongoing revisions as new data comes in), much of this is due to elevated and LAGGING shelter costs. Shelter costs have a lower weighting in the PCE Price Index, which already ordinarily tends to undershoot CPI growth.

Looking at the CPI on an ex-shelter basis, I currently forecast that CPI inflation will fall well below 2% from May 2023, and remain there throughout the rest of the year. My current forecast has June 2023 as being close to seeing outright DEFLATION. The chances of outright deflation are significantly increased in the event of a severe recession.

Given my outlook for the economy and inflation, I expect a MINIMUM of one 25bp rate cut in 2H23. In the event of a severe recession, I would expect to see rates fall much more quickly, and once again quickly trend towards zero.

While lower rates in 2H23 may provide valuation support for stocks, I expect an earnings decline to outweigh the valuation benefit. With the S&P 500 continuing to trade at a rich valuation in spite of its significant 2022 decline, my expectation is for another year of double digit declines in the S&P 500 in 2023.

Given my outlook for both lower inflation and a significant recession, I believe that the price performance of US Treasuries will see a major turnaround in 2023. I expect US government bond prices to benefit from: safe-haven flows as recession concerns rise & are subsequently confirmed; a major fall in inflation; and 2H23 rate cuts from the Fed. I thus expect a significant decline in yields from their year-end 2022 levels, with them instead yo-yoing back towards the levels seen from 2019-2021.

Thank you for continuing to read and support my work — I hope you enjoyed this latest piece. As noted above, be sure to see the important disclaimer contained below, at the end of this report.

In order to help support my work, and to best allow me to continue providing high-quality, in-depth, and independent economic research such as this, please like and share this article. If you haven’t already, please also consider subscribing — it’s free!

Be sure to stay tuned for my upcoming preview of December’s CPI report, and further in-depth inflation analyses over the weeks and months ahead.

Excellent macro overview, thanks for writing.

There are two forces pulling on bond prices. Yes, if inflation goes down, bond prices are likely to go up as buyers come back. A tanking stock market combined with low inflation will also make bonds attractive.

But what is the effect of QT and the fed shrinking their balance sheet on bond prices? They're not doing a lot of outright selling. Instead they're letting the bonds they do own mature and simply let them roll off.

Since the Fed is not buying, somebody else must buy. We're still running big deficits. So more supply and less demand implies lower prices and higher yields. These two forces will push and pull the bond market in opposite directions. How do you reconcile this? Why do you think there will be more buyers to absorb the bonds now that Fed is not buying?